Wire transfers are the best option and sometimes the only choice when it comes to moving large amounts of funds between accounts. However, they are not the fastest and the cheapest; therefore, other methods are suggested for usual payments.

Below, best brokerages with the bank wire transfer option are listed.

| IC Markets | |||

| FxPro | |||

| OctaFX | |||

| 4 |  | AvaTrade | ||

| 5 |  | FBS | ||

| 6 |  | Pepperstone | ||

| 7 |  | IronFX |

Trustpilot Ratings in Bank Wire Forex Brokers

Trustpilot remains one of the most reliable sources to get information about the user experiences with a service or product. The mentioned brokers are ranked based on user scores.

Broker Name | Trustpilot Rating | Number of Reviews |

50,727 | ||

AvaTrade | 11,736 | |

FBS | 8,377 | |

3,149 | ||

OctaFX | 9,093 | |

FxPro | 803 | |

IronFX | 669 |

Broker Fees for Bank Wire Transfers

The table below demonstrates the fees and costs charged by the brokerages for accepting wire transfers. Note that these are separate from the bank fees.

Broker Name | Deposit Fee | Withdrawal Fee |

IC Markets | Not Specified | Not Specified |

$0 | $0 | |

Swissquote | $0 | $0 |

MultiBank Group | $0 | $0 |

IronFX | $0 | $0 |

XM | $0 | $0 for transfers over $200 |

$0 | Withdrawals Not Supported |

Bank Wire Deposit/Withdrawal Processing Time in Forex Brokers

This section investigates the time required for deposits/withdrawals to take place in each Forex brokerage.

Broker Name | Deposit Time | Withdrawal Time |

OctaFX | Instant | Withdrawals Not Supported |

1 Business Day | 1 Business Day | |

IUX | 1–3 Business Days | Within 24 Business Hours |

Swissquote | 1–3 Business Days | 1 to 2 Business Days |

XM | 1-5 Business Days | 2-5 Business Days |

Pepperstone | 3-5 Business Days | 3-5 Business Days |

AvaTrade | 3–7 Business Days | Up to 10 Business Days |

Minimum Required Amount for Bank Wire Deposits/Withdrawals

The table in this part of the article ranks the recommended brokers based on the minimum amounts in bank wire transfers.

Broker Name | Min. Deposit | Min. Withdrawal |

100 ZAR (South Africa) | 30 ZAR (South Africa) | |

IronFX | $50 | $50 |

IUX | Subject to the Bank | Subject to the Bank |

$100 | Not Specified | |

IG | Not Specified | $150 |

AvaTrade | $500 | Not Specified |

Swissquote | $1,000 | Not Specified |

Top 6 Forex Brokers with Bank Wire Option

7 recommended brokerages were mentioned in the previous sections. Next, 6 of them are introduced in more depth, with information on account types, regulatory licenses, platforms, and more.

IC Markets

Founded in Australia in 2007, IC Markets has grown into a global multi-asset brokerage serving retail and professional traders. The broker supports 10 base currencies and requires a $200 minimum deposit, making it accessible while still targeting serious market participants.

IC Markets offers access to 2,100+ stock CFDs alongside forex, indices, commodities, bonds, and crypto CFDs. Pricing is built around tight spreads, starting from 0.8 pips on Standard accounts and 0.0 pips on Raw Spread accounts, with market execution optimized for speed-sensitive strategies. An IC Markets rebate program is provided for reduced fees.

From a regulatory standpoint, IC Markets operates through multiple licensed entities overseen by ASIC, CySEC, and the FSA. Client funds are held in segregated accounts, AML frameworks are enforced, and EU traders benefit from compensation coverage of up to €20,000 under CySEC rules.

On the technology side, the broker supports MetaTrader 4, MetaTrader 5, and cTrader, including web and mobile versions. This platform diversity, combined with scalping and EA support, positions IC Markets as a strong choice for algorithmic and high-frequency trading setups.

