The Federal Financial Supervisory Authority or Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) is a tier-1 regulator and the main financial authority in Germany with strict rules. Founded in May 2002, it is considered a highly reputable organization.

Below are some of the best Forex brokerages operating under the supervision of BaFin.

| Pepperstone | |||

| FxGrow | |||

| Degiro | |||

| 4 |  | MultiBank | ||

| 5 |  | CMC Markets | ||

| 6 |  | LYNX |

Trustpilot Scores Submitted for BaFin Brokers

This section of the article ranks the mentioned brokers based on their respective Trustpilot ratings by users.

Broker Name | Trustpilot Rating | Number of Reviews |

718 | ||

MultiBank | 1,645 | |

CMC Markets | 2,855 | |

Pepperstone | 3,162 | |

DEGIRO | 5,343 | |

FxGrow | 5 |

Trading Spread in BaFin Forex Brokers

The table below ranks the recommended brokerages according to the minimum spread charged by them.

Broker Name | Min. Spread |

LYNX | 0 Pips |

MultiBank | 0 Pips |

0 Pips | |

Pepperstone | 0 Pips |

FxGrow | 0.00001 pips |

Not Specified |

Non-Trading Fees and Costs in Select BaFin Forex Brokers

In the table below, each broker with its respective deposit, withdrawal, and inactivity fees is listed. The listing is ranked by the costs involved.

Broker Name | Deposit Fee | Withdrawal Fee | Inactivity Fee |

$0 | $0 | $0 | |

FxGrow | $0 | $0 | $0 |

DEGIRO | $0 | $0 | $0 |

CMC Markets | $0 | $0 | £10 monthly |

MultiBank | $0 | $0 | $60 monthly |

LYNX | $0 | Only One Free Withdrawal per Month | For Months with Less than 5 EUR Commission |

Tradable Instruments in BaFin-Regulated Brokerages

The table in this section ranks the recommended Forex brokers in BaFin territory based on the available trading symbols and instruments.

Broker Name | Number of Instruments |

20,000+ | |

CMC Markets | 12,000+ |

Pepperstone | 1,200+ |

600+ | |

LYNX | 150+ |

DEGIRO | 45+ |

Top 5 Forex Brokers Regulated by BaFin

The following sections review five of the recommended brokerages in more detail regarding spreads, account types, platforms, and more.

LYNX

LYNX is a European online brokerage founded in 2006 and headquartered in Utrecht, the Netherlands. The broker provides access to more than 150 exchanges across 30+ countries, positioning itself as a multi-market gateway for active and professional traders.

LYNX primarily targets experienced market participants by offering advanced platforms such as LYNX+, a dedicated Mobile Trading App, and Trader Workstation (TWS). These platforms support trading in Forex, shares, ETFs, options, futures, and CFDs, with institutional-grade tools and execution infrastructure.

From a cost perspective, LYNX applies a transparent commission-based model. Share trading commissions start from EUR 3, while Forex symbols are offered with zero commissions, aligning the broker with professional pricing standards rather than retail-style spread marketing.

On the regulatory side, LYNX operates through multiple European entities and branches. The German branch is supervised by BaFin, while other entities fall under AFM, DNB, CNB, and FSMA oversight. Client funds are segregated, negative balance protection applies, and investor compensation schemes cover up to €20,000, depending on the entity.

Specifics and Parameters

Account Types | Individual, Joint, Corporate |

Regulating Authorities | BaFin and Other Authorities For Branches |

Minimum Deposit | 3,000 EUR |

Deposit Methods | Interactive Brokers |

Withdrawal Methods | Interactive Brokers |

Maximum Leverage | 1:30 |

Trading Platforms & Apps | LYNX+, Mobile Trading App, Trader Workstation |

LYNX Pros & Cons

LYNX stands out for its regulatory strength, professional-grade platforms, and broad market access. Below is a concise overview of the broker’s key advantages and limitations to help assess its suitability among BaFin-regulated Forex brokers before going through LYNX registration.

Pros | Cons |

Regulated by BaFin and other Tier-1 EU authorities | High minimum deposit of €3,000 |

Access to 150+ exchanges and global markets | Platforms can be complex for beginners |

Zero commission on Forex symbols | No copy trading or investment plans |

Advanced platforms (TWS, LYNX+, Mobile App) | No Islamic or PAMM account options |

MultiBank

MultiBank Group is a global multi-asset broker established in 2005, offering Forex, commodities, indices, shares, and crypto CFDs. With minimum deposits from $50 and leverage up to 1:500 (entity-dependent), it caters to both retail and professional traders across regulated jurisdictions.

