The Malta Financial Services Authority (MFSA) is a well-respected regulatory body that oversees financial activities in Malta. Forex brokers regulated by the MFSA offer a high level of trust, security, and compliance with EU financial standards.

These brokers are required to follow strict guidelines to protect traders' funds, provide fair trading conditions, and ensure transparency. The following are some of the best Forex brokerages operating under MFSA’s oversight.

| deriv | |||

| eToro | |||

| ALB | |||

| 4 |  | tier1fx | ||

| 5 |  | trive | ||

| 6 |  | TRADEVIEW Forex |

Trustpilot Rankings for Brokers Regulated by MFSA

Trustpilot rankings provide valuable insights into the experiences of real traders, offering an unbiased perspective on the quality of services provided by Forex brokers. In this section, we will review the Trustpilot ratings of MFSA-regulated brokers, focusing on their reputation within the trading community.

Broker Name | Trustpilot Rating | Number of Reviews |

70,453 | ||

eToro | 30,459 | |

Trive | 159 | |

Tier1FX | 2 | |

ALB | 9 | |

Tradeview Forex | 402 |

Spread Conditions in MFSA-Regulated Forex Brokers

Spread conditions are a crucial factor when selecting a Forex broker, as they directly affect trading costs and overall profitability. For brokers regulated by the Malta Financial Services Authority (MFSA), spread conditions are typically competitive, but they can vary depending on the broker, account type, and market conditions.

Broker Name | Min. Spread |

0.0 Pips | |

Swissquote | 0.0 Pips |

Tradeview Forex | 0.0 pips |

Trive | 0.1 Pips |

Tier1FX | 0.3 Pips |

ALB | 0.7 Pips |

Overview of Non-Trading Charges in MFSA Forex Brokers

Non-trading charges, although not directly related to the act of trading, can still significantly impact your overall trading costs. MFSA-regulated Forex brokers are required to maintain transparent fee structures, which often include non-trading charges such as deposit and withdrawal fees, account maintenance fees, and inactivity fees.

Broker Name | Deposit Fee | Withdrawal Fee | Inactivity Fee |

IMS Markets | $0 | $0 | $0 |

Deriv | $0 | $0 | 25 USD, EUR, or GBP |

$0 | $0 | $25 | |

Tier1FX | $0 | $20 / €15 / £15 for bank withdrawals | $20 |

Trive | 1.5% fee e-wallets | 0.5% fee for bank withdrawals / 1.5% fee e-wallets | €10 |

Tradeview Forex | $0 | $0 | $10 monthly |

Tradable Assets in Forex Brokerages Regulated by MFSA

Forex brokerages regulated by the MFSA (Malta Financial Services Authority) typically offer a wide variety of tradable assets to cater to diverse trader preferences and investment strategies. These brokers provide access to popular asset classes such as currency pairs, indices, commodities, stocks, and cryptocurrencies.

Broker Name | Number of Instruments |

10,000+ | |

eToro | 7,000+ |

Tradeview Forex | 600+ |

ALB | 350+ |

Deriv | 150+ |

90+ |

Top 5 Forex Brokers Regulated by MFSA

Choosing a reliable Forex broker is crucial for ensuring a secure and efficient trading experience. In this section, we highlight the top four Forex brokers regulated by the Malta Financial Services Authority (MFSA).

Deriv

Deriv, formerly known as Binary.com, is a well-established Forex and CFD broker that has been in operation since 1999. With its rebranding in 2020, the company expanded its offerings to include leveraged trading, options, and CFDs across a wide range of asset classes, including Forex, stocks, cryptocurrencies, and commodities.

Deriv verficiation process and its requirements operates under multiple regulatory entities, including the Malta Financial Services Authority (MFSA), the Vanuatu Financial Services Commission (VFSC), and the Labuan Financial Services Authority (FSA).

With over 2.5 million registered users globally and a monthly volume of $650 billion, Deriv is a trusted name in the Forex and CFD trading world. Deriv dashboard offers a variety of account types, including Standard, Financial, and Swap-Free accounts, with a low minimum deposit of just $5.

