FTMO Rules establish clear guidelines on time limits, news trading, overnight positions, and real market conditions to ensure fair trading. Traders must hold positions for at least 4 days in the evaluation phase, with no restrictions on trade timing.

News trading is unrestricted in the Challenge phase, but has a 2-minute restriction for FTMO Account holders before and after key reports like NFP, CPI, and FOMC.

FTMO Rules Overview

To maintain the integrity and consistency of its trading environment, FTMO Prop Firm has some regulations. FTMO Prop Trading Rules:

- Challenge Rules

- Time Limits

- News Trading

- Positions Overnight and Over Weekends

- Trading According to a Real Market

FTMO Challenge Rules

FTMO has one of the simplest challenge rules among prop firms, allowing traders to buy an evaluation that best suits their needs and trading styles.

Parameters | 2-Step Challenge |

Step 1 Profit Target | 10% |

Step 2 Profit Target | 5% |

Maximum Drawdown | 10% |

Maximum Daily Drawdown | 5% |

if these challenge conditions meet your expectations, you can check the prop discount code page and buy FTMO evaluations with discounted prices.

FTMO Rules for Time Limits

One of the essential FTMO rules is related to the time limit for holding trades.

- Minimum Trading Period: Traders must hold positions for at least 4 days during the evaluation phase;

- Flexibility: There’s no restriction on the time for holding positions, but all trades should be executed within market hours.

FTMO Rules for News Trading

FTMO allows news trading, but it comes with specific guidelines; FTMO News Trading Rules:

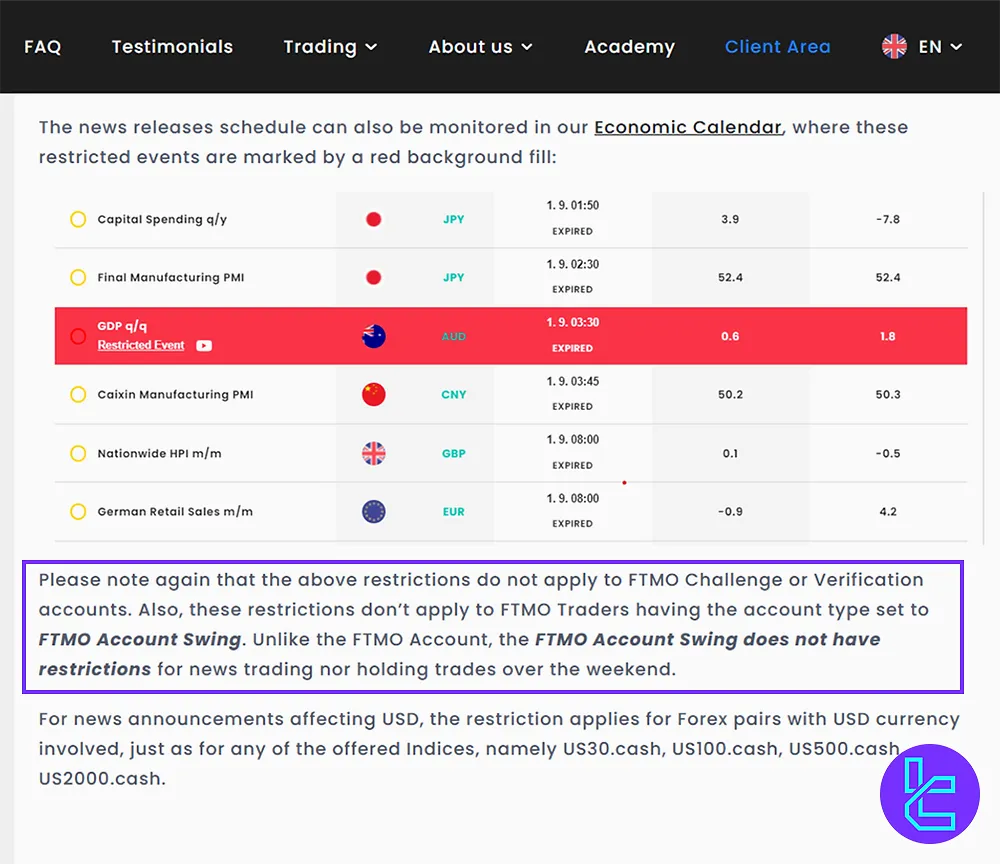

- FTMO Challenge and Verification accounts have no restrictions for news trading;

- After passing the Evaluation Process, FTMO Account traders must follow news trading restrictions for certain instruments;

- Restrictions apply 2 minutes before and after key news releases for targeted instruments (e.g., USDJPY, GBPUSD;)

- Non-targeted instruments (e.g., EURGBP, AUDNZD) can be traded normally during restricted news events;

- FTMO Account swing traders are exempt from news trading restrictions and can hold trades over the weekend.

FTMO Positions Overnight and Weekends

Generally, the firm allows positions to be held overnight and over the weekends; FTMO rules for funded accounts on overnight and weekend holding:

- In FTMO Challenge and Verification, you can keep positions open overnight and over the weekend;

- FTMO Traders with a Funded Account must close positions before the market closes for the weekend or if the rollover exceeds 2 hours;

- Market hours for each asset class and instrument can be checked on the trading platforms, or the Symbols sit;

- Trading hours may change due to holidays or other events, and updates are announced in the Trading Updates section;

- FTMO Account Swing traders are exempt from closing positions before weekends or adhering to news trading restrictions.

FTMO Trading According to a Real Market

One of the key policies of FTMO is that all trading must be conducted under real market conditions; FTMO Real Market Conditions:

- Trading strategies must align with legitimate market practices and cannot misuse the FTMO Evaluation Process or FTMO Account;

- Familiarize yourself with FTMO Terms & Conditions, particularly clause 5.4, which outlines forbidden trading practices;

- All FTMO trading is simulated with fictitious capital, and proper risk management is required, as it mimics real market conditions.

FTMO Allowed Strategies and Instruments

FTMO supports a wide range of trading strategies, provided they comply with the firm’s risk management policies. Allowed Instruments and Strategies in FTMO:

- Forex: Traders can use any major, minor, or exotic forex pairs for trading;

- CFDs: Contracts for difference (CFDs) on indices, commodities, and stocks are allowed;

- No Restrictions on Strategy: There are no restrictions on trading strategies as long as risk management protocols are followed;

- Automated Trading: Traders can use Expert Advisors (EAs), but they must adhere to FTMO’s trading rules regarding drawdown limits and timeframes.

Now that you are fully aware of the rules and trading conditions, you can begin your FTMO registration by following a 3-step process.

Writer’s Opinion and Conclusion

As FTMO Rules say, the firm mandates real market trading, prohibiting forbidden practices (Clause 5.4), and only allows Forex, CFDs, and EAs while enforcing strict risk management rules.

Overnight and weekend positions are allowed in the Challenge phase, but must be closed on funded accounts if the rollover exceeds 2 hours. Swing Traders are exempt from these restrictions. For more informative articles, check the FTMO Tutorials page.