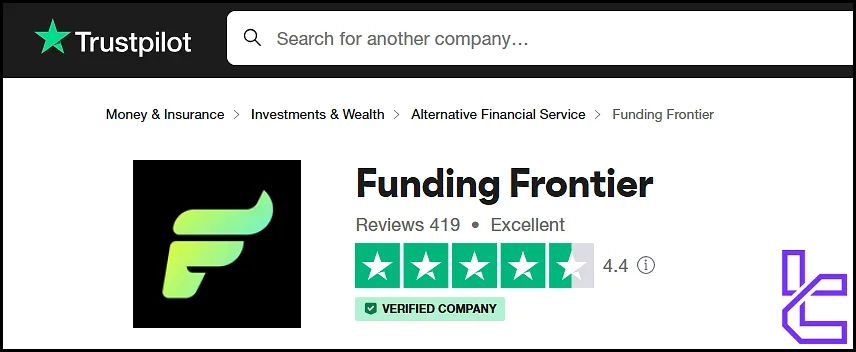

95% profit split and $200,000 capital without any time limit are just some of the features of Frontier Funding Prop Form. This Emirati company has paid more than $1M to traders in less than a year and has a trust score of 4.4/5 in Trustpilot.

With a growing user base of over 12,400 active traders from more than 50 countries, Funding Frontier is attracting attention for its competitive profit targets, flexible funding programs, and support for over 50 tradable assets including Forex, indices, commodities, stocks, and cryptocurrencies.

Funding Frontier Prop Firm Introduction

Funding Frontier is a relatively new player in the prop firm arena, but it's quickly making waves with its trader-friendly policies and innovative approach. Founded by “Zain Omar” and “Keashif Beyg”, this UAE-based firm offers aspiring traders the chance to manage accounts ranging from $5,000 to $200,000.

What sets Funding Frontier apart from other prop firms?

- No time limits on challenges

- Competitive profit targets

- Access to a wide range of tradable assets

- Up to 95% profit split for funded traders

- Support for popular trading platforms like MetaTrader 5 and cTrader

Funding Frontier caters to traders from various nationalities, including Europe, North America, South America, Africa, Asia, Australia, and New Zealand. However, traders from Syria, North Korea, Cuba, and Iran are excluded due to regulatory restrictions.

Funding Frontier CEO

Zain Omar is the CEO of Funding Frontier, openly presenting himself as the firm’s chief executive across his social media presence, especially on X (Twitter), where he actively posts about prop trading, trader development, and updates related to the company.

Based on the Zain Omar Twitter page, he is positioned as the public face of Funding Frontier, frequently discussing industry trends, firm improvements, and trader success stories.

Zain Omar’s branding focuses on transparency, trader empowerment, and building a modern prop-firm environment. His activity suggests a hands-on leadership style, being directly involved with the community, and positioning the firm as a competitive player in the global prop-trading space.

Summary of Specifications

Here's a quick overview of what Funding Frontier brings to the table in order to compete with other firms:

Account Currency | USD |

Minimum Price | $49 |

Maximum Leverage | 1:15 |

Maximum Profit Split | 95% |

Instruments | Forex, Indices, Commodities, Stocks, Cryptocurrencies |

Assets | +50 |

Evaluation Steps | 1-Step, 2-Step, 3-Step, Flex Pass |

Withdrawal Methods | Credit/Debit Card, Crypto, PayPal |

Maximum Fund Size | $200k [Scalable Up to $400k] |

First Profit Target | 5% |

Max. Daily Loss | 5% |

Challenge Time Limit | Unlimited |

News Trading | Allowed |

Maximum Total Drawdown | 10% |

Trading Platforms | MetaTrader 5, Match Trader |

Commission Per Round Lot | $3.5 |

Trustpilot Score | 4.4/5 |

Payout Frequency | Bi-weekly |

Established Country | UAE |

Established Year | 2024 |

What Are the Advantages and Disadvantages of Funding Frontier?

Like any prop firm, Funding Frontier has its strengths and weaknesses. Let's break them down:

Advantages | Disadvantages |

Multiple Account Sizes to Suit Different Trader Needs | Geographical Advantage For UAE-Based Traders (Indoor Meetings) |

Realistic And Achievable Profit Targets | Profit Split Could Potentially Be More Competitive |

