Leeloo Trading Rules enforce a 5% flipping cap and a strict 30% rule to manage risk exposure. Traders are limited to 3 accounts for copy trading and must be cautious around the 18:00 EST close.

Platforms like Glide and Practice offer exceptions during the 17:00–18:00 EST window.

Leeloo Trading Rule Topics

As with many platforms, Leeloo Trading Prop Firm defines certain policies for traders; Key Concepts of Leeloo Policy:

- Leeloo Trading Challenge Rules

- Copy Trading

- Position Holding and Drawdown Risk

- The 5% Flipping

- The 30% Rule

- Restricted Country

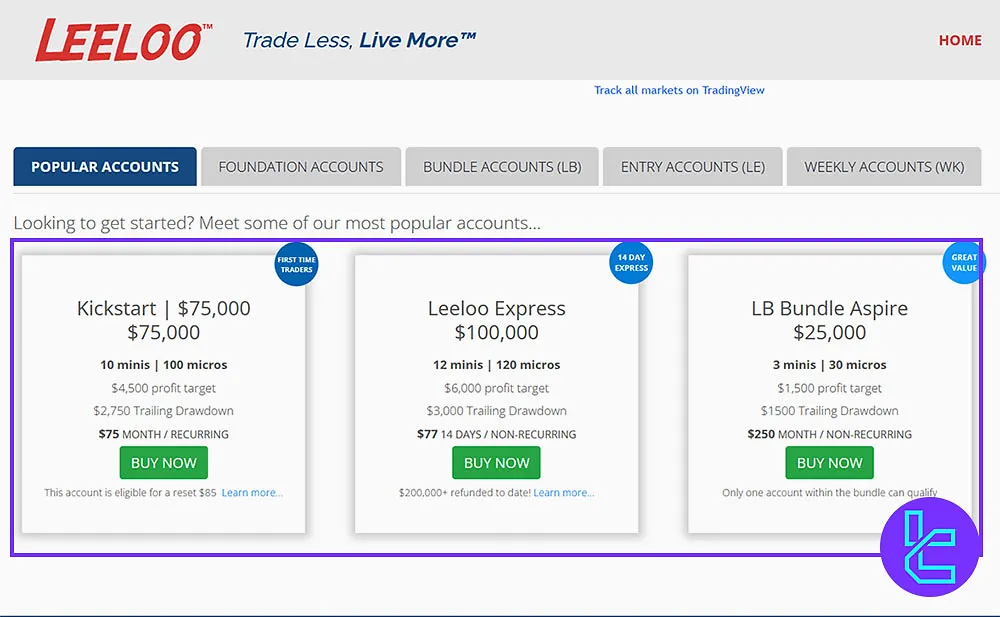

Challenge Rules at Leeloo Trading

Each Leeloo Challenge account type comes with a defined profit target and drawdown limit, using either a trailing or static structure; Leeloo Evaluation Conditions:

Account Name | Balance | Profit Target % | Drawdown Limit % |

Kickstart | $75,000 | 6.0% | 3.67% |

Leeloo Express | $100,000 | 6.0% | 3.0% |

Aspire | $25,000 | 6.0% | 6.0% |

Launch | $50,000 | 6.0% | 5.0% |

Climb | $100,000 | 6.0% | 3.0% |

Cruise | $150,000 | 6.0% | 3.33% |

Burst | $250,000 | 6.0% | 2.6% |

Explode | $300,000 | 6.67% | 2.5% |

Static Max Loss | $100,000 | 6.0% | 3.0% |

LB Bundle Aspire | $25,000 | 6.0% | 6.0% |

LB Bundle Launch | $50,000 | 6.0% | 5.0% |

LB Bundle Climb | $100,000 | 6.0% | 3.0% |

LB Bundle Cruise | $150,000 | 6.0% | 3.33% |

LB Bundle Burst | $250,000 | 6.0% | 2.6% |

LB Bundle Explode | $300,000 | 6.67% | 2.5% |

LE Aspire | $25,000 | 6.0% | 6.0% |

LE Launch | $50,000 | 6.0% | 5.0% |

LE Climb | $100,000 | 6.0% | 3.0% |

LE Cruise | $150,000 | 6.0% | 3.33% |

LE Burst | $250,000 | 6.0% | 2.6% |

LE Explode | $300,000 | 6.67% | 2.5% |

Aspire WK | $25,000 | 6.0% | 6.0% |

Launch WK | $50,000 | 6.0% | 5.0% |

Explode, LE Explode, and LB Bundle Explode have the lowest drawdown limit of 2.5%.

Leeloo Trading Copy Trading

The platform prohibits both manual and software-based copy trading on some accounts; Leeloo Copytrade Rules:

- Accelerator, Weekly, Third-party, and Performance Accounts (with 10-day, 15-day, WAIVE 30%, or Reduce Rule Edge Enhancers);

- Only 3 accounts can be copied simultaneously (e.g., 2 out of 10 Foundation Pass);

- Violations result in immediate account closures.