Specifics and Details

Account Types | Standard, Raw Spread, Islamic |

Regulating Authorities | FSA, CySEC, ASIC |

Minimum Deposit | $200 |

Deposit Methods | Bank Cards, Wire Transfers, Electronic payments, etc. |

Withdrawal Methods | Bank Cards, Wire Transfers, Electronic payments, etc. |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile |

IC Markets Pros & Cons

The following pros and cons highlight where the broker excels and where certain limitations may affect specific trader profiles.

Pros | Cons |

Very low spreads with Raw accounts from 0.0 pips | Leverage capped at 1:30 for EU and ASIC-regulated clients |

Wide platform choice: MT4, MT5, cTrader | $200 minimum deposit may be high for beginners |

Strong regulatory coverage across ASIC, CySEC, and FSA | No PAMM account offering |

Extensive market access with 2,100+ stock CFDs | Bonus promotions not consistently available globally |

AvaTrade

AvaTrade is a globally recognized forex and CFD broker established in 2006, operating under nine regulatory licenses across Europe, Asia-Pacific, the Middle East, and Africa. Key regulators include the Central Bank of Ireland, ASIC, FSCA, FSA Japan, and ADGM, reinforcing its multi-jurisdiction credibility.

The broker applies strict risk controls, with margin call and stop-out levels set at 25% and 10%, respectively. Client funds are held in segregated accounts, and negative balance protection is enabled across all regulated entities, aligning AvaTrade with MiFIDII and international investor-protection standards.

AvaTrade requires a minimum deposit of $100 and supports six base currencies, including USD, EUR, GBP, and JPY. Traders can fund accounts via credit/debit cards, bank wires, Skrill, Neteller, WebMoney, and PayPal, with most electronic payments processed instantly and without broker-side fees.

For more details on AvaTrade deposit and withdrawal methods, check out our article on it.

In terms of platforms, AvaTrade offers MetaTrader 4, MetaTrader 5, WebTrader, mobile apps, and AvaOptions. More than 1,250 instruments are available across forex, stocks, indices, commodities, cryptocurrencies, bonds, and options, with leverage reaching up to 1:400, depending on regulation and client classification.

Broker Specifics

Account Types | Retail, Professional, Islamic, Demo |

Regulating Authorities | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Withdrawal Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Maximum Leverage | 1:400 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader |

AvaTrade Pros and Cons

It’s worth noting that AvaTrade positions itself as a regulation-first broker with a broad asset range and diverse platform support, while certain structural limitations may affect advanced or highly specialized traders. Learn about the benefits and drawbacks before going on with AvaTrade registration.

Pros | Cons |

Regulated by 9 financial authorities worldwide | Inactivity fees after prolonged dormancy |

Strong fund security with segregation and NBP | No PAMM or MAM account solutions |

Wide range of platforms including MT4, MT5, and AvaOptions | Bonuses restricted by region |

Copy trading via DupliTrade and AvaSocial | Not available to U.S. residents |

FBS

Founded in 2009, FBS is an international forex and CFD broker serving over 27 million registered users worldwide. The company provides access to more than 550 tradable instruments, combining long-standing market experience with modern trading infrastructure for retail clients across multiple regions.

You can check out our FBS dashboard review to learn about the broker’s user interface.

From a cost perspective, FBS operates with floating spreads starting from 0.7 pips and applies zero trading commissions on its Standard account. Order execution follows a market model, supporting strategies such as hedging and automated trading via Expert Advisors (EAs). Also, an FBS rebate program is available for discount on spreads.

Regulation is structured across several entities. Tradestone Limited, the EU arm, is licensed by Cyprus Securities and Exchange Commission (CySEC, license 331/17), while the global entity is overseen by the Financial Services Commission.

The Australian branch operates under Australian Securities and Investments Commission, providing a multi-jurisdictional compliance framework.

On the technology side, FBS supports MetaTrader 4, MetaTrader 5, and a proprietary mobile trading app featuring over 90 built-in technical indicators. With fast execution speeds, multilingual 24/7 support, and a streamlined onboarding process, the broker is designed to accommodate both new and experienced traders.

