Trader2B Rules enforces structured trading policies with limits like 6% profit targets and a required consistency score of 50%.

Traders must maintain at least $25,000 in equity to meet SEC pattern day trader rules.

Strict trading hours end at 16:00 ET, and overnight positions are not allowed.

Margin rules include 4:1 day trading and 2:1 overnight leverage for U.S. stocks.

Trader2B Rule Topics

Unlike the other platforms, Trader2B Prop Firm takes a different approach in its trading policy; Trader2BKey Areas Rules:

- Profit Target

- Payout Frequency

- Consistency

- Leverage Limits

- Day Trading Restrictions

Trader2B Challenge Rules

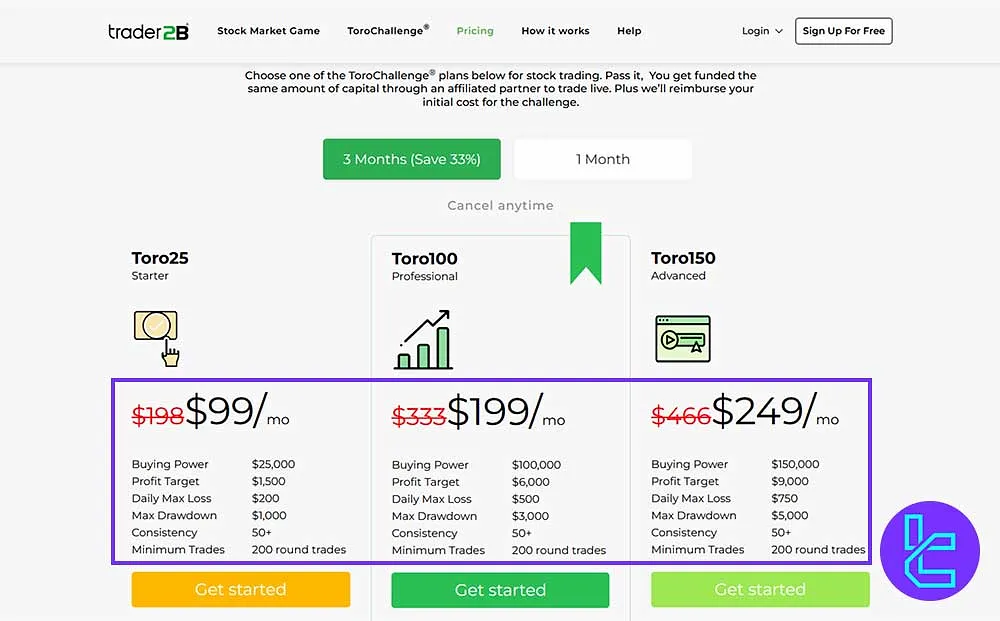

The firm’s challenges have distinct requirements; Trader2B Evaluation Limits:

Plan | Buying Power | Profit Target | Daily Max Loss | Max Drawdown |

Toro25 | $25,000 | $1,500 | $200 | $1,000 |

Toro100 | $100,000 | $6,000 | $500 | $3,000 |

Toro150 | $150,000 | $9,000 | $750 | $5,000 |

If you consider Toro100, it has a fair max drawdown compared to other plans.

Trading Time in Trader2B

Trader2B has strict trading hours. Traders are only allowed to trade during market hours and must flatten all positions before 16:00 ET. Overnight positions are prohibited.

Trader2B Payout Conditions

Trader2B processes withdrawals bi-weekly or monthly, depending on the trader's profits for the previous month. Payout requests are available in the 1st and 3rd weeks of each month.

Consistency Rule set by Trader2B

To succeed with Trader2B, traders must meet a 6% profit, 200 roundtrades, and a consistency ratio (CR) of 50% or more; Trader2B Consistency Score:

- Consistency Score = (Total Balance / Trading Period) × (Daily Net Profit / Max Daily Drawdown).

Trader2B Limited Leverage on US Stock

Trader2B sets certain rules for leveraged trading in stock positions. Margin calls are considered for exceeding limits; Trader2B US Stock Leverage Conditions:

- Leverage for U.SDay Traders: 4:1

- Overnight Leverage: 2:1

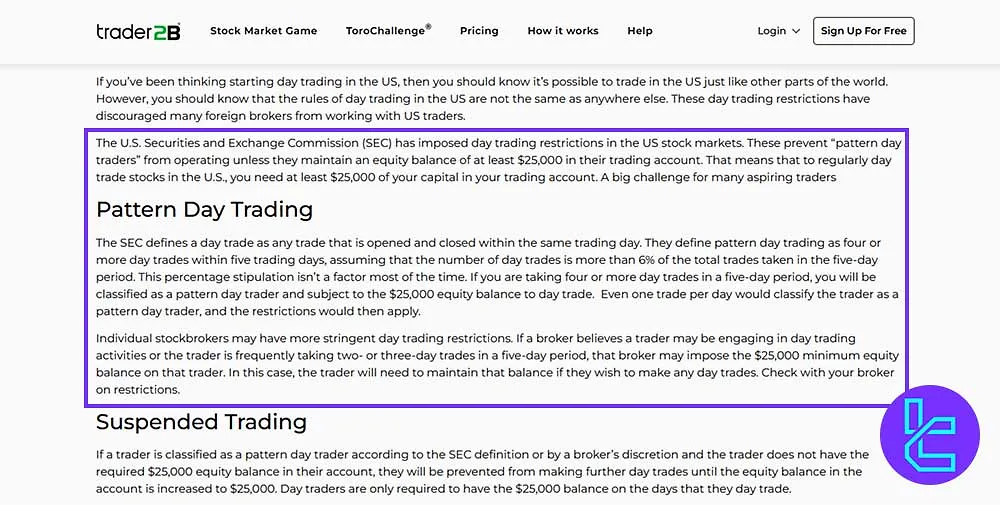

Day Trading Restrictions on Trader2B

As per the SEC guidelines, a pattern day trader is anyone who executes four or more day trades within five business days, where day trades make up more than 6% of total trades.

A trader classified as a pattern day trader must maintain a minimum of $25,000 equity to continue day trading.

Trader2B Prohibited Strategies

Trader2B does not explicitly mention prohibited strategies on its website. However, the platform is structured to ensure that all traders adhere to the rules mentioned in this article.

Writer’s Opinion and Conclusion

Trader2B rules that traders execute 4+ day trades within 5 days, and exceeding 6% of total trades face classification policies.

Key formulas like Consistency Score = (Total Balance / Trading Period) × (Daily Net Profit / Max Daily Drawdown) define performance evaluation.

To find more informative articles, check out the Trader2B Tutorial.