South Korea’s Forex framework, overseen by the FSC and FSS, enforces strict investor protection, mandatory fund segregation, negative balance protection, and retail leverage up to 1:10. Compared with Japan, India, and Singapore, South Korea balances high compliance standards with open access to international brokers and global trading platforms.

South Korea’s Forex market is tightly regulated by the Financial Services Commission (FSC) and supervised by the Financial Supervisory Service (FSS). Only brokers meeting strict compliance, transparency, and investor protection standards can legally serve Korean traders, ensuring secure trading environments and fair market practices.

With trading activity aligning closely to the Tokyo session and overlapping London and New York hours, top brokers offer diverse instruments, MetaTrader 4 and 5, and competitive pricing tailored to Korean traders.

| IUX | |||

| AvaTrade | |||

| Eightcap | |||

| 4 |  | IC Markets | ||

| 5 |  | XM Group | ||

| 6 |  | FP Markets | ||

| 7 |  | Octa | ||

| 8 |  | Pepperstone |

Forex Brokers in South Korea Ranked by Trustpilot Ratings

Trustpilot ratings offer valuable insight into broker credibility for South Korean Forex traders, reflecting real user feedback and service quality.

Among leading global brokers, Trustpilot scores range from 3.5 to 4.8 out of 5, based on nearly 90,000 combined reviews, highlighting differences in reliability, support standards, and overall trading experience.

Broker | Trustpilot Score | Number of Reviews |

IC Markets | 4.8/5 ⭐️ | 49,656 |

4.8/5 ⭐️ | 9,716 | |

AvaTrade | 4.7/5 ⭐️ | 11,431 |

4.3/5 ⭐️ | 3,190 | |

IUX | 4.2/5 ⭐️ | 876 |

Eightcap | 4.1/5 ⭐️ | 3,348 |

Octa | 3.9/5 ⭐️ | 8,706 |

XM Group | 3.5/5 ⭐️ | 2,818 |

South Korea CFD Brokers with Lowest Spreads

For South Korean CFD traders, brokers advertising 0.0 spreads typically apply no mark-ups and pass through pure market spreads.

These minimum spreads depend on account type and traded instruments and represent the lowest available pricing, with leading providers such as IC Markets, Pepperstone, AvaTrade, and FP Markets offering competitive conditions.

Broker | Minimum Spread |

IC Markets | 0.0 pips |

0.0 pips | |

FP Markets | 0.0 pips |

AvaTrade | 0.0 pips |

IUX | 0.0 pips |

Vantage | 0.0 pips |

TMGM | 0.0 pips |

0.6 pips | |

FBS | 0.7 pips |

South Korea Brokers in Non-Trading Fees

Non-trading fees play a major role for Forex and CFD traders in South Korea, especially for long-term account efficiency.

Leading brokers differ in policies on deposits, withdrawals, and inactivity, with IC Markets, Pepperstone, Vantage, and IUX standing out for zero non-trading costs, while others apply limited withdrawal or inactivity fees.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

No | No | No | |

Vantage | No | No | No |

No | No | No | |

FP Markets | No | Up to 1% | No |

XM Group | No | No | $10/month |

AvaTrade | No | No | $10/month |

TMGM | No | No | $10/month |

FBS | $0 | Up to 2.5% | No |

South Korea Forex Brokers’ Trading Instruments

The range of trading instruments defines how South Korean Forex traders diversify across global markets.

Top brokers offer access to Forex pairs, CFDs on stocks, indices, commodities, metals, and cryptocurrencies, with TMGM and FP Markets leadingin instrument count, followed by IC Markets, AvaTrade, and Pepperstone.

Broker | Number of Trading Instruments |

TMGM | 12,000+ |

FP Markets | 10,000+ |

IC Markets | 2,250+ |

AvaTrade | 1,250+ |

Pepperstone | 1,200+ |

800+ | |

FBS | 550+ |

277+ |

Top 6 Forex Brokers in South Korea

South Korea’s Forex market is shaped by strict FSC and FSS oversight, advanced digital infrastructure, and strong participation in global trading sessions.

The best Forex brokers serving Korean traders combine multi-jurisdiction regulation, low spreads, professional platforms like MT4 and MT5, diverse CFDs, and secure trading conditions tailored to Asian market hours.

