Vietnam is a fast-growing economy with people who have an interest in financial markets. However, it does not host a financial authority that specifically regulates Forex trading. The State Bank of Vietnam, the country’s central bank, only regulates the Vietnamese Dong’s flow.

Vietnam-based traders can trade in almost any brokerage they wish, but those with high-tier regulators are recommended first.

Best Forex Brokers for Vietnam

| Justmarkets | |||

| IC-markets | |||

| IUX | |||

| 4 |  | XM | ||

| 5 |  | Fxglory | ||

| 6 |  | PU-Prime | ||

| 7 |  | Errante | ||

| 8 |  | Alpari | ||

| 9 |  | D prime |

Vietnam Highly Rated Forex Brokers Based on Trustpilot

Here’s a ranking of the brokerages mentioned above based on the user reviews and scores submitted on Trustpilot.

Broker Name | Trustpilot Rating | Number of Reviews |

4.8 ⭐ | 49,744 | |

IUX | 4.2 ⭐ | 876 |

FXGlory | 4.2⭐ | 65 |

PU Prime | 3.8⭐ | 1,567 |

JustMarkets | 3.7⭐ | 3,845 |

XM | 3.5⭐ | 2,826 |

D Prime | 3.1⭐ | 460 |

2.7⭐ | 298 | |

2.6⭐ | 37 |

Brokers With Low Spreads for Vietnam-Based Traders

Spreads directly affect the profits and efficiency of your trades in a broker. The list below introduces some of the best options for Vietnam in this regard.

Broker Name | Min. Spreads |

JustMarkets | 0 Pips |

IC Markets | 0 Pips |

Interactive Brokers | 0 Pips |

0 Pips | |

PU Prime | 0 Pips |

Errante | 0 Pips |

0.1 Pip | |

ActivTrades | 0.5 Pips |

XM | 0.6 Pips |

Non-Trading Fees Ranking in Forex Brokers for Vietnam

Sometimes the costs go beyond spreads and commissions; some brokers charge clients with deposit/withdrawal and inactivity fees.

Broker Name | Deposit Fee | Withdrawal Fee | Inactivity Fee |

IC Markets | None | None | None |

None | None | None | |

IUX | None | None | None |

JustMarkets | None | None | $5 |

VT Markets | None | Varies | None |

FxPro | None | None | $15 First, then $5 Monthly |

None | None | $10 | |

FXGlory | Varies | Varies | None |

Alpari | Varies | Varies | $10 |

Trading Instruments Variety in Vietnam Forex Brokers

Having access to a high number of tradable symbols is a benefit worth noting while reviewing a broker. The table below ranks the options for the Vietnam-based with highest number of instruments.

Broker Name | Number of Instruments |

IC Markets | 2,200+ |

XM | 1,400+ |

800+ | |

Libertex | 300+ |

Exness | 200+ |

IUX | 160+ |

Alpari | 120+ |

90+ | |

FXGlory | 40+ |

Top 7 Forex Brokers for Vietnam Residents

In each of the following sections, we will briefly, but comprehensively, introduce and review the best brokerages for Vietnam-based traders. Also, pay attention to the pros and cons of each option.

IC Markets

IC Markets is a global multi-asset Forex and CFD broker established in Australia in 2007 and widely used across Asia-Pacific markets.

The broker operates under multiple regulatory frameworks, including ASIC, CySEC, and the Seychelles FSA, offering traders a balance between institutional-grade infrastructure and flexible trading conditions.

For traders in Vietnam, IC Markets provides access to leverage of up to 1:500 through its offshore entity, alongside strong fund-safety practices such as segregated client accounts and external audits.

The broker supports MetaTrader 4, MetaTrader 5, and cTrader, with ultra-fast market execution and spreads from 0.0 pips on Raw Spread accounts. More than 60 Forex pairs and over 2,100 stock CFDs are available, with a minimum deposit of $200 and multiple base currencies including USD, SGD, and JPY.

IC Markets is particularly suitable for scalpers, algorithmic traders, and high-volume Forex traders in Vietnam who prioritize tight pricing, deep liquidity, and platform flexibility. You can participate in the IC Markets rebate program for a discount on trading costs and spreads.