Headquartered in Dubai, MultiBank operates through a broad international structure with offices in Germany, Austria, Australia, Cyprus, and the UAE. Its European presence includes oversight from BaFin, aligning the broker with strict EU compliance and operational transparency standards.

MultiBank supports MetaTrader 4, MetaTrader 5, and its proprietary MultiBank-Plus platform, delivering fast execution, zero-commission trading on select accounts, and spreads from0.0 pips. The broker offers Standard, Pro, and ECN accounts to match varying trading styles and capital requirements.

To open a new account, you may go through our MultiBank registration guide.

From a regulatory standpoint, MultiBank is supervised by multiple authorities, including ASIC and CySEC, alongside BaFin. Client safeguards include segregated funds, negative balance protection (where applicable), and up to $1 million excess loss insurance per account.

Table of Specifics

Account Types | Standard, Pro, ECN |

Regulating Authorities | FSAS, FSCM, VFS, TFG, MAS, FMA, FSC, CySEC, ESCA, CIMA, BaFin, AUSTRAC, ASIC |

Minimum Deposit | $200 |

Deposit Methods | credit or debit card, Bank Transfer, Crypto, SEPA |

Withdrawal Methods | bank wire, credit cards, Neteller |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MultiBank-Plus, MT4 Platform, MT5 Platform, Web Trader MT4 |

MultiBank Pros & Cons

Overall, MultiBank combines broad regulatory coverage, diverse platforms, and high leverage options under non-EU entities. Below is a concise overview of its key strengths and limitations to help evaluate its position among BaFin-regulated Forex brokers.

Pros | Cons |

Regulated by BaFin, ASIC, CySEC, and other authorities | Restricted in several major countries (US, UK, Iran, etc.) |

Wide platform support (MT4, MT5, MultiBank-Plus) | Educational and research tools are relatively limited |

Zero-commission trading with spreads from 0.0 pips | High minimum deposit for ECN account |

Strong client protection incl. segregated funds & insurance | No guaranteed stop-loss orders |

CMC Markets

CMC Markets is a globally established brokerage with over 1 million clients across four continents and more than 30 years of operating history. Listed on the London Stock Exchange (LSE), the company combines public transparency with long-term financial stability.

Under its BaFin-regulated entity, CMC Markets Germany GmbH, the broker serves European traders within a strict Tier-1 regulatory framework. BaFin supervision enforces capital adequacy, segregated client funds, and participation in the EdW compensation scheme up to €20,000 (90%).

CMC Markets offers Spread Betting, CFD Trading, and FX Active accounts with no minimum deposit and access to 12,000+ instruments. Traders can operate across forex, indices, commodities, shares, ETFs, treasuries, and crypto CFDs, with floating spreads from 0.0 pips.

The broker’s technology stack includes the proprietary Next Generation platform alongside MetaTrader 4, delivering advanced charting, institutional-grade execution, and multi-device trading. Support for multiple base currencies and professional-level analytics positions CMC Markets as a high-infrastructure broker under BaFin oversight.

Here’s a table summarizing the broker’s specifications.

Account Types | Standard, Pro, ECN |

Regulating Authorities | FSAS, FSCM, VFS, TFG, MAS, FMA, FSC, CySEC, ESCA, CIMA, BaFin, AUSTRAC, ASIC |

Minimum Deposit | $200 |

Deposit Methods | credit or debit card, Bank Transfer, Crypto, SEPA |

Withdrawal Methods | bank wire, credit cards, Neteller |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MultiBank-Plus, MT4 Platform, MT5 Platform, Web Trader MT4 |

CMC Markets Pros & Cons

CMC Markets stands out for its regulatory depth, extensive market coverage, and advanced trading technology. Before going through with the CMC Markets registration forms, a concise overview of the broker’s main advantages and limitations is essential to help assess its fit within BaFin-regulated Forex broker comparisons.

Pros | Cons |

BaFin regulation with EdW investor protection | Higher commissions on share CFDs |

12,000+ tradable instruments across global markets | Limited deposit and withdrawal methods |

No minimum deposit requirement | Inactivity fee after prolonged non-trading |

Advanced proprietary Next Generation platform | No PAMM or managed account solutions |

Pepperstone

Pepperstone is a global forex and CFD broker founded in 2010 in Melbourne, Australia. The company processes over $9.2 billion in daily trading volume and serves 400,000+ clients worldwide, highlighting its strong liquidity access and high-frequency execution capabilities.

