Alfa-Forex, founded in 1991, is a well-established Forex broker based in Russia. This broker provides trading services for over 40 currency pairs.

Alfa-Forex has been a member of the "Association of Forex Dealers" since 2018 and obtained a Bank of Russia license. Minimum deposit is only $1, and you are able to trade forex pairs with maximum leverage of 1:40. Review below explores all of the Alfa-Forex features.

Alfa-Forex Broker Company Information & Regulation

Alfa-Forex stands out as part of the Alfa Group Consortium - one of Russia's largest private financial investment powerhouses.

With over three decades of successful operations under its belt, Alfa Group's high-reliability rating translates into a robust foundation for Alfa-Forex, offering traders unparalleled access to abundant foreign exchange liquidity and unrestricted trading opportunities.

Alfa-Forex is regulated by the Central Bank of Russia (025/04-02) and operates within the guidelines of this financial authority.

Here is an overview of the regulatory information:

Entity Parameters / Branches | Alfa-Forex LLC |

Regulation | Central Bank of Russia (CBR) |

Regulation Tier | Tier 3 |

Country | Russia |

Investor Protection Fund / Compensation Scheme | Compensation procedure governed by Federal Law No. 39-FZ “On the Securities Market” and Bank of Russia Instruction No. 3796-U, through the SRO AFD Compensation Fund |

Segregated Funds | N/A |

Negative Balance Protection | N/A |

Maximum Leverage | 1:40 |

Client Eligibility | Residents eligible under Russian jurisdiction except the residents of United States, Canada, UK, North Korea, New Zealand, Australia, Belgium, and Germany |

Alfa-Forex Broker Summary of Specifications

Alfa-Forex has carved out a niche for itself in the competitive Forex broker world. Let's break down the key specifics that make Alfa-Forex stand out:

Broker | Alfa-Forex |

Account Types | Standard, ECN, Demo |

Regulating Authorities | CBR |

Based Currencies | USD, EUR |

Minimum Deposit | $1 |

Deposit Methods | Visa/MasterCard, Bank wired |

Withdrawal Methods | Visa/MasterCard, Bank wired |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:40 |

Investment Options | No |

Trading Platforms & Apps | MT5 |

Markets | Forex, Stocks, Indices, Commodities |

Spread | Floating from 1.4 pips |

Commission | No commission |

Orders Execution | Market |

Margin Call/Stop Out | 100%/85% |

Trading Features | Demo account, Forex calculator, economic calendar |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, live chat, phone, Telegram bot, WhatsApp |

Customer Support Hours | 07:00 to 23:00 Moscow time on weekdays |

Restricted Countries | USA, Canada, Belgium, and more |

Alfa-Forex Broker Account Types

Alfa-Forex provides three core account types to serve different levels of trader experience:

- Demo Account: A fully-featured unlimited demo account is available for practice with no risk. It mirrors live conditions and allows resettable virtual balances, making it ideal for beginners;

- Standard Account: Designed for entry-level and intermediate traders, this account requires a minimum deposit of $100. It supports scalping, hedging, and all trading instruments, with floating spreads starting from 1.2 pips;

- ECN Account: Targeted at professionals, the ECN account requires a minimum deposit of $20,000, offering raw spreads from 0.0 pips and support for automated strategies via Expert Advisors (EAs).

All accounts are denominated in USD, EUR, or RUB and provide access to MetaTrader 5, with market execution and full trading strategy flexibility.

What are the Pros and Cons of Alfa-Forex Broker

When considering Alfa-Forex as your Forex broker, it's crucial to weigh both the pros and cons. Here's a balanced overview:

Advantages | Disadvantages |

Various support channels | No top-tier regulation |

Low minimum deposit | Limited tradable instruments |

| - | High Forex trading fees compared to competitors |

| - | Lack of variety in trading platforms |

Alfa-Forex Broker Registration & Verification

To create a new trading account with the Alfa-Forex broker, traders must follow the steps outlined below:

#1 Visit the Official Website

Search for Alfa-Forex on your preferred browser and click on the "Registration" button to begin the account opening process.

