The UK offers one of the most secure Forex trading environments, regulated by the FCA with a 1:30 leverage cap, mandatory negative balance protection, and strict fund segregation. Compared with Kenya, Australia, and Cyprus, the UK combines high investor protection, transparent disclosures, broad platform access, and strong global broker availability.

The United Kingdom stands as a key global forex center, supported by deep liquidity and firm oversight from the Financial Conduct Authority (FCA). FCA authorization sets clear requirements for capital adequacy, client fund segregation, and CFD disclosures, establishing a transparent and well-defined regulatory framework for the UK forex market.

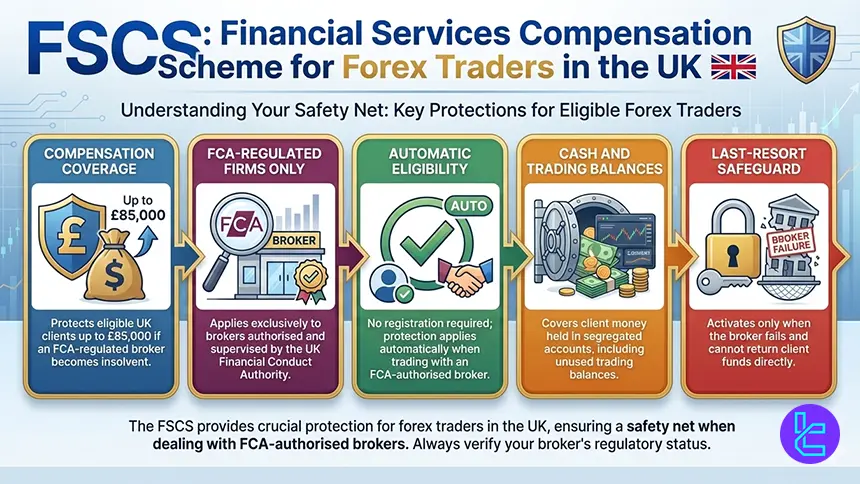

FCA-regulated forex brokers in the UK compete on pricing efficiency, execution quality, and transparent cost structures, including spreads, swaps, and non-trading fees. Additional safeguards include formal complaint mechanisms and eligibility for coverage under the Financial Services Compensation Scheme (FSCS).

| Fusion Markets | |||

| Global Prime | |||

| BlackBull Markets | |||

| 4 |  | FxPro | ||

| 5 |  | IC Markets | ||

| 6 |  | Pepperstone | ||

| 7 |  | Tickmill | ||

| 8 |  | Vantage Markets | ||

| 9 |  | XM Group | ||

| 10 |  | Eightcap |

Top Rated UK Forex Brokers According to Trustpilot

Beyond trading features, trust scores are a key benchmark when comparing UK Forex brokers. Independent ratings, particularly Trustpilot scores, capture real user experiences with execution, withdrawals, and support quality, making them an essential reference point in the sections that follow.

Broker | Trustpilot Score (Out of 5) | Number of Reviews |

| IC Markets | 4.8 ⭐️ | 49,719 |

Fusion Markets | 4.8 ⭐️ | 5,382 |

BlackBull Markets | 4.8 ⭐️ | 2,881 |

Global Prime | 4.6 ⭐️ | 377 |

Pepperstone | 4.3 ⭐️ | 3,189 |

| Eightcap | 4.1 ⭐️ | 3,354 |

| FxPro | 3.8 ⭐️ | 860 |

| Tickmill | 3.6 ⭐️ | 1,050 |

| XM Group | 3.5 ⭐️ | 2,823 |

| Vantage UK | 2.6 ⭐️ | 13 |

UK Forex Brokers with the Lowest Spreads

UK Forex brokers with the lowest spreads typically operate raw or ECN-style pricing, where 0.0 pips means no broker mark-ups and only direct market spreads apply.

These minimum spreads vary by account type and trading instrument and represent the lowest pricing levels a broker offers under optimal market conditions.

Broker | Minimum Spread |

Pepperstone | 0.0 pips |

0.0 pips | |

Global Prime | 0.0 pips |

0.0 pips | |

IronFX | 0.0 pips |

IC Markets | 0.0 pips |

CMC Markets | 0.0 pips |

Spreadex | 0.6 pips |

0.6 pips | |

Capital.com | 0.67 pips |

UK Brokers in Non-Trading Fees

Top UK brokers in non-trading fees focus on cost efficiency beyond spreads and commissions, minimizing charges for deposits, withdrawals, and account inactivity.

