AMarkets, a financial market broker since 2007 and regulated by the FSA in Saint Vincent and the Grenadines, is chosen by more than 2 million clients worldwide.

There are 4 live accounts [Standard, ECN, Fixed, Crypto] available. The broker requires a minimum of $100 for a trading account and provides a leverage of up to 1:3000.

AMarkets - Company Information & Regulation

AMarkets is a forex broker with regulatory licenses from 4 organizations. With a focus on client protection and regulatory compliance, the brokerage has taken measures to ensure its traders' peace of mind. Here's what you need to know about the company's services and regulatory status:

- Offering services to regions in Latin America, Asia, and CIS (Commonwealth of Independent States);

- Licensed and regulated in multiple jurisdictions, including the Island of Mwali (Comoros), the Cook Islands, and Saint Vincent and the Grenadines;

- Official member of The Financial Commission, an independent financial organization;

- Monthly audits by Verify My Trade, an independent third party, to ensure compliance with best execution standards;

- Providing services to more than 2M clients across the globe;

- Achieved over 30 awards for its quality of services, growth, and other factors.

Here's an overview of Amarkets' regulatory status:

Amarkets LTD | AMarkets LLC | AMarkets LTD | Entity Parameters/Branches |

FSA | FSC | MISA | Regulation |

3 | 3 | 3 | Regulation Tier |

Saint Vincent and the Grenadines | Cook Islands | Island of Comoros | Country |

Up to €20,000 under Financial Commission | Up to €20,000 under Financial Commission | Up to €20,000 under Financial Commission | Investor Protection Fund/Compensation Scheme |

Yes | Yes | Yes | Segregated Funds |

Yes | Yes | Yes | Negative Balance Protection |

1:3000 | 1:3000 | 1:3000 | Maximum Leverage |

Global | Global | Global | Client Eligibility |

Specifications Summary Table

In this section, we provide a table of the broker's main specifics and properties:

Broker | AMarkets |

Account Types | Standard, ECN, Fixed, Crypto, Demo |

Regulating Authorities | FSA, FSC, Misa, FinaCom |

Based Currencies | USD, EUR, MBT (0.001 BTC) |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards, Crypto, Bank Transfer |

Withdrawal Methods | Credit/Debit Cards, Crypto, Bank Transfer |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:3000 |

Investment Options | Copy Trading |

Trading Platforms & Apps | Mt4, Mt5, Mobile Proprietary App |

Markets | Forex, Crypto, Stock, Indices, Commodities, ETFs |

Spread | From 0 |

Commission | From 0 |

Orders Execution | Instant, Market |

Margin Call/Stop Out | 50-100%/20-40% |

Trading Features | Crypto Trading, Autochartist |

Affiliate Program | Yes |

Bonus & Promotions | Cashback, Double Deposit, Broker Switch, Risk-Free Trading |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | 24/7 |

Customer Support Hours | Email, Live Chat, Telegram, Phone Number |

Account Types

AMarkets understands that one size doesn't fit all when it comes to forex trading. That's why they offer five distinct account types to provide the facilities for different trading needs and preferences:

- Crypto: Account denominated in BTC, balance grows when bitcoin's price increases

- Fixed: a suitable choice for beginners with fixed spread & cashback

- ECN: highest speed in execution & lowest spread in pairs

- Standard: Variable spreads with the cashback program

- Demo account: for testing your knowledge and expertise in financial markets

Parameter | Standard | ECN | Fixed | Crypto |

Minimum Deposit | $100 | $200 | $100 | MBT 10 |

Leverage | Up To 1:3000 | Up To 1:3000 | Up To 1:3000 | Up To 1:500 |

Spreads | From 1.3 Pips | From 0 Pips | From 3 Pips | From 1.3 Pips |

Commission | None | $2.5 Per 1 Lot Per Side | None | None |

Account Currency | USD, EUR | USD, EUR | USD, EUR | MBT (0.001 BTC) |

AMarkets supportsIslamic (swap-free) accounts for Standard, ECN, and Fixed accounts. Crypto accounts are excluded. Traders must manually request the activation of this feature after opening an account.

Pros And Cons

Let's take a closer look at the advantages and disadvantages of trading with AMarkets:

Pros | Cons |

Long Track Record In The Industry | Not Regulated By Major Authorities Like FCA Or CySEC |

Regulated By Several Authorities | Restricted Access For Traders From Certain Countries |

Variety Of Account Types To Suit Different Trading Styles | High Initial Deposit Of $200 Required For The ECN Account |

