TradeDay prop firm offers a unique 1-phase evaluation process, allowing traders to showcase their skills with trading on popular platforms like TradingView, NinjaTrader, and Tradovate.

The firm allows automated trading, and with a variety of instruments, such as Gold, Soybeans, Crude Oil, and Nikkei/USD futures, traders can diversify their portfolios.

The firm’s commission structure rates range from $1 to $4, depending on the asset class.

TradeDay prop firm company overview

TradeDay, a U.S.-based prop firm founded in 2020, offers flexible funded trading accounts from $50,000 to $150,000.

With a simple single-step evaluation and a team boasting 80+ years of experience, TradeDay specializes in futures trading on major exchanges like CME and CBOT.

Traders can use popular platforms such as Tradovate, NinjaTrader, and TradingView, making it an appealing choice for aspiring futures traders.

TradeDay Prop Firm CEO

James Thorpe, Founder and CEO of TradeDay, leads one of the most innovative proprietary trading firms in Chicago, Illinois. With over 15 years of trading experience and a strong background in building global trading teams, he combines leadership, technology, and mentorship to help traders succeed worldwide.

- Founder and CEO of TradeDay since 2020, overseeing its growth as a global trader evaluation platform;

- Former CEO of Mercury Derivatives and Lakeside Trading LLC;

- Managed a professional trading group executing over 250 million contracts annually across 11 offices;

- Experienced in money management, trader development, and technology integration;

- Creator of TradeDayX, a high-performance trading platform designed by traders for traders;

- Worked across Europe, Africa, Asia, and the US in capital markets leadership roles.

TradeDay’s specifications summary

TradeDay's unique combination of a single-step evaluation process, high-profit split, and allowance for automated trading systems sets it apart in the competitive world of prop firms.

Account currency | USD |

Minimum price | $69 |

maximum leverage | N/A |

maximum profit split | 90% |

Instruments | Equity Index, Bond, Energy, Metals, Agricultural Contracts |

Assets | Soybean, Gold, Oil, Ultra Bond, Nikkei/USD |

evaluation steps | 1-step |

Trading platform | Tradovate, NinjaTrader, TradingView, Jigsaw |

Withdrawal methods | Crypto, Bank Transfer/Wire Transfer |

maximum fund size | $150,000 |

First profit target | 6% |

Max. daily loss | 3% |

Challenge time limit | Not Limited |

news trading | No |

Maximum total drawdown | 3% |

commission | Ranges from $1 to $4 |

trust pilot score | 4.6 |

payout frequency | Not Limited |

established country | USA |

established year | 2020 |

TradeDay prop firm pros & cons

Let's weigh the advantages and disadvantages of trading with TradeDay:

Pros | Cons |

High-profit split (90% after first $10,000) | Restrictions on news trading |

Single-step evaluation process | Monthly fees for evaluation accounts |

Allows automated trading systems | Limited to futures trading |

Multiple trading platforms are available | Stricter evaluation rules compared to some competitors |

Access to major futures exchanges | - |

Supportive trading community | - |

Transparent evaluation and payout process | - |

While TradeDay offers numerous benefits, particularly for futures traders, it's important to consider the restrictions and fees associated with their program.