Summary of Parameters

Account Types | Standard |

Regulating Authorities | FSC, CySEC |

Minimum Deposit | $5 |

Deposit Methods | Bank Transfers, Payment Systems, Credit/Debit Cards |

Withdrawal Methods | Bank Transfers, Payment Systems, Credit/Debit Cards |

Maximum Leverage | 1:3000 |

Trading Platforms & Apps | MT4, MT5, Mobile App |

FBS Pros & Cons

Overall, FBS presents a balanced trading environment where competitive pricing, strong regulation, and platform diversity stand out, while certain structural limitations, such as account variety, may influence advanced traders’ preferences. The following table summarizes its key advantages and drawbacks.

Pros | Cons |

Low minimum deposit starting from $5 | Only one main trading account available |

Regulated by multiple authorities (ASIC, CySEC, FSC) | Service not available in some countries |

Zero commission with spreads from 0.7 pips | No PAMM or copy trading options |

Advanced proprietary mobile app with 90+ indicators | Wider spreads on some indices |

Pepperstone

Pepperstone is a global forex and CFD broker processing an average of $9.2 billion in daily trading volume for more than 400,000 active clients. It supports 10 base currencies and allows order sizes from 0.01 to 100 lots with leverage reaching 1:500.

Founded in Melbourne in 2010, Pepperstone has expanded into a multi-jurisdiction broker with offices across Europe, the Middle East, Africa, and Asia-Pacific. This global structure enables localized services while maintaining consistent execution standards and deep liquidity access.

A core strength of Pepperstone lies in its strong regulatory coverage, including ASIC, FCA, CySEC, BaFin, DFSA, and CMA. Client funds are held in segregated accounts, negative balance protection is applied, and retail traders in regulated regions benefit from investor compensation schemes.

From a trading-environment perspective, Pepperstone delivers spreads from 0.0 pips, commission-free Standard accounts, and Razor accounts with raw pricing. Traders can access Forex, Shares, Indices, Crypto, Commodities, and ETFs via MT4, MT5, cTrader, TradingView, and proprietary platforms.

Specifics and Features

Account Types | Standard, Razor |

Regulating Authorities | ASIC, SCB, FCA, DFSA, CMA, BaFin, CySEC |

Minimum Deposit | $1 |

Deposit Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Withdrawal Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Maximum Leverage | Up to 1:500 |

Trading Platforms & Apps | Proprietary Platform, cTrader, Trading View, MetaTrader 4&5 |

Pepperstone Pros & Cons

Pepperstone stands out for its regulation, pricing transparency, and platform diversity. However, like most heavily regulated brokers, some limitations appear in promotional offerings and investment account structures, which are outlined below. Learn about them before the Pepperstone registration process.

Pros | Cons |

Regulated by multiple tier-1 authorities (ASIC, FCA, BaFin) | No PAMM or managed investment accounts |

Tight spreads with Razor accounts from 0.0 pips | No trading bonuses due to regulatory limits |

Wide platform support (MT4, MT5, cTrader, TradingView) | Demo account access is time-restricted |

No inactivity or account maintenance fees | Leverage capped at 1:30 in EU/UK regions |

OctaFX

OctaFX is a global forex and CFD broker (est. 2011) with 40M+ accounts opened and $33M+ in bonuses paid. The brand focuses on accessible trading conditions, offering a low entry point for retail traders while supporting multi-asset exposure across forex, metals, indices, stocks, and cryptocurrencies.

Regulation is handled through multiple entities, including CySEC (Octa Markets Cyprus Ltd, License No. 372/18) for EU/EEA clients, plus regional oversight such as FSCA and MISA for broader international coverage. Depending on the entity, protections can include segregated funds and compensation schemes (e.g., up to €20,000 under ICF/Financial Commission).

OctaFX supports MT4, MT5, and OctaTrader, and follows an ECN/STP-style execution approach with market execution. Trading starts from $25 minimum deposit, with floating spreads from 0.6 pips and $0 trading commission, positioning it as a cost-focused broker for both discretionary and system traders.