IUX

IUX is a global Forex and CFD broker founded in 2016, offering trading access across currencies, crypto CFDs, indices, stocks, commodities, and asset quotes. With a very low minimum deposit of just $10, three live account types, and leverage up to 1:3000, IUX targets active traders seeking flexibility and fast execution.

IUX operates under multiple regulatory authorities, including ASIC in Australia, FSCA in South Africa, and FSC in Mauritius, with segregated client funds and negative balance protection applied across entities. The broker follows an STP execution model, supporting transparent order processing and high-speed trade execution.

IUX registration provides access to the proprietary IUX Trade App, web-based trading platform, and MetaTrader 5. All platforms support real-time pricing, technical analysis, and algorithm-friendly environments, making the broker suitable for day traders, scalpers, and strategy-driven market participants.

From a cost perspective, IUX offers floating spreads from 0.0 pips, commissions from $0, no inactivity fees, and a wide range of funding methods, including cards, bank transfer, crypto, e-wallets, mobile money, and virtual banking. These conditions make IUX particularly attractive to cost-sensitive traders.

Account Types | Standard, Razor |

Regulating Authorities | ASIC, SCB, FCA, DFSA, CMA, BaFin, CySEC |

Minimum Deposit | $1 |

Deposit Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Withdrawal Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | Proprietary Platform, cTrader, Trading View, MetaTrader 4&5 |

IUX Pros and Cons

Below is a focused overview of IUX’s main strengths and limitations, highlighting factors that South Korean traders should carefully consider before opening an account.

Pros | Cons |

Very low $10 minimum deposit for easy market entry | High leverage increases risk for inexperienced traders |

Fast STP execution with deep liquidity | No copy trading or PAMM investment options |

No inactivity or platform maintenance fees | Educational resources less comprehensive than top brokers |

Multiple platforms including MT5 and proprietary app | - |

Eightcap

Eightcap is an Australia-based Forex and CFD broker founded in 2009, offering access to more than 800 tradable instruments across Forex, indices, commodities, metals, shares, and cryptocurrencies. Eightcap registration process allows access to leverage up to 1:500 with a minimum deposit of $100, making it accessible to active retail traders.

The broker operates under multiple regulatory authorities, including ASIC in Australia, FCA in the United Kingdom, CySEC in Cyprus, and SCB in The Bahamas. This multi-jurisdiction structure allows Eightcap to offer varying leverage levels, investor protections, and client eligibility based on the regulatory entity.

Eightcap supports three main trading platforms: MetaTrader 4, MetaTrader 5, and TradingView. In addition, traders gain access to advanced tools such as Capitalise.ai for code-free automation, FlashTrader for rapid execution, and an AI-powered economic calendar designed for macro-driven strategies.

From a trading conditions perspective, Eightcap offers Standard, Raw, and TradingView accounts. Raw accounts feature spreads from 0.0 pips with commission, while Standard and TradingView accounts provide commission-free pricing. Market execution, scalping permission, and demo accounts support diverse trading styles. Clients receive cashbacks of up to $3.6 per lot for Forex trading through the Eightcap rebate program.

Account Types | Standard, Raw, TradingView, Demo |

Regulating Authorities | ASIC, FCA, CySEC, SCB |

Minimum Deposit | $100 |

Deposit Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Withdrawal Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, TradingView |

Eightcap Pros and Cons

Below is a balanced overview of Eightcap’s pros and cons, highlighting key advantages and limitations that South Korean traders should evaluate before opening an account.

Pros | Cons |

Strong regulation under ASIC, FCA, and CySEC | No Islamic swap-free account available |

Integration with TradingView for advanced charting | No copy trading or PAMM investment options |

High leverage availability via offshore entities | Inactivity fee applies after three months |

Automation tools like Capitalise.ai and FlashTrader | Educational content less structured for beginners |

Octa

Octa is a global Forex and CFD broker established in 2011, serving millions of traders across more than 180 countries. With a low minimum deposit of $25 and floating spreads starting from 0.6 pips, Octa positions itself as an accessible broker for both beginners and cost-sensitive traders.

The broker operates under multiple regulatory entities, including FSCA in South Africa, CySEC in Cyprus, and MISA through offshore structures. This framework allows Octa to provide different leverage levels, client protections, and account conditions depending on jurisdiction, while maintaining negative balance protection across accounts.

Octa offers commission-free trading across its MT4, MT5, and proprietary OctaTrader platforms. Traders gain access to Forex, indices, commodities, metals, cryptocurrencies, and stocks, with market execution, swap-free conditions, and leverage reaching up to 1:1000 under non-European entities.