TradeDay prop firm funding & pricing

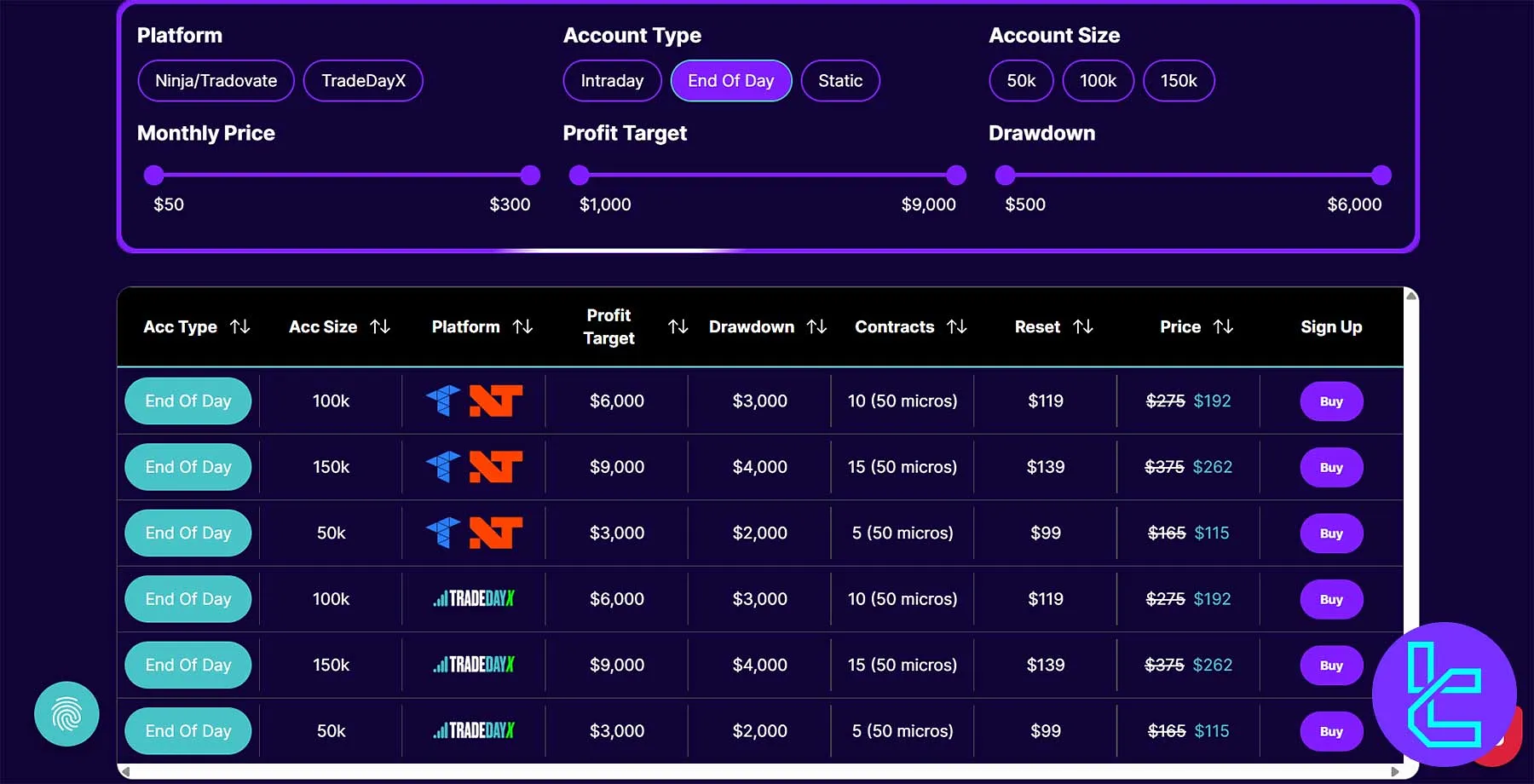

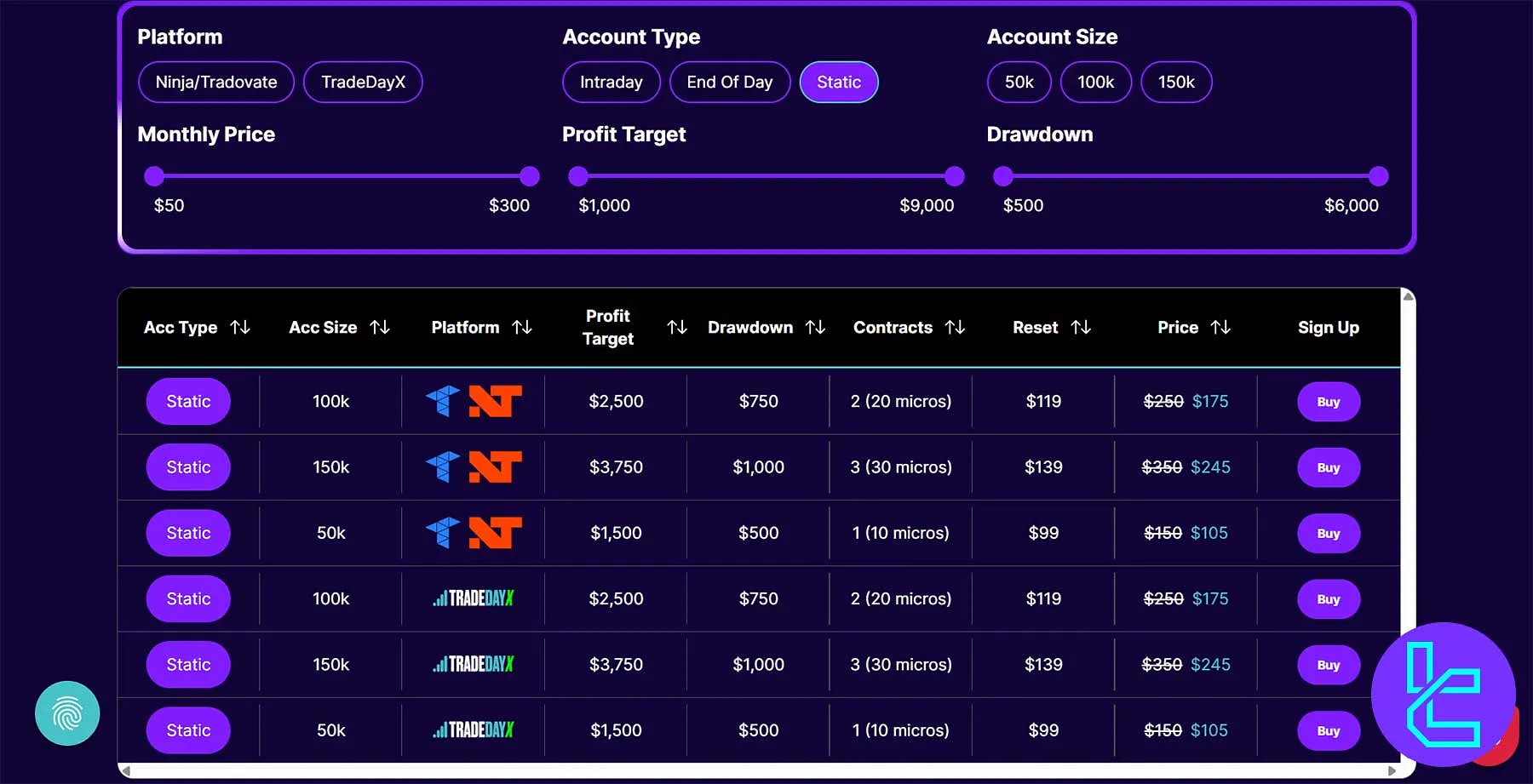

TradeDay provides traders with flexible and transparent challenge pricing tailored to their trading style and budget. Prices vary based on account type (End of Day, Intraday, or Static) and account size ($50K, $100K, or $150K).

Reset fees range from $99 to $139, ensuring affordable account recovery options.

Account Type | Accout Size | Platform | Reset | Price |

End of Day | $50k | Tradovate / NinjaTrader / TradeDayX | $99 | $115 |

End of Day | $100k | Tradovate / NinjaTrader / TradeDayX | $119 | $192 |

End of Day | $150k | Tradovate / NinjaTrader / TradeDayX | $139 | $262 |

Intraday | $50k | Tradovate / NinjaTrader / TradeDayX | $99 | $69 |

Intraday | $100k | Tradovate / NinjaTrader / TradeDayX | $119 | $140 |

Intraday | $150k | Tradovate / NinjaTrader / TradeDayX | $139 | $210 |

Static | $50k | Tradovate / NinjaTrader / TradeDayX | $99 | $105 |

Static | $100k | Tradovate / NinjaTrader / TradeDayX | $119 | $175 |

Static | $150k | Tradovate / NinjaTrader / TradeDayX | $139 | $245 |

Traders can start with plans from $69 to $262, gaining access to professional-grade trading environments, realistic profit targets, and adjustable drawdown levels. Whether you’re a beginner or an advanced trader, TradeDay’s pricing structure offers flexibility, transparency, and a cost-effective pathway to funding success.

TradeDay Registration & Verification Steps

Traders can easily open a new trading account with TradeDay by following a few simple steps. TradeDay registration:

#1 Visit the TradeDay Website

First, search for TradeDay on your favorite browser and enter it. Then, choose your evaluation model.

#2 Provide Personal Information

Now, type in the following information:

- Full name

- Address

- Postal Code

- Phone Number

#3 Pay the Challenge Fee and Verify Your Account

Provide the required billing details and buy your evaluation. After passing it, the prop firm will ask you to provide proof of identity and proof of address documents to verify your account.

TradeDay’s Evaluation Steps

TradeDay’s evaluation programs are built to test, refine, and fund traders based on skill, discipline, and consistency. Each program offers flexible options across three account types, with sizes from $50K to $150K. Reset fees range from $99 to $139, depending on the plan.

Acc Type | Acc Size | Platform | Profit Target | Drawdown | Contracts |

End of Day | 50k | Tradovate / NinjaTrader | $3,000 (6%) | $2,000 (4%) | 5 (50 micros) |

End of Day | 100k | Tradovate / NinjaTrader | $6,000 (6%) | $3,000 (3%) | 10 (50 micros) |

End of Day | 150k | Tradovate / NinjaTrader | $9,000 (6%) | $4,000 (2.67%) | 15 (50 micros) |

Intraday | 50k | Tradovate / NinjaTrader | $3,000 (6%) | $2,000 (4%) | 5 (50 micros) |

Intraday | 100k | Tradovate / NinjaTrader | $6,000 (6%) | $3,000 (3%) | 10 (50 micros) |

Intraday | 150k | Tradovate / NinjaTrader | $9,000 (6%) | $4,000 (2.67%) | 15 (50 micros) |

Static | 50k | Tradovate / NinjaTrader | $1,500 (3%) | $500 (1%) | 1 (10 micros) |

Static | 100k | Tradovate / NinjaTrader | $2,500 (2.5%) | $750 (0.75%) | 2 (20 micros) |

Static | 150k | Tradovate / NinjaTrader | $3,750 (2.5%) | $1,000 (0.67%) | 3 (30 micros) |

End of Day | 50k | TradeDayX | $3,000 (6%) | $2,000 (4%) | 5 (50 micros) |

End of Day | 100k | TradeDayX | $6,000 (6%) | $3,000 (3%) | 10 (50 micros) |

End of Day | 150k | TradeDayX | $9,000 (6%) | $4,000 (2.67%) | 15 (50 micros) |

Intraday | 50k | TradeDayX | $3,000 (6%) | $2,000 (4%) | 5 (50 micros) |

Intraday | 100k | TradeDayX | $6,000 (6%) | $3,000 (3%) | 10 (50 micros) |

Intraday | 150k | TradeDayX | $9,000 (6%) | $4,000 (2.67%) | 15 (50 micros) |

Static | 50k | TradeDayX | $1,500 (3%) | $500 (1%) | 1 (10 micros) |

Static | 100k | TradeDayX | $2,500 (2.5%) | $750 (0.75%) | 2 (20 micros) |

Static | 150k | TradeDayX | $3,750 (2.5%) | $1,000 (0.67%) | 3 (30 micros) |

TradeDay End of Day Evaluation Program

The End of Day program is ideal for traders who prefer managing risk with closing-of-day assessments rather than intraday limits. It offers consistent targets, fair drawdowns, and larger contract sizes across both Tradovate/NinjaTrader and TradeDayX platforms.

