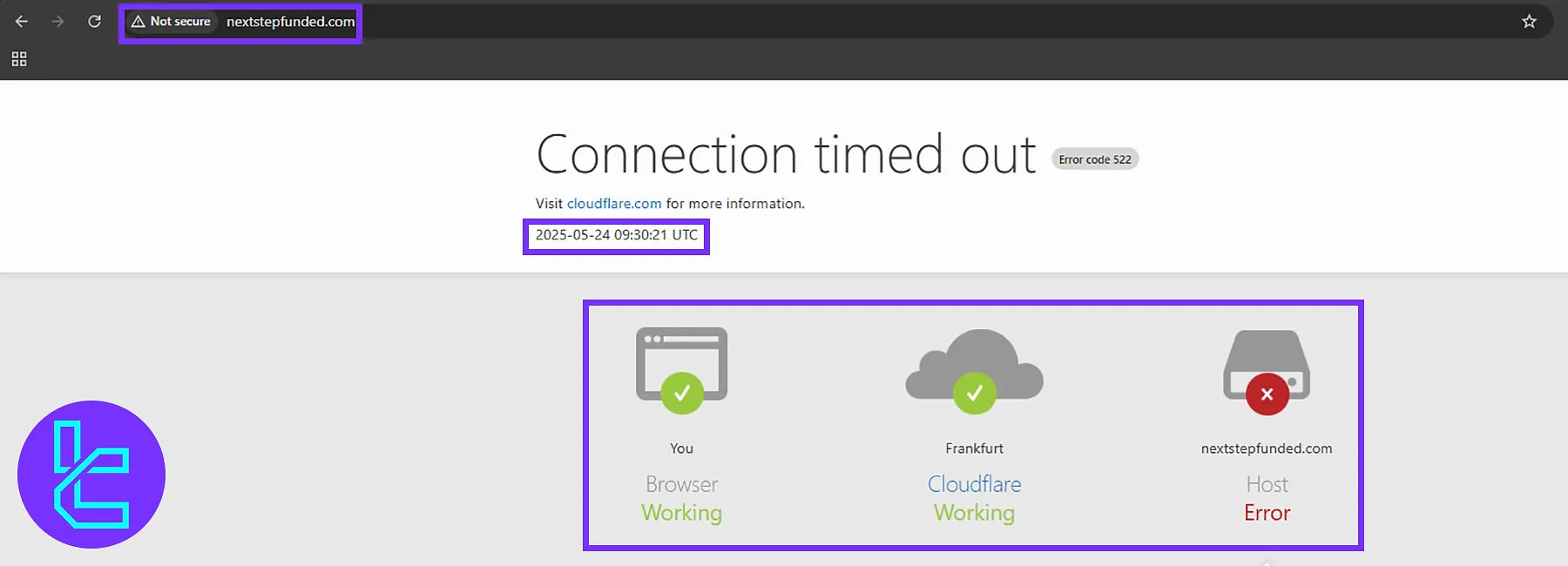

The website nextstepfunded.com is currently down (24/5/2025). As indicated by the "Connection timed out (Error code 522)" message in the image, the browser and Cloudflare are functioning properly, but the website's host server is not responding.

Next Step Funded

Investing and trading in financial markets such as the stock exchange, forex, digital currencies in the form of spot or with leverage face a high inherent risk. According to the statistics of all exchanges and brokers, more than 75% of people lose!

The website nextstepfunded.com is currently down (24/5/2025). As indicated by the "Connection timed out (Error code 522)" message in the image, the browser and Cloudflare are functioning properly, but the website's host server is not responding.

Next Step Funded is an Australian prop trading firm with four 1-step and 2-step challenges. These evaluations allow traders to receive funded accounts with sizes ranging from $7.5k to $400k and prices ranging from $28 to $2,150.

Next Step Funded (Prop Solutions FZE-LLC) is a prop trading firm that empowers traders by providing access to significant capital, allowing them to unleash their full potential in the forex prop trading market.

Here's what you need to know about Next Step Funded:

Let's break down the key specifications of Next Step Funded prop firm:

Account currency | N/A |

Minimum price | $71 |

Maximum leverage | 1:100 |

Maximum profit split | 90% |

Instruments | Forex, indices, commodities, metals, stocks |

Assets | USD/JPY, FTSE 100, Gold, oil |

Evaluation steps | 2 |

Trading platform | MT5 |

Withdrawal methods | Rise |

Maximum fund size | $400,000 |

First profit target | 10% |

Maximum daily loss | 5% |

Challenge time limit | Unlimited |

News trading | Yes |

Maximum total drawdown | 12% |

Commission per round lot | N/A |

Trust pilot score | 3.0/5 |

Payout frequency | weekly |

Established country | Australia |

Established year | N/A |

Before diving in, it's crucial to weigh the advantages and disadvantages of Next Step Funded:

Advantages | Disadvantages |

Diverse funding options starting from $7,500 up to $300,000 | High number of negative reviews on Trustpilot |

24/7 trading with weekend position holding allowed | Very strict trading rules with a 10% profit target and 5% daily drawdown |

Variety of funding evaluations | Concerns about safety and legitimacy due to negative feedback |

While the funding options appear attractive, traders should carefully consider the strict rules and high challenge fees before proceeding.