Here’s a summary of the broker’s specifics.

Account Types | Standard, Raw Spread, Islamic |

Regulating Authorities | FSA, CySEC, ASIC |

Minimum Deposit | $200 |

Deposit Methods | Bank Cards, Wire Transfers, Electronic payments, etc. |

Withdrawal Methods | Bank Cards, Wire Transfers, Electronic payments, etc. |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile |

IC Markets Pros and Cons

For an outlook of the broker’s benefits and drawbacks, here’s a table.

Pros | Cons |

Competitive pricing with low average spreads | Minimum deposit could be high for some traders |

Wide range of trading platforms | - |

Scalable execution for algorithmic traders | - |

Extensive market offering (2,250+ tradable symbols) | - |

IUX

IUX is a fast-growing Forex and CFD broker founded in 2016, offering flexible trading conditions that appeal to active traders in Southeast Asia, including Vietnam.

The broker operates through multiple regulatory entities under ASIC, FSCA, and FSC Mauritius, while maintaining segregated client funds and negative balance protection across its accounts.

IUX provides Standard, Raw, and Pro accounts with a notably low minimum deposit of $10 and leverage of up to 1:3000, making it accessible for traders who prioritize capital efficiency. You can go through our IUX registration guide for opening an account with the broker.

Trading is available via MetaTrader 5, the IUX Web platform, and a proprietary mobile app, all supporting fast STP execution and floating spreads from 0.0 pips on Raw accounts.

With coverage across Forex, indices, commodities, stocks, and crypto CFDs, IUX is best suited for experienced day and swing traders in Vietnam who value high leverage, low entry costs, and multi-platform flexibility, while accepting the trade-off of lighter regulatory oversight compared to Tier-1-only brokers.

Summary of Specifics

Account Types | Standard, Raw, Pro |

Regulating Authorities | FSC, FSCA, ASIC |

Minimum Deposit | $10 |

Deposit Methods | Mobile Money, Bank Transfer, Cards (Visa, Master), QR, E-wallet, Crypto, Virtual Bank |

Withdrawal Methods | Mobile Money, Bank Transfer, Cards (Visa, Master), QR, E-wallet, Crypto, Virtual Bank |

Maximum Leverage | 1:3000 |

Trading Platforms & Apps | MetaTrader5, Web Trader, Application |

IUX Pros and Cons

You should always consider the advantages and disadvantages of a financial firm before making any investment.

Pros | Cons |

Low transaction costs | overnight fees |

Very high liquidity | Risks associated with high leverage |

A diverse range of tradable products | Lack of strict regulation |

FXGlory

FXGlory is an offshore Forex broker founded in 2011 and based in Saint Lucia, offering trading conditions that prioritize accessibility and high leverage.

The broker is not regulated by major financial authorities, but it provides international clients with simple account access, flexible funding options, and leverage levels of up to 1:3000.

For traders in Vietnam, FXGlory appeals mainly through its extremely low entry barrier, with a minimum deposit starting from just $1 and micro-lot trading from 0.01 lots. FXGlory trading platforms include the MetaTrader 4 and MetaTrader 5.

The broker offers fixed and floating spreads across four FXGlory account types, which are Standard, Premium, VIP, and CIP.

Trading is limited to Forex pairs, metals, and oil, with zero commissions and optional swap-free accounts. A recurring 50% deposit bonus is also available, though it is non-withdrawable.

FXGlory is most suitable for high-risk-tolerant traders in Vietnam who value very high leverage, low capital requirements, and bonus-driven trading, while accepting the trade-offs of limited regulation and a narrower market range.

For a guide on opening an account with the broker, check out our FXGlory registration article. Here’s a summary of the broker’s details.