Many FCA-aligned providers waive funding fees entirely, while others apply small, clearly defined inactivity or low-balance deposit charges, helping maintain transparent and predictable trading costs.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

No | No | No | |

IC Markets | No | No | No |

Fusion Markets | No | No | No |

IC Markets | No | No | No |

No | No | No | |

IronFX | No | No | No |

BlackBull Markets | No | $5 | No |

XM Group | No | No | $10/month |

Capital.com | No | No | €10/month |

Spreadex | £1 for deposits under £50 | No | No |

United Kingdom Forex Brokers’ Trading Instruments

United Kingdom Forex brokers provide access to a wide universe of trading instruments, ranging from core FX pairs to CFD contracts on stocks, indices, commodities, and cryptocurrencies.

Leading multi-asset platforms offer anywhere from a few hundred to over 70,000 instruments, supporting diversified strategies and broad market exposure.

Broker | Number of Trading Instruments |

Saxo | 71,000+ |

BlackBull Markets | 26,000+ |

IG | 17,000+ |

CMC Markets | 12,000+ |

Interactive Brokers | 4,900+ |

Capital.com | 3,200+ |

2,100+ | |

Pepperstone | 1,200+ |

600+ | |

Fusion Markets | 250+ |

Top 8 Forex Brokers in the United Kingdom

UK top forex and CFD brokers typically combine FCA oversight with FSCS protection up to £85,000, segregated client funds, and retail leverage capped at 1:30 (only FCA-regulated entities).

Across leading platforms like MT4, MT5, cTrader, TradingView, and proprietary apps, traders can access multi-asset coverage ranging from 200+ to 70,000+ instruments.

FxPro

FxPro is a global Forex and CFD broker founded in 2006, serving more than 7.8 million client accounts worldwide. The broker provides access to over 2,100 tradable instruments across Forex, shares, indices, commodities, futures markets, and cryptocurrencies, with ultra-fast execution averaging under 12 milliseconds.

The broker operates under multiple regulatory entities, including the FCA in the United Kingdom, CySEC in Cyprus, FSCA in South Africa, and SCB in the Bahamas. This structure supports client fund segregation, negative balance protection, stringet FxPro verification process, and jurisdiction-based investor safeguards.

FxPro offers a wide range of trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, WebTrader, and a proprietary mobile app. Traders can choose from Standard, Pro, Raw+, and Elite accounts, with spreads starting from 0.0 pips on Raw+ accounts.

From a trading environment perspective, FxPro emphasizes execution quality, platform flexibility, and advanced trading tools. FxPro dashboard's support for Expert Advisors, scalping, copy trading, Islamic accounts, and futures trading makes it suitable for both active retail and professional traders.

Account Types | Standard, Pro, Raw+, Elite |

Regulating Authorities | FCA, FSCA, CySEC, SCB |

Minimum Deposit | $100 |

Deposit Methods | Visa, Mastercard, Bank Wire Transfer, Broker to Broker Transfer, Skrill, Neteller, PayPal |

Withdrawal Methods | Visa, Mastercard, Bank Wire Transfer, Broker to Broker Transfer, Skrill, Neteller, PayPal |

Maximum Leverage | 1:30 |

Trading Platforms & Apps | MT4, MT5, cTrader, Web Trader, Mobile App |

FxPro Pros and Cons

Below is a concise overview of FxPro’s pros and cons, highlighting key considerations like FxPro rebate for UK traders evaluating this broker.

Pros | Cons |

Strong multi jurisdiction regulation and oversight | Higher minimum deposit for advanced accounts |

Wide platform selection including MT4, MT5, and cTrader | Limited bonus or promotional offerings |

Fast execution with institutional grade infrastructure | Customer support not available 24/7 |

Up to 30% spread discount through a rebate program | - |

Pepperstone

Pepperstone is a global forex and CFD broker founded in 2010 in Melbourne, processing an average of $9.2B in daily volume for 400,000+ clients. The broker supports 10 base currencies, including GBP, and allows order sizes from 0.01 to 100 lots across its account range.

Trading access spans MetaTrader 4, MetaTrader 5, cTrader, TradingView, and Pepperstone’s proprietary platforms on web and mobile. Instrument coverage includes forex, shares, indices, commodities, crypto, and ETFs, with 1,200+ tradable symbols supporting both discretionary and automated execution.

Regulation is a core pillar, with tier 1 oversight from the Financial Conduct Authority in the UK alongside ASIC, CySEC, and BaFin. UK clients trade under Pepperstone Limited, where fund safeguards include segregated accounts, negative balance protection, and FSCS coverage up to £85,000.