Beyond core trading, an OctaFX copy trading program, swap-free options for Islamic trading, and frequent promotions (deposit bonuses and demo contests) are available. Risk controls like negative balance protection and account thresholds such as 25% margin call / 15% stop out shape the broker’s overall trading environment.

If you are interested in the broker’s payment options beside the bank wire, visit the OctaFX deposit and withdrawal methods page. Here’s a summary of the broker’s specifics.

Account Types | MT4, MT5, OctaTrader |

Regulating Authorities | FSCA, MISA |

Minimum Deposit | $25 |

Deposit Methods | E-wallets, credit/debit cards, bank transfer, crypto |

Withdrawal Methods | E-wallets, credit/debit cards, bank transfer, crypto |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, proprietary OctaTrader, and Copy trading app |

OctaFX Pros and Cons

OctaFX’s strengths and limitations become clearer when comparing its pricing model, platform range, and entity-based regulatory coverage, especially for traders who prioritize low starting capital, commission-free execution, and copy trading alongside region-specific protections.

Pros | Cons |

Low minimum deposit ($25) for account opening | Entity-based protections vary by jurisdiction and client region |

Commission-free trading with spreads from 0.6 pips | EU entity leverage is capped (up to 1:30) compared to offshore entities |

Multi-platform access: MT4, MT5, OctaTrader + Octa Copy | Some funding methods and availability can change by country/time |

Risk protections like negative balance protection and swap-free options | Service availability is restricted in several countries (geo-limits) |

FxPro

Founded in 2006, FxPro is a global multi-asset broker with over 7.8 million client accounts. The company delivers ultra-fast execution, averaging under 12 milliseconds, positioning FxPro among the fastest brokers in the online trading industry.

FxPro provides access to 2,100+ instruments across forex, stocks, indices, commodities, futures, and crypto CFDs. Traders can operate through four trading platforms: MT4, MT5, cTrader, and a proprietary mobile app. Read our FxPro dashboard review for details on the broker’s user interface.

Regulatory compliance is a core pillar of FxPro’s operations. The broker holds licenses from FCA (UK), CySEC (EU), FSCA (South Africa), and SCB (Bahamas), offering segregated funds, negative balance protection, and investor compensation schemes where applicable.

With 125+ international awards, flexible account types (Standard, Raw+, Elite), and a $100 minimum deposit, FxPro caters to both retail and professional traders. Execution models include market and instant execution, while leverage reaches up to 1:500 for eligible clients.

Summary of Features and Specifics

Account Types | Standard, Raw+, Elite |

Regulating Authorities | FCA, FSCA, CySEC, SCB |

Minimum Deposit | $100 |

Deposit Methods | Visa, Mastercard, Bank Wire Transfer, Broker to Broker Transfer, Skrill, Neteller, PayPal |

Withdrawal Methods | Visa, Mastercard, Bank Wire Transfer, Broker to Broker Transfer, Skrill, Neteller, PayPal |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, cTrader, Web Trader, Mobile App |

FxPro Pros and Cons

FxPro’s strengths and limitations become clearer when comparing its trading conditions, regulation, and pricing structure. Below is a balanced overview of the broker’s main pros and cons to help assess overall suitability.

Pros | Cons |

Multiple tier-1 regulated entities (FCA, CySEC) | Restricted in several countries |

Ultra-fast execution (<12 ms average) | Limited bonus and promotion programs |

2,100+ tradable instruments | No 24/7 customer support |

Wide platform support (MT4, MT5, cTrader) | Higher deposit requirement for Elite account |