Wide Range of Tradable Instruments | Lack Of MetaTrader 4 Support |

Transparent Rules and Challenge Structure | - |

Up To $400k Scaling Plan | - |

Monthly Promo Code | - |

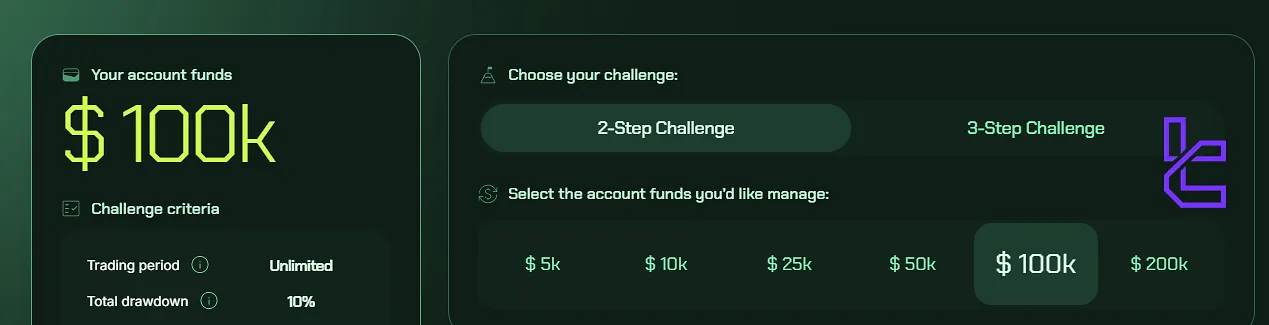

Funding Frontier Challenges Funding and Price

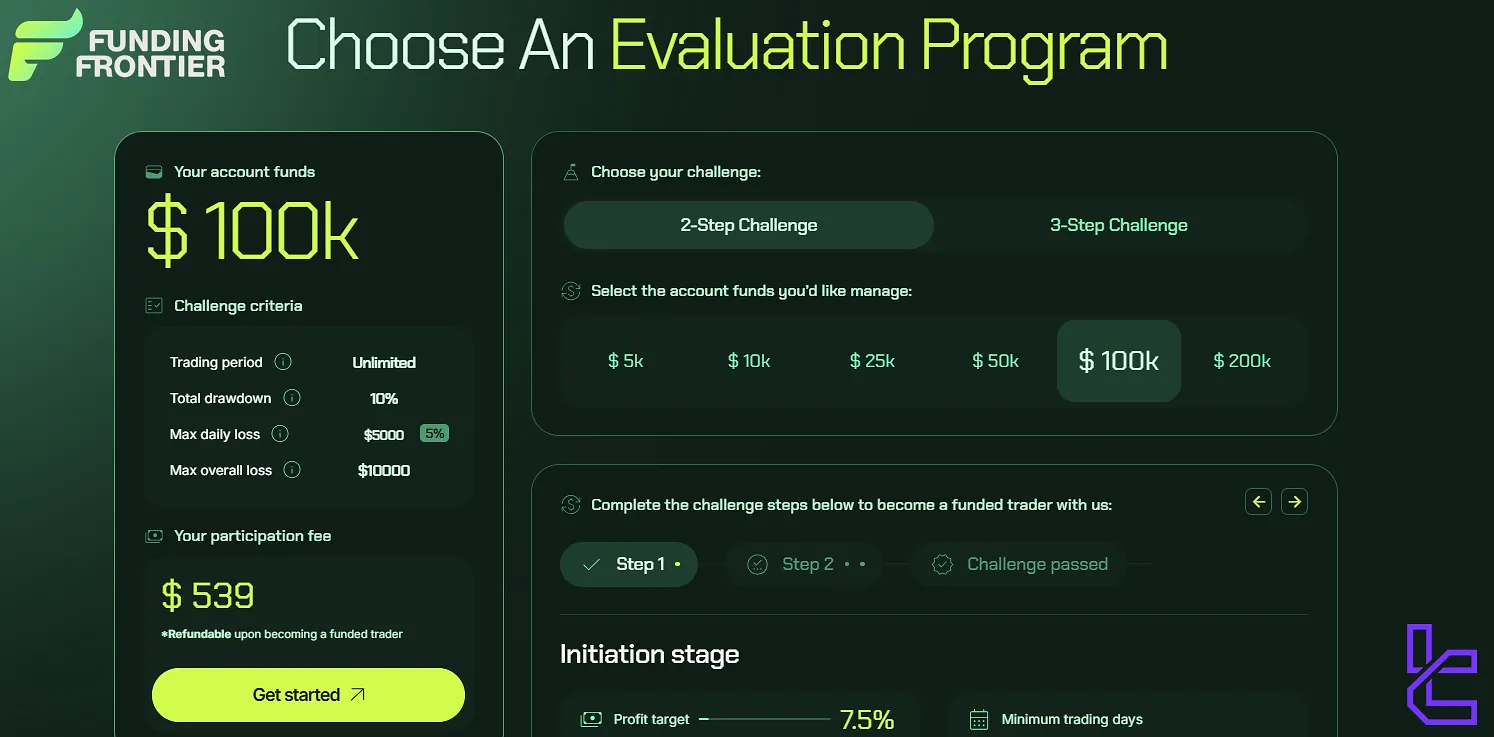

Funding Frontier offers a range of account sizes [From $5k to $200k] to cater to different trader experience levels, and each account has its own price that you should pay.