Account Size | Platform | Profit Target | Drawdown | Contracts |

50k | Tradovate / NinjaTrader | $3,000 (6%) | $2,000 (4%) | 5 (50 micros) |

100k | Tradovate / NinjaTrader | $6,000 (6%) | $3,000 (3%) | 10 (50 micros) |

150k | Tradovate / NinjaTrader | $9,000 (6%) | $4,000 (2.67%) | 15 (50 micros) |

50k | TradeDayX | $3,000 (6%) | $2,000 (4%) | 5 (50 micros) |

100k | TradeDayX | $6,000 (6%) | $3,000 (3%) | 10 (50 micros) |

150k | TradeDayX | $9,000 (6%) | $4,000 (2.67%) | 15 (50 micros) |

This account is best for those who hold positions through the trading day, focusing on strategic setups rather than short-term volatility.

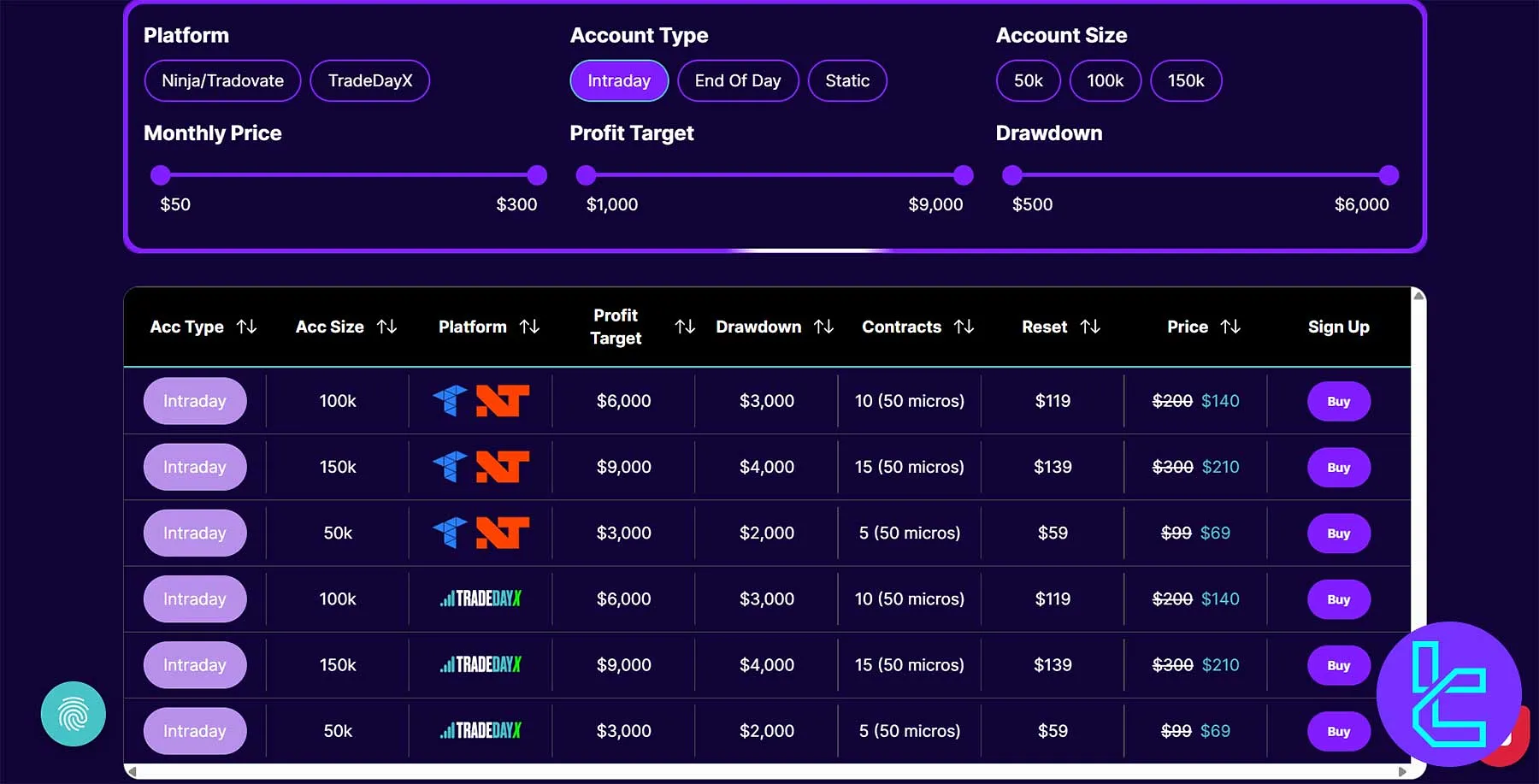

TradeDay Intraday Evaluation Program

The Intraday program suits active day traders who seek flexibility to trade throughout the session. It provides the same profit-to-drawdown structure as the End of Day option but with intraday margin evaluations.

Acc Size | Platform | Profit Target | Drawdown | Contracts |

50k | Tradovate / NinjaTrader | $3,000 (6%) | $2,000 (4%) | 5 (50 micros) |

100k | Tradovate / NinjaTrader | $6,000 (6%) | $3,000 (3%) | 10 (50 micros) |

150k | Tradovate / NinjaTrader | $9,000 (6%) | $4,000 (2.67%) | 15 (50 micros) |

50k | TradeDayX | $3,000 (6%) | $2,000 (4%) | 5 (50 micros) |

100k | TradeDayX | $6,000 (6%) | $3,000 (3%) | 10 (50 micros) |

150k | TradeDayX | $9,000 (6%) | $4,000 (2.67%) | 15 (50 micros) |

This plan is optimized for short-term strategies, scalping, and quick market opportunities while maintaining strong risk management rules.

TradeDay Static Evaluation Program

The Static program is perfect for conservative traders who prefer stable drawdown models and smaller trade sizes. With low drawdowns and attainable profit targets, it’s ideal for building consistency and capital discipline.

Acc Size | Platform | Profit Target | Drawdown | Contracts |

50k | Tradovate / NinjaTrader | $1,500 (3%) | $500 (1%) | 1 (10 micros) |

100k | Tradovate / NinjaTrader | $2,500 (2.5%) | $750 (0.75%) | 2 (20 micros) |

150k | Tradovate / NinjaTrader | $3,750 (2.5%) | $1,000 (0.67%) | 3 (30 micros) |

50k | TradeDayX | $1,500 (3%) | $500 (1%) | 1 (10 micros) |

100k | TradeDayX | $2,500 (2.5%) | $750 (0.75%) | 2 (20 micros) |

150k | TradeDayX | $3,750 (2.5%) | $1,000 (0.67%) | 3 (30 micros) |

This model encourages slow, consistent growth for traders who value stability, lower risk exposure, and clear progression pathways.

TradeDay’s bonuses and discounts

There are some appealing bonuses and discounts for TradeDay’s traders. TradeDay bonus:

- 20% Discount: Use the code "MATCH" to get 20% off the monthly subscription fee for any evaluation program

- 14-Day Free Trial: Traders can try out educational resources and the simulated trading platform for free before committing

- First $10,000 Profit: Keep 100% of your first $10,000 in profits after getting funded

These benefits help reduce costs and increase earning potential for traders.

