Global Forex Funds offers its plans in 3 models [Economy, Private, Instant Funding] with a single-phase evaluation. Providing access to up to $400,000 in funding, the company offers profit splits of up to 90% and a profit target of 8% on its Private accounts.

Global Forex Funds Company Overview

GFF is a trading name of STJL Media LTD, a Cypriot company registered under HE 474901. The prop firm’s website receives over 10K monthly visitors, which is not much compared to the average website.

Global Forex Funds’ head office is registered at Karaiskaki,19 Roussos Building,1st floor, Flavofflce 1 C 3032, Limassol, Cyprus.

Global Forex Funds Summary of Specifications

This prop firm has some strong selling points, such as access to the popular MetaTrader 5 platform and instant funding plans. GFF Specifics:

Account Currency | USD |

Minimum Price | $59 |

Maximum Leverage | 1:100 |

Maximum Profit Split | Up to 90% |

Instruments | N/A |

Assets | N/A |

Evaluation Steps | Single Phase, Instant Funding |

Withdrawal Methods | Skrill, Crypto |

Maximum Fund Size | $400,000 |

First Profit Target | 8% |

Max. Daily Loss | 5% |

Challenge Time Limit | Unlimited |

News Trading | Allowed |

Maximum Total Drawdown | 15% |

Trading Platforms | MetaTrader 5 |

Commission Per Round Lot | N/A |

Trustpilot Score | 4.7 |

Payout Frequency | Bi-Weekly |

Established Country | Cyprus |

Established Year | 2024 |

Benefits and Drawbacks

The prop firm features a wide range of funding options with various prices with access to leverage as high as 1:100. On the other hand, it does not have a long track record. Pros and Cons of Trading with GFF:

Benefits | Drawbacks |

Various Funding Options with Prices Starting at $59 | Relatively High Profit Targets in Evaluation Challenges |

High Leverage of Up to 1:100 | Short Track Record and Relatively Low Reputation in the Industry |

Instant Funding Option Available without Any Evaluation Phases | No Information Provided Regarding the Commissions and Fees |

Access to MetaTrader 5 Trading Platform | - |

Free Retries for Private Challenges | - |

Funding Sizes and Account Prices

Global Forex Funds has a wide range of various funding options with different prices for each, starting from $59, going all the way up to $3,499.99. Each funding option, with its price, is mentioned in this section.

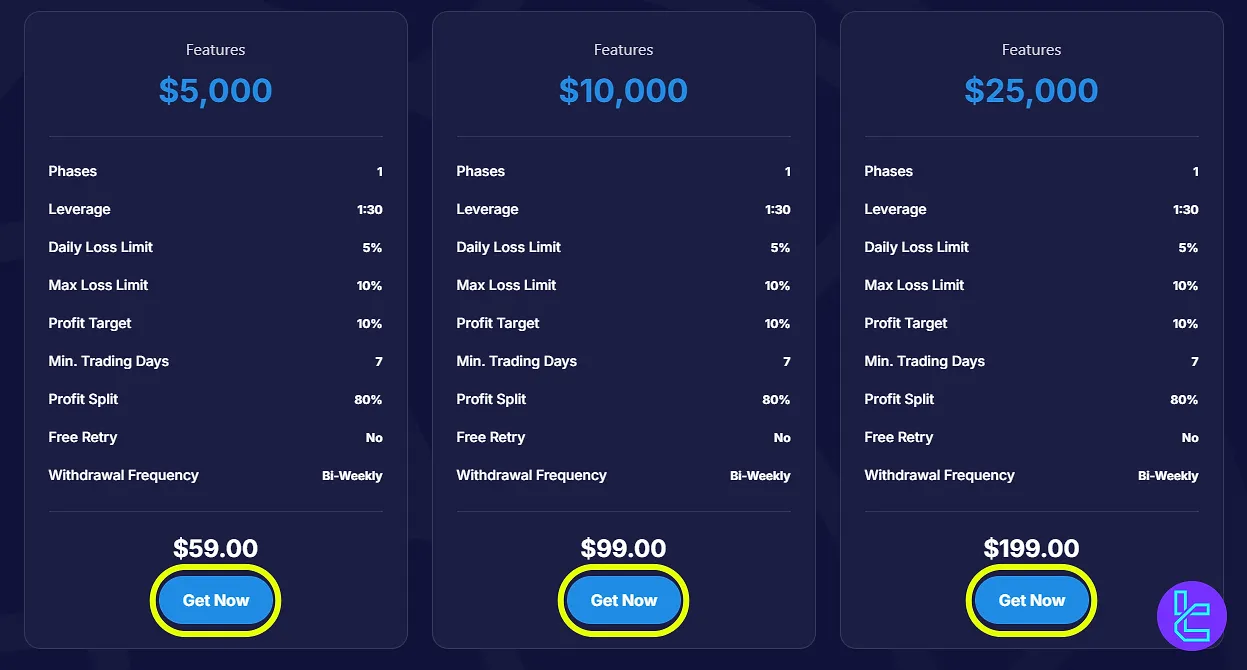

Economy Accounts:

