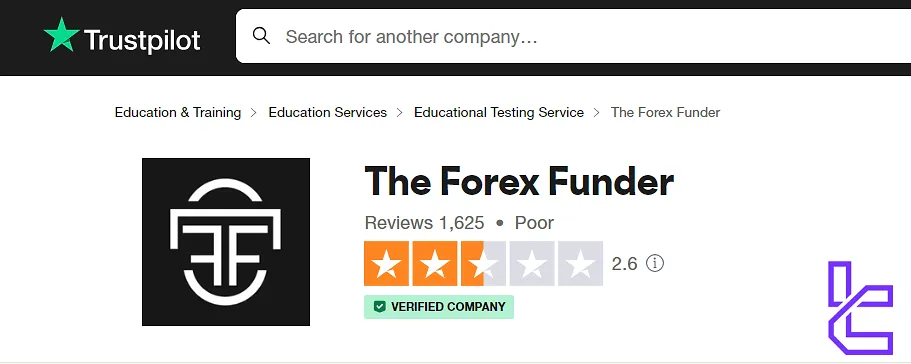

At the time of editing this article in July 2025, The Forex Funder website is down, displaying "Error 1000". Additionally, there are numerous negative reviews on the prop firm's Trustpilot profile, which complain about failed accounts (with no clear reasons) and unresponsive customer support.

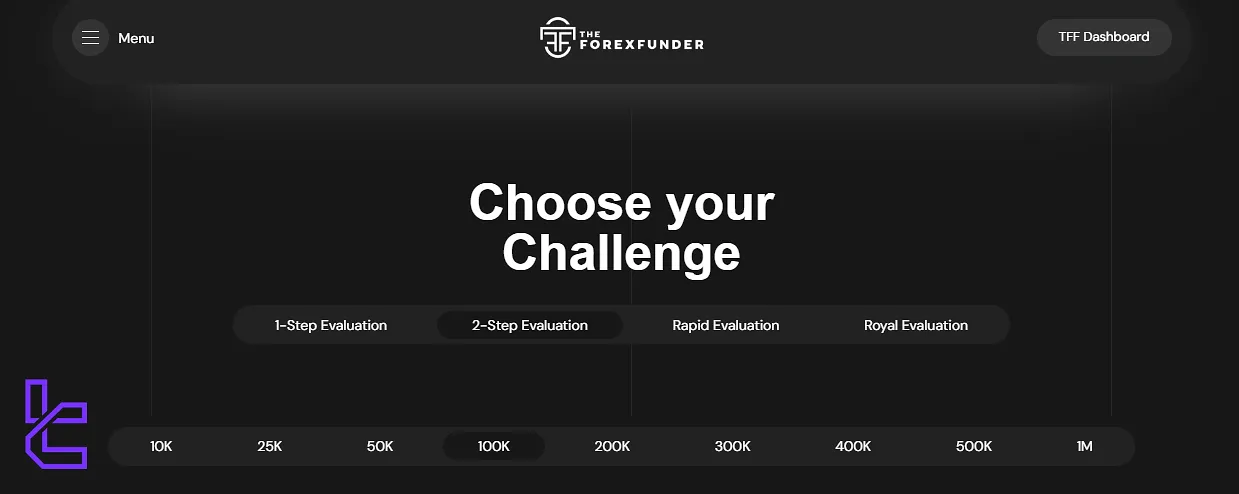

The Forex Funder prop firm offers $1M capital [scalable to $2.5M] via 4 challenges [1-Step Evaluation, 2-Step Evaluation, Rapid Evaluation, Royal Evaluation.] Maximum total drawdown in this prop is 6%, and news trading is allowed with 1:100 maximum leverage.

The Forex Funder Prop Firm Company Overview

The Forex Funder is a prop firm that aims to empower forex traders by providing them with substantial capital to trade in the foreign exchange market.