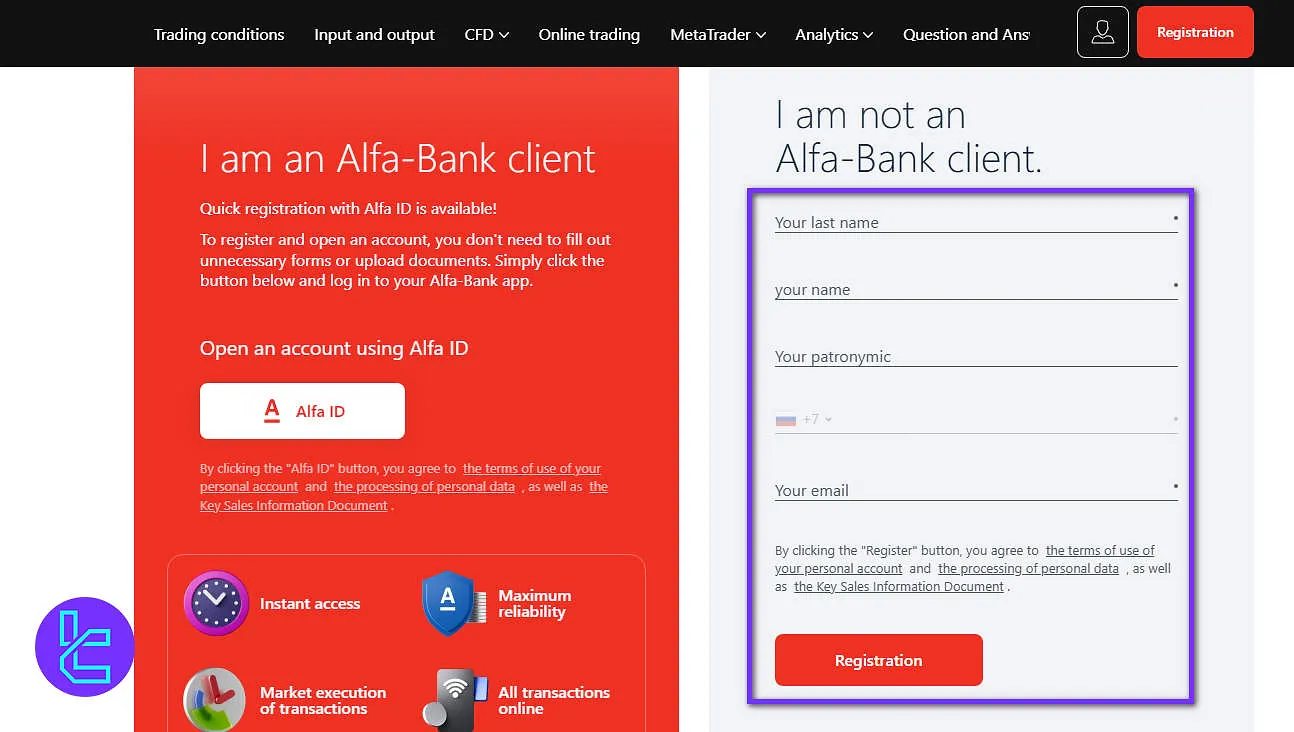

#2 Complete the Account Opening Form

Enter your personal details, including name, email, and phone number.

#3 Verify Your Email Address

Check your rmail inbox for an email from Alfa-Forex, find it, and click on the confirmation link.

#4 Verify your Identity and Address

Complete the verification process by uploading proof of ID and proof of address verification documents.

Alfa-Forex Trading Platforms Review

Alfa-Forex provides traders with access to the industry-leading MetaTrader 5 (MT5) platform, offering a robust and feature-rich trading environment. Here's what you can expect:

- Advanced charting and analytics tools with multiple timeframes

- Over 30 built-in technical indicators

- Support for algorithmic trading and Expert Advisors (EAs)

- Real-time market data and news feeds

- Customizable interface to suit individual preferences

- Available on desktop, web, and mobile devices

The MT5 platform's intuitive design makes it suitable for both novice and experienced traders.

