Alvexo offers commission-free trading across 5 asset classes, including Forex and Bonds. The award-winning broker (e.g., Best Product Innovation from London Trader Show Awards 2022) has implemented a 30% + 75% trading credit bonus.

Alvexo; An Introduction to the Broker and Its Regulatory Status

Alvexo is a brokerage company operated by HSN Capital Group Ltd. The broker has more than 372K users and $54B+ in trading volume.

Alvexo operates primarily under the watchful eye of the Financial Services Authority (FSA) of Seychelles, which ensures oversight for its global operations.

The broker offered services in Europe through VPR Safe Financial Group Ltd., which was regulated by CySEC. However, the CySEC license was suspended.

The suspension was initially implemented in August 2022 due to alleged violations.

In a significant turn of events, the Cyprus Securities and Exchange Commission revoked its previous decision to suspend the authorization of Cyprus Investment Firm (CIF) in October 2023.

In a final twist to this regulatory saga, Alvexo has voluntarily renounced its CIF authorization with License No. 236/14.

The company ceased its European operation in November 2024. Key features of Alvexo:

- 933K+ opened positions

- Regulated by the Financial Services Authority (FSA) of Seychelles with License No. SD030

- 450+ trading instruments

Alvexo Broker Specific Features

The Forex broker prioritizes clients by offering multiple safety factors, such as segregated accounts, and a wide range of features, including:

Broker | Alvexo |

Account Types | Classic, Gold, Prime, Elite |

Regulating Authorities | FSA |

Based Currencies | USD, EUR |

Minimum Deposit | $500 / €500 |

Deposit Methods | MasterCard, Visa, PayPal, Apple Pay, Google Pay |

Withdrawal Methods | MasterCard, Visa, PayPal, Apple Pay, Google Pay |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:400 |

Investment Options | No |

Trading Platforms & Apps | Proprietary WebTrader and mobile application |

Markets | Forex, Stocks, Indices, Commodities, Crypto |

Spread | Variable based on the account type |

Commission | $0 |

Orders Execution | Market |

Margin Call / Stop Out | Variable based on the account type |

Trading Features | Commission-free Trading, Mobile Trading, Trading Signals |

Affiliate Program | N/A |

Bonus & Promotions | 30% + 75% trading credit |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Tel, Ticket |