Offers Popular MetaTrader 4 And 5 Trading Platforms | - |

Competitive Trading Conditions With Low Spreads | - |

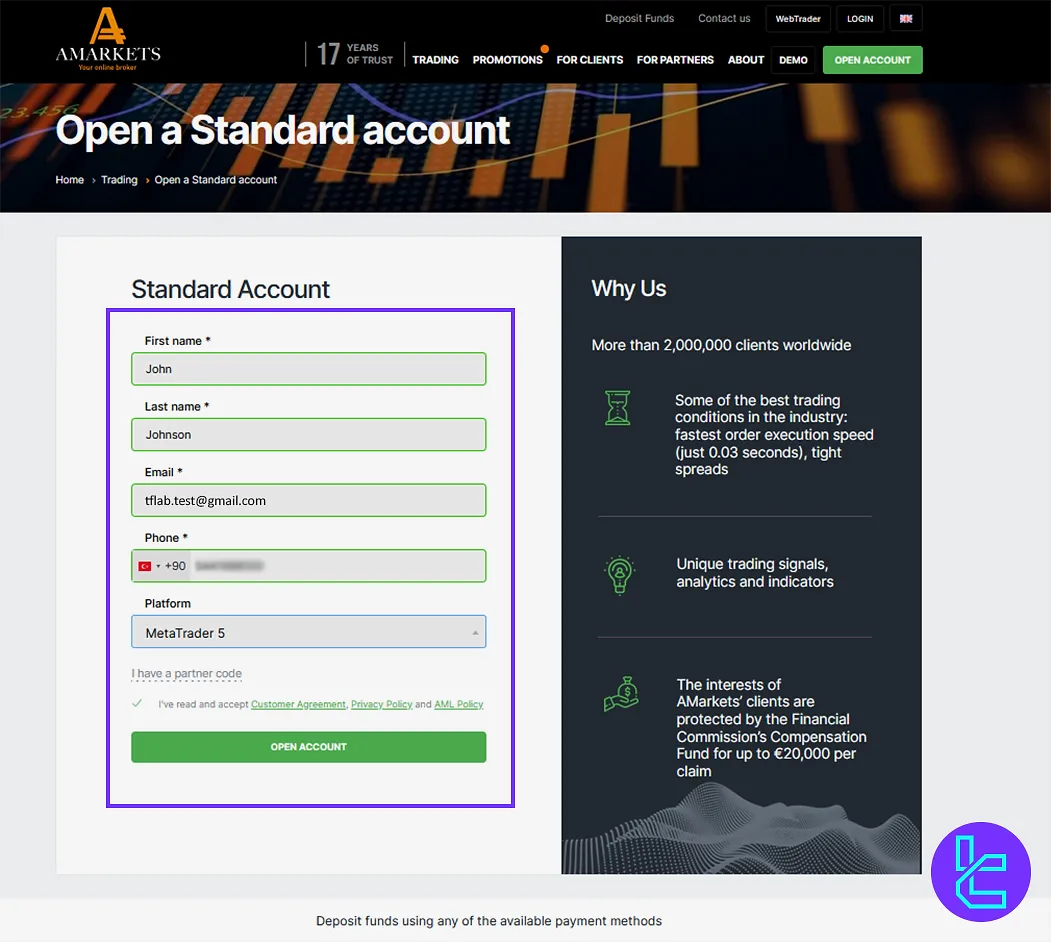

Account Registration And Verification Tutorial

By opening an account and verifying it in the Amarkets, traders can use all the available services in this Forex broker. Amarkets registration process:

#1 Access the Amarkets Website

Open your favorite browser and navigate to the Amarkets official website. On the main page, click on “Open Account”.

#2 Submit Your Information

Fill out the form with yourfirst and last name, a valid email address, and your mobile number. Select your preferred trading platform (e.g., MetaTrader 4 or 5), agree to the terms, and proceed.

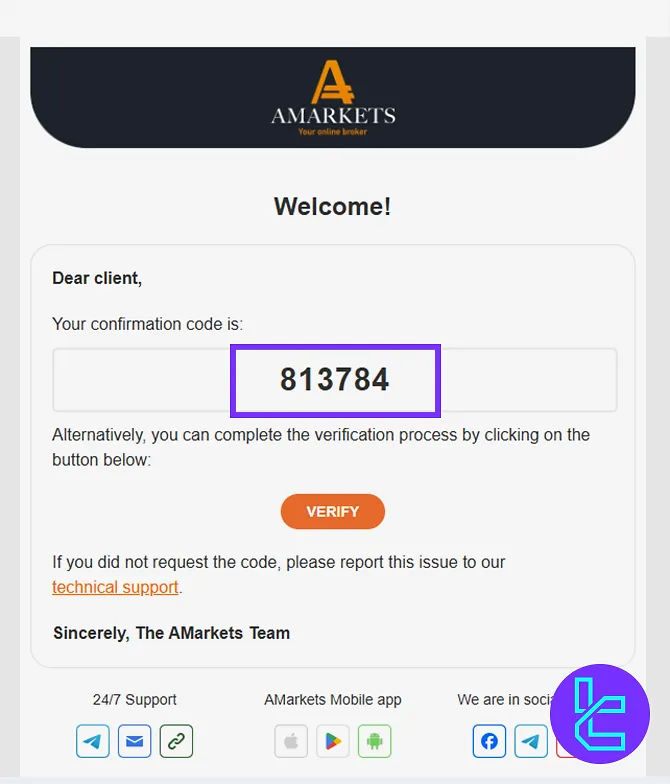

#3 Email Confirmation

Check your inbox for a message titled “Confirmation Code”. Copy the code, return to the "My Profile" section, and verify your email to activate the account.

#4 Complete AMarkets Verification

To complete the AMarkets verification, traders must follow simple steps.. After logging in, go to the "My Profile" section. Initially, document upload is disabled until your email and phone number are confirmed. Enter the code sent to your email and verify your phone via a call by inputting the last four digits.

Once contact details are verified, the "Add Documents" option becomes available. You can continue on your current device or switch to mobile for better photo quality. Upload both sides of a valid passport, ID card, or driver’s license, ensuring your personal details are clear.

After submission, a confirmation message will appear, and your verification status can be tracked under the Documents tab. Completing this process takes just a few minutes and is crucial for compliance and account security. After that, you’re ready to proceed with deposits and withdrawals.

