AETOSCG is an Australian forex broker operates under the supervision of the Australian Securities and Investments Commission (ASIC), holding Australian Financial Services Licence AFSL 313016. The broker provides leverage of up to 1:400 on professional accounts.

The broker offers multiple account types, including standard and professional-style trading accounts. AETOSCG provides access to markets such as forex, indices, commodities, and CFDs across global financial instruments.

General Information and Regulation of AETOSCG

AETOS Capital Group Pty Ltd is incorporated and headquartered in Australia and is regulated by the Australian Securities and Investments Commission (ASIC) under AFSL 313016. The company operates global derivatives trading services and is a member of the Australian Financial Complaints Authority (AFCA).

AETOS also operates through AETOS Markets (M) Ltd, a wholly owned subsidiary incorporated in Mauritius, which is regulated by the Financial Services Commission (FSC) under license number GB23202270. This entity enables the group to provide trading services under an alternative regulatory framework outside Australia.

Here is key information about the AETOSCG:

Entity Parameters/Branches | AETOS Capital Group Pty Ltd | AETOS Markets (M) Ltd |

Regulation | ASIC | FSC Mauritius |

Regulation Tier | Tier-1 | Tier-3 |

Country | Australia | Mauritius |

Investor Protection Fund / Compensation Scheme | None | None |

Segregated Funds | Yes | Yes |

Negative Balance Protection | Yes | No |

Maximum Leverage | 1:30 | 1:400 |

Client Eligibility | Australian clients | Global (except restricted) |

AETOSCG holds client funds in segregated trust accounts in accordance with Australian Client Money Rules, ensuring separation from company operating funds. Also, Retail clients are subject to negative balance protection under ASIC requirements.

AETOSCG Broker Specifications

AETOS Capital Group as a forex market and CFD broker, offering 1:400 leverage and some trading features, including economic calendar and Autochartist. The following table highlights its core trading specifications for a quick overview:

Broker | AETOSCG |

Account Types | Standard, Demo, Professional |

Regulating Authorities | ASIC, FSC Mauritius |

Based Currencies | AUD, USD |

Minimum Deposit | AUD 250 |

Deposit Methods | Bank transfer, credit/debit card |

Withdrawal Methods | Bank transfer, credit/debit card |

Minimum Order | 0.01 lot |

Maximum Leverage | 1:400 (Professional accounts) |

Investment Options | None |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

Markets | Forex, Metals, Energies, Indices, Shares, ETFs |

Spread | Floating spreads |

Commission | From 0 |

Orders Execution | Market execution |

Margin Call/Stop Out | 100%/30% |

Trading Features | Hedging, Demo account, Economic calendar, Autochartist |

Affiliate Program | No |

Bonus & Promotions | Yes |

Islamic Account | N/A |

PAMM Account | Yes |

Customer Support Ways | Live chat, email, phone, In-Person Support |

Customer Support Hours | 24/5 |

Restricted Countries | Singapore, USA, countries / jurisdiction subjected to sanction |

What are the Account Types at AETOSCG?

AETOSCG maintains two primary live trading account categories. These accounts are legally structured under ASIC regulation to segregate client classifications and compliance obligations while supporting global CFD trading operations.

The “Standard” Account is tailored for typical retail traders, providing access to global CFD markets with competitive conditions. The “Professional” Account is structured for eligible wholesale clients and sophisticated investors, granting higher leverage, different protections, and enhanced trading terms subject to qualification criteria set under regulatory standards.

At the table below, we will discuss each live account's specifications and compare them together:

Feature / Attribute | Standard Account | Professional Account |

Client Category | Retail | Wholesale / Sophisticated |

Leverage | Up to 1:30 | Up to 1:400 |

Spread | From 0.4 pips | From 0 |

Commission | 0 | May have rebates / commission |

Required Documentation | Standard KYC / identity verification | Professional client tests & additional documentation |

Trading Products | Forex, Indices, Metals, Energies, Shares, ETFs | Forex, Indices, Metals, Energies, Shares, ETFs |

You don’t need to open a live account directly. AETOSCG provides demo accounts available on both MetaTrader 4 and MetaTrader 5 platforms for practice and familiarization.

AETOSCG Advantages and Disadvantages

AETOSCG is regulated by ASIC, providing compliance with Australian financial standards. Professional clients can access leverage up to 1:400, while all clients can trade multiple CFD instruments across MetaTrader 4 and 5 platforms. However, some limitations exist.

