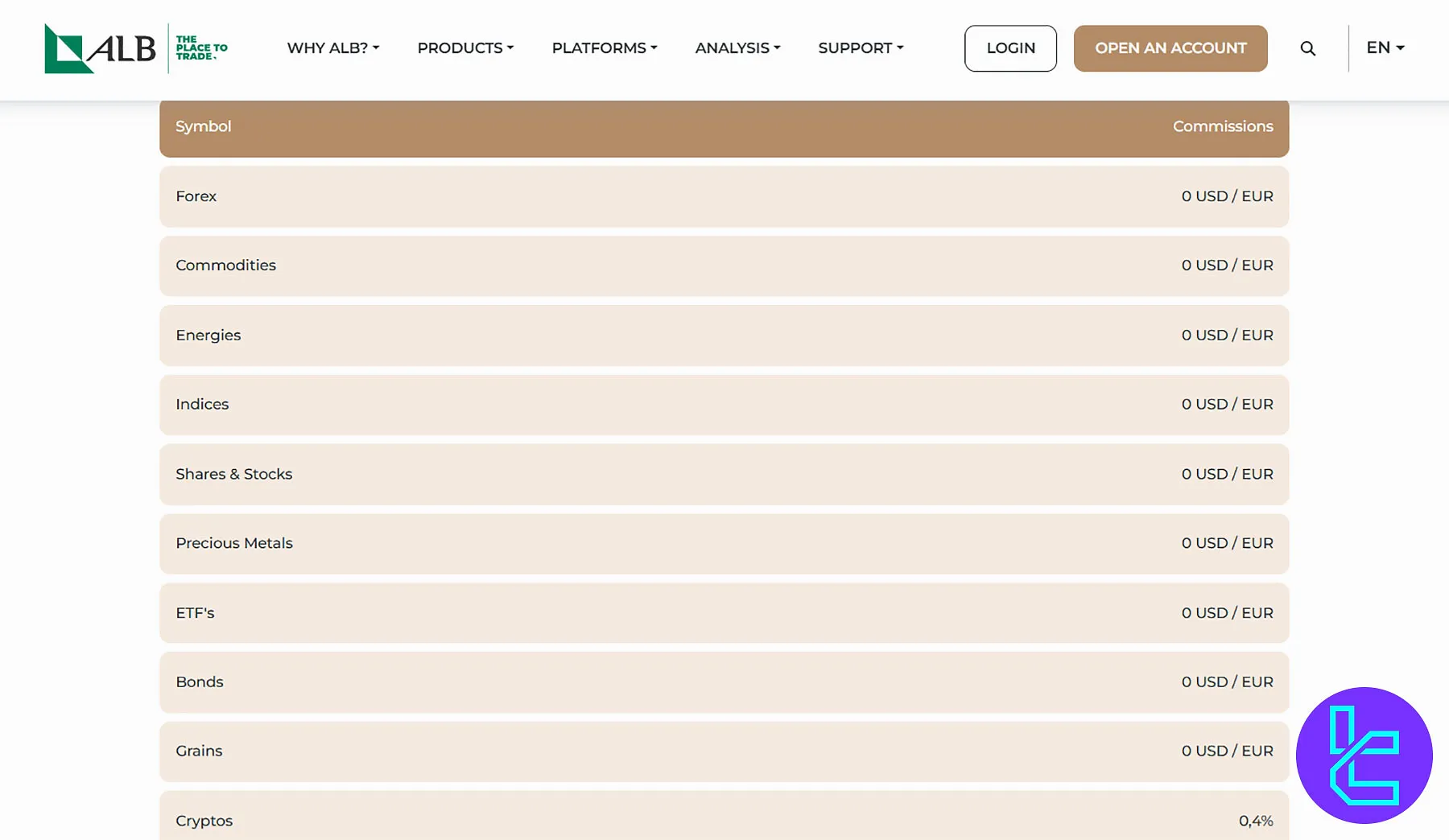

ALB offers access to 8 asset classes with no commissions, except for Cryptos, which have a 0.4% trading commission.

The broker integrates the MT5 platform with UCapital24 for live signals and quotes.

ALB; Broker Information and Regulation

ALB Limited, established in 2017 and headquartered in Malta, has emerged as a noteworthy player in the forex and CFD trading arena.

The company's primary regulatory oversight comes from the Malta Financial Services Authority (MFSA).