Under its Federal Financial Supervisory Authority (BaFin)-regulated entity, Pepperstone operates as a compliant choice for German traders. The broker combines local regulatory oversight with a broader multi-entity framework, ensuring strict operational standards, transparency, and EU-aligned investor protections.

Pepperstone supports 10 base currencies and flexible trade sizing from 0.01 to 100 lots, making it suitable for both retail and advanced traders.

While leverage can reach up to 1:500 under offshore entities, BaFin-regulated accounts follow stricter EU leverage limits designed to reduce excessive risk exposure.

From a technology perspective, Pepperstone offers access to MetaTrader 4, MetaTrader 5, cTrader, TradingView, and proprietary platforms. Traders can operate across Forex, commodities, indices, shares, ETFs, and crypto CFDs, with spreads starting from 0.0 pips on Razor accounts and no inactivity fees.

For a reduction in spreads and fees, a Pepperstone rebate program is provided by TradingFinder.

Specifics and Features

Account Types | Standard, Razor |

Regulating Authorities | ASIC, SCB, FCA, DFSA, CMA, BaFin, CySEC |

Minimum Deposit | $1 |

Deposit Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Withdrawal Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Maximum Leverage | Up to 1:500 |

Trading Platforms & Apps | Proprietary Platform, cTrader, Trading View, MetaTrader 4&5 |

Pepperstone Pros and Cons

Pepperstone stands out for its execution quality, regulatory depth, and platform diversity rather than promotional incentives. Below is a balanced overview of its key strengths and limitations for traders considering a BaFin-regulated forex broker.

Pros | Cons |

Regulated by BaFin and multiple top-tier authorities | Leverage capped for BaFin retail clients |

Tight spreads from 0.0 pips on Razor accounts | No PAMM or managed account solutions |

Wide platform range (MT4, MT5, cTrader, TradingView) | No trading bonuses or promotions |

No inactivity or account maintenance fees | Service availability varies by country |

DEGIRO

Founded in Amsterdam in 2008, DEGIRO began serving retail investors in 2013 and has since grown into one of Europe’s largest online brokers, operating in 15 countries and supporting more than 3 million clients across the EU.

From a regulatory standpoint, DEGIRO operates under a multi-layered European framework. It is supervised by BaFin, with additional oversight from the AFM and prudential supervision by De Nederlandsche Bank, ensuring compliance with EU investment standards.

DEGIRO focuses on cost-efficient investing rather than leveraged trading. Commissions start from €0.75, with U.S. stock trades charged €1 + €1 handling fee. There is no minimum deposit, and pricing is fully transparent via an integrated cost calculator across global markets.

The broker provides access to 45+ exchanges in 30 countries, covering stocks, ETFs, bonds, options, futures, and funds through a proprietary web and mobile platform. Instead of Forex or CFDs, DEGIRO targets long-term and active investors seeking direct market access under strict European regulation. Here’s a summary of details and specifics.

Account Types | N/A |

Regulating Authorities | BaFin, AFM, DNB |

Minimum Deposit | $0 |

Deposit Methods | Bank Transfer |

Withdrawal Methods | Bank Transfer |

Maximum Leverage | N/A |

Trading Platforms & Apps | Proprietary Platform |

DEGIRO Pros & Cons

The table here is a concise breakdown of the broker’s main advantages and limitations to help evaluate its suitability. Check it out before DEGIRO registration.

Pros | Cons |

Supervised by BaFin, AFM, and DNB | No Forex or CFD trading |

Access to 45+ exchanges in 30 countries | Currency conversion fees apply |

Transparent, low-cost commission structure | No demo or Islamic accounts |

€0 minimum deposit requirement | Limited asset variety vs multi-asset CFD brokers |

What were the Factors in Curating the List of Brokers?

Choosing the Best BaFin-Regulated Forex Brokers requires a structured, data-driven approach that goes far beyond surface-level comparisons. At TradingFinder, every broker featured in this article is evaluated using a proprietary 19-metric review framework designed to reflect real trading conditions under BaFin supervision.

Regulation and licensing form the foundation of our methodology. We verify BaFin authorization, assess compliance with German and EU financial laws, and review core safety mechanisms such as client fund segregation, negative balance protection, and cross-border passporting within the EU.

