The Financial Services Commission is an international regulatory authority located in Mauritius which supervises certain Forex brokers in the industry. Considered as an offshore regulator, brokerages regulated by it are more generous in terms of leverage limitations and bonuses.

Here are the best brokers under the supervision of the FSC.

| PU Prime | |||

| STARTRADER | |||

| Prime XBT | |||

| 4 |  | FP Markets | ||

| 5 |  | TMGM | ||

| 6 |  | FXTM | ||

| 7 |  | VT Markets |

Trustpilot Scores for FSC Brokerages

The table below ranks the mentioned brokers based on the user scores submitted on the “Trustpilot” platform.

Broker Name | Trustpilot Score | Number of Reviews |

9,891 | ||

VT Markets | 2,299 | |

STARTRADER | 882 | |

PrimeXBT | 415 | |

TMGM | 2 | |

FXTM | 1,075 | |

1,767 |

Trading Spread in FSC Brokers

Always pay attention to the spread conditions and numbers in a brokerage before making any investments in it.

Broker Name | Min. Spread |

FP Markets | 0 Pips |

0 Pips | |

0 Pips | |

LiteFinance | 0 Pips |

TMGM | 0 Pips |

FXTM | 0 Pips |

Trive | 0 Pips |

Non-Trading Fees in FSC-Regulated Brokers

The table in this part of the article demonstrates the deposit/withdrawal and inactivity fees involving with the mentioned brokers.

Broker Name | Deposit Fee | Withdrawal Fee | Inactivity Fee |

FP Markets | $0 | $0 | $0 |

STARTRADER | $0 | $0 | $0 |

VT Markets | $0 | From 1% via Skrill | $0 |

LiteFinance | $0 on Most Options | $0 on Most Options | $10 Monthly |

TMGM | $0 on Most Options | $0 on Most Options | $10 Monthly |

$0 on Most Options | $0 | $10 Monthly | |

Trive | 1.5% on Select Options | 0.5% on Select Options | €10 Monthly |

Number of Instruments Provided by FSC Brokers

The following table ranks the recommended brokerages based on the number of tradable instruments.

Broker Name | Number of Instruments |

12,000+ | |

D Prime | 10,000+ |

Trive | 5,000+ |

FXTM | 1,000+ |

VT Markets | 800+ |

LiteFinance | 300+ |

100+ |

Top 6 Forex Brokers Regulated by the FSC

The next sections are each dedicated to a summary review of a recommended brokerage that is regulated by the FSC.

FP Markets

Founded in 2005, FP Markets (First Prudential Markets) operates as a multi-jurisdiction Forex/CFD brokerage with licensing that includes Financial Services Commission (Mauritius), Australian Securities and Investments Commission, Cyprus Securities and Exchange Commission, Financial Sector Conduct Authority, and other offshore entities.

Across its Standard and RAW accounts, FP Markets targets cost-sensitive trading with a $50 minimum deposit and floating spreads that can start from 0.0 pips (RAW). The RAW model pairs tight pricing with a $3 commission per lot, while the Standard account avoids commission and typically starts from 1.0 pip.

For a reduction in fees, a FP Markets rebate program is provided.

FP Markets supports MT4, MT5, and cTrader, covering manual execution, algorithmic systems (EAs), and copy/algo setups. The broker lists broad market access, Forex, indices, commodities, metals, stocks, ETFs, and crypto CFDs, alongside features like Islamic (swap-free) options, PAMM/MAM allocation, and 24/7 support channels.

From a safety framework angle, the broker highlights segregated funds and negative balance protection across its entities, while protections and leverage depend on the client’s onboarded branch. Under EU-facing rules, CySEC oversight is shown via license 371/18, whereas non-EU entities can offer materially higher leverage than 1:30.

Overall, FP Markets tends to be shortlisted in FSC (Mauritius) broker comparisons for its low-entry $50 deposit, ECN-style RAW pricing, and wide platform coverage; while trade-offs usually relate to the lack of a proprietary platform, region-based restrictions, and entity-dependent leverage/terms.

Summary of Specifics

Account Types | Standard, RAW |

Regulating Authorities | ASIC, CySEC, FSC, FSCA, FSA |

Minimum Deposit | $50 |

Deposit Methods | Visa and Master card, Skrill, PayPal, Neteller, Bank Transfer |

Withdrawal Methods | Visa and Master card, Skrill, PayPal, Neteller, Bank Transfer |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, cTrader |

FP Markets Pros and Cons

Here’s a summary of the broker’s benefits and drawbacks.

