AMP Futures is a Chicago-based brokerage company providing access to Futures contracts across 7 assets classes, such as Stock Indices, Currencies, and Metals through 50+ trading platforms, including TradingView and MT5.

This broker operates under the reputable CFTC and NFA (U.S.) regulations with Tier-1 status, and traders can access a variety of instruments with a maximum leverage of 1:100 in this broker.

AMP Futures; Who is Behind the Broker? Is It Regulated?

AMP Global (USA) is a USA-based Futures Commission Merchant (FCM) regulated by the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC).

The company was founded in 2010, and its website is registered to “Daniel Culp”.

AMP Global has provided services in Europe since 2011 through AMP Global (Europe), regulated by CySEC.

However, the company stopped all of its operations in this region as of 2024 and now operates only in the USA.

Entity / Parameter | AMP Futures |

Regulation | CFTC, NFA (U.S.) |

Regulation Tier | Tier-1 |

Country | United States |

Investor Protection Fund | None |

Segregated Funds | Yes |

Negative Balance Protection | No |

Maximum Leverage | 1:100 |

Client Eligibility | Most countries, some restricted |

AMP Futures Specific Information

This broker stands out in the crowded futures brokerage market with its unique offerings and client-centric approach. Here's a breakdown of what makes AMP Futures special.

Broker | AMP Futures |

Account Types | Individual, Joint, IRA, Corporate, LLC, Partnership, Trust |

Regulating Authorities | NFA, CFTC |

Based Currencies | USD, EUR, GBP, RUB |

Minimum Deposit | $100 |

Deposit Methods | Bank Wire, ACH, Check |

Withdrawal Methods | Bank Wire, ACH |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:100 |

Investment Options | Auto Trading, Copy Trading |

Trading Platforms & Apps | MT5, TradingView, NinjaTrader, Rithmic, and 46 more solutions |

Markets | Stocks, Currencies, Energies, Metals, Meats, Interest Rates, Grains |

Spread | Variable |

Commission | Variable |

Orders Execution | Market, Stop Loss, Take Profit, Limit |

Margin Call / Stop Out | 100% / 50% |

Trading Features | Auto Trading, Copy Trading |

Affiliate Program | Yes |

Bonus & Promotions | Referral |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Live Chat, Phone, Remote Desktop, Forum |

Customer Support Hours | 24/7 |

Unlike other Forex brokers, AMP Futures specializes in futures trading.

AMP Futures Broker Account Offerings

The company offers a total of seven account types, including Individual, Joint, IRA, Corporate, LLC, Partnership, and Trust.

However, at first, you can only choose between Individual or Joint accounts, and then you can change your account type. Key features of AMP Futures accounts:

Execution Model | Futures Exchanges/STP |

Leverage | Up to 1:100 |

Min Deposit | 100 USD/EUR/GBP or 6,500 RUB |

Min Trade Size | 0.01 lots |

Max Trade Size | 100.00 lots |

Max Open Positions | Unlimited |

Margin Call | 100% |

Stop-Out | 50% |

Hedging | No |

Scalping, EAs, and News Trading | Yes |

The broker also offers swap-free account with no overnight interest charges for clients following Islamic banking principles. However, it’s limited to selected currency pairs.

