Admiral Brokers was established in the second year of the new millennium [2001] and provides services to more than 130 countries. Admirals brokerage has received valid regulations such as CySEC and FCA and insures each trader's capital of up to $20,000.

This broker offers low-cost trading with spreads starting from 0.0 pips and commissions as low as $0.02.

Admirals Broker Company Information & Regulation

Admirals, formerly known as Admiral Markets, is a Tallinn, Estonia-based trading platform that has been serving traders since 2001.

Founded by “Alexander Tsikhilov”, the company has grown to become a major player in the online brokerage industry, offering forex and contracts for difference (CFDs) across various financial markets.

But what gives Admiral Brokers credit? Regulation is definitely one of them. Admiral Brokers Regulation:

- FCA (United Kingdom Financial Conduct Authority)

- CySEC (Cyprus Securities and Exchange Commission)

- ASIC (Australian Securities and Investments Commission)

- JSC (Jordan Securities Commission)

- CIPC (South Africa Companies And Intellectual Property Commission)

While Admirals has faced some controversies over the years, including incidents of fake websites using its brand, the company has maintained a strong reputation in the industry.

In 2021, an initial fine by the Estonian financial regulator was later annulled by the courts, further solidifying Admirals' commitment to regulatory compliance.

In the table below, you can see the regulatory details of each Admirals branch:

Parameter | Admirals Europe Ltd | Admiral Markets AS |

Regulation | Cyprus Securities and Exchange Commission (CySEC) – License No. 201/13 | Estonian Financial Supervision Authority (EFSA) – License No. 4.1-1/46 |

Regulation Tier | Tier 1 | Tier 1 |

Country | Cyprus | Estonia |

Investor Protection Fund / Compensation Scheme | Investor Compensation Fund (ICF) – up to €20,000 per client | Estonian Guarantee Fund – up to €20,000 per client |

Segregated Funds | Yes | Yes |

Negative Balance Protection | Yes | Yes |

Maximum Leverage | Up to 1:30 (retail), 1:500 (professional) | Up to 1:30 (retail), 1:500 (professional) |

Client Eligibility | Clients from EEA countries (excluding Belgium) | EEA clients (depending on local regulations) |

Specifics Summary

Let's take a closer look at what makes Admirals stand out in the crowded online brokerage market; Admiral brokerage specifics:

Broker | Admirals (Formerly Admiral Markets) |

Account Types | Trade.MT5, Invest.MT5, Zero.MT5, Trade.MT4, Zero.MT4 |

Regulating Authorities | FCA, ASIC, CySEC, JSC, CIPC |

Based Currencies | EUR, GBP, USD, CHF, BGN, CZK, HRK, HUF, PLN, RON |

Minimum Deposit | $1 |

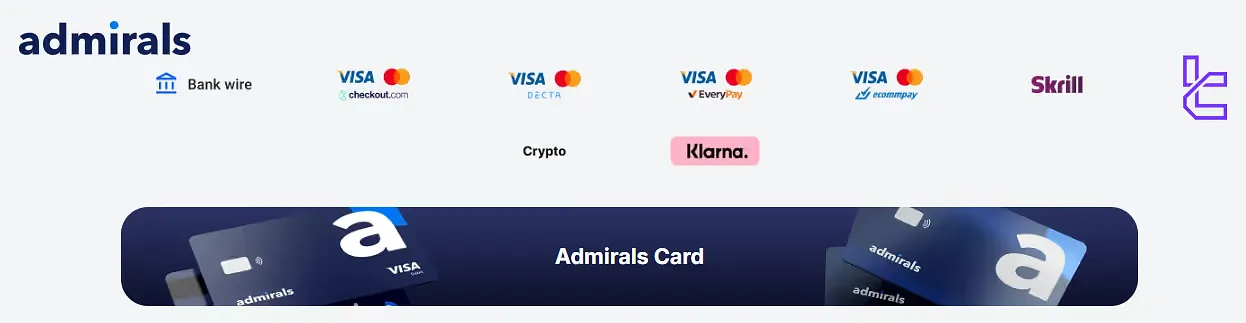

Deposit Methods | Bank Wire, VISA/MasterCard, Skrill, Klarna |

Withdrawal Methods | Bank Wire, VISA/MasterCard, Skrill |

Minimum Order | 0.01 lot |

Maximum Leverage | 1:500 |

Investment Options | Social Trade, Copytrade |

Trading Platforms & Apps | MT4, MT5, Web Trader, Mobile App |

Markets | Currencies, cryptocurrencies, Metal, Energy, Commoditi, Cash Index, Stock, ETF, Bonds |

Spread | Varies based on Account |

Commission | Varies based on Account |

Orders Execution | Market Execution, Exchange Execution |

Margin Call/Stop Out | Varies based on Account |

Trading Features | EA, Hedging, Negative Balance Protection, Economic Calendar, Metatrader Supreme Edition, StereoTrader, VPS |

