Russia’s share of Forex market is an average daily trading volume of up to $60B+, which is not a low number. Central Bank of Russia (CBR) is the main financial authority in this country.

Russia-based traders can register with various brokers locally or internationally regulated. Here are some of the recommended options with optimal conditions and parameters.

| eToro | |||

| FXTM | |||

| IC Markets | |||

| 4 |  | VT Markets | ||

| 5 |  | PU Prime | ||

| 6 |  | ActivTrades | ||

| 7 |  | easyMarkets | ||

| 8 |  | AMarkets |

Trustpilot Ratings in Russia Brokers

Trustpilot provides an accurate image of the user experience in Forex brokers with ratings out of five. The table below ranks the best brokers based on these scores.

Broker Name | Trustpilot Score | Number of Reviews |

49,818 | ||

AMarkets | 3,406 | |

VT Markets | 2,021 | |

eToro | 29,855 | |

easyMarkets | 1,768 | |

1,251 | ||

PU Prime | 1,578 | |

FXTM | 1,073 |

Forex Brokers with Low Spreads for Russia

Trading with low spreads leads to more money saved and higher net profits. Here are some of the candidates for Russia-based traders with reasonable spreads.

Broker Name | Min. Spreads |

IC Markets | 0 Pips |

AMarkets | 0 Pips |

VT Markets | 0 Pips |

0 Pips | |

ATFX | 0 Pips |

MultiBank | 0 Pips |

XM | 0.6 Pips |

0.7 Pips |

Non-Trading Fees in Brokers for Russia

Some of the brokers only charge their clients with fees for trading; however, some others also charge commissions for funding and account management.

Broker Name | Deposit Fee | Withdrawal Fee | Inactivity Fee |

IC Markets | None | None | None |

easyMarkets | None | None | None |

None | From 0.5% | None | |

D Prime | None | Varies | None |

None | None | Varies | |

eToro | None | $5 | $10 |

ATFX | None | 5 Units | $10 |

XTB | From 1% on Skrill and Neteller | Not Specified | Not Specified |

Tradable Instruments Provided in Forex Brokers for Russia

Having access to a long list of tradable symbols is a benefit that must be paid attention to. The brokers here are ranked by the number of assets.

Broker Name | Deposit Fee |

eToro | 6,000+ |

XTB | 2,000+ |

AvaTrade | 1,250+ |

VT Markets | 1,000+ |

1,000+ | |

800+ | |

Tickmill | 600+ |

AMarkets | 500+ |

Top 6 Forex Brokers in Russia

In the following sections, each broker will be introduced and reviewed with a summary of specifics and table of pros and cons.

IC Markets

IC Markets is an Australia-founded forex and CFD broker established in 2007, offering institutional-grade trading conditions to global clients, including traders from Russia.

The broker operates through multiple regulated entities under ASIC, CySEC, and the Seychelles FSA, combining strong operational oversight with flexible leverage options of up to 1:500 under its offshore framework.

Client funds are held in segregated accounts, and external audits support transparency and risk control.

IC Markets provides access to forex, indices, commodities, crypto, bonds, and over 2,100 stock CFDs, supported by MetaTrader 4, MetaTrader 5, and cTrader. Pricing is a core strength, with Raw Spread accounts offering spreads from 0.0 pips plus low commissions, while Standard accounts feature commission-free trading with competitive spreads.

With a $200 minimum deposit, fast market execution, and full support for scalping and algorithmic strategies, IC Markets is well suited to experienced Russian traders seeking low-cost execution, deep liquidity, and multi-platform flexibility in global forex markets.

It’s worth noting that an IC Markets rebate program is available for reducing trading costs.

Summary of Specifics

Account Types | Standard, Raw Spread, Islamic |

Regulating Authorities | FSA, CySEC, ASIC |

Minimum Deposit | $200 |

Deposit Methods | Bank Cards, Wire Transfers, Electronic payments, etc. |

Withdrawal Methods | Bank Cards, Wire Transfers, Electronic payments, etc. |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile |

IC Markets Pros and Cons

The table below demonstrates the broker’s most important benefits and drawbacks.

Pros | Cons |

Competitive pricing with low average spreads | Minimum deposit could be high for some traders |

Wide range of trading platforms | - |

Scalable execution for algorithmic traders | - |

Extensive market offering (2,250+ tradable symbols) | - |

VT Markets

VT Markets is an Australia-based forex and CFD broker that has expanded rapidly across global markets since its launch, operating under multiple regulatory licenses including ASIC, FSCA, and the FSC of Mauritius.

