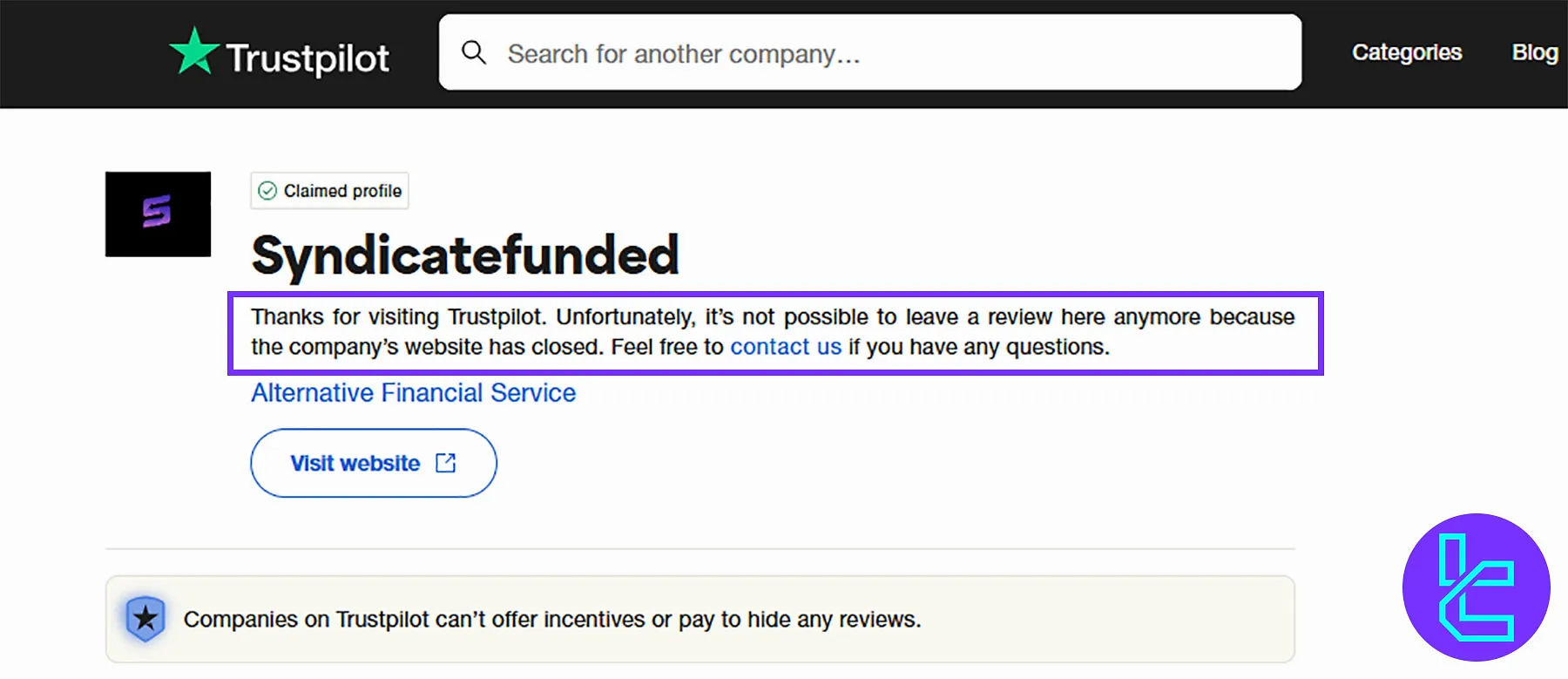

At the time of editing this Syndicate Funded review in July 2025, the prop firm's website is not operational. According to its Trustpilot profile, the Syndicate Funded website is closed.