Funding Frontier Prop Firm Funding and Price:

Evaluation Type | Instant Funding | 1-Step | 2-Step | 3-Step | Flex Pass |

$5,000 | $198 | $55 | $55 | $49 | - |

$10,000 | $398 | $105 | $105 | $89 | $10/Phase |

$25,000 | $898 | $210 | $210 | $179 | $10/Phase |

$50,000 | $1898 | $329 | $329 | $249 | $10/Phase |

$100,000 | - | $539 | $539 | $389 | $10/Phase |

$200,000 | - | - | $1050 | - | - |

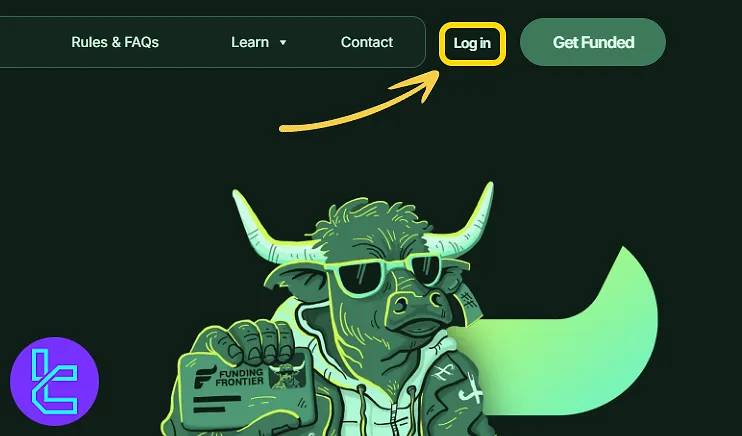

How to Open an Account and Verify it in Funding Frontier

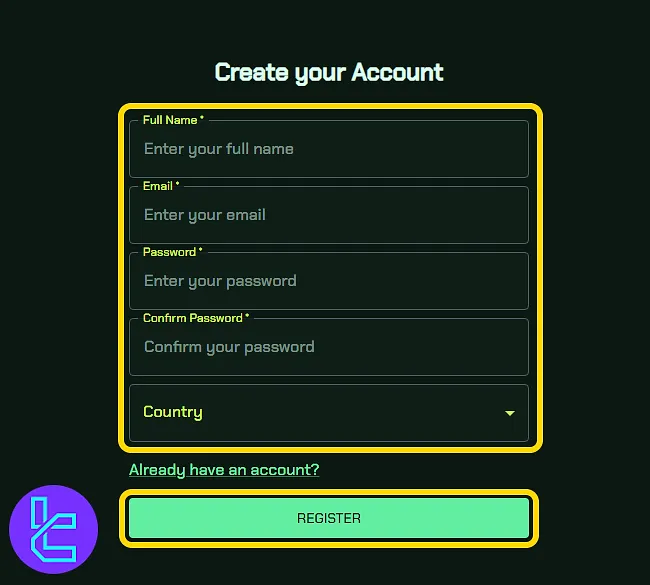

Creating a new prop trading account with Funding Frontier is straightforward and requires only a few simple steps. Funding Frontier registration:

#1 Visit the Platform & Begin Registration

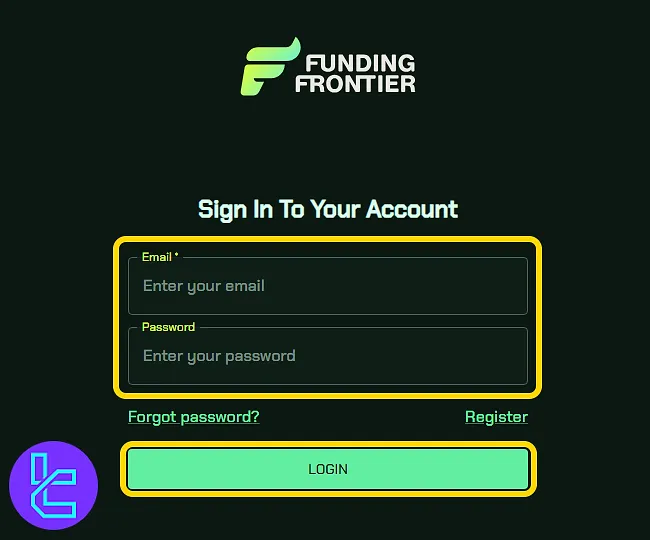

Go to the official Funding Frontier website and click on "Log in". On the login page, select "Register" to initiate the account creation.

#2 Complete the Sign-Up Form

Fill out the form by entering your first and last name, email address, country of residence, and set a secure password. No phone or email verification is needed.

#3 Access Your Trading Dashboard

After submitting the form, return to the login page, enter your credentials, and you’ll be directed to your personal dashboard, where you can view rules and explore available funding programs.

#4 Verify Your Account

After choosing your evaluation and passing it, traders must verify their identity to cash out their profits. Although this process is not specified, it requires you to upload documents verifying your identity and address.

What Challenges Are Offered by Funding Frontier?

Each evaluation has its own set of profit targets, daily, and overall drawdown limits.

