Our latest examination of the prop firm's website indicates that it may no longer be operational; some important pages on the official domain do not function properly and return the error code "521". Also, the "Help" webpage shows the error 1014.

High Roller Funding offers traders funding between $5,000 and $400,000 with 1:60 maximum leverage and a profit split of up to 90%.

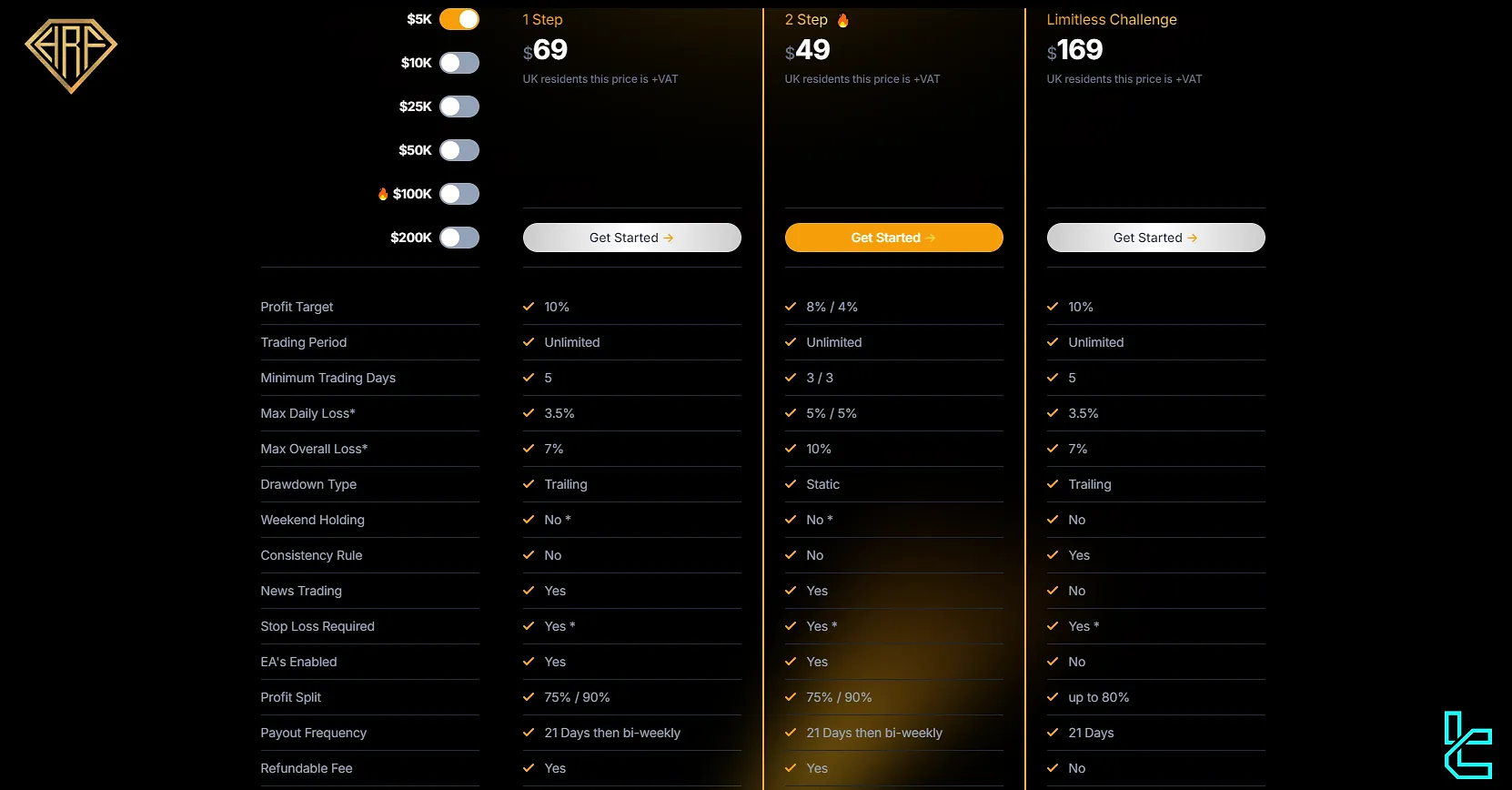

Traders can choose from 3 evaluation options: 1-Step, 2-Step, and Instant Funding, each with different trading targets and conditions.

Company Information and Specifics

Based on our investigations on the available sources, there's not much information and data at hand about the company. The broker claims on the website that they "transform proprietary trading by offering a unique mix of opportunity, support, and innovation to traders".