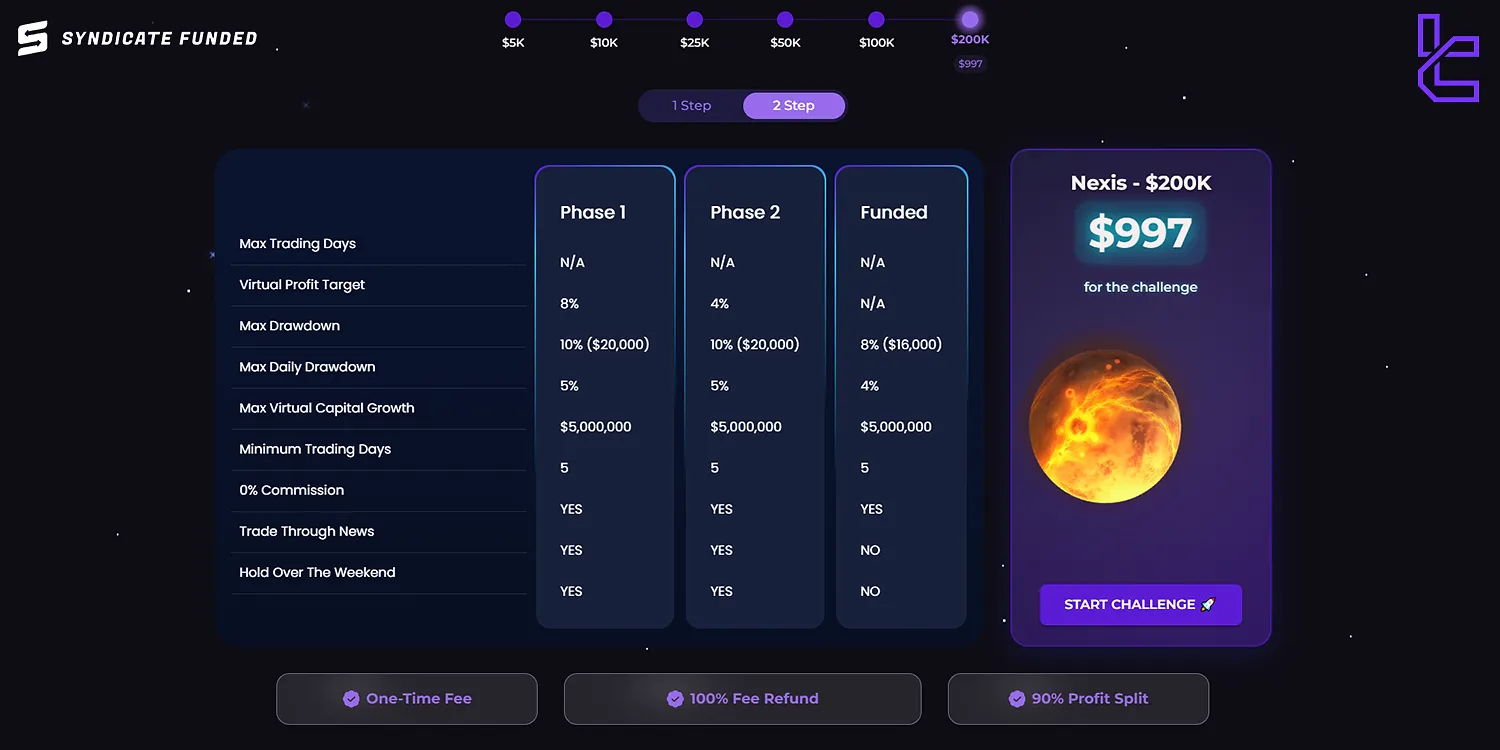

Syndicate Funded prop offers evaluation challenges with an 8% profit target and a 10% maximum drawdown. These challenges are available in various account sizes, including $5k, $10k, $25k, $50k, $100k, and $200k.

Traders can trade on Syndicate Funded accounts with 0 commission and hold their trades open during weekends and important financial news.