Deriv is known for its user-friendly platforms, including MetaTrader 5 (MT5), cTrader, and Deriv X, which provide fast execution and a wide range of trading tools. Additionally, Deriv offers zero-commission trading with spreads starting from 0.24 pips, making it an appealing option for cost-conscious traders.

Account Types | Demo, Standard, Financial, Swap-Free |

Regulating Authorities | MFSA, FSA, VFSC, BVI |

Minimum Deposit | $5 |

Deposit Methods | Credit/Debit Cards, Online Banking, Mobile Payments, E-Wallets, Crypto, Voucher, Deriv P2P |

Withdrawal Methods | Credit/Debit Cards, Online Banking, Mobile Payments, E-Wallets, Crypto, Voucher, Deriv P2P |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT5, cTrader, Deriv X |

Deriv Pros and Cons

Deriv provides a balanced trading environment with solid regulation, low fees, and multiple Deriv deposit and withdrawal methods. Below is a brief overview of its key advantages and drawbacks.

Pros | Cons |

Wide range of tradable assets | Complex user interface |

Leverage up to 1:1000 | Limited support options |

Regulated by multiple financial authorities | No PAMM or MAM accounts |

24/7 multilingual customer support | Some products can be complex for beginners |

Copy trading available | No phone support available |

eToro

eToro is a global financial broker founded in 2007 in Tel Aviv, Israel. It has become one of the largest and most popular brokers, offering a wide range of assets including stocks, Forex, cryptocurrencies, and ETFs.

The platform is known for its user-friendly interface, easy eToro registration and innovative social trading features like CopyTrader, Smart Portfolios, and Crypto Staking. eToro allows traders to follow successful investors and replicate their trades in real-time, making it an ideal platform for beginners and experienced traders alike.

The broker is regulated in multiple jurisdictions, including by the FCA (UK), CySEC (Cyprus), MFSA (Malta), and ASIC (Australia). eToro’s leverage can reach up to 1:400, but it depends on the client's classification (retail or professional).

The platform supports MetaTrader 4, MetaTrader 5, and a proprietary app for trading across various markets. A notable feature of eToro is its Islamic accounts, allowing traders who follow Islamic finance principles to trade without paying interest.

Despite its strengths, eToro has some drawbacks, such as the lack of MT4/MT5 support, and the absence of phone support for customer service. It also charges a $10 monthly inactivity fee and 1% commission on crypto transactions.

Account Types | Personal, Professional, Corporate, Islamic |

Regulating Authorities | FCA, CySEC, MFSA, FSRA, ASIC, FSA, Gibraltar FSC |

Minimum Deposit | $10 |

Deposit Methods | eToro Money, Credit/Debit Card, PayPal, Neteller, Skrill, Bank Transfer, Trustly, iDEAL, Sofort, Przelewy24 |

Withdrawal Methods | eToro Money, Credit/Debit Card, PayPal, Neteller, Skrill, Bank Transfer, Trustly, iDEAL, Sofort, Przelewy24 |

Maximum Leverage | 1:400 (Retail), 1:400 (Professional) |

Trading Platforms & Apps | Proprietary App, MT4, MT5 |

eToro Pros and Cons

eToro delivers a well-rounded trading experience, offering strong regulation, low trading costs, and a diverse range of products. Here’s a summary of its primary strengths and weaknesses.

Pros | Cons |

Wide range of tradable assets (7,000+) | No MT4/MT5 support |

Innovative social trading features | No phone support for customer service |

Regulated by multiple authorities | Monthly inactivity fee of $10 |

Leverage up to 1:400 for professional clients | Crypto trading commissions of 1% |

Swap-free accounts available | Limited customer support options |

24/5 multilingual customer support | Withdrawals via PayPal and bank transfers incur fees |

ALB

ALB (ALB Limited) is a well-established Forex and CFD broker founded in 2017 and headquartered in Malta. The broker operates under the regulatory oversight of the Malta Financial Services Authority (MFSA), ensuring a secure environment for trading.