AMP Futures Pros & Cons

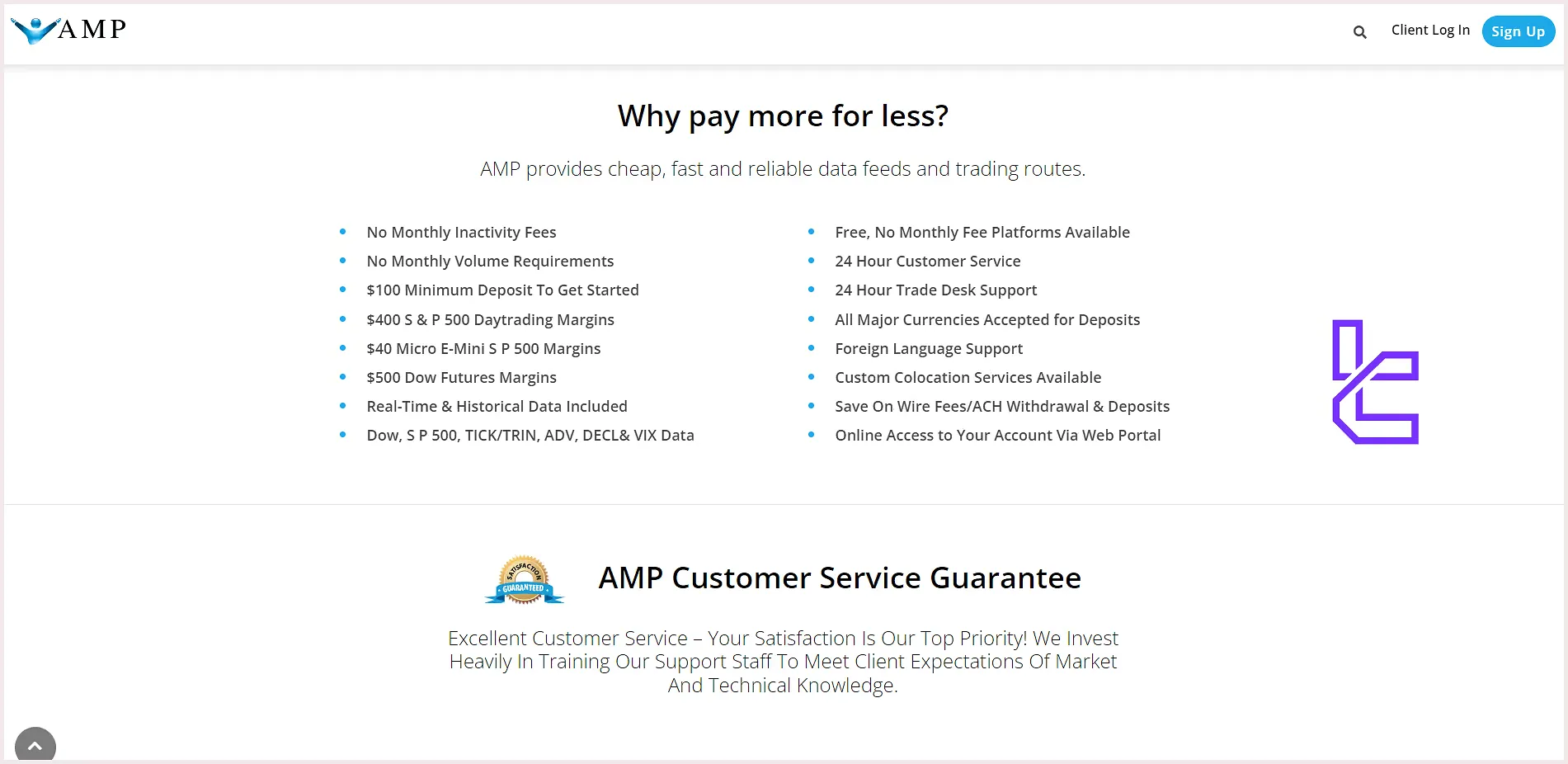

With its combination of low costs, diverse platforms, and comprehensive support, AMP Futures aims to cater to traders with different levels.

However, to have a balanced look we must consider the cons, too.