Pros | Cons |

Multi-regulated structure including FSC (Mauritius), ASIC, and CySEC | No proprietary trading platform (platform stack is MT4/MT5/cTrader) |

RAW account pricing with spreads from 0.0 pips + clear commission model | Not available to U.S. clients (geo-restrictions apply) |

Broad multi-asset lineup (10,000+ instruments cited across product range) | Protections/conditions vary by entity, which can complicate comparisons |

Supports copy/algo trading plus PAMM/MAM options and Islamic accounts | High leverage availability under offshore entities increases risk if misused |

VT Markets

Founded in Australia, VT Markets is a multi-asset Forex and CFD broker serving over 400,000 active traders and processing 30+ million trades per month. The broker provides access to 1,000+ instruments across 7 markets, including Forex, indices, shares, metals, energies, ETFs, and bonds.

From a regulatory standpoint, VT Markets operates under a multi-jurisdiction framework, holding licenses from Australian Securities and Investments Commission (ASIC), Financial Sector Conduct Authority (FSCA), and the Financial Services Commission.

The FSC-regulated entity allows global clients to access leverage up to 1:500 with negative balance protection.

Account diversity is a core strength. VT Markets offers Standard STP, RAW ECN, Cent STP, and Cent ECN accounts, supporting base currencies such as USD, EUR, GBP, AUD, CAD, and HKD. Spreads start from 0.0 pips on ECN models, while STP accounts feature commission-free pricing.

On the technology side, traders can access MetaTrader 4, MetaTrader 5, WebTrader+ (TradingView-powered), and the proprietary VT Markets mobile app. You can visit the VT Markets dashboard page to learn more about the broker’s interface.

Additional investment options such as Copy Trading and PAMM accounts further expand its appeal beyond manual trading.

Specifics and Details

Account Types | Standard STP, RAW ECN, Cent STP, Cent ECN, Demo |

Regulating Authorities | FSCA, ASIC, FSC Mauritius |

Minimum Deposit | $50 |

Deposit Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Withdrawal Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Webtrader+, VT Markets App |

VT Markets Pros & Cons

Before going through VT Markets registration, take a look at the broker’s main advantages and limitations to help assess its suitability among FSC-regulated Forex brokers.

Pros | Cons |

FSC Mauritius regulation with global client eligibility | No excess loss insurance beyond regulatory standards |

ECN spreads from 0.0 pips with flexible account types | ASIC entity limited to wholesale clients only |

Support for MT4, MT5, WebTrader+, and mobile app | Trust score declined after separation from Vantage Group |

Copy Trading and PAMM investment options available | Crypto trading availability is limited and region-dependent |

STARTRADER

Founded in 2012 and headquartered in Seychelles (Registration No. 8427362-1), STARTRADER is a multi-asset CFD broker listing 1,000+ instruments, including 50+ forex pairs and 70+ global equities, with micro-lot trading from 0.01 lots and a stated minimum deposit of $50.

The broker runs STP and ECN account structures with market execution, targeting different cost models: STP pricing typically embeds costs in the spread, while ECN pricing can start from 0.0 pips with commissions (instrument/account dependent). Leverage can reach up to 1:1,000, depending on the entity and client location.

For a review of the broker’s funding options, check out the STARTRADER deposit and withdrawal methods page.

Platform access is built around MetaTrader 4, MetaTrader 5, WebTrader, and a proprietary mobile app, supporting multi-device trading and common workflows such as scalping and algorithmic execution. Base currencies listed include AUD, CAD, EUR, GBP, USD, and NZD.

Regulation is spread across multiple entities, including Financial Services Commission (Mauritius) (license GB24203371) and other frameworks such as Australian Securities and Investments Commission, Financial Conduct Authority, Financial Sector Conduct Authority, Financial Services Authority (Seychelles), and Securities and Commodities Authority.

Table of Specifications

Account Types | STP, ECN |

Regulating Authorities | FCA, SCA, FSC, FSA, FSCA, ASIC |

Minimum Deposit | $50 |

Deposit Methods | Visa/Mastercard, E-Wallet, International Bank Wire Transfer |

Withdrawal Methods | Visa/Mastercard, E-Wallet, International Bank Wire Transfer |

Maximum Leverage | 1:1000 (Depend on the Country of Registration) |

Trading Platforms & Apps | Proprietary Mobile App, MT4, MT5 |

STARTRADER Pros and Cons

STARTRADER fits an FSC (Mauritius)-focused shortlist when the priority is broad instrument coverage, MT4/MT5 availability, and low entry requirements, while the trade-off often comes down to jurisdiction-specific protections, plus how much research/education depth is needed for your content benchmarks.