Founded with the vision of democratizing access to professional-level trading, The Forex Funder offers a unique proposition in the prop firm landscape. Here's a quick overview of what sets them apart:

- Generous funding options ranging from $10,000 to $1 million [Scalable to $2.5 million];

- High profit split of up to 95% for successful traders;

- One-step evaluation process, simplifying the path to funded trading;

- Access to advanced trading platforms like TradeLocker and Edge by Axe;

- Focus on forex trading, catering to currency market specialists;

- Educational resources to support traders in their journey.

The Forex Funder's model is designed to attract both novice and experienced traders, offering them a chance to prove their skills and potentially earn significant profits without the substantial personal financial risk typically associated with forex trading.

Specifications Summary

The Forex Funder's model is designed to attract both novice and experienced traders; here are its specifications:

Account Currency | USD |

Minimum Price | $95 |

Maximum Leverage | 1:100 |

Maximum Profit Split | 95% |

Instruments | Forex, Crypto, Metals, Indices, Stocks |

Assets | +70 |

Evaluation Steps | 4 |

Trading Platform | Edge By Axe, TradeLocker |

Withdrawal Methods | Visa, Mastercard, American Express, Skrill, Neteller, Cryptocurrency, Wired Transfer |

Maximum Fund Size | $1,000,000 |

First Profit Target | 8% |

Maximum Daily Loss | 5% |

Challenge Time Limit | Unlimited |

News Trading | Yes |

Maximum Total Drawdown | 6% |

Commission Per Round Lot | $3 Per Lot Traded |

Trust Pilot Score | 2.6 Out of 5 |

Payout Frequency | 2 Days |

Established Country | UAE |

Established Year | 2023 |

This table provides a quick snapshot of The Forex Funder's key offerings and requirements, highlighting the firm's competitive edge in terms of funding size, profit split, and evaluation process simplicity.

Advantages and Disadvantages

While The Forex Funder offers attractive features like high profit splits and large funding options, potential traders should weigh these against the limitations. The Forex Funder prop firm pros and cons:

Pros | Cons |

High Profit Split (Up To 95%) | Limited Instrument Selection (Mainly Forex) |

Large Funding Options (Up To $2.5M) | Relatively New in The Market |

Simple One-Step Evaluation | Mixed Customer Reviews |

No Time Limit on Funded Accounts | Limited Educational Resources |

Multiple Trading Platforms Available | Strict Drawdown Rules |

What Are The Forex Funder Fundings and Prices?

The Forex Funder offers a wide range of funding options to cater to traders at different levels of experience and ambition. TFF Funding and Costs:

Fundings | 1-Step Evaluation Price | 2-Step Evaluation Price | Rapid Evaluation Price | Royal Evaluation Price |

$10K | $155 | $95 | $119.99 | $100 |

$25K | $270 | $169 | $211.99 | $177 |

$50K | $490 | $305 | $381.99 | $320 |

$100K | $860 | $539 | $673.99 | $566 |

$200K | $1550 | $929 | $1161.99 | $975 |

$300K | $2235 | $1339 | $1673.99 | $1406 |

$400K | $2860 | $1689 | $2111.99 | $1773 |

$500K | - | $1750 | $2187.99 | $1838 |

$1M | - | $3300 | $4,125.99 | $3465 |

Higher funding options up to $2.5 million are available upon request and scalable plan. The pricing structure is designed to be accessible for beginners while also providing substantial capital for experienced traders.

It's important to note that these fees are for the evaluation phase only, and successful traders can access the full funding without additional costs.

How to Register in The Forex Funder Prop Firm? Complete Guide!

Registering and getting verified with The Forex Funder is an easy process designed to get traders started quickly. TFF Sign Up:

- Visit The Forex Funder's official website and click on the "Get Started" button.

- Fill out the registration form with your personal details, including name, email, country, street address, town/city, postcode and phone number.

- Choose your preferred funding amount and pay the corresponding evaluation fee.

- Verify your email address by clicking on the confirmation link sent to your inbox.

- Complete the KYC (Know Your Customer) process by submitting required documents, including: government-issued ID (passport or driver's license) and Proof of address (utility bill or bank statement).

- Wait for the verification team to review and approve your documents (usually within 24-48 hours).

- Once approved, gain access to your evaluation account and trading platform.