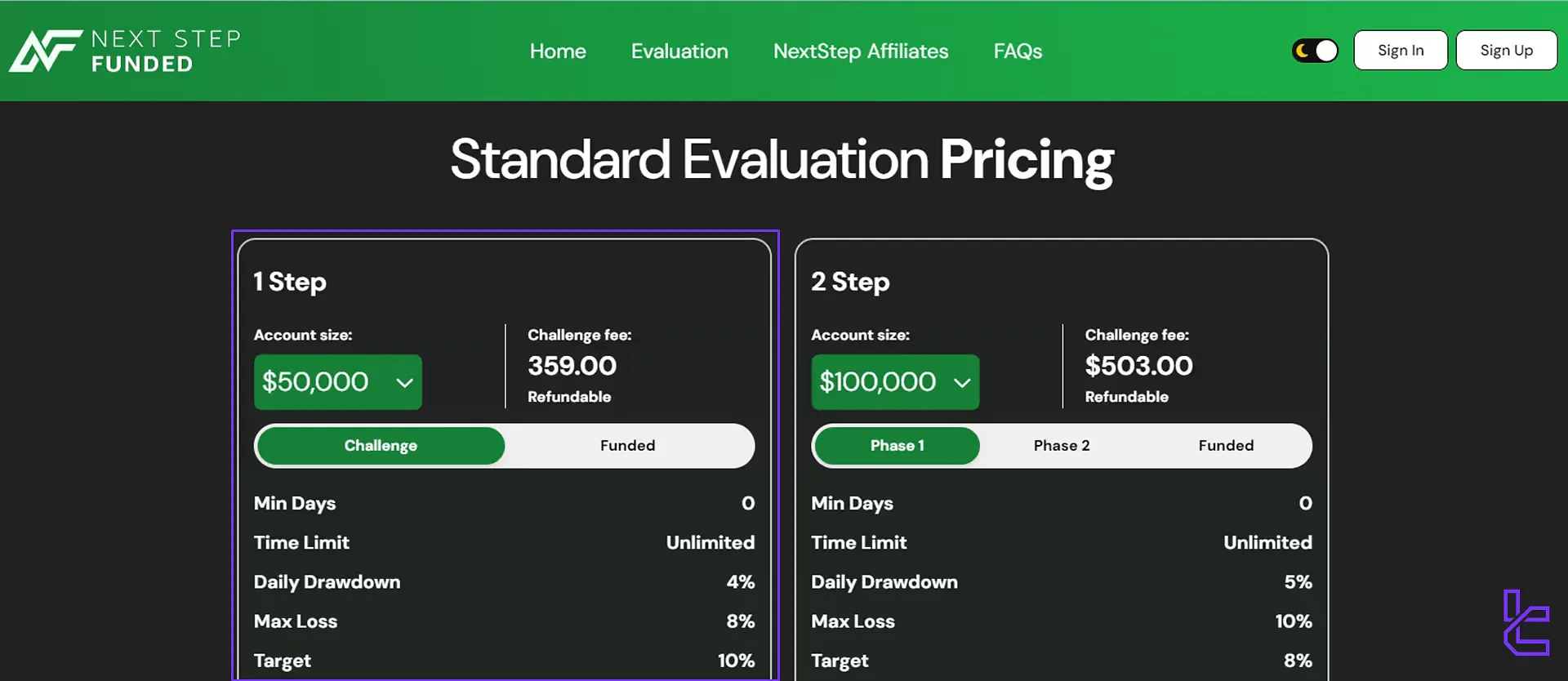

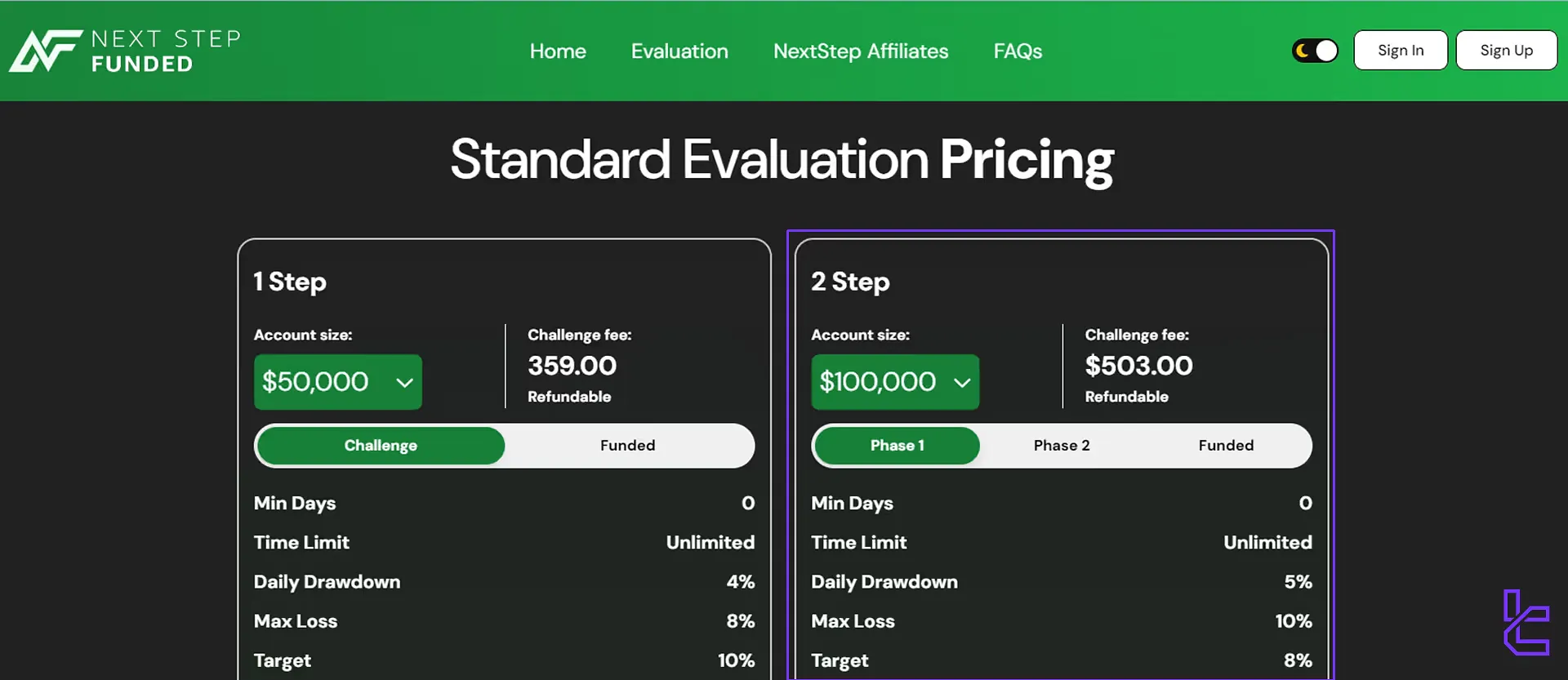

Next Step Funded offers traders two types of standard challenges to access funded accounts: A one-step challenge and a more rigorous two-step challenge. Each challenge type supports a range of account sizes, from $15,000 to $200,000.