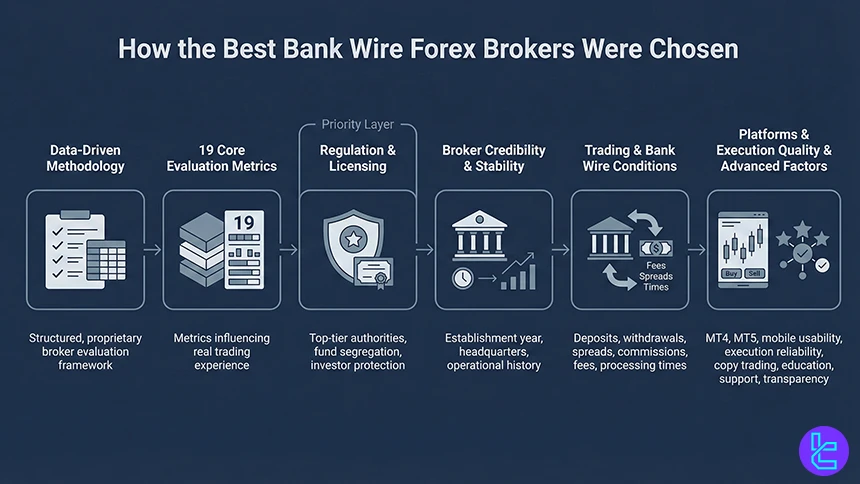

How the Best Bank Wire Forex Brokers Were Chosen

Selecting the best forex brokers that accept bank wire transfers requires more than surface-level comparisons.

At TradingFinder, broker evaluation is built on a structured, data-driven review methodology designed to protect traders’ capital and improve decision-making accuracy. Each broker featured in this article has been assessed using a proprietary framework that prioritizes transparency, reliability, and real-world trading conditions.

Our analysts examine19 core metrics that directly influence trader experience. Regulation and licensing sit at the top of this hierarchy, ensuring brokers operate under reputable financial authorities and offer safeguards such as fund segregation and investor protection schemes.

Broker background data, including establishment year, headquarters, and operational history, adds another layer of credibility assessment, especially for wire-transfer-focused traders who prioritize institutional stability.

Account type diversity, tradable instruments, and bank wire deposit and withdrawal conditions are reviewed in parallel with trading costs. This includes spreads, commissions, inactivity fees, and processing times, all of which can significantly impact long-term profitability when using bank transfers.

Platform availability, such as MetaTrader 4, MetaTrader 5, and mobile apps, is also tested for execution quality and usability.

Beyond trading mechanics, TradingFinder evaluates copy trading options, educational resources, global office presence, and customer support responsiveness. Independent sentiment analysis using Trustpilot scores, broker response to complaints, scam alerts, and transparency in updates further refine the final rankings.

What is a Bank Wire Transfer?

A bank wire transfer is a method of electronically transferring funds directly from one bank account to another through secure banking networks. In the forex industry, this process is commonly handled via international systems such as SWIFT or domestic clearing networks, depending on the countries involved.

Unlike card payments or e-wallets, bank wire transfers move funds at the institutional level, making them a preferred option for large deposits and withdrawals.

Forex brokers use bank wire transfers to facilitate high-value transactions with enhanced traceability and regulatory oversight. Funds are sent from the trader’s personal or corporate bank account to the broker’s segregated account, typically held with tier-1 banks.

While processing times are slower, usually ranging from 1 to 5 business days, bank wire transfers offer higher limits, stronger compliance controls, and broad global acceptance, making them a reliable funding method for professional and long-term forex traders.

What Are the Benefits and Drawbacks of Using Bank Wire Transfers in Forex Brokers?

Bank wire transfers are widely used in forex trading due to their security, transparency, and high transaction limits. They are especially suitable for large deposits and withdrawals, offering strong regulatory oversight. However, slower processing times and higher banking fees can make them less convenient for short-term or frequent transactions.