Pros | Cons |

Ultra-low pricing structure | Geo-Restrictions |

Multiple free trading platforms | Limited markets |

24/7 customer support | Limited account types |

Various data feed options (CQG, Rithmic) | - |

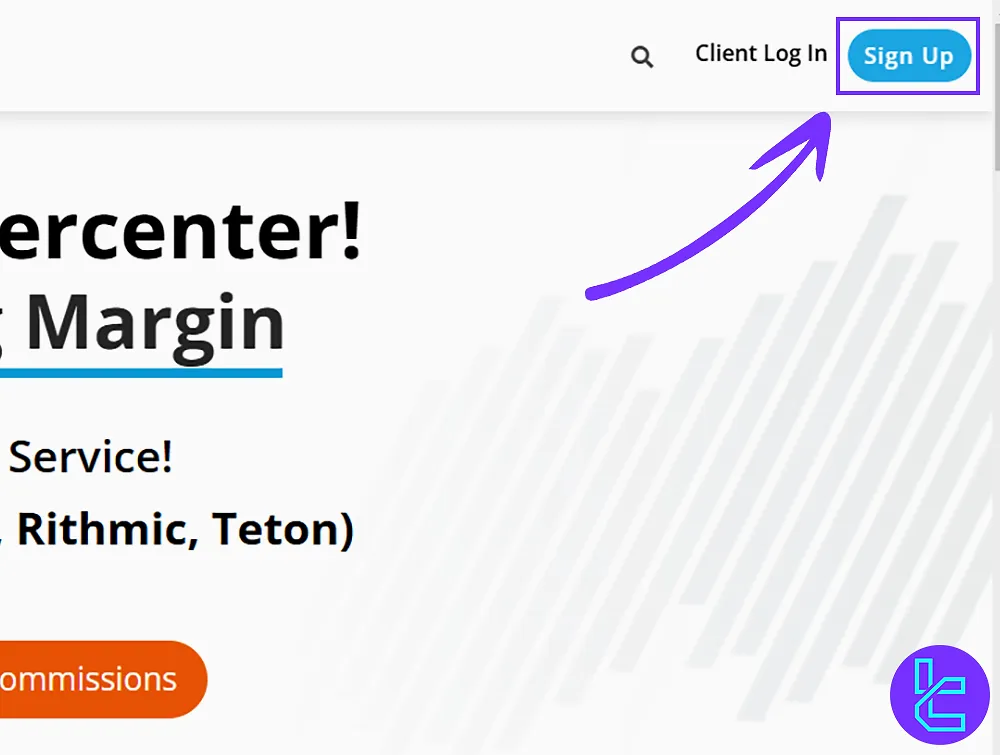

AMP Futures Account Opening and Verification

Opening an account with AMP Futures is a straightforward process designed to get you trading as quickly as possible while ensuring compliance withregulatory requirements. AMP Futures registration:

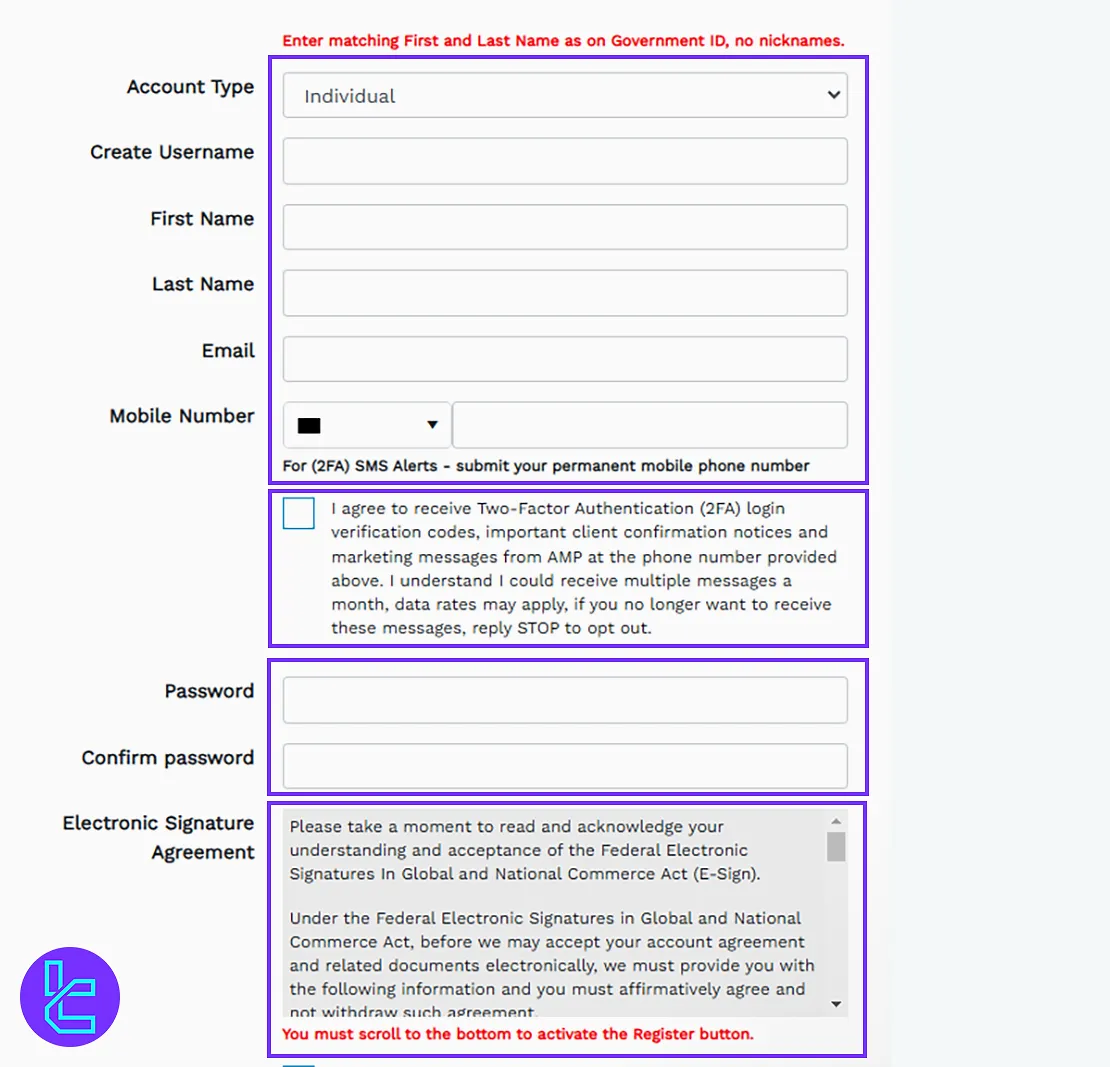

#1 Access the AMP Futures Registration Page

Head to the AMP Futures official website and click on “Sign Up”. You’ll be redirected to the secure onboarding platform where account creation begins.

Step 2: Complete the Registration Form

Choose your account type (e.g., individual), then provide:

- Your first and last name

- A unique username

- The email address and phone number not linked to other AMP accounts

- A secure password (minimum 12 characters with upper/lowercase letters, numbers, and symbols)

Agree to the platform's terms and proceed.