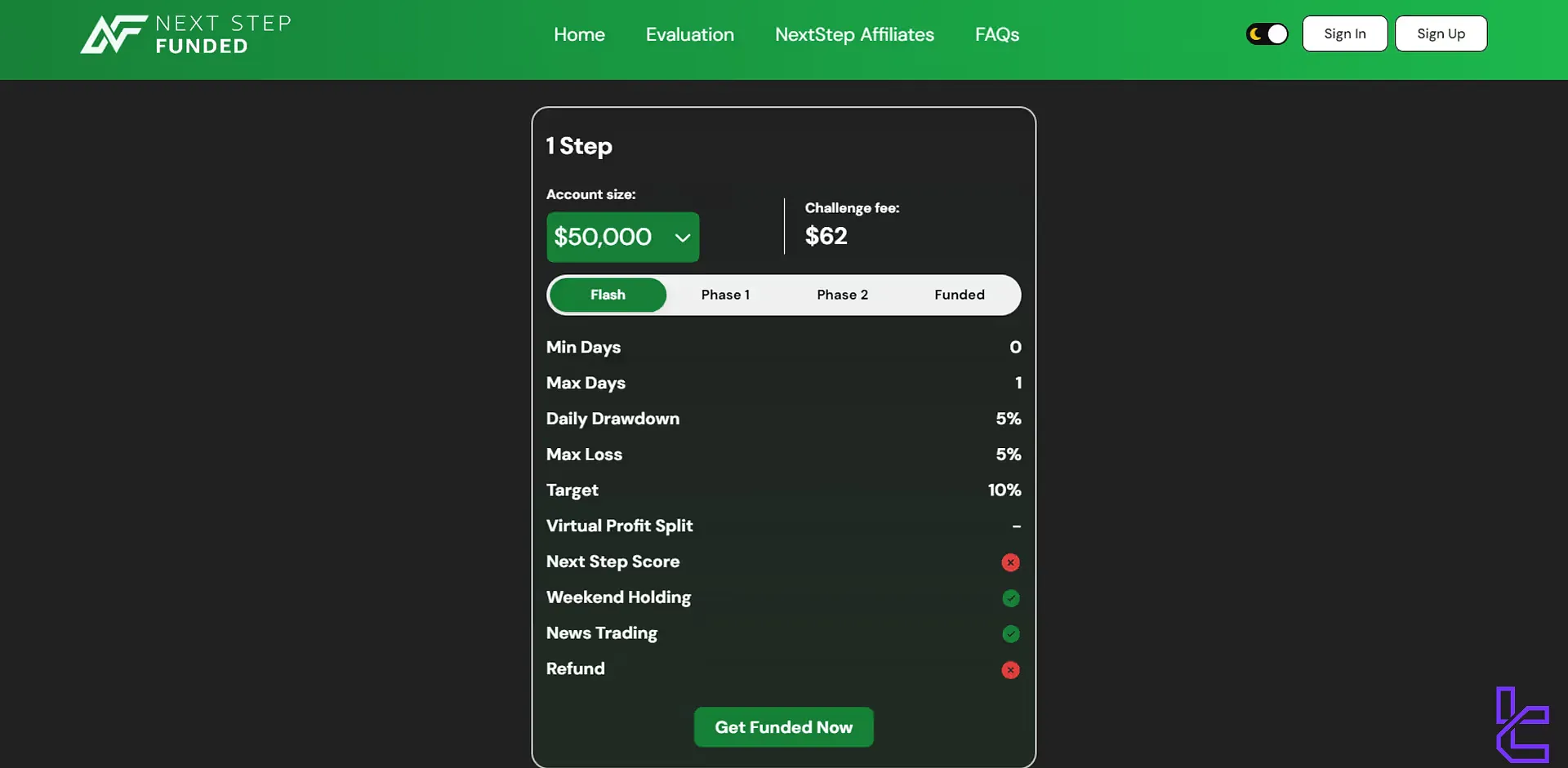

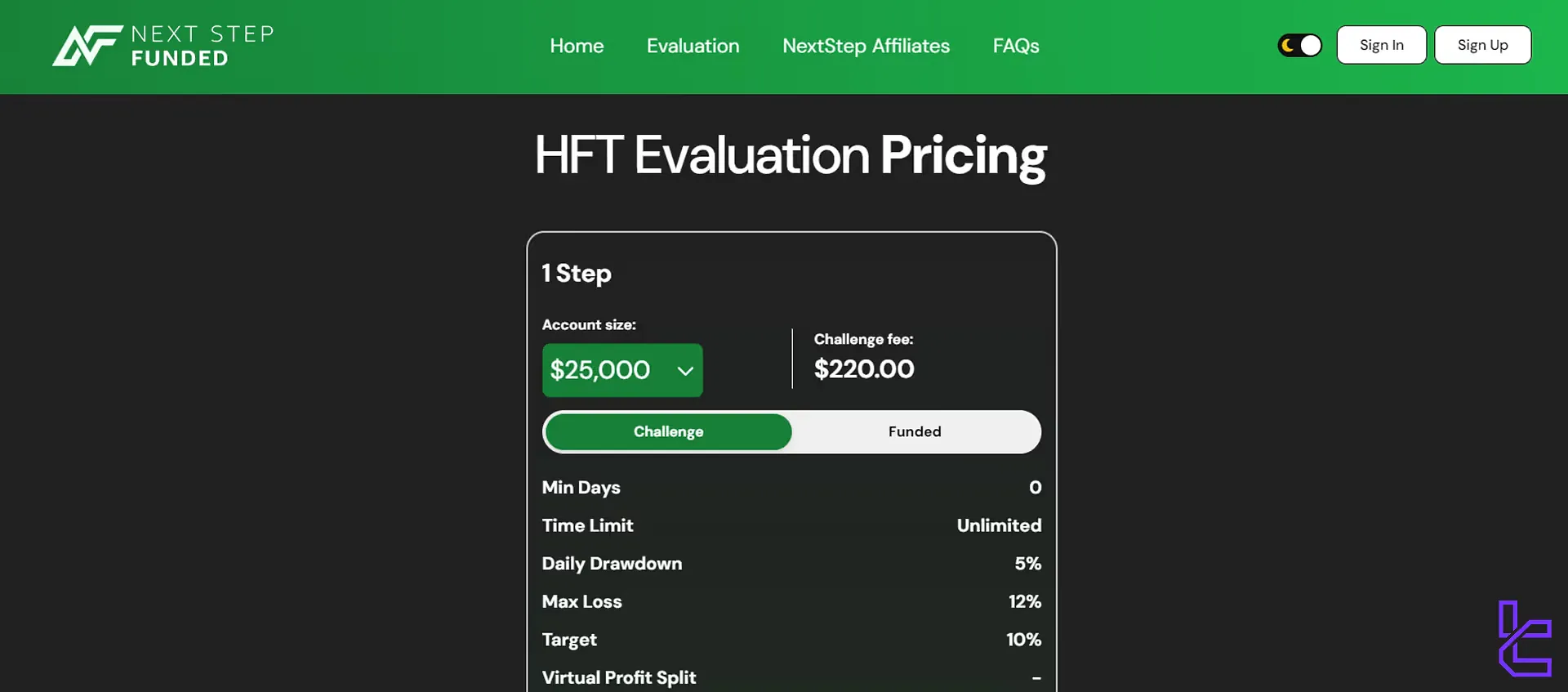

The prop firm also features two other account types, including Flash and HFT, with the following prices:

Funding size | $25k | $50k |

Evaluation price | $28 | $62 |

Funding size | $15k | $25k | $50k | $100k | $200k |

Evaluation price | $125 | $179 | $359 | $602 | $1,205 |

Funding size | $15k | $25k | $50k | $100k | $200k |

Evaluation price | $98 | $152 | $305 | $503 | $998 |

Funding size | $7.5k | $15k | $25k | $50k | $100k | $300k |

Evaluation price | $71 | $140 | $220 | $440 | $890 | $2150 |

While the funding options appear attractive, traders should carefully consider the strict rules and high challenge fees before proceeding.

Next Step Funded allows traders to scale their access to capital up to a total of $600,000.

Although individual challenges range up to $300,000 in funding per account, traders can hold multiple funded accounts as long as the combined total does not exceed the firm’s maximum allocation cap.