Customer Support Hours | 24/5 |

Account Types

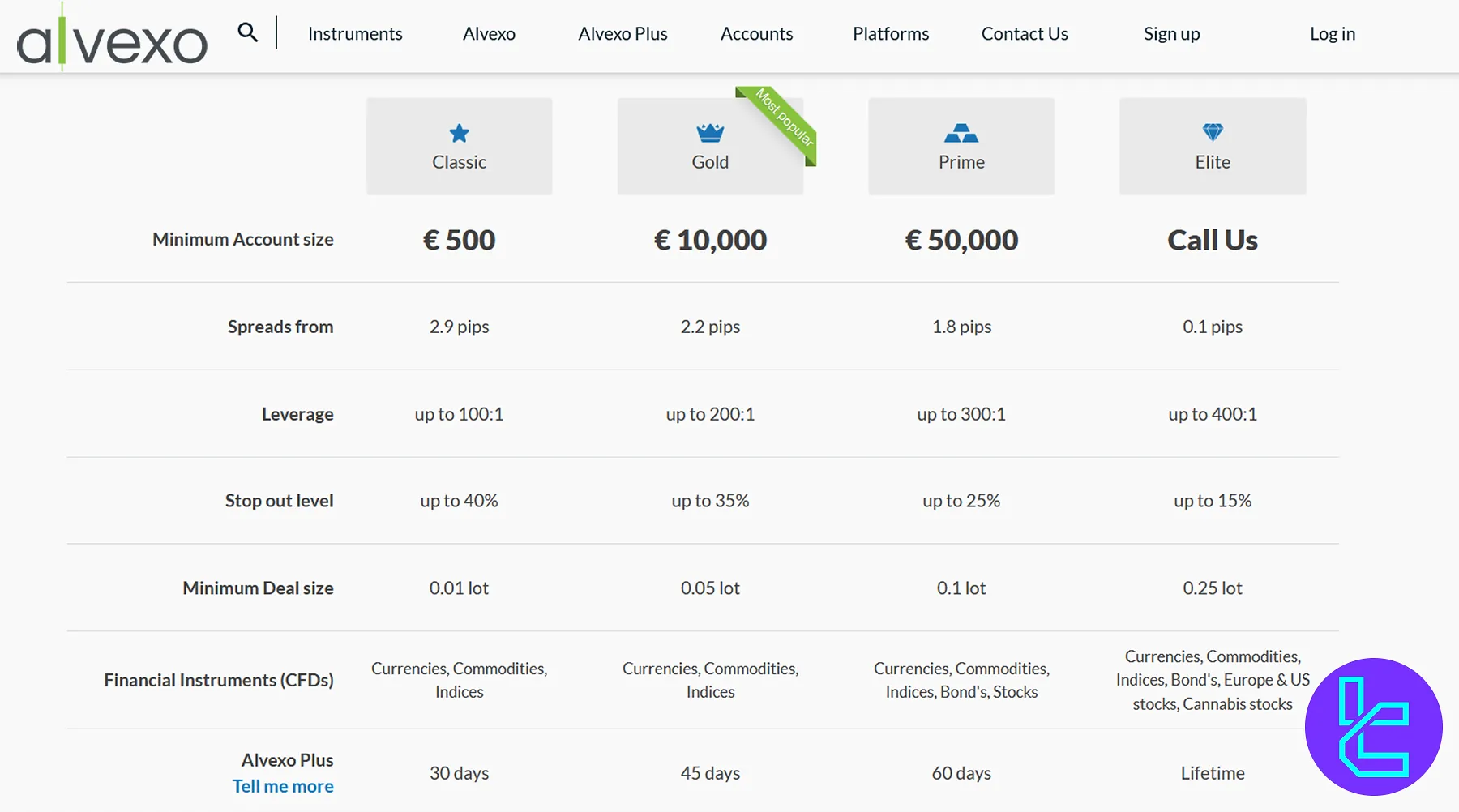

In this Alvexo review, we must mention that the broker offers four distinct account types: Classic, Gold, Prime, and Elite.

Each type comes with different leverage options and minimum deposit requirements.

Features | Classic | Gold | Prime | Elite |

Min Deposit | €500 | €10,000 | €50,000 | N/A |

Max Leverage | 1:100 | 1:200 | 1:300 | 1:400 |

Min Order Size (lots) | 0.01 | 0.05 | 0.10 | 0.25 |

Markets | Forex, Commodities, Indices | Forex, Commodities, Indices | Forex, Commodities, Indices, Bonds, Stocks | Forex, Commodities, Indices, Bonds, EU/US/Cannabis Stocks |

Stop Out Level | 40% | 35% | 25% | 15% |

Spreads from (pips) | 2.9 | 2.2 | 1.8 | 0.1 |

Upsides and Downsides

While the high entry barrier of $500 can be an automatic stop for some traders, the comprehensive Alvexo Plus product, containing trading signals and an academy, can perform as an incentivize.

Pros | Cons |

Multiple account types | High minimum deposit |

Access to Cannabis stocks | Lack of advanced trading platforms like MetaTrader |

Mobile application | Geo-restrictions |

Comprehensive educational resources | Lack of tier-1 licensing |

Registration and KYC on Alvexo Broker

Navigating the registration and Know Your Customer (KYC) process is crucial in starting your trading journey with Alvexo.