Affiliate Program | Yes |

Bonus & Promotions | None |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Live Chat, Phone Call, FAQ |

Customer Support Hours | 24/7 |

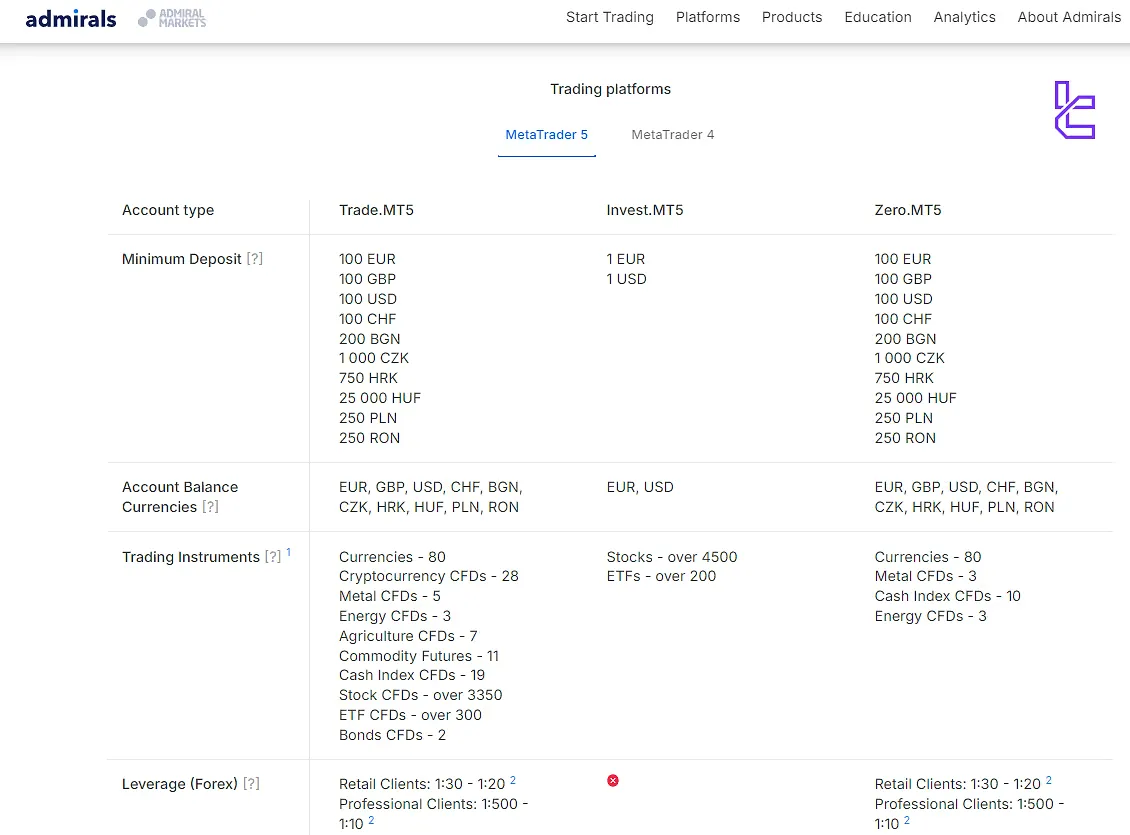

What are Admirals Broker Trading Accounts?

Admirals offers several types of trading accounts based on its trading platforms [Metatrader 4 and Metatrader 5].

Admiral Markets account types:

Account Type | Zero.MT4 | Trade.MT4 | Zero.MT5 | Invest.MT5 | Trade.MT5 |

Minimum Deposit | $100 | $100 | $100 | $1 | $100 |

Base Currencies | EUR, GBP, USD, CHF, BGN, CZK, HRK, HUF, PLN, RON | EUR, GBP, USD, CHF, BGN, CZK, HRK, HUF, PLN, RON | EUR, GBP, USD, CHF, BGN, CZK, HRK, HUF, PLN, RON | EUR, USD | EUR, GBP, USD, CHF, BGN, CZK, HRK, HUF, PLN, RON |

Trading Instruments | Currencies, Metal, Cash Index, Energy | Currencies, cryptocurrencies, Metal, Energy, , Cash Index, Stock | Currencies, Metal, Cash Index, Energy | Stocks, ETF | Currencies, cryptocurrencies, Metal, Energy, Commoditi, Cash Index, Stock, ETF, Bonds |

Leverage | 1:20 for retail clients, 1:500 for professional clients | 1:20 for retail clients, 1:500 for professional clients | 1:20 for retail clients, 1:500 for professional clients | No | 1:20 for retail clients, 1:500 for professional clients |

Spread | Form 0.0 pips | Form 0.5 pips | Form 0.0 pips | Form 0.0 pips | Form 0.5 pips |