Pricing is structured around Standard and Razor accounts, with spreads from 0.0 pips on Razor and a forex commission of $3.5 per side, while Standard pricing bundles costs into the spread with $0 commission. Non-trading fees are positioned competitively, with no account keeping or inactivity charges stated. Pepperstone rebate allows traders to earn up to 12.857% cashback on commissions.

Account Types | Standard, Razor |

Regulating Authorities | ASIC, SCB, FCA, DFSA, CMA, BaFin, CySEC |

Minimum Deposit | $1 |

Deposit Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Withdrawal Methods | Apple Pay, Google Pay, Visa, Mastercard, Bank transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Maximum Leverage | 1:30 |

Trading Platforms & Apps | Proprietary Platform, cTrader, Trading View, MetaTrader 4&5 |

Pepperstone Pros and Cons

The pros and cons below summarize how the broker stacks up for UK-based accounts, focusing on FCA oversight, protections, leverage limits, platform choice, secure Pepperstone registration, and total cost structure.

Pros | Cons |

FCA-regulated entity with FSCS protection up to £85,000 | Retail leverage capped at 1:30 under FCA rules |

Broad platform suite including MT4, MT5, cTrader, TradingView, and proprietary apps | No traditional bonuses or promotions due to regulatory limits |

Razor pricing can reach 0.0 pips on majors with transparent commission | Demo access can be more limited than some competitors |

No inactivity or account maintenance fees stated, with wide funding methods including PayPal | No PAMM account option for managed allocation setups |

IC Markets

CMC Markets UK is a long-established broker with 30+ years of operating history and 1,000,000+ customers across 4 continents. The company is listed on the London Stock Exchange, and it maintains a multi-office footprint spanning regions such as Australia, Canada, Spain, Norway, and Poland.

UK operations sit under FCA oversight with registration number 173730, supported by a tier 1 regulatory network that includes ASIC, BaFin, MAS, FMA, and DFSA. Client safeguards include segregated funds, negative balance protection, and FSCS coverage up to £85,000 for eligible UK accounts.

IC Markets account access includes Spread Betting, CFD Trading, and FX Active, each connected to the Next Generation web platform and MetaTrader 4.

Market coverage is broad, with 12,000+ instruments available across forex, indices, commodities, shares, ETFs, treasuries, and cryptocurrencies, supported by advanced charting and analytics.

Pricing is built around tight, floating spreads that can start from 0.0 pips, with share CFD commissions typically starting from $10 per trade. IC Markets rebate program offers up to $3 cashback on FX pairs commissions. Non-trading costs remain limited, with £0 broker fees on deposits and withdrawals, and a potential £10 monthly inactivity fee after 12 months with no trading activity.

Account Types | Spread Betting, CFD Trading, FX Active |

Regulating Authorities | FCA, ASIC, CySEC, DFSA, NFRA, FMA, BaFIN |

Minimum Deposit | $0 |

Deposit Methods | Visa/MasterCard, Bank wired, Online Banking |

Withdrawal Methods | Visa/MasterCard, Bank wired, Online Banking |

Maximum Leverage | 1:30 |

Trading Platforms & Apps | MT4, Next Generation web trading platform |

IC Markets Pros and Cons

The pros and cons below summarize what stands out for UK accounts, focusing on FCA oversight, platform strengths, product depth, and the fee structure that affects long-term usage.

Pros | Cons |

FCA-regulated UK entity with FSCS protection up to £85,000 | £10 monthly inactivity fee can apply after 12 months without trading |

Spread betting access for UK residents alongside CFD and FX Active accounts | Deposit and withdrawal methods are relatively limited compared with e-wallet heavy brokers |

Next Generation platform with 115 indicators, 70 patterns, and 12 chart types | Share CFD commission structure can be costly, with minimum charges per trade |

12,000+ instruments including 330+ FX pairs and 10,000+ shares | No swap-free account option in the UK branch |

XM Group

XM Group is a global Forex and CFD broker established in 2009, serving more than 15 million clients worldwide. The broker offers access to over 1,400 trading instruments, including 55+ Forex pairs, indices, commodities, metals, shares, and cryptocurrencies, with a very low minimum deposit of $5.

While the broker is not publicly listed or bank-owned, it maintains long standing regulatory compliance, a stable operational track record across multiple jurisdictions, and a stringent XM Group verification procedure for KYC and AML policies.

For UK traders, XM operates within a strict regulatory environment, applying strong standards for transparency, client fund segregation, and negative balance protection.

XM focuses primarily on the MetaTrader ecosystem, providing MetaTrader 4 and MetaTrader 5 on desktop, web, and mobile devices. The broker supports both market and instant execution models, with fast order processing and leverage levels adjusted to regulatory requirements applicable to UK clients. XM Group deposit and withdrawal methods include credit cards, bank transfers, and e-wallets.