Syndicate Funded Company Information

Syndicate Funded is a Dubai-based prop trading firm that has quickly gained attention for its unique offerings. Here’s an overview of the general details of Syndicate Funding:

- Founding location: Dubai

- Founding year: 2021

- Account sizes: ranging from $5,000 to $200,000

- Challenge fees: ranging from $57 to $1097

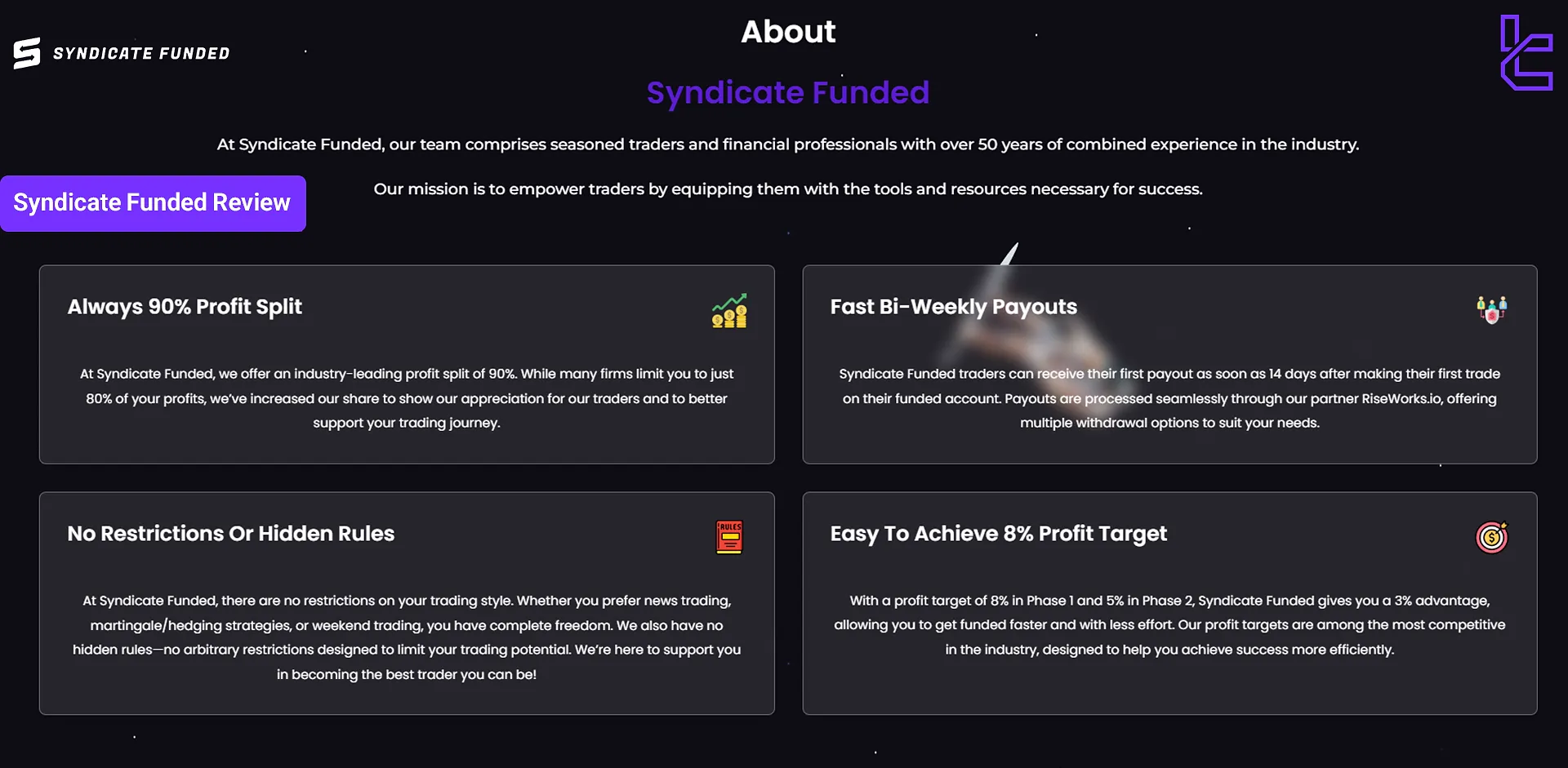

Syndicate Funded boasts a team with over 50 years of combined experience in the trading industry. The firm aims to empower traders of all experience levels by providing a supportive environment with trading conditions designed to enhance profitability.

