SGB Trading (Sarmaye Gozar Bartar) is a newly established firm that commenced operations in 2021. This Emirati prop firm offers flexible rules, 0.0 spread, with up to $200K capital [scalable to $1M]. This prop firm provides an 85% profit split and 1:100 leverage on all accounts.

SGB Trading Company Information

SGB Trading was founded by in January 2021 and is based in Dubai, UAE. It quickly gained traction in the proprietary trading firm space by offering traders competitive payout models and scalable growth paths.

The firm has already recorded over 22,000 registrations and has paid out more than $1.8 million in interest to its traders. Notably, the company boasts a payout of over 50,000% to the most prominent individual trader, underscoring its commitment to rewarding high performers.

In the first two months, traders receive an 80% profit share, which increases to 85% thereafter. Key Highlights From SGB Trading:

- Launch Date: January 2021

- Headquarters: Dubai, United Arab Emirates

- Total Registrations: 22,000+

- Maximum Interest Paid: +50,000% to a single account

- Total Interest Paid: $1.8M+

- Profit Split: First two months equal 80%, Afterward it will be up to 85%

SGB Trading Specifications

SGB Trading prop firm offers a minimalistic structure, featuring one-time payment plans, competitive evaluation targets, and flexible capital scaling. Traders operate in MetaTrader environments with broad access to global assets. SGB prop firm Specifics:

Account Currency | USD |

Minimum Price | $66 |

Maximum Leverage | 1:100 |

Maximum Profit Split | Up to 85% |

Instruments | Forex Pairs, Cryptocurrencies, Stocks, Indices, and Metals |

Assets | N/A |

Evaluation Steps | 2 Step |

Withdrawal Methods | Not Specified |

Maximum Fund Size | $200,000 |

First Profit Target | $400 |

Max. Daily Loss | 5% |

Challenge Time Limit | 10 Days |

News Trading | Specified Limit |

Maximum Total Drawdown | 12% |

Trading Platforms | MT4, MT5 |

Commission Per Round Lot | Not Specified |

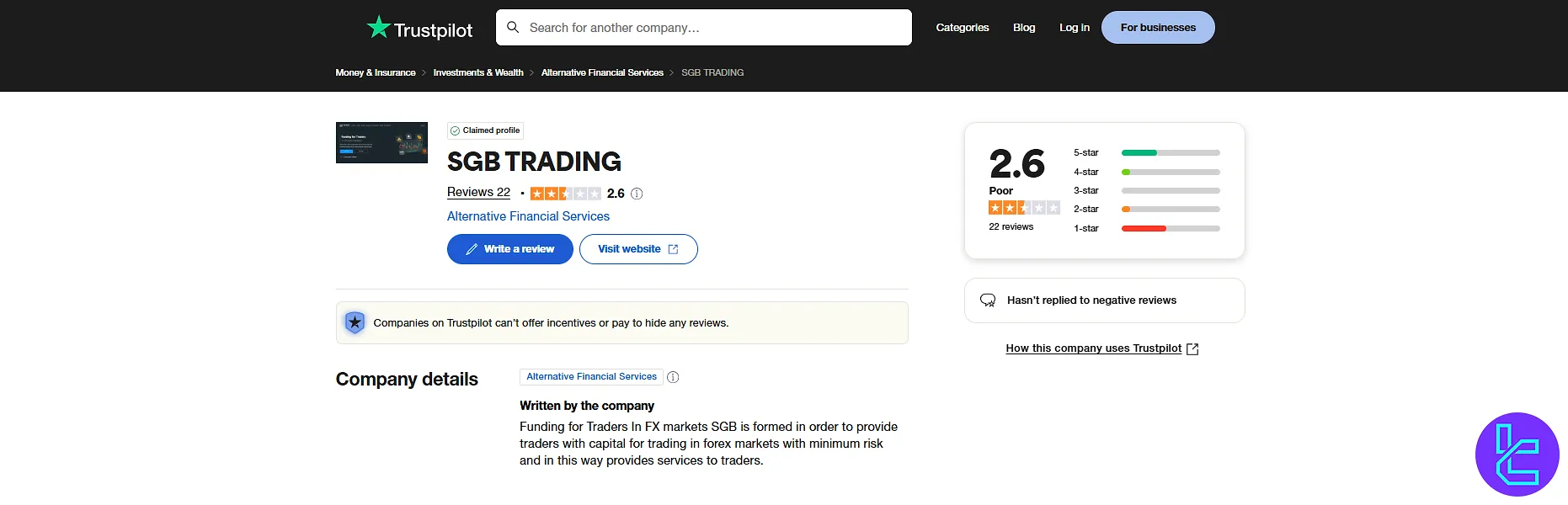

Trustpilot Score | 2.6 |

Payout Frequency | Not Specified |

Established Country | UAE |

Established Year | 2021 |

SGB Trading Pros & Cons

While SGB Trading offers promising opportunities for funded traders, it still has areas for improvement. SGB firm upsides and downsides:

Pros | Cons |

High profit share (up to 85%) | No educational academy |

One-time payment model | Lack of transparency on fees |

MT4 & MT5 access with fast execution | Currently closed registration |

Multi-asset class availability | No public performance dashboard |

Funding & Price in SGB Trading

SGB Trading uses a single-plan model with no hidden fees or recurring charges. Traders can choose capital amounts from $5,000 to $200,000, depending on their risk appetite and trading experience. The price of each challenge varies depending on the selected funding size.

Prices range from $66 to $858, making it relatively affordable compared to other forex prop firms. This pricing structure suits both beginners seeking entry-level capital and experienced traders aiming for high-volume accounts.

SGB Trading Registration; Is It Available Right Now?

Currently, registration is not available on the SGB Trading platform. Although this could happen to any prop firm, there have been no announcements on their website, and based on our research, we found out that only users who created accounts in the past can now use SGB services.

Traders are advised to follow the firm’s official Telegram channels or social media pages for updates regarding account openings.

SGB Trading Challenge Conditions

SGB Trading offers a two-step evaluation plan to determine trader eligibility for a funded account. The process includes manageable profit targets and conservative risk limits. Additionally, traders can scale their capital up to $1 million upon successful performance.

SGB prop firm challenge conditions:

Plans | $5000 | $10000 | $25000 | $50000 | $100000 | $200000 |

First Level Target | $400 | $400 | $400 | $400 | $400 | $400 |

Second Level Target | $200 | $200 | $200 | $200 | $200 | $200 |

Daily Drawdown | 5% | 5% | 5% | 5% | 5% | 5% |

Maximum Drawdown | $4400 | $4400 | $4400 | $4400 | $4400 | $4400 |

Scaling Plan | Up to $1M | Up to $1M | Up to $1M | Up to $1M | Up to $1M | Up to $1M |

Price | $66 | $88 | $157 | $314 | $502 | $858 |

Does SGB Trading Offer Bonuses & Discounts?

SGB Trading does not provide any bonuses or discounts on its funding challenges. Unlike some proprietary trading firms that run promotions or coupon-based discounts, SGB maintains a flat-fee model.

All traders must pay the standard price listed on the platform regardless of seasonal campaigns or referral programs.

