Thailand hosts a tier-2 financial authority, that is the Securities and Exchange Commission (SEC Thailand). Also, the Bank of Thailand supervises Forex transactions. Both have been regulating this industry since 2017.

Forex traders in the country may trade with almost any brokerage, but it is advised to go with those regulated by top-tier authorities, such as the CySEC, the ASIC, or the SEC itself.

| FBS | |||

| STARTRADER | |||

| VT Markets | |||

| 4 |  | BlackBull Markets | ||

| 5 |  | ActivTrades | ||

| 6 |  | OneRoyal | ||

| 7 |  | FP Markets | ||

| 8 |  | eToro |

Trustpilot Ratings in Forex Brokers for Thailand

Here’s a ranking of the best Forex brokers based on the Trustpilot ratings and user reviews submitted on the evaluation platform.

Broker Name | Trustpilot Rating | Number of Reviews |

4.8⭐ | 2,915 | |

FP Markets | 4.8⭐ | 9,722 |

VT Markets | 4.4⭐ | 1,982 |

FBS | 4.3⭐ | 8,000 |

4.2⭐ | 29,865 | |

ActivTrades | 3.9⭐ | 1,250 |

STARTRADER | 3.8⭐ | 709 |

OneRoyal | 3.5⭐ | 518 |

Low-Spread Brokers for Thailand Residents

Spreads make up a major part of costs in some brokers. The table below lists some of those with low and fair spreads on trading pairs.

Broker Name | Min. Spreads |

Fusion Markets | 0 Pips |

FP Markets | 0 Pips |

VT Markets | 0 Pips |

Pepperstone | 0 Pips |

0 Pips | |

0 Pips | |

ActivTrades | 0.5 Pips |

FBS | 0.7 Pips |

Non-Trading Fees and Costs for Forex Brokers in Thailand

This section ranks Forex brokers based on non-trading fees and provides details about them in this regard.

Broker Name | Deposit Fee | Withdrawal Fee | Inactivity Fee |

None | None | None | |

OneRoyal | None | None | None |

STARTRADER | None | None | None |

None | 1% on Skrill and Paysafe | None | |

BlackBull Markets | None | $5 flat | None |

XM | None | None | $10 |

IG | Varies | None | $18 |

eToro | None | $5 | $10 |

Number of Tradable Instruments in Thailand Forex Brokers

Brokers always mention the high number of tradable symbols as one of their strong points (if existed). The table below ranks the best choices for Thailand traders based on instruments.

Broker Name | Number of Instruments |

BlackBull Markets | 26,000+ |

OneRoyal | 2,200+ |

STARTRADER | 1,000+ |

1,000+ | |

FP Markets | 1,000+ |

1,000+ | |

IronFX | 500+ |

Global Prime | 150+ |

Introduction to the Top 6 Forex Brokers for Vietnam-Based Traders

In each of the following sections, we will provide a short review and go through the details of each mentioned broker with considerations for traders in Vietnam.

FBS

FBS has been operating in the global forex industry since 2009 and serves more than 27 million traders worldwide. The broker is regulated by CySEC, ASIC, and the FSC, offering a structured regulatory framework suitable for Asian markets, including Thailand.

Client funds are held in segregated accounts, and Negative Balance Protection is available across entities.

FBS provides access to over 550 CFD instruments covering forex, indices, commodities, shares, and cryptocurrencies.

Trading is supported via MetaTrader 4, MetaTrader 5, and a proprietary mobile app that includes more than 90 technical indicators. Spreads are floating and start from 0.7 pips, with zero trading commissions on standard accounts.

To reduce trading costs, you can participate in the FBS rebate program with 25% cashback on spreads.

For Thailand-based traders, FBS stands out with flexible leverage options up to 1:3000, a low minimum deposit from $5, and fast market execution. The broker also offers Islamic accounts, 24/7 multilingual customer support, and a streamlined registration process designed for quick onboarding.

Summary of Specifics

Account Types | Standard |

Regulating Authorities | FSC, CySEC, ASIC |

Minimum Deposit | $5 |

Deposit Methods | Bank Transfers, Payment Systems, Credit/Debit Cards |

Withdrawal Methods | Bank Transfers, Payment Systems, Credit/Debit Cards |

Maximum Leverage | 1:3000 |

Trading Platforms & Apps | MT4, MT5, Mobile App |

FBS Pros and Cons

Before going through with the FBS registration, learn about its benefits and drawbacks.

