IC Funded rules include a 10% Phase 1 and 5% Phase 2 target. Traders must meet a 5-day minimum, with a 5% daily loss and a 10% max loss limit.

EAs are allowed if they don’t exceed 3,000 messages, while copy trading, HFT, merging accounts, and arbitrage are prohibited.

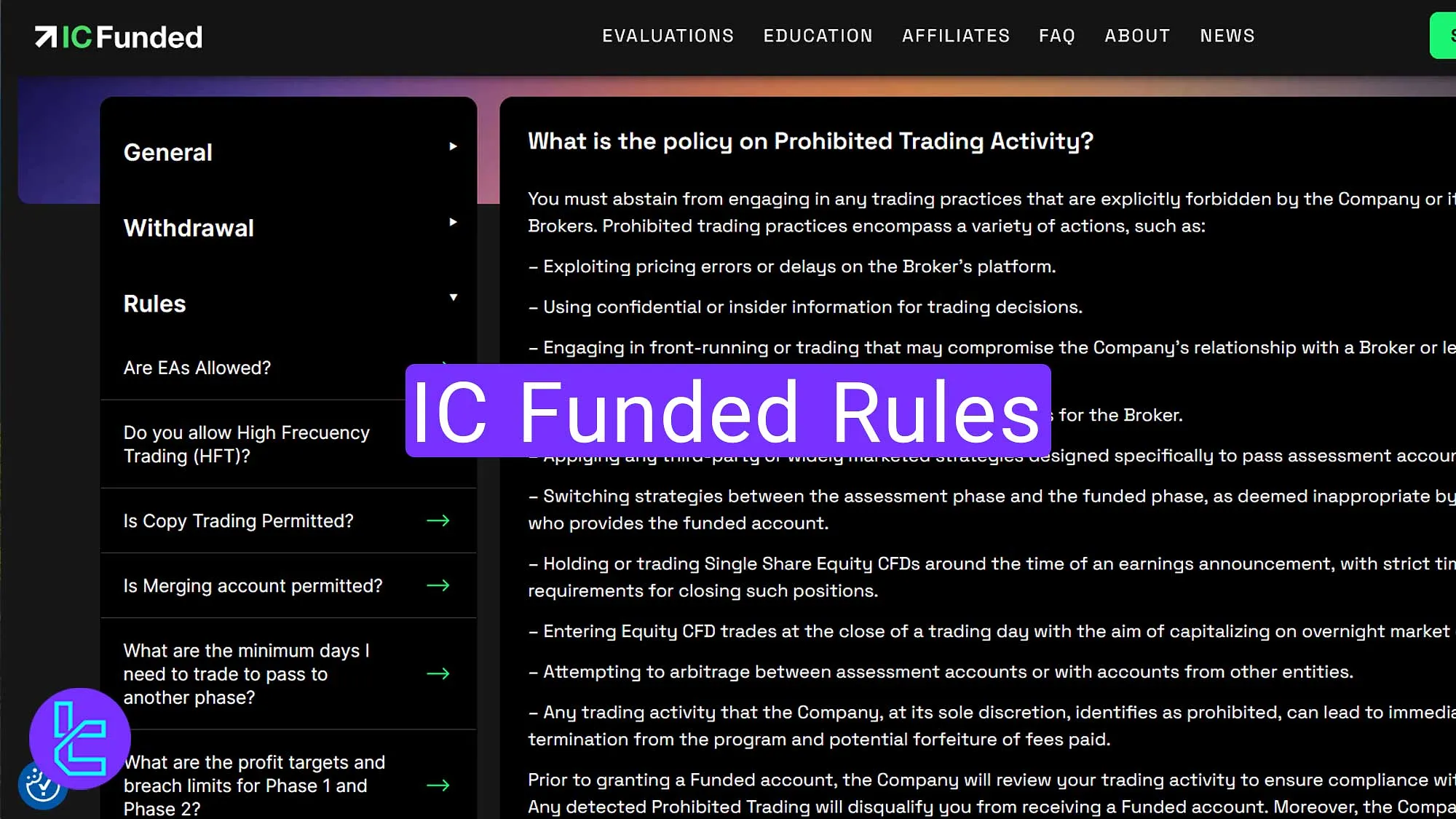

IC Funded Rule Topics

Below are the topics that we will explore whether IC Funded Prop Firm has set any restrictions for them; IC Funded Conditions:

- Challenge Rules

- Trading at Day Close

- Use of EAs

- Copy Trading

- HFT

- Merging Accounts

- Arbitrage

- Payout Rules

IC Funded Challenge Rules

The IC Funded prop firm rules for the challenge are essential to know before starting; IC Funded Evaluation Rules:

Target | Phase 1 = 10% / Phase 2 = 5% |

Min/Max Trading Days | 5 / Unlimited |

Max Daily Loss | 5% |

Max Loss (Drawdown Limit) | 10% |

Live Account Gain Split | 75/25 (First Month), 80/20 (Afterward) |

IC Funded Trading at Day Close

Opening Equity CFD trades at the end of the trading day to exploit expected price gaps when the market reopens, is prohibited.

This type of strategy is not allowed because it involves taking positions at the close of the market, which can lead to unwanted exposure to overnight price gaps.

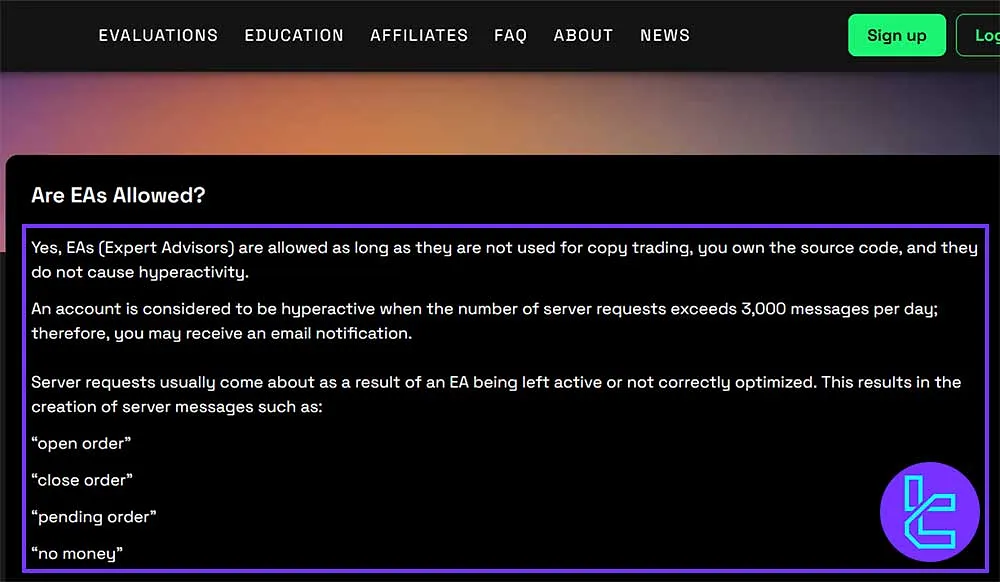

IC Funded Use of EAs

Expert Advisors (EAs) are allowed under specific conditions; IC Funded EAs Rules:

- They must not be used for copy trading;

- You must own the source code of the EA;

- The EA should not cause hyperactivity in the account (defined as exceeding 3,000 messages per day.)

IC Funded Copy Trading

Copy trading across multiple accounts is not allowed:

- Violations of this rule may result in severe penalties, including account termination.

IC Funded HFT

As with many Prop Firms, high-frequency trading strategies that rely on executing many orders in a short time frame are prohibited by IC Funded.

IC Funded Merging Accounts

Combining or transferring funds between separate trading accounts is strictly prohibited under IC Funded rules.

IC Funded Arbitrage

Arbitrage involves exploiting price differences in different markets, which is against IC Funded’s policies and can lead to account suspension.

IC Funded Payout Rules

As with many Prop Firms, the company has certain conditions for payouts; IC Funded Withdrawal Policy:

Payout Frequency | Monthly gain split |

On-Demand Distribution | Available after 14 days from the first trade |

Withdrawal Fees | None – IC Funded does not charge withdrawal fees |

Minimum Profit Requirement | $20 for bank wire transfers |

Writer’s Opinion and Conclusion

IC Funded rules prohibit Equity CFDs trading at close to exploiting market gaps. The gain split starts at 75/25, increasing to 80/20 after the first month.

Payouts are on-demand after 14 days, with no withdrawal fees, but require $20 for wire transfers and $50 for crypto payouts.

To learn more about the platform, check IC Funded Tutorials.