Funding Frontier challenge conditions:

Evaluation Type | Instant Funding | 1-Step | 2-Step | 3-Step | Flex Pass |

Profit Target | - | 9.5% | 7.5% / 5% | 5% / 4% / 3% | 9% / 6% |

Maximum Daily Drawdown | 4% | 4% | 5% | N/A | 4% |

Maximum Total Drawdown | 8% | 6% | 10% | 5% | 10% |

Minimum Trading Days | 3 Days | 3 Days | 3 Days | 3 Days | N/A |

Maximum Trading Days | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited |

Profit-Split | Up to 95% | Up to 90% | Up to 90% | Up to 90% | 100% First Payout |

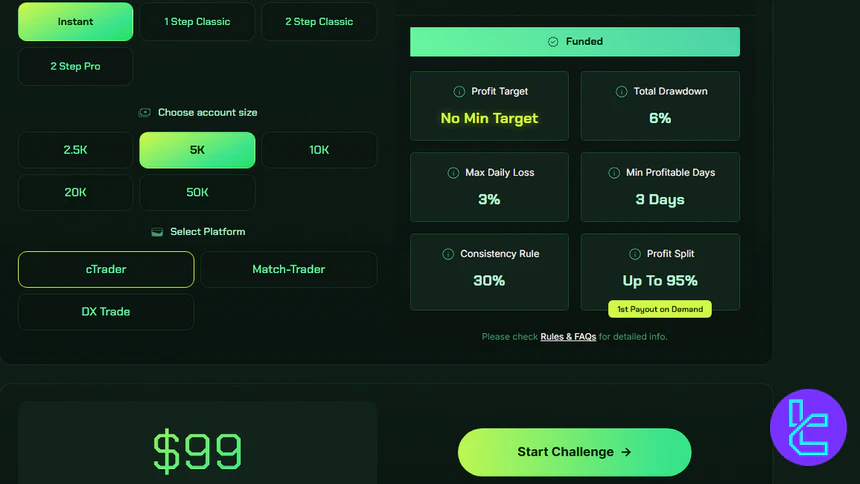

Instant Funding Plan

The Instant Funding Plan is designed for traders who want fast access to capital with clear, structured rules.

Offering account sizes from $2,500 to $50,000, the plan maintains consistent risk management across all levels, including a 6% total drawdown, 3% maximum daily loss, and a 30% consistency requirement.

Traders can start earning a profit split of up to 95% once the minimum profitable days and consistency criteria are met, making it a streamlined option for both new and experienced traders seeking immediate funding opportunities. Here are the details:

Parameters / Account Size | 2.5K | 5K | 10K | 20K | 50K |

Total Drawdown | 6% | 6% | 6% | 6% | 6% |

Max Daily Loss | 3% | 3% | 3% | 3% | 3% |

Min Profitable Days | 3 Days | 3 Days | 3 Days | 3 Days | 3 Days |

Consistency Rule | 30% | 30% | 30% | 30% | 30% |

Profit Split | Up to 95% | Up to 95% | Up to 95% | Up to 95% | Up to 95% |

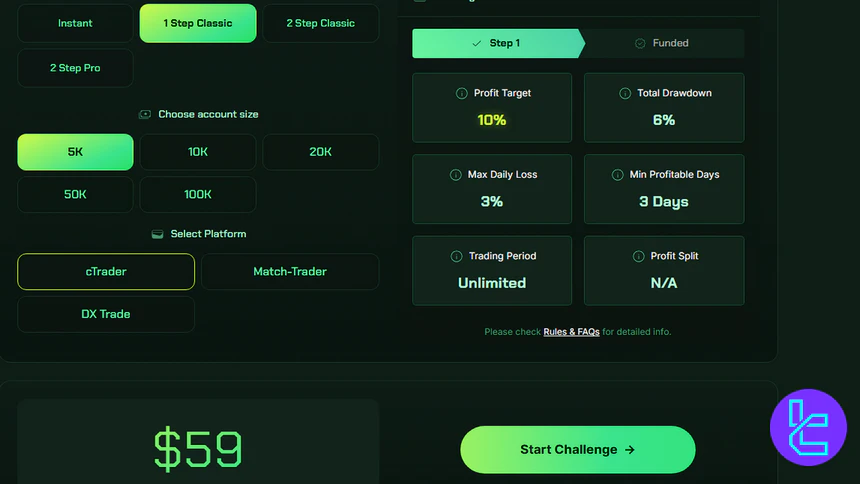

1 Step Classic Plan

The 1-Step Classic Plan is designed for traders who want a fast and straightforward route to a funded account.

With just a single evaluation step, clear rules for daily loss, total drawdown, and minimum profitable days, this plan allows traders to focus on their strategy without unnecessary complexity.

Once the criteria are met, traders gain access to an 80% profit split, making it an attractive option for those confident in their trading skills. Here’s an overview:

Parameters/ Steps | Step 1 | Funded |

Profit Target | 10% | Unlimited |

Max Daily Loss | 3% | 3% |

Trading Period | Unlimited | Unlimited |

Total Drawdown | 6% | 6% |

Min Profitable Days | 3 Days | None |

Profit Split | N/A | 80% |

2 Step Classic Plan

The 2-Step Classic Plan provides a gradual, structured path to funding, ideal for traders who prefer a step-by-step approach.

With two evaluation stages, traders can demonstrate both consistency and effective risk management before reaching the funded account.