The registration process is designed to be user-friendly while ensuring compliance with financial regulations. Traders are advised to have all necessary documents ready to expedite the verification process.

What Are The Forex Funder Challenges?

In The Forex Funder Review we noticed that this company designed 4 plans [1-Step Evaluation, 2-Step Evaluation, Rapid Evaluation, Royal Evaluation] for traders. Full Comparison of TFF Plans:

1-Step Evaluation

Specifics | CHALLENGE | TFF TRADER |

Trading Period | Unlimited | Indefinite |

Minimum Trading Days | 0 | 0 |

Maximum Daily Loss | 4% | 4% |

Maximum Loss | 8% | 8% |

Profit Target | 10% | 10% |

Trading Leverage | 1:100 | 1:30 |

Profit Split | - | 95% |

News Trading | Allowed | Not Allowed |

Weekend Holding | Allowed | Not Allowed |

Algorithmic Trading | Allowed | Allowed |

2-Step Evaluation

Specifics | CHALLENGE | VERIFICATION | TFF TRADER |

Trading Period | Unlimited | Unlimited | Indefinite |

Minimum Trading Days | 0 | 0 | 0 |

Maximum Daily Loss | 5% | 5% | 5% |

Maximum Loss | 12% | 12% | 10% |

Profit Target | 8% | 5% | - |

Trading Leverage | 1:100 | 1:100 | 1:30 |

Profit Split | - | - | 95% |

News Trading | Allowed | Allowed | Not Allowed |

Weekend Holding | Allowed | Allowed | Not Allowed |

Algorithmic Trading | Allowed | Allowed | Allowed |

Rapid Evaluation

Specifics | CHALLENGE | VERIFICATION | TFF TRADER |

Trading Period | Unlimited | Unlimited | Indefinite |

Minimum Trading Days | 0 | 0 | 0 |

Maximum Daily Loss | 3% | 3% | 3% |

Maximum Loss | 6% | 6% | 6% |

Profit Target | 6% | 6% | - |

Trading Leverage | 1:100 | 1:100 | 1:30 |

Profit Split | - | - | 95% |

News Trading | Allowed | Allowed | Not Allowed |

Weekend Holding | Allowed | Allowed | Allowed |

Algorithmic Trading | Allowed | Allowed | Allowed |

Royal Evaluation

Specifics | CHALLENGE | VERIFICATION | TFF TRADER |

Trading Period | Unlimited | Unlimited | Indefinite |

Minimum Trading Days | 0 | 0 | 0 |

Maximum Daily Loss | 4% | 4% | 4% |

Maximum Loss | 10% | 10% | 10% |

Profit Target | 10% | 4% | - |

Trading Leverage | 1:100 | 1:100 | 1:30 |

Profit Split | - | - | 95% |

News Trading | Allowed | Allowed | Not Allowed |

Weekend Holding | Allowed | Allowed | Not Allowed |

Algorithmic Trading | Allowed | Allowed | Allowed |

TFF Bonuses and Discounts

The Forex Funder offers various bonuses and discounts to make their services more accessible and attractive to traders. TFF Bonuses:

- Promo Code "TFF20": Provides a 20% discount on evaluation fees;

- Seasonal Promotions: Occasional discounts during holidays or special events;

- Referral (Affiliate) Program: Earn credits or discounts by referring new traders;

- Loyalty Rewards: Returning traders may receive special offers on additional accounts.

What Trading Platforms are Available to Use in The Forex Funder?

In The Forex Funder Review, we discovered that this prop does not support the famous and old MetaTrader 4 and 5 platforms. TFF trading platforms:

TradeLocker:

- Web-based platform accessible from any device

- Real-time trade monitoring and performance tracking

- User-friendly interface suitable for both novice and experienced traders

Edge By Axe:

- Advanced desktop platform for professional traders

- Comprehensive charting tools and technical analysis features

- Customizable workspace for efficient trading

Traders can choose the platform that best suits their trading style and technical requirements, ensuring a seamless trading experience during both the evaluation and funded phases.

What are The Forex Funder Prop Firm Instruments and Assets?

