Accuindex is a financial brokerage with a maximum leverage of 1:400 and 3 stop out levels [20%, 30%, 50%] in accounts. Spreads on the Standard and Pro accounts are at least 1.4 pips and 0.8 pips, respectively. The broker charges a $25 fee on withdrawals made via the bank wire method.

Company Details and Regulation

Accuindex, with the legal name Accuindex LTD, is a financial company founded by Hasan Al Aqqad in 2016. Company Key Specifics:

- Licensed and regulated by CySEC (Cyprus Securities and Exchange Commission) and FSC (Financial Services Commission) in Mauritius;

- Cyprus office located at Leontiou A, 159 MARYVONNE, Office 102 ,3022, Limassol, Cyprus;

- Mauritius office located at The Cyberati Lounge, Ground Floor, The Catalyst, Silicon Avenue, 40 Cybercity, 72201 Ebène.

Broker Specifications

In our reviews, we provide users with a summary table of key features and details for every firm. In this section, we will provide that table:

Broker | Accuindex |

Account Types | Standard, Pro, Raw |

Regulating Authorities | CySEC, FSC |

Based Currencies | USD |

Minimum Deposit | $50 for Standard, $5,000 for Pro, $25,000 for Raw |

Deposit Methods | Wire Transfer, VISA, MasterCard By jccHPP, GateToPay and My Fatoorah, Cryptocurrency (BTC,ETH,USD) By Hyvn and BVNK |

Withdrawal Methods | Bank Wire Transfer, Credit/Debit Cards, E-wallets |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:400 |

Investment Options | Copy Trading |

Trading Platforms & Apps | MetaTrader 5, AccuGo, Web Trader |

Markets | Forex, Metals, Indices, Commodities, Shares |

Spread | From 0 Pips on Raw Account |

Commission | $5 per Lot on Raw Account Zero on Other Accounts |

Orders Execution | Market |

Margin Call/Stop Out | Not Specified/From 20% |

Trading Features | Demo Account |

Affiliate Program | Yes |

Bonus & Promotions | 30% Deposit Bonus |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Live Chat, Email, Phone Call, Ticket |

Customer Support Hours | Monday to Friday from 10:00 to 19:00 (GMT+4) |

Which Trading Accounts Are Offered by Accuindex?

This broker offers three main account types tailored to different trading styles and conditions. We are going to investigate their specifics in the table below:

Account Type | Standard | Pro | Raw |

Min. Deposit | $100 | $5,000 | $25,000 |

Max. Leverage | 1:400 | 1:100 | |

Expert Advisors | Allowed | ||

Stop Out Level | 20% | 30% | 50% |

Account Currency | USD | ||

These accounts also differ in trading commissions and spreads, but we will get to that later in the article.

In addition to live accounts, Accuindex offers a demo account for improving skills and practice without the risk of losing funds.

Accuindex offer Islamic (swap-free) accounts, which has %50 minimum deposit and will be atumaticly available when you create account.

Benefits and Drawbacks

Every Forex broker has two sides: positivity and negativity. Let's examine the key pros and cons of trading with Accuindex:

Benefits | Drawbacks |

Regulated by CySEC & FSC | %30 deposit bonus is only available for $500 bonuses and more |

Multiple Trading Platforms With A Proprietary One | - |

Various Payment Methods | - |

Account Opening and Verification Guide

Opening an account with the Accuindex broker is easy, even for beginner traders. Accuindex registration:

#1 Access the Registration Portal

Start by visiting the official Accuindex website and clicking the "Start Now" button on the homepage.