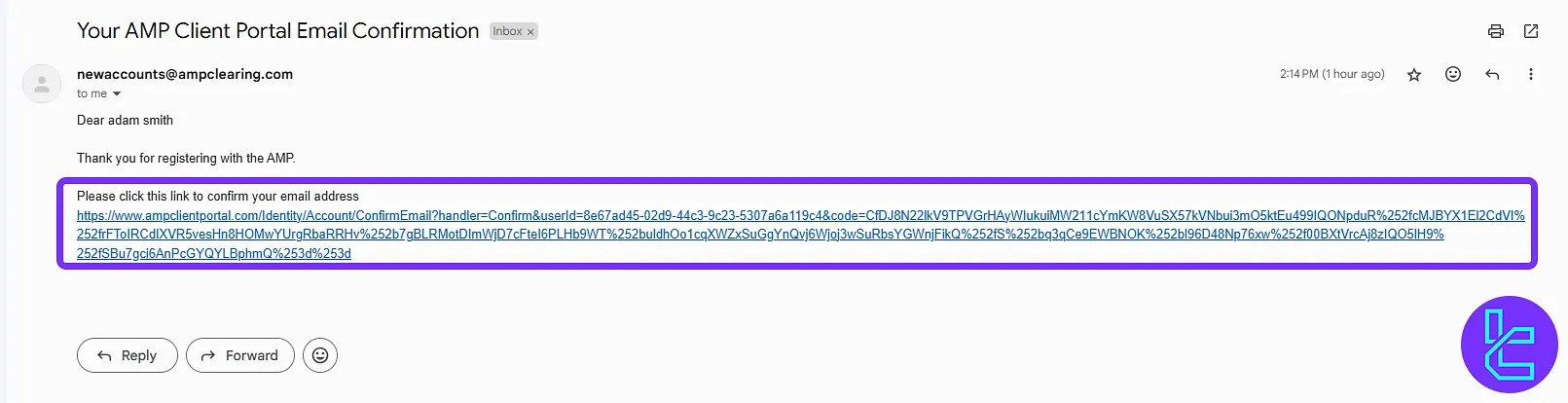

Step 3: Verify Your Contact Information

AMP Futures sends a verification link via email. Click to confirm. Then, enter the SMS code sent to your mobile.

Once verified, you’ll be granted access to your dashboard and can proceed with full identity verification and account setup.

For account verification, traders must provide valid identification documents, such as a national ID card, passport, or driver's license.

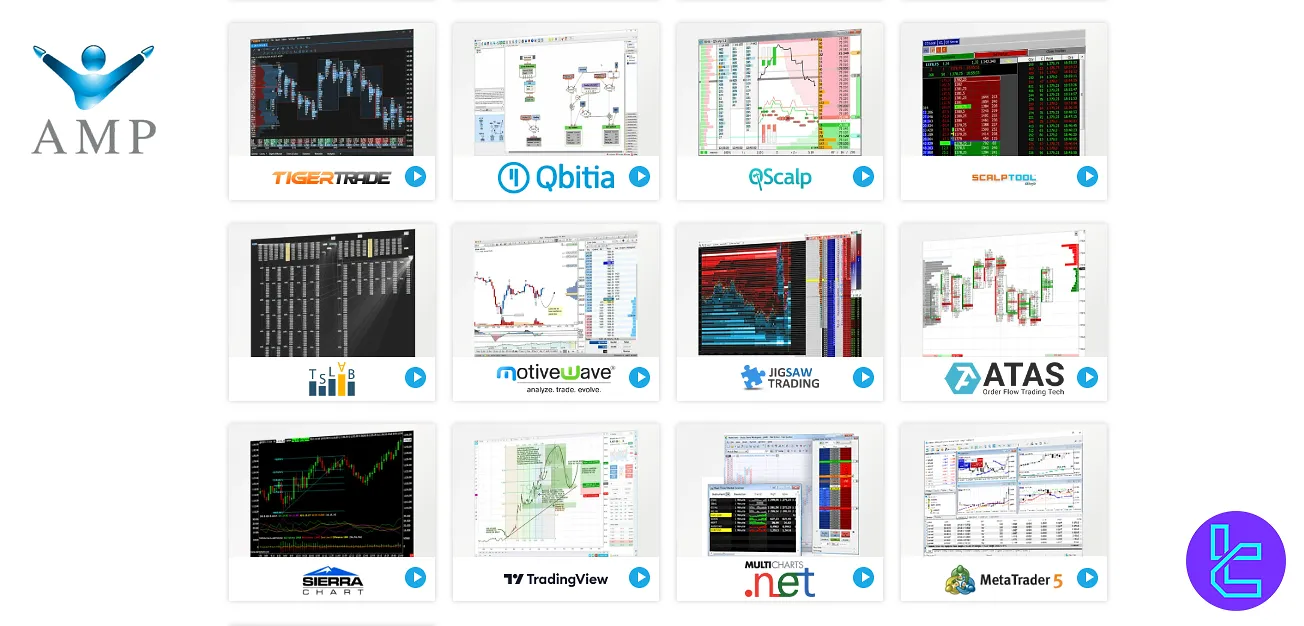

What Are the Available Trading Platforms on AMP Futures?