Funding | Price |

$5,000 | $59 |

$10,000 | $99 |

$25,000 | $199 |

$50,000 | $329 |

$100,000 | $449 |

$200,000 | $799 |

Private Challenges:

Funding | Price |

$10,000 | $149.99 |

$25,000 | $299.99 |

$50,000 | $499.99 |

$100,000 | $673.50 |

$200,000 | $1,199.99 |

$400,000 | $2,249.99 |

Instant Funding Options:

Funding | Price |

$5,000 | $249.99 |

$10,000 | $449.99 |

$25,000 | $899.99 |

$50,000 | $1,749.99 |

$100,000 | $3,499.99 |

The GFF’s website mentions that the account scaling is possible, yet it does not mention any further details.

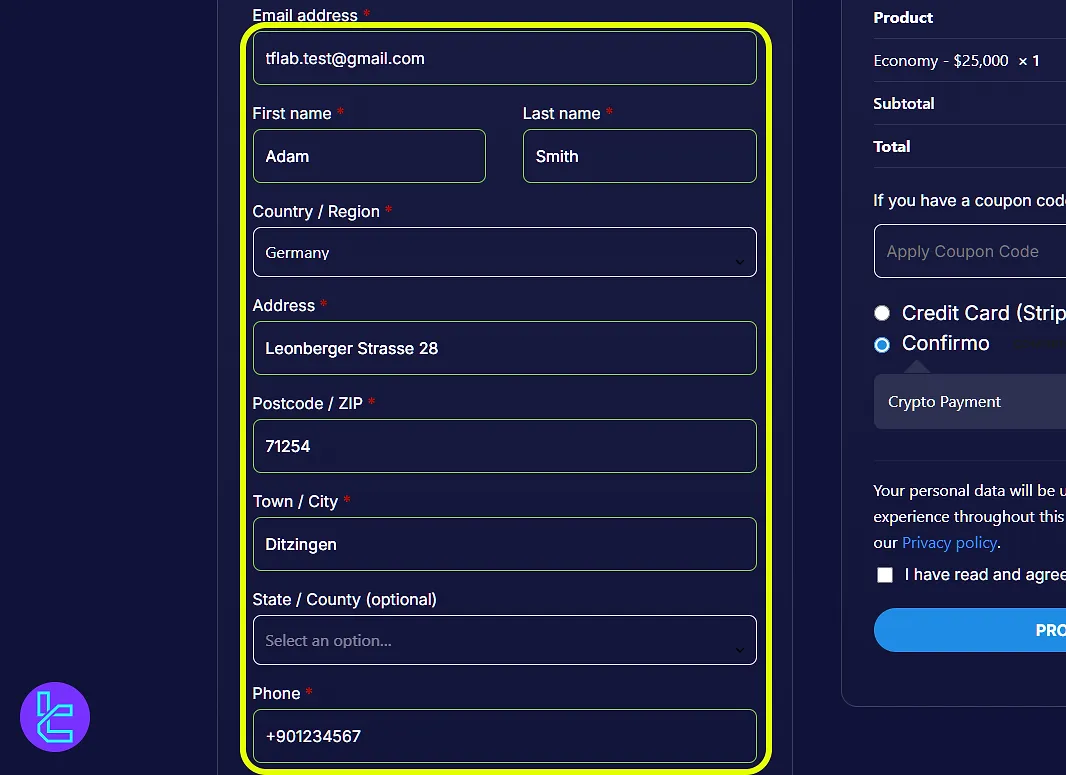

Global Forex Funds Registration and Verification Guide

The prop firm accepts registrations only through buying challenges. The process of signing up and verification is explained in 3 stages here.

#1 Go to the Website

Visit the GFF’s official site as the first step. Then, look for the “Get Started” button at the top of the page; click on it.

You will be navigated to the challenges section; pick one and click on the “Get Now” button underneath.