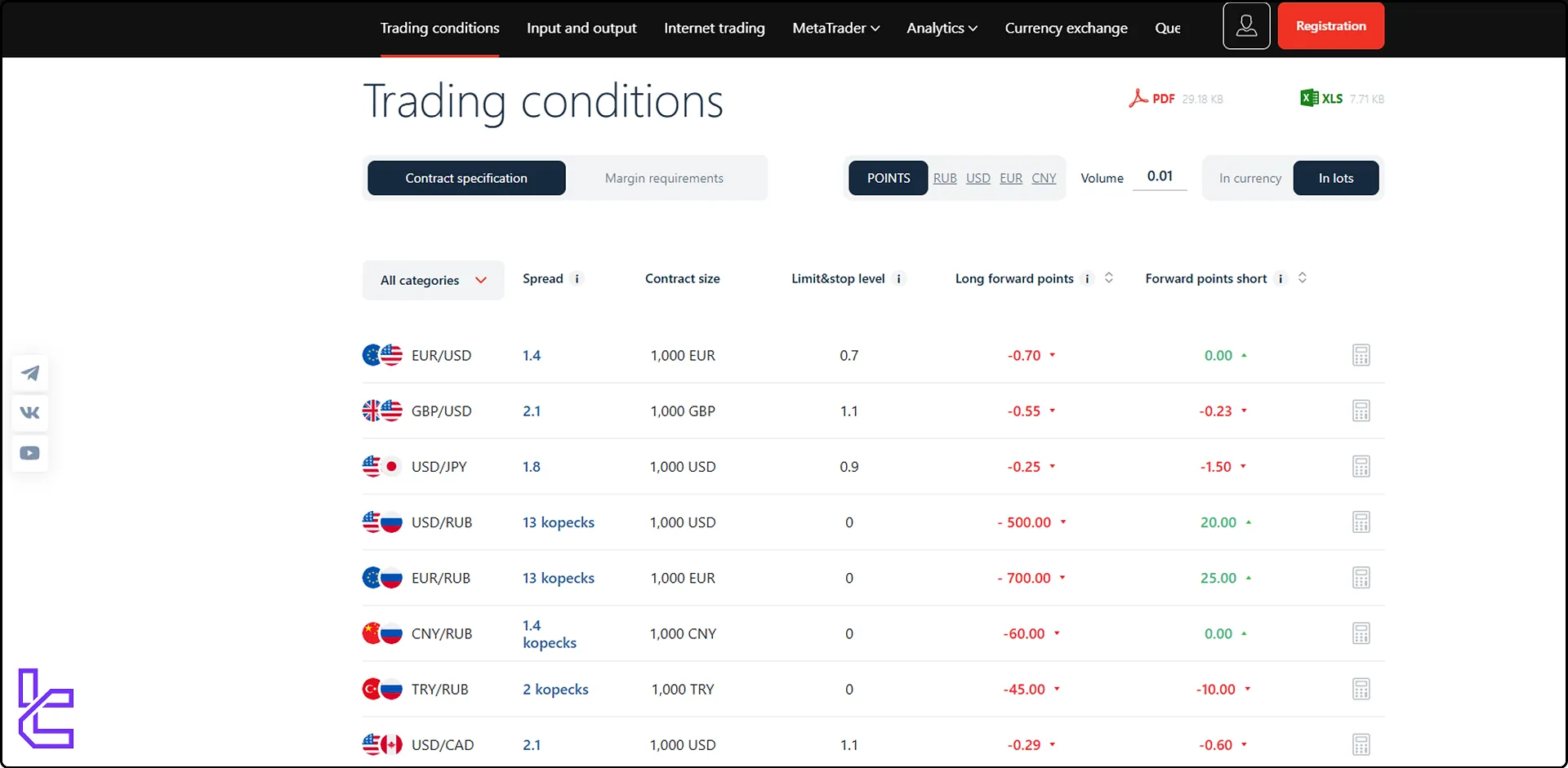

What are the Spreads and Commissions in Alfa-Forex?

Alfa-Forex operates on a commission-free model, embedding costs within floating spreads. The broker’s spreads are considered above-average, especially on non-major pairs:

- EUR/USD: typically ranges from 0.4 to 1.4 pips

- GBP/USD: from 1.5 to 2.1 pips

These rates are higher than what’s offered by many ECN or raw spread brokers, particularly for traders with high-frequency strategies. The broker does not offer dedicated RAW or ECN-style accounts, which limits fee transparency and may impact appeal for institutional traders. Non-trading fees are light:

- No withdrawal or inactivity fees

- Deposits may incur a fee up to 1%, depending on the method used

Overall, Alfa-Forex’s fee model is simple, but less competitive when compared to brokers offering razor-thin spreads or volume-based rebates.

Alfa-Forex also has deposit fees, which is another major drawback for the platform and discourages many traders from joining this Russian broker.