Platforms & Apps

AMarkets broker provides traders with access to industry-leading trading platforms and mobile apps, ensuring a seamless trading experience across devices:

MetaTrader 4 (MT4):

- A very popular forex trading platform

- Advanced charting tools and technical indicators

- Customizable interface and automated trading capabilities

- Available for Windows, Mac, web, and mobile devices

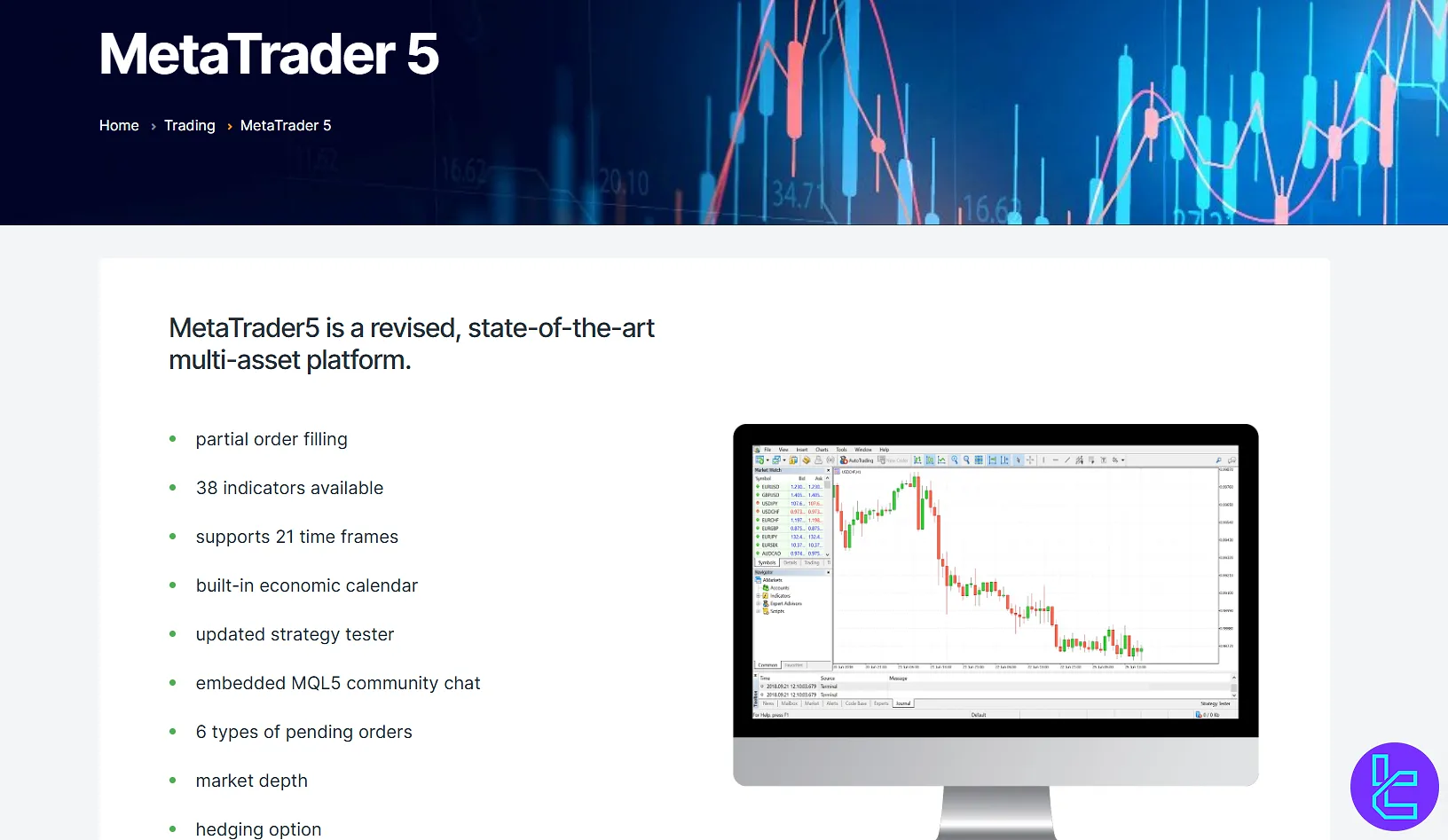

MetaTrader 5 (MT5):

- Newer trading platform with 38 indicators

- 6 types of pending orders for trading

- Economic calendar included

- Available for PC, browser, and mobile

AMarkets Mobile App:

- Trade on the go with the official AMarkets mobile app

- Access to real-time quotes and market analysis

- Manage your account and execute trades from your smartphone

- Available for both iOS and Android devices

Commissions And Spreads

AMarkets broker offers competitive pricing structures across its various account types. In the table below, we have prepared a summary of fees and spreads on different accounts:

Account Type | Standard | Fixed | ECN | Crypto |

Commission | None | None | $2.5 per 1 lot per side | None |

Spread | From 1.3 pips | From 3 pips | From 1.3 pips | From 1.3 pips |

Swap Fees

AMarkets applies overnight swap fees to non-Islamic trading accounts, which are calculated based on the interest rate differential between the two currencies involved in a position. These fees are typically charged at the end of each trading day when positions are held overnight, with triple charges applied on Wednesdays to account for weekend rollovers.

The fee amount varies depending on the instrument, position type (buy or sell), and prevailing market conditions. Traders using standard accounts should factor swap rates into their long-term strategies to avoid unexpected costs.

Non-Trading Fees

AMarkets does not impose any inactivity charges, allowing clients to maintain dormant accounts without monthly fees. In terms of deposits, the broker fully absorbs transaction costs, ensuring that 100% of the transferred amount is credited to the user’s balance, regardless of the chosen payment method.

However, withdrawals are subject to fees, typically ranging from 0.5% to 1.8%, depending on the method used. These non-trading conditions may influence overall cost-efficiency for traders focused on capital preservation or frequent fund transfers.

This fee policy reflects AMarkets’ approach to lowering entry barriers while maintaining operational cost recovery through withdrawal processing.