Pros | Cons |

High transaction limits suitable for large deposits | Slower processing times (1–5 business days) |

Strong security and regulatory traceability | Higher bank and intermediary fees |

Widely accepted by regulated forex brokers | Not ideal for instant funding needs |

Direct transfer to segregated broker accounts | Limited availability on weekends and holidays |

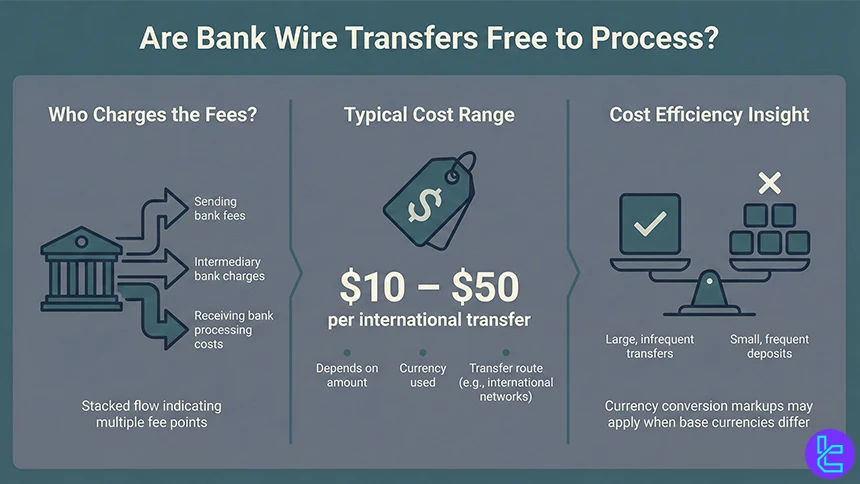

Are Bank Wire Transfers Free to Process?

Bank wire transfers are not usually free when used with forex brokers. While most brokers do not charge internal fees for receiving or sending wire transfers, the costs typically come from banks involved in the transaction. Sending banks, intermediary banks, and receiving banks may each apply processing fees, especially for international transfers routed through networks like SWIFT.

Fees vary based on transfer amount, currency, and geographic route, but international bank wires commonly cost between $10 and $50 per transaction. In addition, currency conversion markups may apply if the transfer currency differs from the trading account’s base currency.

As a result, bank wire transfers are generally more cost-efficient for large, infrequent transactions rather than small or frequent deposits.

Are Bank Wire Transfers Safe for Forex Traders?

Bank wire transfers are considered one of the safest funding methods for forex traders, particularly when used with regulated brokers. These transfers operate through established banking infrastructures and international messaging systems such as SWIFT, ensuring high levels of encryption, identity verification, and transaction traceability.

Unlike card payments or some digital wallets, bank wires require full sender and recipient verification, significantly reducing the risk of fraud or unauthorized transactions.

Safety largely depends on the broker’s regulatory status. Forex brokers licensed by authorities such as the Financial Conduct Authority, ASIC, or CySEC are required to hold client funds in segregated bank accounts and comply with strict anti-money laundering (AML) and know-your-customer (KYC) standards. These rules add an extra layer of protection for traders using bank wire transfers.

Another security advantage is transparency. Every wire transfer creates a clear banking record, making disputes easier to investigate and resolve. However, bank wires are generally irreversible once processed, meaning traders must ensure they send funds only to verified broker accounts.

For this reason, TradingFinder recommends using bank wire transfers exclusively with well-established, regulated forex brokers that publish clear banking details and compliance disclosures.

What to Do if Funds Do Not Appear After a Bank Wire Deposit/Withdrawal

If a bank wire deposit or withdrawal does not appear within the expected timeframe, the issue is usually related to processing delays rather than lost funds. The following steps help identify and resolve the problem efficiently:

- Check standard processing times: Bank wire transfers typically take 1-5 business days, especially for international transfers routed through SWIFT. Weekends and public holidays can extend this period;

- Verify transfer details: Confirm that the broker’s bank name, IBAN, SWIFT/BIC code, reference number, and beneficiary details were entered correctly. Even minor errors can delay crediting;

- Review intermediary bank involvement: International wires may pass through intermediary banks, each adding extra processing time or compliance checks;

- Contact your bank first: Request a SWIFT MT103 or official transfer confirmation to verify the transaction status and identify where the funds are currently held;

- Reach out to broker support: Provide the transfer receipt and MT103 document to the broker’s finance department. Regulated brokers typically credit funds once confirmation is received;

- Escalate if delays persist: If the broker is regulated by authorities, unresolved issues can be escalated through formal complaint channels.