A key differentiator is Octa’s focus on technology and trader engagement. Features such as Octa Copy for social trading, AI-powered tools like OctaVision, and built-in analytics within OctaTrader support both self-directed traders and those seeking passive exposure through copy trading. Octa deposit and withdrawal methods include cryptocurrencies, e-wallets, credit cards, etc.

Account Types | MT4, MT5, OctaTrader |

Regulating Authorities | FSCA, MISA |

Minimum Deposit | $25 |

Deposit Methods | E-wallets, credit/debit cards, bank transfer, crypto |

Withdrawal Methods | E-wallets, credit/debit cards, bank transfer, crypto |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, proprietary OctaTrader, and Copy trading app |

Octa Pros and Cons

Below is a focused overview of Octa’s pros and cons, highlighting strengths and limitations that South Korean traders should carefully assess before choosing this broker and using the OctaFX dashboard.

Pros | Cons |

Very low minimum deposit suitable for beginners | Regulatory coverage weaker than top top-tier global brokers |

Commission-free and swap-free trading on all accounts | Smaller range of instruments compared to large ECN brokers |

High leverage availability via offshore entities | Frequent changes in payment methods |

Built-in copy trading and proprietary analytics tools | Limited transparency across some offshore entities |

XM Group

XM Group is a global Forex and CFD broker founded in 2009, serving more than 15 million clients worldwide. The broker offers access to over 1,400 CFDs, including 55+ currency pairs and 1,200+ stock CFDs, with a very low minimum deposit of $5. Social trading is available via the XM Group copy trading service.

XM Group operates through multiple international entities regulated by authorities such as CySEC in Cyprus, FSCA in South Africa, DFSA in Dubai, and FSC in Belize and Mauritius. This multi-entity structure allows the broker to provide region-specific trading conditions and broad global market access.

XM Group dashboard provides access to MetaTrader 4, MetaTrader 5, and a proprietary mobile app. It offers market and instant execution, guaranteed fills up to 50 lots, leverage up to 1:1000 under certain entities, and negative balance protection across all retail accounts.

From a cost and accessibility perspective, XM provides commission-free trading on most account types, spreads starting from 0.6 pips, free deposits and withdrawals, andIslamic accounts. Its 24/7 multilingual customer support and educational ecosystem appeal to both new and experienced traders. XM Group cashback promotion offers rebates of up to $7 per lot for FX trading.

Account Types | Standard, Ultra Low, Shares |

Regulating Authorities | FSC Belize, CySEC Cyprus, FSCA South Africa, DFSA Dubai, FSC Mauritius, FSA Seychelles |

Minimum Deposit | $5 |

Deposit Methods | Credit/Debit Cards, Bank Transfers, E-Wallet Payments |

Withdrawal Methods | Credit/Debit Cards, Bank Transfers, E-Wallet Payments |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, Mobile App |

XM Group Pros and Cons

Below is a focused overview of XM Group’s pros and cons, highlighting key considerations for South Korean traders evaluating this broker.

Pros | Cons |

Very low $5 minimum deposit ideal for beginners | Monthly inactivity fee on dormant accounts |

Strong multi-jurisdictional regulation and oversight | Trustpilot score lower than some competitors |

Negative balance protection on all retail accounts | MetaTrader only, no cTrader or TradingView |

Wide range of CFDs and high leverage options | No PAMM or managed account solutions |

AvaTrade

AvaTrade is a globally established Forex and CFD broker offering access to more than 1,250 trading instruments across Forex, stocks, indices, commodities, cryptocurrencies, bonds, and options. Founded in 2006, the broker requires a minimum deposit of $100 and supports six base currencies, appealing to both beginner and experienced traders.

AvaTrade operates under a wide regulatory framework, holding licenses from authorities such as the Central Bank of Ireland, ASIC, FSCA, CySEC, FSA Japan, and ADGM. The broker also complies with MiFID II standards in Europe, applying segregated accounts and negative balance protection for retail traders.

AvaTrade dashboard provides multiple trading platforms, including MetaTrader 4, MetaTrader 5, WebTrader, AvaTrade mobile app, and AvaOptions for options trading. Orders are executed instantly, with margin call and stop out levels set at 25% and 10%, supporting controlled risk management across volatile markets.