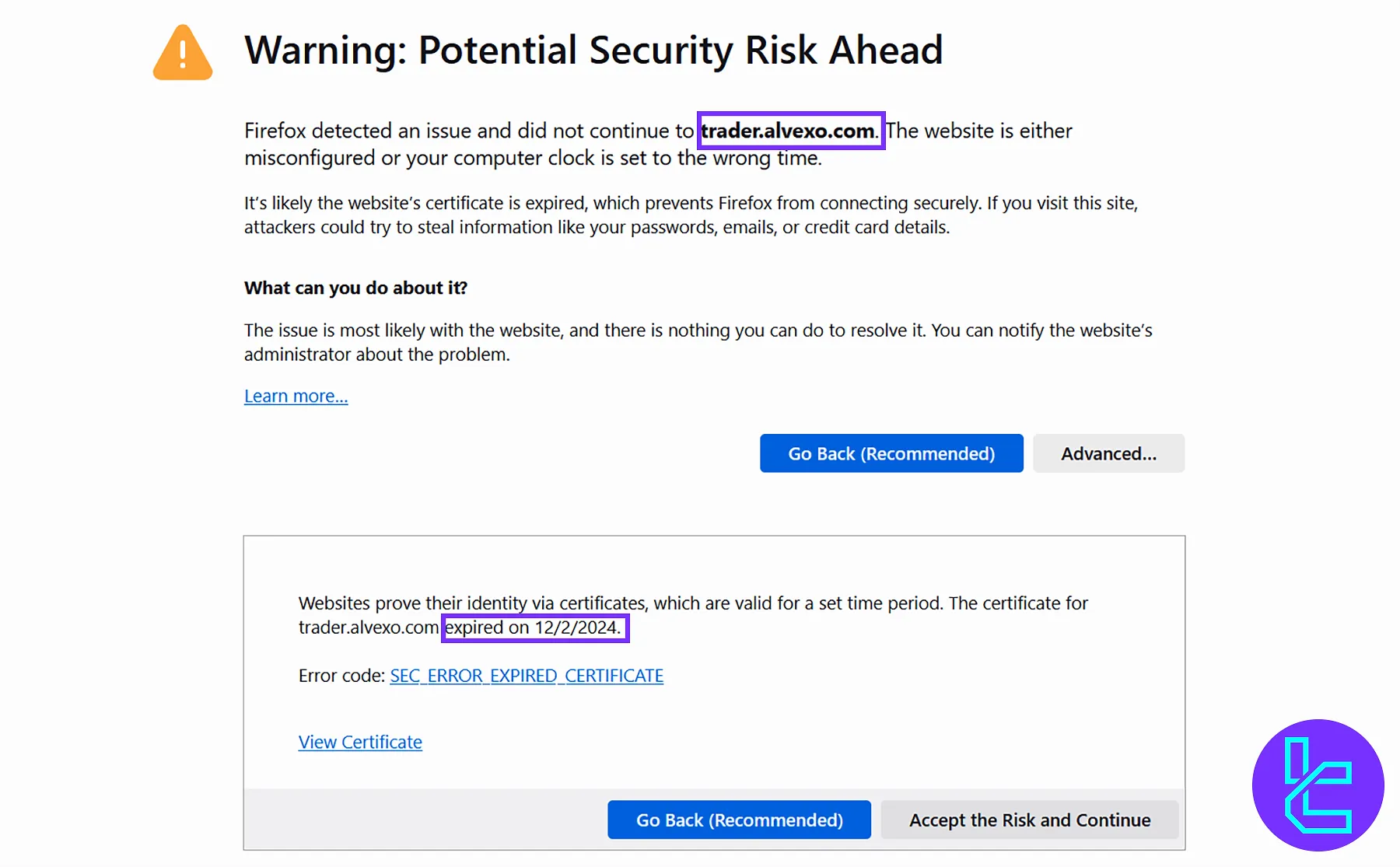

The certificate for the “trader.alvexo.com” website, used as the client registration portal, expired on December 2, 2024.

We suggest not proceeding with the registration process to avoid potential attacks andsecurity breaches. However, if you’re determined to open an account with Alvexo, follow these steps:

#1 Visit the Broker's Website

First, search for Alvexo broker on your preferred browser. Enter it and click on the "Sign Up" button.

#2 Complete the Registration Process

Provide the necessary information to create your account with Alvexo Broker.

#3 Verify Your Account

Provide proof of residence (utility bill or bank statement), proof of identity (passport or ID card), and proof of payment (colored copies of your debit/credit card).

Apps and Platforms

Alvexo provides traders with a proprietary web-based platform and mobile applications. The mobile platform was titled the “Best Mobile Trading App Germany 2022” by the International Business Magazine Award. It’s available across various operating systems, including:

- Alvexo Android app

- iOS (Not available on the Apple App Store)

Alvexo Commissions and Spreads

The broker offers commission-free trading on all instruments, with spreads being the primary trading fees, which vary depending on the account type.

Account Type | Spreads from (Pips) |

Classic | 2.9 |

Gold | 2.2 |

Prime | 1.8 |

Elite | 0.1 |

For traders using ECN-style accounts, Alvexo offers a RAW account with tighter spreads and separate commissions:

- Average spreads: EUR/USD and GBP/USD at 0.1 pip

- Commission: $3 per lot (per side)

The broker scores well in terms of non-trading fees. Alvexo charges:

- 0% on deposits

- 0% on withdrawals

- 0% inactivity fee

While the absence of administrative fees is a positive, the floating spreads on entry-level accounts are slightly higher than industry averages. High-volume traders may find better value in Prime or Elite accounts where tighter spreads and lower trade costs apply.

