Rebels Funding rules include the prohibition of hedging, EAs, and arbitrage while allowing scalping if trades last at least 30 seconds.

Overnight trading and weekend trading are permitted, leverage may be reduced to 1:5 leverage for non-compliance, and traders have 6 months to activate their accounts and begin trading.

Rebels Funding Trading Rules

Strict trading regulations are enforced by Rebels Funding Prop Firm to ensure fair market participation; Areas of Rebels Funding Policies:

- Holding Trades During the Night

- Scalping

- Holding Trades Over the Weekend

- Trading During News Releases

- Trading Activation Period

- Using EA

Rebels Funding Holding Trades During the Night

- Holding trades overnight is allowed but discouraged;

- Spread widening, particularly on less liquid currency pairs, can impact trades;

- Traders should exercise caution when leaving positions open overnight.

Rebels Funding Scalping

- Scalping is allowed if trades last at least 30 seconds;

- Accidental trade closures under 30 seconds are tolerated;

- If repeated short trades form part of a strategy, the account may be terminated.

Rebels Funding Holding Trades Over the Weekend

- Weekend position holding is allowed but discouraged due to spread risks;

- Cryptocurrencies cannot be traded over the weekend;

- Increased volatility may lead to unexpected price movements.

Rebels Funding Trading During News Releases

- News trading is allowed but highly risky;

- Traders must avoid large positions to comply with trading rules in this prop firm;

- Inexperienced traders should avoid news trading due to market instability.

Rebels Funding Trading Activation Period

- Traders have six months to activate their accounts after purchase;

- After activation, trading can begin immediately;

- Failure to activate may result in account loss.

Rebels Funding Using EA

The firm enforces manual trading to ensure fair market participation; Rebels Funding EAs Rule:

- EAs and automated trading are strictly prohibited;

- Only manual trading is allowed;

- Traders violating this rule risk account termination.

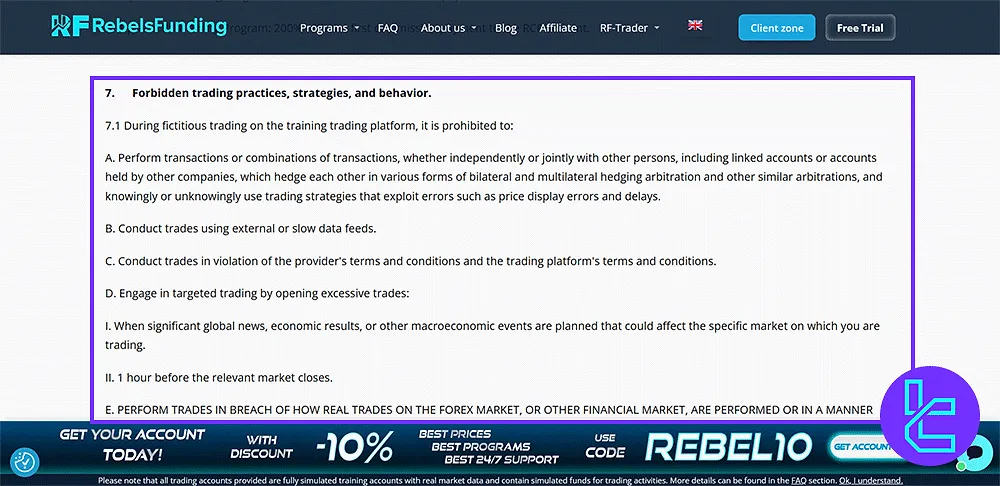

Rebels Funding Other Forbidden Strategies

To maintain a fair trading environment, Rebels Funding prohibits several high-risk strategies; Rebels Funding Forbidden Practices:

- Martingale: Doubling down on losses to recover quickly;

- One-sided bet multiplication: Placing multiple trades in the same direction to manipulate outcomes;

- Aggressive scalping: Executing trades lasting less than 30 seconds;

- Excessive orders: Placing an abnormally high number of trades, creating risks for the platform;

- All forms of arbitrage: Price, gap, swap arbitrage, and other exploitative strategies;

- Hedging: Opening opposite trades to reduce risk, which is not allowed.

Rebels Funding Consequences of Prohibited Trading

Traders violating Rebels Funding rules may face severe penalties; Rebels Funding Violation Results:

- Removing violating trades from trading history

- Ignoring profits/losses from rule-breaking trades

- Terminating services and contracts with the trader

- Reducing leverage to 1:5 on all accounts

Writer’s Opinion and Conclusion

Rebels Funding Rules allow News trading, but excessive risk-taking, such as martingale and one-sided bets, is strictly forbidden.

Violating these rules can result in trade removal penalties, profit being ignored, or even account termination.

To learn about the evaluation phases and their conditions, read Rebels Funding Challenges from the listed articles on the Rebels Funding Tutorials page.