Commissions | $1.8 to $3 for forex & Metals, $0.05 to $3 for cash indices, $1 for Energies | No commission, $0.02 for single shares | $1.8 to $3 for forex & Metals, $0.05 to $3 for cash indices, $1 for Energies | $0.02 per share | No commission, $0.02 for single shares |

Order Execution | Market Execution | Market Execution | Market Execution | Exchange Execution | Market Execution |

Min Order | 0.01 Lot | 0.01 Lot | 0.01 Lot | No | 0.01 Lot |

Stop Out | retail clients: 30%, Professional Clients 50% | retail clients: 30%, Professional Clients 50% | retail clients: 50%, Professional Clients 30% | No | retail clients: 30%, Professional Clients 50% |

Negative Balance Protection | Yes | Yes | Yes | No | Yes |

Islamic Account | No | No | No | No | Yes |

Trading Platform | MetaTrader 4, MetaTrader Web Trader | MetaTrader 4, MetaTrader Web Trader | MetaTrader 5, MetaTrader Web Trader | MetaTrader 5, MetaTrader Web Trader | MetaTrader 5, MetaTrader Web Trader |

Expert Advisor | Yes | Yes | Yes | Yes | Yes |

Hedging | Yes | Yes | Yes | No | Yes |

Economic calendar | Yes | Yes | Yes | Yes | Yes |

Admirals Broker Pros and Cons

Let's break down the advantages and disadvantages of using Admirals as your broker:

Pros | Cons |

Highly regulated by multiple tier-1 authorities | Social trading feature is relatively new and less developed |

Wide range of tradable instruments (+8000) | Mobile app experience lags behind some competitors |

Excellent educational resources and market analysis tools | Not available in some countries (e.g., USA, Canada, Japan) |

Competitive pricing and transparent fee structure | No trading Bonuses |

- | $20000 insurance |

Overall, Admirals offers a robust trading experience with a strong emphasis on regulation, diverse product offerings, and trader education. While there are some limitations, the pros generally outweigh the cons for most traders.

Admirals Broker Sign-up Guide

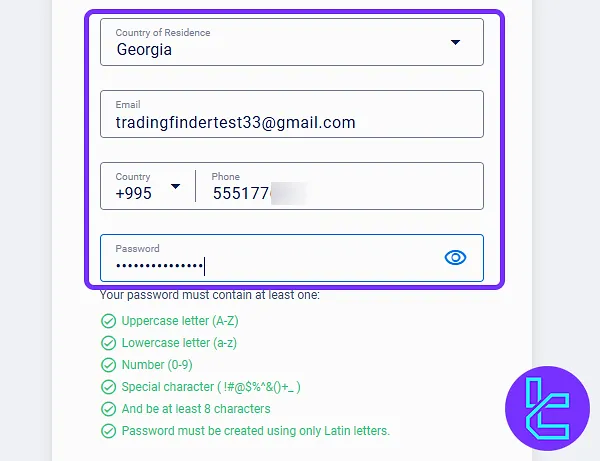

Follow this simple 3-step process to open an account and start trading with the Admirals broker. Admirals registration:

#1 Visit the Admirals Official Website

Go to the Admirals homepage by searching for the broker via any browser. Select the “Register” option to begin the onboarding process.

#2 Fill in Your Personal Information

Select your country of residence, enter a valid email address and mobile number, and then create a secure password. Utilize a combination of characters to enhance account security.

#3 Confirm Your Email Address

Check your inbox for the verification email from Admirals. Click the provided link to confirm your email and activate your trading dashboard.

After registration, traders must complete the Admirals verification process to gain full access to the platform features and unlock withdrawals. Required documents, include:

- Proof of identity: Passport, driver's license, or ID card

- Proof of address: Bank statement or utility bill

What are Admirals Broker Trading Platforms?

Admirals offers a variety of advanced trading platforms [Metatrader 4, Metatrader 5, Mobile app and Web Trader], which you can download with the links below:

- MetaTrader 4 Download

- MetaTrader 5 Download

- Admiral Markets Android App Download

- Admiral Markets iOS App Download

Admiral Markets Brokers Fees and Spreads

Admirals offers competitive pricing across its various account types and tradable instruments; Admirals Brokerage fees & spreads:

Account Type | Spread | Commission |

Trade.MT5 | From 0.5 Pips | No commission, $0.02 for single shares |

Invest.MT5 | From 0.0 Pips | $0.02 per share |

Zero.MT5 | From 0.0 Pips | $1.8 to $3 for forex & Metals, $0.05 to $3 for cash indices, $1 for Energies |

Trade.MT4 | From 0.5 Pips | No commission, $0.02 for single shares |

Zero.MT4 | From 0.0 Pips | $1.8 to $3 for forex & Metals, $0.05 to $3 for cash indices, $1 for Energies |

If you are interested in lowering your trading costs via earning admirals rebate, check TradingFinder IB services.