Broker background data, including year of establishment, corporate structure, headquarters, and global office presence, are analyzed to gauge operational stability and long-term credibility.

Trading conditions are assessed in detail. Our analysts examine account type diversity (Standard, ECN, Micro, PAMM, Professional), leverage policies aligned with BaFin and ESMA rules, and the breadth of tradable instruments, covering forex pairs, CFDs on indices, commodities, stocks, ETFs, and crypto derivatives where permitted.

Pricing transparency is critical, so we test spreads, commissions, deposit and withdrawal fees, and inactivity charges using live accounts whenever possible.

Technology and usability are equally important. We evaluate platform availability and performance across MetaTrader 4, MetaTrader 5, cTrader, proprietary platforms, and mobile apps, alongside execution quality, account-opening workflows, and verification speed. Copy trading, investment tools, and educational resources are reviewed for depth and cost transparency.

Finally, qualitative factors complete the assessment. Customer support responsiveness, broker communications, scam alerts, dispute handling, and verified user feedback from Trustpilot are incorporated into the final score. This holistic methodology ensures that every BaFin-regulated broker listed meets practical, trader-focused standards

What is BaFin?

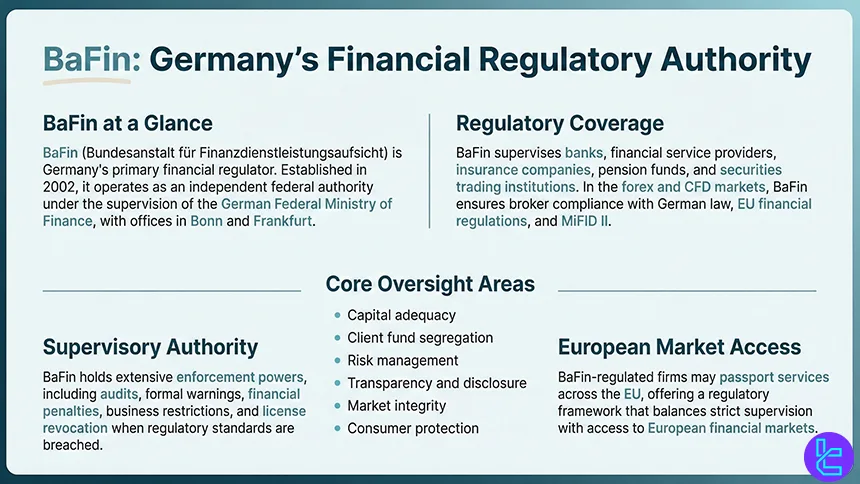

BaFin, officially known as Bundesanstalt für Finanzdienstleistungsaufsicht (Federal Financial Supervisory Authority), is Germany’s primary financial regulator. Established in 2002, BaFin operates as an independent federal authority under the supervision of the German Federal Ministry of Finance and is headquartered in Bonn and Frankfurt.

BaFin is responsible for supervising banks, financial service providers, insurance companies, pension funds, and securities trading institutions operating in Germany. In the forex and CFD market, BaFin oversees brokers to ensure compliance with German law, EU financial regulations, and MiFID II standards.

Key areas of BaFin’s oversight include capital adequacy, client fund segregation, risk management, transparency, market integrity, and consumer protection. BaFin also has strong enforcement powers, allowing it to conduct audits, issue warnings, impose fines, restrict business activities, or revoke licenses when necessary.

As part of the European regulatory framework, BaFin-regulated brokers may passport services across the EU, making BaFin regulation particularly relevant for traders seeking a balance between strict oversight and access to European markets.

Advantages and Disadvantages of BaFin for Forex Brokers

Regulation by BaFin places forex brokers under one of Europe’s strictest supervisory frameworks. BaFin enforces German financial law alongside EU rules such as MiFID II and ESMA product intervention measures.

While this enhances transparency, investor protection, and market integrity, it also limits leverage, promotions, and operational flexibility for brokers targeting retail traders.

Pros and Cons of BaFin Regulation for Forex Brokers

Pros | Cons |

High regulatory credibility under German and EU law | Retail leverage capped (typically up to 1:30 under ESMA) |

Strong enforcement powers and continuous supervision | No trading bonuses or aggressive promotions allowed |

Mandatory client fund segregation and risk disclosures | Higher compliance and operational costs for brokers |

EU passporting rights for cross-border services | Slower product innovation compared to offshore regulators |

Is Leverage Limited in BaFin Brokers?