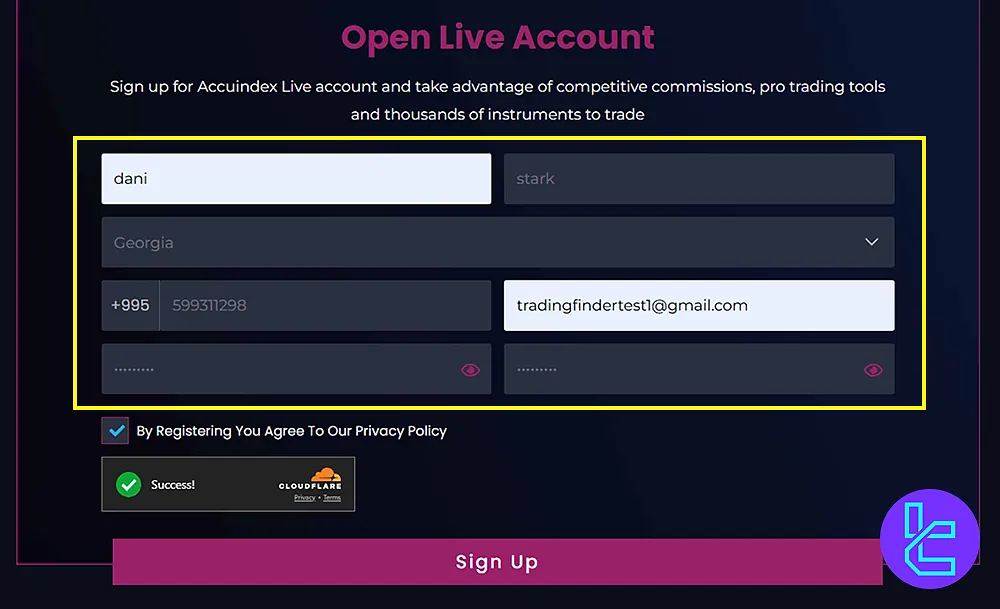

#2 Complete Basic Details

Fill in your first and last name, country of residence, mobile number, email address, and set a secure password. Accept the terms, solve the captcha, and proceed.

#3 Log In to You Account

Use your registered email and password to access your personal dashboard.

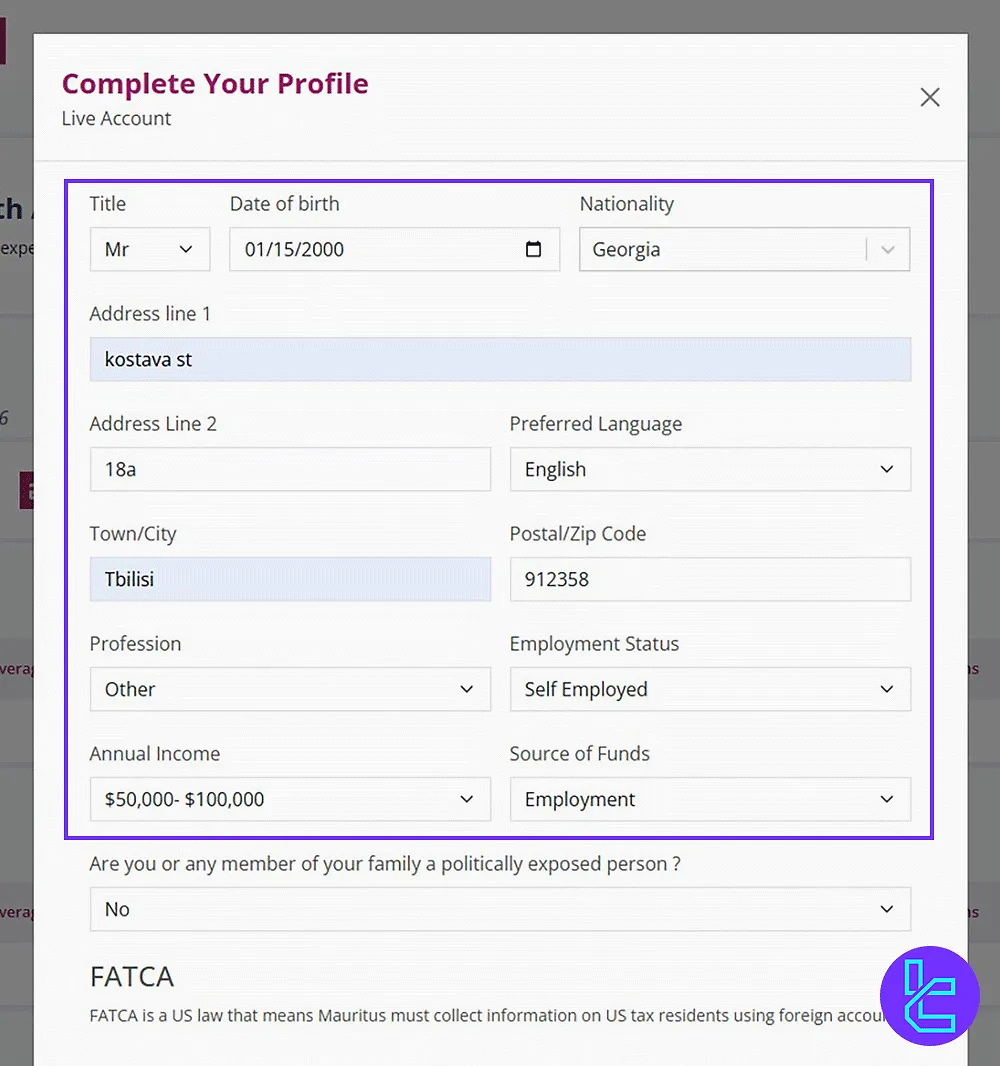

#4 Finalize Your Profile

Enter additional details like your date of birth, nationality, residential address, and respond to compliance questions (e.g., U.S. citizenship or political exposure). Provide your financial background and submit the form to complete registration.