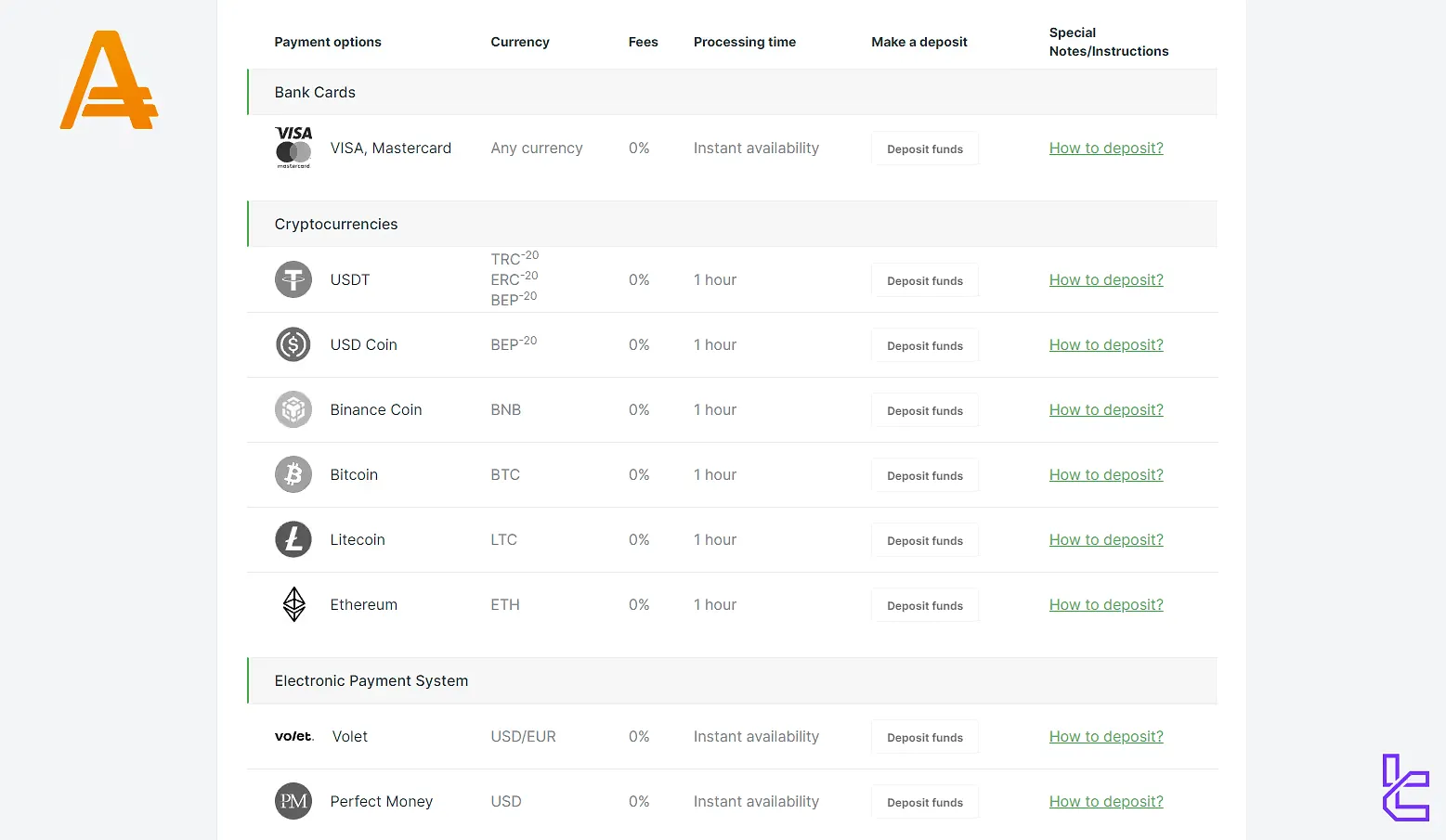

Payment Options

AMarkets offers a variety of convenient and secure payment options for its clients. Note that these methods might be different based on your region or the time of reading this article. AMarkets Deposit and withdrawal methods:

- Bank Cards (Visa, Mastercard): Instant availability

- Cryptocurrencies: USDT, USDC, BNB, BTC, LTC, ETH

- Electronic Payment Systems: Options include Volet and Perfect Money

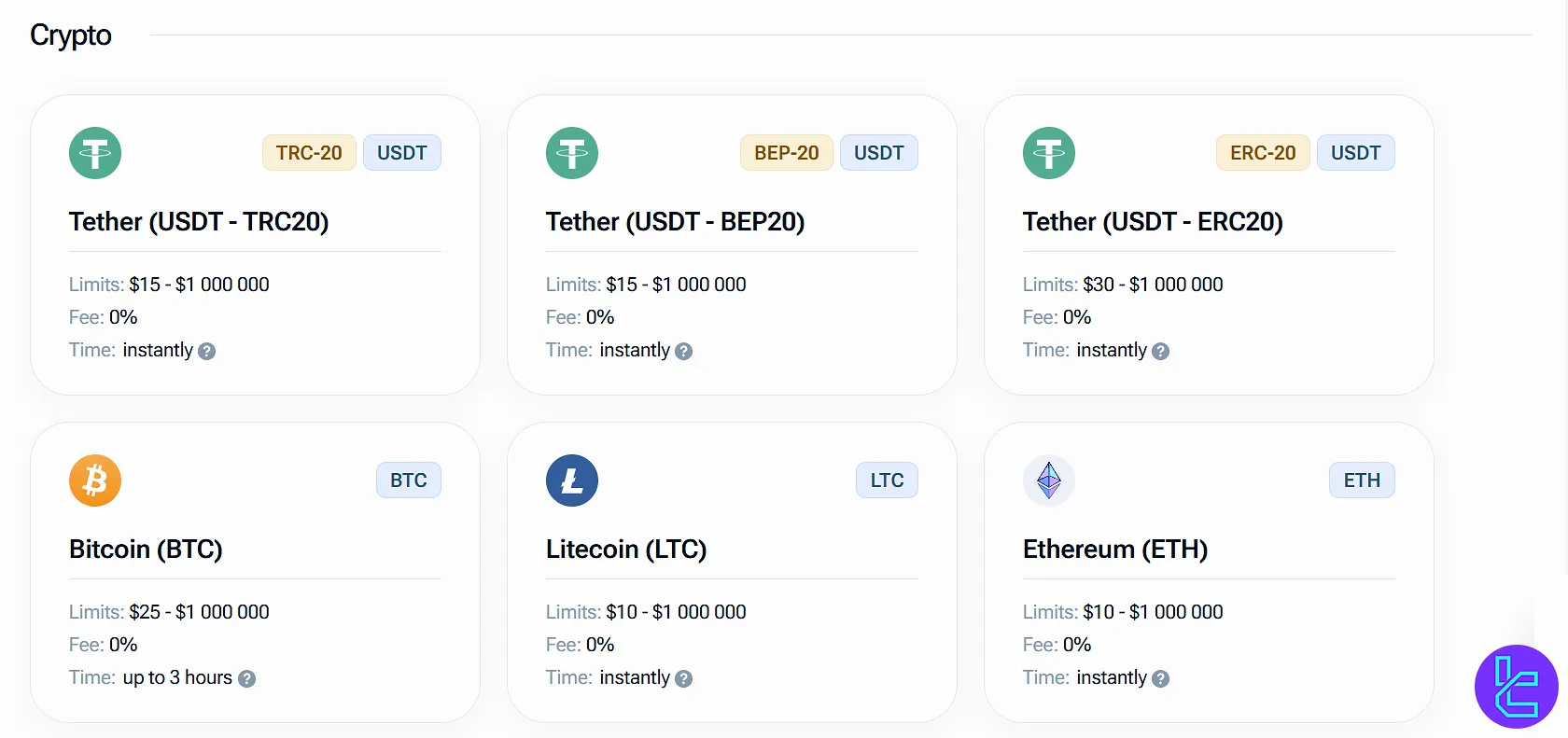

AMarkets Deposit

Amarkets supports a wide range of deposit methods tailored to meet the needs of traders across different regions. Users can fund their accounts using credit/debit cards such as Visa, MasterCard, and GoPay (for RUB transactions), offering fast processing and broad accessibility.

For those who prefer digital currencies, the platform accepts multiple cryptocurrencies, including USDT (TRC20, ERC20, BEP20), USDC, Bitcoin, Ethereum, Litecoin, and BNB, providing instant funding and minimal fees.

Additionally, e-wallets like TopChange (TC Pay) and Volet are available for seamless online transfers. Traditional bank transfers are also supported for larger transactions, and local exchanges may be used in certain countries to facilitate domestic funding.

All methods are designed for convenience, speed, and cost-efficiency, with zero deposit fees charged by the broker itself.

Method | Minimum Deposit | Deposit Fee |

Visa/MasterCard | $10 | 0% |

USDT (TRC20/ERC20) | $15 | 0% |

BTC/ETH/BNB | From $10 to $25 | 0% |

Volet/TC Pay | $1 | 0% |

Bank Transfer | $10 | 0% |

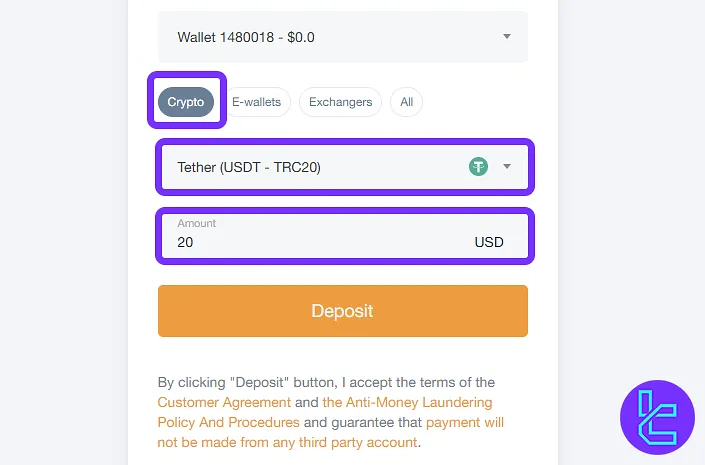

AMarkets USDT TRC20 Deposit

If you're looking to fund your Amarkets account quickly and without complications, USDT (TRC20) is one of the best choices. It offers instant processing, minimal fees, and supports large transfers, ideal for both retail and high-volume traders. Amarkets Tether TRC20 deposit method:

- Access Your Amarkets Profile: Sign in and go to the main dashboard. From there, head over to the “Deposit” section to begin the process.

- Select TRC20 and Enter Your Amount: Under cryptocurrency methods, chooseTether (USDT – TRC20). Input the desired amount you wish to transfer (min: $5, max: $1,000,000).

- Complete the Transfer via QR or Address: A unique address and QR code will appear. Copy the address or scan the code using your personal wallet. Ensure you're sending via the Tron blockchain (TRC20) to avoid any transfer issues.

Once confirmed on-chain, the deposit typically appears in your account within 2 minutes. To review the status of your transaction, navigate to the “Transactions” section of your dashboard.