Key Features

In this section, we will provide a summary of the main specifics and features of High Roller Funding prop firm in the form of a table:

Account Currency | USD |

Minimum Price | $35 |

Maximum Leverage | 1:60 |

Maximum Profit Split | 90% |

Instruments | Forex, Crypto, Stocks, Commodities, Indices |

Assets | Not Specified |

Evaluation Steps | 1-Step, 2-Step, Instant Funding |

Withdrawal Methods | Crypto, Credit/Debit Cards |

Maximum Fund Size | $400K |

First Profit Target | 10% |

Max. Daily Loss | From 3.5% |

Challenge Time Limit | Unlimited |

News Trading | Allowed (Except on Limitless Challenge) |

Maximum Total Drawdown | From 7% |

Trading Platforms | Metatrader 5, cTrader, DXTrade, Match-Trade |

Commission Per Round Lot | Not Specified |

Trustpilot Score | 4.3/5 (Less Than 10 Reviews) |

Payout Frequency | Bi-Weekly |

Established Country | United Kingdom |

Established Year | 2024 |

Benefits and Weaknesses

Every prop firm has pros and cons, and High Roller Funding is no exception. Let's break it down:

Benefits | Weaknesses |

Diverse Challenge Options | Limited Broker Transparency |

Fast Account Creation And Payouts | Prohibited EA Usage On Limitless Challenge |

- | Non-Refundable Fee For Limitless Challenge |

Funding & Price on High Roller Funding

High Roller Funding isn't playing small ball when it comes to funding options. They've got something for everyone, from the cautious newcomer to the seasoned pro looking to make big moves. Here's the scoop:

- Price Range: $35 to $3600

- Funding Range: $5,000 to $400,000

The beauty of High Roller Funding's approach is that it allows traders to find their sweet spot. Whether you're dipping your toes in with a $5K account or going all-in with $400K, there's a funding option that fits.

How to Register and Verify Your Identity

Creating a new trading account with High Roller Funding prop firm is easy and only requires following 3 simple steps. High Roller Funding registration:

#1 Visit the Official Website

Go to the High Roller Funding homepage and click on "Dashboard" or the "Open an Account" button to initiate registration.

#2 Select “Create an Account”

From the dashboard interface, choose the “Create an Account” option to access the sign-up form.

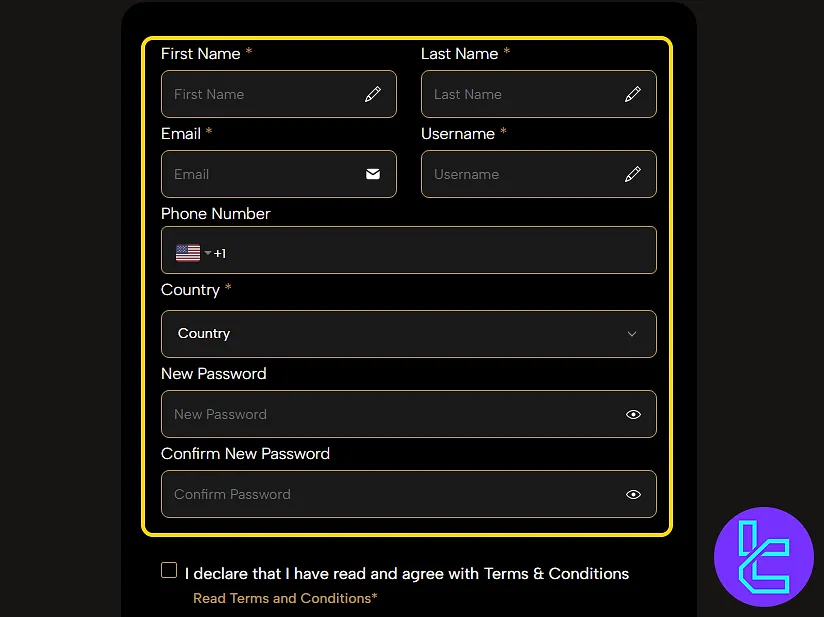

#3 Enter Required Information

Complete the form with the following details:

- First and last name

- Email address

- Username (4–20 unique characters)

- Mobile number

- Country of residence

- Strong password (uppercase, lowercase, digits, symbols)

Once submitted, your account will be activated immediately. You can now explore funding options and begin your evaluation.

#4 Complete KYC Process

To enable withdrawals, traders must verify their trading accounts by providing proof of address (utility bill or bank statement) and proof of identity documents, such as a passport or driver's license.