#2 Complete the Form

On the next page, you will see a “Billing Details” form. Complete it with these:

- Email address

- Full name

- Country/Region

- Address

- Postcode/ZIP

- Town/City

- Phone Number

Afterwards, select your preferred payment method and apply your coupon code, if applicable. Agree to the Terms and Conditions, then proceed and pay for the account.

#3 Verify Your Identity

You must provide proof of identity and proof of address to complete the Know Your Customer (KYC) process with the prop firm.

GFF Challenge Specifics and Evaluation Stages

Global Forex Funds has designed two distinct 1-phase evaluation models, plus an instant funding option. The profit split goes up to 90%, and the payout frequency is every 14 days across all accounts.

The table below reviews and compares each plan’s details side-by-side:

Account/Challenge | Economy | Private | Instant Funding |

Max. Leverage | 1:30 | 1:100 | 1:50 |

Max. Daily Loss | 5% | 5% | 4% |

Max. Overall Drawdown | 10% | 15% | 8% |

Profit Target | 10% | 8% | N/A |

Min. Trading Days | 7 | 1 | None |

Free Retry | 80% | 90% | 80% |

Profit Split | No | Yes | No |

Payout Frequency | Bi-weekly | Bi-weekly | Bi-weekly |

The prop firm’s evaluation rules are relatively strict; most traders will likely face difficulties with passing the challenges or keeping their accounts. However, the company is quite lenient when it comes to total drawdown limitations.

Global Forex Funds Bonuses and Promotional Offers

Per our investigations and research, no bonuses or promotions are officially offered by the prop firm. Also, we checked out third-party sources and could not find anything except a promo code: Trusted25.

The mentioned code applies a 25% discount on all challenge fees. We will update this page in case of any changes in this regard.

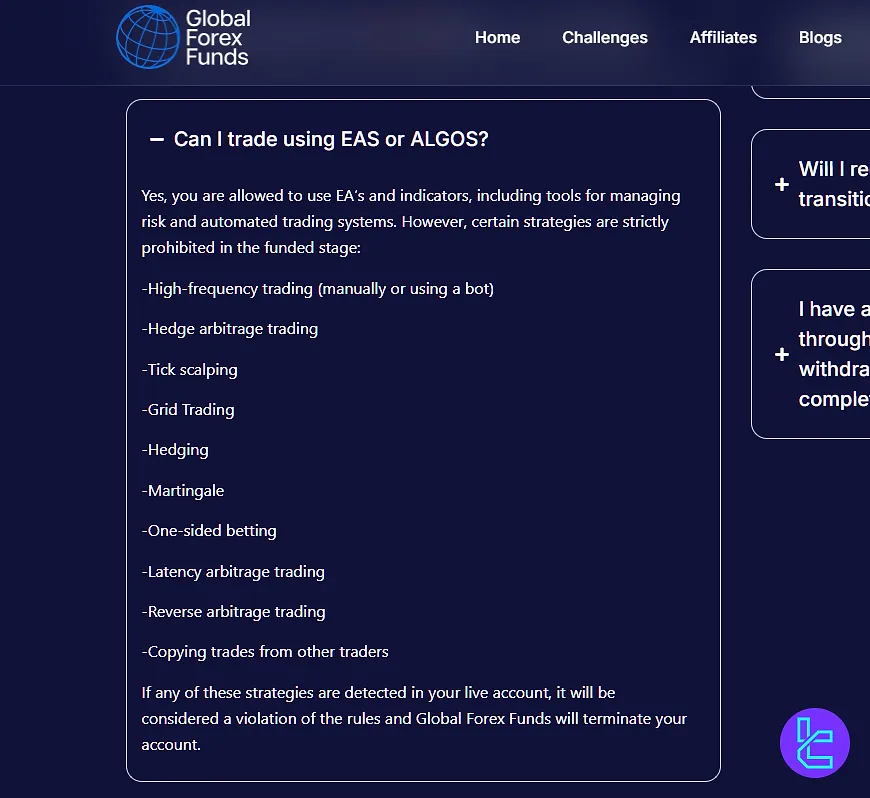

Global Forex Funds Rules

Like any other prop firm, GFF has a set of trading rules for its plans that traders must obey:

- Hedging: Prohibited in funded accounts;

- Using Expert (EA): Traders are allowed to use Expert Advisors (EAs) and indicators, including automated systems for risk management and trading;

- Martingale and Arbitrage Strategy: Hedge arbitrage, martingale, latency arbitrage, and reverse arbitrage strategies are strictly prohibited in the funded stage;

- News Trading: Traders are permitted to trade based on news events. However, it is recommended to use proper risk management to ensure controlled exposure.