Leverage is strictly limited for retail traders using forex and CFD brokers regulated by BaFin. These limits are not arbitrary; they are enforced under Germany’s implementation of EU-wide product-intervention measures derived from European Securities and Markets Authority (ESMA) and aligned with MiFID II.

For retail clients, BaFin-regulated brokers must apply the following maximum leverage caps:

- 1:30 for major forex pairs (e.g., EUR/USD, GBP/USD)

- 1:20 for non-major forex pairs, gold, and major indices

- 1:10 for commodities other than gold and minor indices

- 1:5 for individual equities

- 1:2 for cryptocurrencies (where crypto CFDs are permitted)

These limits are combined with mandatory negative balance protection, meaning retail traders cannot lose more than their deposited capital, even during extreme market volatility. Brokers must also enforce margin close-out rules, typically requiring positions to be closed when account equity falls to 50% of the required margin.

Importantly, professional clients may access higher leverage levels under BaFin supervision, but only after meeting strict eligibility criteria related to trading experience, portfolio size, and transaction frequency.

Professional status comes with reduced regulatory protections, including the loss of negative balance protection and compensation eligibility.

In practice, BaFin’s leverage restrictions prioritize capital preservation and systemic risk reduction. While they limit aggressive, high-risk strategies, they significantly reduce the probability of rapid account wipeouts, making BaFin-regulated brokers particularly suitable for risk-aware retail traders and long-term market participants.

What Are BaFin’s Responsibilities?

BaFin is responsible for maintaining the stability, integrity, and transparency of Germany’s financial system. Its mandate covers banks, financial service providers, insurance companies, pension funds, securities markets, and investment firms-including forex and CFD brokers.

One of BaFin’s core responsibilities is licensing and supervision. It authorizes financial institutions, monitors their ongoing compliance, and ensures they operate within the scope of German financial law and EU regulations such as MiFID II.

This includes reviewing capital adequacy, internal controls, risk management frameworks, and governance structures.

BaFin also plays a central role in investor and consumer protection. It enforces rules on client fund segregation, transparency, risk disclosures, and fair marketing practices. When misconduct or systemic risk is identified, BaFin has the authority to issue warnings, impose fines, restrict business activities, suspend licenses, or initiate enforcement actions.

Another key responsibility is market oversight and integrity. BaFin monitors trading activity to detect market abuse such as insider trading, price manipulation, and misleading conduct, working closely with European authorities under the EU supervisory framework.

Additionally, BaFin contributes to financial stability by identifying emerging risks, participating in macroprudential supervision, and cooperating with institutions such as the Deutsche Bundesbank and EU regulators.

Through these combined responsibilities, BaFin acts as a cornerstone of trust and regulatory discipline in Germany’s financial markets.

What Powers Does BaFin Have?

BaFin exercises extensive statutory powers to supervise, regulate, and enforce compliance across Germany’s financial markets. These powers are granted under German financial law and reinforced by EU legislation, enabling BaFin to act decisively to protect investors and preserve market stability.

One of BaFin’s primary powers is licensing authority. It can grant, refuse, restrict, or revoke authorization for banks, investment firms, and forex/CFD brokers.

Authorization is conditional on meeting strict requirements related to capital adequacy, governance, risk management, and operational integrity.

BaFin also holds broad investigative and supervisory powers. It can request documents and data, conduct on-site inspections, commission special audits, and question management or staff.

Where irregularities are identified, BaFin may impose administrative measures, including binding orders, activity restrictions, or temporary bans on specific products or services.

In terms of enforcement, BaFin can impose fines, issue public warnings, prohibit misleading marketing, and refer serious breaches for criminal prosecution. It also has the authority to suspend or terminate business operations if a firm poses a risk to clients or the financial system.

Additionally, BaFin participates in product intervention at the national and EU level, enforcing measures such as leverage limits, bonus bans, and risk-disclosure requirements for high-risk instruments like CFDs.

What Rules Must be Adhered to by BaFin-Regulated Forex Brokers?