Evaluation Programs: Stages & Details

Here’s a complete look at the evaluations and challenges of trading conditions in the High Roller Funding prop firm.

Evaluation Type | CFD/Forex 1-Step | CFD/Forex 2-Step | CFD/Forex Instant Funding | Crypto 1-Step | Crypto 2-Step |

Profit Target Phase 1 | 10% | 8% | - | 9% | 6% |

Profit Target Phase 2 | - | 5% | - | 9% | |

Maximum Daily Drawdown | 5% | 5% | 5% | +/-3% | +/-3% |

Maximum Overall Drawdown | 6% | 5% | 8% | 6% | 9% |

Minimum Trading Days | 0 | 0 | 5 | 0 | 0 |

Profit Split | 80% | 80% | 80% | 90% | 90% |

The 90% profit split is one of the main benefits of trading with High Roller Funding accounts.

Does High Roller Funding Offer Any Bonuses?

When it comes to bonuses, HRF takes a relatively straightforward approach – they don't offer any. However, there's currently an official promo code available for getting a 200% refund and 15% off on challenges: 200FUNDED.

High Roller Funding Rules

High Roller Funding implements various measures to maintain the integrity of its platform. High Roller Funding rules:

- VPN and VPS: No official information available regarding VPN or VPS usage; clarification should be sought from support

- Hedging: Hedging within a single HRF account is permitted, but cross-account hedging is prohibited to prevent risk-free profit manipulation

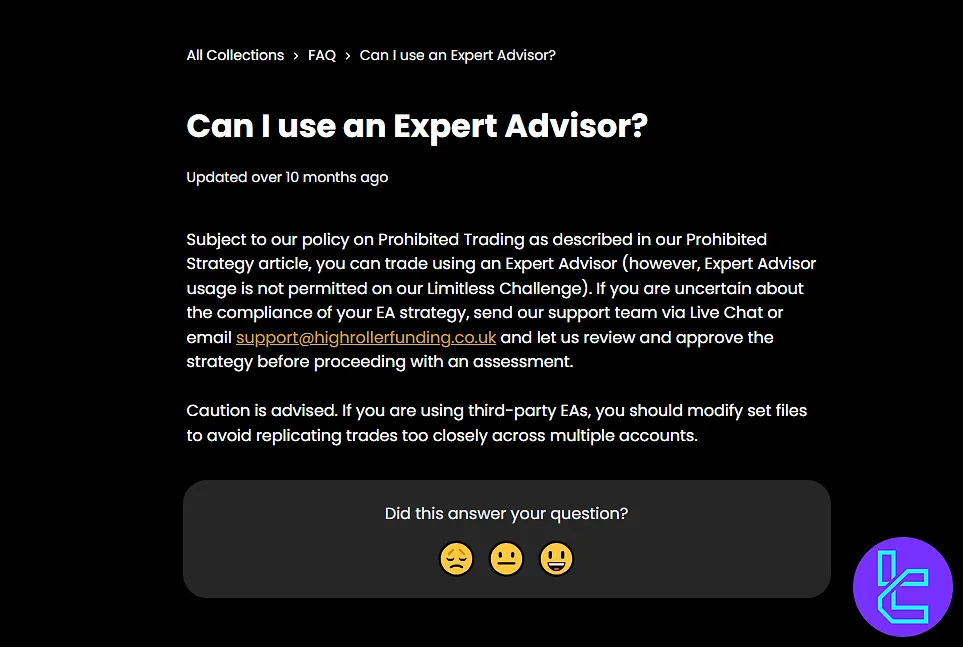

- Expert Advisors (EAs): EAs can be used, except during the Limitless Challenge. Support approval is required if unsure about EA strategy compliance

- Gambling and Risky Strategies: Prohibited strategies include arbitrage trading, latency trading, front-running, and high-frequency trading, with strict rules against group hedging and account management services

- News Trading: Opening positions within 3 minutes before or after a news event is prohibited, and violations will result in closed positions and potential account penalties

VPN and VPS Usage

Unfortunately, no official information is available regarding the use of VPNs or VPS on the High Roller Funding website. Traders should assume the policy will be clarified directly with the support team upon registration or account verification.

Hedging

Hedging is allowed within a single HRF account under specific conditions. It enables traders to employ strategies involving long and short positions on the same or related assets for risk management. However, there are restrictions:

- Permitted Hedging: Traders may hedge positions within one HRF account to manage risk or employ complex strategies.