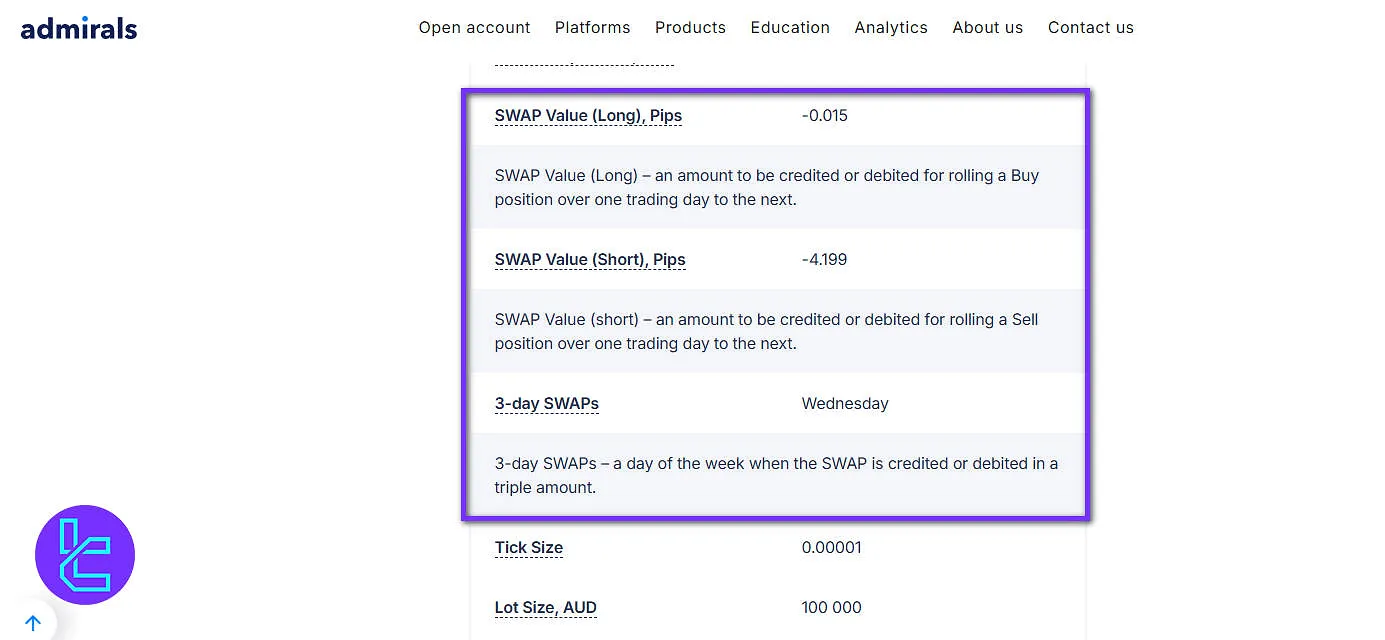

Admirals Swap Fees

Admirals (formerly Admiral Markets) applies swap fees, also known as overnight or rollover charges, on trading positions held open past the end of a trading day.

Traders can view the exact swap rates for each symbol directly in the Admirals’ Contract Specification section or within the MT4/MT5 platform under “Swap (Long)” and “Swap (Short)”.

Like most brokers, Admirals applies a triple swap on one weekday, typically Wednesday, to account for the weekend when markets are closed.

Admirals also offers swap-free (Islamic) accounts, where traditional interest-based swaps are replaced by a fixed administration fee after a specific holding period.

Admirals Non-Trading Fees

Admirals maintains a transparent fee structure for non-trading operations. The broker does not charge any deposit fees, allowing clients to fund their accounts freely regardless of the method used.