Pros | Cons |

Low Minimum Deposit | Only One Trading Account Offered |

Regulated By a Top-Tier Authority | - |

Fast Order Execution (0.01 Seconds) | - |

User-Friendly Mobile App | - |

STARTRADER

STARTRADER is a multi-asset forex and CFD broker founded in 2012, offering services tailored to active traders across Asia, including Thailand.

The broker operates under multiple regulatory bodies such as ASIC, FCA, FSCA, FSA, and FSC, with segregated client funds and entity-level Negative Balance Protection enhancing operational safeguards.

STARTRADER provides access to more than 1,000 trading instruments across forex, commodities, indices, metals, and shares.

Traders can choose between STP and ECN account structures, with spreads starting from 0.0 pips on ECN accounts and leverage options reaching up to 1:1000 depending on the registration entity. Trading is supported via MetaTrader 4, MetaTrader 5, WebTrader, and a proprietary mobile app.

Note that for accessing all features, you should pass the STARTRADER verification process.

For Thailand-based traders, STARTRADER stands out with a low minimum deposit of $50, micro-lot trading from 0.01 lots, fast market execution, and support for copy trading, PAMM, and MAM solutions. The broker also offers Islamic accounts and 24/6 multilingual customer support.

The table below summarizes the broker’s specifics.

Account Types | STP, ECN |

Regulating Authorities | FCA, SCA, FSC, FSA, FSCA, ASIC |

Minimum Deposit | $50 |

Deposit Methods | Visa/Mastercard, E-Wallet, International Bank Wire Transfer |

Withdrawal Methods | Visa/Mastercard, E-Wallet, International Bank Wire Transfer |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | Proprietary Mobile App, MT4, MT5 |

STARTRADER Pros and Cons

Before opening an account through the STARTRADER registration form, consider the pros and cons.

Pros | Cons |

Competitive spreads, especially on ECN accounts | Limited research and educational content |

Multiple deposit and withdrawal options | High entry barrier |

24/6 customer support | No support for cryptocurrencies |

Multiple regulatory licenses | - |

VT Markets

VT Markets is an Australia-founded multi-asset forex and CFD broker that serves more than 400,000 active traders globally. The broker is regulated by ASIC, FSCA, and the FSC of Mauritius, with segregated client funds and entity-level Negative Balance Protection providing baseline risk safeguards.

The ASIC-regulated arm focuses on wholesale clients, while offshore entities serve international traders.

VT Markets offers access to over 1,000 tradable instruments across forex, indices, shares, metals, energies, ETFs, and soft commodities. Traders can choose between Standard STP, RAW ECN, and Cent account structures, with spreads starting from zero on ECN accounts and leverage reaching up to 1:500.

Trading is supported via MetaTrader 4, MetaTrader 5, Webtrader+, and the VT Markets mobile app. You can check out our VT Markets dashboard article to learn more about the broker’s user interface.

For Thailand-based traders, VT Markets stands out with a $50 minimum deposit, flexible base currencies, copy trading and PAMM options, and competitive execution for short-term and active trading strategies. Here’s a n overview of the broker’s details.

Account Types | Standard STP, RAW ECN, Cent STP, Cent ECN, Demo |

Regulating Authorities | FSCA, ASIC, FSC Mauritius |

Minimum Deposit | $50 |

Deposit Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Withdrawal Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Webtrader+, VT Markets App |

VT Markets Pros and Cons

You may read our VT Markets registration guide and open an account with the broker, but, before that, learn about its advantages and disadvantages.

Pros | Cons |

Robust regulatory framework | Higher Minimum Deposit Compared to Some Competitors |

Advanced trading platforms | No Crypto Trading |

Multiple Account Types | - |

Negative balance protection | - |

BlackBull Markets

BlackBull Markets is a New Zealand-based ECN broker founded in 2014, regulated by the FMA in New Zealand and the FSA in Seychelles.

The broker operates with segregated client funds and Negative Balance Protection, providing a structured trading environment for global clients, including traders in Thailand.

BlackBull Markets offers access to more than 26,000 tradable instruments across forex, stocks, indices, commodities, metals, and cryptocurrencies.

