Fuze Traders is a prop firm with a maximum fund size of $100K and a minimum of 5 trading days. The company evaluates traders in a 2-step model.

Fuze Traders has received a trust score of 4/5 with 10+ reviews on the Trustpilot website.

Company Overview and Specifics

Fuze Traders Sàrl is headquartered in Rolle, Switzerland. This company is backed by investment holding and advisory firm Guru Capital SA. Note that this prop firm is still relatively new, being established in 2023.

Summary of Features

Traders compare prop firms based on several common parameters. In the table below, we will take a look at these related to Fuze Traders:

Account Currency | USD |

Minimum Price | $100 |

Maximum Leverage | 1:30 |

Maximum Profit Split | 80% |

Instruments | CFDs on Forex, Metals, Stock Indices, and Energy Sources |

Assets | Not Specified |

Evaluation Steps | 2-Step |

Withdrawal Methods | Not Specified |

Maximum Fund Size | $100K |

First Profit Target | 10% |

Max. Daily Loss | Starting From 5% |

Challenge Time Limit | Unlimited |

News Trading | Allowed |

Maximum Total Drawdown | Starting From 10% |

Trading Platforms | Metatrader 5 |

Commission Per Round Lot | Not Specified |

Trustpilot Score | 4.0/5 |

Payout Frequency | On-Demand |

Established Country | Switzerland |

Established Year | 2023 |

Pros And Cons

By looking at the advantages and disadvantages side-by-side, we can have a balanced perspective of a firm. Pros and Cons in Trading With Fuze Traders:

Pros | Cons |

Multiple Asset Classes | Low Maximum Funding |

Advanced Trading Platform | Limited Educational Resources |

On-Demand Payouts | Potential For High-Pressure Environment |

Company Transparency | - |

Funding & Price On Fuze Traders

Fuze Traders offers a 2-step challenge program with pricing based on the selected funding size. The fees are as follows:

- $10,000 account: $100

- $25,000 account: $160

- $50,000 account: $338

- $100,000 account: $550

These are one-time, non-refundable evaluation fees. Fuze Traders does not currently provide a free trial or free repeat option for failed challenges, which may be a limitation for some users.

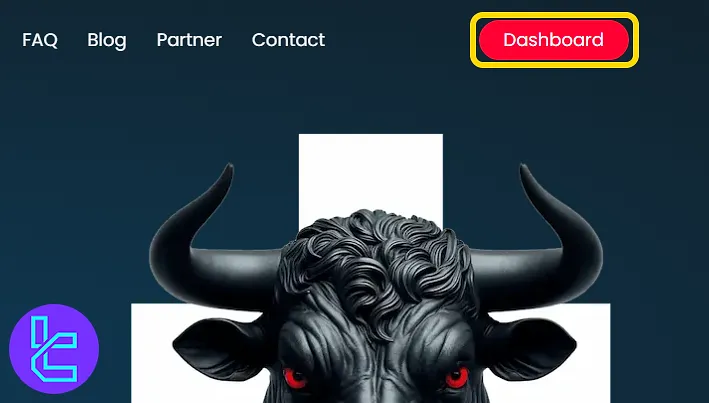

Account Opening and Verification Guide

To begin using this prop firm's services, traders must complete the Fuze Traders registration process, which includes:

#1 Access the Fuze Trader's Registration Page

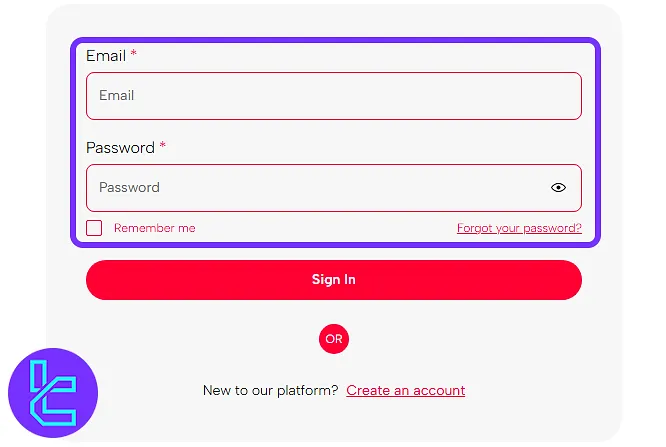

Visit the official Fuze Traders website and select “Dashboard” from the homepage. Click “Create an Account” on the login screen to begin the sign-up process.

