TopTier Trader rules enforce News trading restrictions for Funded Accounts, requiring an Add-on for high-impact events. Leverage varies by asset class, with Forex at 1:30, Gold & Commodities at 1:25, and Crypto at 1:10 as the base, while Double Leverage increases these limits for eligible traders.

Both Challenge and Funded Accounts can engage in Weekend Trading without restrictions.

TopTier Trader Important Rules

A range of rules is set by TopTier Trader Prop Firm to ensure fair trading. Some of the TopTier Trader Restriction Topics:

- News

- Leverage

- Weekend Trade

- Account Rolling/Churning

- Gambling/Betting Behavior

- Group Hedging

- Over-exposure

- Payout

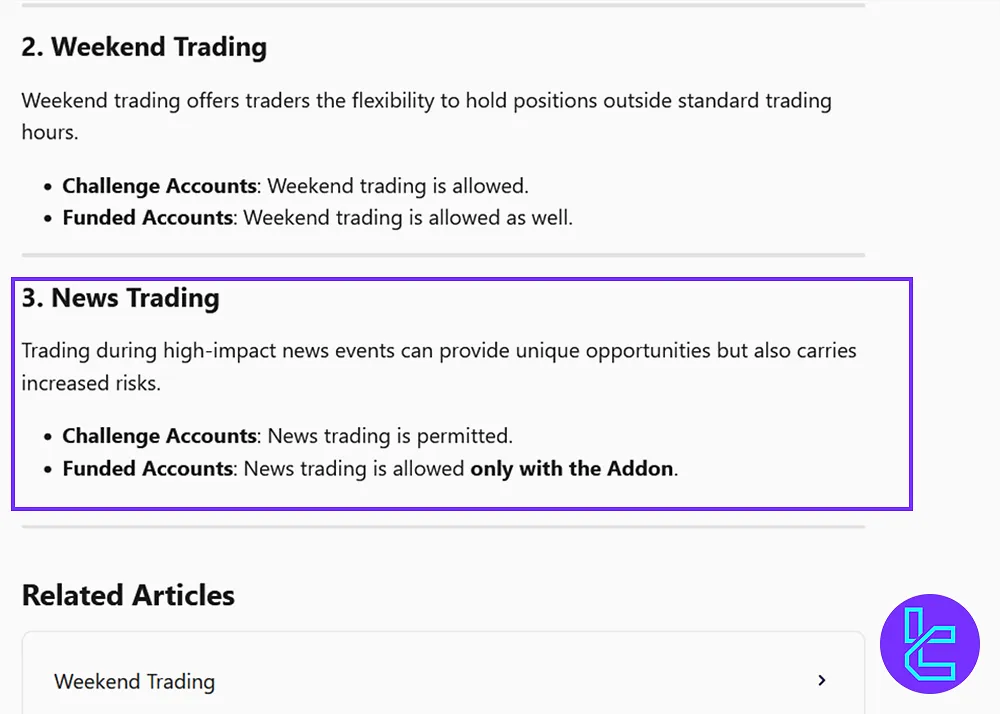

TopTier Trader News Rule

TopTier Trader prop firm has specific guidelines regarding trading during high-impact news events; TopTier Trader Limits for News:

- Challenge Accounts: Can trade during high-impact news events;

- Funded Accounts: Need an Addon to trade news events;

- Risk Consideration: News trading can offer high-risk, high-reward opportunities.

TopTier Trader Leverage Rules

Leverage is a critical tool for traders, but it comes with risks and rewards; TopTier Trader Restrictions for Leverage:

Asset Class | Base Leverage | Double Leverage Addon |

Forex | 1:30 | 1:60 |

Gold & Commodities | 1:25 | 1:40 |

Indices | 1:15 | 1:30 |

Crypto | 1:10 | 1:20 |

TopTier Trader Weekend Trade Rules

Weekend trading is permitted for both Challenge and Funded Accounts; TopTier Trader Weekend Trade:

- No Restrictions: There are no limits on trading/holding over the weekend, offering flexibility for long-term positions

- Flexibility: Traders can manage positions outside regular trading hours

TopTier Trader Risk Management Policies

TopTier Trader also enforces various risk management policies to ensure that all traders participate in a fair and sustainable environment. TopTier Trader risky activities:

- Account Rolling/Churning

- Gambling/Betting Behavior

- Group Hedging

- Over-exposure

TopTier Trader Account Rolling/Churning

Account rolling or churning involves traders acquiring several evaluation accounts and intentionally failing some to focus on others:

- Impact: It creates a false impression of trading skills by bypassing the evaluation process

- Policy: This practice is prohibited and leads to disqualification from the platform

TopTier Trader Gambling/Betting Behavior

Traders who engage in gambling-like behavior put their accounts at significant risk:

- Characteristics: Involves high-risk, impulsive trading decisions without a strategy