Account Types | Standard, Premium, VIP, CIP |

Regulating Authorities | None |

Minimum Deposit | $1 |

Deposit Methods | Wire Transfer, Credit/Debit Card, PayPal, NETELLER, Payza, Skrill, OKPAY, Webmoney, Sticpay, Perfect Money, CryptoCurrency, Zelle |

Withdrawal Methods | Wire Transfer, Credit/Debit Card, PayPal, NETELLER, Payza, Skrill, OKPAY, Webmoney, Sticpay, Perfect Money, CryptoCurrency, Zelle |

Maximum Leverage | 1:3000 |

Trading Platforms & Apps | Metatrader 4, Metatrader 5 |

FXGlory Pros and Cons

It’s essential to familiarize yourself with a chosen broker’s advantages and disadvantages.

Pros | Cons |

Multiple account types to suit different trading styles | High minimum deposits for premium, VIP, and CIP account types |

High leverage up to 1:3000 | No copytrading system available |

No commission charges | Lack of regulation by major financial authorities like the FCA or CySEC |

Competitive spreads starting from 0.1 pips on CIP accounts | Limited educational resources compared to other competitors, such as Admirals |

Demo account available | Limited trading instruments |

XM

XM Group is a well-established Forex and CFD broker founded in 2009, serving millions of clients across Asia, Europe, and emerging markets.

The broker operates under multiple regulatory frameworks, including CySEC, FSCA, DFSA, FSC, and FSA, providing a structured and transparent trading environment.

For traders in Vietnam, XM combines broad market access with a very low entry threshold, requiring a minimum deposit of just $5 while offering negative balance protection across retail accounts.

XM provides access to more than 55 currency pairs and over 1,400 CFDs covering indices, commodities, shares, cryptocurrencies, and precious metals.

Trading is available exclusively via MetaTrader 4 and MetaTrader 5, with spreads starting from around 0.6 pips and no commissions on standard and ultra-low accounts.

The XM Group rebate program reduces your trading costs by offering cashbacks. Leverage can reach up to 1:1000, depending on the trading entity and instrument.

Overall, XM Group is well suited for Vietnamese traders seeking a regulated, MetaTrader-focused broker with low capital requirements, stable execution, and a broad multi-asset offering rather than ultra-tight institutional pricing. You can read our XM Group dashboard review for details into the broker’s interface.

Here’s a summary of the broker’s specifications.

Account Types | Standard, Ultra Low, Shares |

Regulating Authorities | FSC Belize, CySEC Cyprus, FSCA South Africa, DFSA Dubai, FSC Mauritius, FSA Sechelles |

Minimum Deposit | $5 |

Deposit Methods | Credit/Debit Cards, Bank Transfers, E-Wallet Payments |

Withdrawal Methods | Credit/Debit Cards, Bank Transfers, E-Wallet Payments |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, Mobile App |

XM Group Pros and Cons

Before going through the XM Group registration process, consider the pros and cons.

Pros | Cons |

Wide Range of Trading Instruments | Inactivity Fees |

Low Minimum Deposit | - |

Multiple Regulatory Licenses | - |

Negative Balance Protection | - |

JustMarkets

JustMarkets is a global Forex and CFD broker established in 2012, serving traders across more than 160 countries with a strong focus on accessibility and flexible trading conditions.

The broker operates under multiple regulatory entities, including CySEC, FSCA, FSC, and the Seychelles FSA, while applying client fund segregation and negative balance protection across all accounts.

For traders in Vietnam, JustMarkets offers high leverage options of up to 1:3000 through non-EU entities, combined with fast execution and broad account flexibility.

JustMarkets supports MetaTrader 4 and MetaTrader 5, covering Forex, commodities, indices, stocks, and crypto CFDs. Traders can start with a minimum deposit of $10 on Standard Cent or Standard accounts, open positions from 0.01 lots, and access floating spreads from 0.0 pips on Raw Spread accounts with transparent commissions.

JustMarkets deposit and withdrawal methods cover a good range of options, including bank transfers, e-payments, credit/debit cards, etc.

Overall, JustMarkets is suitable for Vietnamese traders seeking high leverage, low entry requirements, and multi-asset access, particularly those interested in flexible account structures rather than purely institutional-style pricing.