Accuindex Verification

You must provide the following documents to verify your account on the Accuindex broker. Accuindex verification:

- Proof of Identity: ID card, passport, driver's license, or residence permit

- Proof of address: Utility bill, rental agreement, or bank statement

Trading Platforms and Related Apps

Accuindex does a solid job in this regard, offering diverse trading platforms. Let's have a brief overview of each:

- AccuGo: Proprietary mobile trading solution with a convenient interface and extensive tools for account management;

- MetaTrader 5: A very popular trading platform with 21 timeframes and an embedded economic calendar;

- WebTrader: A light platform that only needs a browser and synchronizes with MT accounts.

We recommend you visit the MT5 indicators page to get access to valuable technical analysis tools available on MetaTrader 5.

What is the Structure of Spreads And Commissions?

Trading costs at Accuindex vary based on account type, asset, market conditions, etc. Let's investigate the spread and commission for each account:

Account Name | Standard | Pro | Raw |

Spread | From 1.4 Pips | From 0.8 Pips | From 0 |

Commission | None | $5 per Lot | |

Also, based on our investigations, the broker charges withdrawal fees for clients. The amount is $25 for wire transfers and varies for other methods. There are no costs in other operations and parts.

To estmiate profits and final account balance when trading, you can use a Forex profit calculator that operates based on fees.

Methods to Fund Your Account and Withdraw From It

Brokerages provide several payment options to meet the needs of traders from various regions of the world. Multiple payment methods are available in Accuindex:

- Wire Transfer

- VISA,MasterCard – jccHPP

- VISA,MasterCard – GateToPay (Accucard)

- Crypto (BTC, ETH, USDT) – Hyvn

- Crypto (BTC, ETH, USDT) – BVNK

- VISA,MASTER CARD – My Fatoorah

Minimum Deposit Amount for the Accuinex Broker?

The minimum deposit amount is set based on account types:

- $50 for Standard

- $5,000 for Pro

- $25,000 for Raw

This structure accommodates both entry-level traders and professionals seeking tighter trading conditions.

Copy Trading and Other Investment Options

Copy Trading is one of the most popular methods for earning passive income via financial brokers and firms. Accuindex's AccuConnect platform offers comprehensive copy trading features:

- Real-time trade copying

- Performance tracking

- Risk management tools

- Strategy selection

- Customizable allocation

The platform's application is available for mobile device systems. Here are the download links:

Trading Instruments and Markets on Accuindex Broker

This broker provides access to CFDs on some of the most traded instruments in the financial industry, and the diversity is above-average. Trading Symbols on Accuindex:

- 70+ Forex pairs (majors, minors, exotics)

- 180+ share CFDs from the US, EU, and Asia

- 11 index CFDs

- 5 commodity contracts, including oil, gold, and gas

- 4 cryptocurrency CFDs, including Bitcoin and Ethereum

Bonuses And Promotions for Clients

Some brokerages provide multiple bonuses and promotional offers to their clients as a marketing technique. However, Accuindex does not have a wide range of these promotions. Currently, it offers only one 30% deposit bonus for $500 deposit and more:

- Earn funds up to $5,000

- Available for Forex and metal asset classes

- For all accounts, either existing or new

Note that terms and conditions apply to this promotional offer. Trading bonuses may not be available in certain jurisdictions due to regulatory restrictions.

How and When to Contact Support in Accuindex

You should always put the support services in priority when choosing a financial broker. Support Channels in Accuindex:

- Live Chat: On all pages of the website

- Email: info@accuindex.com

- Phone: +230 464 4888

- Ticket System: In the "Contact Us" section of the website

The company does not state a schedule for working hours on its official website, but during our attempt to contact them via chat, we discovered that the team is unavailable 24/7 and offers services Monday to Friday from 10:00 to 19:00 (GMT+4).

Does Accuindex Accept Clients from All Regions?

The brokerage maintains compliance with international regulations and local laws by restricting services in certain jurisdictions. Notable Restricted Regions:

- United States

- Canada

- Israel

- Japan

- North Korea

- Belgium

- Iran

- Iraq

- UN/EU-sanctioned countries

Traders should verify their eligibility based on their residence before opening an account. Restrictions may change based on regulatory updates.