The plan maintains transparent rules for daily loss, total drawdown, and minimum profitable days, and rewards successful traders with an 80% profit split at the funded stage. Here are the details:

Parameters/ Steps | Step 1 | Step 2 | Funded |

Profit Target | 9% | 6% | Unlimited |

Max Daily Loss | 4% | 4% | 5% |

Trading Period | Unlimited | Unlimited | Unlimited |

Total Drawdown | 10% | 10% | 10% |

Min Profitable Days | 3 Days | 3 Days | 3 Days |

Profit Split | N/A | N/A | 80% |

2 Step Pro Plan

The 2-Step Pro Plan is tailored for advanced traders seeking a more challenging evaluation.

Featuring tighter profit targets and stricter drawdown limits across two steps, this plan emphasizes disciplined trading and careful strategy execution.

By successfully completing the steps, traders earn access to a funded account with an 80% profit split, while honing their skills under a structured, professional trading framework. Let’s check out the details:

Parameters/ Steps | Step 1 | Step 2 | Funded |

Profit Target | 7.5% | 5% | Unlimited |

Max Daily Loss | 3% | 5% | 3% |

Trading Period | Unlimited | Unlimited | Unlimited |

Total Drawdown | 8% | 8% | 8% |

Min Profitable Days | 3 Days | 3 Days | 3 Days |

Profit Split | N/A | N/A | 80% |

Bonuses and Discounts

Funding Frontier does offer various bonuses and discounts:

- Monthly Promo Code: Use "TRIPLE15" for a 15% discount, 15% Phase 2 Profit Split, and 115% Refund

- Exclusive Discounts:30% off Magic Keys trade management tool and MT5 simulator software for traders with $50,000+ evaluations

Funding Frontier Rules

To provide a safe trading environment for all traders with various trading styles and strategies, Funding Frontier has clear policies and conditions that traders must adhere to. Funding Frontier rules:

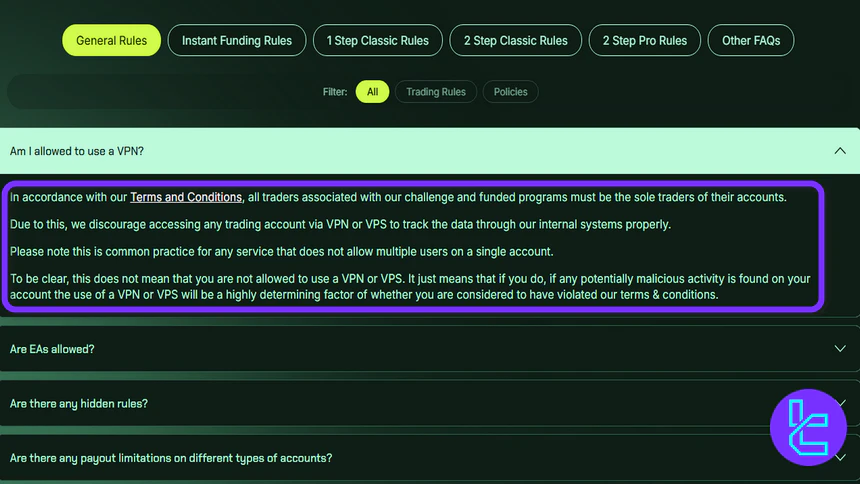

- VPN and VPS Usage: VPN/VPS use is allowed, but may be scrutinized for malicious activity, and IP discrepancies can lead to violations;

- Hedging Conditions: Doesn't provide information regarding the usage of hedge strategies;