Summary of Specifics

Account Types | Standard Cent, Standard, Pro, Raw Spread |

Regulating Authorities | CySEC, FSA, FSCA, FSC |

Minimum Deposit | From $10 |

Deposit Methods | Bank transfer, E-payments, Credit/Debit cards, Crypto, Local banks |

Withdrawal Methods | Bank transfer, E-payments, Credit/Debit cards, Crypto, Local banks |

Maximum Leverage | 1:3000 |

Trading Platforms & Apps | MT4, MT5, Mobile App |

JustMarkets Pros and Cons

If you are about to enter the JustMarkets registration page, first, learn about the broker’s important upsides and downsides.

Pros | Cons |

Multi-regulated (CySEC, FSA, and FSCA) | Limited asset offerings |

Fast withdrawals | Service restrictions for some countries |

User-friendly platforms | Some reports of technical glitches |

Multi-lingual customer support | - |

PU Prime

PU Prime is a multi-asset Forex and CFD broker founded in 2016, offering broad market access and flexible trading conditions for clients across Asia-Pacific regions.

The broker operates under several regulatory frameworks, including ASIC, FSCA, and offshore entities regulated by the Seychelles FSA and Mauritius FSC, while applying client fund segregation and negative balance protection for retail traders.

Regarding payments, e-wallets and crypto transactions are some of the options among PU Prime deposit/withdrawal methods.

PU Prime provides access to more than 800 instruments across Forex, indices, commodities, shares, bonds, metals, and ETFs. Trading is available via MetaTrader 4, MetaTrader 5, and the proprietary PU Prime mobile app, with floating spreads from 0.0 pips on Prime and ECN accounts.

The minimum deposit starts from $20, and leverage can reach up to 1:1000 depending on the entity and instrument.

Overall, PU Prime suits Vietnamese traders looking for a balance between multi-asset coverage, moderate entry costs, copy trading options, and platform flexibility rather than ultra-low institutional-only pricing. You can visit our PU Prime dashboard page to read a review of the broker’s user interface.

The table below demonstrates an overview of the specifics:

Account Types | Standard, Prime, ECN, Cent |

Regulating Authorities | SVG FSC, Mwali FSC, FSCA, ASIC |

Minimum Deposit | $20 |

Deposit Methods | Credit Card, E-wallets, cryptocurrencies, wire transfer |

Withdrawal Methods | Credit Card, E-wallets, cryptocurrencies, wire transfer |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, PU Prime app |

PU Prime Pros and Cons

If you are considering opening an account through the PU Prime registration form, learn about the broker’s pros and cons, first.

Pros | Cons |

Wide range of tradable assets | Mixed reviews on credible websites |

Variety of account types | - |

Up to 1:1000 | - |

Advanced trading platforms | - |

Various bonuses | - |

Alpari

Alpari is one of the longest-standing Forex and CFD brokers in the industry, operating since 1998 and serving traders across more than 150 countries.

The broker is regulated by the Mwali International Services Authority (MISA) and the National Bank of the Republic of Belarus, and applies key safety measures such as segregated client funds and negative balance protection.

For traders in Vietnam, Alpari offers flexible access to global markets with leverage reaching up to 1:1000 on Standard accounts and higher levels available on ECN-based accounts.

Alpari supports MetaTrader 4 and MetaTrader 5, providing access to Forex, commodities, metals, indices, stock CFDs, and crypto CFDs.

The minimum deposit starts from $50 on the Standard account, with spreads from around 1.2 pips and commission-free pricing on non-ECN accounts. Advanced traders can also use ECN and Pro ECN accounts with tighter spreads and market execution. Also, this broker offers up to 40% discount on Forex spreads through the Alpari rebate program.

Overall, Alpari is suitable for Vietnamese traders who value a long operating history, MetaTrader flexibility, PAMM investment options, and a balance between moderate entry costs and high leverage rather than strict Tier-1 regulation.

If you have registered with the broker after reading our review but are confused with the authorization process, check out our Alpari verification guide.

For an outline of the broker’s details, look at the table below.