TradeDay Rules

TradeDay has set various rules and trading conditions to ensure traders will perform strict risk management techninches and follow the platform guide lines to avoid account termination. TraderDay rules:

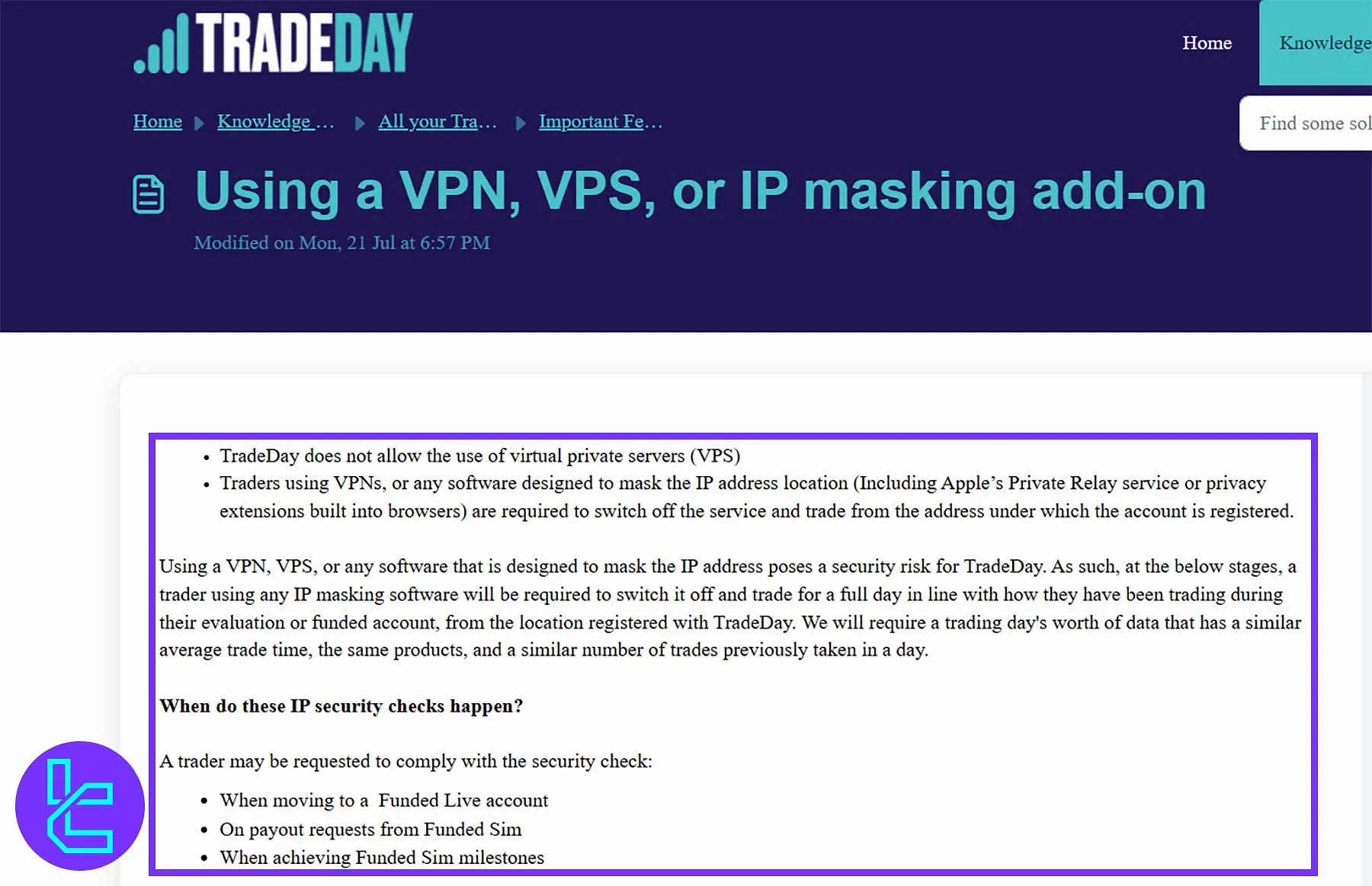

- VPS and VPN Usage: Security checks occur before funding, at milestones, or during payout requests

- Hedging: This Trading strategy is banned entirely

- Expert Advisors: No specific rules or conditions

- Gambeling and risk strategies: Strategies that employ significant unmanaged risk or use the exploits in the system are banned

- News Trading: trading during Tier-1 news is restricted; violations may result in account loss

- Payout Policy: Withdrawals via Riseworks with a minimum of $250

VPS, VPN & IP-Masking Restrictions

Use of VPS, VPN, or any tool that hides IP location (including Apple Private Relay or browser extensions) is prohibited. Traders must disable such services and trade from the registered IP location. When detected, traders must complete one full day of trading with:

- Similar asset types

- Average trade duration

- Comparable trade count

This applies when:

- Upgrading to Funded Live

- Requesting Funded Sim payouts

- Hitting Funded Sim milestones

Inability to comply or failed background checks (e.g., felony convictions) cancels funding. Evaluation pass fees are refundable, but failed evaluations or active subscriptions are not.

Hedging Policy

TradeDay disallows hedging, opening opposing trades on the same asset across accounts.

Expert Advisors

TradeDay does not enforce specific rules for Expert Advisors (EAs), but traders must still avoid prohibited behaviors.

Banned Strategies

TradeDay does not permit:

- Use of third-party trading bots or Automated Trading Systems (ATS), especially if shared among users

- Scalping strategies and systems executing more than 200 trades per day or engaging in queue-based exploitation

- Spoofing, layering, and order-splitting (placing multiple identical orders simultaneously)

- Exploiting sim features like unrealistic stop-loss execution or lack of slippage (e.g., bracketing news)

- Trading illiquid, gapped markets or outside the best bid/offer for advantage

- Use of slow or external data feeds

- Coordinated activity between connected accounts or accounts at different firms to manipulate outcomes

- Opening multiple accounts with different credentials to bypass rules

Tier-1 News Trading

TradeDay automatically liquidates all open trades 2 minutes before Tier-1 economic news releases and resumes trading 2 minutes after. Violations will not cause automatic failure but repeated abuse leads to account suspension.

Traders are responsible for being aware of when news events occur. Tier-1 Events Include:

Event | Time (CT) | Instruments |

FOMC Minutes & Rate Decision | 1:00 PM | All Products |

US CPI / NFP Report | 7:30 AM | All Products |

Crude Oil & Gas Inventories | 9:30 AM | Oil / Gas |

Crop Production Reports | 11:00 AM | Ag Commodities |

Times may change. Use the Investing.com or CME calendars in your TradeDay Members Area.