Trading is supported through MetaTrader 4, MetaTrader 5, TradingView, and cTrader, with ECN pricing and spreads starting from 0.0 pips on Prime and Institutional accounts. Leverage is available up to 1:500, depending on the trading entity.

For Thailand-based traders, BlackBull Markets stands out with zero minimum deposit on ECN Standard accounts, high-speed execution via Equinix servers, copy trading and stock investing options, and 24/7 multilingual customer support.

The broker also supports Islamic accounts and a wide range of local and international payment methods.

Here’s a summary of the broker’s details.

Account Types | ECN Standard, ECN Prime, ECN Institutional |

Regulating Authorities | FSA, FMA |

Minimum Deposit | $0 |

Deposit Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Neteller, Skrill, SEPA, FasaPay |

Withdrawal Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Neteller, Skrill, SEPA, FasaPay |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, TradingView, cTrader, BlackBull CopyTrader, BlackBull Invest |

BlackBull Markets Pros and Cons

Before going to the BlackBull Markets registration form, consider the broker’s noteworthy advantages and disadvantages.

Pros | Cons |

Extremely fast execution speeds | A $2,000 minimum deposit for the ECN Prime account |

Tight spreads starting from 0 pips and leverage up to 1:500 | Potential complexity for beginner traders due to the wide range of offerings |

Wide selection of over 26,000 tradable instruments | - |

Multi-jurisdictional regulation (New Zealand and Seychelles) | - |

Integration with popular trading platforms (MT4/5, cTrader, TradingView) | - |

ActivTrades

ActivTrades is a London-based forex and CFD broker founded in 2001, with more than two decades of operating history in global financial markets.

The broker is regulated by top-tier authorities including the FCA in the United Kingdom, alongside CMVM, SCB, BACEN, and CVM, providing a strong compliance framework.

Client funds are held in segregated accounts and protected by FSCS coverage up to £85,000, with additional private insurance of up to £1,000,000 per client.

ActivTrades offers access to over 1,000 tradable instruments across forex, indices, shares, commodities, ETFs, bonds, and selected cryptocurrencies.

Trading is available via MetaTrader 4, MetaTrader 5, TradingView, and the proprietary ActivTrader platform, featuring fast market execution and advanced risk-management tools. Spreads are floating from 0.5 pips, with no minimum deposit requirement.

For Thailand-based traders, ActivTrades stands out with robust fund protection, professional leverage up to 1:400, Islamic account availability, and a stable pricing environment focused on execution quality rather than promotional incentives. If you are about to open an account, check out our ActivTrades registration guide.

Table of Specifics

Account Types | Professional, Individual, Demo, Islamic |

Regulating Authorities | FCA, SCB, CMVM, BACEN, CVM |

Minimum Deposit | $0 |

Deposit Methods | Bank Wire, Credit/Debit Cards (Visa, MasterCard), E-Wallets (Skrill, Neteller), Local Payment Methods |

Withdrawal Methods | Bank Wire, Credit/Debit Cards (Visa, MasterCard), E-Wallets (Skrill, Neteller), Local Payment Methods |

Maximum Leverage | 1:400 |

Trading Platforms & Apps | MT4, MT5, ActivTrader, TradingView |

ActivTrades Pros and Cons

The table below demonstrates the broker’s noteworthy benefits and drawbacks.

Pros | Cons |

Multi-Regulated by Top-Tier Authorities | Higher Minimum Deposit Compared to Some Competitors |

Wide Range of Tradable Instruments | Limited Promotional Offers or Bonuses |

Competitive Spreads and Fees | No Social Trading and Copy Trading Features |

Excellent Educational Resources | - |

Robust Risk Management Tools | - |

Fast Execution Speeds | - |

Negative Balance Protection | - |

OneRoyal

OneRoyal is a multi-licensed forex and CFD broker founded in 2006 and operating under the Royal Group. The broker is regulated by ASIC in Australia alongside VFSC and SVGFSA entities, enabling global client coverage while maintaining segregated client funds and Negative Balance Protection under specific jurisdictions.

OneRoyal provides access to a broad range of markets including forex, metals, energies, indices, stocks, ETFs, and cryptocurrencies. Traders can choose from multiple account types such as Classic, ECN, VIP, ECN Elite, and Cent, with spreads starting from 0.0 pips on ECN models and leverage reaching up to 1:1000 depending on the entity.