Pay attention to the advantages and disadvantages before opening an account through STARTRADER registration.

Pros | Cons |

1,000+ CFD instruments across multiple markets | Protection levels differ by entity (compensation is not universal) |

ECN pricing with spreads from 0.0 pips (account/instrument dependent) | Research and education stack is comparatively limited |

Multiple platforms (MT4/MT5/WebTrader + mobile app) | Leverage and features vary materially by registration country |

Payment flexibility, including Perfect Money and Wise | Crypto availability can be restricted depending on region/entity |

PrimeXBT

Founded in 2018, PrimeXBT serves over 1 million clients worldwide, delivering multi-asset trading across Forex, CFDs, and Crypto markets. With a minimum deposit of just $15, the platform targets both entry-level and active traders seeking flexible market access.

PrimeXBT offers Forex, 100+ CFDs, and Spot & Futures Crypto trading, enhanced by native TradingView charting. Crypto Futures fees are competitive, starting from 0.01% maker and 0.02% taker, positioning the broker as a cost-efficient option for high-frequency and derivatives traders.

From a regulatory standpoint, PrimeXBT operates under a multi-jurisdiction framework, including oversight from the FSC Mauritius, FSA Seychelles, FSCA South Africa, Lithuania FCIS, and El Salvador’s BCR. This structure allows global reach while maintaining baseline compliance safeguards.

Trading infrastructure includes a proprietary WebTrader, mobile apps, and MT5 access via a regulated partner, with leverage up to 1:1000, spreads from 0.1 pips, and support for copy trading, promotions, and Crypto Futures.

If you are willing to choose this one, there’s a PrimeXBT registration guide you may get help from.

Specifics and Parameters

Account Types | Standard, Demo |

Regulating Authorities | FSA, FCIS, FSCA, BCR, FSC |

Minimum Deposit | $15 |

Deposit Methods | Visa/Mastercard, E-Wallet, International Bank Wire Transfer, Crypto |

Withdrawal Methods | Visa/Mastercard, E-Wallet, Bank cards, Crypto |

Maximum Leverage | 1:1000 (Depend on the Country of Registration) |

Trading Platforms & Apps | Proprietary Mobile App, WebTrader, MT5 |

PrimeXBT Pros & Cons

Before starting with the broker through PrimeXBT registration, here is a balanced overview of its main advantages and limitations to help evaluate whether it aligns with different trading strategies and risk profiles.

Pros | Cons |

Low minimum deposit of $15 | No Tier-1 regulatory license |

Crypto Futures with TradingView integration | Limited number of traditional CFD assets |

High leverage up to 1:1000 | Fee structure lacks full transparency |

Built-in copy trading and promotions | MT5 available only via partner entity |

TMGM

TMGM (TradeMax Global Markets) is an Australian forex and CFD broker launched in 2013, offering access to 12,000+ instruments across Forex, stocks, indices, commodities, energies, and cryptocurrency CFDs. Its product depth is paired with multi-platform coverage, including MT4, MT5, IRESS, and the TMGM Mobile App.

For traders comparing FSC (Mauritius) Forex brokers, TMGM operates a multi-entity structure that includes FSC Mauritius alongside ASIC (Tier-1), VFSC, and CMA oversight. Client-fund segregation is listed across entities, while negative balance protection is available under specific jurisdictions, making the regulatory setup highly entity-dependent.

Pricing is structured around two core retail accounts: EDGE/ECN (spreads from 0.0 pips with $3.5/lot commission) and CLASSIC (from 1.0 pip with $0 commission). There is an official TMGM rebate program for discounts on trading costs.

The broker supports 0.01-lot minimum orders, $100 minimum deposit, and leverage up to 1:1000 under eligible non-ASIC entities.

Beyond execution and liquidity focus, TMGM adds copy trading and social trading (HUBx/ZuluTrade integration) plus a Rewards Program where lots traded convert into redeemable points.

Funding options include cards, bank transfer, e-wallets, and stablecoins like USDT/USDC, with 24/7 support via live chat, phone, and email. The table below demonstrates a summary of specifics.