The next topic to discuss in this AMP Futures review is the trading platform. The broker offers 50+ advanced platforms across various devices, including Android, iOS, Desktop, and Web.

This diverse selection caters to traders of all experience levels and preferences. AMP Futures trading platforms:

- MetaTrader 5

- CQG Trader

- Trading Technologies (TT)

- Rithmic

- R Trader Pro

- NinjaTrader

- TradingView

- QuanTower

- MultiCharts

- Sierra Chart

- Bookmap

- MotiveWave

These platforms support various data feeds, including CQG, Rithmic, TT, and Teton. The maximum available leverage in any of these platforms is1:100.

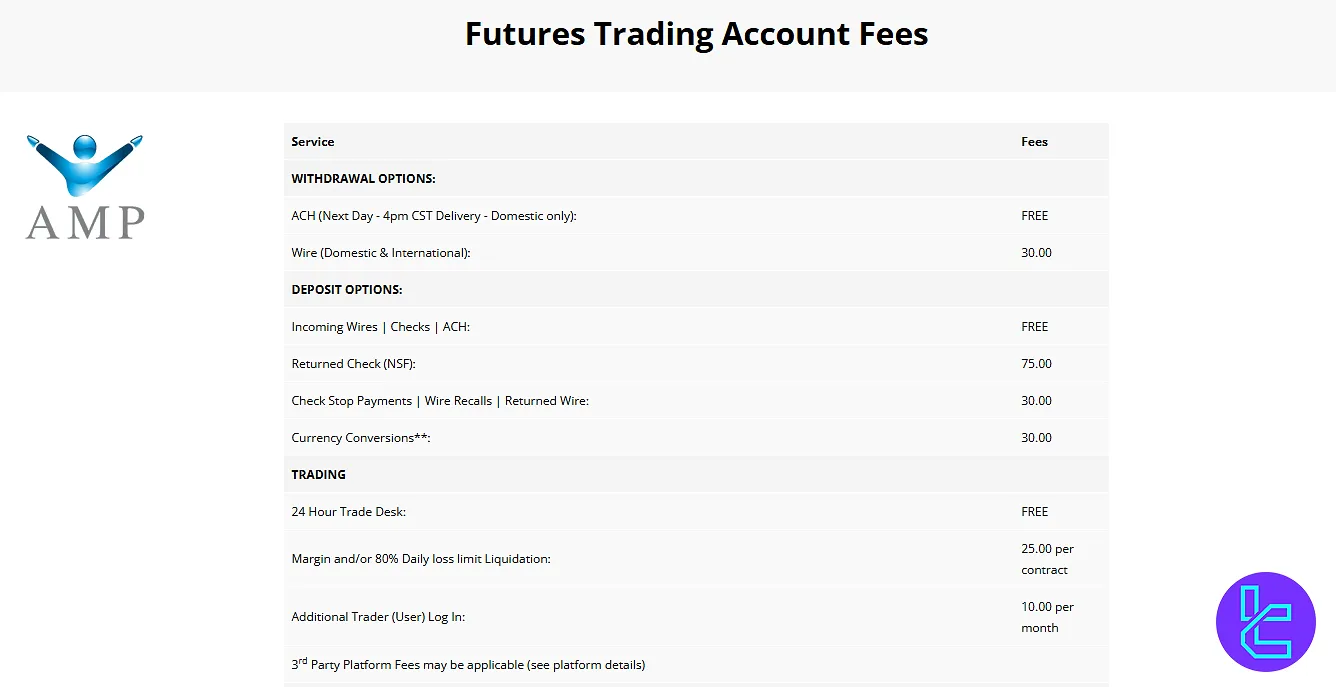

AMP Futures Fee Structure

Understanding the fee structure is crucial when choosing a futures broker.