From a trading environment perspective, AvaTrade focuses on fixed spread pricing with no commission on deposits or withdrawals. The broker also offers Islamic accounts, demo accounts, and copy trading solutions such as AvaSocial and DupliTrade, supporting diverse trading styles and long-term portfolio strategies.

AvaTrade deposit and withdrawal methods include Visa, MasterCard, Skrill, Neteller, WebMoney, and more.

Account Types | Retail, Professional, Islamic, Demo |

Regulating Authorities | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Withdrawal Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Maximum Leverage | 1:400 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader |

AvaTrade Pros and Cons

Below is a focused overview of AvaTrade’s pros and cons, highlighting factors that South Korean traders should consider before opening an account.

Pros | Cons |

Strong multi-jurisdictional regulation and MiFID compliance | Inactivity fees apply after periods of no trading |

Low $100 minimum deposit suitable for beginners | Fixed spreads may be higher during volatile sessions |

Wide platform selection including MT4, MT5, and AvaOptions | No PAMM or MAM account structures available |

Copy trading via AvaSocial and DupliTrade | 24/5 support instead of full 24/7 availability |

IC Markets

IC Markets is an international multi-asset Forex and CFD broker founded in 2007, offering access to more than 2,250 tradable instruments across Forex, stocks, indices, commodities, bonds, and cryptocurrencies. The broker supports 10 base currencies and requires a minimum deposit of $200, positioning it toward active traders.

The broker operates through multiple regulated entities under ASIC in Australia, CySEC in Cyprus, and the FSA in Seychelles. These licenses allow IC Markets to serve global clients with different leverage conditions, investor protections, and compliance frameworks depending on the trading entity.

IC Markets is best known for its pricing structure and execution model. Raw Spread accounts provide spreads from 0.0 pips with commissions, while Standard accounts offer commission-free trading with spreads starting around 0.8 pips. Trading platforms include MetaTrader 4, MetaTrader 5, cTrader, and mobile apps.

From an infrastructure standpoint, IC Markets focuses on institutional liquidity, low-latency execution, and support for algorithmic trading. Features such as Expert Advisors, scalping-friendly conditions, Islamic accounts, and diverse funding methods make it suitable for technically driven trading strategies. IC Markets rebate program offers cashbacks of up to $3 per lot for FX trading.

Account Types | Standard, Raw Spread, Islamic |

Regulating Authorities | FSA, CySEC, ASIC |

Minimum Deposit | $200 |

Deposit Methods | Bank Cards, Wire Transfers, Electronic payments, etc. |

Withdrawal Methods | Bank Cards, Wire Transfers, Electronic payments, etc. |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile |

IC Markets Pros and Cons

Below is a concise overview of IC Markets' pros and cons, highlighting key factors South Korean traders should evaluate before choosing this broker.

Pros | Cons |

Very low spreads on Raw Spread accounts | South Korea listed among restricted jurisdictions |

Supports MT4, MT5, and cTrader platforms | $200 minimum deposit may be high for beginners |

Fast execution with deep liquidity access | Negative balance protection not universal |

Broad CFD offering, including global stocks | Leverage conditions vary by regulatory entity |

Is Forex Trading Legal in South Korea?

Forex trading is legal in South Korea when conducted through compliant and properly regulated intermediaries. The market operates under a strict legal framework designed to protect retail investors and maintain financial stability across domestic and cross border transactions involving FX and CFD contracts.

South Korean residents may access both local and international Forex brokers, provided those firms respect national financial laws. Oversight focuses on transparency, capital adequacy, and fair dealing, which reduces systemic risk and discourages unlicensed offshore activity targeting Korean traders.

What Client Protection Protocols Are Required for Forex Broker in South Korea?

Client protection is a central pillar of Forex regulation affecting South Korean traders. Brokers are expected to apply international best practices even when licensed abroad.

These protocols include segregated accounts, negative balance protection, transparent execution, and dispute resolution mechanisms aligned with global regulatory norms.

- Segregation of client funds

- Negative balance protection

- Fair execution policies

- Complaint handling procedures

What Are FSC and FSS Requirements for Forex Brokers?

Forex brokers targeting South Korean traders must meet strict operational and compliance benchmarks. These include capital adequacy, transparent pricing, client fund segregation, and ongoing regulatory reporting.