Account Types | EDGE/ECN, CLASSIC |

Regulating Authorities | ASIC – Australia, VFSC – Vanuatu, CMA -Kenya, FSC-Mauritius, FSA - Seychelles |

Minimum Deposit | $100 |

Deposit Methods | VISA, MasterCard, Bank Transfer, RMB Instant, Revolut, WISE, Neteller, Skrill, Union Pay, Fasapay, Crypto (USDT, USDC) |

Withdrawal Methods | Bank Transfer, RMB Instant, Revolut, WISE, Neteller, Skrill, Crypto (USDT, USDC) |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, IRESS, TMGM Mobile App |

TMGM Pros and Cons

TMGM blends deep instrument coverage, competitive ECN-style pricing, and copy trading features, while its protections and leverage vary by entity, especially under offshore regulators like the FSC Mauritius branch. Below is a quick snapshot of the broker’s main advantages and limitations.

Pros | Cons |

12,000+ tradable instruments across multiple CFD markets | Investor protections differ by entity (e.g., NBP not universal) |

Tight pricing on EDGE/ECN (from 0.0 pips) with clear commission model | Inactivity fee applies after prolonged non-use |

Strong platform mix: MT4, MT5, IRESS, and mobile app | Limited variety in core retail account types (2 main options) |

Copy/social trading plus Rewards Program for active traders | Some regions restricted (e.g., USA, Japan, Iran) |

FXTM

FXTM (ForexTime) is an international Forex and CFD broker established in 2011, serving 1M+ traders across 150+ countries. Operating under FSC in Mauritius, the broker focuses on high-leverage trading and global market access.

FXTM offers trading on Forex, stocks, indices, commodities, metals, and cryptocurrencies, supporting spot and futures instruments. With leverage reaching up to 1:3000, the broker targets experienced traders seeking flexible margin conditions beyond what top-tier regulators typically allow.

The broker provides access to MetaTrader 4, MetaTrader 5, and its proprietary FXTM Trader App, alongside copy trading via FXTM Invest. Account options include Advantage, Advantage Plus, and Advantage Stocks, with spreads starting from 0.0 pips depending on the account structure.

There is a FXTM rebate program available for reduced spreads and trading fees.

From a regulatory standpoint, FXTM currently operates solely under FSC Mauritius (Tier-3). While the broker previously held licenses from authorities such as the FCA and CySEC, those registrations are no longer active, placing FXTM firmly in the offshore-regulated category today.

Table of Specifics and Parameters

Account Types | Advantage, Stocks Advantage, Advantage Plus |

Regulating Authorities | FSC |

Minimum Deposit | $200 |

Deposit Methods | FasaPay, TC Pay, M-Pesa, VISA, MasterCard, Maestro, Google Pay, GlobePay, Skrill, PayRedeem, Perfect Money, Neteller, Bank Wire Transfer |

Withdrawal Methods | FasaPay, TC Pay, M-Pesa, VISA, MasterCard, Maestro, Google Pay, GlobePay, Skrill, PayRedeem, Perfect Money, Neteller, Bank Wire Transfer |

Maximum Leverage | 1:3000 |

Trading Platforms & Apps | MT4, MT5, FXTM Trader App |

FXTM Pros & Cons

The following pros and cons outline where the broker stands strong, and where limitations may matter for risk-aware traders, which are essential before FXTM registration.

Pros | Cons |

High leverage up to 1:3000 under FSC | Only offshore regulation (FSC Mauritius) |

Supports MT4, MT5, and FXTM Trader App | No investor compensation scheme |

Copy trading via FXTM Invest | Limited regulatory protection compared to Tier-1 brokers |

Wide range of markets and account types | Not available to U.S. and several other jurisdictions |

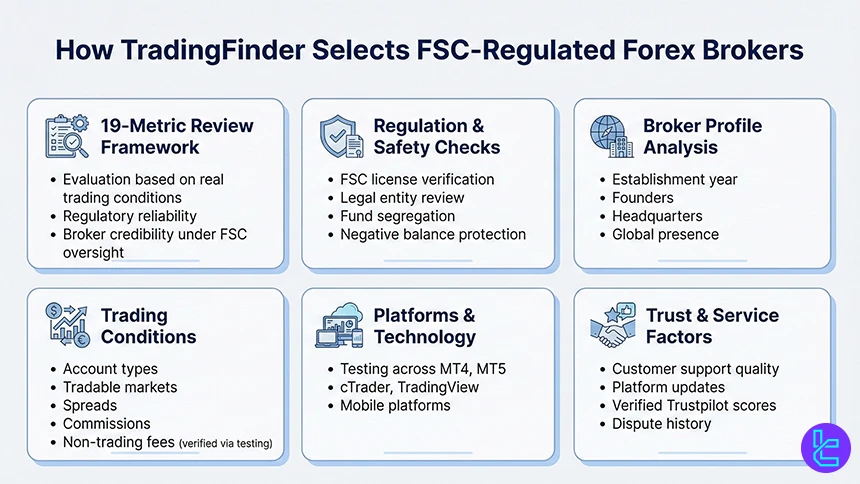

How We Chose Each Broker Regulated by FSC

Selecting the Best FSC-regulated Forex brokers requires more than comparing spreads or leverage claims. At TradingFinder, each broker featured in this article is evaluated using a 19-metric review methodology designed to reflect real trading conditions, regulatory reliability, and long-term broker credibility under Financial Services Commission (FSC) oversight.