VPN Usage

Currently, no data has been provided by the prop firm regarding VPN usage.

Hedging

Hedging is not allowed in funded accounts. This rule ensures a fair and transparent trading environment by preventing positions that might artificially hedge against market risks.

Using Expert Advisors (EA)

Traders are permitted to utilize Expert Advisors (EAs) and indicators, including tools for risk management and automated trading strategies. This allows for greater flexibility in trading while still maintaining the integrity of the account.

Martingale and Arbitrage Strategies

The following strategies are strictly forbidden during the funded stage:

- Hedge Arbitrage Trading: Attempting to exploit price discrepancies through hedging strategies is prohibited;

- Martingale: This strategy involves increasing position size after each loss, which is not allowed;

- Latency Arbitrage: Exploiting delays in market data between exchanges for profit is banned;

- Reverse Arbitrage: Attempting to profit from price differences between correlated markets is also restricted.

News Trading

Traders are allowed to engage in news-based trading. However, it is highly recommended that traders apply proper risk management techniques to mitigate the inherent volatility that can occur around news events.

Trading Platforms Employed by Global Forex Funds

The prop firm offers MetaTrader 5 as the option for trading in financial markets for its traders. The platform is one of the most popular choices in the industry, providing access to a wide range of indicators for technical analysis and additional trading tools.

You can access Expert Advisors (EAs) and bots for risk management calculations and algorithmic trading via the platform. Also, a Signal Centre is provided in MT5.

The platform’s software is available on desktop and mobile devices. Mobile Application Details and Links:

- MT5 Android: 10M+ downloads with an average user rating of 7/5 based on 860K+ reviews

- MT5 iOS: 8 out of 5 according to over 52,000 ratings

Tradable Instruments and Markets

The prop firm’s website and other official sources do not include any information regarding the tradable assets. However, we can say that GFF most likely offers these instruments:

- Forex Market

- Indices

- Commodities

- Metals

Global Forex Funds Deposit/Withdrawal Methods

The prop firm offers three options for paying for its challenge fees, including:

- Credit/Debit Cards: VISA and MasterCard

- Electronic Payment System: Skrill

- Cryptocurrency: Transactions on blockchain

GFF does not explicitly mention the options for payouts; however, the possible options are Skrill and crypto.

Trading Commissions and Other Fees

Global Forex Funds indicates that their partnered broker offers “industry-leading spreads and commissions to traders”. It claims that the same fee structure is applied to the prop firm’s traders.

However, no information related to the company’s partnered broker or its name is provided to the public.

Educational Resources in Global Forex Funds

This prop firm is not the best at providing educational materials to traders. GFF has a “Blog” section on its website containing only three articles about prop challenges and the instant funding model.

Additionally, the website features an FAQ page that includes questions about the rules and GFF’s features, along with their respective answers.

Upon further investigation, the mentioned resources are not actual educational content; they primarily target the company’s details.