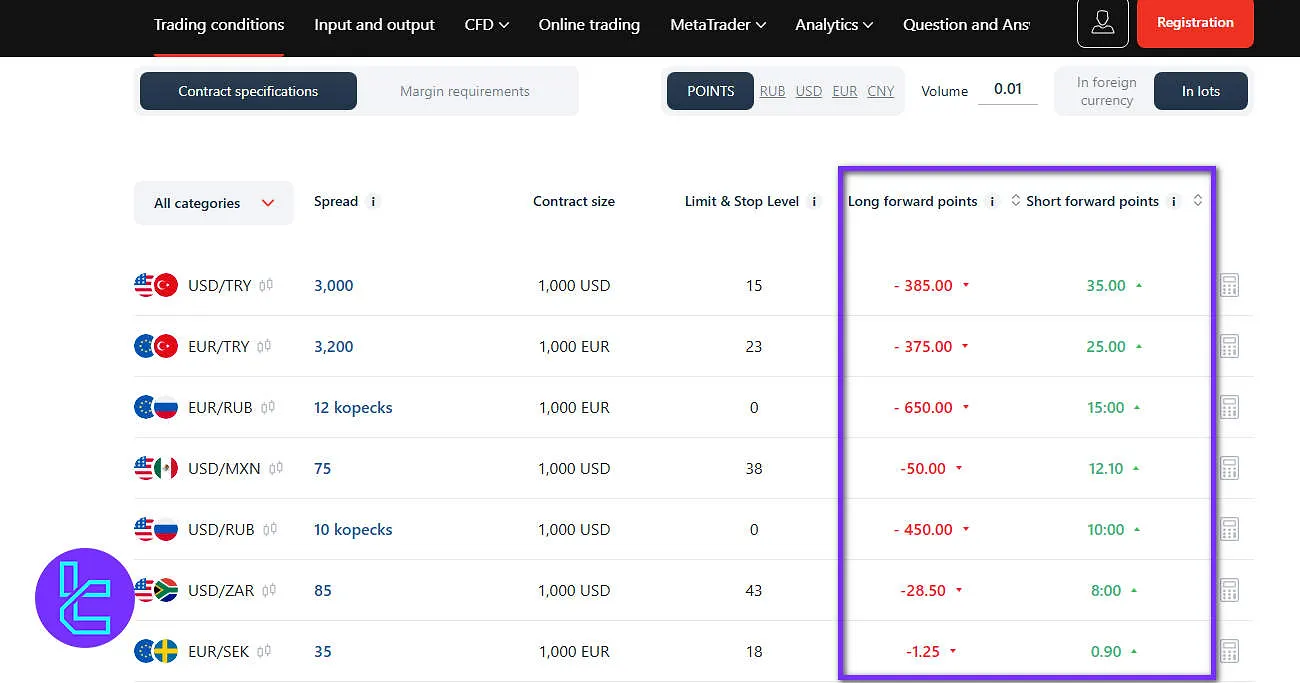

Alfa-Forex Swap Fees

The overnight financing, or swap, applied by Alfa-Forex is determined by the forward points associated with each traded currency pair.

These points are influenced by current market swap rates and are recalculated based on the prevailing exchange rate at the time the charge or credit is applied.

As a result, the displayed swap values serve only as indicative figures and may vary depending on real-time market conditions.

Additionally, Alfa-Forex applies a triple swap rate once per week to account for weekend rollover.

For most instruments, this adjustment occurs on Wednesday nights. However, for specific currency pairs such as USDRUB, EURRUB, CNYRUB, TRYRUB, and USDCAD, as well as CFDs on Russian shares, the triple swap is charged or credited from Thursday to Friday.

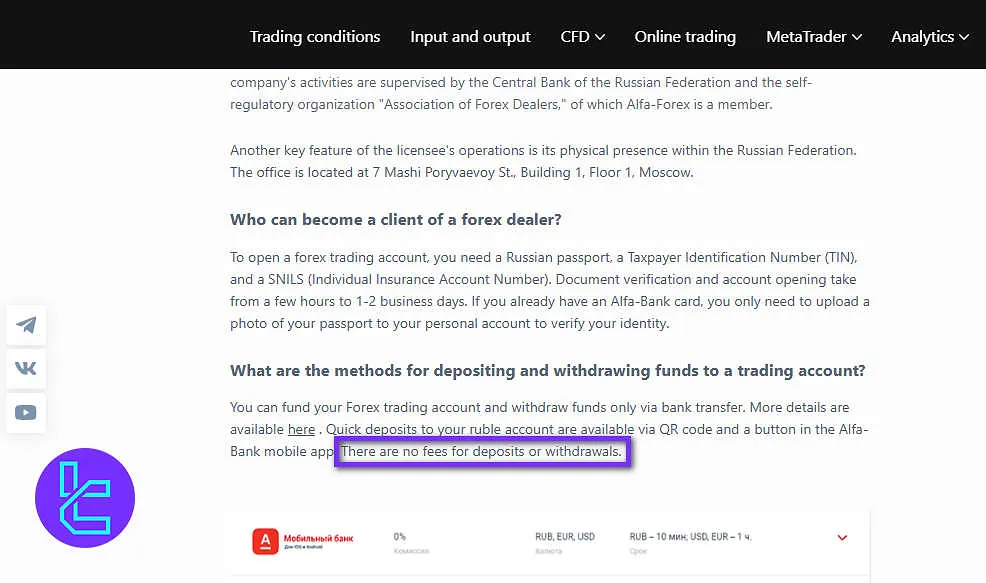

Alfa-Forex Non-Trading Fees

Alfa‑Forex does not impose any charges on deposits or withdrawals.

However, the broker does not disclose any details regarding inactivity fees, leaving it unclear whether such fees exist.