Regulation and licensing form the foundation of our assessment. Our analysts verify FSC authorization, legal entity details, and cross-border regulatory coverage, while also reviewing client-fund segregation policies, negative balance protection, and available investor protection mechanisms.

Broker background data, such as year of establishment, founders, headquarters location, and global office presence, is carefully examined to assess operational stability.

Trading conditions are analyzed in depth. We review account type diversity (Standard, ECN, Micro, PAMM, Copy Trading), tradable instruments (Forex pairs, indices, commodities, stocks, ETFs, and CFDs), and cost structures, including spreads, commissions, deposit and withdrawal fees, and inactivity charges.

All pricing data is validated through hands-on testing and direct broker documentation.

Technology and usability are equally important. Brokers are tested across MetaTrader 4, MetaTrader 5, cTrader, TradingView, and mobile platforms, with attention to execution quality, account-opening procedures, KYC verification speed, and overall user experience.

Investment features such as copy trading, automation tools, and educational resources are also assessed for transparency and practical value.

Finally, qualitative factors complete the evaluation. We analyze customer support responsiveness, broker communication quality, educational infographics, platform updates, verified Trustpilot scores, scam alerts, and dispute-resolution behavior.

This structured, data-driven approach ensures every FSC broker listed meets TradingFinder’s standards for transparency, reliability, and trader-focused performance and not just regulatory compliance.

What is the FSC of Mauritius?

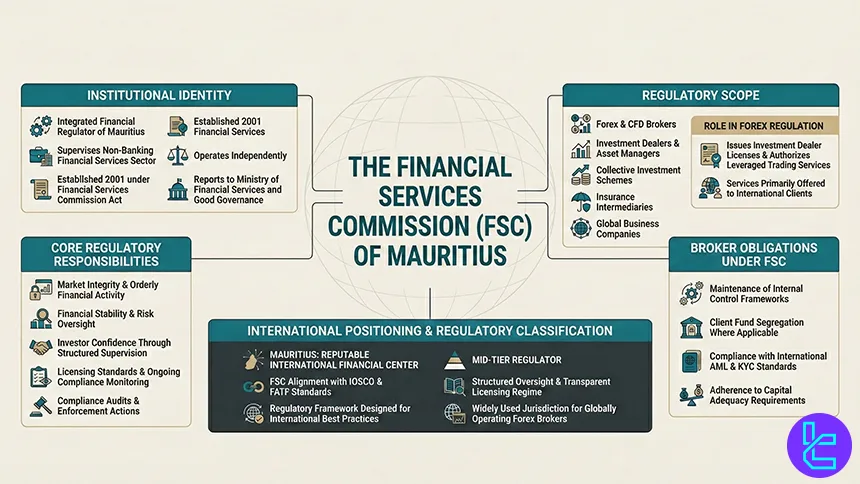

The Financial Services Commission is the integrated financial regulator responsible for supervising the non-banking financial services sector in Mauritius. Established in 2001 under the “Financial Services Commission Act”, the FSC operates independently and reports to the Ministry of Financial Services and Good Governance.

The FSC’s regulatory scope covers a wide range of financial activities, including Forex and CFD brokers, investment dealers, asset managers, collective investment schemes, insurance intermediaries, and global business companies.

For Forex brokers, the FSC issues Investment Dealer licenses, which authorize firms to provide leveraged trading services to international clients outside Mauritius.

A key role of the FSC is to ensure market integrity, financial stability, and investor confidence. This is achieved through licensing requirements, ongoing supervision, compliance audits, capital adequacy rules, and enforcement actions when regulatory breaches occur.

FSC-regulated brokers are required to maintain proper internal controls, segregate client funds where applicable, and comply with international AML and KYC standards.

Mauritius has positioned itself as a reputable international financial center, and the FSC plays a central role in aligning the country’s regulatory framework with global best practices set by organizations such as IOSCO and FATF.

