The Trading Capital Rules require that accounts must not be more than $5,000,000.

Traders face an 8% profit target in Phase 1, reduced to 5% in Phase 2.

Risk rules include 6% daily loss and up to 12% max drawdown, tightening to 10% later.

Using EAs is permitted, and hedging is allowed.

The Trading Capital Rule Topics

Unlike many platforms, The Trading Capital Prop Firm enforces less strict rules; Core Concepts of Trading Capital Policy:

- Challenge Rules

- Trading News

- Account Size Rule

- Hedging

- Payout Conditions

- Holding Over Weekends

- Expert Advisors (EAs)

The Trading Capital Challenge Rules

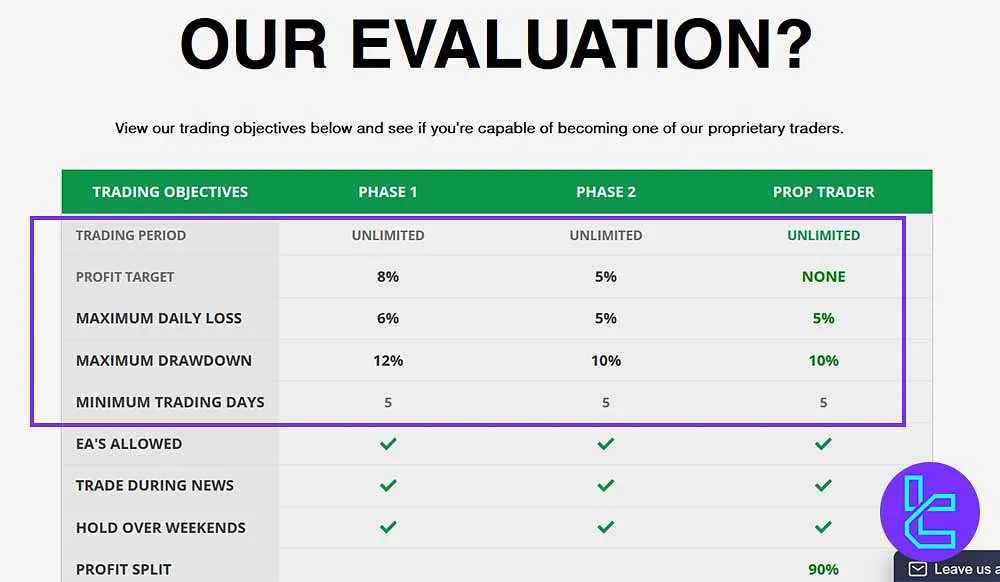

The firm’s challenge is split into 2 phases, followed by the live Prop Trader stage; The Trading Capital Challenge Stage Limits:

Category | Phase 1 | Phase 2 | Prop Trader |

Profit Target | 8% | 5% | NONE |

Maximum Daily Loss | 6% | 5% | 5% |

Maximum Drawdown | 12% | 10% | 10% |

Minimum Trading Days | 5 | 5 | 5 |

Profit Split | – | – | 90% |

Refundable Fee | – | – | 125% |

As you can see, the profit target decreases by 3% during the second phase, while the max drawdown decreases by 2%.

Trading News at The Trading Capital

Trading during high-impact news events is allowed on major and minor pairs.