- Prohibited Hedging: Hedging across multiple HRF accounts is forbidden. This includes strategies designed to create a risk-free profit by offsetting positions across different accounts.

- Intentional Exploitation: Any attempt to exploit hedging to manipulate balances or gain an unfair advantage will be penalized. High Roller Funding actively monitors accounts for such behavior.

- Monitoring and Reporting: High Roller Funding continuously monitors trading activity for adherence to its hedging rules. If you suspect unauthorized hedging, report it immediately to support.

Expert Advisors (EAs)

Traders are permitted to use Expert Advisors (EAs), except during the Limitless Challenge. To ensure compliance with HRF policies, it's advised to contact support if uncertain about the EA strategy being used.

If utilizing third-party EAs, avoid replicating trades across multiple accounts to prevent any unintended violations.

Gambling and Risky Strategies

High Roller Funding strictly prohibits:

- Arbitrage Trading

- Latency Trading

- Front-running Price Feeds

- Exploiting Mispricing

- High-frequency Trading

- Reverse Trading/Group Hedging

Additionally, Account Management Services are not allowed, meaning all accounts and trades must be executed by the account holder. Traders are encouraged to understand the rules and policies to avoid accidental violations thoroughly.

News Trading

Traders are prohibited from opening positions within 3 minutes before or after a News Event. If a trade is executed during this time, the position will be closed, and the associated profit and loss will be nullified. Further penalties may include reduced leverage or account suspension.

Trading Platforms and Terminals

High Roller Funding understands that a trader's platform is their command center. That's why they offer a selection of industry-standard platforms to suit different trading styles and preferences:

- DXTrade: User-friendly interface with customizable layouts and advanced charting tools

- MetaTrader 5 (MT5): Powerful analytical tools, support for algorithmic trading, and a wide range of technical indicators

- cTrader: Modern-looking interface with advanced features and access to VPS

- Match-Trade: An independent platform designed mainly for prop firms

By offering these platforms, HRF ensures that traders have access to the tools they need to execute their strategies effectively.

TradingFinder has developed a wide range of advanced MT5 indicators that you can use for free.

Which Instruments are Tradable in High Roller Funding?

Based on our investigations, tradable markets with HRF vary by the trading platform used by the client, but they mainly consist of Forex and some other assets, including:

- Forex: Currency pairs with various levels of popularity

- Indices: Global stock market indices

- Commodities: Energy resources, metals, and agricultural products

- Stocks: Major global equities

- Cryptocurrencies: Popular digital assets

Payment Options and Methods

High Roller Funding offers a streamlined approach to payments, focusing on convenience and security. Here's what you need to know about their payment options:

- Credit/Debit Cards: Visa, MasterCard, etc.

- Cryptocurrencies: Blockchain transactions

It seems the payment options are somewhat limited compared to some other prop firms.

Commissions and Costs Evaluation

Per our latest investigations on the website and resources, High Roller Funding does not reveal much information on the trading costs and commissions. The only data we got our hands on was this:

- RAW accounts are used by the broker

- These accounts charge a commission for Forex and Stock trading

- Other markets are free of commissions

The lack of enough data about trading costs is a downside for HRF and should be considered.

Education Materials Overview

Some prop firms provide access to vast or limited educational resources for their clients in order to help them improve and level up. High Roller Funding does not follow this pattern, and no content for educational purposes is found on the website or in other official sources.