Let’s take a closer look at the strengths and weaknesses of this broker:

Pros | Cons |

Regulated by ASIC | Spreads and commission structures for some instruments not fully detailed |

High leverage up to 1:400 for eligible clients | Islamic / swap-free accounts not clearly offered |

Access to multiple CFD instruments | No social/copy trading features |

Demo accounts available on MT4 and MT5 | - |

Multiple Account Types | - |

Getting Started: Sign Up & Create Your AETOSCG Account

Registration and opening an account with AETOSCG are required in order to deposit funds and start trading. During this process, you need to provide information such as login details, account features, identity information, and employment details.

Follow the tutorial in the following sections to complete all 8 essential steps:

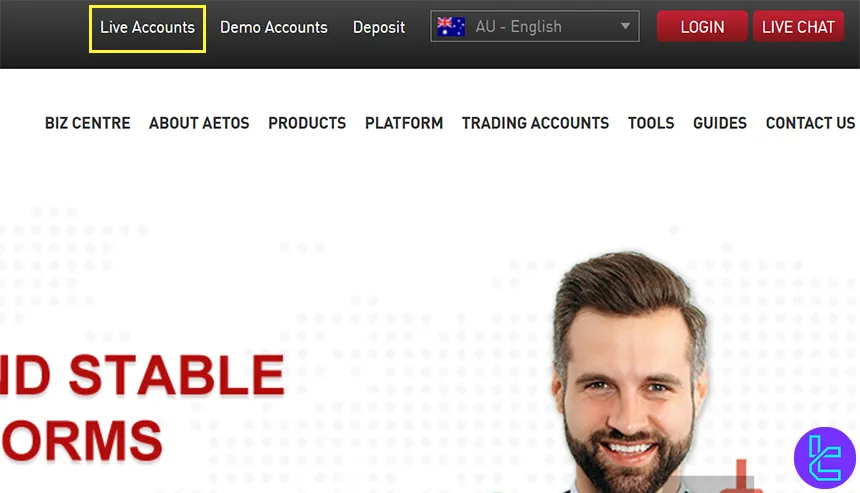

#1 Navigate to the Official Website

Visit the AETOSCG website and click on "Live Accounts" button to access the registration page.

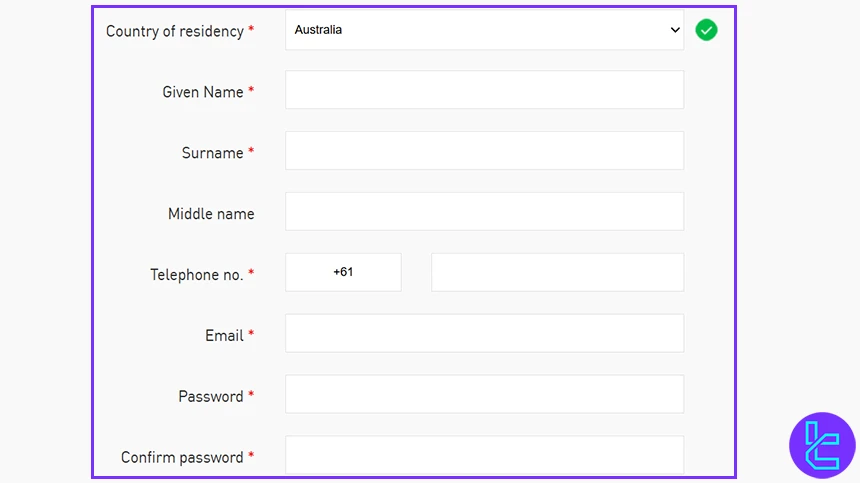

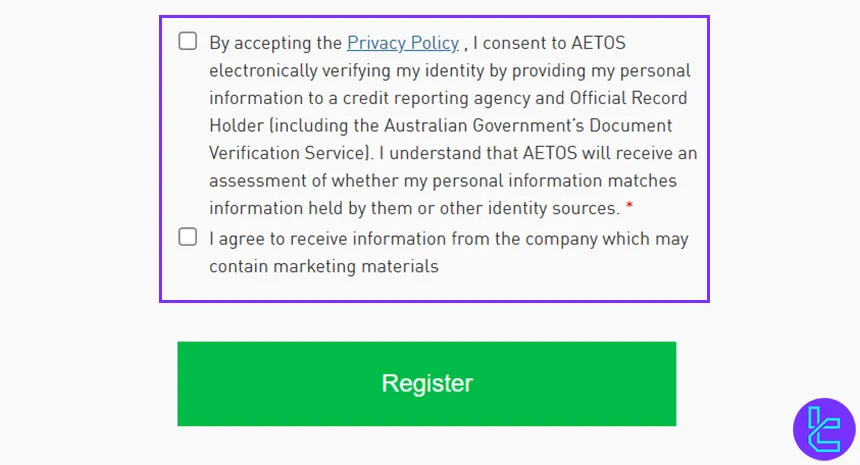

#2 Enter Login Details

At this stage, enter your Country of residency and information you will later use to log in (such as email and password).