Deposits and Withdrawals

Alvexo supports a straightforward funding and withdrawal process with a modest set of payment channels. Traders can deposit and withdraw using:

- Visa & MasterCard

- PayPal

- Apple Pay

- Google Pay

The broker accepts deposits in two base currencies: USD and EUR. Alvexo does not charge any deposit or withdrawal fees, which helps reduce transaction friction. However, processing times for withdrawals vary — typically taking 3–5 business days for e-wallets and longer for wire transfers.

Minimum deposit thresholds are tied to account tiers:

- Classic: $500

- Gold: $10,000

- Prime: $50,000

The minimum withdrawal amount is $100. While Alvexo scores well for its zero-fee policy and broad payment coverage, its minimum deposit requirements may be a hurdle for beginners.

Copy Trading and Growth Plans

The broker doesn’t offer its clients investment plans, copy trading, orsocial trading services.

The lack of these features can be a disappointment for those seeking to earn passive income.

Alvexo Broker Trading Assets

The company offers over 450 trading instruments across five asset classes, ranging from Forex to Bonds. The availability of tradable assets differs based on the chosen account type.

Account Type | Markets |

Classic | Forex, Commodities, Indices |

Gold | Forex, Commodities, Indices |

Prime | Forex, Commodities, Indices, Bonds, Stocks |

Elite | Forex, Commodities, Indices, Bonds, EU/US/Cannabis Stocks |

The broker also provides access to the cryptocurrency market. However, retail clients can’t trade digital assets with Alvexo.

Does Alvexo Offer Promotional Programs?

The broker offers a 30% and 75% trading credit bonus from time to time on first deposits and each subsequent deposit, respectively.

However, you must meet specific trading volume criteria to be eligible for withdrawals.

Alvexo Customer Support

The broker provides 24/5 support through a ticket system and 3 hotlines. Note that the hotlines are virtual toll-free landlines and don’t indicate a physical office in the related country.

support@alvexo.com | |

Ticket | Through the “Contact Us” page |

Tel (Switzerland) | 41449746327 |

Tel (Seychelles) | 2484671950 |

Tel (Japan) | 815050508506 |

Jurisdictional Restrictions

As with many online brokers, Alvexo faces certain jurisdictional restrictions due to local laws and regulatory requirements.

Prohibited countries on Alvexo:

- United States of America

- Canada

- Islamic Republic of Iran

- Israel

- Japan

- North Korea

Trust Score

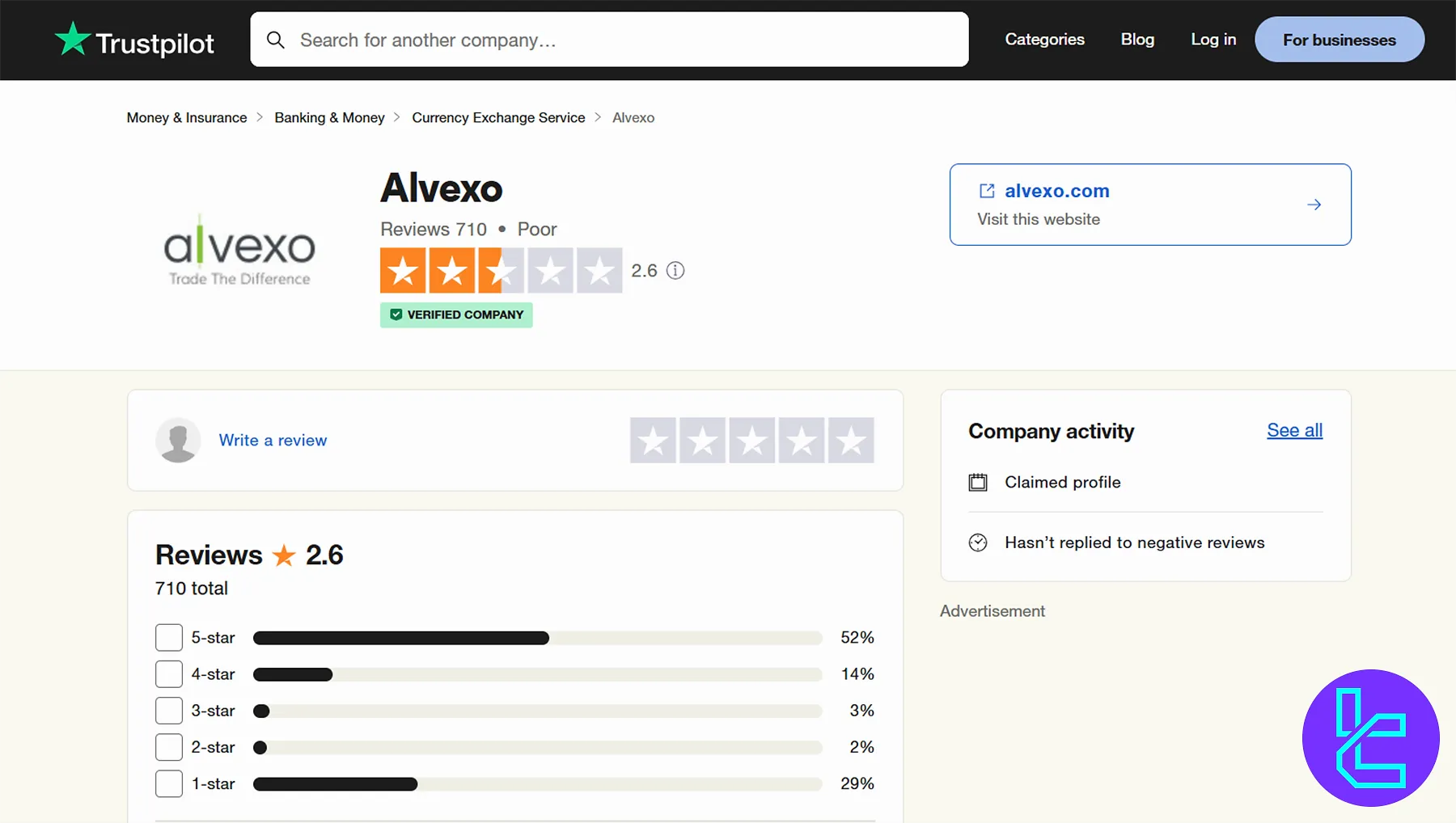

In this Alvexo review, we must mention that the broker hasn’t garnered positive feedback on reputable review websites, such as:

2.6/5 based on 710 reviews | |

Forex Peace Army | 2.538/5 based on 42 ratings |

There are 31% negative reviews on the Alvexo TrustPilot profile, most of which complain about withdrawal issues and poor customer support.

Alvexo Educational Resources

Alvexo Plus, the broker's educational arm, offers a range of resources to help traders improve their skills:

- Webinars hosted by industry experts

- E-books covering various trading topics

- Trading academy with structured courses

- Daily market analysis and news updates

Access to Alvexo Plus resources varies by account type, with higher-tier accounts generally receiving more comprehensive educational support.

Alvexo in Comparison with Other Brokers

To fully understand the pros and cons of trading with Alvexo in comparison with other brokers, check the table below.

Parameters | Alvexo Broker | |||

Regulation | FSA | No | FCA, FSCA, CySEC, SCB | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Minimum Spread | From 0.1 Pips | From 0.1 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | $0 | $0 | From $0 | From $0.2 to USD 3.5 |

Minimum Deposit | $500 / €500 | $1 | $100 | $10 |

Maximum Leverage | 1:400 | 1:3000 | 1:500 | Unlimited |

Trading Platforms | Proprietary WebTrader and mobile application | MetaTrader 4, MetaTrader 5 | MT4, MT5, cTrader, Web Trader, Mobile App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Account Types | Classic, Gold, Prime, Elite | Standard, Premium, VIP, CIP | Standard, Pro, Raw+, Elite | Standard, Standard Cent, Pro, Raw Spread, Zero |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 450+ | 45 | 2100+ | 200+ |

Trade Execution | Market | Market, Instant | Market, Pending | Market, Instant |

Conclusion and Final Words

Alvexo provides access to 450+ trading instruments with leverage options of up to 1:400. The broker supports PayPal, Google Pay, and Apple Pay payments through a partnership with Paynt and Nuvei.

While the company offers Alvexo Plus, a comprehensive educational hub, a poor support team and withdrawal issues have resulted in a poor TrustPilot score of 2.6/5.