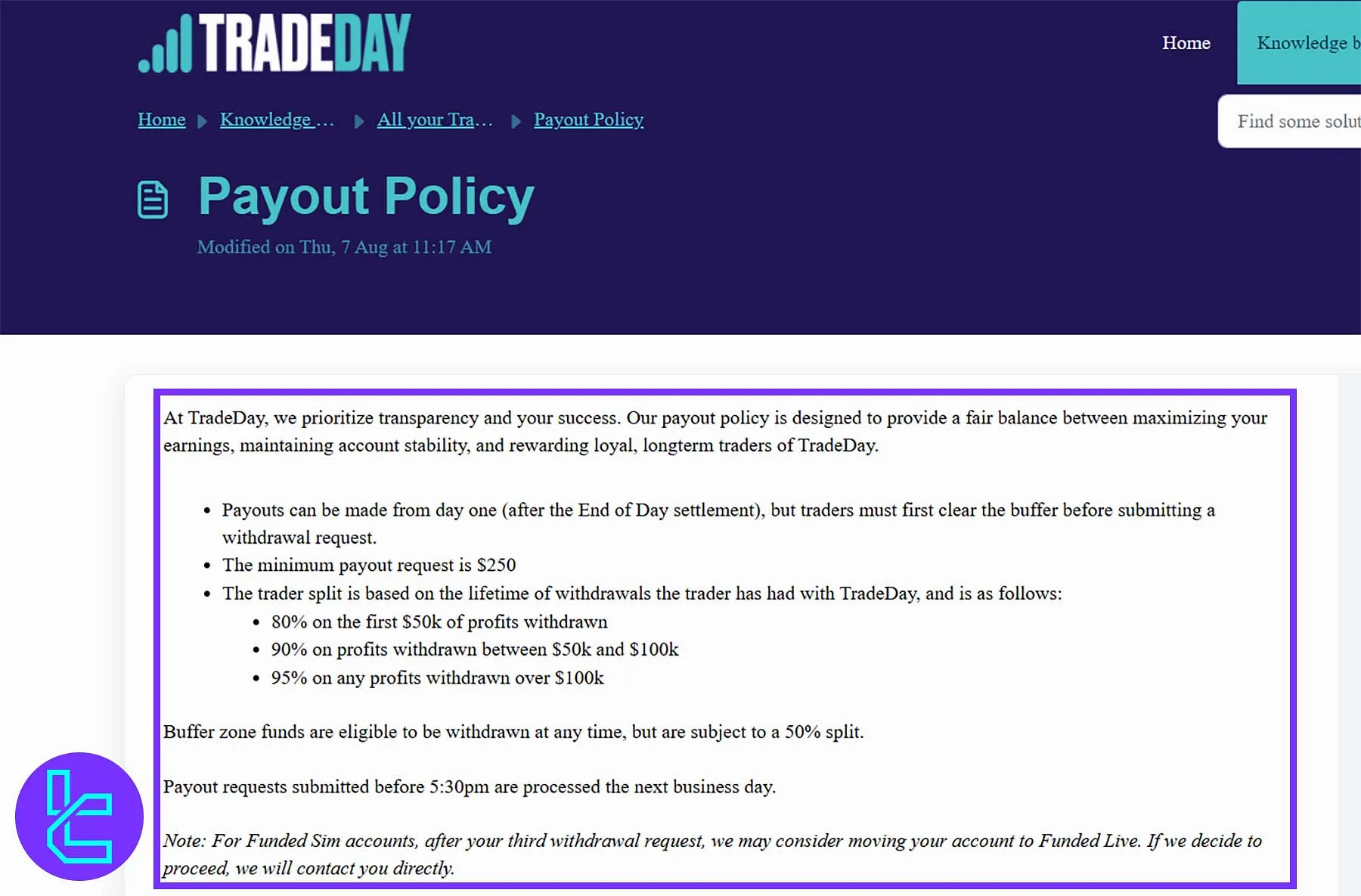

TradeDay Payout Policy

TradeDay’s payout policy is built on transparency, flexibility, and fairness — allowing traders to withdraw profits efficiently while maintaining account stability. Traders can begin withdrawing from day one, once they’ve cleared the Buffer Zone, with a minimum payout of $250 and tiered profit splits up to 90%.

- Tiered Payout Splits: 80% up to $50K in profits, 90% between $50K–$100K;

- Processing Speed: Requests before 5:30 p.m. CT are processed within 24 hours (business days);

- Withdrawal Methods: Via Riseworks, offering free U.S. bank wires, $15 international wires, and free L2 crypto transfers;

- Buffer Zone Rule: Withdrawals into the buffer are subject to a 50% split;

- Graduation Path: After 3 withdrawals, traders may advance to a Funded Live Account.

TradeDay prop firm trading platforms

TradeDay understands that having the right tools is crucial for trading success. That's why they offer a range of popular and powerful trading platforms to suit different trading styles and preferences. TradeDay’s trading platforms:

Platform | Key Features |

Tradovate | Cloud-based with advanced charting and order execution, Mobile-friendly for trading on the go, Customizable workspace layouts |

NinjaTrader | Feature-rich platform with advanced charting and analytical tools, Supports automated trading strategies, Offers market replay for backtesting |

TradingView | Web-based platform with social networking features, Comprehensive range of technical indicators and drawing tools, Supports multiple assets beyond futures |

Jigsaw | Specialized order flow trading platform, Provides detailed market depth and volume analysis, Offers trading from the DOM (Depth of Market) |

All these platforms are fully integrated with TradeDay's systems, ensuring seamless execution and reporting. Traders can choose the platform that best fits their trading style and technical requirements.

To access additional analytical tools, check TradingFinder's list of TradingView indicators.

What instruments & symbols can I trade on TradeDay?

TradeDay specializes in futures trading, offering access to various instruments across major exchanges. TradeDay’s tradable assets:

Asset Class | Contract Name | Contract Code | Tick Size | Data Feed |

Equity Index Futures | E-mini S&P 500 Futures | ES | $12.50 | CME |

Micro E-mini S&P 500 Index Futures | MES | $1.25 | CME | |

E-mini Nasdaq-100 Futures | NQ | $5.00 | CME | |

Micro E-mini Nasdaq-100 Index Futures | MNQ | $0.50 | CME | |

E-mini Russell 2000 Index Futures | RTY | $5.00 | CME | |

Micro E-mini Russell 2000 Index Futures | M2K | $0.50 | CME | |

E-mini Dow ($5) Futures | YM | $5.00 | CBOT | |

Micro E-mini Dow Jones Industrial Average Futures | MYM | $0.50 | CBOT | |

FX Futures | Australian Dollar Futures | 6A | $5.00 | CME |

British Pound Futures | 6B | $6.25 | CME | |

Euro FX Futures | 6E | $6.25 | CME | |

Micro Euro FX Futures | M6E | $1.25 | CME | |

Bond Futures | 2-Year T-Note Futures | ZT | $7.81 | CBOT |

10-Year T-Note Futures | ZN | $15.63 | CBOT | |

Energy Futures | Crude Oil Futures | CL | $10.00 | NYMEX |

Micro Crude Oil | MCL | $1.00 | NYMEX | |

Metals Futures | Gold Futures | GC | $10.00 | COMEX |

Micro Gold Futures | MGC | $1.00 | COMEX | |

Agricultural Futures | Corn Futures | ZC | $12.50 | CBOT |

Soybean Futures | ZS | $12.50 | CBOT |

This diverse range of instruments allows traders to capitalize on opportunities across various sectors and implement diverse trading strategies.