Syndicate Funded Prop Firm Summary of Specifications

Here's a quick overview of Syndicate Funded's key specifications as one of the prop firms in the industry:

Account currency | USD |

Minimum price | $57 |

Maximum leverage | N/A |

Maximum profit split | 90% |

Instruments | Forex, crypto, indices, commodities |

Assets | EUR/USD, Bitcoin, S&P 500, Gold |

Evaluation steps | 2 |

Trading platform | TradeLocker, MT5 (coming soon) |

Withdrawal methods | Bank transfer, crypto |

Maximum fund size | $200,000 |

First profit target | 8% |

Maximum daily loss | 5% |

Challenge time limit | Unlimited |

News trading | Yes |

Maximum total drawdown | 10% |

commission per round lot | No commission |

Trust pilot score | 4.3/5 |

Payout frequency | Bi-weekly |

Established country | United Arab Emirates |

Established year | 2021 |

Syndicate Funded Pros and Cons

Let's examine the advantages and disadvantages of trading with Syndicate Funded:

Advantages | Disadvantages |

Generous 90% profit split | Relatively new and unverified firm |

Scaling plan up to $2 million | High-profit target for one-step evaluation |

Allows news trading and weekend positions | Lack of extensive educational resources |

bi-weekly payouts | - |

Syndicate Funded Prop Funding Options and Challenge Prices

Syndicate Funded offers a range of account sizes to suit different trader needs and experience levels:

1-Step accounts:

Funding size | $5k | $10k | $25k | $50k | $100k | $200k |

Evaluation price | $62.70 | $117.70 | $227.70 | $337.70 | $557.70 | $1097 |

2-Step accounts:

Funding size | $5k | $10k | $25k | $50k | $100k | $200k |

Evaluation price | $57 | $107 | $207 | $307 | $507 | $997 |

Syndicate Funded's pricing model allows traders to test their skills without significant financial risk, thanks to the refundable fee structure.

This approach makes it an attractive option for traders looking to prove their abilities and gain access to substantial trading capital.