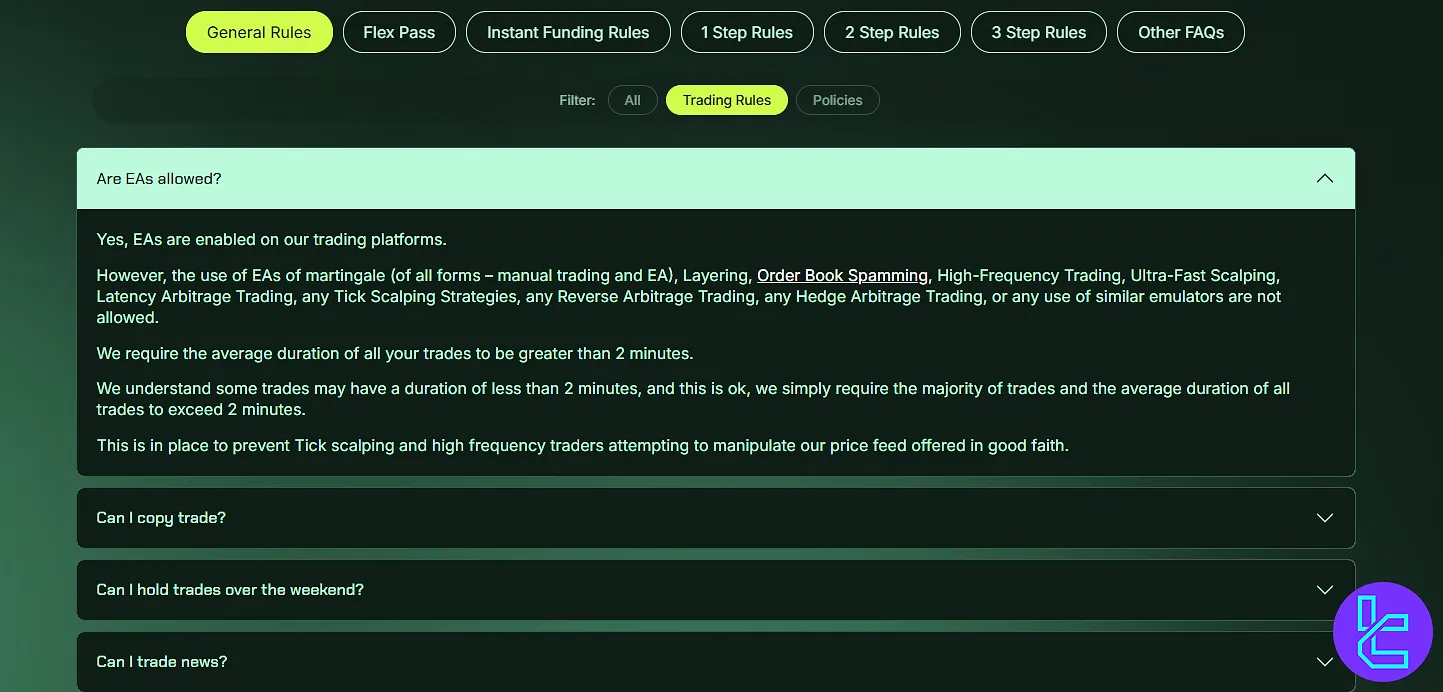

- Expert Advisors (EA): EAs are permitted;

- Gambling & Risky Strategies: Accounts must be traded individually, and strategies like Martingale, High-Frequency Trading, and Arbitrage are banned;

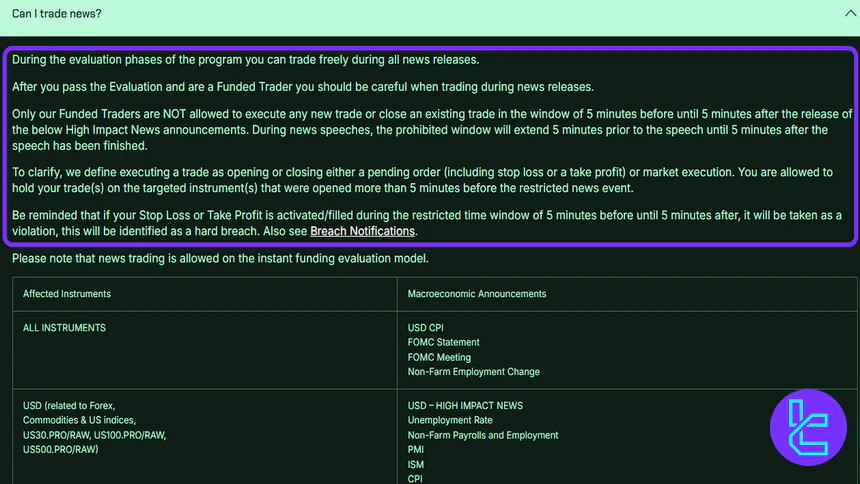

- News Trading: News trading is unrestricted during evaluation, but Funded Traders must avoid opening or closing trades within 5 minutes before or after high-impact news releases;

- Payouts: You can request your first payout immediately on demand once funded-phase objectives are met, with subsequent payouts every 14 days. Each plan requires a few profitable days and consistency to qualify for expedited payout processing.

IP Changing Tools Usage Guidelines

As outlined in the Terms and Conditions, all traders participating in our challenge and funded programs must be the sole users of their accounts. This policy is standard for services that do not allow multiple users on a single account. However, the use of a VPN or VPS will be considered a determining factor if any potentially malicious activity is detected on your account.

Is Hedging Allowed?

The prop firm doesn't provide detailed information regarding the use of hedge strategies. We strongly recommend that you verify this with the support team.

EA Usage Conditions

Expert Advisors (EAs) are supported on trading platforms. However, the use of certain EAs is prohibited. Specifically, the following strategies are not allowed:

- Martingale strategies (whether manual or via EA)

- Layering

- Order Book Spamming

- High-Frequency Trading

- Ultra-Fast Scalping

- Latency Arbitrage Trading

- Tick Scalping Strategies

- Reverse Arbitrage Trading

- Hedge Arbitrage Trading

The platform requires that the average duration of your trades be greater than 2 minutes. While some trades may last less than 2 minutes, the majority of your trades must meet this duration to prevent high-frequency trading tactics that aim to manipulate our price feed.

Prohibited Strategies

Each evaluation account must be traded individually. Copying trades (whether manually or via EA) from one account to another is strictly prohibited. All accounts and trades must be carried out by the trader whose name is on the account, and account management services are not allowed.

The following trading strategies are prohibited:

- Martingale

- High-frequency trading

- Arbitrage

News Trading Rules

During the evaluation phase of the program, you are free to trade during all news releases.

Once you pass the Evaluation and become a Funded Trader, special restrictions apply. Funded traders are not allowed to open or close trades within the 5-minute window before or after high-impact news releases. This includes any market execution or pending order activities (e.g., stop loss or take profit).