Account Types | Standard, ECN, Pro ECN, Demo |

Regulating Authorities | MISA |

Minimum Deposit | $50 |

Deposit Methods | Local Payment Solutions, Credit/Debit Cards, E-Wallets, Bank Wire Transfers (in some regions), Crypto Payments |

Withdrawal Methods | Local Payment Solutions, Credit/Debit Cards, E-Wallets, Bank Wire Transfers (in some regions), Crypto Payments |

Maximum Leverage | 1:3000 |

Trading Platforms & Apps | MT4, MT5, WebTrader |

Alpari Pros and Cons

Let’s learn about some of the important advantages and disadvantages that are worthy of noting.

Pros | Cons |

Support for MT4 and MT5 platforms | Limited regulatory coverage |

Diverse trading instruments | - |

Multiple account types | - |

Long-standing reputation in the industry | - |

What Are the Factors Considered in Choosing the Best Vietnam Brokers?

Selecting the best Forex brokers in Vietnam requires a structured, data-driven approach, as traders are effectively entrusting brokers with both capital security and execution quality.

To ensure objectivity and transparency, TradingFinder applies a proprietary evaluation framework designed to reflect real trading conditions rather than promotional claims.

At the core of our review process is a 19-metric assessment model developed by experienced forex market analysts.

Regulation and licensing form the foundation of this analysis, with close attention paid to brokers operating under recognized international authorities, particularly those accessible to Vietnamese traders.

Beyond compliance, TradingFinder evaluates each broker’s background - including founding year, operational history, and global office presence - to assess long-term reliability.

Trading conditions are reviewed in depth. This includes account-type diversity (Standard, ECN, PAMM, and micro structures), available tradable instruments (FX pairs, indices, commodities, CFDs), and the full cost structure covering spreads, commissions, and non-trading fees. Deposit and withdrawal efficiency is tested directly, focusing on speed, transparency, and supported payment methods relevant to the Vietnam market.

Platform accessibility is another key pillar. Brokers offering stable environments such as MetaTrader 4, MetaTrader 5, cTrader, and mobile trading apps score higher for flexibility. Additional factors include account opening simplicity, copy trading availability, educational resources, and the accuracy of market data and infographics.

Finally, TradingFinder incorporates external sentiment by analyzing verified client feedback from Trustpilot, alongside broker responsiveness, scam alerts, and transparency in news updates. This holistic methodology ensures our Vietnam broker rankings are practical, unbiased, and trader-focused.

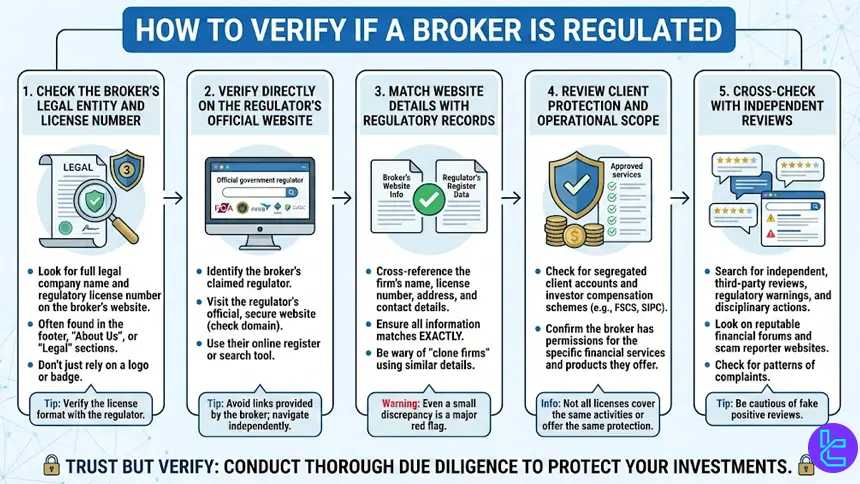

How to Verify if a Broker Is Regulated

Verifying a broker’s regulatory status is a critical step before opening a trading account, especially in offshore-friendly markets like Vietnam where international brokers actively operate. A regulated broker is subject to legal oversight, capital requirements, and client-protection rules that directly affect fund safety and dispute resolution.

#1 Check the Broker’s Legal Entity and License Number

Start by identifying the broker’s legal entity name, not just the brand. This information is usually listed in the website footer or legal documents. A legitimate broker clearly discloses its license number and supervising authority, such as the FSA, ASIC, or CySEC.