Trading is supported via MetaTrader 4, MetaTrader 5, and the MT4 Accelerator with enhanced execution tools.

For Thailand-based traders, OneRoyal stands out with a low minimum deposit from $10, flexible account structures, Islamic account availability, PAMM and copy trading options, and 24/5 multilingual support tailored to active regional markets.

OneRoyal Specifications

Account Types | Classic, ECN, VIP, ECN Elite, Cent, Demo |

Regulating Authorities | ASIC, FSA, VFSC |

Minimum Deposit | $10 |

Deposit Methods | Visa, Mastercard, Bank Wire Transfer, Skrill, Neteller, Cryptocurrencies |

Withdrawal Methods | Visa, Mastercard, Bank Wire Transfer, Skrill, Neteller, Cryptocurrencies |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, MT4 Accelerator |

OneRoyal Pros and Cons

The table here demonstrates the brokerage’s advantages and disadvantages.

Pros | Cons |

Multi-licensed and regulated | High minimum deposit for VIP accounts |

Competitive spreads starting from 0.0 pips | Limited range of tradable assets (compared to some competitors) |

High leverage up to 1:1000 | - |

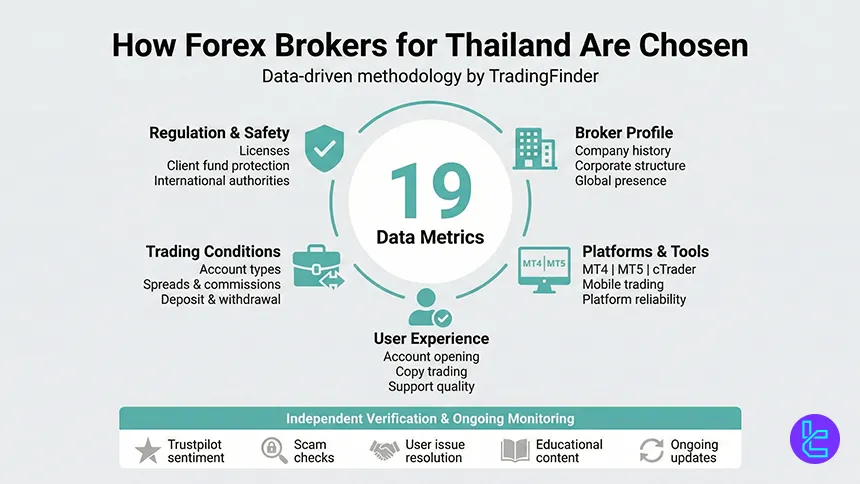

How Have the Forex Brokers for Thailand Been Chosen?

Selecting the best Forex brokers in Thailand requires a structured, transparent, and data-driven approach, as traders are entrusting real capital to global financial institutions.

At TradingFinder, broker selection is based on a comprehensive evaluation framework designed to reflect the real trading conditions faced by Thai market participants.

This methodology is built around 19 independent data metrics, ensuring objectivity and consistency across all broker reviews.

The first layer of analysis focuses on regulation and licensing, verifying that each broker operates under recognized international authorities and applies mechanisms to protect client funds.

This is followed by a detailed broker profile review, including establishment history, corporate structure, and global office presence. Account diversity is another key factor, covering standard, micro, ECN, and PAMM structures to suit different trading strategies and risk profiles.

TradingFinder also evaluates the range of tradable instruments, commissions, spreads, deposit and withdrawal conditions, and overall cost transparency. Platform accessibility plays a crucial role, with support for industry standards such as MetaTrader 4, MetaTrader 5, cTrader, and mobile trading apps carefully assessed.

Account opening procedures, verification speed, and copy trading availability are tested end to end to reflect real user experience.

Additional metrics include customer support responsiveness, educational resources, data presentation quality, scam alerts, and broker accountability in resolving user issues. Independent user sentiment is validated through platforms like Trustpilot, while ongoing updates, infographics, and social engagement further influence final rankings.

How to Verify if a Broker is Regulated by the SEC/Bank of Thailand

Verifying whether a Forex broker is properly regulated in Thailand is a critical step before opening a trading account. Thailand, financial market oversight is primarily handled by the Securities and Exchange Commission of Thailand and the Bank of Thailand, each with clearly defined supervisory roles.