From a cost and usability perspective, XM offers commission-free trading on most account types, spreads starting from around 0.6 pips, free deposits and withdrawals, and access to a wide range of educational resources. XM Group copy trading, continuous customer support, and localized services further enhance its appeal to UK-based traders.

Account Types | Standard, Ultra Low, Shares |

Regulating Authorities | FSC Belize, CySEC Cyprus, FSCA South Africa, DFSA Dubai, FSC Mauritius, FSA Sechelles |

Minimum Deposit | $5 |

Deposit Methods | Credit/Debit Cards, Bank Transfers, E-Wallet Payments |

Withdrawal Methods | Credit/Debit Cards, Bank Transfers, E-Wallet Payments |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, Mobile App |

XM Group Pros and Cons

Below is a concise overview of XM Group’s pros and cons, highlighting key considerations for UK traders evaluating this broker.

Pros | Cons |

Very low minimum deposit suitable for new traders | Inactivity fees apply to dormant accounts |

Negative balance protection for retail clients | Platform choice limited to MetaTrader only |

Commission-free pricing on most accounts | Fewer advanced tools for professional traders |

Strong educational content and customer support | No TradingView or cTrader integration |

Eightcap

Eightcap is a global Forex and CFD broker founded in 2009 in Melbourne, offering access to more than 800 tradable instruments across Forex, indices, commodities, metals, shares, and cryptocurrencies. The broker supports leverage up to 1:30, provides three main account types, and requires a minimum deposit of $100.

Eightcap supports MetaTrader 4, MetaTrader 5, and full TradingView integration, making it one of the few brokers closely aligned with TradingView users in the UK. Additional tools such as Capitalise.ai, FlashTrader, and an AI-powered economic calendar enhance automation, execution speed, and macro-driven analysis are available after completing the Eightcap registration process.

For UK traders, Eightcap operates under strict Financial Conduct Authority (FCA) regulation, ensuring segregated client funds, negative balance protection, and eligibility for compensation of up to £85,000 under the FSCS scheme. This regulatory structure places Eightcap among brokers offering strong investor protection within the UK market.

From a trading conditions perspective, Eightcap offers Raw and Standard pricing models, with spreads starting from 0.0 pips on Raw accounts and market execution across all platforms. Traders can receive up to $3.6 per lot cashback on FX trading commissions through the Eightcap rebate program. Scalping and algorithmic trading are permitted, while margin call and stop-out levels are set at 80% and 50%.

Account Types | Standard, Raw, TradingView, Demo |

Regulating Authorities | ASIC, FCA, CySEC, SCB |

Minimum Deposit | $100 |

Deposit Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Withdrawal Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Maximum Leverage | 1:30 |

Trading Platforms & Apps | MT4, MT5, TradingView |

Eightcap Pros and Cons

Below is a focused overview of Eightcap’s main pros and cons, highlighting factors that UK traders should carefully evaluate before opening an account.

Pros | Cons |

FCA regulation with FSCS protection up to £85,000 | Crypto CFDs unavailable for UK retail traders |

Deep TradingView integration with advanced charting | No copy trading or PAMM investment options |

Access to MT4, MT5, and automation tools | Educational content less structured for beginners |

Competitive spreads and fast market execution | Inactivity fee applies after prolonged dormancy |

Global Prime

Global Prime is an Australian-founded forex and CFD broker launched in 2010, linked to Jeremy Kinstlinger and operating through multi-entity licensing. It provides access to 150+ instruments across forex, indices, commodities, crypto CFDs, bonds, and US share CFDs, with raw pricing options and execution speeds listed from 10 ms.

Global Prime regulatory coverage includes tier 1 ASIC oversight for the Australian entity and a VFSC license for international onboarding. Client safety features vary by entity, but segregated accounts are stated, alongside negative balance protection under the ASIC-regulated branch and higher leverage availability under the offshore entity.

Trading is built around MetaTrader 4, with Standard and Raw accounts designed for different cost preferences. Standard pricing starts from 0.9 pips with $0 commission, while Raw pricing can start from 0.0 pips with commissions shown as $3.5 per side or $7 per round lot on FX and metals. Global Prime rebate program offers spread discounts up to 44.44%.

Funding is designed for broad access, with 15+ payment methods and broker-side deposit and withdrawal fees listed as $0 across common options, including cards, bank wire, PayPal, Neteller, Skrill, and crypto. Added value programs include Autochartist signals, ZuluTrade integration, and perks like TradingView Premium and an FT subscription, all available by completing the Global Prime registration process.