AMarkets Withdrawal

Amarkets offers a streamlined and user-friendly withdrawal process, giving traders access to multiple reliable payout options. Clients can request withdrawals via the same methods used for deposits, including bank cards, cryptocurrencies, e-wallets, and bank transfers.

Most withdrawal requests are processed within 24 hours, ensuring quick access to funds. Cryptocurrency withdrawals are particularly efficient, often completed within minutes and with fixed, low fees (as little as $1 or even zero, depending on the coin and network).

E-wallets like Volet and TC Pay also deliver fast transfers with minimal commission, while card withdrawals may take slightly longer, typically up to a day, and carry a 1.8% fee.

For added security, all withdrawal methods require prior verification. Overall, Amarkets combines speed, security, and transparency to make the withdrawal experience smooth and dependable for traders around the world.

Method | Minimum Withdrawal | Withdrawal Fee |

Visa/MasterCard | $5 | 1.8% |

USDT (TRC20/ERC20) | $10 | $1 |

BTC/ETH/BNB | From $10 to $25 | 0% |

Volet/TC Pay | $1 | 0.5% |

Bank Transfer | $10 | Varies |

Copy Trade and Investment Options

For traders looking to benefit from the expertise of others, AMarkets' copy trading platform is a perfect option. It can be useful for both traders and investors. Some key features of the broker's copy trading system:

- Simplicity: Select experienced traders to copy, and the platform automatically replicates their trades in your account;

- Strategy selection: Choose trading strategies based on factors like profitability, number of investors, and strategy age;

- Protective features: protection from unexpected drops to save your funds from excessive losses;

- Fair fees & schemes: Pay only a percentage of the profits earned by the copied trader on transparent fee schemes

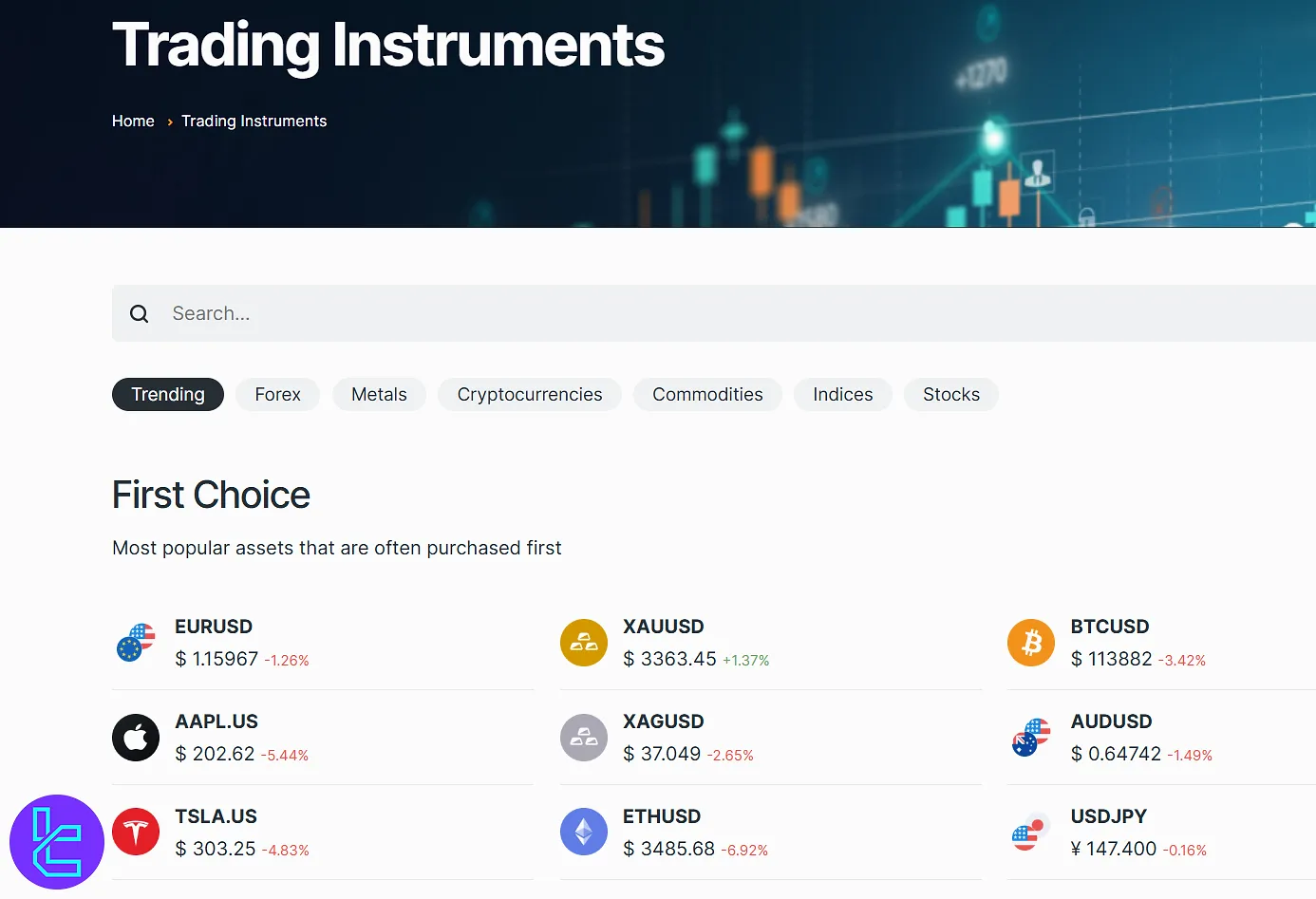

Markets & instruments

AMarkets offers a diverse range of markets and instruments to meet the needs of traders with various thoughts and approaches:

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

CFDs on currency pairs (majors, minors & exotics) | 44–48 currency pairs | 50–70 currency pairs | 1:3000 | |

Stocks | CFDs on shares from global exchanges (US, EU) | Over 400 stock CFDs | 800–1,200 global stocks | Not Specified |

Commodities & Metals | CFDs on metals, energies & soft commodities | 17–18 commodity instruments | 10–20 instruments | 1:3000 |

Indices | CFDs on global indices | 13–16 index CFDs | 10–20 indices | 1:3000 |

CFDs on major crypto pairs | 26–29 crypto pairs | Varies (often 5–15) | Not Specified | |

Bonds & ETFs | Government bond CFDs; ETF CFDs | 2 bond CFDs; 19 ETF CFDs | N/A | Not Specified |

This diverse range of instruments allows traders to trade and invest in various markets.

Does AMarkets Offer Any Bonuses Or Promotions?

The broker offers several attractive bonuses and promotions to both new and existing clients:

- Switch your broker bonus: New clients who switch to AMarkets can receive a 20% bonus on their initial deposit, up to a maximum of $5,000/€5,000.

- Cashback program: A portion of the spread is returned to clients based on their trading volume with currency pairs & metals.

- Double your trading deposit: AMarkets will add the amount of any deposit made by a client up to $10,000 per user as a credit to their account, effectively doubling their trading capital.

- Trade Demo, Earn Real cash: Profits made on a demo account can be transferred to a live trading account, allowing risk-free practice with potential real rewards.

Amarkets Awards

AMarkets has garnered several industry accolades over recent years, reflecting its performance across key service areas such as trading conditions, transparency, and client support.

Noteworthy recognitions include the “Best Trading Conditions Asia 2025” by Global Brands Magazine and the “Fastest Growing Broker Asia 2023” from Global Business Review Magazine.

The broker was also named “Most Transparent Broker 2024” and “Most Reliable Broker 2023” by FinanceFeeds. Additionally, the International Business Magazine awarded AMarkets titles such as “Most Reliable Broker Asia 2023,” “Most Reliable Broker Uzbekistan 2023,” and “Best Customer Service Asia 2024.”

These distinctions underline AMarkets’ consistent presence in regional financial markets and its emphasis on operational transparency and customer service quality.

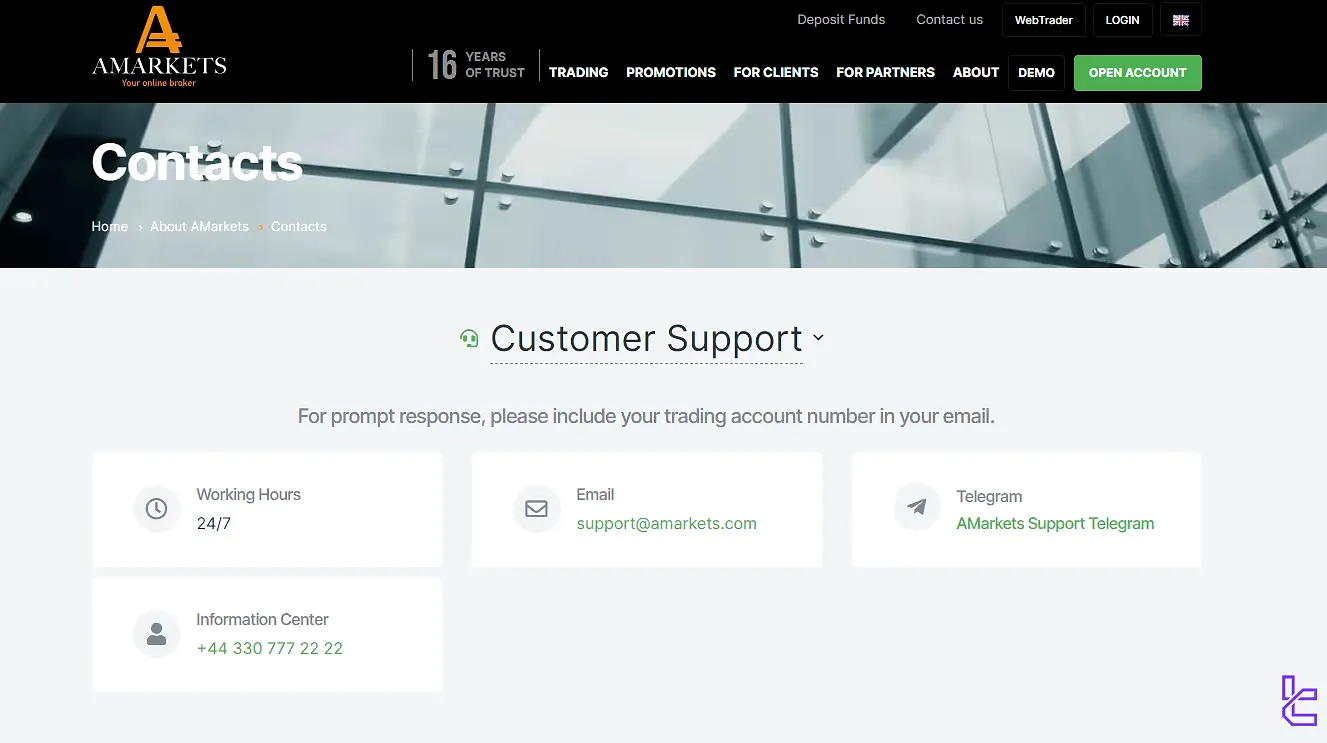

AMarkets Customer Support: Opening Hours & Channels

This part of the AMarkets review is dedicated to the support overview. This broker provides support 24/7 through different channels listed below:

- Email: support@AMarkets.com

- Telegram: @AMarkets_supportbot

- Phone: +44 330 777 22 22

- Live chat: Through the official website

AMarkets also maintains physical offices in various locations worldwide, including the Cook Islands, Panama, Turkey, Ukraine, Russia, Georgia, Nigeria, Kazakhstan, the United Kingdom, Cyprus, South Africa, Thailand, Serbia, Indonesia, Vietnam, India, and Uzbekistan.