Identify the Broker’s Claimed Regulatory Status

The first step is to review the broker’s official website and locate its legal and regulatory disclosures. Legitimate brokers clearly state their registered company name, license number, and supervising authority.

In Thailand, any broker claiming local authorization must reference oversight by the Securities and Exchange Commission of Thailand or compliance with local financial regulations. Missing, vague, or unverifiable licensing information is a key red flag.

Check the SEC Thailand Licensed Entities Database

To confirm a broker’s legal status, visit the SEC Thailand website and search its database of licensed capital market operators. Enter the broker’s legal entity name or license number exactly as displayed on its website.

Understand the Role of the Bank of Thailand

The Bank of Thailand does not license Forex brokers directly but oversees foreign exchange activity, cross-border payments, and local financial infrastructure. Traders should verify that a broker’s deposit and withdrawal methods comply with Bank of Thailand regulations, particularly when using Thai bank transfers or domestic payment providers.

Distinguish Between Local and Offshore Regulation

Many international Forex brokers legally accept Thai clients while being regulated outside Thailand. In such cases, traders should confirm the broker’s primary regulator and evaluate whether investor protections such as fund segregation and dispute resolution mechanisms are in place.

Review SEC Warnings and Public Alerts

Finally, check the SEC Thailand’s warning lists and public announcements. Brokers listed in these alerts may be operating without authorization or violating regulatory requirements, making them significantly higher risk for Thai traders.

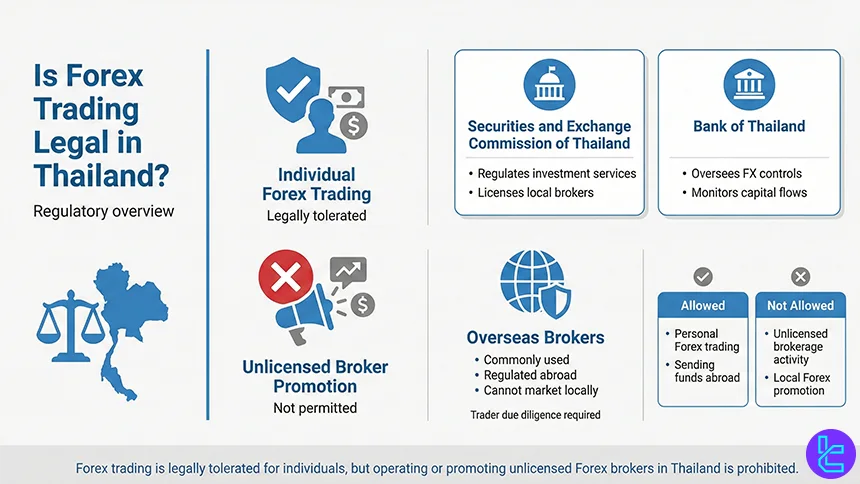

Is Forex Trading Legally Accepted in Thailand?

Forex trading is not illegal in Thailand, but it operates within a restricted and tightly regulated framework. Thai law does not explicitly ban individuals from trading the foreign exchange market; however, the legality depends on how and through whom the trading activity is conducted.

The Securities and Exchange Commission of Thailand is responsible for regulating investment-related activities, including derivatives and brokerage services offered to Thai residents.

Under current regulations, only locally licensed entities are permitted to actively market or provide Forex trading services within Thailand. As a result, most international Forex brokers are not licensed domestically and therefore cannot legally promote their services inside the country.

At the same time, the Bank of Thailand oversees foreign exchange controls, cross-border capital flows, and payment systems. Thai residents are generally allowed to send funds abroad for investment purposes, provided the transfers comply with BoT regulations and reporting requirements.

In practice, many Thai traders access Forex markets through international brokers regulated overseas. While this is common, it places the responsibility on traders to ensure that the broker is reputable, properly regulated in another jurisdiction, and transparent about client fund protection.

In summary, Forex trading itself is legally tolerated for individuals, but operating or promoting an unlicensed Forex brokerage within Thailand is not permitted under local regulatory rules.

Is There a Leverage Cap for Forex Trading in Thailand?

Thailand does not impose a fixed, legally defined leverage cap for individual Forex traders at the national level. Unlike jurisdictions with explicit leverage limits enforced by local regulators, Thailand’s regulatory framework approaches leverage indirectly through licensing and oversight rules.