The FSC sets policy and licensing direction, while the FSS conducts supervision, audits, and enforcement. Non-compliant brokers risk warnings, access restrictions, or blacklisting.

FSC Warning Lists for Online Traders

The FSC regularly publishes warning lists highlighting unauthorized investment platforms and high-risk online brokers. These lists are essential for South Korean traders to avoid scams and illegal Forex services.

Checking the warning list before opening an account reduces exposure to fraud, withdrawal issues, and unprotected capital. Many flagged entities operate via aggressive online marketing.

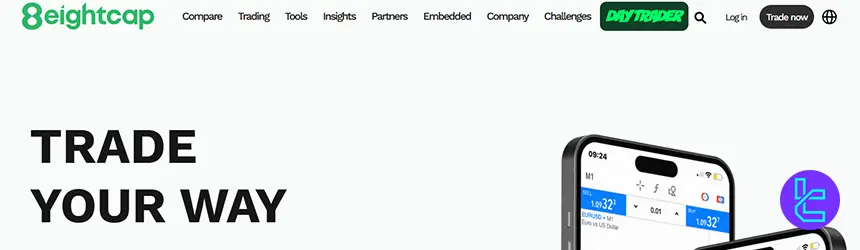

How to Verify FSC Authorization?

Verifying broker authorization is a critical step before trading Forex in South Korea. Traders should confirm whether a broker appears in FSC records or official warning notices.

This process involves checking regulatory disclosures, license references, and cross verification with global regulators such as FCA, ASIC, or CySEC.

- Visit the FSC Official Website: Check the Financial Services Commission official website for licensed entities and regulatory announcements related to Forex brokers;

- Search FSC Warning and Alert Lists: Review FSC warning lists to identify unlicensed or blacklisted Forex and CFD brokers targeting South Korean traders;

- Review Broker Regulatory Disclosures: Check the broker’s website for clear license numbers, regulatory entities, and legal disclosures related to South Korea;

- Cross-Verify with Global Regulators: Confirm broker licenses with international regulators such as FCA, ASIC, or CySEC through their official databases;

- Assess Consumer Alerts and Complaints: Search for FSC consumer alerts, enforcement actions, or repeated complaints linked to the broker’s legal name.

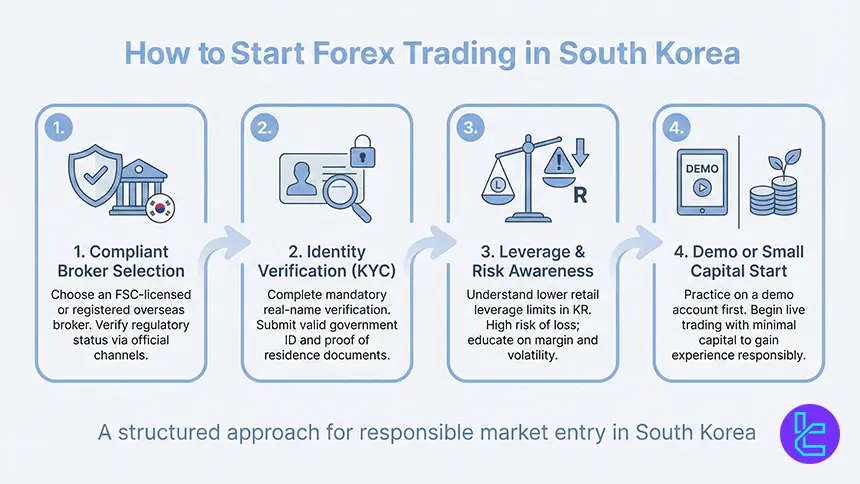

How to Start Forex Trading in South Korea?

Starting Forex trading in South Korea requires careful preparation. Traders must choose compliant brokers, understand leverage rules, and ensure proper tax and reporting awareness.

Most traders begin by opening an online account, completing KYC verification, funding via approved payment channels, and selecting suitable trading platforms and instruments.

- Choose a compliant broker;

- Complete identity verification;

- Understand leverage and risk;

- Start with a demo account or small capital.

Negative Balance Protection in South Korea Brokers

Negative balance protection prevents traders from losing more than their deposited funds. While not mandated locally, many brokers offering services to South Koreans provide this feature voluntarily.

This protection is especially important during high volatility events, gaps, and fast-moving global market sessions.

Is Forex Trading Taxable in South Korea?