This multi-jurisdiction structure allows the broker to offer flexible trading conditions, with leverage reaching up to 1:500 under non-ASIC entities, while maintaining segregated client funds and negative balance protection for most international accounts.

VT Markets provides access to forex, indices, metals, energies, ETFs, bonds, and stock CFDs, with more than 40 currency pairs available.

Trading is supported via MetaTrader 4, MetaTrader 5, and a web-based platform powered by TradingView, covering both manual and algorithmic strategies. For a review on the broker’s interface, check out the VT Markets dashboard article.

Account types include Standard STP and RAW ECN, with spreads from zero on ECN accounts and a minimum deposit starting from $50. If you are about to open an account with the broker, here’s our VT Markets registration guide.

Summary of Parameters

Account Types | Standard STP, RAW ECN, Cent STP, Cent ECN, Demo |

Regulating Authorities | FSCA, ASIC, FSC Mauritius |

Minimum Deposit | $50 |

Deposit Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Withdrawal Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Webtrader+, VT Markets App |

VT Markets Pros and Cons

Some of the broker’s noteworthy pros and cons are mentioned in the table below.

Pros | Cons |

Robust regulatory framework | No Crypto Trading |

Advanced trading platforms | Higher Minimum Deposit Compared to Some Competitors |

Multiple Account Types | - |

Negative balance protection | - |

AMarkets

AMarkets is an international forex and CFD broker founded in 2007, with a strong footprint across CIS markets and long-standing familiarity with Russian traders.

The broker operates under offshore regulation through entities registered in Saint Vincent and the Grenadines, the Cook Islands, and Comoros, and is an official member of The Financial Commission, providing investor compensation coverage of up to EUR 20,000 per claim.

Client funds are segregated, and execution quality is verified through regular third-party audits.

AMarkets offers access to forex, indices, commodities, stocks, ETFs, and crypto CFDs, supported by MetaTrader 4, MetaTrader 5, and a proprietary mobile app. Account types include Standard, ECN, Fixed, and Crypto, with spreads from zero on ECN accounts and leverage up to 1:3000 under offshore entities.

With a minimum deposit of $100, broad payment support including crypto and RUB-friendly methods, and full compatibility with scalping and algorithmic trading, AMarkets remains a practical choice for experienced Russian forex traders seeking flexible leverage and multi-asset exposure. The table below provides an outline of the broker’s features.

Account Types | Standard, ECN, Fixed, Crypto, Demo |

Regulating Authorities | FSA, FSC, Misa, FinaCom |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards, Crypto, Bank Transfer |

Withdrawal Methods | Credit/Debit Cards, Crypto, Bank Transfer |

Maximum Leverage | 1:3000 |

Trading Platforms & Apps | Mt4, Mt5, Mobile Proprietary App |

AMarkets Pros and Cons

The table below summarizes the important benefits and drawbacks. Be aware of them before going through with AMarkets registration.

Pros | Cons |

Long Track Record In The Industry | Not Regulated By Major Authorities Like FCA Or CySEC |

Regulated By Several Authorities | High Initial Deposit Of $200 Required For The ECN Account |

Variety Of Account Types To Suit Different Trading Styles | - |

Offers Popular MetaTrader 4 And 5 Trading Platforms | - |

Competitive Trading Conditions With Low Spreads | - |

eToro

eToro is a global multi-asset broker founded in 2007 and headquartered in Israel, operating under a broad regulatory framework that includes FCA, CySEC, ASIC, and FSRA.

This structure provides strong oversight and client fund segregation across its main entities, positioning eToro as a compliance-focused platform for international traders, including Russian residents where services are permitted.

The broker offers access to forex, stocks, ETFs, indices, commodities, and cryptocurrencies through a proprietary web and mobile platform. A key distinction is its investment-centric model, built around CopyTrader, Smart Portfolios, and crypto staking, rather than traditional high-frequency forex execution.

Maximum leverage reaches 1:30 for retail clients under top-tier regulation, with higher limits available to professional accounts.

With a low minimum deposit starting from $10, broad payment method support, and an intuitive interface, eToro suits Russian traders who prioritize diversified exposure, social investing tools, and long-term portfolio strategies over MT4 or MT5-based trading environments.