You can check out the financial authorities’ credibility tiers on the TF score page.

#2 Verify Directly on the Regulator’s Official Website

Never rely solely on claims made on the broker’s website. Visit the regulator’s official registry and search using the license number or legal entity name.

Confirm that the broker’s status is “authorized” or “licensed” and check whether passporting or cross-border services are permitted for international clients, including those based in Vietnam.

#3 Match Website Details with Regulatory Records

Ensure consistency between the broker’s website and regulatory filings. The registered address, company name, and domain should match exactly. Any discrepancies may indicate clone firms or misuse of another company’s license.

#4 Review Client Protection and Operational Scope

Regulation alone is not enough. Check what protections the license provides, such as segregated client funds, leverage limits, negative balance protection, and complaint-handling procedures. Some regulators also publish warning lists for unauthorized brokers.

#5 Cross-Check with Independent Reviews

Finally, validate your findings using independent research platforms like TradingFinder, which analyze regulatory credibility as part of a broader broker-evaluation framework. This layered verification process significantly reduces the risk of trading with unregulated or misleading brokers.

Is Forex Trading Legal in Vietnam?

Forex trading in Vietnam exists in a legal gray area that often causes confusion among retail traders. While individuals in Vietnam can access international forex brokers and trade global currency markets online, domestic forex trading services are heavily restricted under local law.

The primary regulatory authority overseeing monetary and financial activities in the country is the State Bank of Vietnam. Under Vietnamese regulations, only licensed credit institutions - such as banks and authorized financial entities - are permitted to offer foreign exchange services within Vietnam.

These services are typically limited to currency exchange, international payments, and hedging activities for businesses, not speculative retail forex trading.

As a result, no local broker is legally allowed to provide leveraged forex trading to retail clients inside Vietnam. However, this does not explicitly prohibit Vietnamese residents from trading forex through foreign-regulated offshore brokers. In practice, many traders in Vietnam access brokers regulated in jurisdictions such as the UK, Australia, or the EU, where retail forex trading is clearly defined and supervised.

It is important to note that trading with overseas brokers places responsibility on the trader to ensure the broker’s legitimacy, regulatory standing, and client protection policies. Vietnamese authorities generally focus enforcement on unlicensed domestic providers rather than individuals trading with international platforms.

In summary, forex trading is not formally legalized nor directly criminalized for individuals in Vietnam. The key distinction lies in where the broker is licensed and operates.

Vietnamese traders should prioritize well-regulated international brokers and avoid any local entities claiming domestic authorization for retail forex trading, as these claims often conflict with Vietnamese financial law.

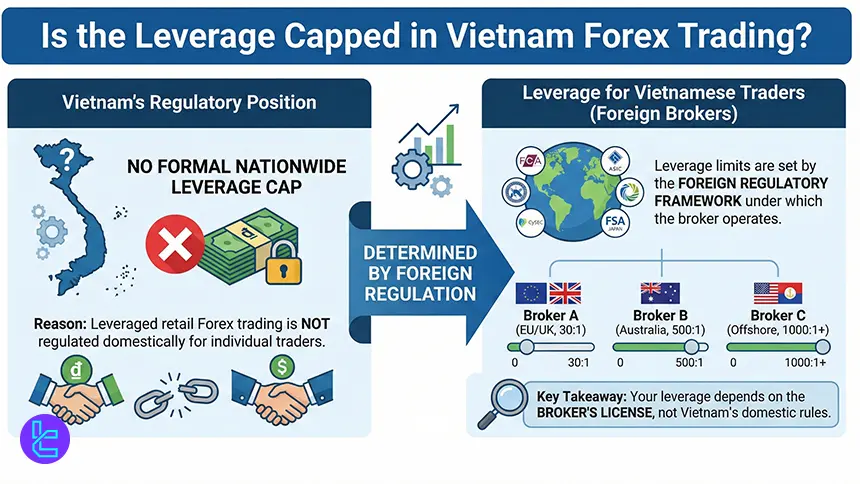

Is the Leverage Capped in Vietnam Forex Trading?