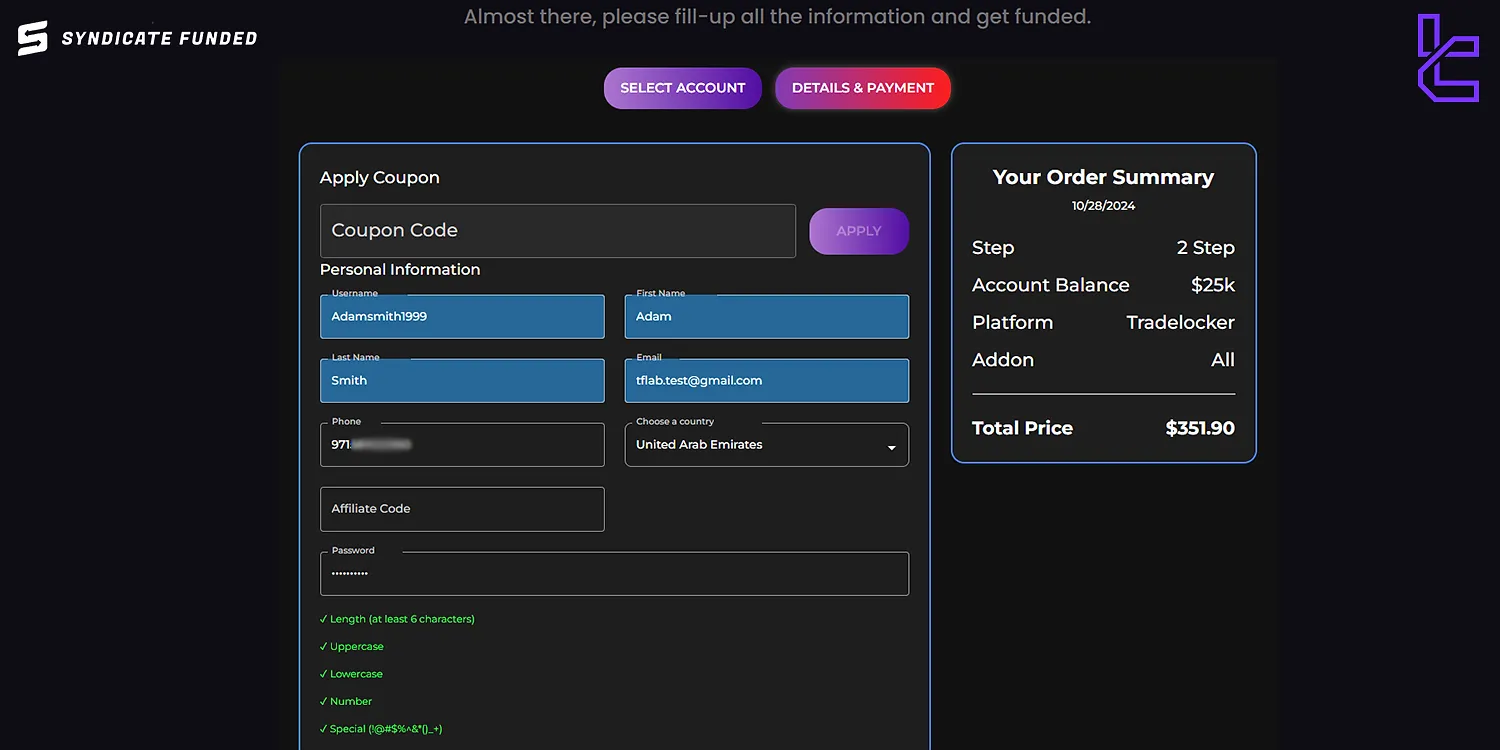

Syndicate Funded Account Opening and Registration

The registration and verification process at Syndicate Funded is designed to be straightforward and user-friendly. Here's the steps you need to take:

- Visit the Syndicate Funded website and choose a challenge;

- Enter your personal information;

- Choose your preferred payment methods and place your order;

- Receive your funded account and trade to reach the profit target without exceeding the maximum total drawdown and maximum daily drawdown;

- Submit necessary documents for KYC (Know Your Customer) verification.