Trust Scores

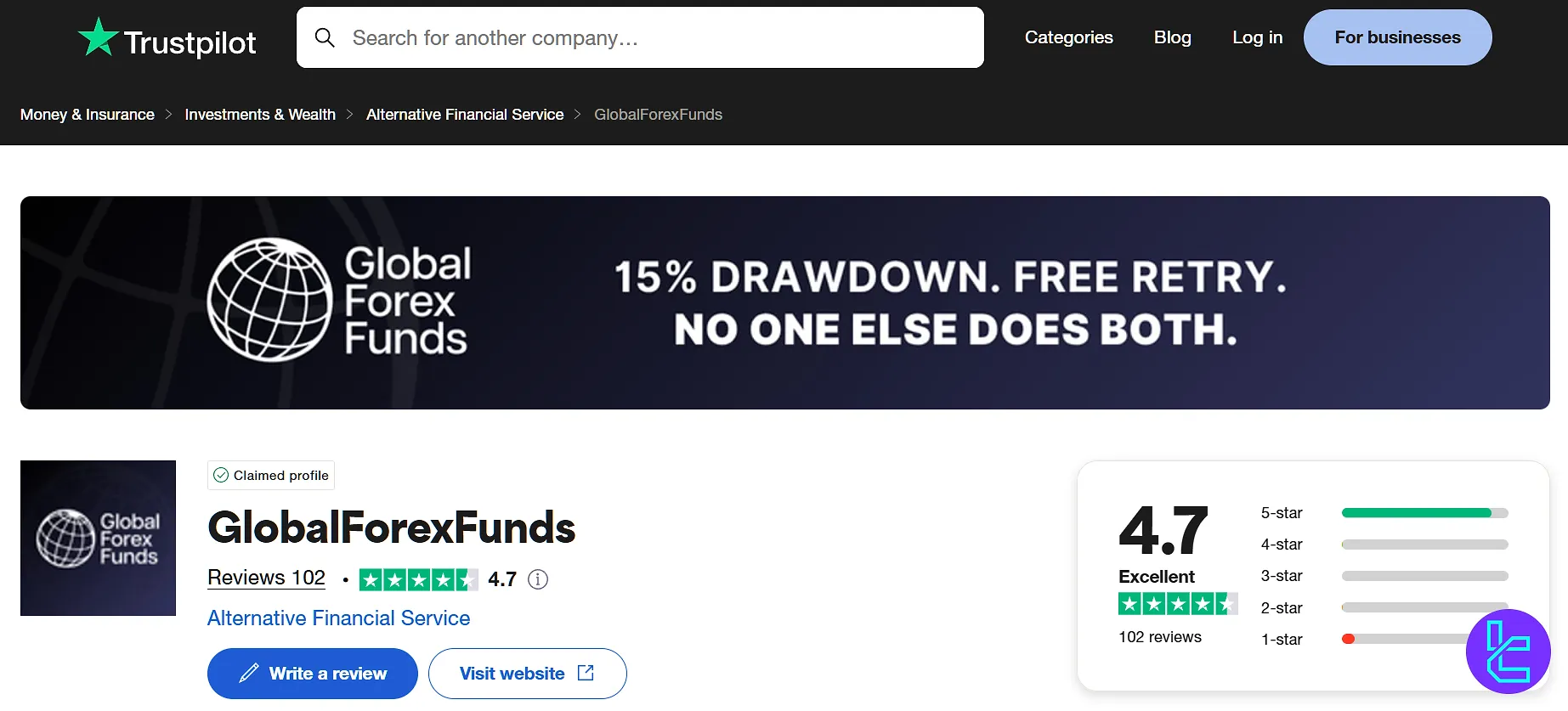

Global Forex Funds does not have a high number of reviews and ratings across the sources on the internet. Nevertheless, it has obtained mostly high scores. GFF Ratings Review:

- ScamAdviser: 47/100 Trustscore based on certain algorithms

- GFF Trustpilot: 4.7 out of 5 according to over 100 user reviews

On the latter, over 90% of user ratings are 4- and 5-star, indicating a high level of user satisfaction. The prop firm has replied to 100% of the negative reviews, typically taking less than 1 week.

Global Forex Funds Support

These days, most prop firms and other financial companies feature a live chat option for contacting the support team; this is not the case with GFF. The discussed company provides only 2 basic channels for support, such as:

- Email: support@globalforexfunds.com

- Ticket: On the “Contact Us” page of the website

Global Forex Funds prop firm does not disclose any working schedule for the customer service department.

Global Forex Funds Social Media Communities

You can follow the company and receive the latest news and updates regarding its services on these networks:

- GFF Facebook

- GFF Discord

- Telegram

Global Forex Funds Compared to Other Prop Firms

The table below compares the GFF’s features and specifics against its top competitors:

Parameters | Global Forex Funds Prop Firm | |||

Minimum Challenge Price | $59 | $33 | $15 | $39 |

Maximum Fund Size | $400,000 | $400,000 | $100,000 | $250,000 |

Evaluation steps | Single Phase, Instant Funding | 1-Step, 2-Step, 3-Step, Instant Funding | 1-Step, 2-Step | 1-Step, 2-Step, 3-Step |

Profit Share | Up to 90% | 100% | 85% | 100% |

Max Daily Drawdown | 5% | 7% | 4% | 5% |

Max Drawdown | 15% | 14% | 8% | 10% |

First Profit Target | 8% | 6% | 8% | 5% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:100 | 1:75 | 1:100 |

Payout Frequency | 14 Days | Weekly | 10 Days | Bi-weekly |

Number of Trading Assets | N/A | 40+ | 400+ | 3000+ |

Trading Platforms | MT5 | MetaTrader 5, Match Trader | Match-Trader, cTrader | Metatrader 5 |

Expert Suggestions

Global Forex Funds is a very young prop firm, established in 2024; however, it has received a high score of 4.7 out of 5 based on over 100 user reviews on the “Trustpilot” website.

“ScamAdviser” has given the prop firm’s website a 47/100 Trustscore, indicating its low number of visitors.