Activotrade offers30,000+ trading instruments from 125 exchanges worldwide. There is no minimum deposit requirement. Gold and WTI trading come with spreads of 0.6 and 0.05 pips, respectively.

Activotrade; Company Information and Regulation [CNMV, Member of FOGAIN]

Activotrade was founded in 2009 in Barcelona, Spain by Luis Gomes. The broker has turned into a Securities company after 15 years of operation.

The broker is a member of The General Investment Guarantee Fund (FOGAIN) and operates under the watchful eye of the Spain National Securities Market Commission (CNMV).

Entity Parameters/Branches | Activotrade |

Regulation | CNMV |

Regulation Tier | Tier-1 |

Country | Spain |

Investor Protection Fund/Compensation Scheme | Member of FOGAIN (Spanish Investor Compensation Scheme) |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:30 |

Client Eligibility | Clients from most countries, except restricted jurisdictions such as the United States, Canada, Japan, Iran, North Korea, Syria, Cuba, and other sanctioned countries. |

Key features of Activotrade broker:

- €96B traded

- Direct Market Access

- Free demo account

- Access toEurope, the USA, and Asia Stock exchanges

Activotrade Specific Details

The FOGAIN membership offers an insurance scheme of up to €100,000 for each client. The table below provides a brief look into the Forex broker’s offerings.

Broker | Activotrade |

Account Types | Basic, Standard, Trader, Active, Demo |

Regulating Authorities | CNMV |

Based Currencies | USD, EUR |

Minimum Deposit | $1 |

Deposit Methods | Bank Transfer |

Withdrawal Methods | Bank Transfer |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:30 |

Investment Options | Fixed Income, Investment Funds |

Trading Platforms & Apps | Active Plus |

Markets | Stocks, Forex, CFDs, Bonds, ETFs, Futures, Options |

Spread | Variable based on the account type |

Commission | Variable based on the account type. |

Orders Execution | Market |

Margin Call / Stop Out | N/A |

Trading Features | Autochartist Signals, Futures, Options |

Affiliate Program | No |

Bonus & Promotions | None |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | WhatsApp, Email, Ticket, Phone Call |

Customer Support Hours | 8:30 AM to 6:00 PM (GMT+1) |

Activotrade Broker Trading Accounts

The company offers 4 account types in EUR or USD with different fee structures andentry barriers, including Basic, Standard, Trader, Active.

Activotrade Basic Account

- No minimum deposit

- No maintenance fee

- Highest trading costs: 0.12% for Spain shares, from 0.1% for US Stocks, from 0.12% on CFDs, and $6 for Futures / Options

Activotrade Standard Account

- Minimum deposit of €5,000

- Commissions: 0.10% for Spain shares, from 0.09% for US Stocks, from 0.1% on CFDs, and $6 for Futures / Options

Activotrade Trader Account

- A minimum of 10 operations per month

- Commissions: 0.08% for Spain shares, from 0.015 for US Stocks, from 0.0125 on CFDs, and $4.5 for Futures / Options

Activotrade Active Account

- A minimum of 20 operations per month

- Lowest Commissions: 0.08% for Spain shares, from 0.08% for US Stocks, from 0.09% on CFDs, and $3 for Futures / Options

The broker also offers a completely free demo account for practice and backtest purposes. Currently, Activotrade does not offer Islamic (swap-free) account options for clients who adhere to Shariah-compliant trading requirements.

Pros & Cons

In this Activotrade review, we must mention that the broker has a set of complex offerings, especially its account types, which can be confusing for beginners.

Let’s weigh the broker’s advantages against its disadvantages.

Pros | Cons |

Wide range of tradable assets | No English support |

CNMV regulation ensures safety | No passive investment solutions |

Comprehensive educational resources | Lack of support for popular platforms like MetaTrader |