ALB provides access to a variety of assets, including Forex, stocks, indices, commodities, precious metals, energies, bonds, and cryptocurrencies. It offers competitive spreads, starting from 0.0 pips on selected instruments, with a trading commission of 0%, except for cryptos, which incur a 0.4% commission.

The broker supports MetaTrader 5 (MT5) and integrates the UCapital24 platform for live signals, quotes, and market insights. ALB offers negative balance protection and ensures client funds are kept in segregated accounts.

The broker’s minimum deposit requirement is €200 for standard accounts, and it provides a variety of deposit methods, including bank transfers, credit/debit cards, and cryptocurrency payments.

ALB provides various account types including Live, Professional, and demo account. The broker also offers an Islamic account for clients following Islamic finance principles. Notably, ALB has received recognition at the Forex Expo 2022, being named the Best Forex Broker Company Europe.

While ALB has several strengths, such as low spreads and excellent asset variety, it has some drawbacks, including a high entry barrier and limited account types. Additionally, the broker does not offer PAMM accounts or a full range of payment options.

Account Types | Live, Professional, Demo |

Regulating Authorities | MFSA |

Minimum Deposit | €200 |

Deposit Methods | Bank Transfer, Credit/Debit Cards, Crypto |

Withdrawal Methods | Bank Transfer, Credit/Debit Cards, Crypto |

Maximum Leverage | 1:30 |

Trading Platforms & Apps | MetaTrader 5, UCapital24 |

ALB Pros and Cons

ALB offers a trading environment that balances strong regulation, low fees, and a broad selection of products. Below is a short assessment of its strengths and potential limitations.

Pros | Cons |

Regulated by MFSA | High entry barrier (€200 minimum deposit) |

Wide range of tradable assets | Limited account types |

Multiple global awards | Limited deposit/withdrawal methods |

Integration with UCapital24 social network | Geo-restrictions apply |

Negative balance protection | No PAMM accounts available |

Tier1FX

Tier1FX, founded in 2013 and regulated by the Malta Financial Services Authority (MFSA), is a well-regulated broker in the EU. The broker offers a range of trading instruments, including forex pairs, commodities, precious metals, indices, and cryptocurrencies.

It operates with a straight-through processing (STP) and direct market access (DMA) execution model, ensuring fast and transparent trading. Tier1FX allows traders to access MetaTrader 4 (MT4), JForex, and FIX API platforms, catering to various trading strategies, from manual to algorithmic trading.

The broker requires a minimum deposit of €1,000 and offers maximum leverage of 1:200 for eligible clients. While Tier1FX does not provide swap free account or PAMM accounts, it offers transparent commissions for Forex and commodity trades starting at €2.50 per lot for EUR accounts.

Tier1FX also provides negative balance protection, ensuring traders are protected from losses exceeding their deposits. Additionally, it offers a referral agent program.

However, the broker's limitations include a relatively high minimum deposit, lack of promotional offers, and restricted access for certain countries like the USA, Japan, and Turkey due to regulatory restrictions.

Overall, Tier1FX is an appealing choice for traders seeking professional-grade execution and broad market access under EU regulation.

Account Types | Individual, Joint, Corporate |

Regulating Authorities | MFSA |

Minimum Deposit | €1,000 |

Deposit Methods | Bank Transfer |

Withdrawal Methods | Bank Transfer |

Maximum Leverage | 1:200 |

Trading Platforms & Apps | MetaTrader 4, JForex, FIX API |

Tier1FX Pros and Cons

Tier1FX features a well-balanced trading environment with strong regulation, low costs, and a diverse range of products. Below is a quick look at its main strengths and weaknesses.

Pros | Cons |

Regulated by MFSA | High minimum deposit of €1,000 |

Transparent pricing with commission-based model | No Islamic account option |

Negative balance protection | Limited deposit/withdrawal methods |

Access to institutional-grade liquidity | No PAMM accounts |

Multiple platforms including JForex and FIX API | Limited promotional options |

Referral agent program | Restricted in several countries |

Trive

Trive, a multi-jurisdictional Forex and CFD broker founded in 2016, is headquartered in Malta and operates under the Malta Financial Services Authority (MFSA). It has gained recognition in the industry with its competitive trading conditions, offering a maximum leverage of 1:2000 and a minimum order size of 0.01 lots across all accounts.