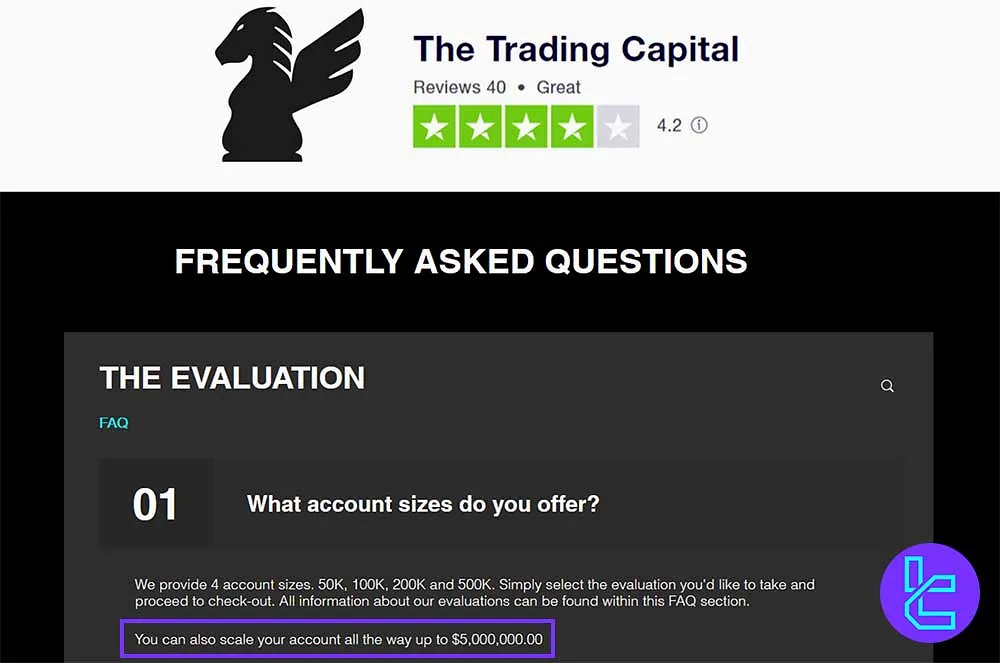

The Trading Capital Account Size Rule

While accounts can grow significantly, there’s a cap to consider; The Trading Capital Policy for Account Size:

- Account sizes must not exceed $5,000,000;

- Traders may scale up, but staying within this cap is mandatory.

Hedging on The Trading Capital

Hedging is allowed under the Trading Capital rules. Traders may hedge positions across instruments or within the same asset.

Copy Trade with Trading Capital

You can manage up to $5,000,000 across multiple accounts on the platform. For safety and speed, it's best to merge accounts instead of relying on trade copiers.

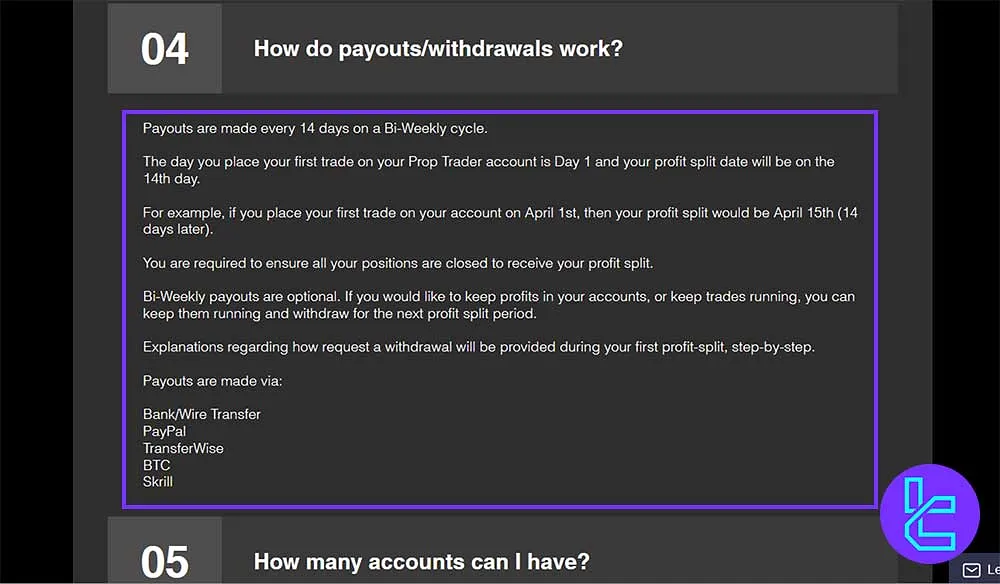

The Trading Capital Payout Policy

Profit withdrawals follow a strict cycle to ensure structure; The Trading Capital Payout Conditions:

- Payouts are processed every 14 days;

- This occurs on a bi-weekly schedule;

- Payouts can only be based on prior verified profits.

Holding Over the Weekend when Trading with Trading Capital

Traders are allowed to hold positions over the weekend. Be aware of market gaps during this time; If any trading parameter is breached due to gaps, it will still be considered a violation.

The Trading Capital EAs

The use of Expert Advisors (EAs) is allowed; All activity must comply with the firm’s risk management rules. Positions being opened under 60 seconds will not count.

Writer’s Opinion and Conclusion

The Trading Capital Rules are as flexible as news trading and holding positions over the weekend are allowed.

A minimum of 5 trading days is required in each challenge stage. Passing the evaluation unlocks a 90% profit split, and Bi-weekly payouts occur every 14 days on the Live stage.

For more educational content, check out the Trading Capital Tutorials page.