FOGAIN membership for added protection | Limited deposit/withdrawal options |

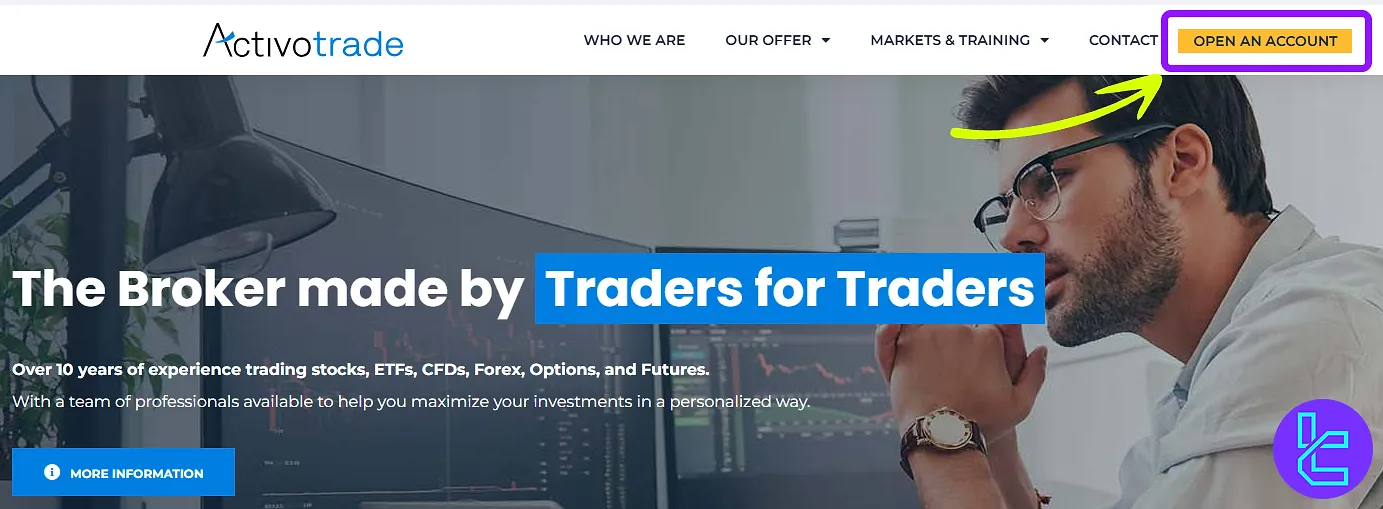

Activotrade Registration and Verification

To begin trading on the Activotrade broker, traders must open an account and verify it. Activotrade registration:

#1 Enter the ActivoTrade Website and Access the Account Opening Section

Search for the Activo broker on your web browser, and enter it. Then, click on the "Open an Account" button.

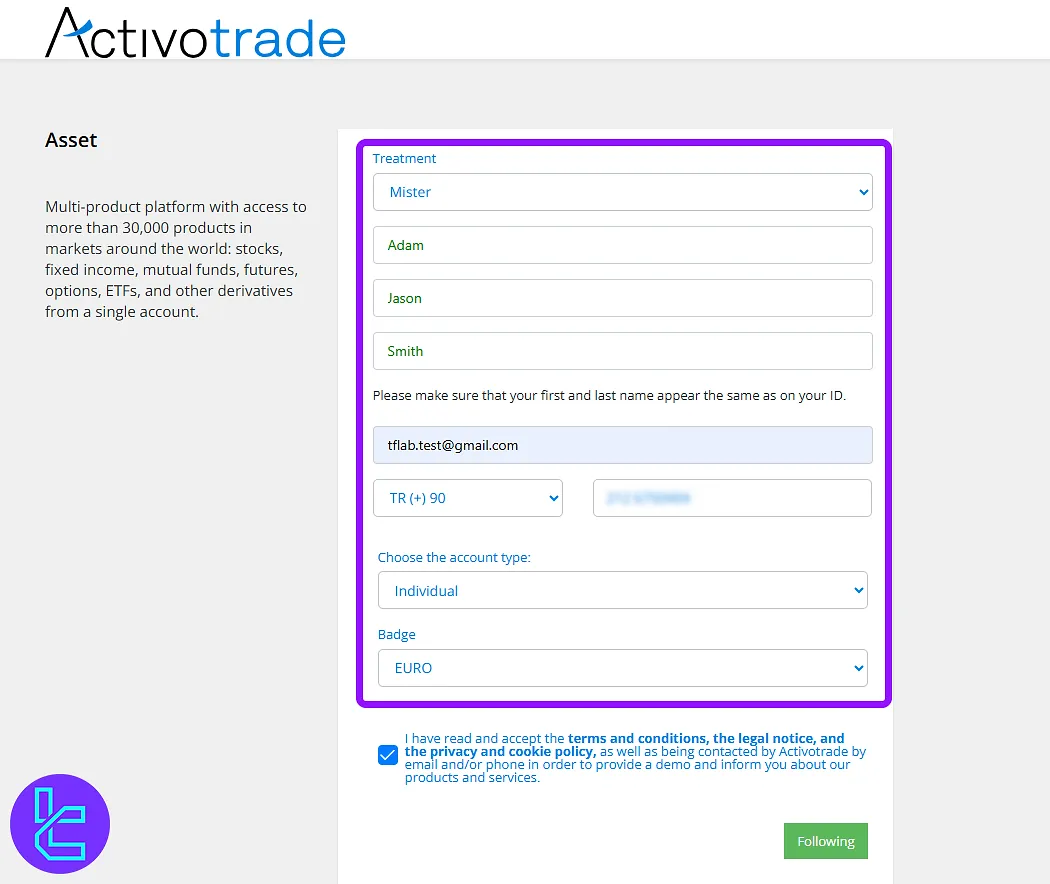

#2 Provide Your Personal Information in the Account Opening Section

In the registration form, provide the following details:

- Gender

- Full name

- Phone number

#3 Verify Your Email Address

Now, check your email inbox and look for a verification link sent by the Activo broker. After finding the email, click on the link to verify your email address.

To use all the platform's services and comply with the anti-money laundering regulations, traders must verify their account in the Activotrade broker by uploading the necessary documents.

Trading Platforms

Activotrade supports trading via the widely used MetaTrader 4 platform as well as its in-house Activotrader platform, accessible on bothweb and mobile devices.

The Activotrader platform offers features such as live market data, customizable charting tools, and direct connectivity to international markets.

Activotrade Broker Fee Structure

The broker provides Futures and Options trading with commissions from $3. We’ve already mentioned the trading commissions in this Activotrade review.

Let’s explore the spreads for some Indices CFDs in the table below:

Trading Pair | Basic | Standard | Trader | Active |

SP500 | 1 Pip | 0.75 Pips | 0.6 Pip | 0.5 Pip |

IBEX35 | 8 Pips | 6 Pips | 5 Pips | 4.25 Pips |

NAS100 | 1.5 Pips | 1.2 Pips | 1 Pip | 1 Pip |

DOW30 | 3 Pips | 2.8 Pips | 2.8 Pips | 2 Pips |

DAX40 | 2 Pips | 1.5 Pips | 1.5 Pips | 1.1 Pips |

The broker charges aninactivity fee of $100 if 180 days have passed since the last purchase/sale transaction.

Swap-Fee in Activotrade

Activotrade applies overnight financing (swap) costs whenever positions with leverage remain open past the daily rollover.

- Swap costs are calculated from interbank Tom/Next rates plus a broker markup, which means traders may either pay or receive financing adjustments;

- For share CFDs, short positions carry an additional borrowing cost starting from 0.50% per year, charged monthly and fixed when the position is opened;

- Exact swap values fluctuate with market conditions and are displayed in the trading platform before order confirmation;

- Activotrade does not offer “swap-free” or Islamic account.

Non-Trading Fees in Activotrade

Beyond spreads and commissions, Activotrade also applies several non-trading fees worth noting.

- 01% monthly custody fee on equities and fixed income;

- 75% markup on currency conversions; 0.5% on internal transfers;

- €30 fee for manual/non-platform withdrawals; extra costs for non-SEPA or foreign-currency transfers;

- €36 inactivity fee if no trades occur for over 365 days.

Activotrade Payment Options

The broker offers limited payment methods.Bank Transfer is the only available option for deposits and withdrawals.

The only silver lining regarding payments is that the broker hasn’t implemented a minimum deposit requirement for its Basic account.

Deposit Methods in Activotrade

Activotrade allows traders to deposit funds using bank transfers and credit or debit cards (Visa and Mastercard).

These methods are secure and reliable, excluding risky or unregulated ways of transferring money.

For deposits, see the table above for currencies, fees and processing times:

Payment Method | Currency | Deposit Fees | Processing Time |

Bank Transfer | EUR, USD | No broker fee | 2–3 business days |

Credit/Debit Cards | EUR, USD | No broker fee | Instant (first-time may take up to 1 business day) |

Withdraw Methods in Activotrade

Traders can withdraw their funds from Activotrade via bank transfers and credit or debit cards (Visa and Mastercard).

The same secure and official methods used for deposits are also available for withdrawals.

For withdrawals, see the table above for currencies, fees and processing times.

Payment Method | Currency | Withdrawal Fees | Processing Time |

Bank Transfer | EUR, USD | No broker fee | 3–5 business days |

Credit/Debit Cards | EUR, USD | No broker fee | Same day (if before 12:30 PM UK time) |

Copy Trading and Investment Plans on Activotrade

The lack of copy trading or social trading services is a letdown in this Activotrade review. While the broker doesn’t offer money management services, it has expert consultants who can be helpful in your trading journey.

The Active Plus platform provides access to the Autochartist tool for trading signals. It also offers fixed income instruments and investment funds.