Account Types | Standard, Raw |

Regulating Authorities | VFSC, ASIC |

Minimum Deposit | $0 |

Deposit Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, FasaPay, Perfect Money, Bank Wire, etc. |

Withdrawal Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, AstroPay, Perfect Money, Bank Wire |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4 |

Global Prime Pros and Cons

The pros and cons below summarize Global Prime’s main strengths and limitations across regulation, pricing, platforms, instruments, and account features before moving into the detailed sections.

Pros | Cons |

Raw pricing available with spreads from 0.0 pips on FX majors | No FCA-regulated UK entity, no FSCS protection |

No broker fees on deposits or withdrawals across major methods | MT4 only, no MT5, cTrader, or TradingView yet |

GBP supported as a base currency, reducing conversion costs | UK residents onboarded via an offshore entity |

Transparent execution model with fast order execution | No swap-free account option available |

Fusion Markets

Fusion Markets is a global forex and CFD broker founded by Phil Horner and operating under the trading name Gleneagle Securities Pty Limited. The broker is regulated by ASIC and the VFSC, offering access to seven major markets with ultra-low trading costs and no minimum deposit requirement.

Fusion Markets is widely known for its raw pricing model, delivering average spreads from 0.0 pips on major forex pairs such as EUR/USD. The broker claims trading costs up to 36% lower than competitors and supports both retail and professional traders through flexible account structures.

Funds are held in segregated accounts with tier-one banks, including HSBC and National Australia Bank, for clients who have completed the Fusion Markets verification process. Institutional backing from Glen Eagle Securities, which manages over $400 million in client assets, reinforces operational transparency and capital strength.

Fusion Markets supports a broad range of platforms, including MetaTrader 4, MetaTrader 5, cTrader, and TradingView. Additional features such as copy trading, MAM accounts, VPS hosting, and commission-free US share CFDs, available through Fusion Markets dashboard, expand its appeal to active and algorithmic traders.

Account Types | Zero, Classic, Swap-Free |

Regulating Authorities | ASIC, VFSC |

Minimum Deposit | $0 |

Deposit Methods | VISA, MasterCard, PayPal, Perfect Money, PayID, Bank Wire, Crypto, Skrill, Neteller, etc. |

Withdrawal Methods | PayPal, Perfect Money, Bank Wire, Crypto, Skrill, Neteller, etc. |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, cTrader, TradingView |

Fusion Markets Pros and Cons

Below is a clear overview of Fusion Markets’ main advantages and limitations, helping assess how its pricing, regulation, and platform offering compare before reviewing detailed specifications.

Pros | Cons |

Very low FX spreads from 0.0 pips on raw pricing accounts | No FCA-regulated UK entity available |

No minimum deposit, suitable for flexible account sizing | No FSCS protection for UK residents |

Access to MT4, MT5, cTrader, and TradingView platforms | GBP is not available as a base account currency |

No deposit or withdrawal fees on most funding methods | Educational resources are limited for beginners |

BlackBull Markets

BlackBull Markets, registered as Black Bull Group Limited, is a New Zealand based broker founded in 2014 by Michael Walker and Selwyn Loekman. It is a multi award winning provider with 7 notable awards, offering access to 6 asset classes and 26,000+ tradable instruments.

BlackBull Markets regulatory coverage includes the New Zealand FMA and the Seychelles FSA, with segregated client accounts and negative balance protection stated across entities. The New Zealand entity lists FSCL membership 5623, while the offshore entity highlights ECN-style access and broader international reach.

Trading is available after completing the BlackBull Markets verification process via MT4, MT5, cTrader, and TradingView, plus BlackBull CopyTrader and BlackBull Invest for copy trading and stock-focused workflows. Account options include ECN Standard, ECN Prime, and ECN Institutional, with minimum deposits from $0 and order sizes from 0.01 lots.

Pricing is structured around spreads and commissions, with minimum spreads from 0.0 pips on higher-tier ECN accounts. Commission levels include $0.0 on ECN Standard, $6.0 on ECN Prime, and $4.0 on ECN Institutional. After going through BlackBull Markets registration process, traders can fund their accounts using cards, SEPA, e-wallets, and crypto.

Account Types | ECN Standard, ECN Prime, ECN Institutional |

Regulating Authorities | FSA, FMA |

Minimum Deposit | $0 |

Deposit Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Neteller, Skrill, SEPA, FasaPay |

Withdrawal Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Neteller, Skrill, SEPA, FasaPay |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, TradingView, cTrader, BlackBull CopyTrader, BlackBull Invest |

BlackBull Markets Pros and Cons

The pros and cons below summarize what stands out for UK-based users, with emphasis on regulation, protections, pricing, platforms, and account costs.