Trive dashboard supports multiple asset classes, including Forex, stocks, indices, commodities, and cryptocurrencies.

Trive's account types include Classic, Prime, and Prime Plus, with the Prime Plus account offering a 5 EUR per lot commission and tighter spreads than the other account types. The broker’s trading platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary platform, which you’ll have access after Trive verification.

Trive also integrates UCapital24 for live signals, quotes, and real-time market insights. Trive’s competitive spreads start from 0.1 pips on the Prime Plus account and the broker has earned a Trustpilot rating of 4.7/5 based on 80+ reviews.

Trive does not charge commissions on most instruments except for cryptocurrencies (0.4% trading commission). The broker also offers various deposit and withdrawal methods, such as credit/debit cards, Neteller, Skrill, and crypto payments. However, it has some limitations, including a high minimum deposit for Prime Plus accounts and no Islamic accounts available.

Account Types | Classic, Prime, Prime Plus, Demo |

Regulating Authorities | MFSA, ASIC, FINRA, SCA, FSC, MNB, BAPPEBTI, FSCA |

Minimum Deposit | €0 (Classic), €2,500 (Prime), €15,000 (Prime Plus) |

Deposit Methods | Credit/Debit Cards, Neteller, Skrill, Online Banking, Crypto |

Withdrawal Methods | Online Banking, Crypto |

Maximum Leverage | 1:2000 |

Trading Platforms & Apps | MT4, MT5, Proprietary Platform (UCapital24) |

Trive Pros and Cons

Trive offers a robust and straightforward Trive registration with excellent regulation, low fees, and a wide array of trading products. Below is an evaluation of its most notable strengths and weaknesses.

Pros | Cons |

Licensed by MFSA and other top-tier regulators | High minimum deposit for Prime Plus account (€15,000) |

Wide range of tradable assets (10,000+ instruments) | No Islamic account available |

Competitive leverage of up to 1:2000 | No copy trading or PAMM accounts |

Low spreads starting from 0.1 pips (Prime Plus) | Limited payment methods for deposits/withdrawals |

Various platforms: MT4, MT5, UCapital24 | No promotional bonuses |

What is MFSA?

The Malta Financial Services Authority (MFSA) is Malta's primary regulatory body overseeing financial services, including Forex trading. Established in 2002, the MFSA ensures that financial institutions operating within Malta comply with EU financial regulations.

The authority's mission is to maintain a secure and transparent financial environment for consumers, businesses, and investors. The MFSA is recognized for its stringent standards and is an essential body in protecting investors' interests in the financial markets.

As a member of the European Union, the MFSA adheres to EU directives and ensures that brokers operating under its jurisdiction meet the legal and ethical standards required by the EU's financial framework.

MFSA’s Advantages and Disadvantages for Forex Trading Firms

MFSA offers a stable regulatory environment for Forex brokers. However, like any regulatory body, it has its pros and cons for traders and brokers alike.

Advantages | Disadvantages |

MFSA follows EU directives, ensuring high standards for consumer protection | Due to ESMA regulations, MFSA-regulated brokers may offer lower leverage compared to non-EU brokers |

Brokers regulated by MFSA must adhere to strict capital requirements and provide investor compensation up to €20,000 | MFSA primarily focuses on EU/EEA residents, limiting access for traders from other countries |

MFSA’s regulations are recognized across the EU, enhancing brokers’ credibility | Compliance with MFSA regulations can lead to higher operational costs for brokers, which may translate into higher fees for traders |

Clients' funds are safeguarded from exceeding their account balance | - |

What Key Criteria Were Used to Compile the List of MFSA Brokers?

Selecting the best MFSA-regulated brokers is a meticulous process that involves evaluating various essential aspects to ensure transparency, reliability, and security for traders.

