During our latest checkup on the prop firm and its operations, we hit a dead-end. Apparently, the official website is no longer active as it shows "ERR_NAME_NOT_RESOLVED". Therefore, Express Funded is currently not operational, and there is no information about when or if the prop firm will be available again.

Express Funded has deep roots in South Africa and provides up to $1,000,000 in trading capital with a generous 90% profit split and refundable fees. Express Funded prop firm supports MetaTrader 5 with leverage options of up to 1:30. The payment options include PayPal and AfriCheckout.

Express Funded; Company Information

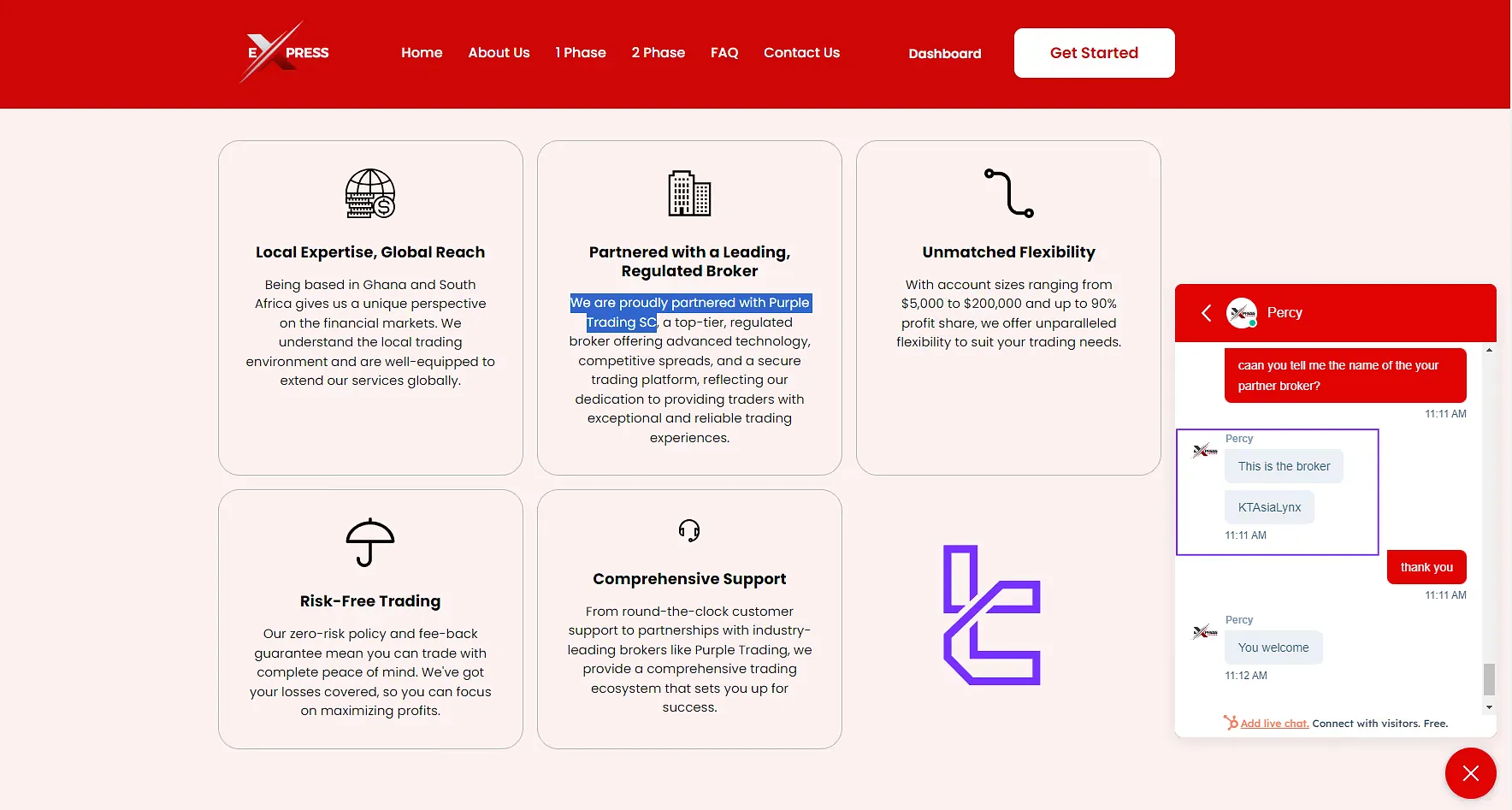

Express Funded is a Ghana-based prop trading firm led by co-founder McGlory Thapelo Mabitsela.The company is not regulated by any financial authorities, and neither is its partner broker, KT-Asia LYNX.