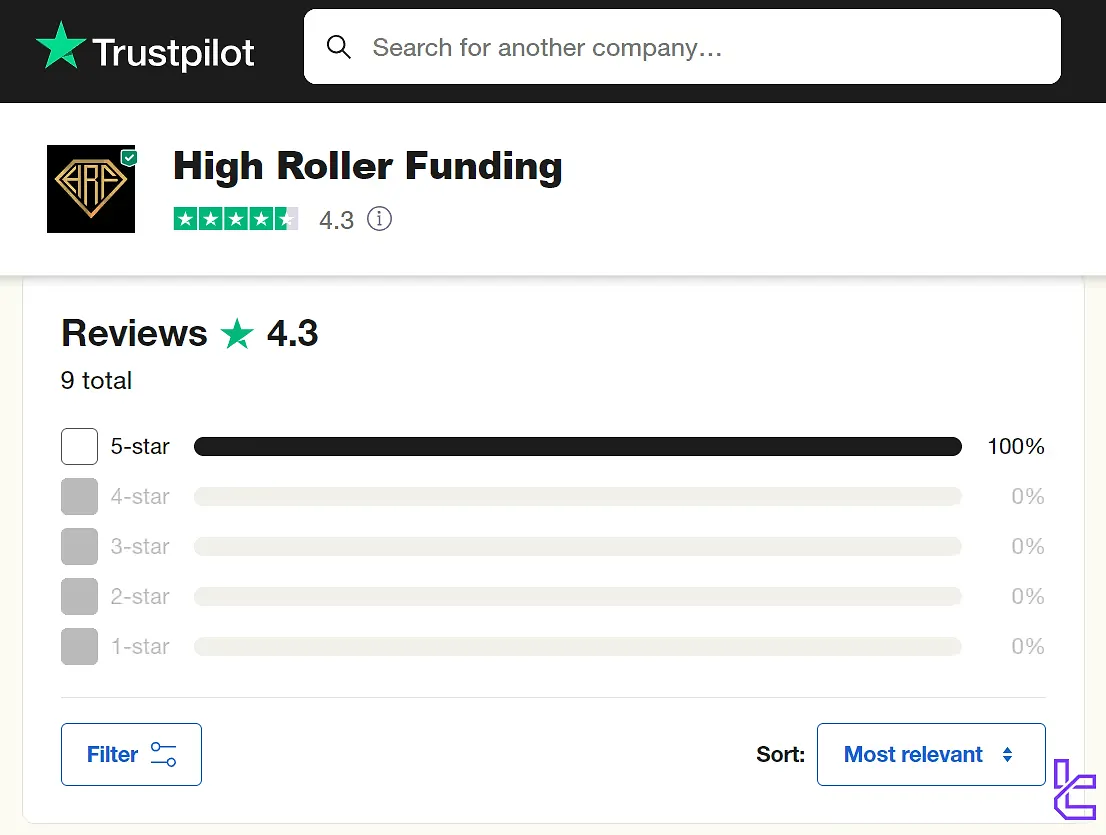

High Roller Funding Prop Firm Trust Scores

Trust is paramount in the world of prop trading, and High Roller Funding Trustpilot scores offer insight into its reputation. Here's a detailed look at these ratings:

- Overall Rating on Trustpilot: 4.3 out of 5 stars

- Number of Reviews: 9

Considering the very low number of reviews on Trustpilot, we cannot take into account the trust score found on this platform.

Customer Services and Support

Support department in a financial firm should be taken utterly seriously since it could make a difference when facing a problem. High Roller Funding claims that itself on providing support via these channels:

- Phone Call

- Live Chat

- Contact form

Also, a Help Center is provided containing information about trading with the firm, challenges, dashboard, etc.

However, there is no email address, phone number, or form on the official website, and you only have access to the live chat button. This is a strange move from the firm. Live chat is available 24/7.

Does High Roller Funding Have Any Social Media Accounts?

In today's digital age, a strong social media presence is crucial for any business, and High Roller Funding is no exception. Here's a snapshot of their social media engagement:

Comparing High Roller Funding and Other Prop Firms

To better understand the pros and cons of using High Roller Funding accounts, take a look at the table below.

Parameters | High Roller Funding Prop Firm | |||

Minimum Challenge Price | $35 | $33 | $55 | $32 |

Maximum Fund Size | $400,000 | $400,000 | $200,000 | $4,000,000 |

Evaluation steps | 1-Step, 2-Step, Instant Funding | 1-Step, 2-Step, 3-Step, Instant Funding | 1-phase, 2-phase | 1-Step, 2-Step |

Profit Share | 90% | 100% | 80% | 95% |

Max Daily Drawdown | 3.5% | 7% | 4% | 5% |

Max Drawdown | 7% | 14% | 6% | 10% |

First Profit Target | 10% | 6% | 8% | 8% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:60 | 1:100 | 1:100 | 1:100 |

Payout Frequency | Bi-Weekly | Weekly | 2 Times a Month | From 5 Days |

Number of Trading Assets | N/A | 40+ | 200+ | 78 |

Trading Platforms | Metatrader 5, cTrader, DXTrade, Match-Trade | MetaTrader 5, Match Trader | Metatrader 5, CFT Platform and Crypto Futures | MT4, MT5, cTrader, MatchTarder |

Expert Suggestions

High Roller Funding provides 1-Step and 2-Step challenges with refundable prices. The Instant Funding Challenge offers direct access to funding but with specific restrictions on news trading and EAs.

While the high-profit split is attractive, there are concerns regarding limited support channels, with only live chat available.

The firm’s Trustpilot rating of 4.3/5 is based on low reviews, so this should be considered when evaluating its reputation.