Table of Specifications

Account Types | Personal, Professional, Corporate, Islamic |

Regulating Authorities | FCA, CySEC, MFSA, FSRA, ASIC, FSA, Gibraltar FSC |

Minimum Deposit | $10 |

Deposit Methods | eToro Money, Credit/Debit Card, Bank Transfer, PayPal, Neteller, Skrill, Online Banking (Trustly), iDEAL, Sofort, Przelewy24 |

Withdrawal Methods | eToro Money, Credit/Debit Card, Bank Transfer, PayPal, Neteller, Skrill, Online Banking (Trustly), iDEAL, Sofort, Przelewy24 |

Maximum Leverage | 1:400 |

Trading Platforms & Apps | Proprietary App |

eToro Pros and Cons

Before going through the eToro registration process, know the broker’s strengths and weaknesses.

Pros | Cons |

Proprietary Platform | No MT4/MT5 Support |

Innovative Social Trading Features | No Phone Call Option for Customer Service |

A Very Wide Range of Instruments | - |

Regulated in Multiple Jurisdictions | - |

easyMarkets

easyMarkets is a Cyprus-based forex and CFD broker with a long operating history and a regulatory structure that includes CySEC, ASIC, FSCA, FSA Seychelles, and FSC BVI.

This multi-entity setup allows the broker to balance strong oversight in regulated regions with higher leverage flexibility of up to 1:2000 under offshore licenses. Client funds are held in segregated accounts, and negative balance protection applies across all entities, reinforcing capital protection standards.

easyMarkets focuses on simplicity and cost transparency, offering commission-free trading with fixed and variable spreads.

The broker supports MetaTrader 4, MetaTrader 5, TradingView integration, and its proprietary platform, which includes unique risk-management tools such as guaranteed stop loss, dealCancellation, and Freeze Rate execution control.

If you are interested in this broker with a low minimum deposit of $25 and straightforward pricing, you may read our easyMarkets registration guide. The table below provides an outlook to the brokerage’s details.

Account Types | easyMarkets Web/App and TradingView, MT4, MT5 |

Regulating Authorities | CySEC, ASIC, FSA, FSC, FSCA |

Minimum Deposit | $25 |

Deposit Methods | VISA, MasterCard, Maestro, Bank Wire, Skrill, Neteller, Fast Bank Transfers |

Withdrawal Methods | VISA, MasterCard, Maestro, Bank Wire, Skrill, Neteller, Fast Bank Transfers |

Maximum Leverage | 1:2000 |

Trading Platforms & Apps | MT4, MT5, TradingView, Proprietary platform |

easyMarkets Pros and Cons

It is necessary to have an understanding of what’s positive and what’s negative in a financial firm before investing in it.

Pros | Cons |

Regulated by multiple top-tier authorities | Limited range of tradable assets |

Trading Safety Features (No Slippage and Guaranteed Stop Loss) | No cryptocurrency deposits or withdrawals |

Fixed and variable spreads | Lack of 24/7 support |

No commissions or hidden fees | - |

Multiple trading platforms (Proprietary, MT4, MT5, TradingView) | - |

Long-standing reputation (since 2001) | - |

ActivTrades

ActivTrades is a UK-founded forex and CFD broker established in 2001, known for its strong regulatory standing and risk-focused trading environment.

The broker operates primarily under FCA regulation, with additional oversight from SCB and CMVM through international entities, ensuring strict client fund segregation and transparent operational standards. Retail leverage is capped at 1:30 under FCA rules, while higher leverage options are available via offshore entities, subject to jurisdiction.

ActivTrades offers access to forex, indices, commodities, shares, ETFs, bonds, and crypto CFDs through MetaTrader 4, MetaTrader 5, and its proprietary ActivTrader platform.

Pricing is spread-based with no commission on most accounts, and execution quality is supported by fast order routing and low-latency infrastructure. A notable advantage is the broker’s additional insurance coverage, extending client fund protection beyond standard regulatory requirements.

With a $0 minimum deposit, robust negative balance protection, and a strong emphasis on capital safety, ActivTrades is well suited to Russian traders seeking a regulation-first broker with reliable execution and multi-asset exposure rather than ultra-high leverage trading.

The table below provides a summary of the broker’s features.