Then, check the agreements and click on “Register”.

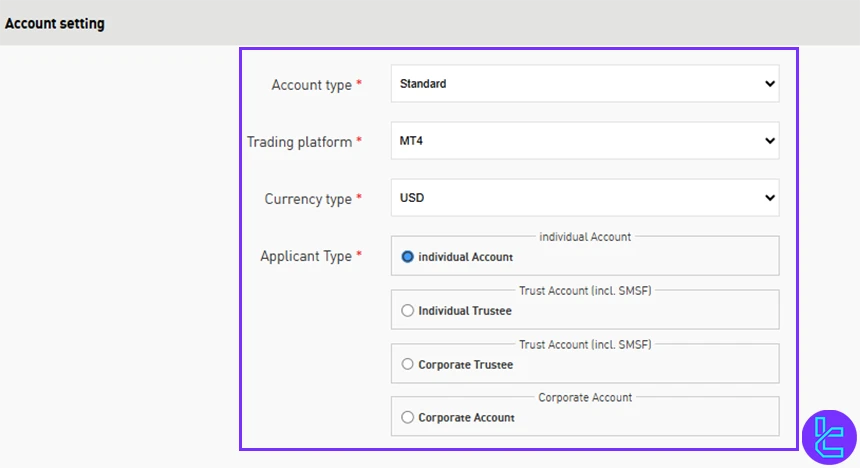

#3 Enter Account Setting

In this step, enter account setting, including:

- Account type

- Trading platform

- Currency type

- Applicant type

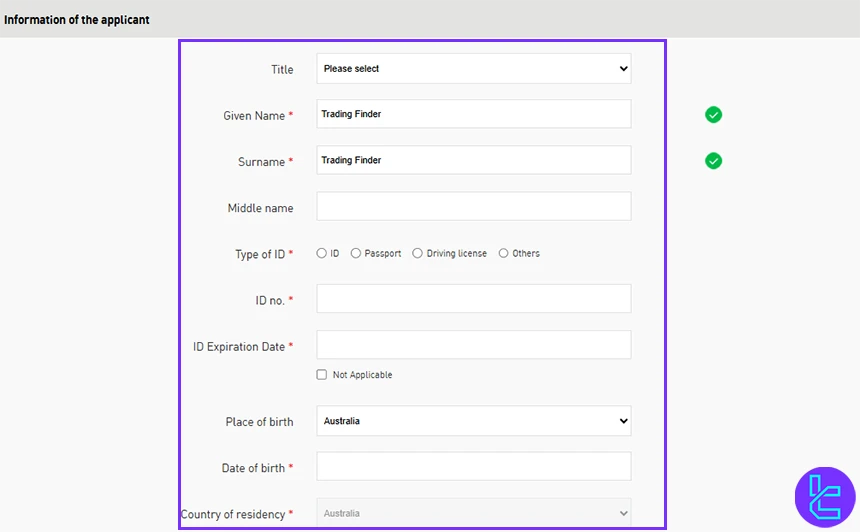

#4 Enter Information of the Applicant

Now, you must enter information of the applicant, such as full name, ID card, birth details and more.

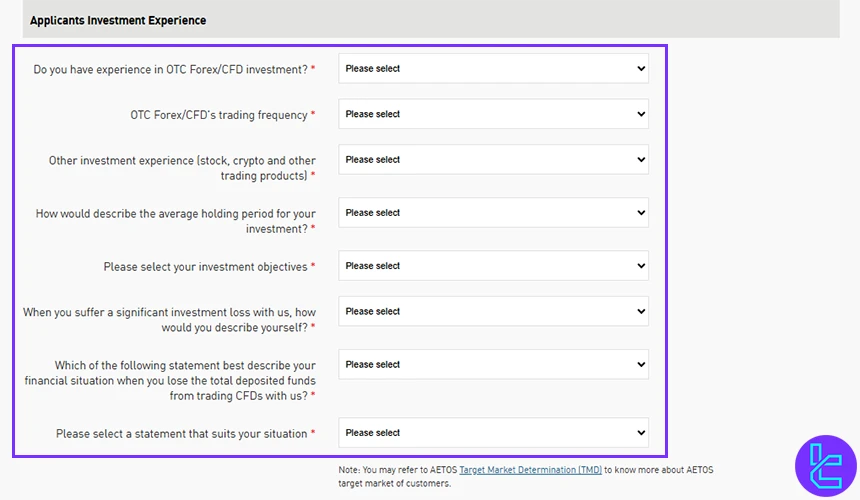

#5 Knowledge and Experience

Now the broker will ask you to assess your knowledge and experience in the financial markets. To do this, a series of pre-prepared questions will appear, and you should select your answers from the available options.