- Policy: Trading should be based on informed decisions rather than speculative guesses

TopTier Trader Group Hedging

As with many prop firms, the platform prohibits group hedging, which involves traders taking opposite positions on the same asset:

- Coordinated Effort: Traders collaborate to create net-zero positions

- Impact: This strategy undermines fair and transparent trading and is strictly banned

TopTier Trader Over-exposure

Over-exposure occurs when a trader risks too much on a specific asset relative to their account size:

- Cause: Excessive leverage beyond sustainable levels

- Risk: Unfavorable market moves can breach drawdown limits, risking account stability

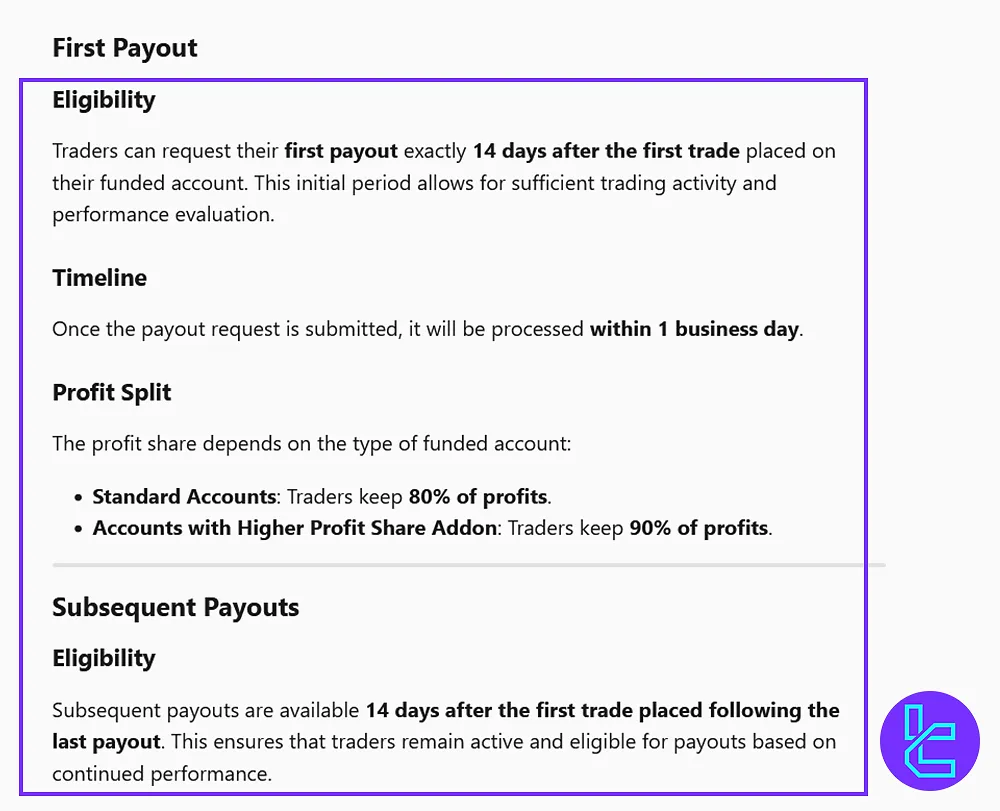

TopTier Trader Payout Rules

TopTier Trader has specific payout rules designed to maintain a transparent and fair process. TopTier Trader Withdrawal Limits:

- First Payout: Available 14 days after the first trade on a funded account

- Subsequent Payouts: Available 14 days after the first trade post-payout

- Processing Time: Processed within 1 business day

Other Breach Cases with Consequences

Violating the following rules may result in immediate consequences, including account suspension or ban. TopTier Trader Breach Cases:

Violation | Consequences |

Latency Arbitrage | Immediate ban from the platform |

Reverse Arbitrage | Immediate ban from the platform |

Tick Scalping | Immediate ban from the platform |

Data Feed Manipulation | Immediate ban from the platform |

Trading on Delayed Charts | Immediate ban from the platform |

Group Hedging | Immediate ban from the platform |

Account Management | Immediate ban from the platform |

High-Frequency Trading | Warning and profit deduction |

Hedging Between Accounts | Warning and profit deduction |

Grid Trading | Warning and profit deduction |

Account Churning/Rolling | Warning and profit deduction |

Martingale | Profit deduction |

Signal Trading | Profit deduction |

Guaranteed Limit Orders | Profit deduction |

News Trading | Profit deduction |

Overleveraging Violation | Profit deduction |

Writer’s Opinion and Conclusion

TopTier Trader rules prohibit risky behaviors like Account Rolling, Gambling Behavior, and Group Hedging, with severe consequences for violations.

Payouts follow a 14-day cycle, with a 1-day processing time. Traders are required to comply with the Profit Split, which ranges from 80% to 90%, depending on their account settings. To find more articles about the firm, check out the TopTier Trader Tutorials page.