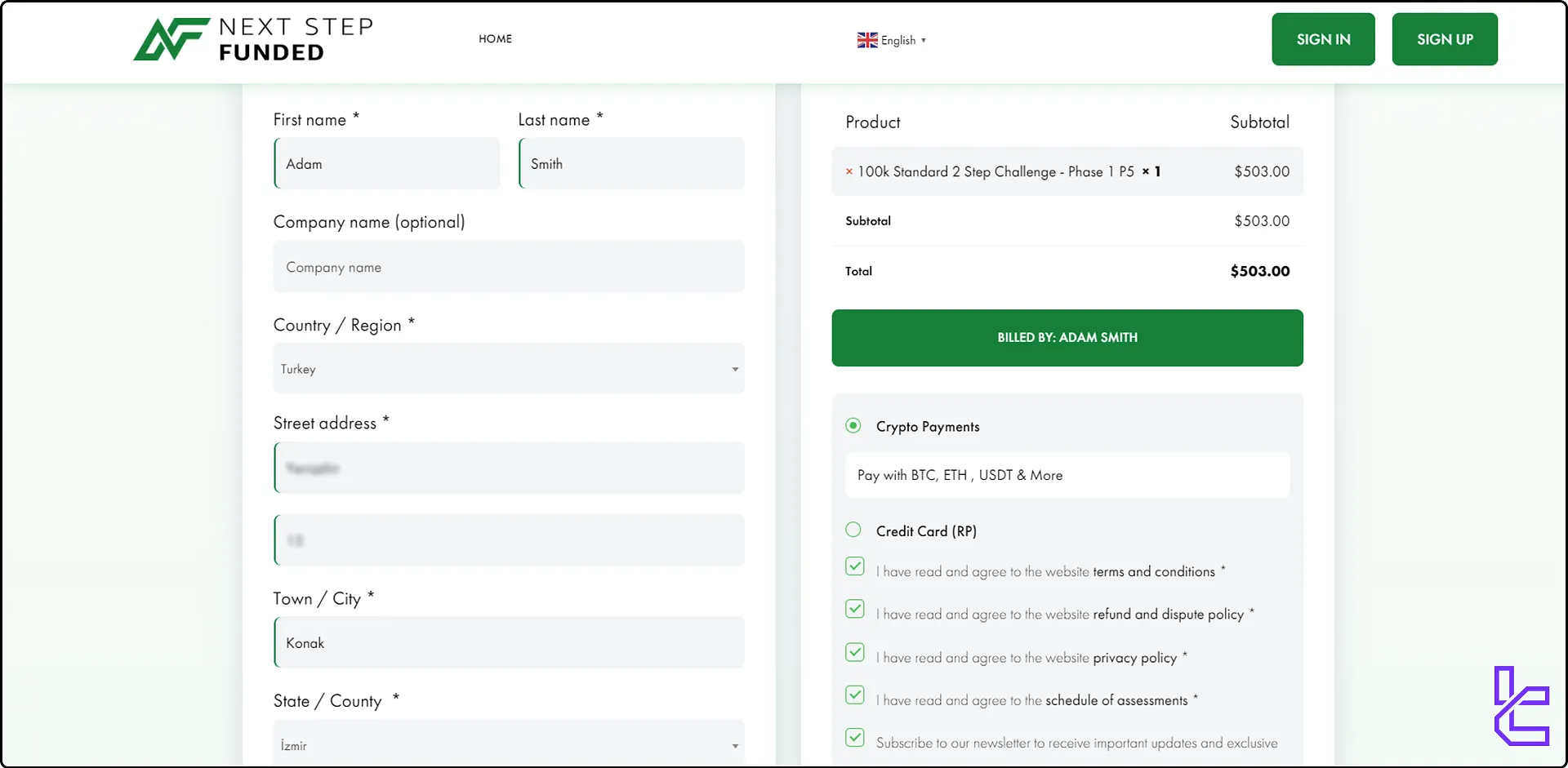

The registration and verification process at Next Step Funded involves several steps:

Navigate to the prop firm's official website, choose a funding program, and click "Complete Order".

Enter your personal details in the checkout form and complete the payment process. Required details for the NSF billing form:

After filling out the billing form, agree to the company's terms and conditions.

Upon reaching the profit target without violating account rules and before proceeding to a live account, complete the Know Your Customer (KYC) verification process (ID and address verification).

Next Step Funded's evaluation process consists of multiple options:

This evaluation plan has no time limits and is suitable for most traders. It is offered in one-step and two-step evaluation stages

Standard Evaluation 1-step:

Account Size | $15k | $25k | $50k | $100k | $200k |

Maximum daily drawdown | 4% | ||||

Maximum overall drawdown | 8% | ||||

Profit target | 10% | ||||

Maximum trading days | Unlimited | ||||

Challenge fee | $125 | $179 | $359 | $602 | $1,205 |

This challenge is convenient for both experienced and beginner traders.

Standard Evaluation 2-step:

Account Size | $15k | $25k | $50k | $100k | $200k |

Maximum daily drawdown | 5% | ||||

Maximum overall drawdown | 10% | ||||

Profit target phase 1 | 8% | ||||

Profit target phase 2 | 5% | ||||

Maximum trading days | Unlimited | ||||

Challenge fee | $98 | $152 | $305 | $503 | $998 |

Traders who prefer a gradual approach toward becoming funded can benefit from this evaluation plan.

Account Size | $25k | 50K |

Maximum daily drawdown | 5% | |

Maximum overall drawdown | 5% | |

Profit target | 10% | |

Maximum trading days | 1 | |

Challenge fee | $28 | 62$ |

This program is designed for traders who want to get funded as soon as possible.

Account Size | $7.5k | $15k | $25k | $50k | $100k | $300k |

Maximum daily drawdown | 5% | |||||

Maximum overall drawdown | 12% | |||||

Profit target | 10% | |||||

Maximum trading days | Unlimited | |||||

Challenge fee | $71 | $140 | $220 | $440 | $890 | $2150 |

This challenge type is tailored for high-frequency traders.

Next Step Funded offers competitive profit-sharing terms that improve over time. Funded traders begin with a standard 60/40 split in their favor during the first payout cycle.

With consistent performance, the share increases to 80/20 and can go as high as 90/10 in the trader's favor. This model rewards reliability and profitability, making long-term collaboration more attractive.

Next Step Funded occasionally offers discount codes so new traders can buy challenges at a discount. Unfortunately, this prop firm doesn’t have any active bonuses.

