Based on our latest review of the KortanaFX prop firm, we found that this company no longer provides services to Forex traders and is currently inactive. We will update the data on this page as soon as the situation changes.

KortanaFX is Dubai-based prop firm that offers 100% profit splits, 10% maximum drawdown, and up to $200,000 trading capital. KortanaFX payout frequency is weekly but the first payout request can be done after 14 days of the first trade.

KortanaFX Prop Firm Company Overview

KortanaFX is a prop firm that provides traders with access to substantial simulated capital to trade various financial instruments. KortanaFX Features:

- Founded in 2023 and based in Dubai, UAE

- Offers simulated funded accounts ranging from $10,000 to $200,000

- Provides access to trade forex, indices, metals, and cryptocurrencies

- Supports popular trading platforms like cTrader and DXTrade

- Unique profit-sharing model with up to 100% profit retention for traders

- One-step evaluation process with specific profit and drawdown targets

- Trading conditions include leverage up to 1:100 and competitive spreads

- Allows algorithmic and high-frequency trading strategies

- Offers a VIP "Prime" program for exceptional traders

KortanaFX stands out for its trader-friendly approach, transparent rules, and commitment to helping traders develop their skills and strategies in the financial markets.

Summary of Specifications

To give you a quick overview of what KortanaFX offers, here's a summary of its key specifications:

Account Currency | USD |

Minimum Price | $147 |

Maximum Leverage | 1:100 |

Maximum Profit Split | 100% |

Instruments | Forex, Crypto, Metals, Indices |

Assets | +40 |

Evaluation Steps | 1 |

Trading Platform | cTrader, MT5, DXTrade, Trade Locker |

Withdrawal Methods | Cryptocurrencies, Credit/Debit Cards |

Maximum Fund Size | $200,000 |

First Profit Target | 8% |

Maximum Daily Loss | 5% |

Challenge Time Limit | Unlimited |

News Trading | Yes |

Maximum Total Drawdown | 10% |

Commission Per Round Lot | $7 Per Lot Traded |

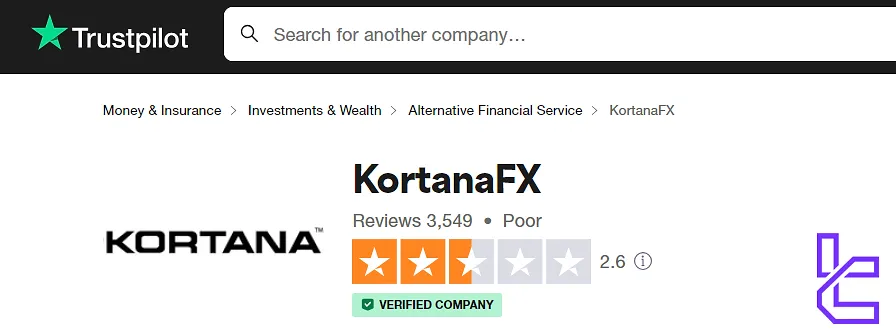

Trust Pilot Score | 2.6 Out of 5 |

Payout Frequency | Weekly |

Established Country | UAE |

Established Year | 2023 |

Pros & Cons

Let's take a look at the advantages and disadvantages of trading with this prop firm; KortanaFX Advantages and Disadvantages:

Pros | Cons |

High Profit Share Potential (Up To 100%) | Low Funding Cap Compared to Other Prop Firms |

Fast Payouts for Kortana Prime Members Unlimited Trading Flexibility | Geographical Restrictions on Trading Relatively New Company (Established In 2023) |

Allows Use of Trading Copiers/EAs | No Free Trial or Refundable Fees |

One-Step Evaluation Process | |

Competitive Spreads and Leverage |

While KortanaFX offers many attractive features, it's important to consider both the pros and cons before deciding if it's the right prop firm for you.

KortanaFX Funding & Price

In Kortana FX review, we noticed that this company offers only one challenge, and that challenge comes in different sizes. Here's a breakdown of their funding options and associated costs:

- $10,000: $147 one-time fee;

- $25,000: $267 one-time fee;

- $50,000: $397 one-time fee;

- $100,000: $597 one-time fee;

- $200,000: $999 one-time fee.

How to Register in KortanaFX?!

Due to the expiration of the KortanaFX Metatrader 5 license, this company has stopped registering new users and only serves old customers; thus, it is currently impossible to register in this prop.

KortanaFX Prop Firm Challenge

Kortana FX has considered only one challenge for traders: a single-step challenge. KortanaFX challenge:

Specifics | KortanaFX 1 Step Challenge |

Profit Target | 8% |

Maximum Daily Loss | 5% |

Maximum Loss | 10% |

Profit Split | Up to 1000% |

EA Trading | Allowed |

Trading Period | Unlimited |

The evaluation process is designed to test traders' skills, risk management, and ability to generate consistent profits. It's important to note that the same rules apply to all account sizes, ensuring a fair evaluation process for all traders.