Following these steps minimizes delays and helps ensure bank wire transactions are resolved transparently and securely.

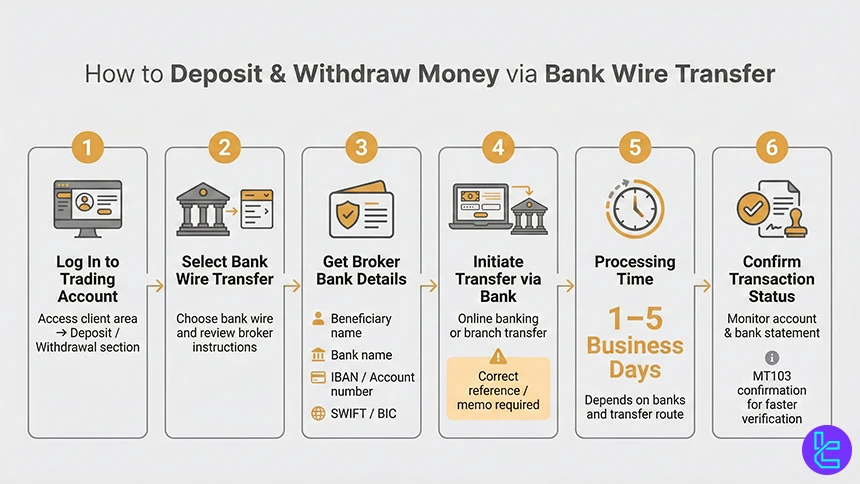

How Can I Deposit/Withdraw Money by a Bank Wire Transfer in a Broker?

Depositing or withdrawing funds via a bank wire transfer follows a structured process designed for security and regulatory compliance. While exact steps may vary slightly by broker, the general procedure is as follows:

- Log in to your trading account: Access the broker’s client dashboard and navigate to the “Deposit” or “Withdrawal” section;

- Select bank wire transfer as the payment method: Choose bank wire transfer from the available funding options and review the broker’s banking instructions;

- Obtain the broker’s bank details: Carefully note the beneficiary name, bank name, IBAN or account number, and SWIFT/BIC code. These details are required by your bank to process the transfer;

- Initiate the transfer through your bank: Submit the wire transfer via online banking or at a branch, ensuring the reference or memo field matches the broker’s instructions;

- Wait for processing and confirmation: Bank wire deposits and withdrawals usually take 1–5 business days, depending on the banks involved and the transfer route;

- Confirm transaction status: Monitor your trading account and bank statements. If needed, request an MT103 confirmation from your bank and share it with broker support to speed up verification.

Are Bank Accounts Charged for Being Dormant?

In most cases, bank accounts themselves are not charged inactivity or dormancy fees simply for not being used to fund a forex trading account. Traditional banks generally do not penalize customers for leaving an account unused, especially if the account maintains the required minimum balance.

However, some banks may impose account maintenance fees or reclassify accounts as dormant after long periods of inactivity, which can limit outgoing transactions until the account is reactivated.

When it comes to forex trading, any inactivity-related charges usually originate from the broker, not the bank. Forex brokers may apply account inactivity fees if no trading activity occurs over a defined period, regardless of whether the funding method is a bank wire transfer or another payment option.

For this reason, traders should clearly distinguish between bank account dormancy policies and forex broker inactivity rules to avoid unexpected charges.