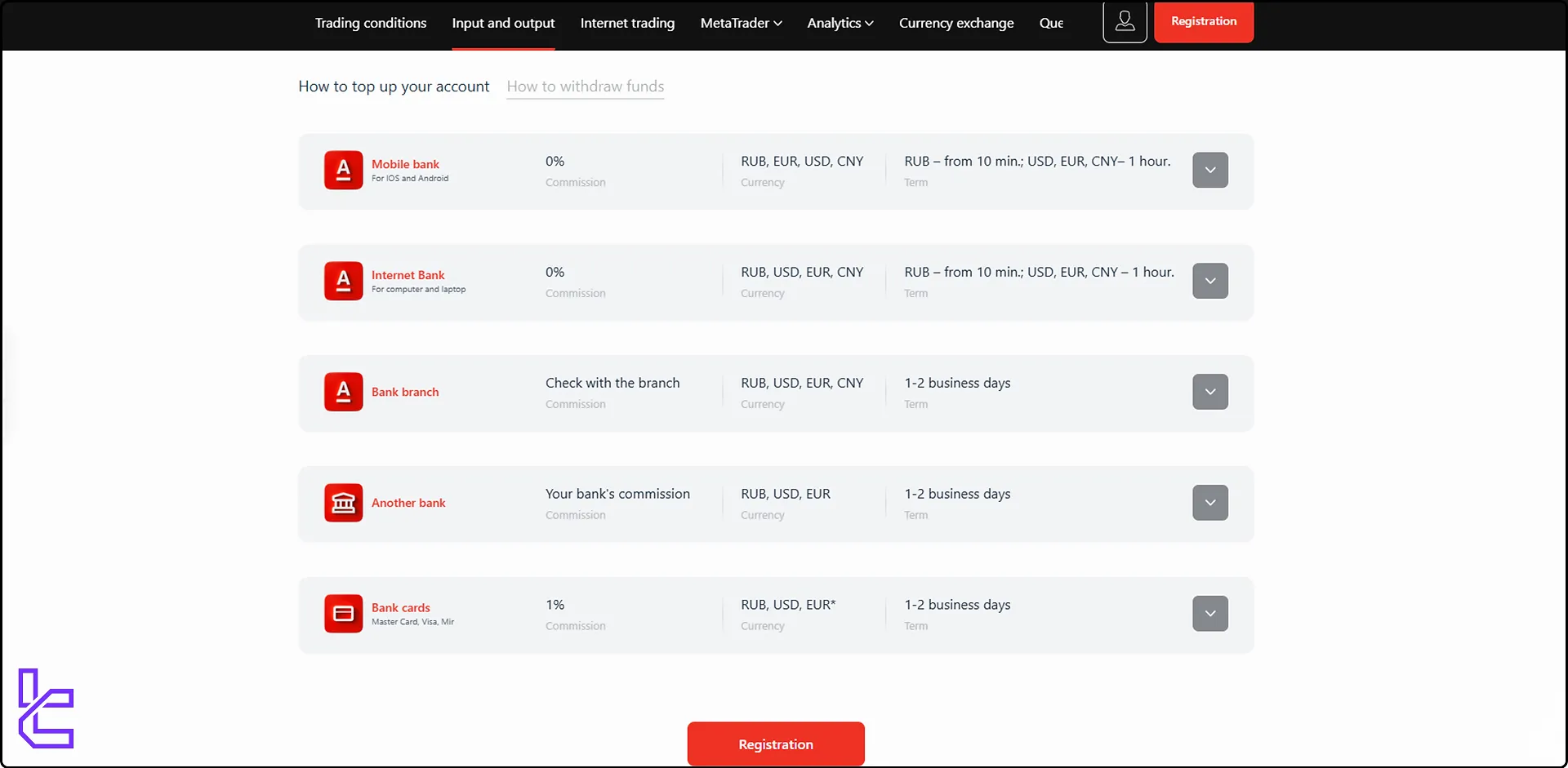

Alfa-Forex Deposit & Withdrawal Methods

Alfa-Forex offers a variety of deposit and withdrawal methods to cater to traders' diverse needs. These methods include:

- Bank wire transfer

- Credit/debit cards

Key points to note:

- Card deposits has a 1% commission

- Minimum deposit is $1

- deposit times vary from 10 minutes to 2 days

- Withdrawals are processed within 48 hours

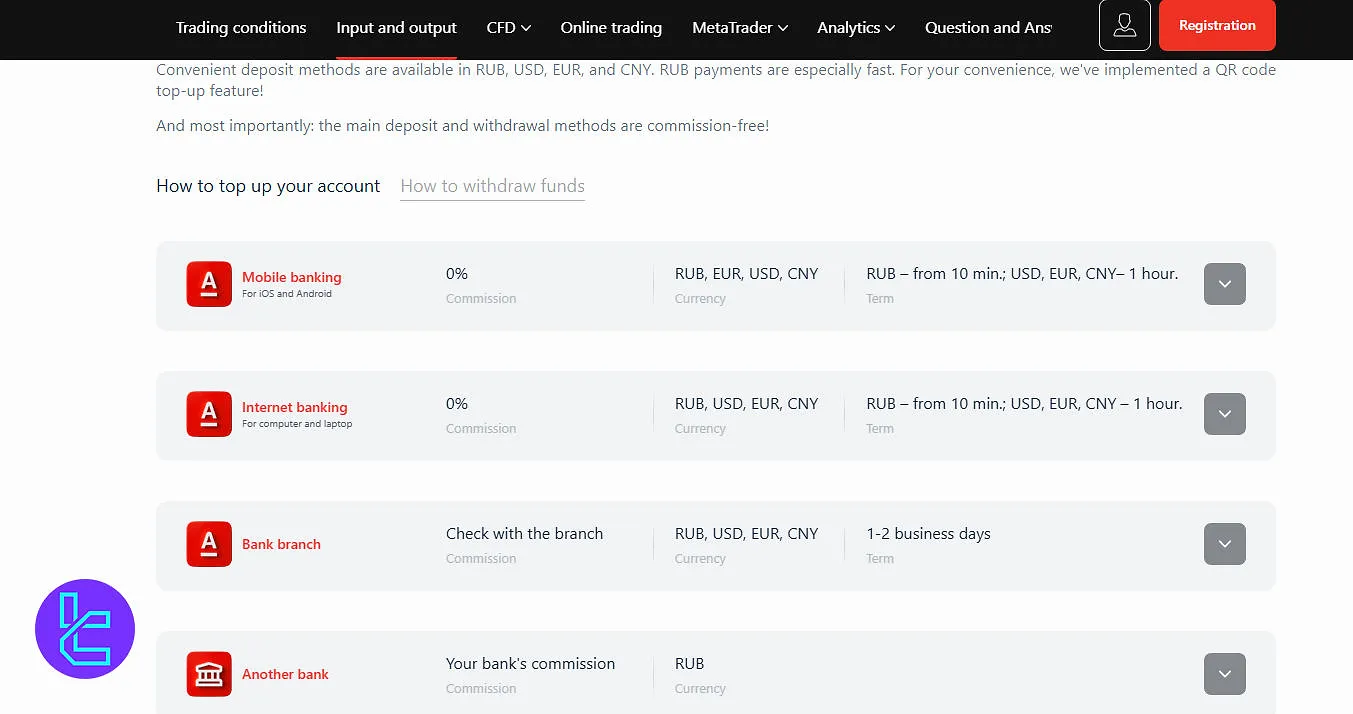

Alfa-Forex Deposit

Alfa-Forex provides multiple deposit channels for clients, supporting RUB, USD, EUR, and CNY currencies.

Processing times vary by method, ranging from a few minutes for mobile or internet banking to 1–2 business days for bank branches or card payments.

Commission fees differ depending on the payment method, with some options being free and others, such as bank cards, incurring a 2.3% fee.

Here are the full details of each deposit method:

Deposit Method | Platform/Type | Commission | Currency Supported | Processing Time |

Mobile Banking | iOS / Android | 0% | RUB, USD, EUR, CNY | RUB – from 10 min.; USD/EUR/CNY – 1 hour |

Internet Banking | Computer / Laptop | 0% | RUB, USD, EUR, CNY | RUB – from 10 min.; USD/EUR/CNY – 1 hour |

Bank Branch | Physical Bank | Check with branch | RUB, USD, EUR, CNY | 1–2 business days |

Another Bank | Any external bank | Your bank's commission | RUB | Depends on bank |