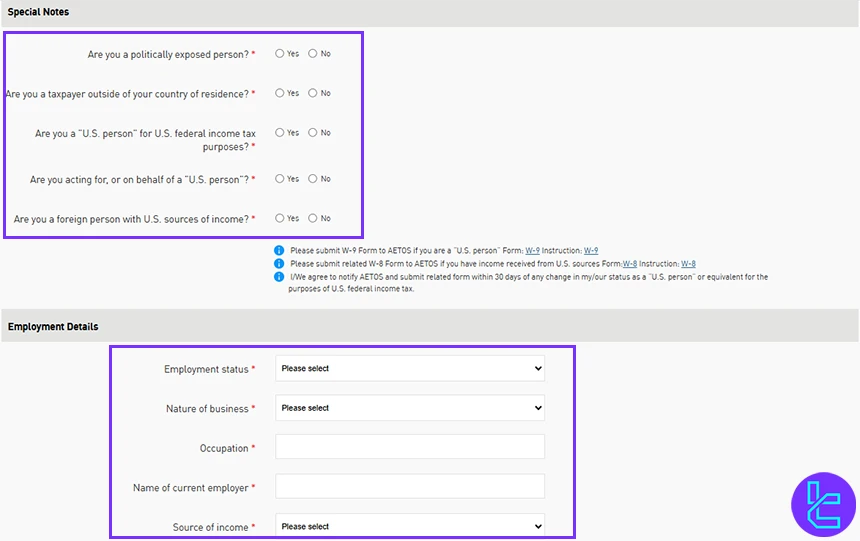

#6 Special Notes and Employment Details

AETOSCG broker will ask you some Yes/No questions related to tax and US persons situation. Then, you must compete a section about Employment details, including:

- Employment stratus

- Nature of business

- Occupation

- Name of current employer

- Source of income

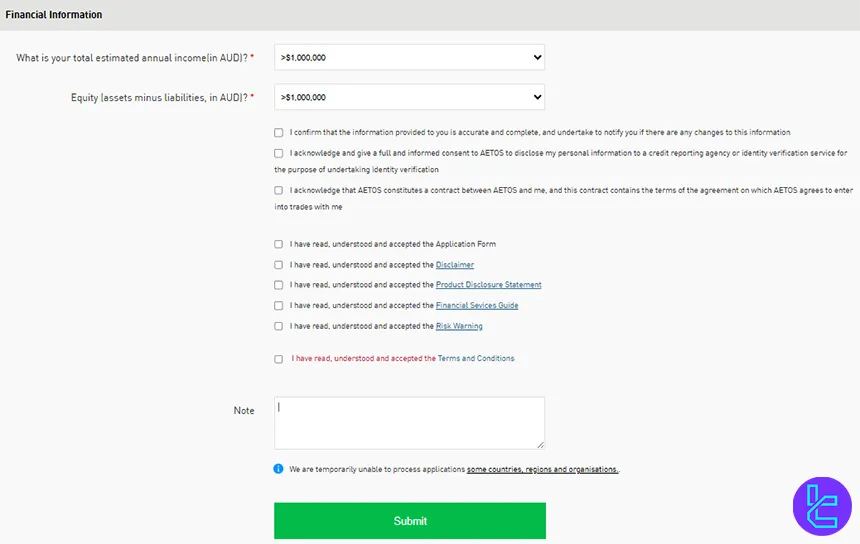

#7 Financial Information

In this stage, you need to enter your financial information, such as your net income. Finally, click the “Submit” button to complete your account opening process.

#8 Verify Account

To verify your trading account, you must provide additional information and submit the required documents on your profile.

AETOSCG Broker Trading Platforms Overview

AETOSCG provides industry‑standard trading technology through MetaTrader platforms, offering clients access to both MetaTrader 4 and MetaTrader 5 on multiple devices and operating systems.