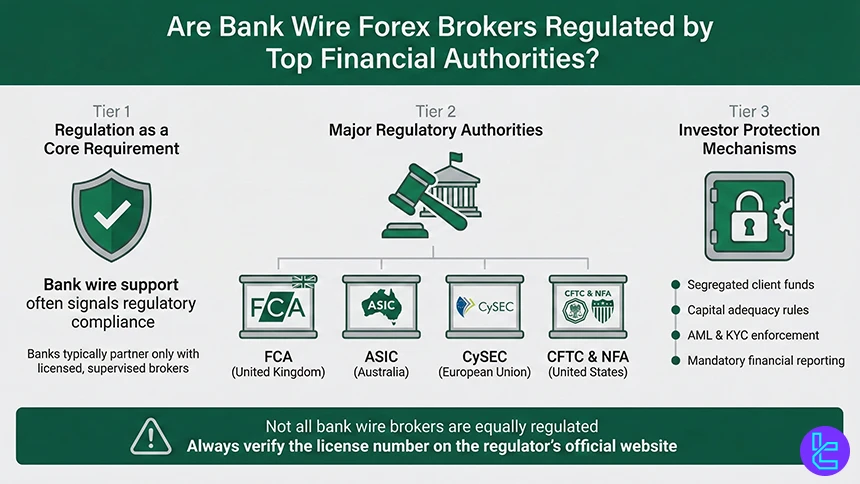

Are Forex Brokers Offering Bank Wire Options Regulated by Top Financial Authorities?

Yes, most reputable forex brokers that support bank wire transfers are regulated by top-tier financial authorities. In fact, offering bank wire funding is often a requirement, or at least a strong indicator, of regulatory compliance, as banks typically work only with licensed and supervised financial institutions.

Well-established brokers are commonly authorized by regulators such as the FCA (UK), ASIC (Australia), and CySEC (EU). These authorities enforce strict rules on client fund segregation, capital adequacy, AML/KYC procedures, and financial reporting. As a result, brokers under their supervision must hold client funds, including bank wire deposits, in segregated accounts with reputable banks.

Outside Europe and Australia, brokers may also be overseen by bodies such as the CFTC and NFA in the United States.

That said, not all brokers offering bank wire transfers are equally regulated. Traders should always verify the broker’s license number directly on the regulator’s official website to ensure the highest level of protection and transparency.

How Does Bank Wire Transfer Compare to Other Payment Methods?

Credit cards remain one of the most convenient funding options for Forex traders due to instant deposits and broad global acceptance. Compared to Bank Wire Transfers, they are significantly faster but usually come with lower withdrawal flexibility and potential processing fees.

E-wallets like Skrill and Neteller strike a balance between speed and cost, offering near-instant transactions with fewer banking delays. However, each method serves a different purpose: bank wires suit large transfers, while cards and e-wallets are better for fast account funding and frequent trading activity.

Parameter | Bank Wire Transfer | Credit Cards | Skrill | Neteller |

Broker Acceptance | Widely accepted by regulated Forex brokers | Widely accepted by most brokers | Widely accepted, especially in Forex | Widely accepted, similar to Skrill |

Deposit Speed | 1–5 business days | Instant to a few minutes | Instant to a few minutes | Instant |

Withdrawal Speed | 1–5 business days | 1–5 business days | Same day to 24 hours | Same day to 24 hours |

Transaction Fees | Often higher; bank & intermediary fees | Low to moderate; issuer/broker-dependent | Low to moderate; wallet fees may apply | Low to moderate; wallet fees may apply |

Supported Currencies | Depends on bank & broker base currencies | Depends on card & broker | 40+ fiat currencies | Multiple fiat currencies |

Security & Compliance | Very high; bank-level AML/KYC | High; chargeback & fraud protection | Strong KYC; regulated e-wallet | Strong KYC under Paysafe Group |

Typical Forex Deposit Limits | High limits; ideal for large transfers | Medium limits; broker-defined caps | Low minimums; flexible limits | Low minimums; flexible limits |

Regional Availability | Global | Global | Global; strong in EU & Asia | Global; strong in Forex-friendly regions |

Conclusion

If you frequently transfer big chunks of money from or to a Forex broker, bank wire is the right option for you, being more expensive and slower but without the limitations of other cheaper solutions. Many brokers accept this method, but IC Markets, AvaTrade, FBS, and Pepperstone sit among the best.

For detailed explanation on the process of curating the best ones, visit our Forex methodology page.