Bank Cards | MasterCard, Visa, Mir | 2.3% | RUB | 1–2 business days |

Fund Transfer | Fast Payments System | 0% | RUB | A few minutes |

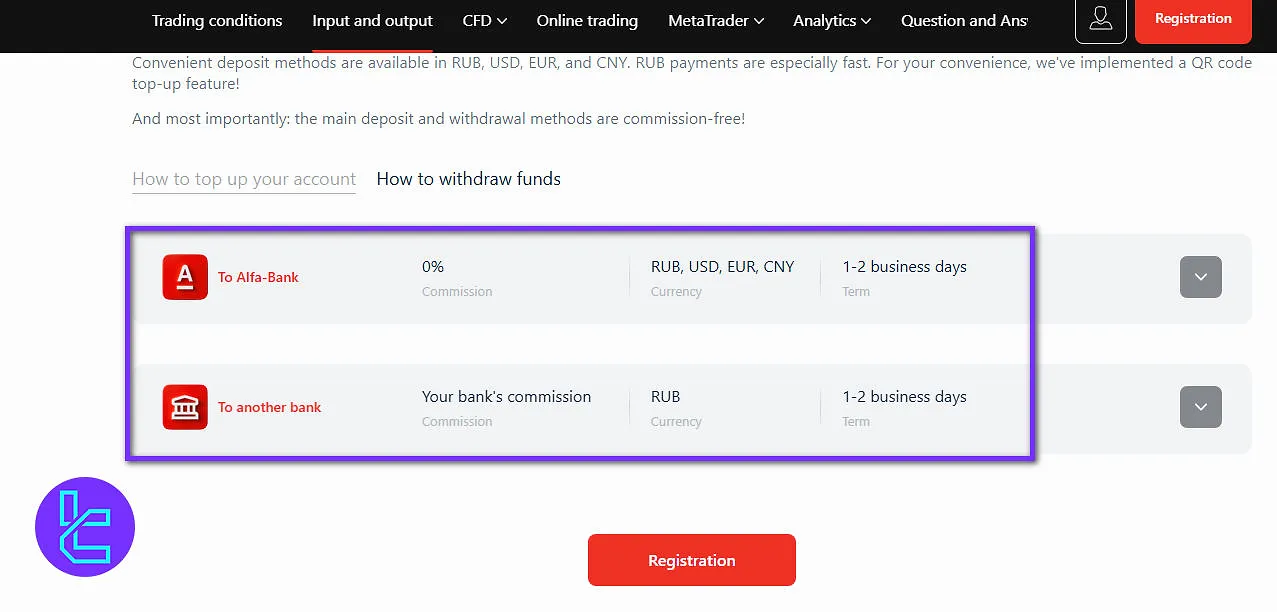

Alfa-Forex Withdrawal

Alfa-Forex allows clients to withdraw funds through multiple banking channels. Processing times are generally 1–2 business days.

Commissions vary depending on the chosen method, with withdrawals to Alfa-Bank accounts free of charge, while transfers to other banks are subject to the fees set by the client’s bank. Supported currencies include RUB, USD, EUR, and CNY.

Here are the full details of Alfa-Forex withdrawal methods:

Withdrawal Method | Platform/Type | Commission | Currency Supported | Processing Time |

To Alfa-Bank | Internal Bank Transfer | 0% | RUB, USD, EUR, CNY | 1–2 business days |

To Another Bank | External Bank Transfer | Your bank’s commission | RUB | 1–2 business days |

Copy Trading & Investment Options Offered on Alfa-Forex Broker

As of the latest information available, Alfa-Forex does not offer copy trading or social trading features. This absence might be a drawback for traders who prefer to follow and replicate the strategies of successful traders. While copy trading can be beneficial for beginners or those with limited time, it's important to note that it also carries risks.

Alfa-Forex Tradable Markets and Instruments

Alfa-Forex provides a limited but sufficient range of tradable instruments for retail forex traders. While its primary focus is on currency trading, clients can also access select non-FX markets:

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | Standard, Micro, Ultra Low accounts | 41 major, minor, and exotic pairs | 50–70 currency pairs | 1:40 |

Stocks | CFDs on shares (via MT5 platform) | 8 Equities | 800–1200 | 1:10 |

Commodities | CFDs on commodities | Includes energies and metals like oil and gold | 10–20 instruments | 1:22 |

Indices | CFDs on global indices | 2 Global Indices (Unspecified) | 10–20 indices | 1:20 |

Although some promotional language suggests broader asset availability, including cryptocurrencies, this is not supported by consistent platform documentation. There is currently no access to crypto, ETFs, or bonds.

Overall, Alfa-Forex’s asset range remains narrow compared to global competitors, making it best suited for traders focused on forex and a few auxiliary instruments.

Alfa-Forex Bonuses and Promotions

Alfa-Forex’s approach to promotions is inconsistent. While the broker previously advertised a bonus of up to 4,000 RUB for new clients via affiliated websites, this promotion is not available or documented on the main broker site at the time of review.

Currently, Alfa-Forex does not offer active bonuses, trading competitions, or loyalty programs for existing clients. There is also no rebate system, deposit match, or cashback incentive available. This minimal approach to promotional activity may reduce appeal for traders who seek frequent incentives or loyalty-based benefits.

Alfa-Forex Awards

Alfa‑Forex LLC has not published any information regarding awards or industry recognitions on its official website.

As of now, there is no evidence that the broker has received external accolades, or if it has, such achievements have not been disclosed publicly.