These platforms are integrated with advanced analytical tools and order management functions to support CFD trading across Forex, indices, metals, energies, shares, and ETFs.

MetaTrader 5 (MT5)

AETOSCG offers the MetaTrader5 (MT5) platform, an updated and enhanced successor to MT4 with a broader set of analytical tools, charting features, and order types.

MT5 supports algorithmic trading via Expert Advisors, comprehensive technical analysis tools, and an integrated economic calendar and news feed.

The platform is available for:

- Desktop (Windows/Mac)

- Mobile application for iOS

- Mobile application for Android

MetaTrader 4 (MT4)

The MetaTrader4 (MT4) platform is also supported by AETOSCG, known globally for its reliable interface, flexible order execution, and extensive library of indicators and analysis tools. MT4 includes features such as technical charting, news feeds, and mobile trading support.

The platform is also available for:

- Desktop (Windows/Mac)

- Mobile application for iOS

- Mobile application for Android

Commission and Spread on AETOSCG Broker

AETOSCG charges transaction costs primarily through the spreads, which vary by instrument and market conditions. These typical spreads are published in the broker’s official Product Specification and reflect representative pricing levels for key forex pairs and other instruments.

Typical spreads for key instruments:

Instrument | Symbol | Typical Spread (Standard Account) |

EUR/USD | EURUSD | 5 points (0.5 pip) |

AUD/USD | AUDUSD | 7 points (0.7 pip) |

GBP/USD | GBPUSD | 10 points (1.0 pip) |

USD/JPY | USDJPY | 7 points (0.7 pip) |

Gold vs US Dollar | XAUUSD | 24 points (2.4 pips) |

Silver vs US Dollar | XAGUSD | 18 points (1.8 pips) |

WTI Crude Oil | USOIL (Futures CFD) | 6 points |

NASDAQ 100 Index | NAS100 | 25 points |

S&P 500 Index | SPX500 | 120 points |

On the other hand, commission costs are applied where explicitly stated, such as on Share CFDs. Share CFDs commission by region:

Region / Market | Commission | Minimum Charge |

AU Share CFDs (Australia) | 0.07% of trading value | AUD 7 per trade |

US Share CFDs (United States) | 0.02 USD per lot | USD 10 per trade |

HK Share CFDs (Hong Kong) | 0.20% of trading value | HKD 50 per trade |

Swap Fee at AETOSCG

AETOSCG applies overnight funding charges (swaps) when CFD positions remain open past the daily cutoff, calculated based on the instrument’s swap rate and notional value.

For example, a EURUSD long position with –2.99% and a short position with 1.49% swap rate reflects the interest adjustment applied.

These points summarize key considerations:

- GBPUSD overnight swap: long –0.70%, short –0.29% per standard lot;

- Swaps are automatically credited or debited in the trading platform;

- AETOSCG has not indicated the availability of swap-free / Islamic accounts.

Non-Trading Fees at AETOSCG

AETOS Capital Group discloses specific non-trading charges in its official Product Disclosure Statement (PDS) and Financial Services Guide (FSG). These costs arise from market data access for Share CFDs, account inactivity, and administrative events rather than from trading execution itself.

AETOS also outlines conversion considerations and third-party payment handling within its ASIC-regulated documentation.

The following points highlight the most relevant non-trading charges:

- A USD 10 monthly data fee is charged for live Share CFD price feeds where applicable;

- A USD 10 dormancy administrative fee may be applied monthly if there is no client-initiated activity over 3 months;

- Clients may incur conversion costs when funds are converted into the account base currency at the prevailing closing price;

- Bank or card charges imposed by financial institutions are payable by the client and are separate from AETOS’s own fees.