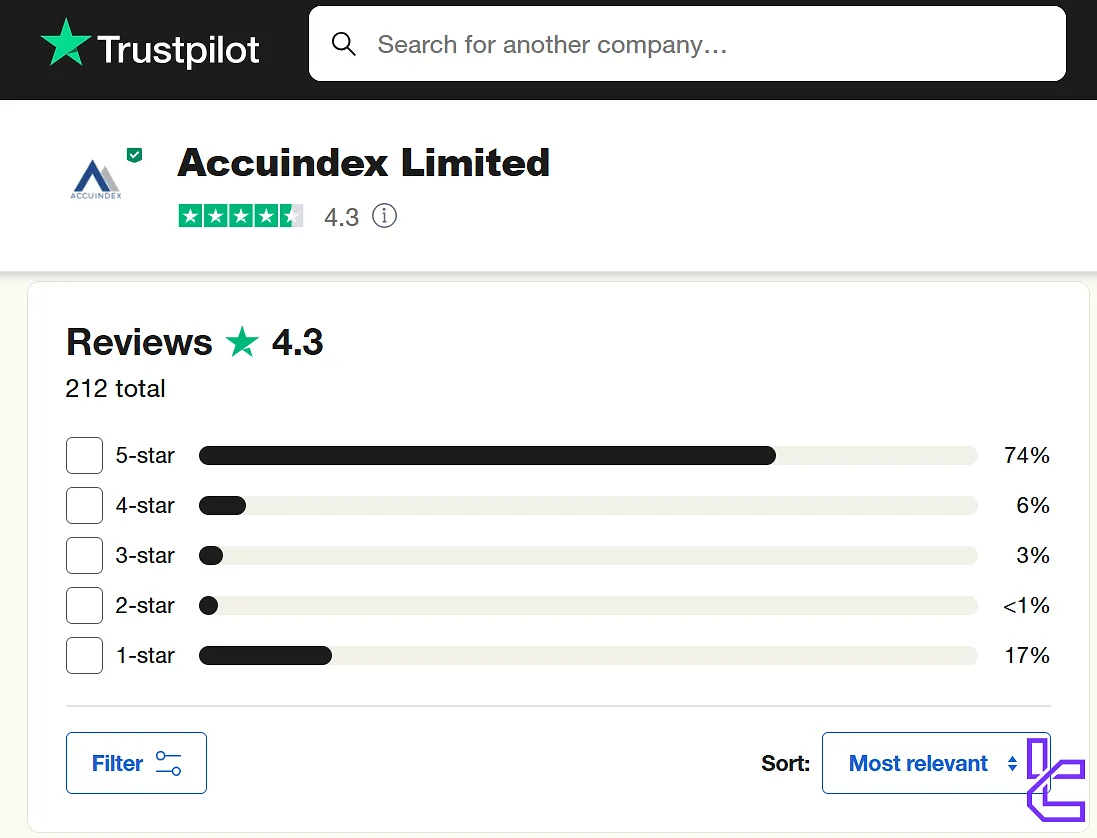

Trust Evaluations and User Reviews

Some websites, including ForexPeaceArmy and Trustpilot, are known for receiving companies' trust scores. Accuindex has received mixed ratings from users on the mentioned platforms. We will investigate these reviews here:

- Trustpilot: 4.3 out of 5 with over 200 reviews, over 70% of them being 5-star

- ForexPeaceArmy: 1/5, based on less than 10 scores

Although the average rating on the latter is disappointing, the number of scores is also too low to be considered reliable.

Does Accuindex Offers Dedicated Educational Resources?

The company does not provide diverse content intended for educating traders. It only offers 2 sections on its website:

- Trading Academy: Contains a thorough article on financial markets and trading

- FAQ: Includes common questions about the broker with answers

The lack of educational resources is not necessarily a drawback; because it's not part of the main services offered by a brokerage.

Accuindex Comparison with Other Forex Broker

The table below helps you understand the quality of services in the Accuindex broker compared to well-known Forex brokers.

Parameters | Accuindex Broker | |||

Regulation | CySEC, FSC | FSC | FSA, FSC, Misa, FinaCom | No |

Minimum Spread | 0.0 Pips | 0.0 Pips | 0.0 Pips | 0.1 Pips |

Commission | $5 per Lot on Raw Account Zero on Other Accounts | $0 | $0 | $0 |

Minimum Deposit | $50 | $200 | $100 | $1 |

Maximum Leverage | 1:400 | 1:3000 | 1:3000 | 1:3000 |

Trading Platforms | MetaTrader 5, AccuGo, Web Trader | MetaTrader 4, MetaTrader 5, FXTM Trader App | MetaTrade 4, MetaTrade 5, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | Standard, Pro, Raw | ADVANTAGE, STOCKS, ADVANTAGE, ADVANTAGE PLUS | Standard, ECN, Fixed, Crypto | Standard, Premium, VIP, CIP |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 300+ | 1000+ | 700+ | 45 |

Trade Execution | Market | Market | Market, Instant | Market, Instant |

Conclusion And Final Words

Accuindex is a financial broker with a 4.3/5 trust score on the Trustpilot platform; this rating is based on more than 200 reviews. The brokerage provides access to 6 markets [forex, metals, indices, commodities, shares] with over 300 currency pairs.