Key Points:

- After collecting buy-side liquidity, USD/JPY has entered the Order Block zone, and the formation of a Pin Bar has strengthened the short-term bearish correction scenario;

- A break below the $151.97 level on the 4-hour timeframe could confirm a market structure break and initiate a move toward lower liquidity pools;

- On the 1-hour timeframe, the consolidation phase plays a decisive role; a close below the compression range increases the probability of continued decline;

- Weakness in the US. Dollar Index combined with simultaneous strength in the Japanese yen has created a power divergence that reinforces the bearish outlook for USD/JPY;

- If buy-side liquidity is temporarily collected and price returns to the consolidation range, a short-term bullish move may occur before the primary decline.

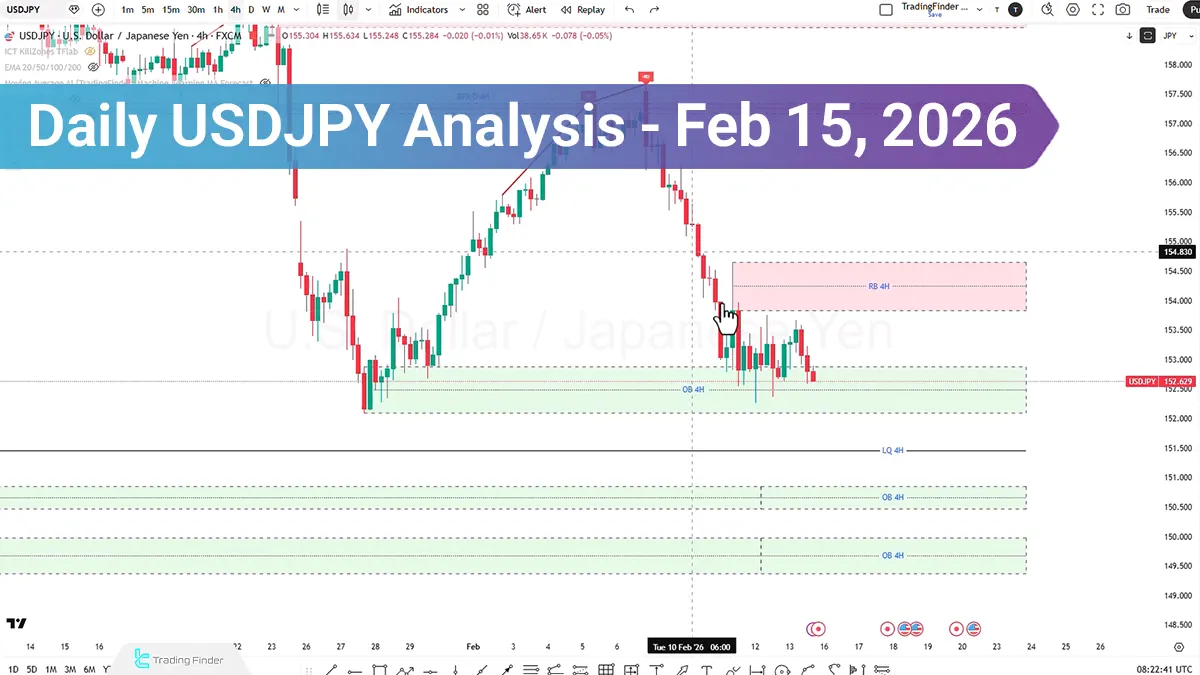

In recent trading activity of the USDJPY, price collected buy-side liquidity following an upward move and reached the specified targets according to the projected levels.

The entry of price into the Order Block zone and the formation of a Pin Bar in this area strengthen the short-term bearish correction scenario at the start of the week.

From a fundamental perspective, the weakening of the U.S. Dollar Index and the strengthening of the Japanese yen have tilted the dominant market outlook toward selling pressure.

USDJPY Analysis on the 4-Hour Timeframe (H4)

On the four-hour timeframe, price is positioned within the Order Block zone and has shown an initial reaction. A decisive break below the $151.97 level could act as the main catalyst for a move toward lower zones and the collection of sell-side liquidity.

In this scenario:

- Market Structure break is confirmed;

- Selling pressure increases;

- The target will be lower liquidity zones.

Under such conditions, the Ryan Soldier Strategy can be used to re-enter buy positions targeting buy-side swings. On the other hand, if higher highs form within the Rejection Block zone, re-entry into the trade is possible with a defined stop loss.

USDJPY Analysis on the 1-Hour Timeframe (H1)

On the one-hour timeframe, price is fluctuating within a consolidation range. This compression phase can serve as confirmation for the next directional move.

Short-term bearish scenario:

- Price moves downward;

- Close below the compression range;

- Pullback to the Fair Value Gap;

- Continuation toward lower levels.

Additionally, if price merely collects lower liquidity and then closes again within the consolidation range, there is a possibility of a bullish move to collect buy-side liquidity.

After price rebalancing and completion of the liquidity collection process by Smart Money, another rotation toward the downside may occur.

U.S. Dollar Index (DXY) Analysis

An examination of the U.S. Dollar Index (DXY – Dollar Index) indicates that the dollar is losing strength and is expected to continue its downward trend.

At the same time, Japan’s monetary policy is aligned with strengthening the yen. A review of currency strength over the past week shows that:

- The Japanese yen has been gaining strength;

- The US dollar has been experiencing weakness.

Over the past 48 hours, although the dollar attempted to strengthen, this strength was not sustained and it moved back toward weakness. In contrast, the Japanese yen has once again entered a strengthening path.

This power divergence shifts the overall market perspective toward a bearish scenario for USD/JPY.

Conclusion

The technical structure of USD/JPY is positioned within the four-hour Order Block zone, and the $151.97 level plays a key role in determining the continuation of the move.

Simultaneously, the decline in the U.S. Dollar Index and the strengthening of the Japanese yen have shifted market momentum toward a bearish scenario.

If stabilization occurs below key levels, the probability of continuation toward lower liquidity zones increases; otherwise, the market may experience a buy-side liquidity collection phase before the main decline.