The Securities and Exchange Commission of Thailand does not publish a standardized maximum leverage ratio for retail Forex trading. Instead, leverage restrictions apply mainly to locally licensed financial institutions and derivatives providers.

Since most international Forex brokers are not regulated domestically, they are not bound by a Thailand-specific leverage ceiling.

However, the Bank of Thailand oversees foreign exchange exposure, capital flows, and systemic risk. From a regulatory perspective, high leverage is viewed as a risk management concern, particularly when combined with cross-border fund transfers and speculative trading behavior.

This is one reason why Thailand restricts the domestic promotion of high-risk leveraged products.

In practice, Thai traders using offshore-regulated Forex brokers may access leverage levels defined by the broker’s primary regulator. For example, brokers regulated by ASIC, FCA, or CySEC often apply leverage limits such as 1:30 for retail clients, while brokers regulated in offshore jurisdictions may offer significantly higher leverage.

As a result, leverage availability for Thai traders depends largely on the broker’s regulatory jurisdiction, not Thai law itself. Traders should carefully assess leverage policies, margin requirements, and risk disclosures before trading, especially when using brokers offering elevated leverage ratios.

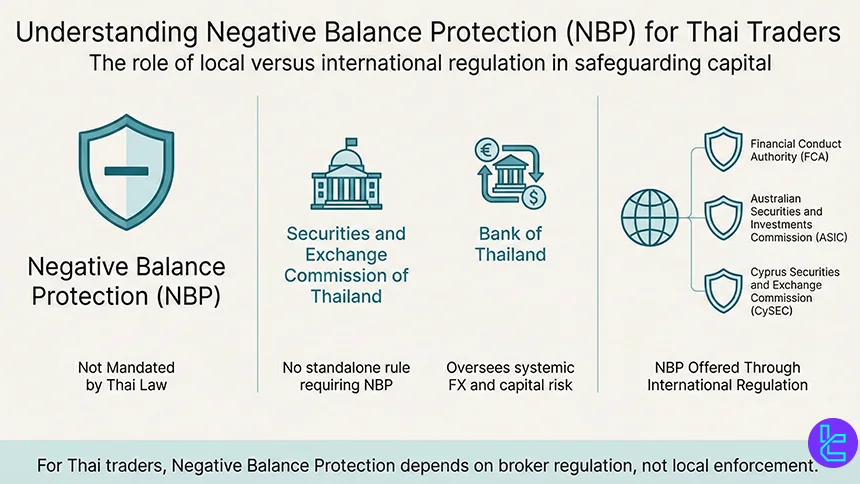

Does Thailand Enforce Negative Balance Protection?

Thailand does not explicitly mandate Negative Balance Protection for Forex traders under a standalone national regulation. There is currently no specific legal requirement issued by the Securities and Exchange Commission of Thailand that obliges all Forex brokers to guarantee that traders cannot lose more than their deposited capital.

Because most international Forex brokers serving Thai traders are not locally licensed, they are also not directly subject to Thailand-specific client protection rules. Instead, trader safeguards such as Negative Balance Protection depend largely on the broker’s primary regulatory jurisdiction and internal risk management policies.

That said, the Bank of Thailand oversees financial stability, foreign exchange exposure, and capital movement risks at a macro level. While the BoT does not regulate broker trading conditions directly, its focus on systemic risk reinforces Thailand’s cautious stance toward highly leveraged speculative products.

In practice, many brokers regulated by top-tier authorities such as the FCA, ASIC, or CySEC voluntarily offer Negative Balance Protection to retail clients as part of their compliance frameworks. This protection ensures that during extreme market volatility, losses are capped at the account balance, preventing debt obligations to the broker.

For Thai traders, this means Negative Balance Protection is not enforced by local law, but it can still be accessed by choosing brokers that apply this safeguard through international regulatory standards. Verifying this feature in a broker’s legal documentation and risk disclosures is essential before opening an account.

Is There an Investor Compensation Scheme for Forex Trading in Thailand?

Thailand does not provide a dedicated investor compensation scheme specifically for Forex trading activities. Unlike some jurisdictions where statutory funds protect retail traders against broker insolvency, Thai law does not guarantee compensation for losses arising from Forex broker failure.