Pros | Cons |

26,000+ instruments across FX, indices, commodities, shares, and crypto | Availability can be limited for UK residents based on entity restrictions |

Platform choice includes MT4, MT5, cTrader, and TradingView | No FCA-regulated UK entity, no FSCS protection |

ECN-style pricing with spreads from 0.0 pips on select accounts | $5 withdrawal fee applies per transaction |

Strong public trust signals, Trustpilot 4.8 out of 5, TradingView 4.5 out of 5 | ECN Prime requires a $2,000 minimum deposit, and ECN Institutional requires $20,000 |

Is Forex Trading Legal in UK?

Forex trading is legal in the United Kingdom and operates under a clearly defined regulatory framework. Activities involving spot FX and CFDs fall within financial services rules overseen by the Financial Conduct Authority.

UK residents can access global FX markets through authorized firms that meet conduct, capital, and reporting standards. Unauthorized entities are prohibited from marketing or providing services to UK clients.

Introduction to the FCA Regulatory Framework for Forex Brokers

The Financial Conduct Authority regulates forex brokers offering services to UK residents. Its mandate focuses on market integrity, consumer protection, and competition across financial services.

Authorized brokers must meet capital adequacy rules, submit regular audits, segregate client funds, and comply with conduct of business standards designed to limit conflicts of interest.

- FCA authorization mandatory for UK brokers

- Capital and liquidity requirements enforced

- Ongoing supervision and reporting

- Marketing and disclosure rules tightly controlled

What Are FCA’s Warning Lists for Online Traders?

The FCA maintains a publicly accessible Warning List identifying firms suspected of providing financial services without proper authorization. These lists include outright scams and clone firms that impersonate regulated brokers by copying names, reference numbers, or branding to deceive UK traders.

Before opening an account or transferring funds, UK residents are advised to check the FCA Warning List. This step significantly reduces exposure to fraud, as unauthorized firms are not protected by UK law and fall outside the scope of FCA supervision and compensation mechanisms.

FCA's Policy on Client Protection Fund for Brokers

UK-regulated brokers participate in the Financial Services Compensation Scheme, which protects eligible clients if a firm becomes insolvent and cannot return customer funds. This scheme applies only to brokers authorized by the FCA and operating under UK regulatory permissions.

The FSCS provides coverage of up to £85,000 per person per firm. This protection works alongside segregated client accounts, offering an additional safety layer for UK residents trading forex and CFDs through FCA-regulated brokers.

How to Verify FCA Authorization for a Broker?

UK traders can verify a broker’s legal status using the FCA Financial Services Register. This database confirms whether a firm is authorized, its permitted activities, and its legal entity structure, providing transparency before account registration or fund transfers.

To avoid clone scams, traders must ensure the broker’s website domain, contact details, and firm reference number exactly match the information shown on the FCA register. Any mismatch is a strong warning signal requiring immediate caution.

- Visit the official FCA Financial Services Register through the FCA website and open the firm search section;

- Enter the broker’s legal name or Firm Reference Number exactly as displayed on the broker’s website;

- Confirm that the broker’s status is shown as authorized and not an appointed representative or unauthorized;

- Review the permitted activities section to ensure forex or CFD services are explicitly listed;

- Check the registered legal entity name and country to confirm it matches the broker’s stated structure;

- Compare the broker’s website domain with the domain listed on the FCA register to detect clone firm risks;

- Verify contact details, including phone numbers and email addresses, against the FCA record;

- Treat any mismatch in reference number, domain, or contact information as a warning sign and avoid funding the account.

How to Select the Best Forex Brokers in the UK?

Selecting a forex broker in the UK requires evaluating regulation, pricing transparency, execution quality, and platform reliability. FCA authorization and FSCS eligibility are primary considerations, as they directly affect client protection and legal accountability.

Beyond regulation, UK traders should assess spreads, commissions, execution speed, and available trading platforms. Strong customer support, transparent disclosures, and long-term operational stability further distinguish reliable brokers from high-risk alternatives.

- FCA authorization: Confirms legal operation in the UK under Financial Conduct Authority supervision and strict compliance standards;

- FSCS protection: Ensures client funds are covered up to £85,000 in case of broker insolvency;

- Pricing transparency: Displays clear spreads and commissions with no hidden trading or non-trading charges;

- Execution quality: Delivers fast order execution with low slippage during normal and volatile market conditions;

- Trading platforms: Offers reliable platforms such as MT4, MT5, cTrader, or stable proprietary systems;

- Customer support: Provides responsive assistance during UK trading hours with clear communication channels;

- Operational history: Demonstrates long-term stability through consistent regulation and market presence.

How to Start Forex Trading in the United Kingdom?