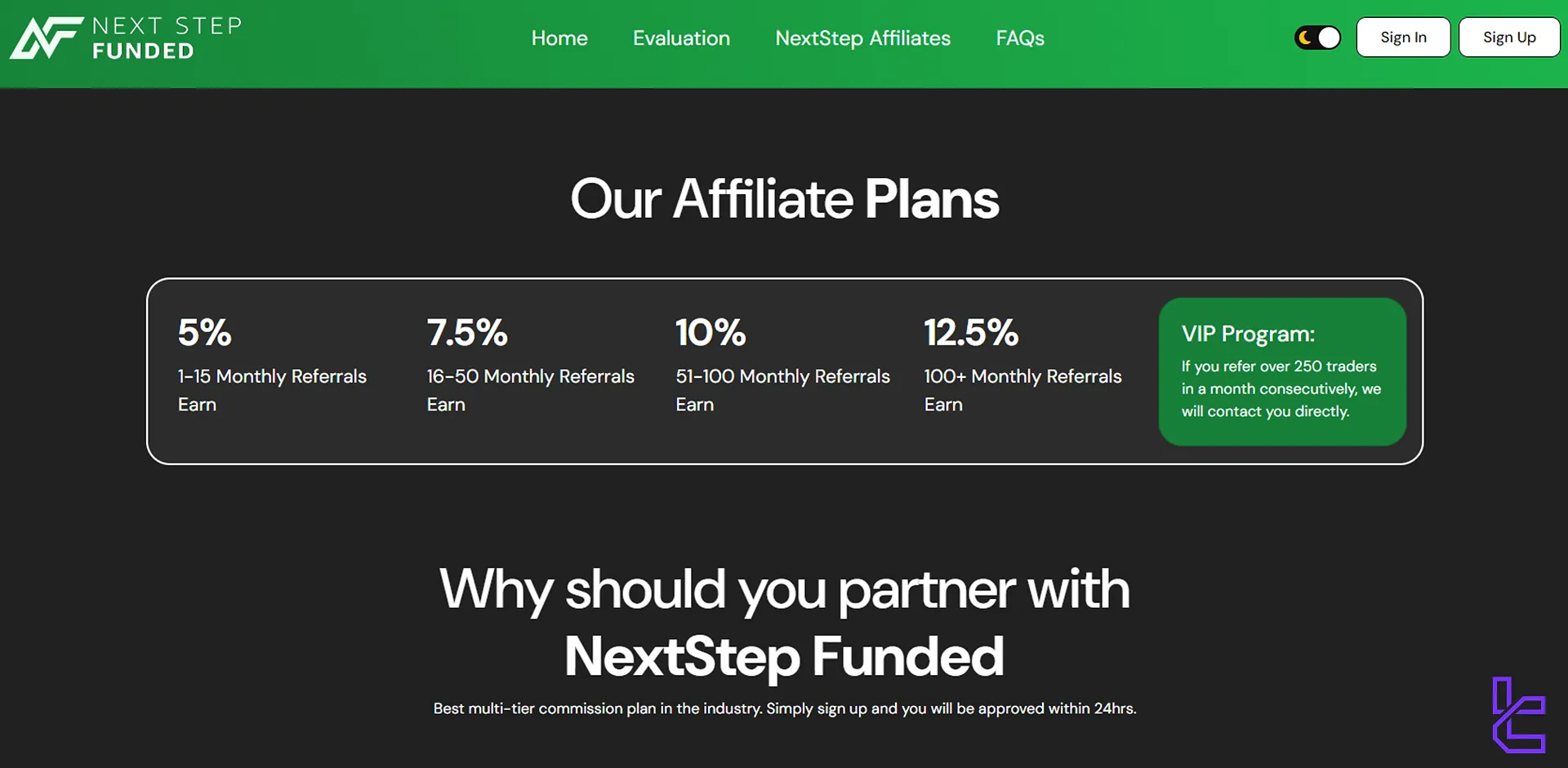

Next Step Funded currently offers an affiliate program for traders to invite their friends to this platform and earn up to 12.5% commission on their purchases. This program is particularly attractive for traders with a high following on the social media accounts.

Next Step Funded utilizes the popular MetaTrader 5 (MT5) platform, provided through their partnership with Eightcap. This offers traders:

NSF trading platform download links:

The use of MT5 ensures that traders have access to a robust and widely used platform, potentially easing the transition for those already familiar with MetaTrader products.

TradingFinder has developed a wide range of MT5 indicators that you can use for free.

Next Step Funded offers a diverse range of tradable instruments, including:

This wide selection allows traders to diversify their strategies and take advantage of various market conditions.

Next Step Funded provides several options for traders to pay challenge fees and withdraw their earnings:

Payment methods:

Payout methods:

The lack of various payout options is one of the major drawbacks of the Next Step Funded prop firm.

Unfortunately, Next Step Funded doesn’t provide any information regarding spread or commission costs of trading on this platform. This is a major drawback for users since it effects their profitability. Traders should consider this before purchasing a challenge from Next Step Funded.

Next Step Funded lacks educational materials about Forex trading tips and tricks, technical or fundamental analysis, and MetaTrader 5 instruction and guidance. Beginner traders could checkout other prop firms such as FTMO and Funded Next for educational resources.