Syndicate Funded Prop Firm Evaluation Steps Overview

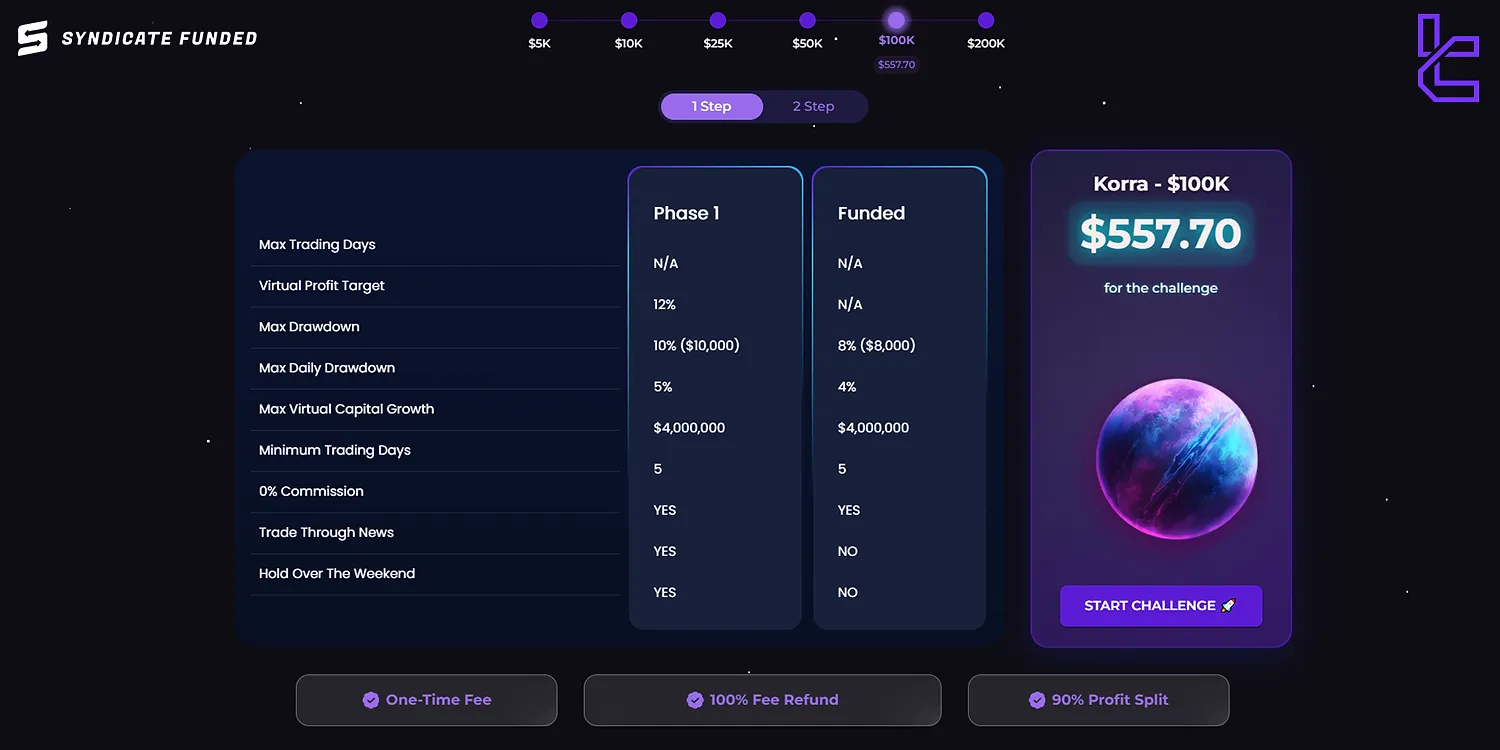

Syndicate Funded offers both 1-phase and 2-phase evaluation options:

Account Size | $5k | $10k | $25k | $50k | $100k | $200k |

Maximum daily drawdown | 4% | |||||

Maximum overall drawdown | 10% | |||||

Profit target | 12% | |||||

Profit split | Up to 90% | |||||

Maximum trading days | Unlimited | |||||

Minimum trading days | 5 days | |||||

Minimum challenge fee | $62.70 | $117.70 | $227.70 | $337.70 | $557.70 | $1097 |

Although, Syndicate Funded 1-step account has high profit target it is the fastest way to become a funded trader.

Account Size | $5k | $10k | $25k | $50k | $100k | $200k |

Maximum daily drawdown | 5% | |||||

Maximum overall drawdown | 10% | |||||

First profit target | 8% | |||||

Second profit target | 4% | |||||

Profit split | Up to 90% | |||||

Maximum trading days | Unlimited | |||||

Minimum trading days | 5 days | |||||

Minimum challenge fee | $57 | $107 | $207 | $307 | $507 | $997 |

This account is suitable for traders who prefer a more gradual approach and less strict trading conditions to become a funded trader.

