PipFarm rules focus on key aspects like news trading (close by 3:45 PM EST Friday), drawdown limits (9% trailing, 6% static), and profit targets (12% Stage 1, 9% Stage 2.)

Inactivity requires closing a trade every 28 days, while hedging is allowed on a single account only.

PipFarm Rule Topics

As with many prop firms, PipFarm Prop Firm sets certain rules for trading; Key topics for PipFarm Policy:

- Challenge Rules

- Inactivity Rules

- High-frequency Trading (HFT) / Latency Arbitrage Bots

- Gap Trading

- Signal Trading/Passing Services

- Hedging

- Cross-Account Risk Manipulation

- Consistency Rule

- Payout Policy

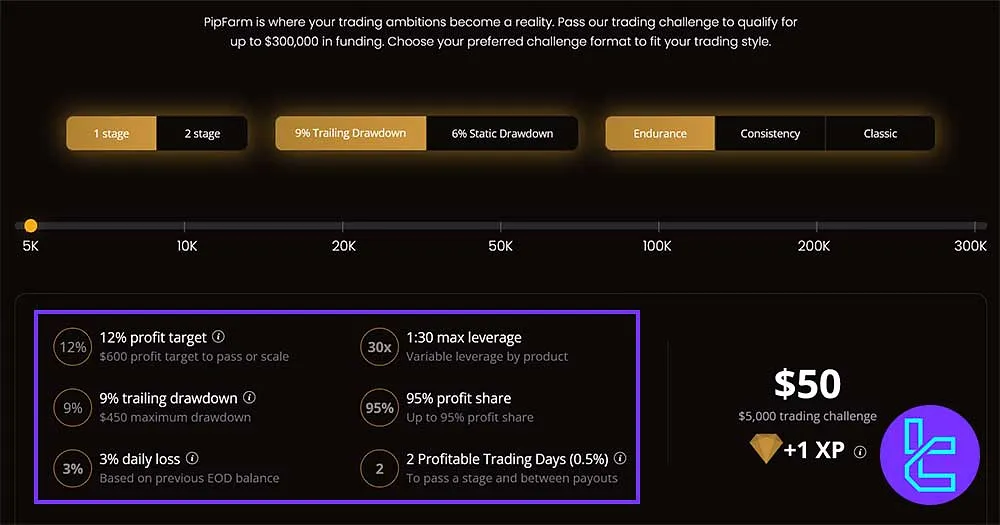

PipFarm Challenge Rules

One of the most important rules is the evaluation conditions; PipFarm Challenge Limits:

Stage | Profit Target | Profit Share | Max Drawdown Limits | Daily Loss Limit |

1st Stage | 12% | 95% | 9% (Trailing) | 3% |

2nd Stage | 9% stage 1 6% stage 2 | 95% | 9% (Static) | 3% |

As you see, the max drawdown for the 1-stage evaluations is Trailing.

PipFarm Inactivity Rules

Traders must close at least one trade every 28 days to keep their accounts active.

PipFarm HFT & Latency Arbitrage Bots

Hedging trades on a single account is allowed, but not for manipulating the program rules; This practice between multiple accounts or across firms is strictly prohibited.

PipFarm Gap Trading

Gap Trading involves opening positions to capitalize on price gaps caused by major global news or market closures. Profits from gaps larger than 0.2% will be deducted from the position.

PipFarm Signal Trading

As with many Prop Firms, PipFarm prohibits copying trades or using strikingly similar patterns to other traders.

Note: This behavior is detected through consistent patterns, not just a few similarities.

PipFarm Cross-Account Risk Manipulation

Cross-Account Risk Manipulation involves opening positions on the same instrument across multiple accounts to bypass risk controls; This strategy violates the program's integrity and is prohibited.

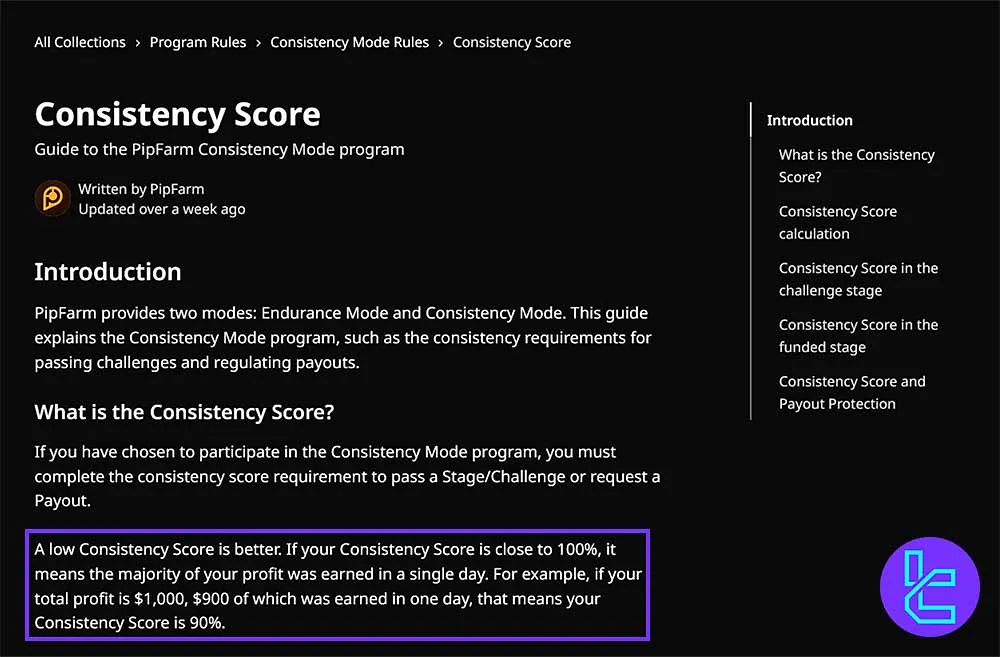

PipFarm Consistency Rule

The Consistency Score is calculated by dividing your best trading day by your total profit; PipFarm Consistency Score for Different Account Sizes:

- 5K/10K/20K/50K: ≤50%

- 100K: ≤40%

- 200K: ≤30%

- 300K: ≤20%

PipFarm Payout Rule

PipFarm processes one payout every Friday. Withdrawals are automatically scheduled if performance requirements are met and no positions are open. PipFarm Payout Qualification:

- Endurance/Consistency Mode: Minimum profit of 1%

- Classic Mode: Minimum profit of 3%

Writer’s Opinion and Conclusion

PipFarm rules for withdrawal set 1 payout per week (1% minimum for Endurance/Consistency Mode and 3% for Classic Mode), processed on Fridays.

Consistency rules vary by account size (≤20% f0 $300k), and profits from gaps (caused by news) larger than 0.2% are deducted. Check out PipFarm Tutorials to learn more about the prop firm.