The Lionheart Funding Program rules outlines essential policies, including profit targets vary from 8%, 10%, to 6%, with 3%, 4%, or 5% daily drawdowns.

Funded status allows unlimited profit, but rules like hedging and martingale are banned. Copy trading, account management, grid trading, and arbitrage also lead to challenge failure.

Lionheart Funding Program Rule Topics

There are strict limitations on Lionheart Funding Program Prop Firm to uphold fairness and risk control; Main Lionheart Rule Categories:

- Challenge Rules

- EA Usage

- Copy Trading Ban

- No Hedging Policy

- News Trading Conditions

- Weekend/Overnight Holding Rules

- Merged Account Restrictions

- Payout Requirements

- Consistency Limit

Lionheart Funding Program Challenge Rules

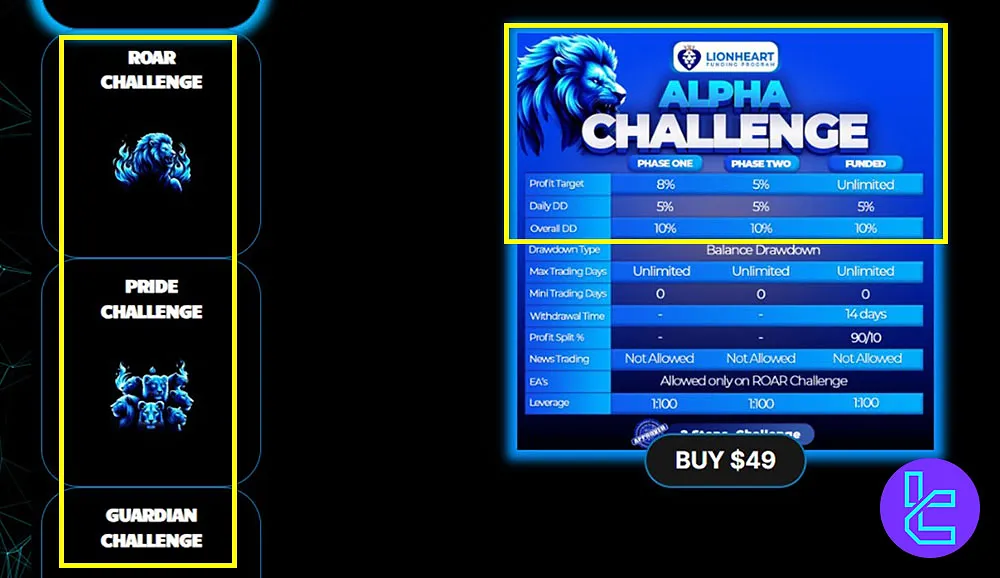

Each challenge type features different profit targets and drawdown rules across phases. Below is a breakdown of the Alpha, ROAR, Pride, and Guardian programs:

Challenge | Phase | Profit Target | Daily DD | Max DD |

Alpha | Phase 1 | 8% | 5% | 10% |

Phase 2 | 5% | 5% | 10% | |

Funded | Unlimited | 5% | 10% | |

ROAR | Phase 1 | 10% | 4% | 10% |

Phase 2 | 5% | 4% | 10% | |

Funded | Unlimited | 4% | 10% | |

Pride | Phase 1 | 10% | 3% | 6% |

Funded | Unlimited | 3% | 6% | |

Guardian | Phase 1 | 6% | 4% | 8% |

Phase 2 | 5% | 4% | 8% | |

Phase 3 | 4% | 4% | 8% | |

Funded | Unlimited | 4% | 8% |

As mentioned, the Guardian Challenge has the tightest drawdown but the longest evaluations.