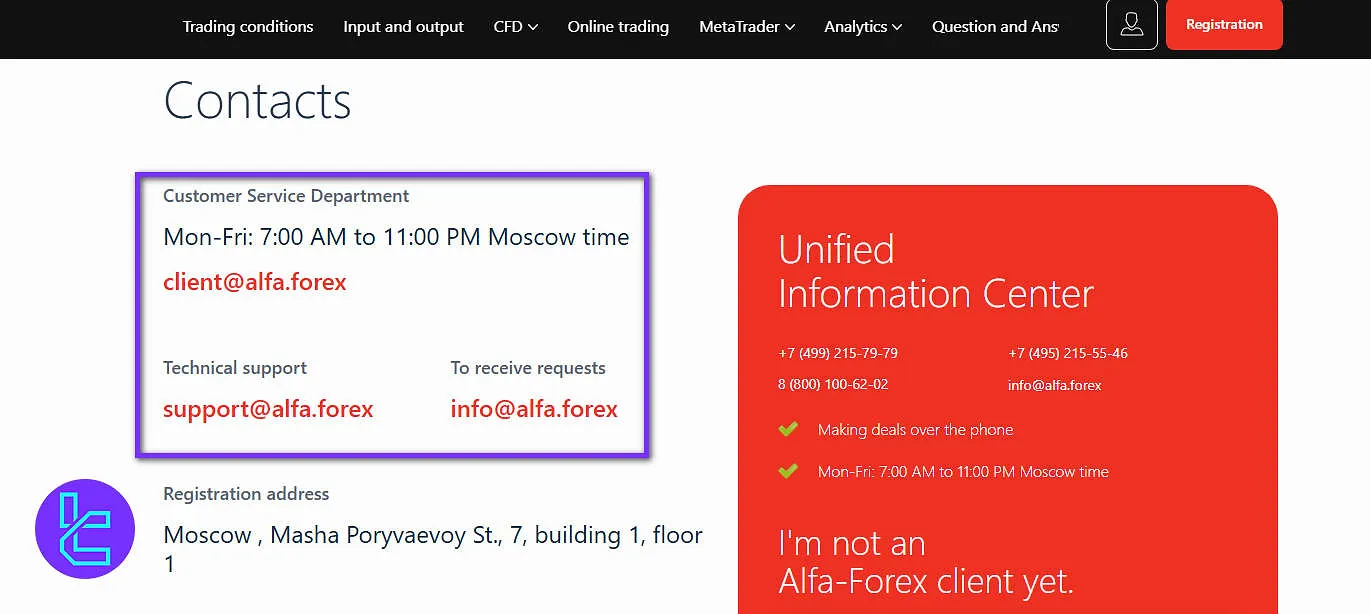

Alfa-Forex Broker Support Channels

Alfa-Forex prides itself on offering comprehensive customer support through multiple channels, ensuring that traders can get assistance whenever they need it. The broker's commitment to client satisfaction is evident in its diverse support options:

- Live Chat: Available directly from the website, offering instant responses to queries.

- Phone Support: Call 8 (800) 100-62-02 and +7 (499) 215-79-79

- Telegram robot: https://t.me/alfaforex_user_bot

- WhatsApp: A modern communication channel for quick and easy contact.

- Email: client@alfa.forex

Alfa-Forex Trust Scores & Customer Reviews

Unfortunately, we weren’t able to find customer reviews of Alfa-Forex on online platforms such as Trustpilot or reviews.io. This draws concerns about this Forex trading platform since traders can’t read other people’s experiences using Alfa-Forex services. Traders must take caution when using this platform services.

Alfa-Forex Restricted Countries and Regions

Alfa-Forex, while widely accessible, has restrictions on clients from certain countries for regulatory and compliance reasons. It's crucial for potential traders to be aware of these restrictions to avoid any complications. Countries restricted from using Alfa-Forex services include:

- United States

- Canada

- New Zealand

- Australia

- Belgium

- United Kingdom

- North Korea

- Germany

Alfa-Forex Education

Alfa-Forex demonstrates a strong commitment to trader education, offering a comprehensive suite of educational resources designed to empower traders at all levels. The broker's educational offerings include:

- Forex Glossary

- Fundamental Analysis Foundations

- Technical Analysis Resources

- MT5 platform guides

Alfa-Forex Comparison Table

Let's compare the most important aspects of trading with Alfa-Forex in comparison to its competitors.

Parameters | Alfa-Forex Broker | |||

Regulation | CBR | ASIC, VFSC | FSA, FCA, CySEC, LFSA, FSCA | FSC, CySEC |

Minimum Spread | From 1.4 pips | From 0.0 pips | From 0.0 Pips | From 0.0 Pips |

Commission | $0 | From $0.0 | From $0.0 | From $0.0 |

Minimum Deposit | $1 | $0 | $100 | $5 |

Maximum Leverage | 1:40 | 1:500 | 1:1000 | 1:3000 |

Trading Platforms | MT5 | MetaTrader 4, MetaTrader 5, TradingView, cTrader | Metatrader 4, Metatrader 5, Metatrader Web, Mobile App | MT4, MT5, Mobile App |

Account Types | Standard, ECN, Demo | Zero, Classic, Swap-Free | Classic, Raw | Standard |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 41+ | 250+ | 620+ | 550+ |

Trade Execution | Yes | Market, Instant | Market | Market |

TF Expert Suggestion

As a broker with over 3 decades of experience providing Forex trading services to traders worldwide, Alfa-Forex doesn’t offer the best trading conditions. The lack of top-tier regulation, high spreads, and no variety in tradable instruments make this platform unsuitable for many traders.