Activotrade Broker Trading Products

Activotrade offers a broad range of tradable instruments across global exchanges, including Stocks, ETFs, CFDs, Forex, Options, Futures, Bonds, and Cryptocurrencies.

Traders can access over 22,000 stocks, 9,000+ CFDs, 190 forex spots, and 3,000+ listed options, as well as 300+ futures contracts.

All products are available on reputable exchanges like CME, NYMEX, CBOT, EUREX, and Euronext.

Here is a summary of the tradable instruments and products available at Activotrade:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Stocks | Global stocks | 22,000+ | ~15,000 | 1:5–1:20 |

ETFs | Exchange-Traded Funds | 6,400+ | ~3,000 | 1:5–1:20 |

Bonds | Government & corporate bonds | Not specified | ~1,500 | 1:5–1:20 |

CFDs | Stocks, ETFs, Indices, Commodities | 9,000+ | ~5,000 | 1:30 |

Forex | Spot & forward currency pairs | 190+ spot, 130+ forward | ~100–150 | 1:30 |

Futures | Indices, Energy, Metals, Agriculture | 300+ | ~200 | 1:20 |

Options | Stocks, Energies, Metals, Forex | 3,000+ | ~1,500 | 1:10–1:20 |

Crypto | BTC, ETH against EUR, USD, JPY | 9 pairs | ~10–20 | 1:2 |

The table above provides an overview of the wide range of tradable instruments and products offered by Activotrade.

- Stocks: 22,000 Global stocks across 50 exchanges

- Forex: 190 spots and 130+ forward currency crosses

- CFDs: 9,000+ instruments, including Metals, Energies, and Indices

- Bonds: Government and corporate bonds from various countries

- ETFs: Exchange-traded funds tracking various indices and cryptocurrencies

- Futures: Over 300 futures contracts on stock indices, energy, metals, agriculture, rates, and currencies

- Options: 3,000+ listed options on stocks, energies, metals, Forex futures, and more from 20 exchanges

- Crypto: BTC and ETH against EUR, USD, and JPY

Promotional Offerings

If you're hoping for lucrative welcome bonuses or ongoing promotions, you might be disappointed. Activotrade offers no deposit bonuses, trading contests, or referral programs. This approach aligns with CNMV guidelines and policies.

Activotrade Awards

As of now, Activotrade does not appear to have received any major industry awards. The broker prioritizes delivering quality trading services and account solutions over pursuing formal industry awards.

Activotrade Customer Support

The company provides customer support from 8:30 AM to 6:00 PM (GMT+1) through various channels, including:

contact@activotrade.com | |

Online Chat | |

Tel Barcelona | +34932200768 |

Tel Madrid | +34919012319 |

Ticket | Through the “Contact Us” page |

The table above clearly outlines the primary contact options available for Activotrade customers.

Activotrade Broker Geo-Restrictions

While the company strives to serve a global clientele, it’s prohibited in certain jurisdictions, including the United States and OFAC-sanctioned jurisdictions. Activotrade restricted countries:

- United States of America

- Cuba

- Iran

- North Korea

- Syria

- Russia

- Ukraine

Trust Score

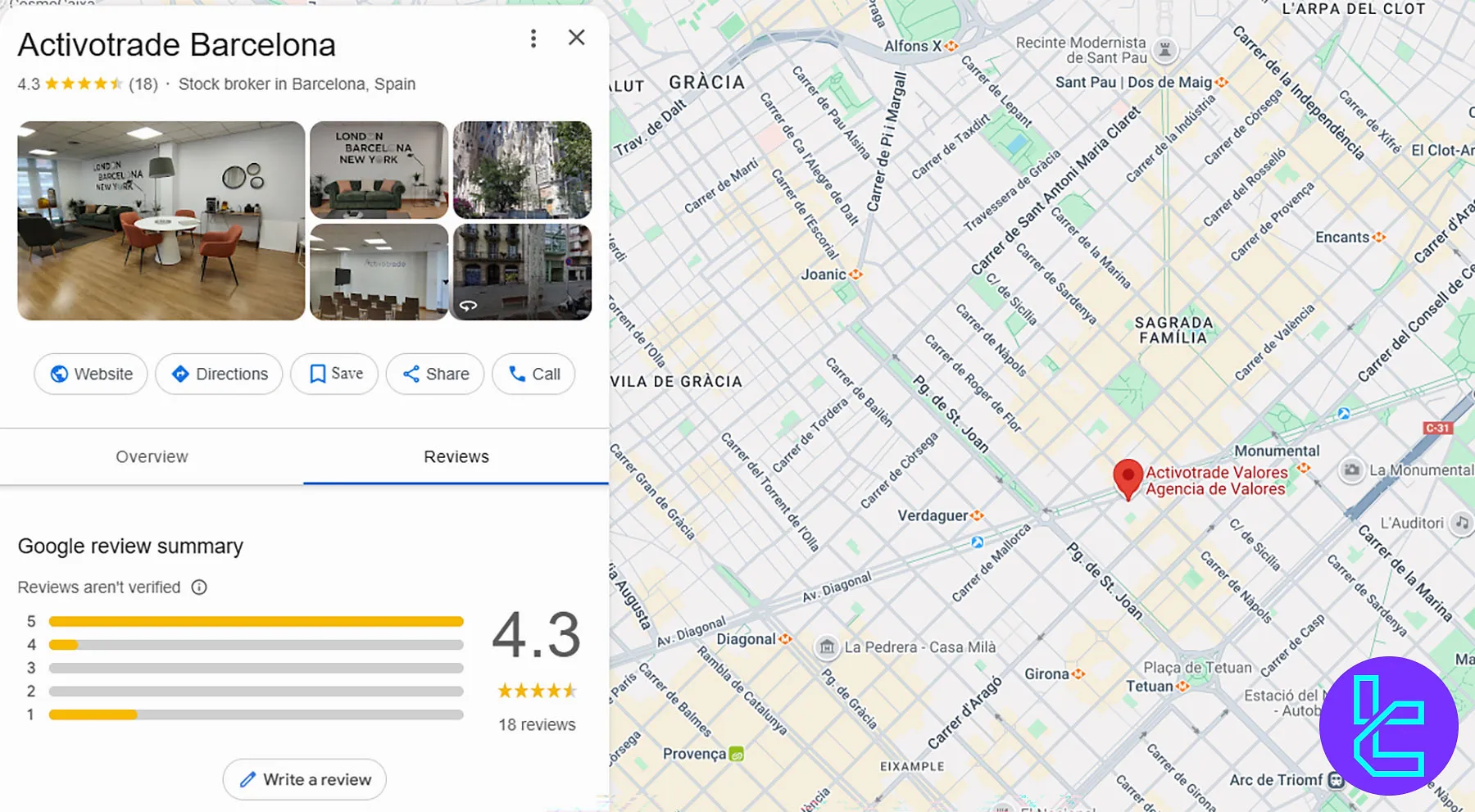

There are no Activotrade reviews on rating platforms like Trustpilot or Forex Peace Army. However, the broker’s account on Google Maps has 18 reviews resulting in a great score of 4.3 out of 5.

While three comments on the Activotrade Google Reviews profile are 1-star, the others are 5-stars.

Educational Resources

So far, 40K investors have participated in Activotrade training courses and seminars. The broker’s website also features 3 main learning sections, including:

- Active Blog: Training, technical analysis, assets

- Platform Tutorials: Guides on the Active Plus platform

- Webinars: Free online courses on trading strategies and investment products

Activotrade Comparison with Other Forex Broker

The table below provides valuable data regarding the quality of services in the Activotrade compared to other Forex brokers.

Parameters | ActivoTrade | |||

Regulation | CNMV | ASIC, FSC, DFSA, CySEC | FCA, FSCA, CySEC, SCB | CySEC, DFSA, FCA, FSCA, FSA |

Minimum Spread | 0.9 Pips | 0.6 Pips | 0.0 Pips | 0.0 Pips |

Commission | From 0.08% | $0 (Except On Shares Account) | From $3 | No commission for Forex pairs (except in Zero accounts) |

Minimum Deposit | $1 | $5 | $100 | $0 |

Maximum Leverage | 1:30 | 1:1000 | 1:500 | 1:2000 |

Trading Platforms | MetaTrader 4 | MetaTrade 4, MetaTrade 5, Mobile App | MetaTrade 4, MetaTrade 5, Mobile App, cTrader, Web Trader | MetaTrade 4, MetaTrade 5, Mobile App |

Account Types | Basic, Standard, Trader, Active, Demo | Micro, Standard, Ultra Low, Shares | Standard, Pro, Raw+, Elite | Cent, Zero, Pro, Premium |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 30000+ | 1400+ | 2100+ | 500+ |

Trade Execution | Market | Market, Instant | Market | Market, Instant |

Conclusion and Final Words

Activotrade provides access to CFDs and Futures on the Forex market. It also offers 40 vanilla currency options with maturities from overnight to 12 months. The commissions for these contracts start from $3.