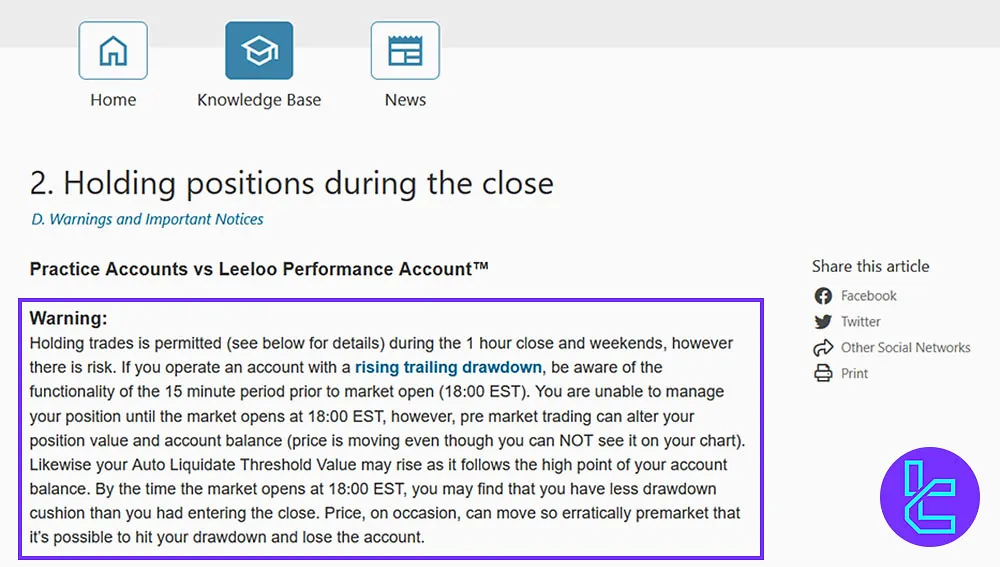

Position Holding Rule at Leeloo Trading

The firm allows holding trades during specific times; Leeloo’s Holding Rule:

- The 1-hour market close and weekends, trade with caution;

- Price can move before 18:00 EST, risking Auto Liquidate from a tightened drawdown;

- Glide is the only account without a rising trailing drawdown;

- Practice Accounts can hold trades from 17:00 to 18:00 EST.

Leeloo Trading Flipping Policy

Leeloo limits flipping activity by certain requirements; Leeloo’s Flipping Rule:

- Less than 5% of total trading days should be used for ‘flipping’;

- Flipping includes placing trades solely to meet activity requirements.