While the FSC is generally classified as a mid-tier regulator, its structured oversight and transparent licensing regime make it a widely used jurisdiction for globally operating Forex brokers.

What are the Advantages and Disadvantages of the FSC Regulation for Brokers?

The FSC provides a balanced regulatory framework that allows brokers to operate internationally while maintaining core compliance standards. FSC regulation is often chosen for its operational flexibility, reasonable licensing costs, and structured oversight.

However, compared to top-tier regulators, investor protection mechanisms and enforcement intensity are more limited, which affects how traders perceive broker credibility.

Advantages and Disadvantages of FSC Regulation

Advantages | Disadvantages |

Recognized and established regulatory authority in an international financial center | Classified as a mid-tier regulator, not Tier-1 |

Faster licensing process compared to FCA or ASIC | No mandatory investor compensation scheme |

Flexible leverage and product offerings for global clients | Lower leverage of enforcement compared to EU regulators |

Clear legal framework for Forex and CFD brokers | Investor protection depends heavily on broker internal policies |

Alignment with international AML and KYC standards (FATF-compliant) | Less restrictive oversight may increase broker quality variance |

What Rules Are Followed by FSC-Regulated Brokers?

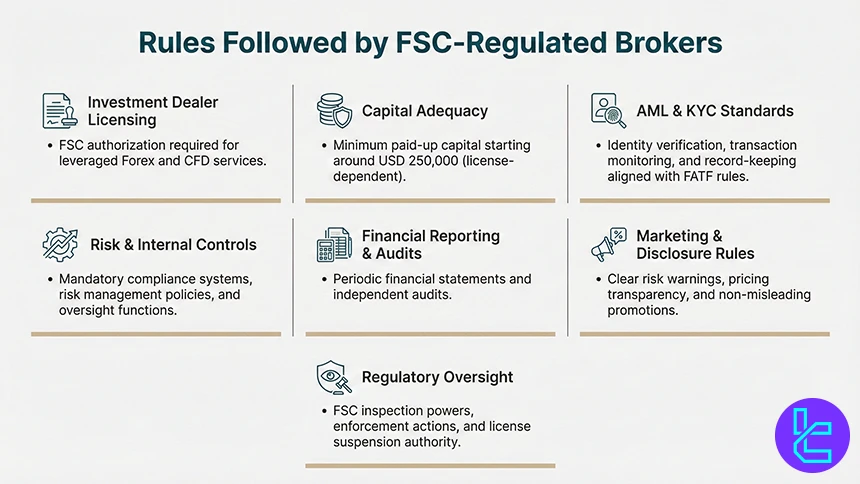

Forex and CFD brokers regulated by the FSC must comply with a defined regulatory framework designed to ensure legal accountability, financial integrity, and minimum investor protection standards for international clients. While the FSC offers more operational flexibility than Tier-1 regulators, it still enforces several mandatory obligations.

Key rules and requirements for FSC-regulated brokers include:

- Licensing as an Investment Dealer: Brokers must obtain an FSC Investment Dealer license (Full Service, Broker, or Discount Broker), which legally authorizes them to provide leveraged Forex and CFD trading services;

- Minimum Capital Requirements: FSC requires brokers to maintain a minimum paid-up capital (commonly starting from USD 250,000, depending on license type) to ensure operational stability;

- AML and KYC Compliance: Brokers must implement strict Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures in line with FATF standards, including identity verification, transaction monitoring, and record-keeping;

- Internal Controls and Risk Management: Licensed brokers are required to maintain adequate internal controls, compliance officers, risk-management policies, and reporting systems to monitor trading activity and client exposure;

- Financial Reporting and Audits: FSC-regulated firms must submit periodic financial statements and are subject to independent audits to confirm ongoing compliance and solvency;

- Fair Marketing and Disclosure Rules: Brokers must provide clear disclosures regarding trading risks, pricing models, execution policies, and conflicts of interest, and avoid misleading promotional practices;

- Regulatory Supervision and Enforcement: The FSC retains authority to conduct inspections, request records, impose sanctions, or suspend and revoke licenses in cases of non-compliance.

How to Check if a Broker Is Regulated by the FSC

Verifying a broker’s regulatory status with the Financial Services Commission (FSC) is an essential step before opening a trading account. The process is straightforward, but it must be done carefully to avoid cloned entities or misleading regulatory claims.