The company offers a competitive pricing model, but knowing all potential costs is important. Key specifics of AMP Futures pricing:

Trading Fees

- Commission-free access to the 24-hour trade desk

- $25 per contract for margin and/or 80% daily loss limit liquidation

- $10 monthly fee for additional user logins

Platform Costs

- Vary depending on the chosen platform

- Some platforms like CQG, R Trader Pro, TradingView, and MT5 are offered free of charge

Administrative Fees

- Free electronic daily and monthly statements

- $30 for mailed monthly statements

- $30 for account statement reproductions

- $30 for electronic trading audit detail logs

Deposit and Withdrawal Fees

- Free incoming wires, checks, and ACH deposits

- Free ACH withdrawals

- $30 for domestic and international wire withdrawals

- $75 for returned checks

- $30 for wire recalls/returns

Swap-Fee at AMP Futures

Unlike many forex brokers, AMP Futures focuses on futures trading, so the concept of “swap” or overnight interest as in forex is less central.

There is no explicit swap charge listed in their fee schedule. Also, no Islamic accounts are offered at AMP Futures.

Non-Trading Fees at AMP Futures

AMP Futures charges some non-trading (ancillary) fees for services not directly related to executing trades.

These include wire transfer fees, statement reproduction, platform/data fees, and currency conversion.

Key points / features to mention:

- Wire withdrawal costs $30 per transaction;

- Incoming deposits via ACH or wire are free;

- Returned check or wire recall fees range $30–$75;

- Paper statements or reproductions cost $30 per request;

- Currency conversion or reg-code transfers cost $30;

- Market data and platform subscriptions have monthly charges;

- No inactivity or account maintenance fees are applied.