Express Funded is a prop trading firm founded in 2023 in South Africa

Express Funded is a prop trading firm founded in 2023 in South Africa

It’s noticeable that the firm mentions Purple Trading, regulated by the UK FCA, as the partner broker on its official website, but the support team confirmed that they are partnered with the Hong Kong-based broker KT-Asia LYNX. Key features of Express Funded:

- Innovative 1-step and 2-step trading challenges

- Flexible funding options with accounts up to $100,000

- Scaling program up to $1 million

- Profit splits of up to 90%

- Comprehensive educational resources and round-the-clock support

- Refundable challenge fees

Express Funded Specifications

To give you a clear picture of what Express Funded offers, here's a table outlining the prop firm's key specifications.

Account currency | USD |

Minimum price | $24 |

Maximum leverage | 1:30 |

Maximum profit split | Up to 90% |

Instruments | Forex, Indices, Commodities, Crypto |

Assets | N/A |

Evaluation steps | 1-Phase, 2-Phase, Instant Funding |

Withdrawal methods | USDT |

Maximum fund size | $1,000,000 |

First profit target | 8% |

Max. daily loss | 4% |

Challenge time limit | Unlimited |

News trading | Allowed |

Maximum total drawdown | 12% |

Trading platforms | MT5 |

Commission | Only the partner broker’s spreads and swaps |

TrustPilot score | 3.8 |

Payout frequency | Bi-Weekly |

Established country | Ghana |

Express Funded offers a dynamic profit split structure, starting at 70%, progressing to 80% after three successful withdrawals, and ultimately reaching up to 90% for consistently performing traders.

Express Funded Advantages and Disadvantages

Like any prop firm, Express Funded has its strengths and weaknesses, so to have a balanced look, we must discuss both.

Pros | Cons |

Fast-track funding process | Limited account options compared to some competitors |

High profit splits (up to 90%) | Low daily drawdown (4%) |

Opportunity to scale accounts up to $1 million | Relatively new in the prop firm market |

Comprehensive educational resources | Limited information on company background |