- Check the Broker’s Legal Disclosure: Visit the broker’s official website and review the footer, “Legal Documents”, or “About Us” section. An FSC-regulated broker should clearly display its legal company name, license type, and registration number;

- Visit the Official FSC Mauritius Website: Navigate directly to the FSC Mauritius website without using links provided by the broker. This reduces the risk of being redirected to fake or unofficial registries;

- Access the Licensee or Register of Licensees Section: Use the FSC’s public search tools to locate the “Register of Licensees”, where all authorized entities are listed;

- Search by Legal Name or License Number: Enter the broker’s exact legal entity name or license number as stated on the broker’s website. A valid entry should show the firm’s authorization status, license category, and approval date;

- Verify License Scope and Activity: Confirm that the license covers Investment Dealer / Forex or CFD-related activities, not unrelated financial services;

- Match the Trading Brand and Domain: Ensure the trading brand and website domain you are using are explicitly associated with the licensed entity. Some FSC license holders operate multiple brands, and not all domains may be covered;

- Review Status and Warnings: Check whether the license is marked as “Active”, “Suspended”, or “Revoked”, and look for any FSC warnings or enforcement notices linked to the firm.

Are Crypto Trading Services Provided in FSC-Regulated Brokers?

Yes, FSC-regulated brokers are allowed to provide crypto-related trading services, but the scope depends on how cryptocurrencies are offered and which license the broker holds. Under the supervision of the Financial Services Commission FSC, most Forex brokers offer cryptocurrencies primarily through CFD products, rather than direct ownership.

In practice, this means traders can speculate on the price movements of major digital assets such as Bitcoin or Ethereum without holding the underlying coins.

Crypto CFDs fall under the FSC’s Investment Dealer framework, allowing brokers to offer leveraged trading, short selling, and multi-asset access alongside Forex, indices, and commodities. Compared to EU regulators, FSC rules impose fewer product restrictions, which is why higher leverage on crypto CFDs is often available under Mauritius-licensed entities.

However, spot cryptocurrency trading and custody services are treated differently. Providing direct crypto buying, selling, or wallet custody typically requires additional registration as a Virtual Asset Service Provider (VASP) under Mauritius’ virtual asset regulations.

Not all FSC-regulated Forex brokers hold this authorization, which is why many limit their crypto exposure to derivative products only.

It is also important to note that client protections for crypto trading under FSC regulation differ from Tier-1 jurisdictions. While AML and KYC compliance is mandatory, there is no investor compensation scheme specifically covering crypto positions, and risk disclosures rely heavily on broker transparency.

As a result, FSC-regulated brokers offer broader crypto trading flexibility, but traders should carefully review whether crypto services are CFD-based or spot-based, and which regulatory entity governs those products.

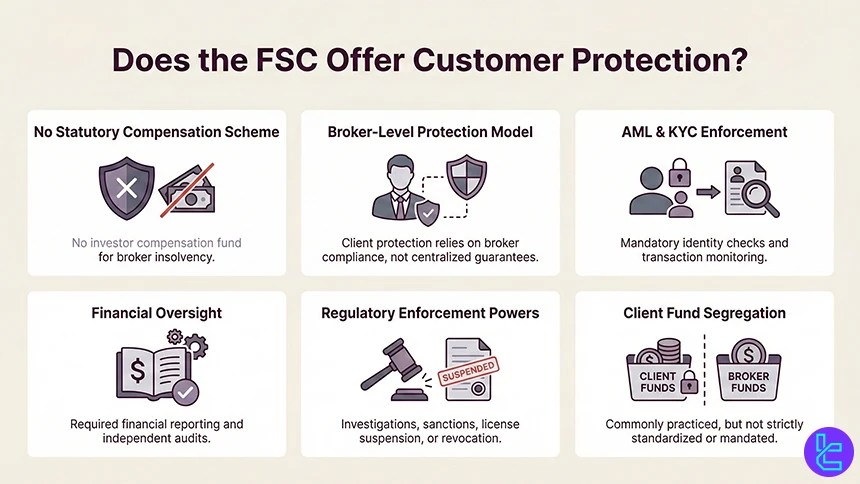

Does FSC Offer Any Customer Protections?

The FSC provides a regulatory oversight framework, but it does not offer direct, statutory customer protection schemes comparable to Tier-1 regulators. Instead, client protection under FSC regulation is principle-based and relies on broker-level compliance rather than centralized compensation mechanisms.

FSC-regulated brokers are required to comply with AML and KYC standards, maintain proper internal controls, and operate within the scope of their licensed activities. The FSC also enforces financial reporting and audit requirements, which aim to reduce insolvency risk and promote operational transparency.

In cases of misconduct, the FSC has the authority to investigate, impose sanctions, suspend licenses, or revoke authorization.