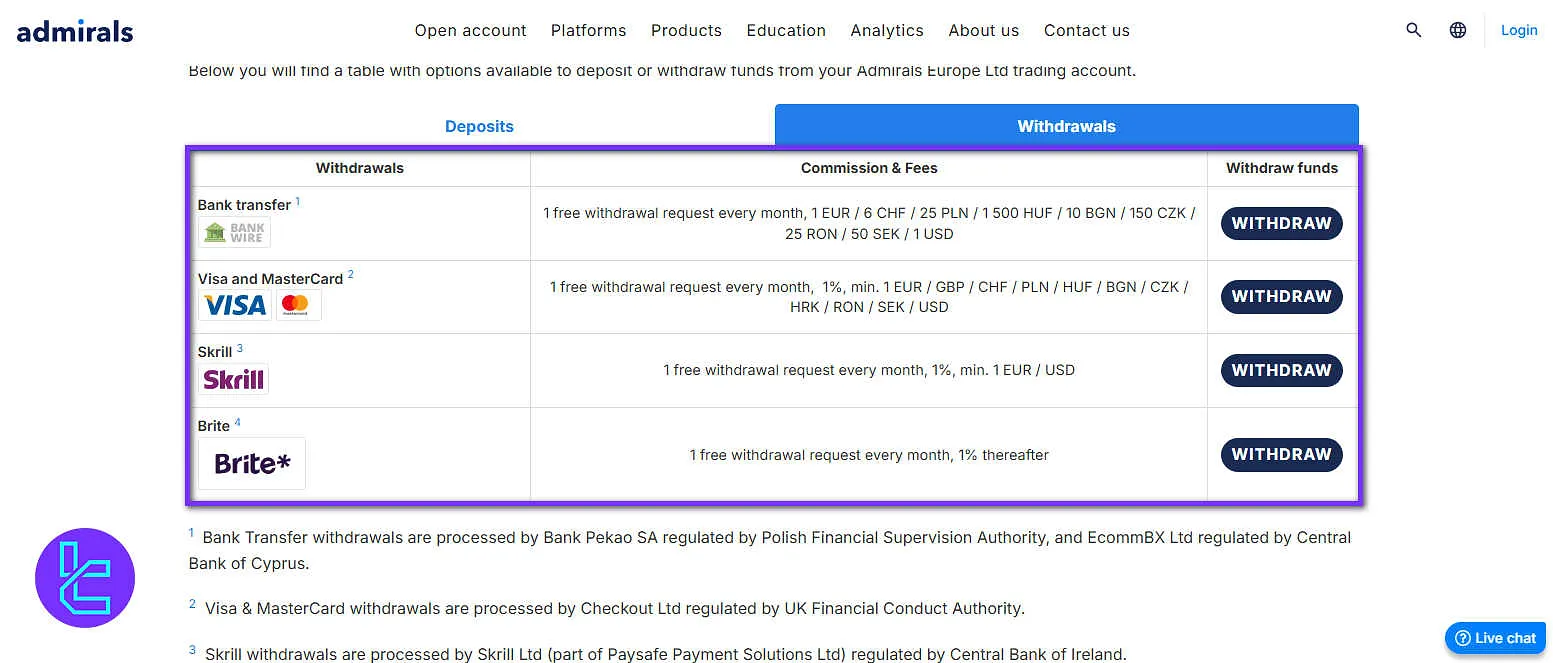

However, withdrawals may include minor service costs once the first free request of each month is used.

For example, bank transfers incur a fee of around 1 EUR (or the equivalent in other currencies), while Visa and MasterCard withdrawals carry a 1% charge, with a minimum of 1 EUR / USD / GBP, depending on the account currency.

The same 1% fee applies to Skrill and Brite transactions after the initial free monthly withdrawal.

Additionally, Admirals applies an inactivity fee to dormant accounts. Clients who have not conducted any trading activity for 24 consecutive months and maintain a positive balance are charged 10 EUR per month.

This policy is designed to maintain active accounts and ensure proper account management, while still providing one free withdrawal per month for regular users.