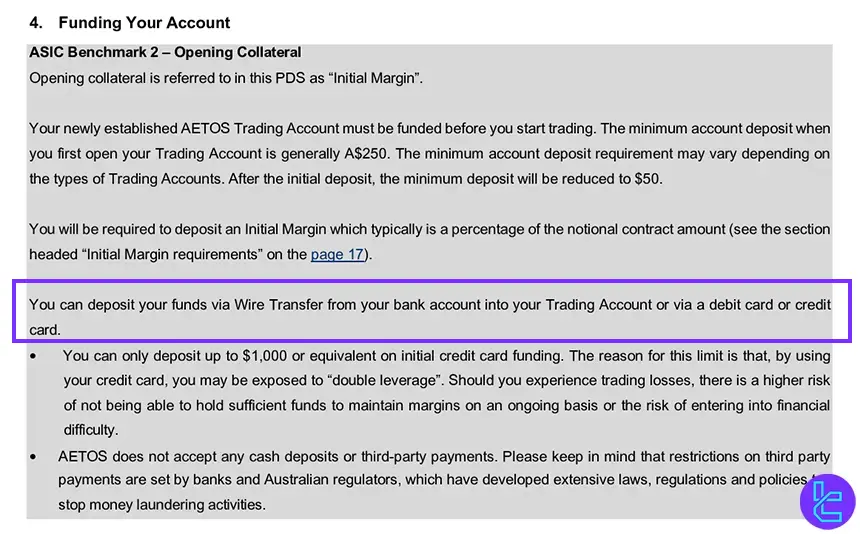

AETOSCG Broker Deposit & Withdrawal Methods

AETOS Capital Group provides clients with clearly defined withdrawal options under its ASIC-regulated framework. Withdrawals must be made from accounts held in the client’s own name and follow all compliance and verification procedures specified by the broker.

The officially supported methods are:

- Bank Wire Transfer

- Credit Card / Debit Card

Deposit Methods at AETOS Capital Group

AETOSCG provides deposit channels under ASIC licensing. Deposits are processed in base currencies USD or AUD, with processing times and applicable fees depending on the chosen method.

These methods are officially documented in the broker’s Product Disclosure Statement (PDS) and Funding Procedures.

See the table below for details:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Wire Transfer | USD, AUD | AUD 250 (first deposit) | None (bank fees may apply) | 1 to 5 business days |

Credit / Debit Card | USD, AUD | AUD 250 (first deposit) | None (card issuer fees may apply) | N/A |

Withdrawal Methods at AETOS Capital Group

Withdrawals are processed using the same methods (Bank wire transfer, credit/debit card) as deposits, in the same currency, with no broker fees.

Here are some key points:

- AETOSCG does not charge fees for withdrawals, although third-party bank or card processing fees may apply;

- Bank transfers typically take 1-5 business days, while card withdrawals may be processed faster depending on the card issuer;

- All withdrawal requests require account verification and compliance checks before processing.

Copy Trade and Other Investment Options of AETOSCG

AETOSCG does not provide a dedicated copy trading or social trading platform within its official offerings. There is no mention of services that allow automatic replication of other traders’ strategies.

However, AETOSCG does offer PAMM accounts as an alternative investment solution for clients who prefer managed trading rather than direct trade execution.

PAMM Accounts at AETOSCG

AETOSCG’s PAMM (Percentage Allocation Management Module) allows clients to appoint a professional Money Manager to trade on their behalf.

All trading results, including profits, losses, margin requirements, commissions, and rollover fees, are distributed proportionally based on each investor’s percentage allocation within the master account.

Key Points of AETOSCG PAMM Accounts:

- Funds are managed through a master account that reflects the combined balance of all participating investors;

- Clients retain ownership of their funds while granting limited trading authority to the Money Manager;

- During settlement or rollover periods, trading activity may be temporarily restricted.

What Markets and Instruments Can I Trade?

AETOSCG offers a diverse range of trading instruments across multiple asset classes, including Forex, Indices, Commodities, Stocks, and ETFs under CFD contracts.

Some useful details in this area can be found in the table below:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Major, Minor, Exotic currency pairs | 28 | 40-70 | 1:400 | |

Metals | Gold, Silver | 2 | 2-5 | 1:200 |

Energies | CFD on Oil, national gas | 3 | 5-10 | 1:100 |

Indices | CFD on Major indices | 13 | 10-20 | 1:100 |

Share | CFD on US, AU, and HK stocks | 250+ | 200-1000 | 1:5 |

Although ETFs are mentioned on the broker’s website, there is currently no dedicated ETF page available, and clicking on the related section results in a 404 (Page Not Found) error.