Account Types | Professional, Individual, Demo, Islamic |

Regulating Authorities | FCA, SCB, CMVM, BACEN, CVM |

Minimum Deposit | $0 |

Deposit Methods | Bank Wire, Credit/Debit Cards (Visa, MasterCard), E-Wallets (Skrill, Neteller), Local Payment Methods |

Withdrawal Methods | Bank Wire, Credit/Debit Cards (Visa, MasterCard), E-Wallets (Skrill, Neteller), Local Payment Methods |

Maximum Leverage | 1:400 |

Trading Platforms & Apps | MT4, MT5, ActivTrader, TradingView |

ActivTrades Pros and Cons

Before opening an account through ActivTrades registration, learn about the broker’s benefits and drawbacks.

Pros | Cons |

Multi-Regulated by Top-Tier Authorities | Higher Minimum Deposit Compared to Some Competitors |

Wide Range of Tradable Instruments | Limited Promotional Offers or Bonuses |

Competitive Spreads and Fees | No Social Trading and Copy Trading Features |

Excellent Educational Resources | - |

Robust Risk Management Tools | - |

Fast Execution Speeds | - |

Negative Balance Protection | - |

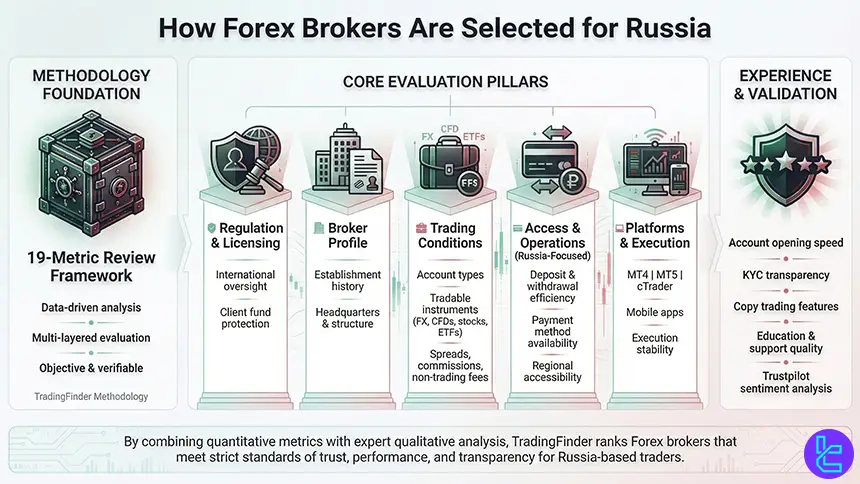

How We Selected the Forex Brokers for Russia

Selecting the best Forex brokers in Russia requires a structured, data-driven approach, as traders are ultimately trusting brokers with real capital in a complex regulatory and geopolitical environment. At the core of our evaluation process stands TradingFinder, which applies a transparent and multi-layered review methodology designed to deliver objective, verifiable, and actionable insights.

Each broker featured in this guide is assessed using 19 distinct evaluation metrics, covering both macro-level credibility and micro-level user experience. The process begins with regulation and licensing, where international oversight, client fund protection, and operational legitimacy are verified.

This is followed by an in-depth broker profile analysis, including establishment history, headquarters, and corporate structure, which helps contextualize long-term reliability.

Trading conditions are examined through multiple lenses, including account type diversity, the range of tradable instruments such as forex pairs, CFDs, stocks, and ETFs, as well as commissions, spreads, and non-trading fees. For Russia-based traders, particular attention is paid to deposit and withdrawal efficiency, supported payment methods, and regional accessibility.

Platform availability is another core pillar. Brokers are reviewed based on support for industry-standard solutions like MetaTrader 4, MetaTrader 5, and cTrader, alongside mobile trading apps and execution stability. Additional factors include account opening speed, KYC transparency, copy trading features, educational resources, and real-time customer support responsiveness.

To validate user sentiment, independent feedback from Trustpilot is integrated into the final scoring. By combining quantitative data with expert-led qualitative analysis, TradingFinder ensures that each broker listed meets strict standards of trust, performance, and transparency, resulting in a ranking that genuinely reflects trader priorities in the Russian forex market.

How Can I Verify if a Broker is Regulated?

Verifying a broker’s regulatory status is a critical step before opening a trading account, especially in the forex market where investor protection varies significantly across jurisdictions. Below are the most reliable methods used by professionals and analysts to confirm whether a broker operates under valid regulatory oversight.

Check Official Financial Regulator Registers

The most authoritative approach is to search the broker’s name or license number directly on the website of a recognized financial authority.

Well-known regulators include the Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Australian Securities and Investments Commission (ASIC), and the Central Bank of Russia. A valid listing should clearly display the broker’s legal name, registration number, and authorization status.