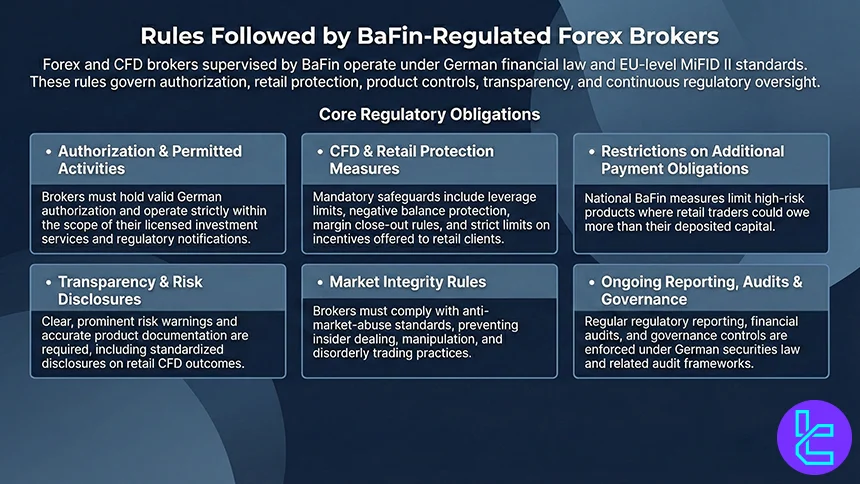

Forex and CFD brokers supervised by BaFin must follow a combination of German financial law and EU conduct standards, especially MiFID II-aligned rules, covering authorization, client protection, marketing, and ongoing supervision.

Key obligations typically include:

- Authorization & permitted activities: Firms must hold the correct German authorization to provide investment services and must operate strictly within the scope of their license and notifications;

- CFD/retail protection measures (product intervention): Brokers must apply CFD safeguards such as leverage limits, negative balance protection, margin close-out rules, and restrictions on incentives offered to retail clients;

- Stronger restrictions on “additional payment obligations”: BaFin has used national measures to restrict high-risk retail products (notably around CFDs and similar structures where clients could owe more than their deposit);

- Transparency & risk disclosures: Clear, prominent risk warnings and accurate product documentation are required, including disclosures tied to CFD risks and retail outcomes under EU rules;

- Market integrity rules: Firms must comply with rules designed to prevent market abuse (e.g., insider dealing and manipulation) and maintain orderly conduct in trading-related activities;

- Ongoing reporting, audits, and governance: BaFin oversight includes periodic reporting and audit expectations under the German securities framework (e.g., WpHG-linked requirements and related audit regulations).

In practice, BaFin regulation pushes brokers toward stricter retail safeguards, conservative marketing, and continuous compliance, often trading off flexibility (like high leverage or aggressive bonuses) for stronger investor-protection standards.

How Can I Check if a Broker Is Regulated by BaFin?

Verifying whether a forex broker is genuinely regulated by BaFin is a critical step before opening an account. BaFin maintains an official public register that allows traders to confirm a broker’s legal status, authorized activities, and operating entities with high reliability.

To check a broker’s BaFin regulation status, follow these steps:

- Review the broker’s legal disclosures: Visit the broker’s official website and check the footer or legal documents for its full legal company name, registered address, and any reference to BaFin authorization. Marketing names alone are not sufficient;

- Access BaFin’s official company database: Go directly to BaFin’s public database of regulated institutions. Avoid clicking links provided by brokers to prevent redirection to cloned or misleading pages;

- Search by legal entity name: Enter the broker’s registered legal name (not just the brand name). A valid BaFin-regulated broker will appear with details such as authorization type and supervisory scope;

- Confirm permitted activities: Check that the broker is authorized to provide investment services or CFD/forex trading. Some firms are listed but licensed only for limited financial activities;

- Match the trading domain: Ensure the website domain you are using is explicitly associated with the BaFin-licensed entity. Scams often use similar brand names with unregistered domains;

- Check for EU passporting (if applicable): If the broker operates across Europe, confirm that it holds passporting rights under MiFID II, which should be reflected in BaFin records.

Completing these checks helps traders avoid unregulated or cloned brokers and ensures they receive the protections associated with BaFin supervision.