However, unlike regulators such as the FCA or CySEC, the FSC does not mandate an investor compensation fund. This means retail traders are not automatically entitled to compensation if an FSC-regulated broker becomes insolvent.

Client fund segregation is encouraged and commonly implemented, but it is not enforced with the same prescriptive structure seen in EU jurisdictions.

Negative balance protection is also not universally mandated by FSC rules. While many FSC-regulated brokers voluntarily offer it as part of their global risk policies, its availability depends on the broker’s internal terms and the trading entity used.

In summary, FSC regulation offers legal oversight and supervisory protection, but limited financial safety nets. Traders using FSC-regulated brokers should place greater emphasis on broker reputation, internal safeguards, and transparency when assessing overall risk.

How Does the FSC Differ from Top-Tier Regulatory Authorities?

The FSC differs from top-tier regulatory authorities primarily in regulatory intensity, investor protection depth, and enforcement reach. While the FSC provides a structured and internationally recognized licensing framework, it is generally classified as a mid-tier regulator, whereas authorities such as the FCA, ASIC, or CySEC are considered Tier-1.

One of the most significant differences lies in investor protection mechanisms. Top-tier regulators typically require mandatory participation in compensation schemes, such as the FSCS in the UK or the ICF in the EU, which can reimburse retail clients if a broker becomes insolvent.

The FSC does not operate a comparable statutory compensation fund, placing greater responsibility on brokers’ internal safeguards.

Leverage and product restrictions also vary considerably. FSC-regulated brokers often have more flexibility in offering higher leverage, crypto CFDs, and a wider range of derivative products. In contrast, top-tier regulators impose strict leverage caps, margin rules, and product intervention measures to limit retail risk exposure.

From anenforcement perspective, top-tier authorities generally have broader investigative powers, higher financial penalties, and more frequent public enforcement actions. While the FSC can suspend or revoke licenses and impose sanctions, its enforcement approach is typically less aggressive and more principles-based.

Finally, market perception and legal recourse differ. Brokers regulated by top-tier authorities benefit from stronger global trust and clearer dispute-resolution channels, while FSC regulation is often used to serve international clients seeking flexibility rather than maximum regulatory protection.

In essence, the FSC emphasizes operational efficiency and global accessibility, whereas top-tier regulators prioritize strict oversight and comprehensive investor safeguards.

FSC Comparison Table VS Other Regulatory Authorities

When comparing global Forex regulations, the FSC of Mauritius is generally positioned as a mid-tier regulator, offering greater operational flexibility than Tier-1 authorities such as the FCA, ASIC, and CySEC. FSC regulation is commonly used by internationally focused brokers that aim to provide higher leverage, broader product access, and fewer trading restrictions.

In contrast, top-tier regulators emphasize stricter capital requirements, mandatory investor compensation schemes, and tighter leverage limits for retail clients. Understanding these structural differences helps traders balance regulatory protection versus trading flexibility when choosing between FSC-regulated and Tier-1-regulated brokers.

Parameter | FSC (Mauritius) | CySEC (Cyprus) | ASIC (Australia) | FCA (UK) |

Regulatory Tier | Mid-tier | Tier-1 (EU) | Tier-1 | Tier-1 |

Minimum Capital Requirement | From ~USD 250,000 (license-type dependent) | €750,000+ depending on firm type | Not Specified | £125,000 – £730,000+ depending on model |

Client Fund Segregation | Required (principle-based) | Required | Required | Required (CASS rules) |

Investor Compensation Scheme | No statutory compensation fund | Investor Compensation Fund (~€20,000) | No statutory scheme (AFCA dispute resolution) | FSCS (~£85,000) |

Leverage Limits (Retail) | Flexible, often up to 1:500+ | ~1:30 under ESMA/MiFID II | ~1:30 | ~1:30 |

Negative Balance Protection | Not mandatory (broker-dependent) | Required | Required | Required |

Crypto & Product Restrictions | Broad flexibility (CFDs, high leverage) | Strict product intervention | Moderately strict | Highly restrictive (UK retail bans) |

Reporting & Audits | Periodic reporting and audits | Ongoing financial reporting | Regular compliance reporting | Intensive reporting & supervision |

Conclusion

Most of the Forex brokers in the industry could be eligible for a license from the FSC since it is considered an offshore financial authority. Traders choose these brokerages for less limitations and restrictions. Some of the best you can go with are FP Markets, VT Markets, STARTRADER, and PrimeXBT.

To learn about the details and factors in the way each brokerage is chosen, visit our “Forex methodology” page.