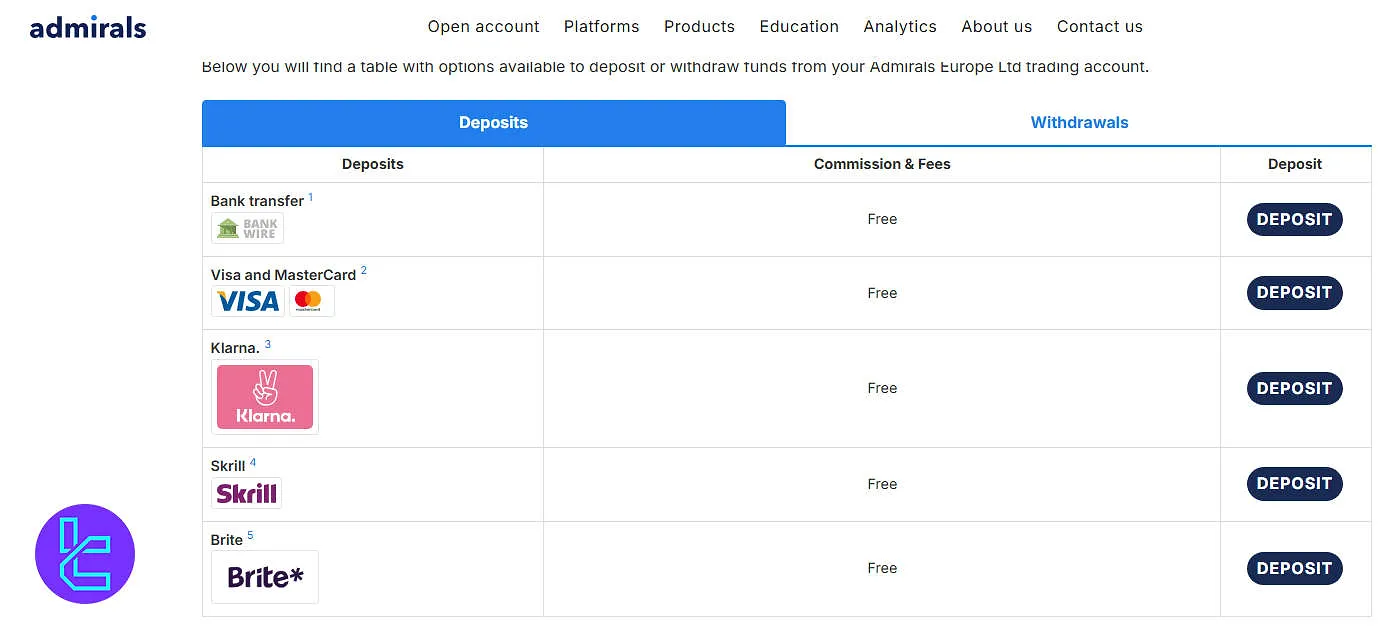

Withdrawal & Deposit Methods

Admirals broker supports bank wire transfer, VISA, Mastercard, Skrill and Klarna as payment methods; don’t know which to choose?

Check the Admirals Broker payment methods table.

Deposit Method | Deposit Method Fees | Withdrawal Method | Withdrawal Method Fees |

Bank Wire | Fee | Bank Wire | 1 free withdrawal request every month, 1 EUR / 6 CHF / 25 PLN / 1 500 HUF / 10 BGN / 150 CZK / 25 RON / 50 SEK |

VISA/MasterCard | Fee | VISA/MasterCard | 1 free withdrawal request every month, 1%, min. 1 EUR / GBP / CHF / PLN / HUF / BGN / CZK / HRK / RON / SEK |

Skrill | Fee | Skrill | 1 free withdrawal request every month, 1%, min. 1 EUR / USD |

Klarna | Fee | - | - |

Admirals Deposit

Admirals provides a zero-fee deposit structure, allowing clients to fund their trading accounts without incurring additional costs.

The broker supports multiple payment channels, including bank transfers, Visa and MasterCard, Klarna, Skrill, and Brite, all of which can be used to add funds instantly or within standard banking timeframes.

This policy ensures traders can allocate their capital efficiently without worrying about deposit-related deductions, regardless of the currency or region.

Below is a summary of the available deposit options and their associated fees:

Deposit Method | Commission / Fees | Notes |

Bank Transfer | Free | Standard processing time applies |

Visa / MasterCard | Free | Instant funding available |

Klarna | Free | Region-specific availability |

Skrill | Free | E-wallet deposit option |

Brite | Free | Instant bank payment service |

Admirals Withdrawal

Admirals provides several withdrawal options with clear and transparent fee conditions. Each client is entitled to one free withdrawal per calendar month, after which minimal processing fees apply depending on the payment method.

Supported channels include bank transfers, Visa/MasterCard, Skrill, and Brite, each handled by licensed financial institutions under regional regulatory authorities.

Withdrawals via bank transfer are executed through Bank Pekao SA (regulated by the Polish Financial Supervision Authority) and EcommBX Ltd (supervised by the Central Bank of Cyprus), incurring a small fixed fee of 1 EUR / 1 USD (or currency equivalent) after the first free request.

Card transactions processed by Checkout Ltd, authorized by the UK Financial Conduct Authority (FCA), are subject to a 1% fee with a minimum charge of 1 unit in the account currency.

Skrill, part of Paysafe Payment Solutions Ltd under the Central Bank of Ireland, and Brite AB, a Swedish Financial Supervisory Authority-regulated provider, also apply a 1% charge after the first free monthly withdrawal.

Here are the details of each method:

Withdrawal Method | Commission / Fees | Processor & Regulation |

Bank Transfer | 1 free per month, then 1 EUR / 6 CHF / 25 PLN / 1 USD etc. | Bank Pekao SA – Polish FSA; EcommBX Ltd – Central Bank of Cyprus |

Visa / MasterCard | 1 free per month, then 1% (min. 1 EUR / GBP / USD etc.) | Checkout Ltd – UK Financial Conduct Authority |

Skrill | 1 free per month, then 1% (min. 1 EUR / USD) | Skrill Ltd – Central Bank of Ireland |

Brite | 1 free per month, then 1% | Brite AB – Swedish Financial Supervisory Authority |

Admirals Broker Copy Trade and Investment Options

Admirals offers copy trading functionality through the social trading platform. You can check traders' performance in this company's copy trade system and choose your desired option. After choosing a trader, there are three ways to copy trade in Admiral Brokers:

- Automatic copy trading: Trades are replicated automatically;

- Semi-automatic copy trading: Receive notifications and choose which trades to copy;

- Manual copy trading: Manually replicate trades of successful traders.

Besides that, you can copy trade in Admiral Markets Brokers via MQL5.Community. To do this, sign up for MQL5 and then select your preferred trader.

What Instruments are Tradable on Admirals Broker?