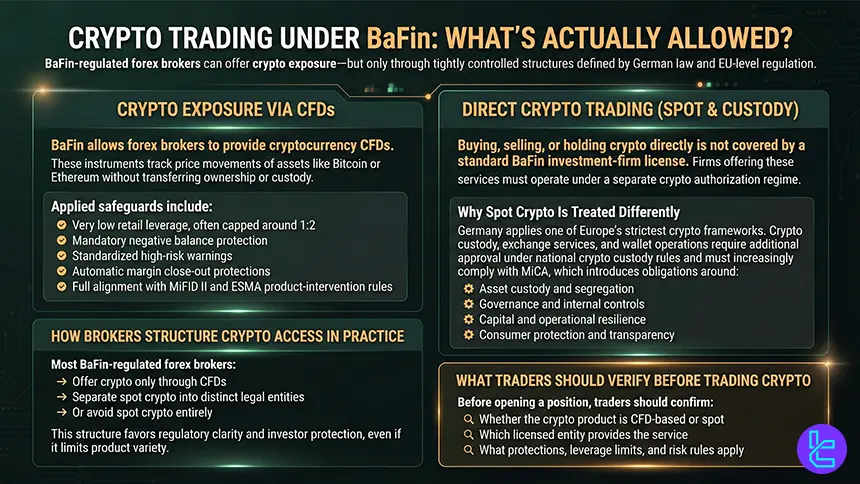

Do BaFin Forex Brokers Offer Crypto Trading Services?

Yes, BaFin-regulated forex brokers can offer crypto-related trading services, but only within a strict regulatory framework enforced by BaFin and aligned with EU law. The key distinction lies in how crypto exposure is provided, not the assets themselves.

Under BaFin supervision, brokers are generally permitted to offer cryptocurrency CFDs (Contracts for Difference). These products allow traders to speculate on price movements of assets like Bitcoin or Ethereum without owning the underlying crypto.

Crypto CFDs fall under MiFID II and ESMA product-intervention rules, meaning retail clients face leverage caps (often 1:2), mandatory negative balance protection, standardized risk warnings, and margin close-out protections.

However, spot crypto trading (direct buying/selling or custody of cryptocurrencies) is not automatically permitted under a standard BaFin investment-firm license.

To provide custodial crypto services or operate a crypto exchange, firms typically require additional authorization under Germany’s crypto custody regime and, increasingly, must comply with the EU’s Markets in Crypto-Assets Regulation (MiCA) framework, which introduces specific rules on custody, governance, capital, and consumer protection.

In practice, many BaFin-regulated forex brokers limit crypto exposure to CFDs via their investment-services license, while offering spot crypto only through separately licensed entities, or not at all. This structure prioritizes investor protection and regulatory clarity over broad crypto access.

As a result, traders considering crypto with BaFin-regulated brokers should verify whether the product is a CFD or spot, the licensed entity providing the service, and the applicable protections and limits before trading.

What Are the Investor Protections Provided by BaFin?

Investor protection under BaFin is built on a combination of German financial law and EU-wide safeguards, creating a strong, rules-based framework for retail traders using BaFin-regulated forex and CFD brokers.

A core protection is client fund segregation. Brokers must keep retail client money separate from their own operating capital, reducing the risk that customer funds are used to cover business losses. BaFin also enforces capital adequacy requirements, ensuring brokers maintain sufficient regulatory capital to withstand market stress and operational risks.

Retail traders benefit from negative balance protection, meaning losses cannot exceed deposited funds, even during extreme volatility or market gaps.

In addition, leverage limits and margin close-out rules, aligned with MiFID II and ESMA product-intervention measures, cap retail leverage (typically up to 1:30 on major FX pairs) and require automatic position closure when margin falls below set thresholds.

In the event of broker insolvency, eligible clients of BaFin-regulated investment firms may be covered by Germany’s statutory investor compensation scheme, the Entschädigungseinrichtung der Wertpapierhandelsbanken (EdW), which can compensate up to €20,000 per investor, subject to eligibility conditions.

Additional protections include strict risk disclosures, transparent pricing and execution policies, ongoing regulatory audits, and formal complaint-handling procedures. Brokers must also cooperate with dispute-resolution mechanisms and respond to supervisory actions by BaFin.