In South Korea, Forex trading profits are not taxed under a separate flat regime and are instead included in an individual’s total taxable income. Resident traders are subject to progressive income tax rates, with an additional local income surtax, depending on income classification and annual profit levels.

Taxable Income (KRW) | Basic Income Tax Rate | Local Income Surtax Rate | Combined Tax Rate |

Up to 14M | 6% | 0.6% | 6.6% |

14M to 50M | 15% | 1.5% | 16.5% |

50M to 88M | 24% | 2.4% | 26.4% |

88M to 150M | 35% | 3.5% | 38.5% |

150M to 300M | 38% | 3.8% | 41.8% |

300M to 500M | 40% | 4.0% | 44.0% |

500M to 1B | 42% | 4.2% | 46.2% |

Over 1B | 45% | 4.5% | 49.5% |

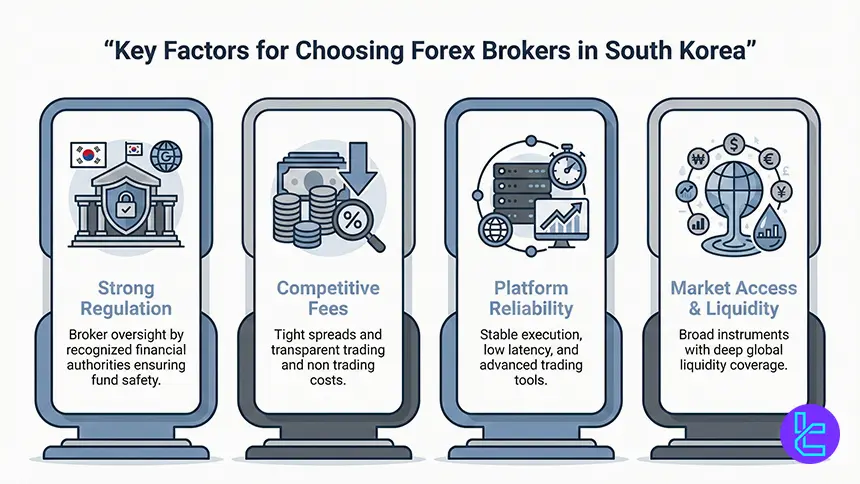

How to Select the Best Forex Broker in South Korea?

Choosing the right Forex broker directly impacts trading outcomes. South Korean traders prioritize regulation, fees, platform stability, and asset coverage.

Other critical factors include customer support quality, funding methods, and compatibility with Asian trading sessions and global liquidity providers.

- Strong regulatory coverage

- Competitive spreads and fees

- Platform reliability

- Market access and liquidity

What Are Leverage Caps for Forex Brokers in South Korea?

South Korea applies a conservative approach to Forex leverage, particularly for retail traders, with limits commonly set around 1:10 for major currency pairs and lower thresholds for minor or exotic instruments. These restrictions aim to reduce excessive risk, control market volatility, and protect retail investors under FSC and FSS supervision.

Leverage conditions differ when traders use offshore brokers, where higher ratios such as 1:30 or 1:100 may be available, depending on the broker’s regulation. However, locally compliant brokers prioritize capital protection, margin discipline, and regulatory alignment over aggressive leverage offerings.

What Trading Fees Should South Korean Traders Expect?

Trading fees include spreads, commissions, swaps, and non-trading costs. South Korean traders typically focus on tight spreads, low commissions, and minimal withdrawal or inactivity fees.

Fee structures vary by account type, platform, and instrument, making transparency a key selection factor.

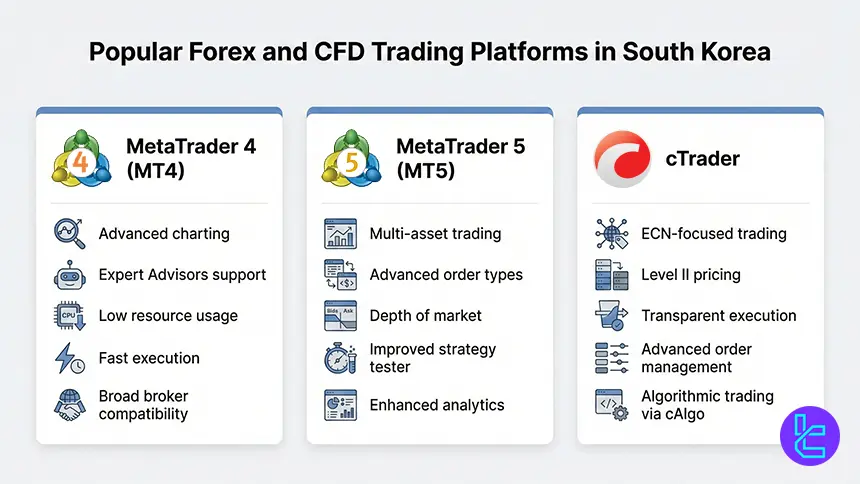

What Trading Platforms Are Popular in South Korea?