#2 Submit Your Details

Complete the form with your name, email, username, phone number, and country. Choose a strong password, accept the terms, and hit “Register”.

#3 Access the Dashboard

Log in using your email and password to reach your personal dashboard. You’re now ready to explore challenges and trading rules inside your Fuze Traders account.

To access withdrawals, Fuze Traders requires users to verify their accounts by providing the necessary documents, including proof of address and identity.

Evaluation Programs

Most prop firms provide programs in different step counts, but FT employs only 2-step evaluation models, which will be discussed in this section in detail. Two-Step Challenge in Fuze Traders:

Funding Size | $10k | $20k | $30k | $40k | $50k | $60k | $70k | $80k | $90k | $100k |

Profit Target | 10-8% | |||||||||

Max. Total Drawdown | 10-8% | |||||||||

Max. Daily Loss. | 5-4% | |||||||||

Min. Trading Days | 5 | |||||||||

Time Limit | Unlimited | |||||||||

Min. Profit Split | 75% | |||||||||

Drawdown Type | Trailing | |||||||||

Fee | $100 | $160 | $225 | $280 | $338 | $390 | $438 | $480 | $518 | $550 |

Fuze Traders' public evaluation plans provide a maximum funding size of $100,000. Although the firm lists capital sizes as high as $200,000, these likely involve direct negotiations or separate scaling paths, not standard challenge accounts. Therefore, the effective cap for most users is $100,000.

Fuze Traders imposes no strict time limits on its evaluation phases, allowing traders to complete the challenge at their own pace. While some tiers recommend a minimum of 5 trading days, others may enable zero-day completions, depending on the account size. This flexibility suits both active and methodical trading styles.

Are There Any Bonuses And Promotions With Fuze Traders?

The prop firm does not offer specific bonuses or promotions as of the latest information. The firm focuses on providing a fair and reliable evaluation process rather than incentivizing traders with additional perks.

Trading Rules and Conditions

Fuze Traders has set some ground rules and conditions to create a safe trading environment for all traders. Fuze Traders rules:

- Trading Strategies & Expert Advisors (EAs): Allows the use of all trading strategies and Expert Advisors (EAs);

- News Trading: News-based strategies are allowed. However, traders should be cautious when executing trades around high-impact news events;

- Country Restrictions: Fuze Traders has a set of countries that are not permitted to participate in their program.

VPN and VPS Conditions

Fuze Traders doesn't prohibit the use of VPNs and VPS on its platform. However, Traders residing in countries listed below arent allow to use the prop firm services, even by changing their IP via VPN.

- Afghanistan

- Algeria

- Belarus

- Congo

- Iran

- Iraq

- Kenya

- Libya

- Myanmar

- North Korea

- Russia

- Somalia

- Sudan

- Syria

- USA & Territories (including American Samoa, Guam, Puerto Rico, USVI)

- Venezuela

- Yemen

Hedging

Fuze Traders allows various trading strategies, including hedging on its funded accounts.

Expert Advisors (EAs)

Fuze Traders doesn't impose any restrictions on the use of Expert Advisors, which traders can use to increase their profit rate.

Arbitrage and Martingale

As discussed earlier, traders can use various trading strategies on Fuze Traders accounts, including arbitrage, martingale, copy trading, and many more.

News Trading

News-based strategies are allowed. However, traders should be cautious when executing trades around high-impact news events. Specific guidelines regarding timing and risk management during such events may be advisable to avoid unnecessary risks.