Match Legal Entity Details

Regulated brokers often operate multiple brands. Always ensure the legal entity shown on the regulator’s website matches the entity name listed in the broker’s terms and conditions. Mismatches in company name, address, or jurisdiction are common red flags.

Review Disclosures on the Broker’s Website

A regulated broker will prominently disclose its regulatory status in the website footer or legal documents. This information should include license numbers, regulatory bodies, and risk disclosures. Vague or unverifiable claims of regulation should be treated with caution.

Watch for Warnings and Blacklists

Regulators frequently publish warnings about unlicensed or fraudulent brokers. Checking these alerts can help traders avoid platforms that falsely claim regulatory approval or target restricted regions without authorization.

Is It Legal to Trade in the Forex Market in Russia?

Forex trading is legal in Russia, but it operates within a tightly regulated framework designed to protect retail traders and maintain market stability. Oversight of the domestic forex market is carried out by the Central Bank of Russia, which acts as the sole financial regulator for licensed forex dealers operating within the country.

Under Russian law, only companies that obtain official authorization from the Central Bank of Russia are permitted to offer forex trading services to Russian residents as domestic forex dealers.

These licensed entities must comply with strict capital requirements, transparency standards, reporting obligations, and client fund segregation rules. In addition, Russian-regulated forex dealers are required to be members of a self-regulatory organization, which adds an extra layer of supervision.

At the same time, Russian residents are not explicitly prohibited from opening accounts with international offshore forex brokers. However, such brokers operate outside the jurisdiction of Russian regulators, meaning traders do not benefit from local legal protections, dispute resolution mechanisms, or compensation frameworks if issues arise.

As a result, legal responsibility and risk management fall more heavily on the trader.

Another important aspect of legality concerns marketing and solicitation. Unlicensed brokers are not allowed to actively advertise or promote forex services inside Russia. This distinction explains why many international brokers restrict Russian-language promotions or onboard Russian clients through non-local entities.

In summary, forex trading itself is lawful in Russia, but the level of regulatory protection depends heavily on whether a trader chooses a locally licensed forex dealer or an offshore broker regulated abroad. Understanding this legal structure is essential for managing compliance risk and safeguarding trading capital.

Is the Leverage Capped in Russia Forex Trading?

Leverage is capped in Russia’s forex market, and the limits are among the most restrictive globally. These caps are imposed to reduce excessive risk exposure for retail traders and are enforced by the Central Bank of Russia on all domestically licensed forex dealers.

Leverage Limits for Russia-Based Forex Traders

For brokers regulated inside Russia, leverage is strictly regulated as follows:

- Maximum leverage is limited to 1:50 for retail forex traders trading major currency pairs;

- Lower leverage applies to volatile instruments, such as minor or exotic currency pairs;

- Professional trader classification is highly restricted, meaning most individuals remain under retail leverage caps;

- Mandatory margin requirements must be maintained at all times to prevent excessive drawdowns.

These rules apply only to brokers officially licensed by the Central Bank of Russia. The objective is to limit systemic risk and prevent retail traders from taking disproportionately large positions relative to their capital.

Offshore Brokers and Higher Leverage

Russian traders often encounter significantly higher leverage offerings, such as 1:200, 1:500, or even more, when trading with offshore brokers regulated outside Russia. In these cases:

- The broker is not subject to Russian leverage rules;

- Client protection mechanisms under Russian law do not apply;

- Dispute resolution must follow the broker’s foreign regulatory framework.

Is Negative Balance Protection Enforced in the Russian Market?

Negative Balance Protection in Russia depends largely on where the broker is regulated rather than on a single unified national rule applied across all trading accounts.

Under the supervision of the Central Bank of Russia, locally licensed forex dealers are required to implement strict margin control mechanisms designed to prevent retail traders from falling into excessive debt during periods of high market volatility.

In practice, Russia-regulated forex brokers operate within a framework that emphasizes pre-trade risk limitation rather than post-loss compensation. This means positions are typically liquidated automatically once margin thresholds are breached, significantly reducing the likelihood of a negative account balance.

However, Russian regulations do not always mandate a clearly defined “negative balance protection” clause in the same way as some European jurisdictions.

By contrast, many international brokers regulated by authorities such as the FCA or CySEC explicitly guarantee negative balance protection for retail clients. Russian traders using these brokers may benefit from such safeguards, provided their accounts are opened under the relevant regulated entity.