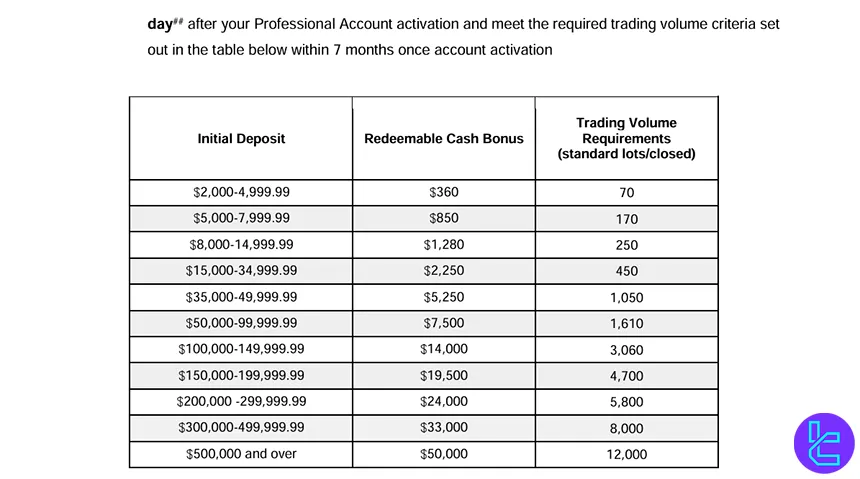

Bonuses and Promotions options

Although AETOSCG’s main website does not display active bonuses, the Professional Account section links to an official cash bonus promotion for eligible clients.

This welcome bonus allows qualified Professional Account holders to earn a redeemable cash bonus based on their initial deposit and trading volume during the Promotion Period.

Key Terms of the Welcome Bonus:

Initial Deposit (AUD/USD) | Redeemable Cash Bonus | Required Trading Volume (Standard Lots/Closed) |

2,000 – 4,999.99 | 360 | 70 |

5,000 – 7,999.99 | 850 | 170 |

8,000 – 14,999.99 | 1,280 | 250 |

15,000 – 34,999.99 | 2,250 | 450 |

35,000 – 49,999.99 | 5,250 | 450 |

50,000 – 99,999.99 | 7,500 | 1,050 |

100,000 – 149,999.99 | 14,000 | 1,610 |

150,000 – 199,999.99 | 19,500 | 3,060 |

200,000 – 299,999.99 | 24,000 | 4,700 |

300,000 – 499,999.99 | 33,000 | 5,800 |

500,000+ | 50,000 | 12,000 |

AETOSCG Awards

AETOSCG has been recognized for its excellence in trading services and client support across the Asia‑Pacific region. The broker’s achievements highlight its credibility, regulatory compliance, and industry trust.

Here are some notable AETOSCG Awards:

- Most Trusted Broker Award, 2024 – FAME

- Best Trading Service in Thailand, 2024 – Traders Awards Ceremony

- Business Excellence in Online Financial Service Provider Award, 2022 – Hurun Australia

AETOSCG Customer Support

AETOS Capital Group provides multiple convenient channels for clients to contact its support team, ensuring timely assistance and guidance for account management and trading inquiries:

Support Channel | Details |

support@aetoscg.com | |

Online Chat | Available via the website |

Phone | +61 2 9929 2100 |

FAQs | Frequently Asked Questions section on the website |

In-person | Level 15, 122 Arthur Street, North Sydney, NSW 2060, Australia |

AETOSCG Banned Countries

AETOS Capital Group does not provide its products and services to residents of certain countries due to regulatory restrictions, sanctions, or local legal prohibitions.

These limitations are in place to ensure compliance with local laws and to protect both the broker and potential clients.

The restricted countries and jurisdictions include:

- Singapore

- United States

- Countries under international sanctions (e.g. Russia, Israel, Iran, North Korea)

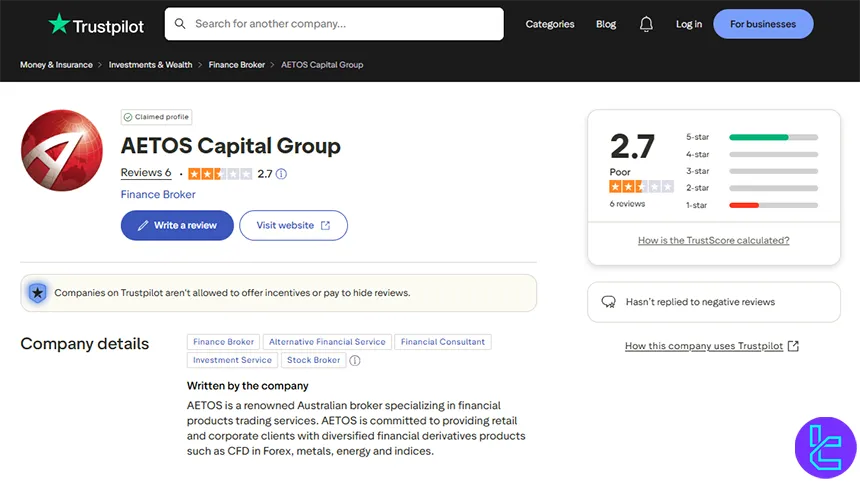

AETOSCG on Review Websites

AETOS Capital Group’s reputation on independent review platforms and broker rating sites presents a mixed picture, reflecting a combination of positive and negative user experiences.