Vietnam does not impose a formal, nationwide leverage cap on retail forex trading in the way some highly regulated jurisdictions do. This is mainly because leveraged retail forex trading is not regulated domestically for individual traders.

Instead, leverage limits applicable to Vietnamese traders are determined by the foreign regulatory framework under which a broker operates.

Since local authorities such as the State Bank of Vietnam do not license domestic retail forex brokers, there are no Vietnam-specific rules defining maximum leverage ratios for private traders. As a result, Vietnamese residents accessing offshore brokers are subject to the leverage restrictions - or lack thereof - imposed by the broker’s regulator.

For example, brokers regulated by the Financial Conduct Authority or Cyprus Securities and Exchange Commission typically cap retail leverage at 1:30 for major currency pairs under ESMA-style investor protection rules.

Also, brokers licensed by the Australian Securities and Investments Commission apply a similar 1:30 cap for retail clients, while offshore regulators may allow leverage of 1:200, 1:500, or higher.

This flexibility can be a double-edged sword. Higher leverage increases market exposure but also magnifies drawdowns and liquidation risk. Because Vietnamese traders often access brokers outside strict regulatory regimes, leverage discipline becomes a personal risk-management responsibility rather than a legal requirement.

In practice, the safest approach is to choose a broker regulated by a reputable authority and treat leverage as a risk-control tool, not a profit accelerator. Regardless of what a broker allows, conservative leverage usage remains critical in the absence of Vietnam-specific regulatory caps.

Negative Balance Protection in Vietnam Forex Brokers

Negative Balance Protection is an essential safety mechanism in forex trading, yet it is not enforced under Vietnamese financial law. Because retail forex brokers are not licensed domestically, there is no national regulation requiring brokers to protect traders from losses exceeding their account balance.

Key points Vietnam-based traders should understand include:

- No domestic enforcement: Vietnam does not mandate Negative Balance Protection, as retail forex trading is not supervised by the State Bank of Vietnam;

- Protection depends on the broker’s regulator: Brokers regulated by authorities such as the FCA and the CySEC are required to provide Negative Balance Protection, including clients based in Vietnam;

- Offshore brokers may exclude this protection: Brokers licensed in offshore jurisdictions often do not guarantee Negative Balance Protection or limit it to specific account types, particularly those offering very high leverage;

- Always confirm in legal documents: Details about Negative Balance Protection are typically outlined in the broker’s Client Agreement or Risk Disclosure, not in marketing materials.

In Vietnam’s loosely regulated forex environment, selecting brokers that explicitly offer Negative Balance Protection should be considered a non-negotiable risk-management requirement, especially during periods of high market volatility.

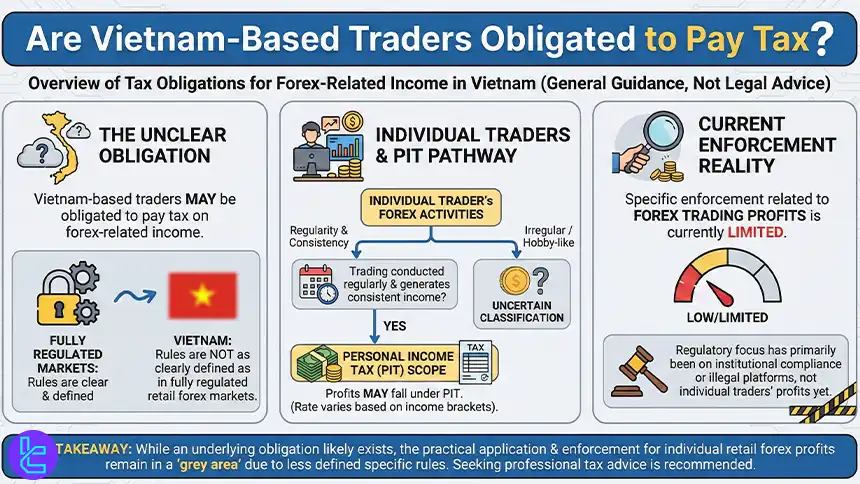

Are Vietnam-Based Traders Obligated to Pay Tax?