This regulatory backing provides traders with a layer of security and ensures that ALB adheres to strict operational standards. Key features of ALB:

- A member of the Investor Compensation Scheme (ICS)

- Segregated bank accounts for clients’ funds

- Class 2 license to provide dealing on its own account and execution of orders on behalf of other persons

- Multilingual service

ALB Broker Key Specifications

The Forex broker offers negative balance protection, and its annual financial reports are audited by Price Waterhouse Coopers. Here's a table summarizing the broker's key specifications:

Broker | ALB Limited |

Account Types | Live, Professional, Demo |

Regulating Authorities | MFSA |

Based Currencies | EUR |

Minimum Deposit | €200 |

Deposit Methods | Bank Transfers, Credit/Debit Cards |

Withdrawal Methods | Bank Transfers, Credit/Debit Cards |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:30 |

Investment Options | N/A |

Trading Platforms & Apps | MetaTrader 5, Ucapital24 |

Markets | Forex, Stocks, Indices, Commodities, Precious Metals, Energies, Bonds, Cryptos |

Spread | Variable based on the instrument |

Commission | All Instruments $0 Crypto 0.4% |

Orders Execution | Market |

Margin Call / Stop Out | N/A |

Trading Features | Mobile Trading, UCapital24 Access, CFDs on Futures |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | N/A |

PAMM Account | No |

Customer Support Ways | Call Center, Ticket, Email, Live Chat, WhatsApp |

Customer Support Hours | Weekdays |

ALB Trading Accounts

One of the letdowns in this ALB review is the broker’s limited account types. The company only offers a Live account for retail clients.

Customers can also use the Demo service to explore the trading platform.

Alb broker also features a Professional account with leverage options of up to 1:100, designed for clients who fulfill 2 of the following requirements:

- Substantial-sized transactions with an average frequency of 10 trades per quarter in the last year

- A portfolio of over €500,000

- At least one year of experience in the financial sector

Here are the key characteristics of the ALB Live account:

- Maximum Leverage: Up to 30

- Minimum Deposit: €200

- Minimum Order Size: 0.01 lots

- Base Currency: EUR

All accounts are also available in an Islamic (swap-free) version upon request.

ALB Pros and Cons

With servers in Equinix LD4 and NY4, the broker ensures server uptime optimizations, low latency, and reduced slippage.

However, to have a balanced view, let’s weigh the ALB’s advantages against its disadvantages.

Pros | Cons |

Regulated by MFSA | High entry barrier ($200) |

Wide range of tradable assets | Limited account types |

Multiple global awards | Limited deposit/withdrawal methods |

Integration with UCapital24 social network | Geo-restrictions |

ALB Broker Registration and KYC

Opening a trading account with ALB.com is a multi-step process that ensures regulatory compliance and secure platform access. From initial sign-up to full KYC completion, the journey is designed for transparency and investor protection.

#1 Start Registration on ALB.com

Head over to ALB official website and click on “Open an Account”. Enter your full name, email address, and mobile number, then proceed.

#2 Email and Phone Verification

Check your inbox and verify your email. Use the login credentials received to access the client portal, then verify your phone number as prompted.

#3 Complete KYC and Submit Documents

Click “Complete Your Account” to begin the KYC process. Enter your personal details, complete the appropriateness and financial assessments, and upload the required documents:

- Proof of Identity (e.g., passport or ID card)

- Proof of Residence (e.g., utility bill or bank statement)

- Proof of Funds (e.g., bank or investment account statement)

ALB Trading Platforms

ALB broker offers integration with the UCapital24 platform, the first financial social network with a global community.

The platform provides live quotes, technical/fundamental analysis, and a free library of indicators.

The company utilizes the robust MetaTrader 5 trading platform, which supports EAs, 21 timeframes, and 38+ preinstalled technical indicators.

TradingFinder has developed a comprehensive list of advanced MT5 indicators that you can use for free.

ALB Fees Explained

In this ALB review, we must mention that the broker charges no fees for account opening, deposits, withdrawals, UCapital24 access, or account closures.

ALB provides commission-free trading on all instruments except for Crypto CFDs.

- Crypto Trading Commissions: 0.4%

- All Other Instruments Trading Commissions: $0

Note that the broker’s official website does not disclose specific information about spreads.

