Key Points:

- The EUR/USD currency pair advanced with buying pressure up to the rejection block zone; at the same time, the weakness of the US Dollar Index supports the euro-strength scenario;

- On the 4-hour timeframe, the overall structure remains bullish; reaction to short-term supply zones may represent only a temporary correction within the upward trend;

- On the 1-hour timeframe, the formation of a consolidation triangle is possible; a valid upside breakout could activate targets at $1.197, $1.20, and $1.2050;

- The short-term bearish scenario, in the event of a downside triangle breakout, is more corrective in nature unless a deeper structural break occurs;

- Price behavior during the London and New York sessions, and the method of liquidity collection, will play a key role in confirming trend continuation or triggering a distribution phase.

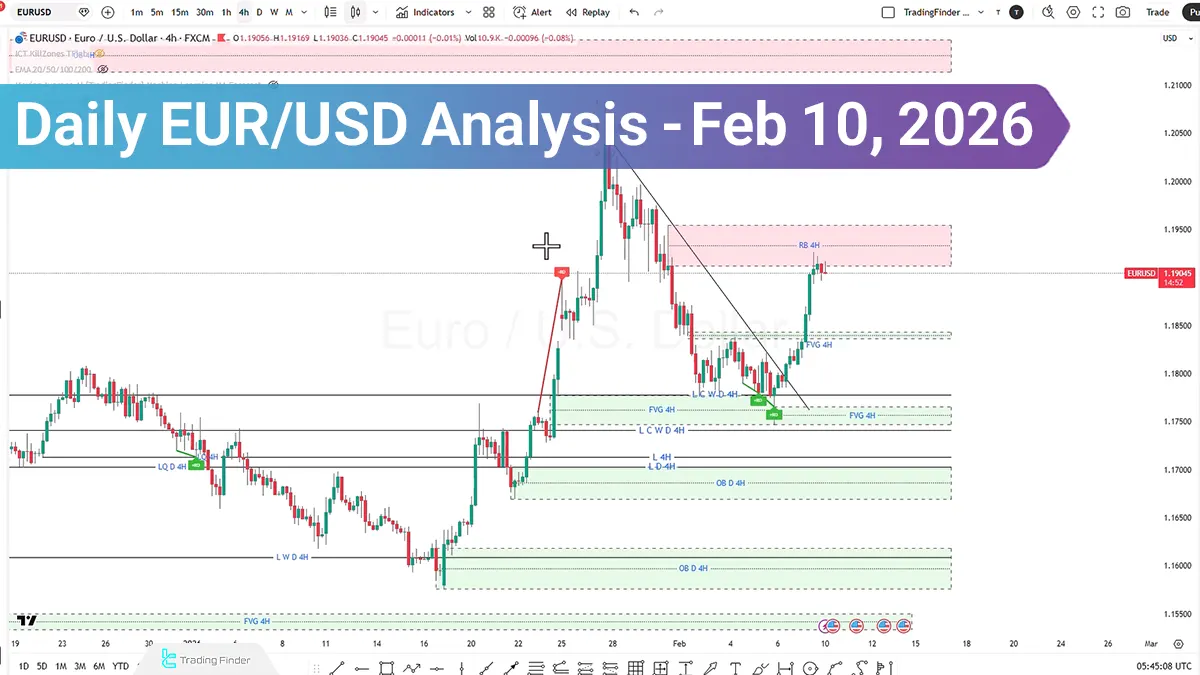

On February 10, 2026, the EUR/USD pair was accompanied by buying pressure and continued its upward path with a bullish displacement move, ultimately reaching the rejection block zone.

At the same time, the US Dollar Index came under selling pressure, and this behavioral divergence supports the euro-strength scenario. Additionally, on lower timeframes, the formation of consolidation structures may determine the market’s next directional move.

EURUSD Analysis on the 4-Hour Timeframe (H4)

On the 4-hour timeframe, the overall market trend is still assessed as bullish; however, the price reaction to order block and short-term supply zones may determine the next phase of movement.

Moreover, analysis of the US Dollar Index indicates that the index is facing increased short positions and supply pressure, experiencing price decline.

A weakening dollar index typically benefits the EUR/USD pair, and this inverse correlation has also been evident in recent trading sessions.

EURUSD Analysis on the 1-Hour Timeframe (H1)

On the 1-hour timeframe, after price entered the order block zone, signs of weakness in bullish momentum are observed. This behavior could pave the way for the formation of a consolidation triangle pattern. Within this framework, two main scenarios can be examined:

Bearish Scenario

- If the pattern breaks to the downside and the breakout is confirmed with a pullback, entry into a short position becomes possible;

- The risk-to-reward ratio in this scenario can be set within the range of 1:1 to 1:2;

- This scenario is mostly corrective within the broader bullish trend, unless a deeper structural break occurs.

Bullish Scenario

- If the triangle breaks to the upside and the pullback is confirmed, entry into a long position can be considered;

- Price targets in this scenario can include higher levels as well as the Draw on Liquidity zone at $1.197;

- If momentum is maintained, price has the potential to continue toward the $1.20 and then $1.2050 zones.

Overall, as long as the general market structure is preserved, the dominant scenario remains bullish.

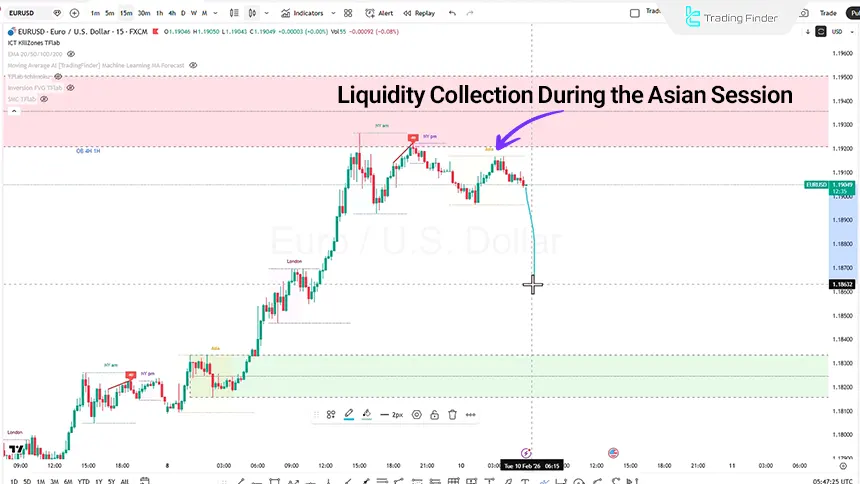

EURUSD Analysis on the 15-Minute Timeframe (M15)

On the 15-minute timeframe, the focus is on price behavior during trading sessions.

Scenario One: Sell-Side Liquidity Collection During the London Session

If a liquidity manipulation move occurs during the London session and sell-side liquidity is collected, the formation of a bullish displacement move becomes likely, potentially targeting buy-side liquidity collection.

Scenario Two: Upside Liquidity Sweep and Close During the Asian Session

If price first collects upside liquidity and then forms a weak candle during the Asian session, this behavior could set the stage for a bearish distribution during the New York session.

In this case, the probability of selling pressure developing later in the day will increase.

Conclusion

The overall structure of EUR/USD remains bullish, and the weakening of the US Dollar Index reinforces this scenario.

However, price reaction to order block zones and its behavior during trading sessions may determine the short-term direction. Additionally, maintaining bullish momentum will pave the way toward $1.20 and $1.2050; however, a structural break on lower timeframes could activate a temporary corrective or distribution phase.