Starting forex trading in the UK requires opening an account with an FCA-authorized broker and completing identity verification. This includes proof of identity, proof of address, and completion of an appropriateness assessment required under UK financial regulations.

Note that you can also trade Forex and CFDs through non-FCA-regulated brokers, but you won’t receive the same level of protection.

Once approved, traders can fund their accounts using supported payment methods and select their preferred trading platform. Retail protections such as leverage limits, negative balance protection, and risk disclosures are applied automatically to eligible UK accounts.

Best UK Forex Brokers for Beginners (Important Factors)

Beginner-friendly forex brokers in the UK focus on simplicity, education, and risk management rather than high leverage or complex instruments. FCA regulations ensure that beginner traders receive adequate disclosures and protection before engaging in leveraged trading.

Key beginner features include demo accounts, intuitive platforms, educational materials, and automatic negative balance protection. These elements help reduce early mistakes and align trading activity with the UK’s consumer protection framework.

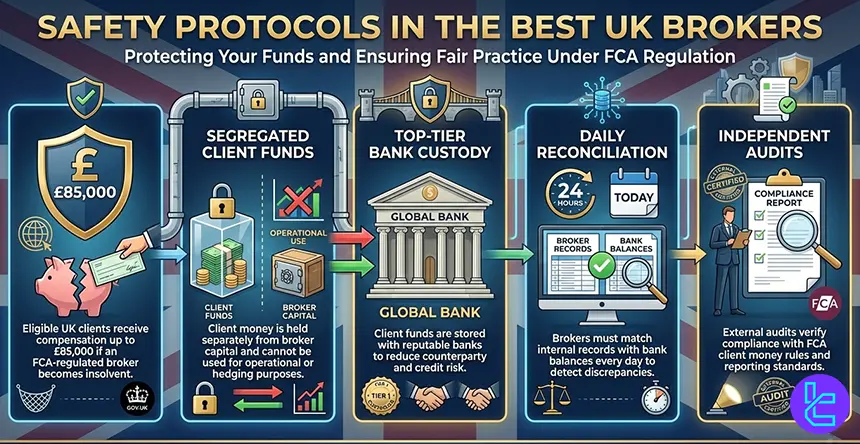

What Are Brokers’ Safety of Funds Protocols for UK Residents?

UK forex brokers must segregate client funds from company operating capital under the FCA Client Assets Sourcebook. Client money is typically held in top-tier banks and cannot be used for hedging, lending, or operational expenses.

Daily reconciliation, independent audits, and strict reporting requirements reduce the risk of misuse. These protocols enhance transparency and provide additional security for UK residents trading through FCA-regulated firms.

Negative Balance Protection in UK Brokers

Negative balance protection ensures that retail traders in the UK cannot lose more than their deposited funds. This rule applies toall FCA-regulated brokers and protects clients during periods of extreme volatility or market gaps.

If losses exceed account equity, the broker absorbs the deficit. This protection applies only to retail accounts and is not guaranteed for traders classified as professional under FCA criteria.

Does Forex Trading in the UK Incur Taxes?

Forex trading profits in the UK may be subject to Capital Gains Tax or Income Tax, depending on trading structure and frequency. CFD trading profits are typically taxable, while spread betting profits are generally exempt under current UK tax law.

Tax treatment varies by individual circumstances and HMRC classification. UK traders are responsible for reporting taxable gains and should consult official HMRC guidance for accurate obligations.

Trading Type | HMRC Classification | Applicable Tax | Tax Rate | Tax Allowance |

Spread Betting | Gambling activity | No tax (generally) | 0% | Not applicable |

Forex & CFD Trading (Retail) | Capital Gains | Capital Gains Tax (CGT) | 10% or 20% | £3,000 CGT allowance (2024/25) |

Forex & CFD Trading (Professional / Business) | Trading income | Income Tax | 20%–45% | Personal Allowance £12,570 |

Forex Trading via Limited Company | Corporate profits | Corporation Tax | 19%–25% | No personal allowance |

What Leverage Caps Do FCA-Regulated Brokers Offer?

The FCA limits leverage for retail forex traders to reduce risk exposure. Major currency pairs are capped at 1:30, while lower limits apply to minor pairs, indices, and commodities under product intervention rules.

Professional traders who meet eligibility criteria may access higher leverage. However, they forfeit certain retail protections, including guaranteed negative balance protection and some compensation rights.

What Trading Fees Should UK Traders Expect?

UK forex traders typically encounter spreads, commissions, overnight financing costs, and currency conversion fees. FCA rules require brokers to disclose all trading costs clearly before execution, ensuring transparency and comparability.