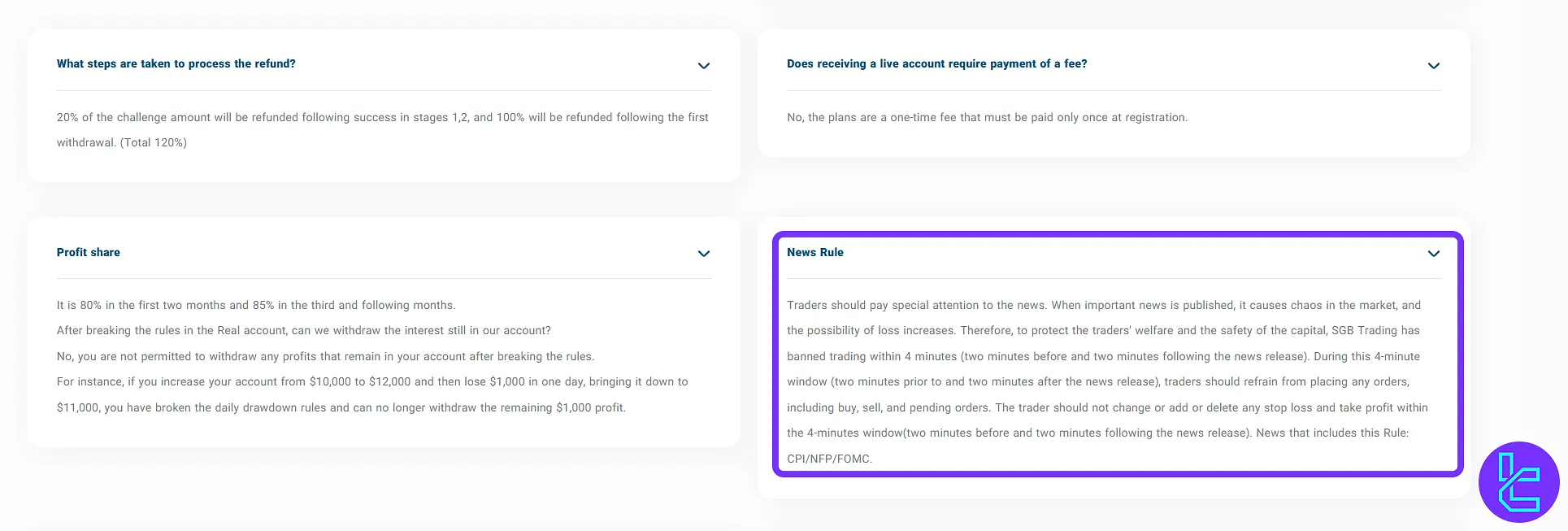

SGB Trading Rules

SGB Trading enforces a clear set of trading rules to maintain platform integrity and ensure consistent trader performance. Some rules relate to risk limits, evaluation phase behavior, and trade frequency, though the firm has not publicly disclosed the full rulebook on its website. Key Points of SGB Trading Rules:

- EA usage requires pre-approval; arbitrage and tick-scalping bots are banned;

- Traders have full discretion over trading strategy and risk levels, but SL/TP is recommended;

- 4-minute ban on trading applies around high-impact news events (e.g., CPI, NFP, FOMC).

EA Usage

Before activating any Expert Advisor (EA) or trading bot, traders must send a request for review to:

- ea@sarmayegozarebartar.com

SGB Trading conducts a manual evaluation of each EA to ensure compliance with platform standards and security protocols. Any EA used without prior authorization is considered a violation.

Note: All forms of forex and crypto arbitrage robots and tick-scalping bots are strictly prohibited.

Trading Strategy and Risk Parameters

SGB Trading allows traders full freedom to apply any strategy of their choosing—there are no predefined risk thresholds or constraints. Whether a trader is conservative or aggressive in their approach, risk management remains their sole responsibility.

While setting a stop-loss and take-profit is optional, it is strongly advised. Internal data shows that over 60% of accounts that incur significant losses were operated without a stop-loss, highlighting the importance of disciplined capital protection.

Trading Restrictions During News Events

To protect capital and maintain orderly execution conditions, SGB Trading enforces a temporary trading blackout around major news announcements. Specifically:

Trading is not permitted during the 4-minute window surrounding high-impact news events—this includes:

- 2 minutes before the scheduled news release

- 2 minutes after the release

During this restricted timeframe, traders must avoid:

- Opening or closing any market or pending orders

- Modifying, deleting, or adding stop-loss and take-profit levels

Violating this rule results in disqualification of affected trades and potential account review.

Events subject to this restriction include:

- Consumer Price Index (CPI)

- Non-Farm Payrolls (NFP)

- Federal Open Market Committee (FOMC) statements

What Are the Trading Platforms of SGB Trading?

SGB Trading supports the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. Both platforms are known for their robust charting tools, wide broker integration, and fast execution—critical for funded traders working within tight risk margins.

