Trading Cult rules enforce 10% profit targets and 4–5% daily loss caps across 1X and 2X evaluations. Traders must avoid tick scalping, HFT, and arbitrage strategy to stay within the firm’s guidelines.

Bots, EAs, and algorithms are fully banned, with violations leading to hard breaches. Payouts are processed every 14 days for traders and 7 days for affiliates, with a $100 minimum.

Trading Cult Rules Overview

Here are the various categories of trading restrictions within Trading Cult prop firm. Rule topics at Trading Cult:

- Challenge Rules

- Payout Policy

- Inactivity Penalty

- Automated Tools Ban

- Prohibited Strategies

- Scalping Conditions

- News Trading Rules

- Weekend & Overnight Holding

Trading Cult Challenge Rules

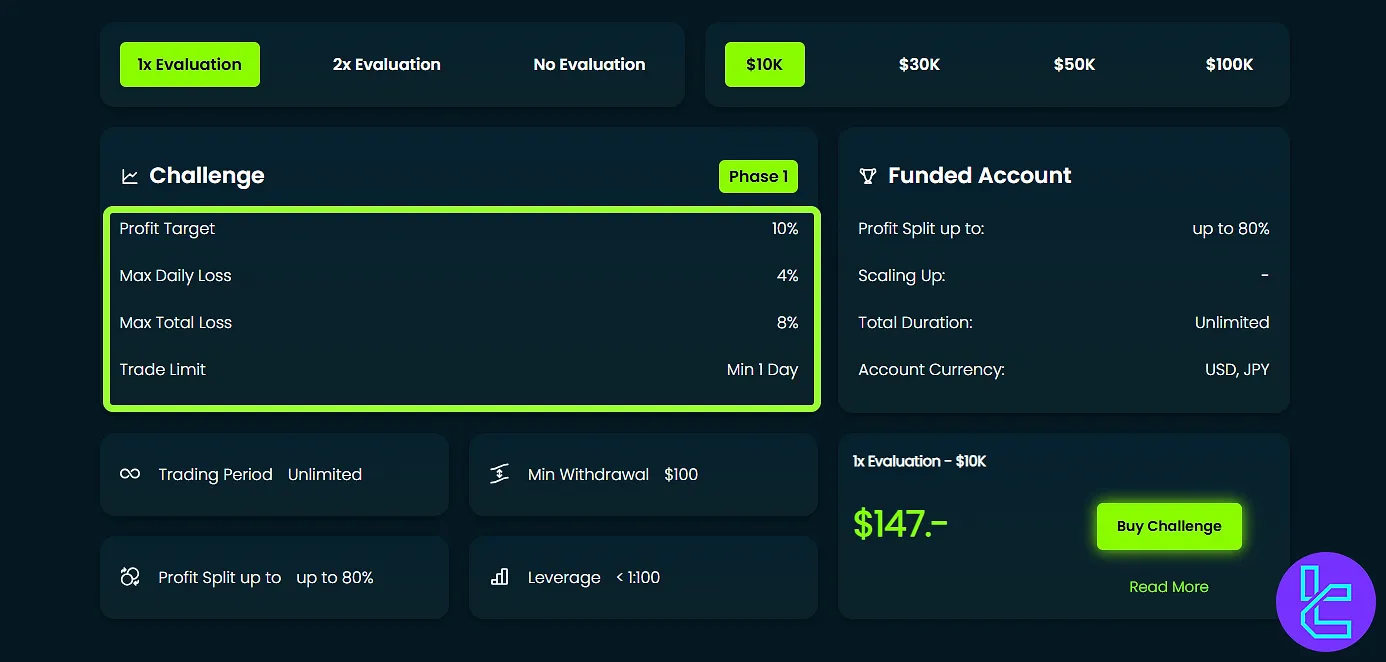

The firm has 3 main plan types with specific targets and risk levels. Trading Cult evaluation conditions:

Plan Type | Phase | Profit Target | Max Daily Loss | Max Total Loss |

1X Evaluation | - | 10% | 4% | 8% |

2X Evaluation | Phase 1 | 8% | 5% | 10% |

Phase 2 | 5% | 5% | 10% | |

No Evaluation | - | None | 5% | 10% |

As you can see, No Evaluation plan has no profit target and is known as instant funding program in the industry.

Trading Cult Payout

To receive payouts, traders must consider the conditions below before submitting their request:

- Meet profit target and drawdown;

- Trade on a funded account;

- Request every 14 days (traders) or 7 days (affiliates;)

- Minimum payout is $100.

Trading Cult Inactivity

If no trading activity occurs for 30 consecutive days, the account will be breached. Failure to meet the minimum activity requirement may result in suspension of trading privileges. To maintain account status, users are encouraged to execute at least one trade within each 30-day cycle.