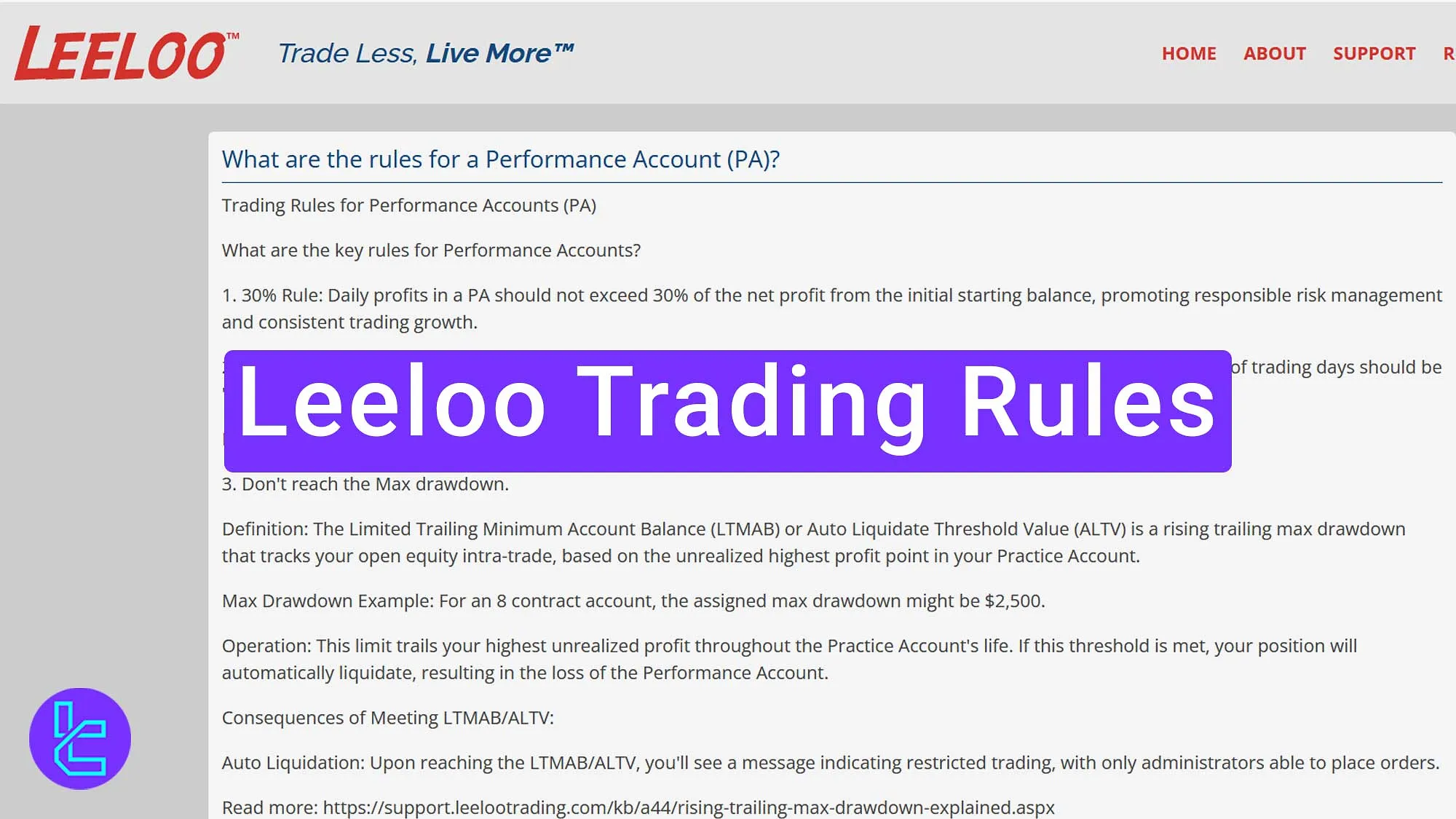

What is Leeloo Trading 30% Rule?

The 30% Rule ensures that traders do not risk too much in a single day; Leeloo's 30% Policy:

- Your best trading day must be less than 30% of your total profit;

- Example: If your initial balance is $50,000 and your current balance is $75,000, the profit is $25,000, so the daily cap is $7,500;

- Formula: Max Daily Profit < 0.30 × (Current Balance − Initial Balance)

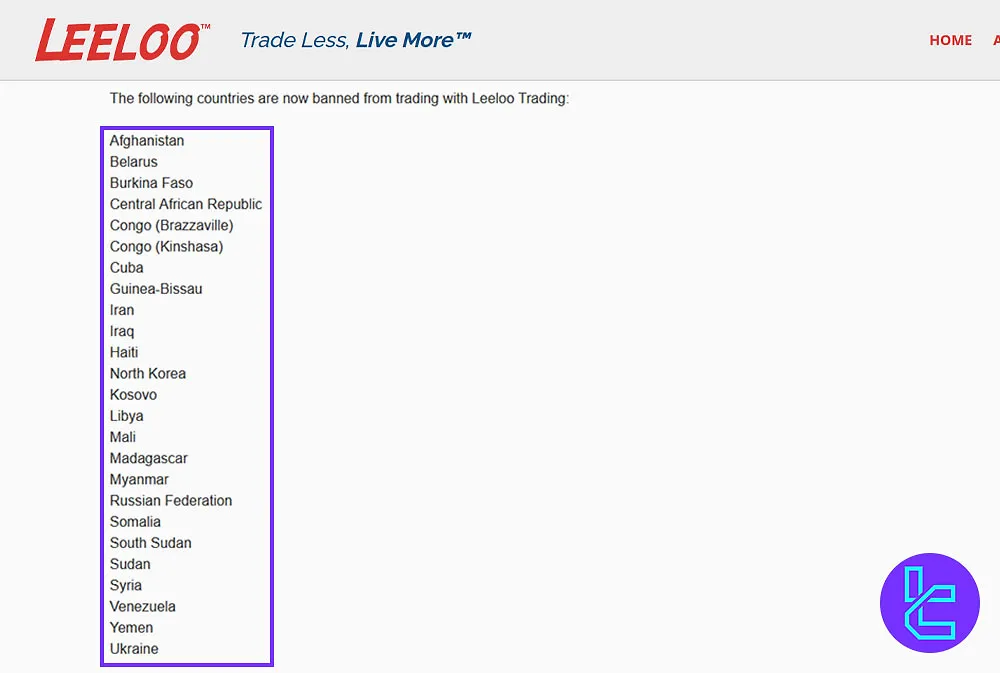

Leeloo Trading Restricted Countries

Leeloo does not support traders from the following countries; Leeloo Trading Banned Regions:

- Afghanistan

- Belarus

- Burkina Faso

- Central African Republic

- Congo (Brazzaville)

- Congo (Kinshasa)

- Cuba

- Guinea-Bissau

- Iran

- Iraq

- Haiti

- North Korea

- Kosovo

- Libya

- Mali

- Madagascar

- Myanmar

- Russian Federation

- Somalia

- South Sudan

- Sudan

- Syria

- Venezuela

- Yemen

- Ukraine

Writer’s Opinion and Conclusion

Leeloo Trading Rules restrict copy trading, applying to 10-day, 15-day, WAIVE 30%, and Reduce Rule accounts. Popular regions like Iran, Russia, Ukraine, and Venezuela remain restricted.

High drawdown risks appear in accounts like Explode at 2.5%, compared to Kickstart’s 3.67% or Aspire’s 6.0%.

For more informative articles, check out Leeloo Trading Tutorials.