The Forex Funder, as its name suggests, primarily focuses on providing traders with access to the foreign exchange (forex) market. TFF Markets and Assets:

- Forex: Major Forex Pairs [EUR/USD, USD/JPY, GBP/USD], Minor Forex Pairs [EUR/GBP, EUR/AUD, GBP/JPY], Exotic Pairs [USD/TRY, USD/ZAR, USD/MXN;]

- Indices: S&P 500, DAX, FTSE, DowJones;

- Cryptocurrency: Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), etc;

- Metals: Gold (XAU/USD), Silver (XAG/USD);

- Stocks: AAPL, TSLA and More.

It's important to note that while The Forex Funder specializes in forex, the specific symbol list may vary and can be subject to change.

You should always check the most up-to-date instrument list on the official website or trading platform before developing your strategies.

Payment Methods

The Forex Funder offers a variety of payment methods to accommodate traders from different regions and with different preferences. TFF Payment Methods:

- Credit/Debit Cards: Visa, Mastercard, American Express;

- E-wallets: Skrill, Neteller;

- Bank Transfer: Wire transfer (it takes 1-3 business days);

- Cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Tether (USDT).

Traders should choose the payment method that best suits their needs in terms of speed, convenience, and cost-effectiveness.

The Forex Funder Commissions Overview

The Forex Funder strives to maintain a transparent and competitive fee structure. Here's a breakdown of the main costs associated with trading through their prop firm:

- Evaluation Fee: One-time cost based on chosen account size;

- Spreads: Competitive spreads starting from 0.1 pips on major pairs;

- Commissions: $3 per lot round turn;

- Overnight Swap Fees: Standard market rates apply for positions held overnight;

- Account Maintenance: No monthly or inactivity fees.

Educational Resources

The Forex Funder recognizes the importance of trader education but currently offers a limited range of educational resources compared to some other prop firms. Here's what they provide:

- Blog Articles: Regular posts covering trading strategies, market analysis, and risk management tips;

- FAQ Section: Answers to common questions about their program and forex trading.

While these resources can be helpful, especially for understanding The Forex Funder's specific programs, traders looking for more comprehensive forex education may need to supplement with external sources.

TFF Score on Review Websites

At The Forex Funder Review, this young prop scored 2.6/5 out of more than 1,600 reviews on Trustpilot. The most important points mentioned by users are:

- Mixed Reviews: While some traders report positive experiences, a significant number express dissatisfaction.

- Payment Issues: Multiple reviewers claim they faced difficulties in withdrawing funds or had payouts denied.

- Account Problems: Several users report issues with account migrations or sudden account blockages.

- Customer Service Complaints: Many negative reviews highlight poor responsiveness and unhelpful support.

- Transparency Concerns: Some traders feel that the company's practices lack transparency, particularly regarding rule changes or account terminations.

- Positive Feedback: A portion of reviews praise the platform's ease of use and the opportunity to trade with significant capital.

This low Trustpilot score suggests that potential traders should approach The Forex Funder with caution and conduct thorough research before committing funds.

Customer Support

The Forex Funder offers 24/7 support with multiple channels, aiming to address trader queries and concerns. The Forex Funder Prop Firm Support:

- Email Support: Response time typically within 24-48 hours;

- Live Chat: Ideal for quick questions and immediate assistance;

- Ticket System: Create a ticket for more complex issues or account-specific queries;

- FAQ Section: Comprehensive resource for common questions and issues;

- Indoor Meeting: Accessible by prior appointment.

While The Forex Funder strives to provide responsive support, some user reviews suggest that the quality and speed of assistance can be inconsistent.

TFF on Social Media

The Forex Funder maintains an active presence across various social media platforms to engage with traders and share valuable information. The Forex Funder Social Media Channels:

- Twitter (X)

- YouTube

- TikTok

- Discord

- Telegram

Trading Finder Expert suggestions

Despite the young age [founded in 2023], The Forex Funder has paid over $10 million to traders. Average withdrawal time in this prop is just two days and you can use any strategy you want including News trading.

On the other hand, they have important disadvantages such as strict drawdown rules [maximum daily loss of 5% e.g.]