Express Funded Prop Firm Funding Plans and Pricing

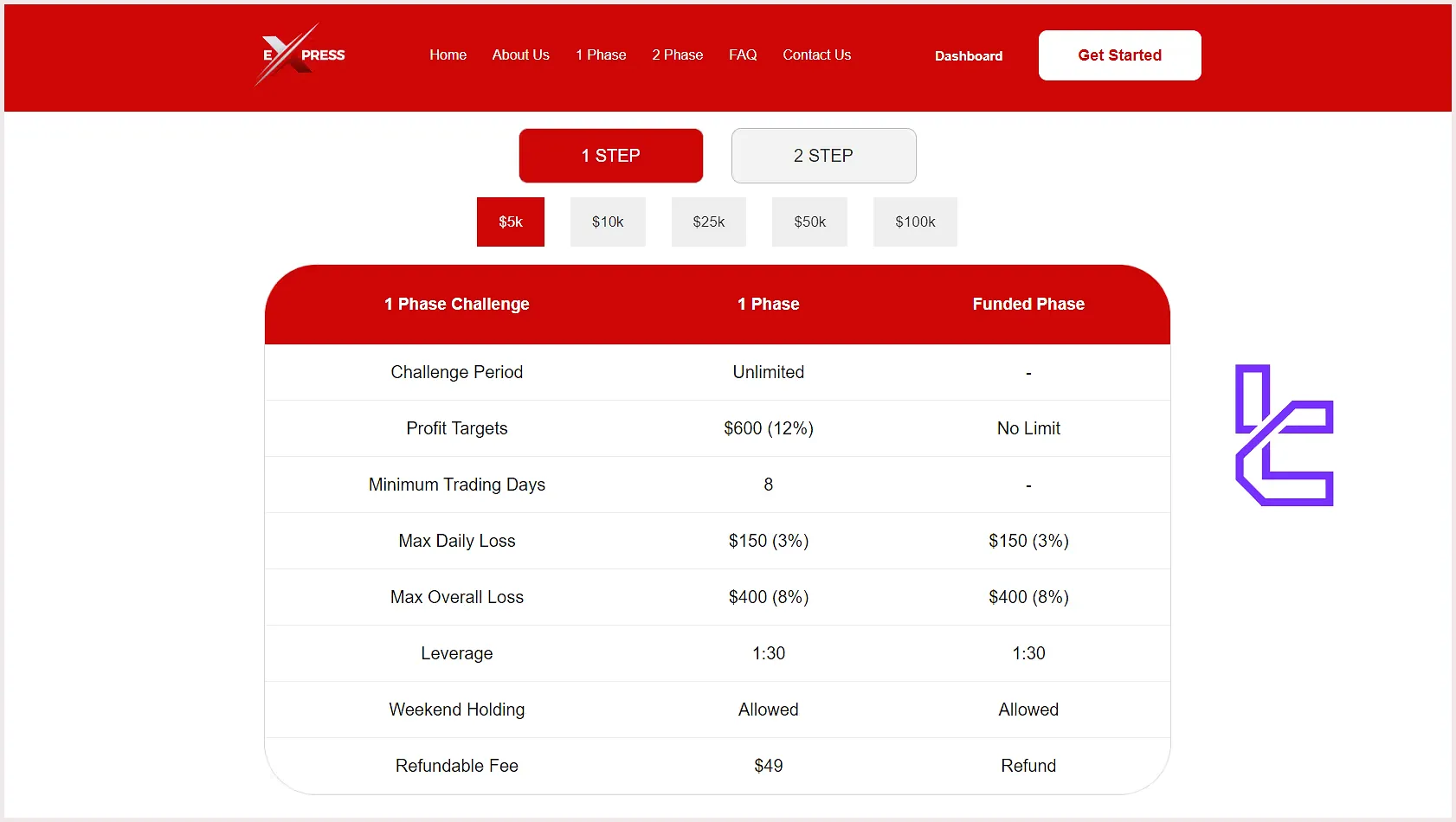

The prop firm offers two main funding plans, 1-Step and 2-Step, designed to cater to traders at various levels of experience and capital requirements. Note that Express Funded doesn’t offer Instant Funding plans.

Funded Account | 1-Step | 2-Step |

$2.5K | $24 | $24 |

$5K | $49 | $49 |

$10K | $99 | $99 |

$25K | $219 | $199 |

$50K | $329 | $299 |

$100K | $549 | $499 |

Registration and Verification on Express Funded

Launching your first challenge with Express Funded is fast and beginner-friendly, designed to get you into the markets in 4 steps.

#1 Visit the Express Funded Official Site

Head over to the Express Funded official website and click “Start Challenge.”

#2 Enter Billing Info in Express Funded

Fill out the form with your full name, country, email, and phone number.

#3 Complete Express Funded Payment

Pay the challenge fee to activate your funded account access. Once the transaction is confirmed, you'll receive your login credentials and can immediately begin the trading evaluation.

#4 Express Funded Verification

While the KYC verification will be mandatory for all challenges, at the time of writing this article, only funded accounts with $25K capital or more require you to complete the KYC.

- Proof of Identity: Passport or Driver’s license

- Proof of Address: Utility bill or Bank statement

Evaluation on Express Funded (Rules and Conditions)

To maintain the integrity of their program and ensure traders are ready for live funding, the firm has established specific rules and conditions for their challenges.

While Hedging and EAs are not allowed on Express Funded, you can trade news by adhering to the 5-minute duration rule

While Hedging and EAs are not allowed on Express Funded, you can trade news by adhering to the 5-minute duration rule

Express Funded key challenge rules:

Conditions | 1-Step | 2-Step |

Duration | Unlimited | Unlimited |

Min Trading Days | 8 | 4 / 4 |

Profit Target | 12% | 8% / 5% |

Daily Loss Limit | 3% | 4% / 4% |

Total Drawdown | 8% | 12% / 12% |

Leverage | 1:30 | 1:30 |

Weekend Holding | Allowed | Allowed |

Refund | Yes | Yes |

Does Express Funded Offer Bonus and Promotional Programs?

It’s time to discuss one of the most attractive topics in this Express Funded review. While the firm focuses primarily on providing competitive funding options, it occasionally offers bonuses and promotions to enhance the trading experience.

- Affiliate Program: Earn commissions by referring new traders;

- Seasonal Discounts: Look out for special offers during holidays or trading events (at the time of writing the article, the firm offers a 25% discount code “EFOCT25”).

Express Funded Rules

Just like other Prop Firms, the Express Funded resricts some trading behaviours, while allows some; Key Points of Express Funded Policy:

- VPN & VPS Usage: Traders must maintain the same IP address region throughout Phase 1, Phase 2, and the Master account. Notify support if traveling or changing IP;

- Hedging: Holding opposite positions for extended periods and closing them in short succession is prohibited;

- Expert Advisors (EAs): EAs and HFT bots are not allowed to maintain focus on individual trading skills;

- News Trading: News trading is permitted and encouraged for taking advantage of market opportunities.

VPN & VPS Usage

Traders must ensure they use the same IP address region throughout all phases of the challenge and the Master account. If traveling or your IP address changes, notify support in advance or be prepared to verify your location. This helps maintain the security and integrity of your account.

Hedging Policy

Holding opposite “hedged” positions for an indefinite period and then closing or partially closing them in a short time frame is strictly prohibited. This practice is considered an improper risk management strategy and may lead to account penalties.