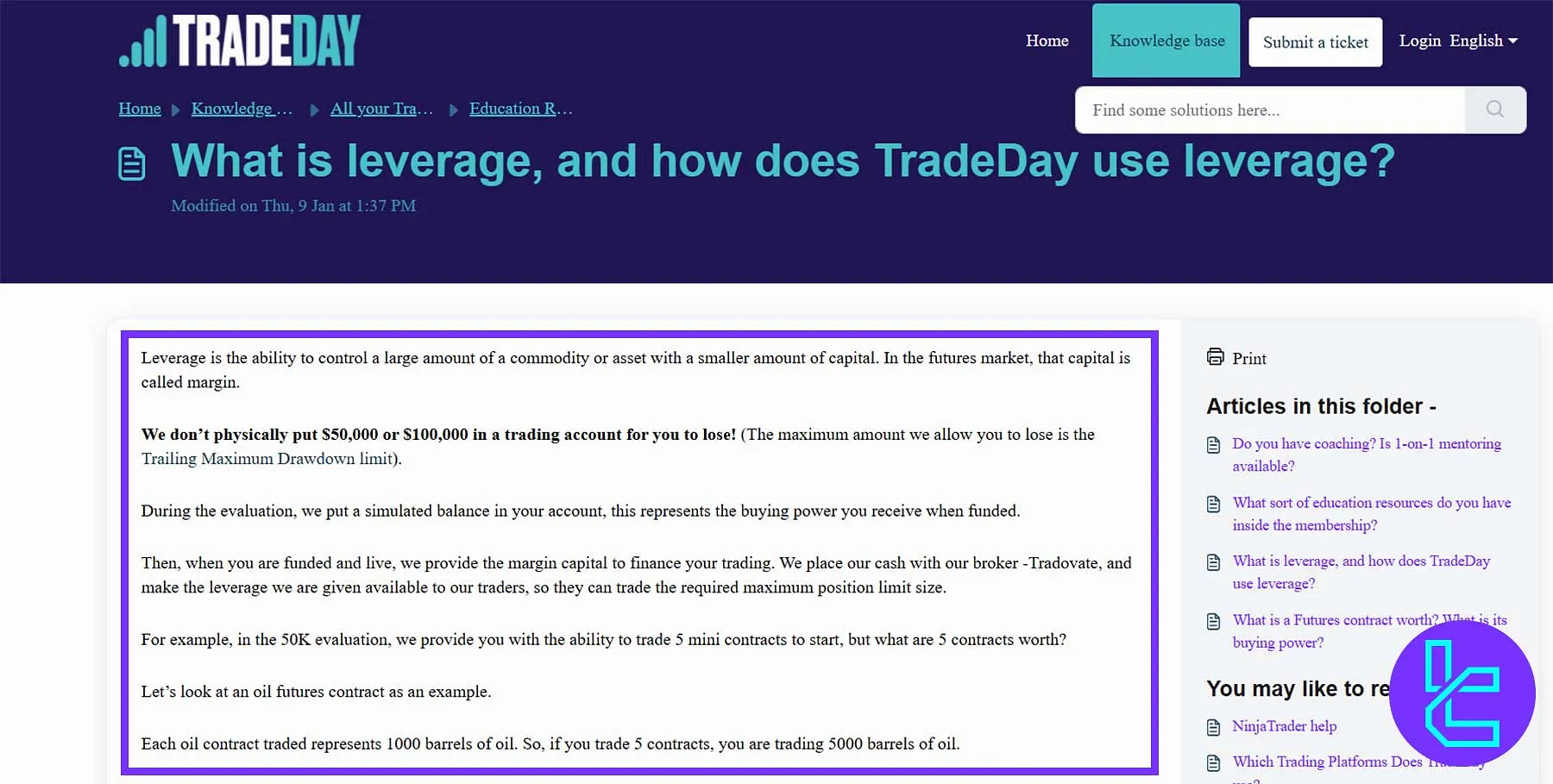

TradeDay Leverage Offerings

TradeDay provides traders with institutional-grade leverage to control large positions in commodities and financial futures using minimal margin capital. Instead of risking the full balance, traders operate within a Trailing Maximum Drawdown limit, gaining simulated buying power during evaluation and full margin backing once funded through Tradovate.

- Real Market Exposure: Traders manage positions worth over $70,000 per oil contract or $180,000 per gold contract, using a fraction of that as margin;

- Position Limits: Fixed by account tier — e.g., a $50K evaluation allows trading up to 5 mini contracts;

- Broker Partnership: Margin capital is provided directly via Tradovate, ensuring seamless execution;

- Transparency & Control: TradeDay simplifies leverage by defining clear contract sizes and risk limits across all evaluations.

TradeDay payment methods

TradeDay offers flexible and secure payment options for both account funding and profit withdrawals. TradeDay’s payment methods:

Transaction Type | Available Methods | Minimum deposit/withdrawal |

Account Funding | Credit/Debit Cards, PayPal | $80 |

Profit Withdrawals | Bank Transfer/Wire Transfer, Crypto | $250 |

Key points to note:

- Minimum withdrawal amount: $250

- No restrictions on withdrawal frequency

- Payouts within one business day

TradeDay prioritizes the security and efficiency of financial transactions. They employ industry-standard encryption and security measures to protect traders' financial information.

TradeDay prop firm commission & costs

Understanding the commission structure and costs associated with trading at TradeDay is crucial for managing your trading capital effectively. TradeDay’s commissions:

Asset Class | Contract | Code | Commission |

Equity Index Futures Contracts | E-mini S&P 500 Futures | ES | $2.34 |

Micro E-mini S&P 500 Index Futures | MES | $0.77 | |

E-mini Nasdaq-100 Futures | NQ | $2.34 | |

Micro E-mini Nasdaq-100 Index Futures | MNQ | $0.77 | |

E-mini Russell 2000 Index Futures | RTY | $2.34 | |

Micro E-mini Russell 2000 Index Futures | M2K | $0.77 | |

Nikkei/USD Futures | NKD | $3.11 | |

E-mini Dow ($5) Futures | YM | $2.34 | |

Micro E-mini Dow Jones Industrial Average | MYM | $0.77 | |

Australian Dollar Futures | 6A | $2.56 | |

British Pound Futures | 6B | $2.56 | |

Canadian Dollar Futures | 6C | $2.56 | |

Euro FX Futures | 6E | $2.56 | |

Micro Euro FX Futures | M6E | $0.66 | |

Japanese Yen Futures | 6J | $2.56 | |

Swiss Franc Futures | 6S | $2.56 | |

New Zealand Dollar Futures | 6N | $2.56 | |

Bond Futures Contracts | 2-Year T-Note Futures | ZT | $1.61 |

5-Year T-Note Futures | ZF | $1.61 | |

10-Year T-Note Futures | ZN | $1.76 | |

U.S. Treasury Bond Futures | ZB | $1.83 | |

Ultra Bond Futures | UB | $1.91 | |

Ultra Note Futures | TN | $1.76 | |

Energy Futures Contracts | Crude Oil Futures | CL | $2.46 |

Micro Crude Oil | MCL | $0.92 | |

E-mini Crude Oil Futures | QM | $2.16 | |

E-mini Natural Gas Futures | QG | $1.46 | |

Henry Hub Natural Gas Futures | NG | $2.56 | |

Metals Futures Contracts | Platinum Futures | PL | $2.56 |

Copper Futures | HG | $2.56 | |

Gold Futures | GC | $2.56 | |

Micro Gold Futures | MGC | $0.92 | |

Silver | SI | $2.56 | |

Micro Silver | SIL | $1.42 | |

Agricultural Futures Contracts | Lean Hog Futures | HE | $3.06 |

Live Cattle Futures | LE | $3.06 | |

Soybean Futures | ZS | $3.06 | |

Corn Futures | ZC | $3.06 | |

Soybean Oil Futures | ZL | $3.06 | |

Soybean Meal Futures | ZM | $3.06 | |

Chicago SRW Wheat Futures | ZW | $3.06 |

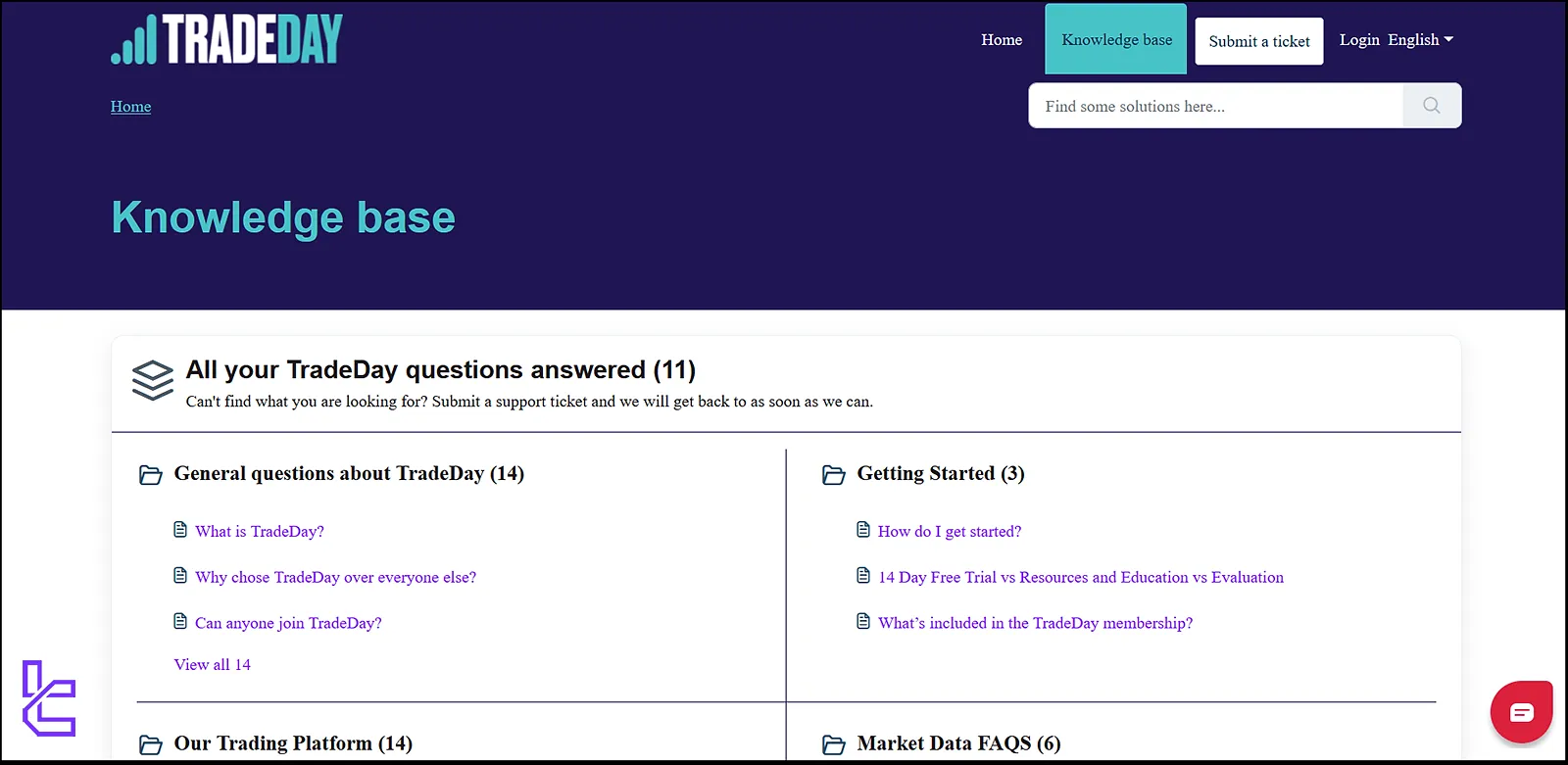

Does TradeDay offer vast educational resources?

TradeDay's "Knowledge Base" offers a comprehensive collection of articles, providing answers to all your TradeDay-related questions.

It covers various topics to help traders learn best practices and strategies, making it a valuable resource for enhancing trading skills.

If you can't find the information you need, TradeDay encourages you to submit a support ticket for further assistance. Needless to say, the firm’s educational resources are far limited compared to the rivals.

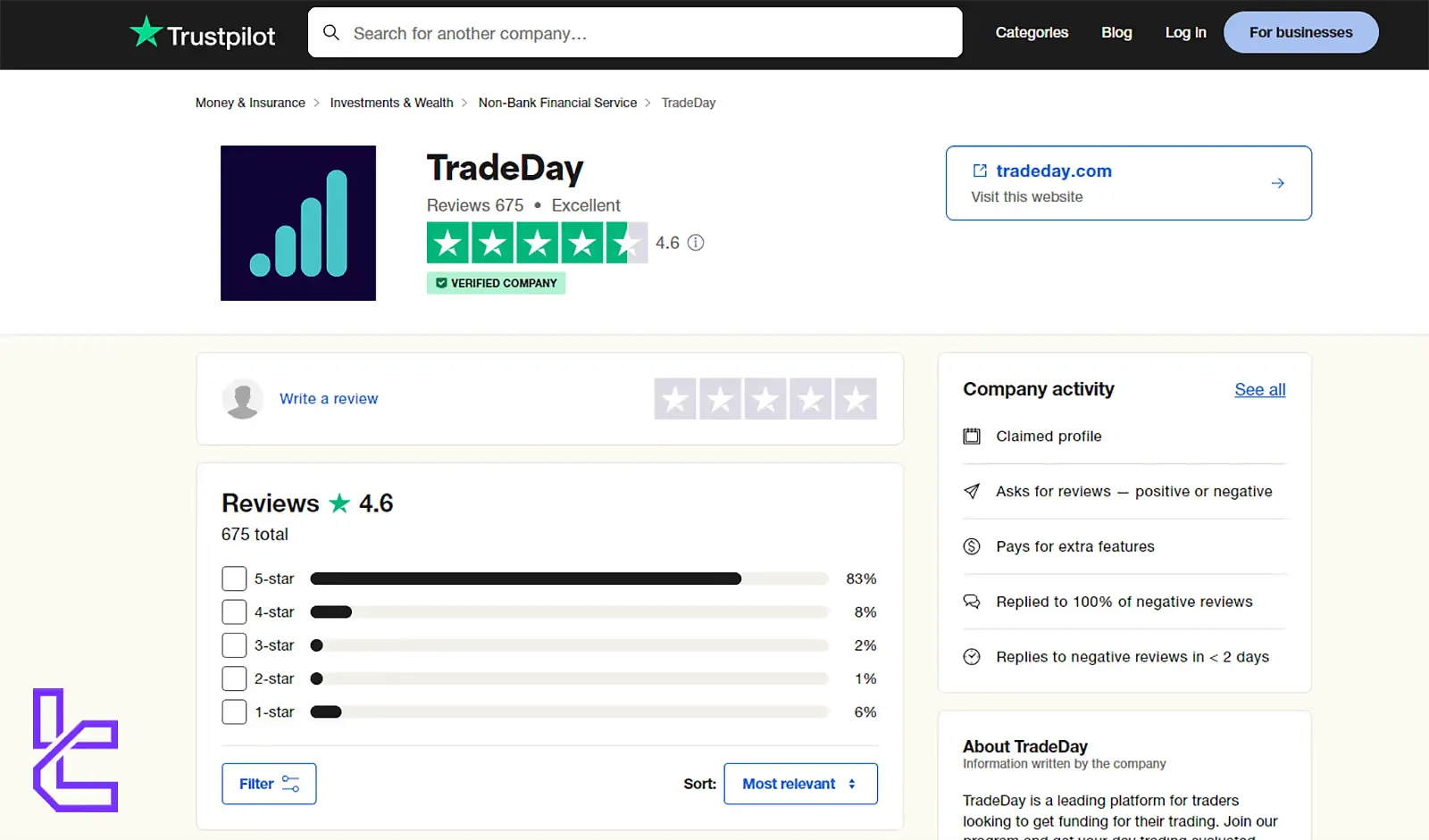

TradeDay Trust scores on Trustpilot

TradeDay, a proprietary trading firm, holds a high trust score of 4.6 on TradeDay Trustpilot, reflecting its strong reputation among users.