Admirals offers an impressive range of over 8,000 tradable instruments across multiple asset classes:

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | Standard, Micro, Ultra Low accounts | 80+ currency pairs (EUR/USD, CHF/USD, GBP/EUR) | 50–70 currency pairs | Up to 1:500 |

Stocks | CFDs on shares via MT5 platform | 3,000+ global shares (AAPL, TSLA, AMZN) | 800–1,200 | Up to 1:20 |

Commodities | CFDs on metals, energies, agricultural products | Around 15 instruments | 10–20 instruments | Up to 1:200 |

Indices | CFDs on global indices | 43 indices (Dow Jones, NASDAQ) | 10–20 indices | Up to 1:200 |

Bonds | US Treasuries, German Bund CFDs | Limited selection | 5-10 | N/A |

ETFs | CFDs on ETFs, Invest.MT5 platform ETFs | 370+ ETFs + hundreds more | 100+ | N/A |

Cryptocurrencies | CFDs on BTC, ETH, LTC | Major cryptocurrencies | 5-10 | N/A |

So Admirals provides a wide range of instruments in different categories with leverages up to 1:500.

Bonus

After checking out the unique features, like 8,000 tradable symbols, it's time for Admiral Brokers' Achilles' heel. This brokerage has not considered any bonuses or promotions for traders. It can be said that Admiral Brokerage's biggest weakness is not offering a bonus.

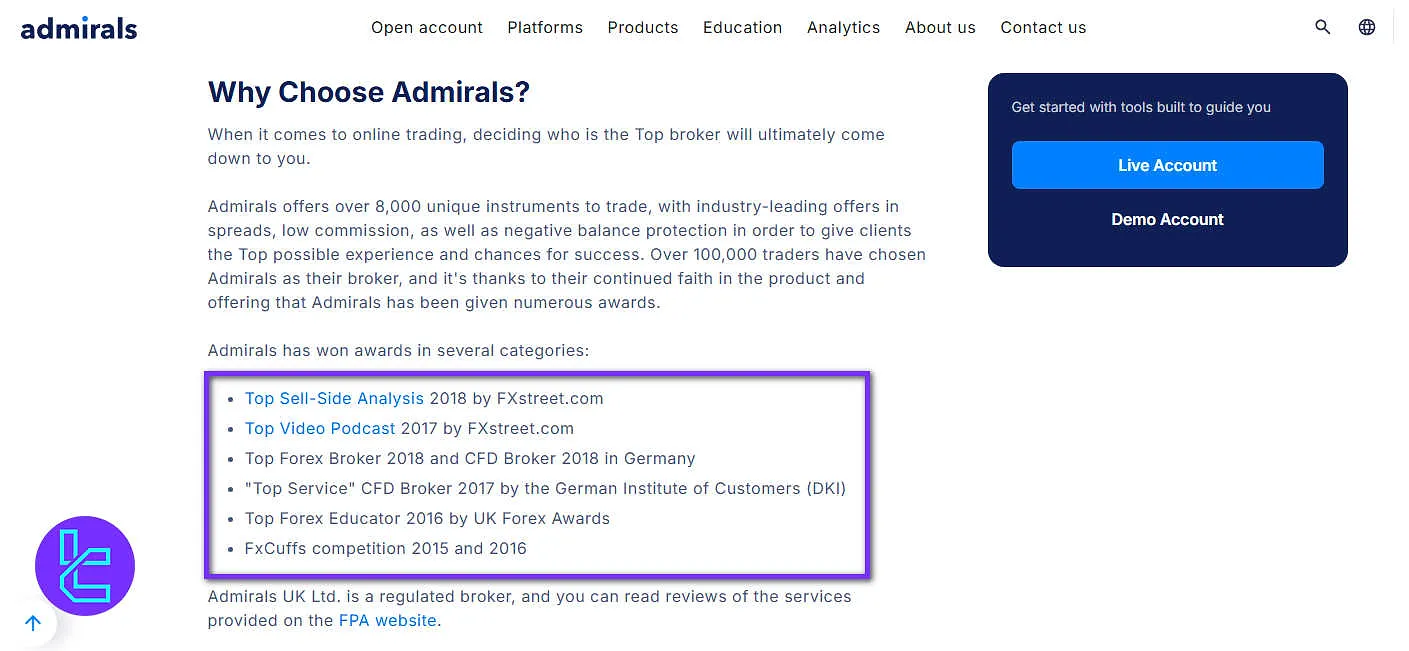

Admirals Awards

Admirals has received recognition across multiple categories in the financial services sector, highlighting its presence in both Forex and CFD trading.

Notable accolades include Top Sell-Side Analysis 2018 and Top Video Podcast 2017 from FXstreet.com, as well as Top Forex Broker 2018 and CFD Broker 2018 in Germany.

The broker was also acknowledged for service quality with the “Top Service” CFD Broker 2017 award from the German Institute of Customers (DKI), and for educational contributions as Top Forex Educator 2016 by the UK Forex Awards.