Expert Advisor (EA) Usage

Expert Advisors (EAs) and High-Frequency Trading (HFT) bots are not allowed. The program focuses on cultivating individual trading skills, and the use of automated trading systems undermines the personal skill development that the program emphasizes.

Martingale & Arbitrage Strategies

No specific mention of Martingale or Arbitrage strategies is provided on the website. Traders should assume these strategies are either discouraged or not directly supported unless explicitly stated otherwise.

News Trading Policy

News trading is fully permitted, and the platform understands that economic news events can offer valuable trading opportunities. Traders are free to engage in news trading without restrictions, enabling them to take advantage of market movements during high-impact events.

Express Funded Trading Platforms

The firm supports the robust MetaTrader 5 (MT5) trading platform to ensure a seamless trading experience.

MT5 is a multi-asset platform known for its fast execution, comprehensive analytical tools, and support for algorithmic trading, making it a popular choice among both retail and professional traders.

Express Funded is partnered with Eightcap broker, a regulated broker that supports a secure and transparent trading environment.

Available Markets on Express Funded

There is no specific information about the financial instrument on the firm’s website. However, after reaching out to live support, they indicated that trades would gain access to various markets, including Forex, Crypto, and more.

- Currency Pairs

- Indices

- Commodities

- Cryptocurrencies

- Metals

- Stocks

Express Funded Payment Methods

While the firm offers numerous deposit options, it only supports USDT Tether transactions for withdrawals. Available funding options on Express Funded prop firm:

- Credit/Debit Cards

- PayPal

- AfriCheckout (Crypto, Mobile Money, and Bank Transfer)

Commission and Spread on Express Funded Prop Firm

Express Funded, in partnership with KT-Asia LYNX, aims to provide competitive trading conditions. In order to achieve this goal,the firm doesn’t charge any Commissions, swaps, or spreads itself.

However, traders should keep in mind the spreads and swaps charged by KT-Asia LYNX broker, while passing the challenges.

What Educational Resources Are Available on Express Funded?

We must mention the educational materials in this Express Funded review. Two of the co-founders of the prop firm are FX GOAT FOREX TRADING ACADEMY and KOJO FOREX ACADEMY.

Through these institutions, the firm offers exceptional educational courses on various topics, including Currency Trading and Day Trading University, with 24/7 support.

Express Funded Prop Firm on Review Websites

While the firm is relatively new in the prop firm market, early reviews have been generally positive.

27% of the reviews on Express Funded’s TrustPilot profile are negative (1-star rating)

27% of the reviews on Express Funded’s TrustPilot profile are negative (1-star rating)

The Express Funded TrustPilot Score is 3.8 out of 5 (based on 112 reviews).

Express Funded Customer Support

The firm prides itself on providing robust 24/7 customer support to assist traders throughout their journey.

- Email (support@expressfunded.com)

- Live Chat

- Discord Support

- Instagram Support

Express Funded on Social Media

Stay connected with Express Funded and the trading community through their active social media presence. They mostly post new content on their Telegram channel.

- Express Funded Facebook

- Express Funded Discord

- YouTube

- Telegram

Express Funded in Comparison with Other Prop Firms

Here are the differences between Express Funded features and those of other platforms; Express Funded Comparison:

Parameters | Express Funded Prop Firm | Breakout Prop Firm | BrightFunded Prop Firm | Crypto Fund Trader Prop Firm |

Minimum Challenge Price | $24 | $50 | €55 | $55 |

Maximum Fund Size | $1,000,000 | $2,000,000 | Infinite | $200,000 |

Evaluation steps | 1-phase, 2-phase | 1-Step, 2-Step | 2-Step | 1-phase, 2-phase |

Profit Share | Up to 90% | 90% | 100% | 80% |

Max Daily Drawdown | 4% | 4% | 5% | 4% |

Max Drawdown | 12% | 6% | 8% | 6% |

First Profit Target | 8% | 5% | 10% | 8% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | 5 Days |

Maximum Leverage | 1:30 | 1:5 | 1:100 | 1:100 |

Payout Frequency | Bi-Weekly | Bi-weekly | 14 Days | 2 Times a Month |

Number of Trading Assets | N/A | 100+ | 150+ | 200+ |

Trading Platforms | MT5 | Proprietary platform | Proprietary platform | Metatrader 5, CFT Platform and Crypto Futures |

Expert Suggestions

Express funded offers funded accounts ranging from $5K to $100K with scaling options up to $1,000,000. The company has a great trust score of 3.8/5 on TrustPilot.

Express Funded prop firm has partnered with KT-Asia LYNX (Brokerage Company) and FX GOAT ACADEMY. The lack of transparency regarding the firm’s background and fee structure, alongside the minimum trading period of 8 days are the main weaknesses in this Express Funded review.