TradingFinder employs a rigorous methodology to provide you with accurate, unbiased broker reviews. Here are the key criteria used in the evaluation:

- Regulation and Licensing: Brokers must be licensed and regulated by the MFSA or other reputable regulatory authorities. This ensures that brokers adhere to financial laws and operate with transparency;

- Account Types: We assess the variety of account types, including standard, ECN, and Islamic accounts, ensuring there’s an option for every trader, whether retail or professional;

- Tradable Assets: The range of tradable instruments such as Forex pairs, commodities, stocks, cryptocurrencies, and CFDs is a critical factor. A diverse offering allows traders to implement various strategies and diversify their portfolios;

- Leverage Limits: Leverage provided to retail clients is reviewed, particularly in compliance with MFSA regulations. We verify the maximum leverage allowed on different asset classes;

- Trading Platforms and Tools: The quality and variety of platforms, such as MetaTrader 4/5, cTrader, or proprietary platforms, and their associated tools, like automated trading features, charting, and market analysis tools, are considered;

- Fees and Spreads: Trading conditions, including spreads and commissions, are scrutinized for transparency. Brokers with transparent and competitive fee structures are prioritized;

- Deposit and Withdrawal Methods: We evaluate the ease, cost, and time efficiency of the broker's deposit and withdrawal methods. A variety of payment options is considered a plus;

- Customer Support: Quality of customer service is crucial for resolving trader issues. We review the responsiveness, availability, and support channels offered by the broker, including live chat, email, and phone support;

- Education and Research Resources: Brokers offering comprehensive educational content, webinars, and research tools to help traders make informed decisions are highly rated;

- Trust and Reputation: Customer reviews from platforms like Trustpilot, ForexPeaceArmy, and others are used to gauge broker reputation and reliability in real-world scenarios.

By utilizing these criteria, TradingFinder compiles a list of MFSA-regulated brokers that stand out in the market, ensuring that traders have access to reliable, trustworthy, and compliant brokers for their trading needs.

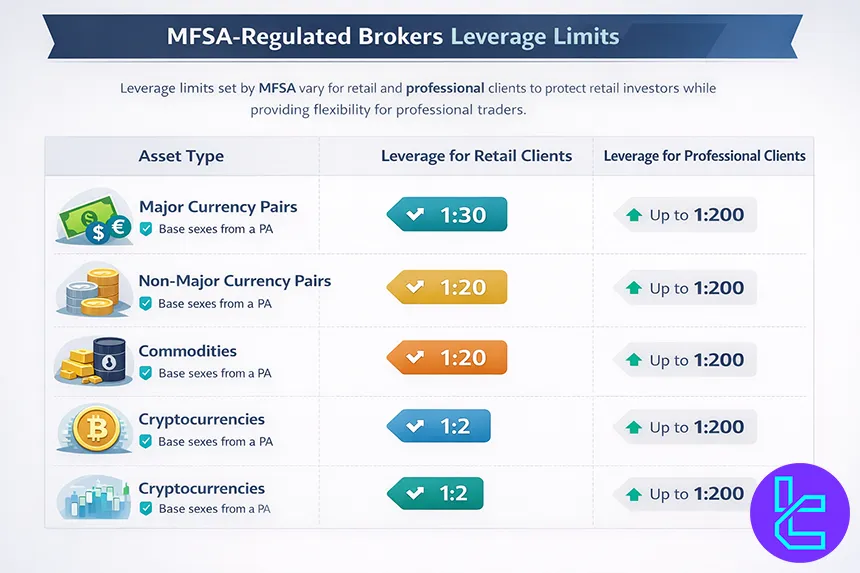

Do MFSA-Regulated Brokers Have Leverage Limits?

MFSA-regulated brokers typically offer leverage limits due to the European Securities and Markets Authority (ESMA) regulations.

Asset Type | Leverage for Retail Clients | Leverage for Professional Clients |

Major Currency Pairs | 1:30 | Up to 1:200 |

Non-Major Currency Pairs | 1:20 | Up to 1:200 |

Commodities | 1:20 | Up to 1:200 |

Cryptocurrencies | 1:2 | Up to 1:200 |

This regulation aims to strike a balance between providing trading opportunities and safeguarding traders from excessive risk exposure.

What Investor Protections Are Offered by MFSA?