MetaTrader 4 and MetaTrader 5 dominate the South Korean Forex landscape due to stability and automation support. cTrader and proprietary web platforms also attract advanced traders.

Mobile trading adoption continues to rise, supported by high internet penetration and smartphone usage.

- MetaTrader 4 (MT4): Advanced charting, Expert Advisors support, low resource usage, fast execution, and broad compatibility with Forex and CFD brokers

- MetaTrader 5 (MT5): Multi-asset trading, enhanced order types, depth of market, improved backtesting, and advanced analytical tools

- cTrader: ECN-focused platform with level II pricing, transparent execution, advanced order management, and algorithmic trading via cAlgo

Professional Forex Accounts for South Korean Traders

Professional accounts offer higher leverage, advanced execution, and institutional pricing but require experience and financial qualification.

These accounts reduce regulatory protections, making them suitable only for experienced traders with strong risk management.

- Higher leverage access

- Advanced execution models

- Eligibility requirements apply

- Reduced retail protections

Helpful Links for South Korean Traders

Access to official resources helps traders stay compliant and informed. Regulatory updates, tax guidance, and consumer alerts should be reviewed regularly. These links support safer trading and better financial decision-making.

Forex Trading Regulations in South Korea vs Other Countries

Comparison Factor | South Korea | |||

Primary Regulator | Financial Services Commission (FSC), Financial Supervisory Service (FSS) | Japan Financial Services Agency (JFSA) | SEBI & RBI | Monetary Authority of Singapore (MAS) |

Regulatory Framework | National FSC regulations | National regulation under FIEA | Highly restricted; exchange-traded FX only | National framework under MAS (non-EU) |

Retail Leverage Cap Forex Majors | Up to 1:10 | 1:25 | ~1:50 (derivatives only) | 1:20 |

Investor Protection Level | High | Very high | High (limited scope) | High (prudential & conduct-based) |

Negative Balance Protection | Mandatory | Structurally enforced | Not standardized | Not mandatory; applied by many brokers |

Client Fund Segregation | Mandatory under FSC rules | Mandatory | Mandatory | Mandatory under MAS rules |

Broker Transparency Requirements | Transparent risk disclosures under FSC oversight | JFSA-licensed domestic brokers | Limited domestic access | Strict disclosure, capital, and reporting standards |

Broker Availability | Local and international | Limited (local entities required) | Restricted | MAS-licensed local and global brokers |

Access to International Brokers | Yes | MT4, MT5, proprietary | Exchange platforms | High (regional financial hub) |

Typical Trading Platforms | MT4, MT5, cTrader | Cannot exceed deposit | Product-dependent | MT4, MT5, cTrader, TradingView |

Maximum Loss Protection | Cannot lose more than deposit | Taxable as miscellaneous income | Taxable | Entity-dependent |

Tax Treatment of Forex Profits | Included in an individual’s total taxable income | Taxable income by Kenya Revenue Authority | Generally treated as assessable income and must be reported to the Australian Taxation Office | Taxable as income depending on activity (IRAS rules) |

Conclusion and Expert Suggestions

South Korea’s Forex market operates within a highly regulated environment shaped by the Financial Services Commission (FSC) and the Financial Supervisory Service (FSS). Brokers serving Korean traders must meet strict standards on transparency, client protection, and execution quality, making regulation, pricing structure, and platform stability decisive selection factors.

With growing participation and strong alignment to Asian, European, and US trading sessions, South Korean traders increasingly favor brokers offering low spreads, multi-asset coverage, and professional platforms such as MetaTrader 4, MetaTrader 5, and cTrader. Careful broker selection remains essential for long-term trading efficiency and risk control.

Our evaluation process assigns scores to brokers using a set of critical criteria such as trading costs, regulatory strength, and account diversity, following the structured principles defined within TradingFinder's Forex methodology framework.