E8 Markets Rules enforces several restrictions, covering areas such as news trading (permitted), copy trading, EAs (Expert Advisors), lot sizes (Max. 50 LPT), and inactivity rules.

Violating these regulations can result in account termination. Additionally, inactivity rules require at least one trade within 90 days to keep accounts active.

E8 Markets Trading Conditions

several rules are enforced by E8 Markets Prop Firm to ensure a fair trading environment; E8 Markets Trading Rules Topics:

- Trading News

- Copy Trading

- Use of EAs

- Holding Positions Overnight & Weekend Trading

- Lot Size Rules

- Inactivity Limits

- Martingale Strategy

- High Frequency Trading

- Hedging Rules

E8 Markets News Trading

E8 Markets allows traders to execute news-based trades, but there are associated risks; E8 Markets News Rules:

- News trading is permitted in all evaluation phases;

- The simulated trading environment follows real market conditions;

- Traders must be cautious of slippage, which may cause unexpected trade executions;

- Profits during news events are not guaranteed, and E8 Markets does not offer protection against losses;

- High-impact news events increase volatility; traders should avoid trading during these periods to minimize risks.

Copy Trading in E8 Markets

Copy trading is allowed under specific conditions; E8 Markets Copy Trade Limits:

- Traders may copy trades between their personal accounts, E8 Trader accounts, and evaluation accounts;

- However, copying trades between multiple E8 evaluation accounts is strictly prohibited;

- Each evaluation account must be traded independently to ensure fair assessments.

E8 Markets Use of EAs

E8 Markets permits the use of Expert Advisors (EAs) with some restrictions; EAs Rules in E8 Markets:

- EAs are allowed, but traders cannot run identical strategies across multiple accounts;

- Each trader is restricted to one trading strategy per account;

- Using the same EA across multiple accounts may result in account termination;

- Third-party EAs are permitted, but using a self-programmed EA is recommended;

- The server request limit is 2000 modifications per day, including stop-loss/take-profit adjustments;

- The maximum number of trades per day is 2000.

E8 Markets Overnight/Weekend Trading

Holding positions overnight and over the weekend is allowed but comes with risks; E8 Markets Overnight/Weekend Limits:

- Traders can keep trades open overnight on all evaluation accounts;

- Weekend trading is permitted, but traders should be mindful of market gaps in Forex, Indices, and Commodities;

- The platform does not protect against slippage or gaps, which could trigger loss violations;

- Risk management is crucial for traders holding positions outside regular trading hours.

Lot Size in E8 Markets

To maintain liquidity and order execution stability, E8 Markets enforces lot size limitations; Lot Size Limits in E8 Markets:

- The maximum lot size per trade is 50 lots, except for XAUUSD, which has a 20-lot limit;

- Traders can place larger positions by opening multiple orders;

- The maximum number of open orders at any given time is 100;

- The server request limit is 2000 per day (includes order modifications and stop-loss/take-profit changes;)

- The daily position limit is 2000 trades.

E8 Markets Inactivity Rules

E8 Markets enforces an inactivity policy to ensure active trading participation; E8 Markets Inactivity Condition:

- Accounts will be closed after 90 days of inactivity;

- To prevent deactivation, traders must place at least one trade every 90 days;

- This rule applies to both active and newly purchased accounts.

E8 Markets Martingale Strategy

E8 Markets allows traders to implement martingale strategies, with specific restrictions; E8 Markets Martingale Conditions:

- Martingale trading is permitted, provided it aligns with live market execution;

- Restricted trading strategies include abuse of feed, freezing, high-frequency trading (HFT), and straddling;

- Traders can use EAs, but identical strategies across multiple accounts are not allowed;

- The server request limit remains at 2000 per day, with a daily position cap of 2000 trades.

HFT Rules in E8 Markets

To prevent high-frequency trading (HFT) abuse, E8 Markets has set the following conditions; E8 Markets HFT Restrictions:

- Over 50% of trades must remain open for at least one minute;

- This rule ensures that traders do not exploit ultra-short-term price movements.

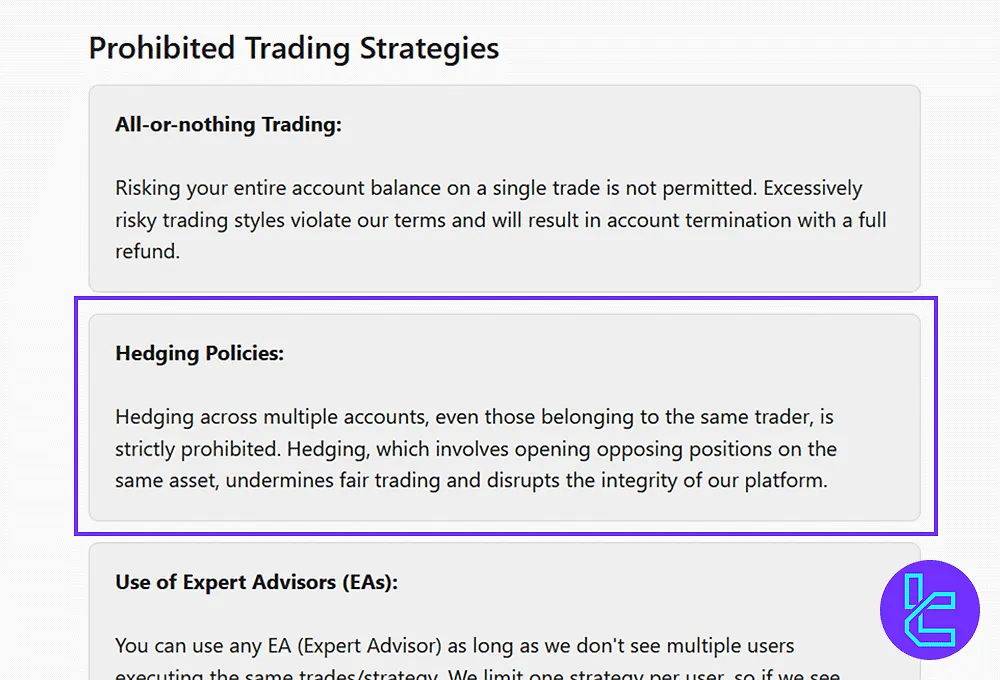

E8 Markets Hedging Rules

Hedging across multiple accounts is strictly prohibited to maintain trading fairness; E8 Markets Hedging Conditions:

- Traders cannot hedge positions between different accounts, even if owned by the same trader;

- Hedging involves taking opposite positions on the same asset, which is considered market manipulation.

E8 Markets Violation Consequences

Breaking any of E8 Markets’ trading rules can result in penalties; E8 Markets Breach Results:

- Traders are not responsible for losses in the E8 Trader Stage or evaluation process;

- Rule violations (e.g., max drawdown, daily loss, inactivity) will lead to account termination;

- If an account is closed due to violations, traders can purchase a new evaluation and start again.

Writer’s Opinion & Conclusion

E8 Markets Rules allow martingale. Traders must comply with the server limit of 2000 modifications per day. HFT strategies are restricted, requiring at least 50% of trades to stay open for one minute.

Hedging is prohibited across multiple accounts to maintain fairness. Check out E8 Markets Tutorials and read the most recent articles about the broker.