MFSA offers several investor protections to ensure that Forex traders are treated fairly and their funds are secure:

- Investor Compensation Scheme: In case of broker insolvency, traders are protected up to €20,000 under the Investor Compensation Scheme (ICS);

- Segregated Funds: Brokers are required to keep client funds separate from their own operational funds, ensuring they cannot be used for other purposes;

- Negative Balance Protection: Traders cannot lose more than the balance in their accounts, preventing them from incurring debt beyond their initial investment;

- Transparency Requirements: MFSA-regulated brokers must disclose their trading conditions, fees, and commissions, ensuring traders are fully informed before making decisions.

What Are the Common Risks When Trading with MFSA-Regulated Brokers?

While MFSA-regulated brokers provide a secure trading environment, traders should still be aware of some risks associated with Forex trading:

- Market Volatility: Forex markets can experience rapid fluctuations in price, leading to potential losses even with regulation in place;

- Leverage Risks: Even though leverage is capped, excessive leverage can still result in substantial losses, especially for retail clients;

- Broker Reliability: Although MFSA-regulated brokers are held to high standards, the broker’s individual integrity and financial stability are still important to assess;

- Fees and Spreads: High spreads or hidden fees may affect traders' profitability, especially for frequent traders.

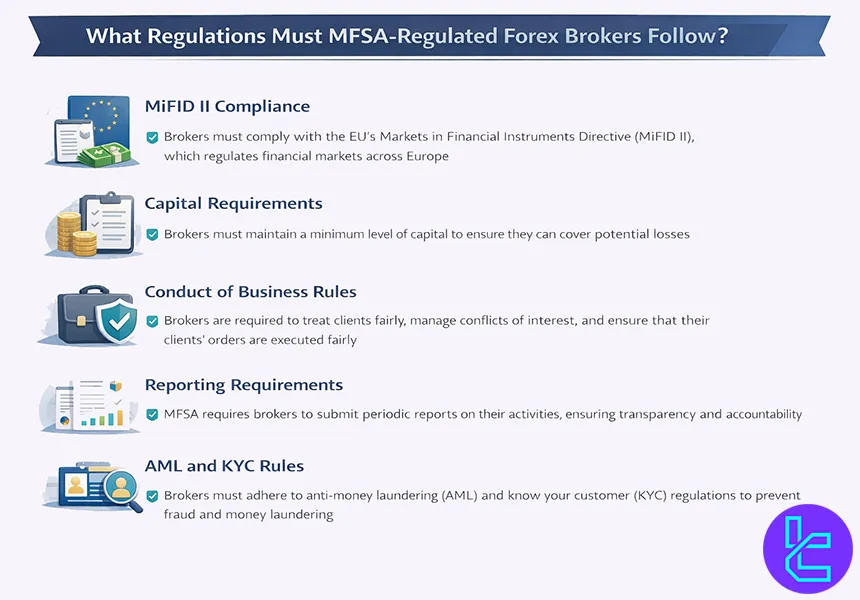

What Regulations Must MFSA-Regulated Forex Brokers Follow?

MFSA-regulated brokers must adhere to several important regulations to ensure they operate fairly and transparently:

- MiFID II Compliance: Brokers must comply with the EU’s Markets in Financial Instruments Directive (MiFID II), which regulates financial markets across Europe;

- Capital Requirements: Brokers must maintain a minimum level of capital to ensure they can cover potential losses;

- Conduct of Business Rules: Brokers are required to treat clients fairly, manage conflicts of interest, and ensure that their clients' orders are executed fairly;

- Reporting Requirements: MFSA requires brokers to submit periodic reports on their activities, ensuring transparency and accountability;

- AML and KYC Rules: Brokers must adhere to anti-money laundering (AML) and know your customer (KYC) regulations to prevent fraud and money laundering.

Do MFSA-Regulated Brokers Support Advanced Trading Strategies?

Yes, MFSA-regulated brokers typically support a wide range of advanced trading strategies. These brokers offer various trading tools, platforms, and features that facilitate professional trading strategies such as below.