User reviews on Trustpilot show a below‑average TrustScore, with feedback ranging from highly positive to sharply critical. On one version of the official Trustpilot profile, AETOSCG holds a TrustScore of around 2.7 out of 5.

Below is a table summarizing AETOSCG’s scores from several review platforms:

Review Website | Score |

2.7/5 | |

ForexPeaceArmy | 3.75/5 |

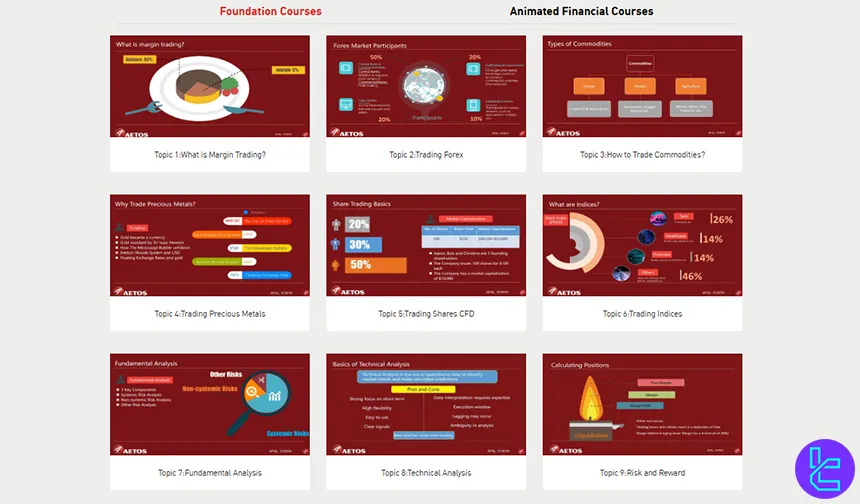

AETOSCG Educational Resources & Market Tools

AETOS Capital Group provides a range of educational resources and market tools. These resources include educational videos, market analysis tools, and trading utilities.

All offerings are accessible via the broker’s official E‑Learning Centre and Trading Tools pages, helping traders build foundational knowledge, monitor market developments, and execute strategies.

Below is a structured overview of the main educational and analytical resources available from AETOSCG:

Resource / Tool | Type | Purpose / Description |

Educational Videos | Video courses | A range of beginner to advanced video lessons covering Forex and CFD trading fundamentals and common trading operations. |

Research & Analysis | Market research | Insights and commentary on key financial market trends delivered by experienced analysts. |

Autochartist | Technical analysis tool | Real-time market scanning and trend detection with alerts for potential trading opportunities. |

Economic Calendar | Market calendar | A calendar of key economic events and data releases that can impact price movements. |

Glossary of Trading Terms | Reference tool | Definitions of essential trading and financial market terminology for better comprehension. |

AETOS App | Mobile/utility tool | A mobile application for real-time market data, account monitoring, and quick access to key trading information. |

AETOSCG in Comparison with Other Brokers

Below, you can find a comparison table of AETOSCG with several well-known brokers in the global financial markets:

Parameter | AETOSCG | |||

Regulation | ASIC, FSC Mauritius | ASIC, FSCA, VFSC, FCA, CIMA | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA | None |

Minimum Spread | 0.0 pips | 0.0 pips | 0.0 Pips | 0.1 Pips |

Commission | From $0 | From $0 | From $0 | None |

Minimum Deposit | AUD 250 | $20 | $100 | $10 |

Maximum Leverage | 1:400 | 1:1000 | 1:400 | 1:3000 |

Trading Platforms | MT4, MT5 | MT4, MT5, ProTrader, TradingView, proprietary application | MT4, MT5, Web Trader, Mobile App | MT4, MT5 |

Account Types | Standard, Professional | Standard STP, Standard Cent, Raw ECN, Pro ECN, Swap Free | Standard, Demo, Professional | Standard, Premium, VIP, CIP |

Islamic Account | N/A | Yes | Yes | Yes |

Number of Tradable Assets | 300+ | 1000+ | 1250+ | 50+ |

Trade Execution | Market | Market | Instant | Market, Instant |

Final Words

AETOS Capital Group offers a regulated trading environment under ASIC for Professional clients, providing leverage up to 1:400, segregated funds, negative balance protection, and structured account types for informed trading.

The broker supports both Standard and Professional accounts with competitive spreads, access to Forex, CFDs, and shares, alongside professional customer support and educational resources.