Does KortanaFX offers Bonus and Discount Codes?

As of the latest information available, KortanaFX does not offer any specific bonuses or discounts to its traders. The company focuses on providing competitive trading conditions, high profit splits, and the opportunity to manage substantial simulated capital.

What are KortanaFX Trading Platforms?

KortanaFX supports several popular trading platforms to cater to different trader preferences:

DXTrade

A web-based trading platform known for its user-friendly interface and advanced charting tools. DXTrade Features:

- Multi-asset trading capabilities

- Real-time market data

- Customizable charts and indicators

cTrader

A popular platform among professional traders, offering:

- Advanced order types

- Algorithmic trading capabilities

- Detailed market analysis tools

Trade Locker

Specific details are not yet available because this platform isn’t been added yet, but it will and is expected to offer additional features and trading capabilities to KortanaFX users.

MetaTrader 5

Multi asset trading Platform to trade different markets and assets; MT5 Features:

- Multi-Asset Trading

- Advanced Charting Tools

- Fudamental Analysis Tools Availability

During Cortana FX Review, we found out that the license of this company's MetaTrader expired in July 2024, and after a few months, there is still no news of the renewal of this license.

Instruments & Symbols

KortanaFX provides the possibility of trading in 4 markets to bring the right variety to traders. KortanaFX Prop Firm Assets:

- Forex: Major currency pairs (e.g., EUR/USD, GBP/USD, USD/JPY) and Minor and exotic pairs;

- Indices: Major global stock indices (e.g., S&P 500, NASDAQ, FTSE 100) plus regional indices;

- Metals: Gold (XAU/USD), Silver (XAG/USD);

- Cryptocurrencies: Bitcoin (BTC/USD), Ethereum (ETH/USD) and Other popular cryptocurrencies.

KortanaFX Payment Methods

KortanaFX offers a variety of payment methods to accommodate traders from different regions:

- Cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Tether (USDT);

- Credit/Debit Cards: Visa, MasterCard, Discover.

The availability of both traditional payment methods and cryptocurrencies provides flexibility for traders when funding their accounts or receiving payouts. It's worth noting that payouts are typically made in cryptocurrency (USDT) to ensure fast and efficient transactions.

Commission & Costs

In our KortanaFX review, we found that the company charges various commissions for trades, including:

Commission Type | Description |

Challenge Fee | Ranges From $147 To $999, Depending on The Account Size |

Trading Commission | $7 Per Lot Traded |

Spreads | Competitive Spreads, Varying by Instrument and Market Conditions |

Withdrawal Fee | 2% Fee on Profit Withdrawals |

Overnight Fees | May Apply for Positions Held Overnight, Varying by Instrument |

It's important to factor in these costs when developing your trading strategy and calculating potential profits. While the $7 per lot commission might seem high, it's offset by the high profit splits offered by KortanaFX.

Educational Resources

Unlike some prop firms that focus heavily on education, KortanaFX does not offer extensive educational resources. The company's primary focus is on providing trading opportunities and capital to experienced traders.

KortanaFX Prop Firm Trust Scores

KortanaFX's Trustpilot score of 2.6 out of 5 indicates mixed reviews from users. Here's a breakdown of the key points:

Positive Aspects:

- Some users report positive experiences with the trading platform;

- Appreciation for the company's innovative approach to prop trading.

Negative Aspects:

- Reports of payout issues and delays;

- Concerns about the company's reliability and transparency;

- Difficulties in contacting customer support;

- Some users label the company as potentially unreliable.

Another noteworthy point is that there is no score of this company in other review sites such as PropFirmMatch and Reviews.io.

Support: Contact Hours + Contact Methods

KortanaFX offers customer support through two main channels:

- Live Chat: Available on their website for real-time assistance;

- Ticket System: For more complex inquiries or issues requiring detailed follow-up.

In addition to very few communication channels, Kortana FX does not offer 24/7 support! To contact them, you can send messages every day from 9 am to 6 pm.

KortanaFX Social Media Channels

KortanaFX maintains an active presence on social media, particularly on:

- Telegram

Although KortanaFX does not have an account on many social media platforms, but it has an active presence and proper interaction with users on these two platforms.

Trading Finder Expert suggestions

More than 72,000 traders use KortanaFX's challenge [1 Step]; Minimum price to buy KortanaFX challenge is $147 and the fundings start from $10000. EAs and news trading are allowed in this prop but no bonus or dicsount code is offered by them.