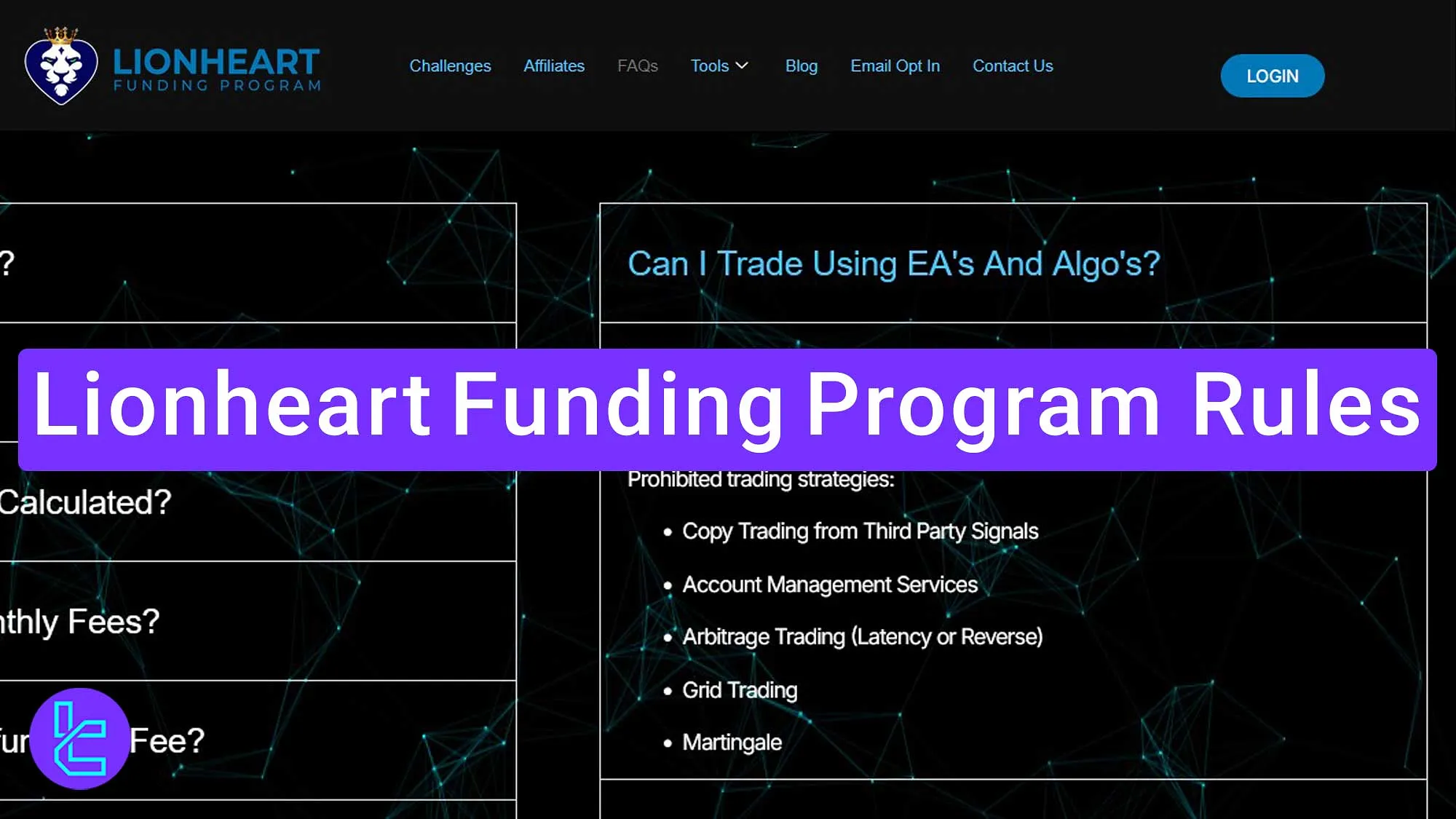

Lionheart Funding Program EA’s

EA and algorithmic trading are only allowed during ROAR Challenge phases and must avoid restricted practices; Lionheart Prohibited Activity:

- Copy trading

- Arbitrage

- Account management

- Grid trading

- Martingale

Lionheart Funding Program Copy Trading

Lionheart strictly prohibits all forms of trade copying:

- Only original trading approaches are permitted;

- Replicated trades lead to disqualification.

Lionheart Funding Program Hedging

Hedging is completely disallowed to maintain controlled risk exposure. Violations lead to challenge failure.

Lionheart Funding Program News Trading

News trading is permitted but must follow safe practices:

- Traders must use proper risk management;

- Avoid oversized positions during volatile news events.

Lionheart Funding Program Weekend and Overnight Holding of Trades (Allowed)

Lionheart allows holding trades over the weekend or overnight:

- No penalties for positions left open;

- Still requires risk management discipline.

Lionheart Funding Program Merged Accounts

Account merging is not supported to preserve individual risk structures; Merging Accounts in Lionheart:

- Each account must remain standalone;

- Contact support for multiple account help.

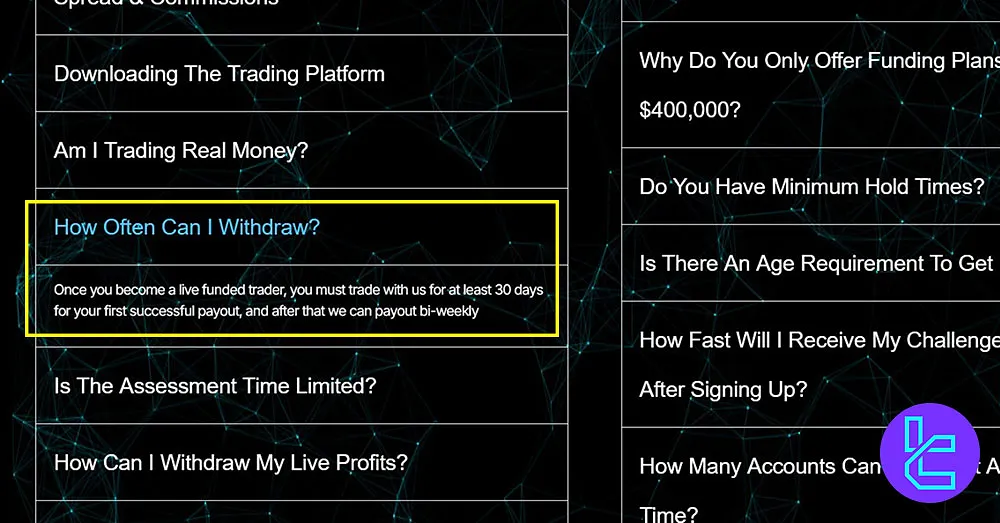

Lionheart Funding Program Payout Rules

Live funded traders are eligible for payouts only after meeting activity requirements.

- First payout: after trading for 30 days

- Following payouts: bi-weekly

Lionheart Funding Program Consistency Rule

Lionheart enforces a 50% consistency cap on best trading days; No single day should exceed 50% of total profit. This rule Promotes steady growth and long-term strategies.

Writer’s Opinion and Conclusion

Lionheart Funding Program rules allow EAs only in the ROAR Challenge and prohibit methods such as martingale.

News trading, weekend, and overnight holding are allowed with proper risk control. Payouts come after 30 days, then bi-weekly, with a strict 50% consistency rule.

For more educational articles, read the Lionheart Funding Program Tutorials page.