Trading Platform

FT utilizes the popular MetaTrader 5 (MT5) platform, offering traders a sophisticated and versatile trading environment:

- Multi-Asset Trading: Access to Forex, stocks, indices, and commodities.

- Advanced Charting: Comprehensive technical analysis tools and indicators.

- Algorithmic Trading: Support for automated strategies via MQL5 programming.

- Enhanced Order Types: More sophisticated order management capabilities.

- Real-Time Market Data: Integrated economic calendar and news updates.

While MT5 provides powerful features, it does require a steeper learning curve compared to its predecessor, MT4. However, its advanced capabilities make it an ideal choice for serious traders looking to optimize their strategies across multiple asset classes.

You can download MetaTrader 5 indicators through our website in the related page.

Tradable Instruments

Fuze Traders provides little information about the trading symbols available with the firm and only specifies the markets. FT offers CFDs on these instruments:

- Forex

- Stock Indices

- Precious Metals

- Energy

Payment and Payout Methods

There's no information about the payment options. We examined the website and couldn't find anything related to the matter. This lack of data is a drawback for the company's website.

Funded traders at Fuze Traders receive a 75% share of their profits, with the firm retaining 25%. Profit payouts are processed on demand and typically completed within 1 to 2 business days. However, the minimum payout threshold is set at $1,000, which may be restrictive for smaller accounts.

Commissions And Costs

While specific commission structures for trading symbols and assets are not detailed, Fuze Traders relies on the profit-sharing model and the initial fee paid for challenges.

These costs were looked into in previous sections.

Does Fuze Traders Offer Any Educational Content?

The prop firm does not perform well in this regard, either, and there's not much educational resources available on the website. Education on Fuze Traders:

- Blog: Articles including insights and information about trading, analysis, etc.

- FAQ: A list of questions with answers related to the prop firm's specifics and features

Commissions And Costs

While specific commission structures for trading symbols and assets are not detailed, Fuze Traders relies on the profit sharing model and the initial fee paid for challenges. These costs were looked into in previous sections.