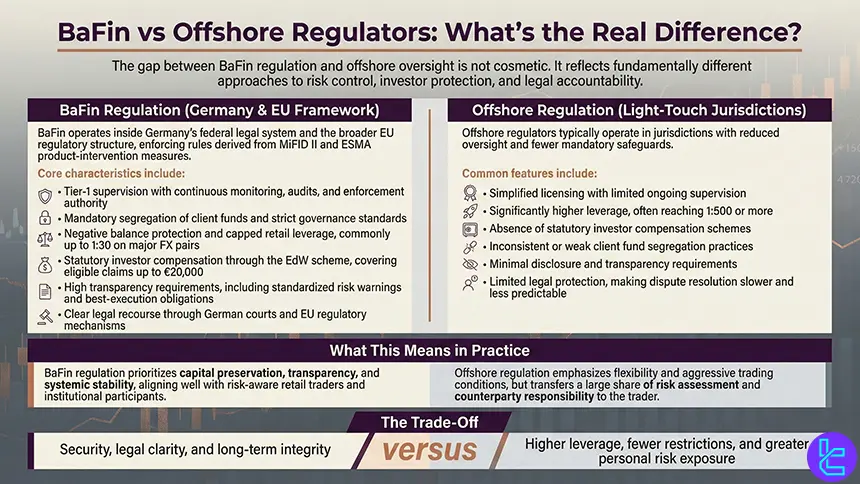

Differences Between BaFin and Offshore Regulators

The difference between BaFin and offshore regulators lies primarily in regulatory strength, investor protection, and legal accountability. BaFin operates within Germany’s federal legal system and the EU framework, enforcing strict standards derived from MiFID II and ESMA product-intervention rules.

Offshore regulators, by contrast, are typically based in jurisdictions with lighter supervision and fewer mandatory protections.

Key Characteristics of BaFin Regulation:

- Tier-1 oversights with continuous supervision, audits, and enforcement powers

- Mandatory client fund segregation and strong governance requirements

- Negative balance protection and retail leverage caps (e.g., up to 1:30 on major FX pairs)

- Statutory investor compensation via Germany’s EdW scheme (up to €20,000 per investor, subject to eligibility)

- High transparency standards, including standardized risk warnings and best-execution policies

- Clear legal recourse within German and EU courts and regulators

Key Characteristics of Offshore Regulation:

- Lighter licensing and supervision, often with minimal ongoing audits

- Higher leverage offerings (frequently 1:500 or more) with fewer risk controls

- No statutory compensation schemes in most jurisdictions

- Weaker or inconsistent fund-segregation rules

- Limited transparency and disclosure requirements

- Restricted legal protection, making dispute resolution more complex for clients

In practice, BaFin regulation prioritizes capital protection, transparency, and long-term market integrity, making it suitable for risk-aware retail traders and institutional participants.

Offshore regulation often appeals to traders seeking greater flexibility and higher leverage, but it places significantly more responsibility on the trader to assess counterparty risk and operational reliability.

How Does BaFin Compare to Other Top Regulators?

BaFin is widely classified as a Tier-1 regulator due to its strict enforcement powers, EU-aligned framework, and strong focus on market integrity.

Compared with other leading authorities such as the FCA, CySEC, and ASIC, BaFin applies similar retail-protection standards while maintaining a particularly conservative stance on risk, leverage, and product intervention.

The comparison below highlights how BaFin stacks up against these regulators in terms of investor protection, compensation schemes, leverage limits, and supervisory strength, helping traders understand the practical differences between Germany’s regulator and other major global oversight bodies.

Parameter | BaFin (Germany) | CySEC (Cyprus) | ASIC (Australia) | FCA (UK) |

Regulatory Tier | Tier-1 | Tier-1 (EU) | Tier-1 | Tier-1 |

Year Established | 2002 | 2001 | 1998 | 2013 |

Legal Framework | German law + MiFID II | EU law + MiFID II | Australian Corporations Act | UK law (MiFID-aligned) |

Client Fund Segregation | Mandatory | Mandatory | Mandatory | Mandatory (CASS rules) |

Negative Balance Protection | Required (retail CFDs) | Required | Required | Required |

Retail Leverage Cap | Up to 1:30 (ESMA) | Up to 1:30 (ESMA) | Up to 1:30 | Up to 1:30 |

Investor Compensation Scheme | EdW up to €20,000 | ICF up to €20,000 | No statutory scheme (AFCA dispute resolution) | FSCS up to £85,000 |

Enforcement & Supervision | Very strict, frequent audits | Strict, EU-wide coordination | Strong, principles-based | Very strict, proactive enforcement |

EU Passporting | Yes | Yes | No | No (post-Brexit) |

Conclusion

BaFin is one of the most stringent regulators for Forex brokers globally, making traders feel more secure for registering with those supervised by the German authority. Although there is not a large number of reputable brokers regulated by this organization, but LYNX, MultiBank, CMC Markets, and Pepperstone are some of the best choices.

If you are wondering how each broker is selected in our list, visiting the Forex methodology page is recommended.