The restricted time window extends to 5 minutes prior to and 5 minutes after news speeches as well. Trades opened more than 5 minutes before the news release are allowed, but if a stop loss or take profit is activated during the restricted time, it will be considered a violation. Note that news trading is allowed during the instant funding evaluation model.

Funding Frontier Payouts

Funding Frontier offers fast and flexible payout options for traders who reach their funded-phase objectives. Your first payout can be requested immediately on demand once you meet the specific requirements for your plan. After that, payouts are processed every 14 days, ensuring consistent and reliable access to your earnings.

Each plan has clear objectives to qualify for a payout on demand:

- Instant Funding Plan: Must meet the 20% consistency rule and have 3 profitable days of at least 0.5% each;

- 1-Step Classic Plan: Must have 3 profitable days of at least 1% each;

- 2-Step Classic Plan: Must have 3 profitable days of at least 0.5% each;

- 2-Step Pro Plan: Must have 3 profitable days of at least 0.5% each.

Failure to meet these criteria will make a trader ineligible for payout on demand, so it’s crucial to ensure full compliance with plan requirements.

With these structured rules, Funding Frontier combines speed, transparency, and reliability in its payout process, giving traders confidence and control over their profits.

What Are Funding Frontier Trading Platforms?

Funding Frontier supports multiple popular trading platforms:

- MetaTrader 5 (MT5): A versatile platform with advanced charting tools and automated trading capabilities;

- Match-Trader: A newer platform gaining popularity for its modern design and features.

Traders can choose the platform that best suits their trading style and preferences.

What Instruments Are Available to Trade in the Funding Frontier Prop Firm?

In this section of “Funding Frontier review” we will reach out to its trading instruments; FF offers over 50 assets from the instruments below:

- Forex: Major, minor, and exotic currency pairs

- Indices: Global stock market indices

- Commodities: Gold, silver, oil, and more

- Stocks: Stocks from major global exchanges

- Cryptocurrencies: Bitcoin, Ethereum, and other popular digital assets

This wide selection allows traders to diversify their strategies and take advantage of various market opportunities.

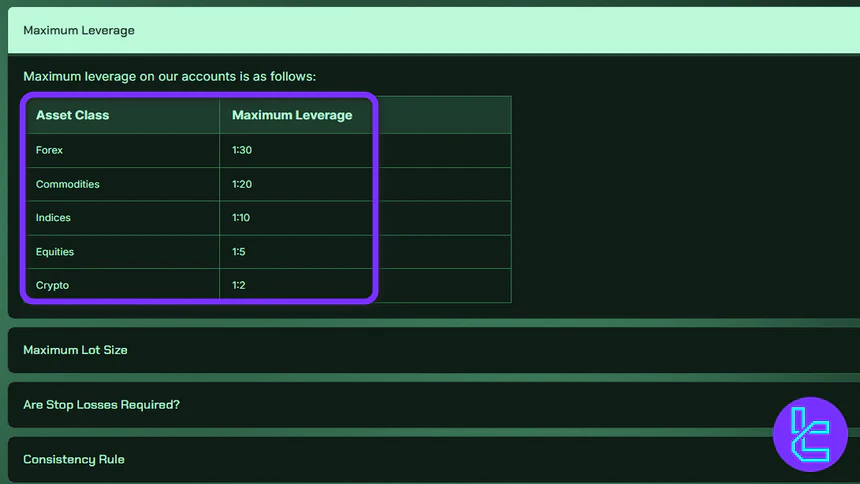

Funding Frontier Leverage

Funding Frontier provides traders with flexible leverage options tailored to different plans and asset classes. For the Instant Funding Plan, maximum leverage ranges from 1:30 on Forex down to 1:2 on crypto, giving traders controlled exposure while managing risk.

For the 1-Step Classic, 2-Step Classic, and 2-Step Pro plans, Forex leverage increases to 1:50, while other asset classes remain the same, allowing traders to amplify positions on more liquid markets while maintaining strict risk management across commodities, indices, equities, and crypto.

This structured approach ensures that traders have the right balance of opportunity and protection, making Funding Frontier suitable for both aggressive and disciplined trading strategies. Here is an overview:

Plan / Asset Class | Forex | Commodities | Indices | Equities | Crypto |

Instant Funding Plan | 1:30 | 1:20 | 1:10 | 1:5 | 1:2 |

1-Step Classic / 2-Step Classic / 2-Step Pro Plans | 1:50 | 1:20 | 1:10 | 1:5 | 1:2 |

What Payment Options Are Available?

Funding Frontier provides 3 payment options for both deposits and withdrawals. Funding Frontier Payment Methods:

- Credit/Debit Cards

- PayPal

- Cryptocurrency

The firm processes payouts bi-weekly after your first profitable trade, ensuring a smooth and timely payment process for successful traders.