To learn how you can access the support team via live chat, we suggest checking the AMarkets dashboard guide.

Which Country Is Restricted From AMarkets Services?

This brokerage does not provide services to citizens and residents of the United States of America. Additionally, the broker restricts access to its services for residents of numerous other countries, including, but not limited to:

- Armenia

- Afghanistan

- Jamaica

- Japan

- The United Kingdom

- The US Virgin Islands

- Venezuela

- Yemen

- Zambia

- Zimbabwe

Furthermore, AMarkets does not accept clients from EU/EEA/EFTA countries, including but not limited to Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, and Germany.

AMarkets Affiliate Program

The broker offers lucrative partnership opportunities through its affiliate program:

Webmaster (CPA) model:

- Fixed payouts for qualified registrations and funded accounts;

- Earn commissions for each new client who opens and funds an account.

Agent (Revenue Share) model:

- Stable commissions based on the trading volume of referred clients;

- Earn a percentage of trading volume, regardless of trading results.

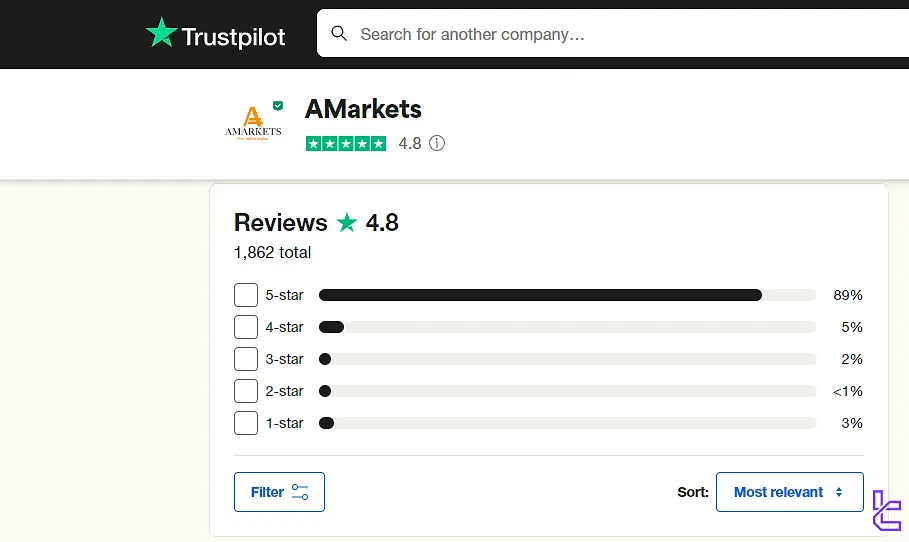

Trust Scores

AMarkets has established a strong reputation in the Forex industry, as evidenced by its impressive trust scores and customer feedback:

- Trustpilot Rating: 4.8/5 based on over 1,800 reviews, 100% response rate to negative reviews within the last 12 months

- Amarkets REVIEWS.io Score: 3.5 out of 5 based on more than 30 ratings

Education Materials

AMarkets provides access to various educational resources on its website and YouTube channel. Here's an overview of the educational resources and materials offered:

- Forex News and Market Analysis: Up-to-date news on the forex market

- FAQ: Answers to common trading questions

- Economic Calendar: User-friendly calendar to track important market events

- Trading Calculator: Automates basic trading parameter calculations

- Video Tutorials: Suitable for visual learners

Amarkets Comparison with Other Well-known Brokers

The table below helps traders understand the pros and cons of trading with Amarkets compared to some competitors.

Parameters | AMarkets Broker | |||

Regulation | FSA, FSC, Misa, FinaCom | ASIC, FSC, DFSA, CySEC | FCA, FSCA, CySEC, SCB | CySEC, DFSA, FCA, FSCA, FSA |

Minimum Spread | 0 Pips | 0.6 Pips | 0.0 Pips | 0.0 Pips |

Commission | From $0 | $0 (Except On Shares Account) | From $3 | No commission for Forex pairs (except in Zero accounts) |

Minimum Deposit | $100 | $5 | $100 | $0 |

Maximum Leverage | 1:3000 | 1:1000 | 1:500 | 1:2000 |

Trading Platforms | MetaTrade 4, MetaTrade 5, Mobile App | MetaTrade 4, MetaTrade 5, Mobile App | MetaTrade 4, MetaTrade 5, Mobile App, cTrader, Web Trader | MetaTrade 4, MetaTrade 5, Mobile App |

Account Types | Standard, ECN, Fixed, Crypto, Demo | Micro, Standard, Ultra Low, Shares | Standard, Pro, Raw+, Elite | Cent, Zero, Pro, Premium |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 550+ | 1400+ | 2100+ | 500+ |

Trade Execution | Instant, Market | Market, Instant | Market | Market, Instant |

Conclusion And Final Words

Spreads starting from 0 pips, +500 tradable assets, and compensation funds of up to 20,000 EUR per trade claim are some of the features in AMarkets.

Furthermore, the broker offers several bonuses, includingDouble Deposit, Broker Switch, Risk-free Trading, and Cashback. Also, a proprietary platform is available in addition to MT4 & MT5.