Non-trading fees, such as inactivity charges or data subscriptions, vary by broker. Understanding the full cost structure is essential for managing long-term trading expenses effectively.

Popular Trading Platforms in UK Brokers

UK forex brokers commonly support MetaTrader 4, MetaTrader 5, TradingView, and proprietary platforms. Platform choice affects charting depth, order execution, automation capabilities, and overall trading efficiency.

Most platforms like MetaTrader 5 offer web, desktop, and mobile access. Stability, latency, indicator availability, and order controls are key considerations for UK traders selecting a trading environment.

Can UK Traders Access Professional Forex Accounts? (Differences with Retail Accounts)

UK traders can apply for professional forex accounts by meeting experience, volume, or portfolio size criteria defined by the FCA. Professional classification allows higher leverage and fewer trading restrictions.

Professional accounts lose certain retail protections, such as negative balance protection and some compensation rights. This classification is intended for experienced market participants with higher risk tolerance.

To be classified as a professional client under FCA rules, a trader must satisfy at least two of the three eligibility criteria below:

- Trading Activity: 10 or more significant trades per quarter over the last year, demonstrating consistent and active market participation

- Financial Portfolio: Financial assets exceeding €500,000 or GBP equivalent, excluding property, vehicles, and physical commodities

- Professional Experience: At least one year in a financial role involving derivatives, trading, or leveraged market instruments

Helpful Links for UK Forex/CFD Traders

Official UK institutions provide essential resources for forex regulation, taxation, and compliance. These sources help traders verify broker authorization, understand tax obligations, and manage payments securely.

- UK Tax Guidance Portal: Official UK government hub covering income tax, capital gains, corporate tax, and reporting obligations

- Financial Conduct Authority (FCA): UK financial regulator overseeing brokers, protecting consumers, and maintaining integrity across financial markets

- FCA Financial Services Register: Official database to verify authorized brokers, firms, permissions, and warning signs of clone scams

- FCA Warning List: Official FCA database identifying cloned, fraudulent, and unregulated firms targeting UK traders

Forex Trading Conditions in UK Compared to Other Countries

Comparison Factor | United Kingdom | |||

Primary Regulator | Financial Conduct Authority (FCA) | Capital Markets Authority (CMA) | Australian Securities and Investments Commission (ASIC) | Cyprus Securities and Exchange Commission (CySEC) |

Regulatory Framework | National FCA regulations | National regulation under CMA | National framework under ASIC | EU wide MiFID II under ESMA |

Retail Leverage Cap Forex Majors | Up to 1:30 | Up to 1:400 | 1:30 | 1:30 (EU retail under MiFID II) |

Investor Protection Level | High | Medium | High | High |

Negative Balance Protection | Mandatory | Mandatory | Mandatory | Mandatory |

Client Fund Segregation | Mandatory under FCA rules | Required under CMA rules | Required under ASIC rules | Mandatory under CySEC rules |

Broker Transparency Requirements | Transparent risk disclosures under FCA oversight | Not Strict | Licensing and conduct rules under ASIC | Strict disclosure and capital adequacy requirements |

Broker Availability | Local and international | CMA-regulated local and international brokers | ASIC licensed brokers | CySEC licensed brokers with EU passporting |

Access to International Brokers | Yes | Yes | Yes | Yes |

Typical Trading Platforms | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader | MT4, MT5, cTrader, TradingView, NinjaTrader | MT4, MT5, cTrader |

Maximum Loss Protection | Cannot lose more than deposit | Cannot lose more than deposit | Cannot lose more than the deposit | Cannot lose more than deposit |

Tax Treatment of Forex Profits | capital gains tax for retail traders | Taxable income by Kenya Revenue Authority | Generally treated as assessable income and must be reported to the Australian Taxation Office | For Cyprus residents, forex trading profits may be treated as personal or business income |

Conclusion and Expert Suggestions

The UK forex market operates under FCA regulation, enforcing leverage caps of 1:30, negative balance protection, segregated funds, and FSCS compensation up to £85,000. Best UK brokers typically offer 1,000 to 17,000 tradable CFDs, GBP base accounts, spreads from 0.0 to 0.8 pips, and multi-platform access.

FCA authorization, FSCS eligibility, execution speed under 50 ms, and transparent pricing models are decisive factors for top Forex brokers. Brokers supporting MT4, MT5, TradingView, and proprietary platforms, with GBP funding, low inactivity fees, and strong Trustpilot scores above 4.0, suit UK traders best.

Brokers are evaluated using a multi-factor scoring model that measures cost efficiency, regulatory strength, and account flexibility, following the core standards established in the TradingFinder Forex methodology framework.