Vietnam-based traders may be obligated to pay tax on forex-related income, although the rules are not as clearly defined as in jurisdictions with fully regulated retail forex markets.

Vietnam does not currently have a specific tax framework dedicated exclusively to retail forex trading, which means taxation is generally interpreted under broader income-tax regulations.

Tax administration in Vietnam falls under the General Department of Taxation, operating under the Ministry of Finance. In principle, any income generated by Vietnamese residents from overseas activities, including online trading with foreign brokers, can be considered taxable personal income, regardless of where the broker is located.

For individual traders, forex profits may fall under personal income tax (PIT) if trading is conducted regularly and generates consistent income. Vietnam’s tax system applies PIT based on residency status, meaning residents are typically taxed on worldwide income, not only income earned domestically.

However, enforcement related specifically to forex trading profits remains limited, largely due to the offshore nature of most trading platforms and the absence of direct reporting from foreign brokers.

It is important to distinguish between casual trading activity and trading that resembles a business operation. High-frequency trading, large capital flows, or consistent withdrawals into Vietnamese bank accounts may increase the likelihood of tax scrutiny.

Banks and payment intermediaries can flag recurring foreign inflows, even if the source is an international broker.

Because regulatory and tax interpretations can evolve, Vietnamese traders are advised to consult a local tax professional for personalized guidance. Relying solely on the lack of explicit forex tax rules may expose traders to compliance risks if regulations tighten in the future.

How Does Vietnam Forex Trading Compare to That in Other Countries?

Vietnam’s Forex market differs notably from both tightly regulated jurisdictions and partially restricted markets. Unlike countries with dedicated retail Forex regulators, Vietnam relies on offshore access, placing greater responsibility on traders to assess broker credibility, leverage risk, and fund protection.

Comparing Vietnam with regulated hubs such as Germany and Singapore, as well as a restricted market like India, highlights how regulation, leverage limits, investor protection, and tax treatment can shape the overall trading environment.

The table below summarizes these structural differences to help traders understand where Vietnam stands globally and what trade-offs exist when choosing to trade from Vietnam versus other major regions.

Comparison Factor | Vietnam | |||

Primary Regulator | No dedicated Forex regulator; SBV oversees currency controls | BaFin under ESMA & MiFID II | Monetary Authority of Singapore (MAS) | SEBI & RBI |

Regulatory Framework | No domestic retail Forex framework | EU-wide MiFID II & ESMA | National framework under MAS | Strict national framework under FEMA |

Retail Leverage Cap (Forex Majors) | Not capped locally; broker-dependent | 1:30 | ~1:20 | Very limited (exchange-traded only) |

Investor Protection Level | Low to moderate (broker-dependent) | Very high | High | High (for exchange products) |

Negative Balance Protection | Broker-dependent | Mandatory | Not mandatory | Not applicable |

Client Fund Segregation | Depends on broker regulation | Mandatory | Mandatory | Mandatory |

Broker Availability | Offshore international brokers | EU-passported brokers | MAS-licensed global brokers | SEBI-approved brokers only |

Access to International Brokers | High | High | High | Limited |

Typical Trading Platforms | MT4, MT5, cTrader | MT4, MT5, cTrader, TradingView | MT4, MT5, TradingView | Exchange platforms, limited MT access |

Maximum Loss Protection | Broker-dependent | Cannot lose more than deposit | Entity-dependent | Defined by exchange rules |

Tax Treatment of Forex Profits | Interpreted as personal income | Capital gains tax | Usually tax-free for retail | Taxable as business or income |

Conclusion

Vietnam is not a regulated space in terms of Forex trading, and it has both benefits and drawbacks; there is no leverage cap or taxation framework, but, on the other hand, no negative balance protection or investor protection scheme is provided.

IC Markets, IUX, Alpari, and XM are some of the best options for Vietnam-based Forex traders who prefer a high number of instruments, low spreads, and fair non-trading fees.

To learn about our full evaluation framework for choosing the best brokers, read our Forex methodology.