ALB Broker Deposit and Withdrawal

ALB offers a range of payment options to cater to traders from various regions, including:

- Bank Transfer

- Credit/Debit Cards (Visa and MasterCard)

There are no minimum withdrawal requirements. While the withdrawals are processed in EUR, USD, and GBP, the only available currency for deposits is EUR.

Does ALB Offer Investment Plans or Copy Trading?

While the company doesn’t provide traditional copy trading services or investment funds, it offers access to MT5 and UCapital24 with the following features:

- MT5: Compatible with 3rd party EAs and Algo trading

- UCapital24: Trading signals, market insights, and news feed

The mentioned features can help traders to enhance their trading strategies and maximize their profits.

You can also invest in US, UK, and German government bonds with the ALB broker.

ALB Tradable Assets

The broker offers diverse tradable assets, from the Forex market to CFDs on Futures, catering to traders with various interests and strategies.

- Forex: Over 100 Spot and Forward FX pairs

- Stocks: CFDs on 200+ shares from London, New York, Hong Kong, and 50+ other global markets

- Indices: Major global indices (e.g., SPX500, US30, and GER40)

- Commodities: CFDs on agricultural products (e.g., Cocoa, Coffee, and Sugar)

- Metals: Precious metals like Gold, Silver, Copper, Platinum, and Palladium

- Energies: US Oil, Natural Gas, and UK Oil

- Bonds: American, German, and British bonds

- Cryptos: CFDs on over 20 digital assets, including AVAX, BNB, BTC, BCH, ETH, ADA, LINK, EOS, and LTC

ALB Broker Bonus and Promotion

While ALB doesn't offer traditional deposit bonuses or promotions, it features a comprehensive partnership program with the following specifications:

- CPA commissions up to $1500

- Monthly payments

- No set-up costs

- Dedicated affiliate team

- Not available to residents of Spain

ALB Customer Support

The broker provides support on weekdays through various channels, including email, live chat, and WhatsApp.

- Email: info@alb.com

- Phone (Malta): +356 2371 6000

- Phone (London): +44 20 3053 3796

- Phone (Milan): +39 03 9974 5507

- Phone (Prague): +420 2340 43 320

- Phone (Warsaw): +48 2215 31 016

- Live Chat: Available on the website

- Ticket: Through the “Contact” page

- ALB WhatsApp Support

Prohibited Countries on ALB

Due to regulatory requirements, the broker doesn’t accept clients from the United States of America and some other countries, including:

- America

- Canada

- Israel

- Iran

- North Korea

- Syria

- Yemen

- Myanmar

- Japan

ALB Trust Scores

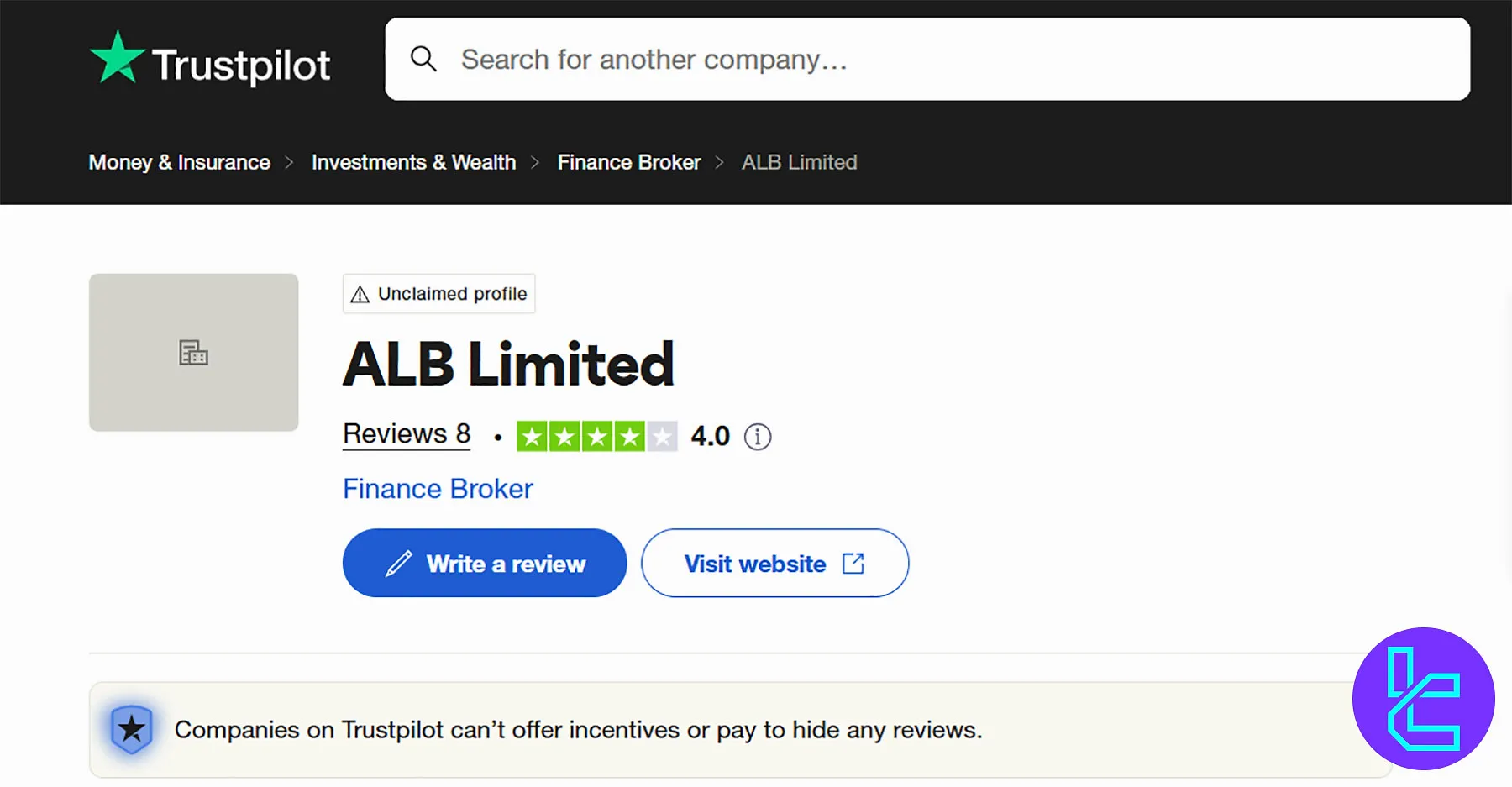

There are 8 ALB reviews on Trustpilot, most of which are positive. However, the ForexPeaceArmy has rated the company as a poor broker based on four comments.

4.0 out of 5.0 | |

ForexPeaceArmy | 2.0 out of 5.0 |

While 75% of comments about the broker on TP are positive (5-star), 25% are negative (1-star).

Educational Offerings

ALB broker website features an “Analysis” section designed to help customers through their trading journeys by providing various resources and tools, including:

- News

- Analysis

- Webinars

- Global Stock Market Analysis

- Economic Calendar

You can also access free learning materials through TradingFinder’s Forex education section.

ALB in Comparison with Others

Let's compare the key features of ALB with those of other brokers; ALB Comparison:

Parameters | ALB Broker | ||||

Regulation | MFSA | ASIC, VFSC | FSC | FSA, FSC, Misa, FinaCom | No |

Minimum Spread | Variable | 0.0 Pips | 0.0 Pips | 0.0 Pips | 0.1 Pips |

Commission | $0 | $0 | $0 | $0 | $0 |

Minimum Deposit | All Instruments $0 Crypto 0.4% | $0 | $200 | $100 | $1 |

Maximum Leverage | 1:30 | 1:500 | 1:3000 | 1:3000 | 1:3000 |

Trading Platforms | Mobile Trading, UCapital24 Access, CFDs on Futures | MetaTrader 4, MetaTrader 5, TradingView, cTrader | MetaTrader 4, MetaTrader 5, FXTM Trader App | MetaTrade 4, MetaTrade 5, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | Live, Professional, Demo | Zero, Classic | ADVANTAGE, STOCKS, ADVANTAGE, ADVANTAGE PLUS | Standard, ECN, Fixed, Crypto | Standard, Premium, VIP, CIP |

Islamic Account | Yes | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 350+ | 250+ | 1000+ | 700+ | 45 |

Trade Execution | Market | Market, Limit, Stop, Trailing Stop, Take Profit | Market | Market, Instant | Market, Instant |

Conclusion and Final Words

ALB allows for trading Forex CFDs and Futures in addition to US, UK, and German Bonds. The broker was titled the “Best Newcomer” in China at Forex Expo 2017. It has a great score of 4 out of 5 on Trustpilot.

![ALB Broker Review [2026]](https://cdn.tradingfinder.com/image/345695/029-330-tf-en-alb-00.webp)