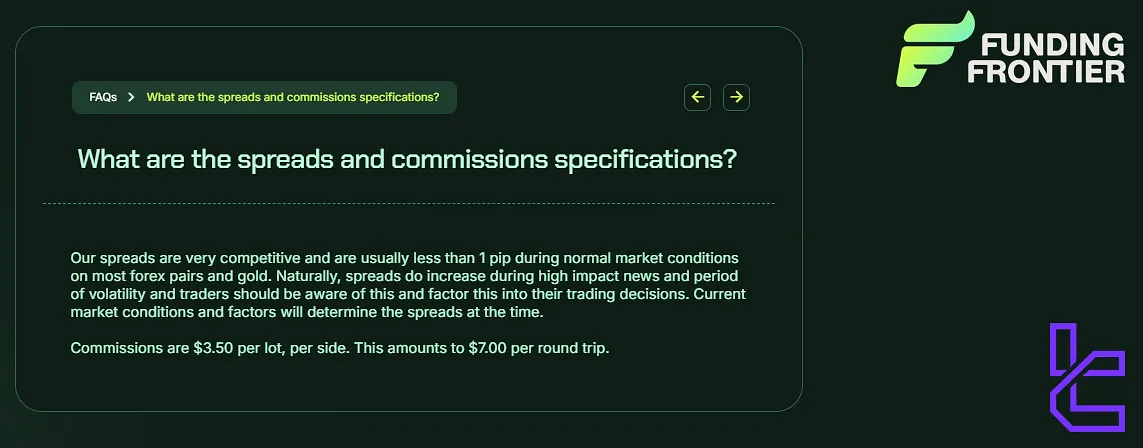

Commissions and Costs

Funding Frontier maintains a transparent and competitive fee structure that you can see in the bullet points below:

- Challenge Fees: Range from $49 to $945, depending on account size and challenge type

- Commission: $3.50 per lot, per side ($7 for a round trip)

- Spreads: Competitive, typically less than 1 pip on major forex pairs

- Refund Policy: Up to25% of the registration fee back upon achieving funded account status

Does Funding Frontier Offer Any al Resources?

Funding Frontier has an extensive educational section called “Learn”, and they provide some resources to help traders:

- Blog: Articles covering trading strategies, market analysis, and prop firm tips;

- Videos: Tutorial videos on platform usage and challenge rules.

Traders looking for more comprehensive educational content may need to supplement with external resources.

Trust Scores

The overall rating of 4.4 out of 5 stars [over 410 reviews] on the Funding Frontier Trustpilot page shows that traders have been satisfied with the prop firm's services. Key points from reviews include:

- Helpful and responsive support team

- Transparent trading guidelines

- Smooth payout process

- Fair challenge system

Some negative reviews mention account breaches and delayed support responses, but these appear to be in the minority.

Customer Support: Working Hours and Channels

Funding Frontier support team is available Monday to Friday, 05:30 AM to 8 PM [GMT+4,] and you can contact them via multiple channels:

Support Method | Availability |

Live Chat | Yes |

No | |

Phone Call | No |

Discord | No |

Telegram | No |

Ticket | Yes |

FAQ | Yes |

Help Center | No |

No | |

Messenger | No |

The firm aims to provide timely and helpful assistance to traders, though some reviews suggest there's room for improvement in response times.

Funding Frontier User Base

Funding Frontier has built a diverse global community of traders, with users spanning multiple continents. The largest portion of the user base comes from India (56.57%), followed by the United Kingdom (12.83%), the United States (10.81%), Vietnam (7.70%), and Pakistan (6.50%).

This international presence reflects the firm’s wide appeal and accessibility, making it a popular choice for traders seeking reliable funding solutions across Asia, Europe, and North America.

Funding Frontier on Social Media

In the Funding Frontier review, we discovered that this prop firm maintains an active presence on social media platforms, engaging with both positive and negative reviews; Funding Frontier Prop Firm Social Media Channels:

Social Media | Members/Subscribers |

10 binin üzerinde | |

18.7 binden fazla | |

2,8 binden fazla | |

6 binin üzerinde |

Funding Frontier in Comparison with Other Prop Firms

To help you better understand the pros and cons of trading with Funding Frontier, let's compare it to other prop firms.

Parameters | Funding Frontier Prop Firm | |||

Minimum Challenge Price | $49 | $33 | $39 | $49 |

Maximum Fund Size | $200,000 | $400,000 | $4,000,000 | $1,500,000 |

Evaluation steps | 1-Step, 2-Step, 3-Step, Flex Pass | 1-Step, 2-Step, 3-Step, Instant Funding | 1-Step, 2-Step, 3-Step | 1-Step, 2-Step |

Profit Share | 95% | 100% | 100% | 90% |

Max Daily Drawdown | 5% | 7% | 5% | 4% |

Max Drawdown | 5% | 14% | 10% | 8% |

First Profit Target | 10% | 6% | 5% | 6% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:15 | 1:100 | 1:100 | 1:125 |

Payout Frequency | Bi-weekly | Weekly | Bi-weekly | 14 Days |

Number of Trading Assets | 50+ | 40+ | 3000+ | 130 |

Trading Platforms | MetaTrader 5, Match Trader | MetaTrader 5, Match Trader | Metatrader 5 | DXTrade, TradeLocker, cTrader |

TradingFinder Expert Suggestions

Funding Frontier has provided services to more than 12,400 active traders and allows them to trade over 50 assets. News trading and EAs are allowed in this prop, and payouts are done bi-weekly. On the other hand, the lack of 24/7 support is a serious issue.