For offshore or lightly regulated brokers, negative balance protection is often offered as a policy feature rather than a regulatory obligation. In these cases, enforcement depends entirely on the broker’s internal risk management rules and legal terms.

Ultimately, Russian traders should not assume negative balance protection is automatic. Verifying margin-out rules, stop-out levels, and legal guarantees in the broker’s client agreement remains essential for managing downside risk.

Do Forex Traders in Russia Need to Pay Taxes?

Forex traders in Russia are generally required to pay taxes on their trading profits, but the exact obligation depends on how and where the trading activity is conducted. Tax oversight in Russia falls under the Federal Tax Service of Russia, which treats forex income as taxable personal income in most cases.

When Russian residents trade through locally licensed forex dealers, tax handling is often streamlined. These brokers typically act as tax agents, meaning they calculate, withhold, and remit personal income tax on behalf of the trader.

In such cases, traders receive net profits after tax and usually do not need to file separate declarations for that income unless additional reporting is required.

For traders using foreign or offshore forex brokers, the responsibility shifts entirely to the individual. Profits earned abroad must be self-declared in annual tax filings and converted into rubles using the official exchange rate on the date of income realization.

Failure to report overseas trading income can result in penalties, interest charges, or compliance issues.

Another important factor is tax residency status. Russian tax residents are generally taxed on worldwide income, while non-residents may be subject to different rules depending on the duration of stay and income source.

Because tax treatment can vary based on broker structure, income classification, and personal circumstances, many active traders consult qualified tax professionals. Proper record-keeping, transaction history preservation, and transparent reporting are essential for remaining compliant with Russian tax regulations while trading the forex market.

Forex Trading in Russia Vs. Other Countries

Forex trading in Russia sits between tightly regulated domestic markets and more flexible offshore environments.

While Russia enforces strict leverage limits and operational controls on locally licensed forex dealers, traders also have access to international brokers operating under foreign regulators.

Compared to major financial hubs such as Germany and Japan, Russia offers greater leverage flexibility only through offshore entities, but with fewer mandatory investor protections.

When compared to emerging markets like Egypt, Russia applies clearer domestic rules for licensed dealers, yet limits product flexibility. The table below highlights how Russia’s forex trading framework compares with selected global markets across regulation, leverage, protection standards, and trading conditions.

Comparison Factor | Russia | |||

Primary Regulator | Central Bank of Russia (CBR) | BaFin under ESMA & MiFID II | Japan Financial Services Agency (JFSA) | Financial Regulatory Authority (FRA) |

Regulatory Framework | National regulation for licensed dealers; offshore access common | EU-wide MiFID II & ESMA | National framework under FIEA | No domestic retail forex licensing |

Retail Leverage Cap (Forex Majors) | 1:50 (CBR-licensed dealers) | 1:30 | 1:25 | No local cap; broker-dependent |

Investor Protection Level | Moderate to high (licensed dealers) | Very high | Very high | Moderate (broker-dependent) |

Negative Balance Protection | Not explicitly mandated; margin controls apply | Mandatory | Structurally enforced via margin rules | Not mandated; broker-dependent |

Client Fund Segregation | Mandatory for licensed dealers | Mandatory | Mandatory | Depends on broker regulation |

Broker Transparency Requirements | High for licensed dealers | Strict EU disclosure rules | Strict domestic disclosure rules | Determined by offshore regulator |

Broker Availability | Local licensed + international brokers | Broad EU access via passporting | Primarily JFSA-licensed brokers | Mainly international offshore brokers |

Access to International Brokers | High | High | Limited | High |

Typical Trading Platforms | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView | MT4, MT5, proprietary platforms | MT4, MT5, cTrader |

Maximum Loss Protection | Often applied, entity-dependent | Cannot lose more than deposit | Cannot exceed deposit | Broker-dependent |

Tax Treatment of Forex Profits | Taxable; local brokers may withhold | Capital gains tax applies | Taxable as miscellaneous income | Potentially taxable as income |

Conclusion

Russia, similar to most other regions, regulates the Forex market with a specific framework, but also allows local residents to trade with international brokerages. Therefore, Russia-based traders have a wide selection.

IC Markets, VT Markets, AMarkets, and eToro are some of the best choices for those living in Russia with positive reviews from users submitted on Trustpilot.

““For details on the way each broker was chosen, visit our Forex methodology webpage.””