The firm offers a unique evaluation program tailored to futures traders, focusing on consistent profitability and risk management.

With flexible trading plans, simulated environments, and no requirement for traders to risk personal capital, it is seen as an accessible platform.

The positive reviews also highlight TradeDay's supportive community and educational resources for traders aiming to improve their skills.

TradeDay prop firm customer support

TradeDay prop firm offers robust customer support to ensure that traders have a seamless experience.

Their customer support is accessible through various channels, including live chat and a ticketing system, allowing clients to receive prompt assistance.TradeDay support options:

Support Method | Availability |

Live Chat | Yes (Instant support) |

Yes (support@tradeday.com) | |

Phone Call | Yes (+1 872 222 7850 Mon-Fri 9 am - 4 pm CT) |

Discord | Yes |

Telegram | No |

Ticket | Yes |

FAQ | Yes |

Help Center | Yes |

No | |

Messenger | No |

By providing these channels, TradeDay aims to enhance user satisfaction and ensure that traders can resolve their issues quickly and effectively.

TradeDay User Base

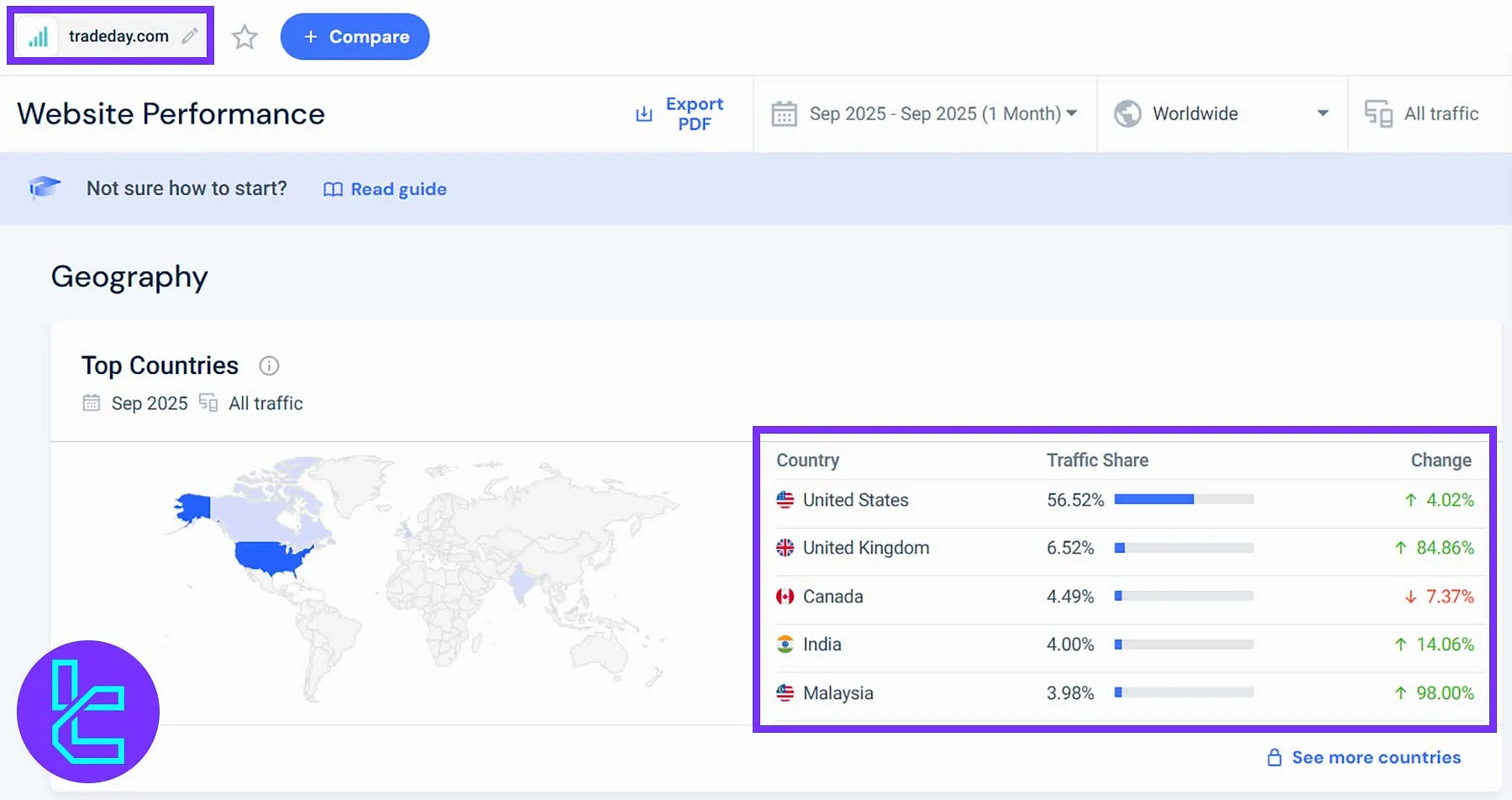

According to Similarweb data from September 2025, TradeDay has built a strong global footprint with a dominant presence in North America and a fast-growing audience in Asia and Europe. The firm continues to expand, driven by its transparent funding model and advanced trading infrastructure.

- Top Markets: United States (56.52%), United Kingdom (6.52%), Canada (4.49%), India (4.00%), and Malaysia (3.98%);

- User Growth: The UK and Malaysia saw the fastest increases, with 84.86% and 98% growth rates respectively;

- Core Demographics: Most users are professional and retail futures traders seeking evaluation and funding opportunities;

- Global Reach: TradeDay maintains multilingual support and localized access for emerging markets.

TradeDay social media channels

TradeDay prop firm maintains an active presence across various social media platforms. According to the image you shared, they have profiles on:

Social Media | Members/Subscribers |

2000 | |

10800 | |

10200 | |

526 | |

10614 |

You can connect with them on these channels to keep up with their latest news and updates.

TradeDay Comparison Table

Let's compare the most important aspects of trading with TradeDay in comparison to other prop firms.

Parameters | TradeDay Prop Firm | |||

Minimum Challenge Price | $59 | $39 | €55 | $32 |

Maximum Fund Size | $150,000 | $4,000,000 | Infinite | $4,000,000 |

Evaluation steps | 1-Step | 1-Step, 2-Step, 3-Step | 2-Step | 1-Step, 2-Step |

Profit Share | 90% | 100% | 100% | 95% |

Max Daily Drawdown | 3% | 5% | 5% | 5% |

Max Drawdown | 3% | 10% | 8% | 10% |

First Profit Target | 6% | 5% | 10% | 8% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | N/A | 1:100 | 1:100 | 1:100 |

Payout Frequency | No restrictions | Bi-weekly | 14 Days | From 5 Days |

Number of Trading Assets | N/A | 3000+ | 150+ | 78 |

Trading Platforms | Tradovate, NinjaTrader, TradingView, Jigsaw | Metatrader 5 | cTrader, DXTrade | MT4, MT5, cTrader, MatchTarder |

Expert suggestions

TradeDay's maximum drawdown of 4% for the $50k challenge makes it an attractive option for traders seeking large capital with manageable risk.

The ability to receive payouts via multiple methods, such as crypto or bank transfers, adds another layer of convenience for traders.

The firm also stands out for its 4.6 Trustpilot score, a testament to its reliability and trader satisfaction.