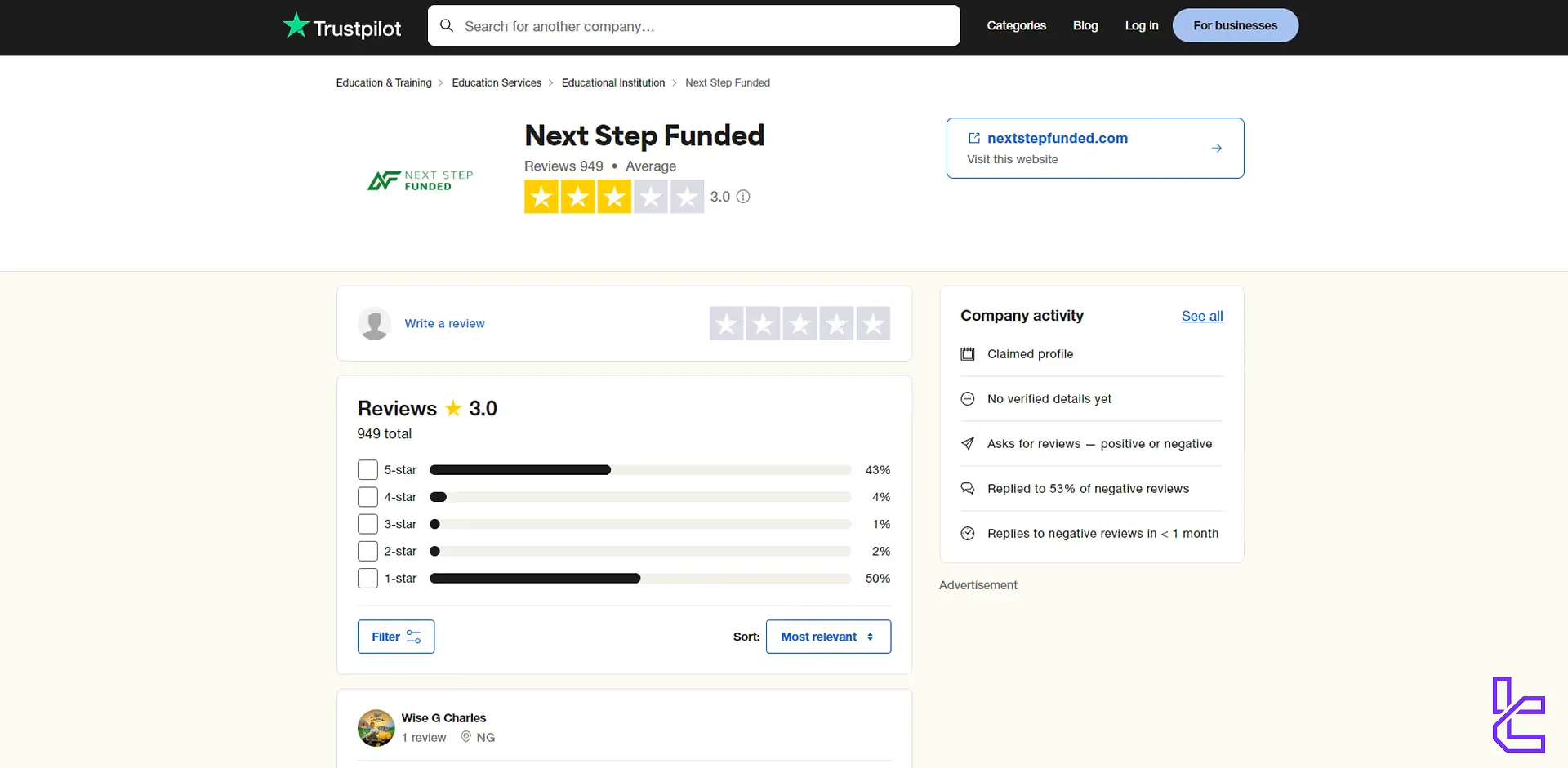

The Next Step Funded Trustpilot profile's score paints a concerning picture:

The company actively responds to negative reviews, indicating an effort to address customer concerns. However, the high proportion of negative reviews raises significant red flags that potential traders should carefully consider.

Next Step Funded claims to offer 24/7 customer support through:

However, user reviews suggest mixed experiences with their support team. While some praise the responsiveness, others report significant delays or lack of resolution to their issues. The inconsistency in support quality appears to be a point of frustration for many traders.

Next Step Funded claims to answer traders' inquiries through Discord as well, but this seems not true since you can’t find their Discord chat by searching on the web.

Next Step Funded maintains a presence on several social media platforms:

Traders can use these social media channels to stay informed about Next Step Funded's offerings and connect with other traders.

Next Step Funded account rules, including the 10% profit target, 5% daily, and 12% maximum drawdowns, ensure that only traders with solid trading strategies can pass their challenges.

Before joining this platform, potential traders should consider Next Step Funded’s 3.0/5 Trustpilot score from over 940 reviews.

While registered as a company, the high number of negative reviews raises concerns about legitimacy.

Challenge fees start from $71 for the smallest account size of $7,500.

Next Step Funded utilizes the MetaTrader 5 (MT5) platform, provided through their partnership with Eightcap.