Key points for both challenges:

- Trading style flexibility during evaluation

- Focus on risk management and consistent performance

- Scaling option up to $2M

Bonuses and Discounts in Syndicate Funded

Syndicate Funded’s main bonus is its affiliate program that allows traders with audiences to invite their friends to the program and receive rewards based on their referee purchases. Traders can withdraw their commissions every 14 days and track their earnings through the affiliate dashboard. Syndicate Funded also offers monthly $100k giveaways to traders who join their discord channel.

Syndicate Funded Prop Trading Platforms

Syndicate Funded currently offers the following trading platform options:

- TradeLocker: Proprietary platform with advanced features

- MetaTrader 5 (MT5): Coming soon, offering expanded capabilities

TradeLocker features:

- Customizable Workspaces

- Advanced Order Types

- Integrated News Feed

- Mobile Compatibility

Links:

MT5 (upcoming):

- Popular, widely-used platform

- Extensive analytics tools

- Automated trading capabilities

- Large community of users and resources

Syndicate Funded plans to expand its platform offerings to cater to diverse trader preferences and needs.

Tradable Symbols in Syndicate Funded Prop Firm

Syndicate Funded offers a diverse range of tradable instruments:

- Forex: Major, minor, and exotic currency pairs

- Indices: Global stock market indices, including S&P500 and Dow Jones

- Metals: Gold and silver

- Cryptocurrencies: Bitcoin, Ethereum, and other high-cap coins

Key Points:

- Wide selection of assets for diversification

- Competitive spreads across all instrument types

- Ability to trade during major news events

- No commissions

Traders should familiarize themselves with the specific instruments available and any associated trading rules or restrictions.

Syndicate Funded Prop Firm Payment Options

Syndicated Funded allows traders to pay challenge prices using credit/debit cards or cryptocurrencies. This platform also utilizes RiseWorks for efficient and reliable payouts with a wide range of benefits:

- Bi-weekly payout schedule

- No minimum withdrawal

- Quick processing times

Traders appreciate the consistent and timely payout system, which allows for better financial planning and cash flow management.

Syndicate Funded Trading Fees (Commission & Costs)

Understanding the commission structure and costs at Syndicate Funded is crucial:

- 0% commission during evaluation phases and funded accounts

- Competitive spreads from 0.1 pips

- Refundable challenge fees

- 35% Withdrawal fees

Syndicate Funded's commission structure is designed to be competitive while ensuring the firm's sustainability and ability to provide high-quality services to traders.

To predict a trade's outcome based on trading fees, you can use a profit/loss calculator tool.

Syndicate Funded Educational Resources

While Syndicate Funded focuses primarily on providing trading opportunities, it currently does not offer extensive educational resources.

This means that traders should look for other platforms’ educational offerings, such as FTMO or Funded Next, to learn prop trading tips and techniques. Also, you can visit our forex strategies education webpage.

Does Syndicate Funded Have a High Trust Score on Review Websites?

While the prop firm previously held a 4.3 out of 5 score, the Syndicate Funded Trustpilot profile currently has no ratings due to the website's closure.

Syndicate Funded Prop Firm Customer Support

Syndicate Funded offers 24/5 customer support through various channels:

- Email support: support@syndicatefunded.com

- FAQ section: Addresses common questions

- Discord channel

The lack of live chat support could be a drawback for traders who are in need of fast/proper help.

Syndicate Funded Social Media Channels

Syndicate Funded maintains an active presence on social media:

- Syndicate Funded Discord

Benefits of following these accounts:

- Stay informed about promotions and new features

- Engage with the trading community

- Access quick support and FAQs

- Gain insights from successful funded traders

Syndicate Funded's social media strategy aims to build a community around its brand and keep traders engaged and informed.

TF Expert Suggestion

Syndicate Funded low challenge prices (starting from $57), up to 90% profit split, and bi-weekly payouts make this platform standout in the prop trading space.

However, the lack of educational resources and low number of user reviews on the Trustpilot website (4.3 out of 5) are important points to consider about this prop firm.