Additionally, Admirals achieved recognition in the FxCuffs competition for both 2015 and 2016.

TheseAdmirals awards collectively reflect the broker’s long-standing engagement in market analysis, client education, and service excellence across regulated trading platforms, including MT4 and MT5, as well as its commitment to maintaining industry standards in Europe and beyond.

Admirals Broker Support Ways & Opening Hours

Admirals Brokers Offers a fascinating support function in different ways! Admiral Brokers Support ways:

- Live Chat

- FAQ

- Phone Call

The interesting thing about Admiral Brokers support is that it offers 24/7 support in multiple languages.

Admirals Broker Banned Countries

While Admirals serves clients globally, there are some restrictions and above that, it Does not serve some countries. Admirals Brokerage Prohibited countries:

- United States

- Canada

- Japan

- Iran

- Libya

- Syria

- North Korea

Traders with citizenship from a prohibited country but residing in an eligible country may still be able to open an account.

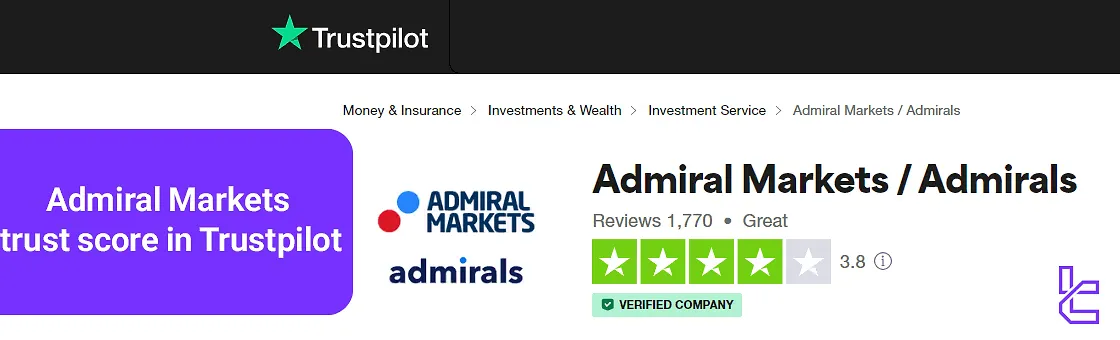

Admirals Broker Trust Scores

Admirals has garnered positive reviews and trust scores from various sources. Admiral Markets Trustpilot score:

- Trust Pilot: 3.8/5 based on 1770 reviews

- ForexPeaceArmy: 3.1/5 based on 156 reviews;

Admirals maintains a strong reputation in the trading community, with generally positive feedback from clients and industry recognition for its services. Key points from reviews:

- Praised for transparency and competitive fees

- Positive feedback on educational resources

- Some negative reviews mention technical issues and leverage changes

- Admirals actively respond to reviews, addressing concerns

Admirals Markets Brokers Educational Materials

Admiral is one of the leading brokerages that produces and provides educational content in different languages. Admiral Brokers educational content:

- Trading Webinars

- "Zero to Hero" 20-day course

- Trading Videos

- Risk Management Education

- Trader’s glossary from different markets

- Trading E-books

- Economic Calendar

Admirals' educational offerings cater to traders at all skill levels, providing a solid foundation for beginners and advanced insights for experienced traders.

Admirals in Comparison with Other Forex Brokers

To understand the key pros and cons of trading with Admirals, check the table below:

Parameters | Admirals Broker | |||

Regulation | FCA, ASIC, CySEC, JSC, CIPC | ASIC, VFSC | FSC | No |

Minimum Spread | 0.0 Pips | 0.0 Pips | 0.0 Pips | 0.1 Pips |

Commission | From $0.2 | $0 | $0 | $0 |

Minimum Deposit | $1 | $0 | $200 | $1 |

Maximum Leverage | 1:500 | 1:500 | 1:3000 | 1:3000 |

Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader, Mobile App | MetaTrader 4, MetaTrader 5, TradingView, cTrader | MetaTrader 4, MetaTrader 5, FXTM Trader App | MetaTrader 4, MetaTrader 5 |

Account Types | Trade.MT5, Invest.MT5, Zero.MT5, Trade.MT4, Zero.MT4 | Zero, Classic | ADVANTAGE, STOCKS, ADVANTAGE, ADVANTAGE PLUS | Standard, Premium, VIP, CIP |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 8000+ | 250+ | 1000+ | 45 |

Trade Execution | Market Execution, Exchange Execution | Market, Limit, Stop, Trailing Stop, Take Profit | Market | Market, Instant |

Trading Finder Expert opinion and conclusion

In addition to its long history [established in 2001], Admiral Markets has received first-class regulations from Australia's ASIC and the UK's FCA to be on the list of the most reliable forex brokers.

In addition to security, it is possible to trade more than 8000 symbols at Admiral Markets Brokers. In contrast to these, disadvantages include not offering any trading bonus.