Trading Cult Automated Tools

Use of algorithms, bots, or Expert Advisors (EAs) is strictly banned. Any usage results in a hard breach and challenge failure.

Trading Cult Prohibited Strategies

The following trading strategies are strictly forbidden:

- Holding shares during earnings

- Arbitrage

- System exploits

- Hedging

- High-Frequency Trading (HFT)

- Tick scalping

- Sharing accounts

- All-in-one bet

- Martingale strategy

- Copy Trading/reverse copy trading

- Poor risk management

- Gambling-like behavior

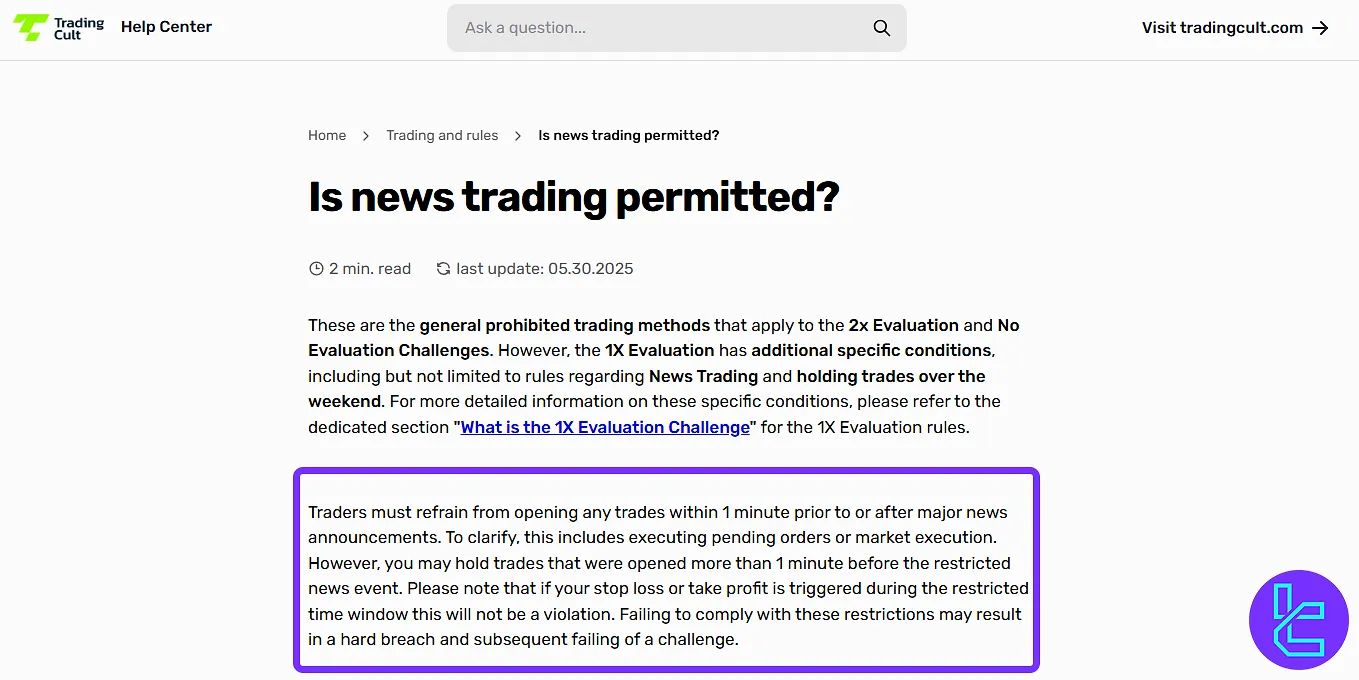

Trading Cult News Trading

For the 1X Evaluation, traders are prohibited from opening trades 1 minute before or after major news events. This rule applies to both market and pending orders, though SL/TP triggers are not considered violations.

Any breach of this rule results in challenge failure.

Trading Cult Holding Overnight & Over the Weekend

1X Evaluation has extra rules, including restrictions on weekend trading. Trades may stay open over weekends, but traders should be cautious of price gaps that can trigger maximum loss limits and cause a hard breach.

Writer’s Opinion and Conclusion

Based on Trading Cult rules, Traders are not allowed to place orders 1 minute before or after news in 1X Evaluation, including pending orders.

Accounts with 30 days of inactivity are breached, emphasizing consistent engagement. Weekend trades are permitted, but price gaps may still trigger loss limits.

Now that you are familiar with the trading conditions on this prop firm, we suggest complete Trading Cult registration process, visit the Trading Cult tutorials page.