The choice between MT4 and MT5 provides flexibility based on trader preference, whether for expert advisor (EA) compatibility, advanced order types, or faster backtesting.

How Many Assets & Instruments Are Available on SGB Trading?

SGB Trading gives its traders access to a broad set of financial instruments across major global markets. While the firm hasn’t disclosed an exact number, available assets include:

- Forex

- Cryptocurrency

- Stocks

- Indices

- Metals

This diversified access enables traders to apply their strategies in both trending and volatile markets, catering to different trading styles.

SGB Trading Withdrawal & Fees

SGB Trading follows a one-time fee model for challenge purchases, meaning traders do not incur monthly or recurring payments. However, beyond this initial cost, the firm has not published specific information about withdrawal fees, processing times, payout methods and frequencies.

Does SGB Trading Offer Educational Resources?

SGB Trading provides limited educational content, mainly through its FAQ section and an on-site blog. These resources do not constitute a comprehensive learning system.

There are no video courses, trading webinars, or mentorship programs available. Therefore, this firm may not suit beginners seeking structured education, but more experienced traders will likely find the available material sufficient to get started.

SGB Trading Trust Scores

As of now, SGB Trading has a rating of 2.6 out of 5 stars on Trustpilot, based on 20+ user reviews. SGB Trustpilot comments reflect a mixed user experience, with some praising the firm’s profit split policy while others express concerns about lack of transparency or communication.

The firm currently does not appear on other review platforms like PropFirmMatch.

SGB Trading Customer Services

SGB Trading offers multiple communication channels for customer inquiries. The support system is accessible through email, messaging platforms, and in-person meetings at their Dubai headquarters.

Available Support Channels:

- Email: admin@sgbtrading.com

- Contact Page Ticket System (via website)

- Office Visit: Duqe Square Business Center, Quarter Deck, QE2, Mina Rashid 554789 Dubai, UAE

- Telegram: @SGB_Sales and @SGB_Sales2

The multi-channel support structure enables users to resolve issues with flexibility, although response times may vary.

SGB Trading on Social Media

SGB Trading maintains an active presence across 2 social media platforms to keep users updated and build community engagement. These platforms often provide announcements, challenge updates, and user interaction opportunities.

SGB Trading Social Channels:

Traders are encouraged to follow these platforms for the latest updates regarding challenge availability, platform changes, or educational blog releases.

SGB Trading Comparison with Other Prop Firms

Compared to leading prop trading firms, SGB Trading offers a basic evaluation model with one-time fees and rapid capital growth. However, its limited educational content and temporary registration freeze position it slightly behind more established names. SGB Comparison:

Parameters | SGB Trading Prop Firm | |||

Minimum Challenge Price | $66 | $33 | $39 | $67 |

Maximum Fund Size | $200,000 | $400,000 | $250,000 | $2,000,000 |

Evaluation steps | 2 Step | 1-Step, 2-Step, 3-Step, Instant Funding | 1-Step, 2-Step, 3-Step | 1-phase, 2-phase, 3-phase |

Profit Share | 85% | 100% | 100% | Up to 90% |

Max Daily Drawdown | 5% | 7% | 5% | 4% |

Max Drawdown | 12% | 14% | 10% | 10% |

First Profit Target | $400 | 6% | 5% | 6% |

Challenge Time Limit | 10 Days | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:100 | 1:100 | 1:100 |

Payout Frequency | Not Specified | Weekly | Bi-weekly | 14 Days |

Number of Trading Assets | Not Specified | 40+ | 3000+ | N/A |

Trading Platforms | MT4, MT5 | MetaTrader 5, Match Trader | Metatrader 5 | MatchTrader, Tradelocker, MT5 |

TF Expert Conclusion

SGB Trading is one-time-fee model prop firm with up to 85% profit share and access to MT4/MT5 platforms. All available assets of Forex pairs, Cryptocurrencies, Stocks, Indices, and Metals.

However, the closed registration, limited transparency, and lack of educational resources are disadvatages of SGB trading firm.