- Scalping: Most MFSA brokers allow scalping, enabling traders to make quick trades to take advantage of small price movements;

- Hedging: Brokers support hedging strategies, where traders can open positions in the opposite direction of their current trades to limit potential losses;

- Algorithmic Trading: Advanced traders can use Expert Advisors (EAs) on platforms like MetaTrader 4 and MetaTrader 5 to automate their strategies;

- Copy Trading: Many MFSA-regulated brokers offer social trading platforms where traders can copy successful traders’ strategies.

How Can I Verify if a Broker Is Regulated by MFSA?

To verify if a broker is regulated by MFSA, follow these steps:

- Visit the MFSA Website: Check the official MFSA website for a list of authorized financial firms;

- Verify License Number: Ensure the broker's license number matches the one provided by MFSA on their official registry;

- Check Regulatory Documents: Look for regulatory documentation on the broker’s website, such as the license number, which should be listed on the homepage or in the legal section;

- Cross-Check with Other Regulators: Some brokers are registered with multiple regulators. You can cross-check their status with other EU financial authorities for further confirmation.

The Role of MFSA in Enhancing Forex Trading Security

The MFSA plays a crucial role in ensuring that Forex brokers operate securely and transparently:

- Regulation and Supervision: The MFSA ensures brokers comply with strict financial rules to protect traders;

- Investor Compensation: In case of broker insolvency, the MFSA provides compensation up to €20,000 to affected investors;

- Transparent Practices: The MFSA mandates brokers to disclose their financial condition, trading practices, and fees, enabling traders to make informed decisions;

- Ongoing Monitoring: The MFSA continuously monitors licensed brokers to ensure they remain compliant with EU regulations and financial standards.

Are Crypto Trading Options Provided by MFSA Forex Brokers?

Many MFSA-regulated Forex brokers offer cryptocurrency trading. These brokers typically provide access to popular digital assets like Bitcoin (BTC), Ethereum (ETH), and stablecoins such as USDT.

However, the availability of cryptocurrencies and the specific trading conditions (e.g., spreads, commissions) vary by broker.

It's important to note that crypto trading in the EU is subject to regulations, and brokers must ensure they comply with local laws regarding digital asset trading, including Anti-Money Laundering (AML) and Know-Your-Customer (KYC) requirements.

MFSA Vs Other Top Regulators

The table below compares the key aspects of the Malta Financial Services Authority (MFSA) and other top regulators like the Seychelles FSA, the UK FCA, and Cyprus's CySEC.

Parameter | MFSA (Malta) | FSA (Seychelles) | FCA (UK) | CySEC (Cyprus) |

Regulatory Tier | Tier 2 | Tier 3 | Tier 1 | Tier 1 |

Year Established | 2002 | 2013 | 1988 | 2004 |

Legal Framework | MiFID II, EU Law | Seychelles Securities Act | Financial Services and Markets Act 2000 | EU Law, MiFID II |

Client Fund Segregation | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes |

Retail Leverage Cap | 1:30 | 1:2000 | 1:30 (Retail) | 1:30 |

Investor Compensation Scheme | Up to €20,000 under ICF | No | Up to £85,000 under FSCS | Up to €20,000 under ICF |

Enforcement & Supervision | Active EU enforcement | Limited enforcement | Strict UK supervision | EU & Cypriot supervision |

EU Passporting | Yes | No | Yes | Yes |

Conclusion

The Malta Financial Services Authority (MFSA) is a well-regarded regulatory body that oversees financial activities in Malta, ensuring high standards of security, transparency, and compliance with EU regulations.

Forex brokers regulated by MFSA are required to adhere to strict guidelines to safeguard traders’ funds and provide fair trading conditions. These brokers offer competitive spreads, low trading fees, and a diverse range of tradable assets, including currency pairs, commodities, and cryptocurrencies.

MFSA-regulated brokers, such as Deriv, eToro, and ALB, are trusted by global traders for their robust regulation and reliable service. While some brokers offer lower leverage and higher spreads, the protection and transparency provided by MFSA make it a favorable regulatory environment for traders.

If you're wondering about the comprehensive process involved in selecting the brokers featured on our list, visiting TradingFinder forex methodology page is highly recommended for a clear and detailed breakdown.