Key regulatory points to consider include:

- Role of the Securities and Exchange Commission of Thailand: Investor protection mechanisms under the SEC Thailand mainly apply to locally licensed securities companies, not international Forex brokers serving Thai residents;

- Scope of the Bank of Thailand: The BoT oversees monetary stability, foreign exchange flows, and payment systems, but does not operate a compensation fund covering trading losses or broker insolvency;

- Offshore broker reality: Most Forex brokers used by Thai traders are regulated outside Thailand, placing them beyond the reach of any domestic investor compensation framework;

- Dependence on the broker’s primary regulator: Brokers licensed in certain jurisdictions may offer compensation through foreign investor protection schemes, while offshore-regulated brokers typically provide no such coverage;

- Importance of fund segregation policies: Since there is no local compensation scheme, segregation of client funds and broker financial transparency become critical risk-management factors.

Forex traders in Thailand should not expect statutory compensation protection. Choosing brokers regulated in strong jurisdictions with clear fund protection rules is essential to managing counterparty risk.

Do Thailand-Based Forex Traders Pay Taxes?

Yes, Thailand-based Forex traders may be required to pay taxes, depending on how their trading activity and profits are classified under Thai tax law. While Thailand does not impose a specific transaction tax on Forex trading itself, profits generated from trading can be considered taxable income.

Tax oversight in Thailand falls under the authority of the Revenue Department of Thailand, which governs personal income taxation. If Forex trading is carried out on a consistent basis with the intention of generating profit, the resulting gains are generally treated as assessable income and may fall within the personal income tax framework.

This applies regardless of whether trading is conducted through local or international brokers.

Using offshore Forex brokers does not automatically eliminate tax obligations. In particular, profits transferred into Thailand or used domestically may become subject to taxation, depending on timing, residency status, and total annual income.

Thailand applies a progressive income tax system, meaning Forex-related profits are taxed alongside other income sources and assessed according to the applicable tax brackets.

It is also important to note that Forex brokers typically do not withhold taxes on behalf of Thai clients. As a result, responsibility for accurate reporting and compliance rests entirely with the trader. Maintaining detailed records of trading activity, deposits, withdrawals, and net profits is essential.

Forex Trading in Thailand Compared to Other Regions

Thailand’s Forex trading environment sits between tightly regulated markets and more flexible offshore-friendly jurisdictions. While Forex trading is legally permitted, local oversight focuses more on capital controls and investor warnings than on licensing retail Forex brokers.

As a result, Thai traders often rely on internationally regulated brokers, similar to traders in Vietnam, but with clearer tax obligations and consumer protections.

When compared to highly regulated regions like Germany or Japan, Thailand offers greater flexibility in leverage and broker choice, though with fewer mandatory safeguards.

The table below highlights how Thailand compares structurally with other major Forex markets.

Comparison Factor | Thailand | |||

Primary Regulator | Bank of Thailand (BoT) & SEC Thailand | BaFin under ESMA & MiFID II | State Bank of Vietnam (SBV) | Japan Financial Services Agency (JFSA) |

Regulatory Framework | National oversight; no dedicated retail Forex licensing | EU-wide MiFID II & ESMA | No domestic retail Forex framework | National regulation under FIEA |

Retail Leverage Cap (Forex Majors) | Not formally capped; broker-dependent | 1:30 | Not capped locally; broker-dependent | 1:25 |

Investor Protection Level | Moderate | Very high | Low to moderate | Very high |

Negative Balance Protection | Broker-dependent | Mandatory | Broker-dependent | Structurally enforced |

Client Fund Segregation | Depends on broker regulation | Mandatory | Depends on broker | Mandatory |

Broker Availability | International offshore brokers | EU-passported brokers | Offshore international brokers | JFSA-licensed domestic brokers |

Access to International Brokers | High | High | High | Limited |

Typical Trading Platforms | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader | MT4, MT5, proprietary |

Maximum Loss Protection | Broker-dependent | Cannot lose more than deposit | Broker-dependent | Cannot exceed deposit |

Tax Treatment of Forex Profits | Taxable as personal income | Capital gains tax | Interpreted as personal income | Taxable as miscellaneous income |

Conclusion

The Securities and Exchanges Commission of Thailand is a high-tier financial authority with strict rules for Forex trading; however, there are so few Forex brokers that operate under the supervision of this authority.

Nevertheless, Thailand-based traders can work with international brokerages. Some of the most reputable ones include FBS, STARTRADER, and VT Markets with top-tier regulators.