Trust Scores and User Ratings

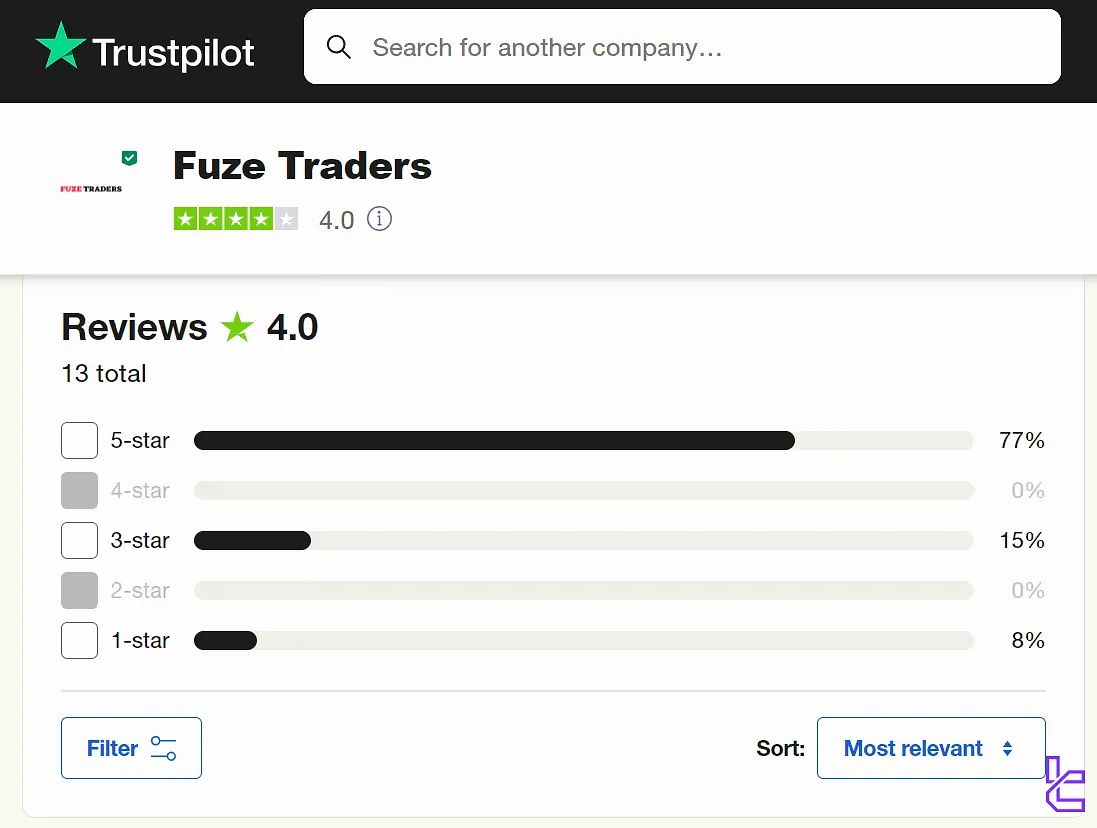

There are several facilities and platforms on the web for users to review and rate companies and firms in various fields, including Trustpilot and REVIEWS.io. In this section, we will have a detailed look at Fuze Traders' scores on the former:

- Average Rating: 4.0 out of 5

- Number of Reviews: +10

- Profile Status: Verified

- Company's Replies to Negative Reviews: In Less Than 24 Hours

While the score is at a high level and considered totally positive and acceptable, the number of ratings are too low. Therefore, we cannot take this evaluation into account.

Customer Services Channels and Schedule

Fuze Traders tries to emphasize customer support as a key component of their service, but it's lagging behind in some parts. Support Contact Information:

- Phone Number: +41 21 561 51 29

- Email Address: support@fuzetraders.com

- Contact Form: In the "Support" section on the website

This prop firm does not provide live chat support, which is very strange and rare among companies since most of them provide it as an essential contact method. Also, no 24/7 support is available; the team answers to your inquires Monday to Friday from 09:00 to 18:00 CET.

Fuze Traders Prop Firm's Social Media Accounts

These days, social media platforms have become a necessary facility for making connections and providing updates. Fuze Traders maintains several accounts across various social media platforms:

Fuze Traders Comparison with Other Prop Firms

The table below helps you identify the pros and cons of trading with Fuze Traders compared to other well-known prop firms.

Parameters | Fuze Traders Prop Firm | |||

Minimum Challenge Price | $100 | $39 | $15 | $33 |

Maximum Fund Size | $100,000 | $250,000 | $100,000 | $400,000 |

Evaluation steps | 2-Step | 1-Step, 2-Step, 3-Step | 1-Step, 2-Step | 1-Step, 2-Step, 3-Step, Instant Funding |

Profit Share | 80% | 100% | 85% | 100% |

Max Daily Drawdown | 5% | 5% | 4% | 7% |

Max Drawdown | 10% | 10% | 8% | 14% |

First Profit Target | 10% | 5% | 8% | 6% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:30 | 1:100 | 1:75 | 1:100 |

Payout Frequency | On-Demand | Bi-weekly | 10 Days | Weekly |

Number of Trading Assets | Not Specified | 3000+ | 400+ | 40+ |

Trading Platforms | Metatrader 5 | Metatrader 5 | Match-Trader, cTrader | MetaTrader 5, Match Trader |

Expert Suggestions

Fuze Traders is a prop firm backed by Guru Capital SA that requires a 10% profit as its first target with a maximum daily loss starting from 5%.

The company's website has received a 96/100 Trustscore on the ScamAdviser website; users have given it 4.6 out of 5 on the mentioned platform.