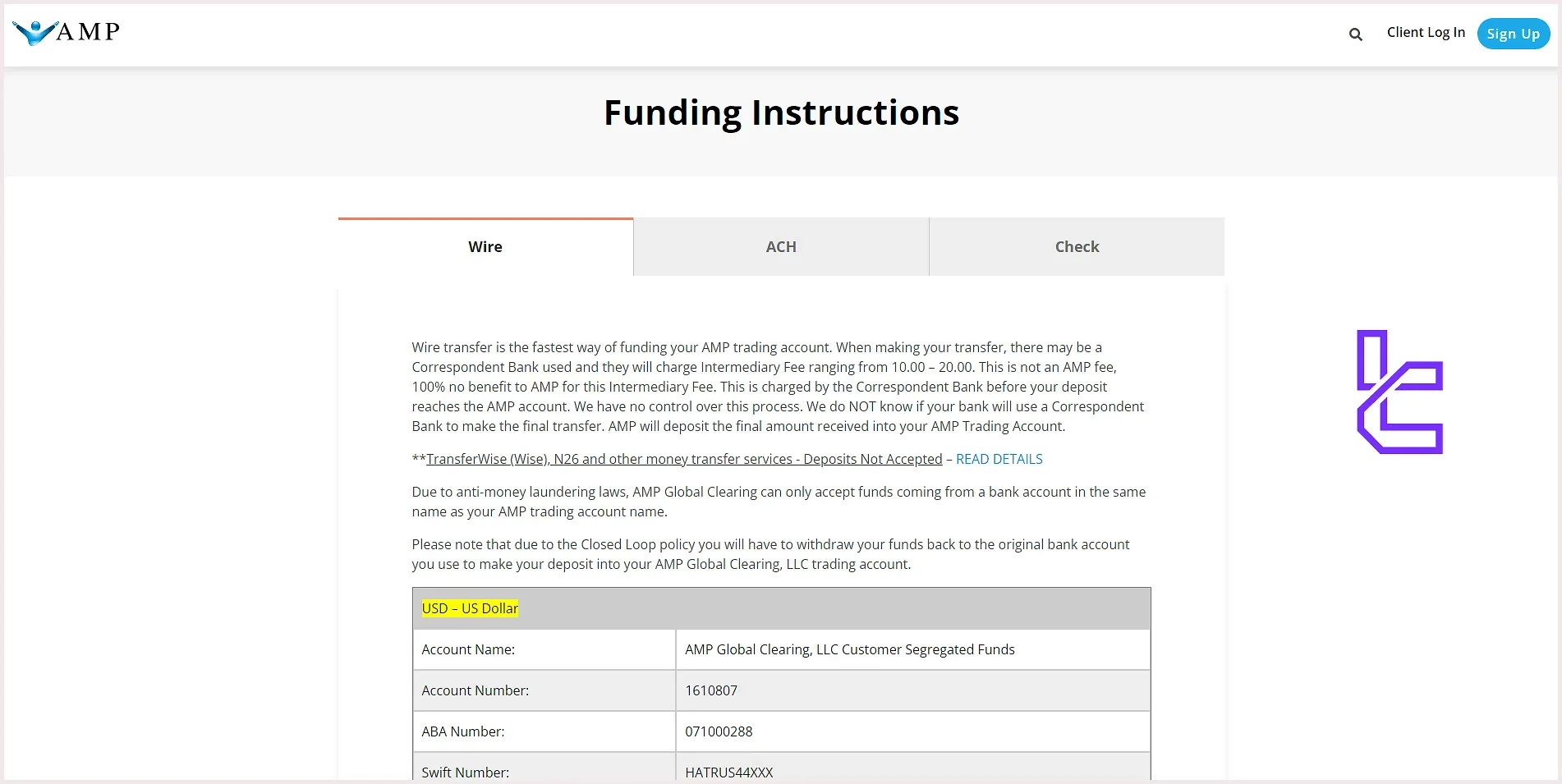

AMP Futures Payment Options

The broker implements traditional banking solutions for funding and withdrawal transactions. Here's an overview of the available payment methods on AMP Futures.

- Wire Transfer: Fastest method for account funding with potential intermediary bank fees (minimum amount $100)

- ACH (Automated Clearing House): A solution to move money electronically between US banks

- Check: Accepted only for deposits, but not recommended due to slow processing times

Deposit Methods at AMP Futures

AMP Futures provides several funding options for clients, including wire transfers, ACH deposits, and checks.

Each method has different processing times, fees, and requirements. International clients mainly use wire transfers, while U.S. clients can also use ACH or personal checks.

Deposit Method | Minimum Amount | Deposit Fee | Funding Time |

Wire Transfer | $100 | No AMP fee (intermediary bank fees possible) | Same day to 1–3 business days |

ACH Transfer (U.S. only) | N/A | Free | 3 business days |

Check (U.S. banks only) | N/A | Free | 5 business days hold |

Withdrawal Methods at AMP Futures

AMP Futures allows clients to withdraw funds using ACH (for U.S. accounts) or bank wire transfers.

Withdrawals must generally go back to the same bank used for deposit (closed-loop policy). You must submit the request via client portal.

Withdrawal Method | Minimum Amount | Withdrawal Fee | Processing / Funding Time |

ACH (U.S. only) | N/A | Free | Next day delivery |

Wire Transfer (Domestic & International) | N/A | $30 per transfer | Same day if before 1 PM CST cutoff |

Copy Trading and Growth Plans on AMP Futures Broker

The company offers innovative features to help traders grow their accounts and improve their trading strategies.

Here's an overview of the copy trading and growth opportunities available on AMP Futures.

- Copy Trading: Available through the MetaTrader 5 (MT5) platform, which allows traders to replicate trades of successful signal providers automatically

- Growth Plans: Advanced analytical tools for technical and fundamental analysis with the ability to create and deploy automated trading strategies (Expert Advisors) using MQL5

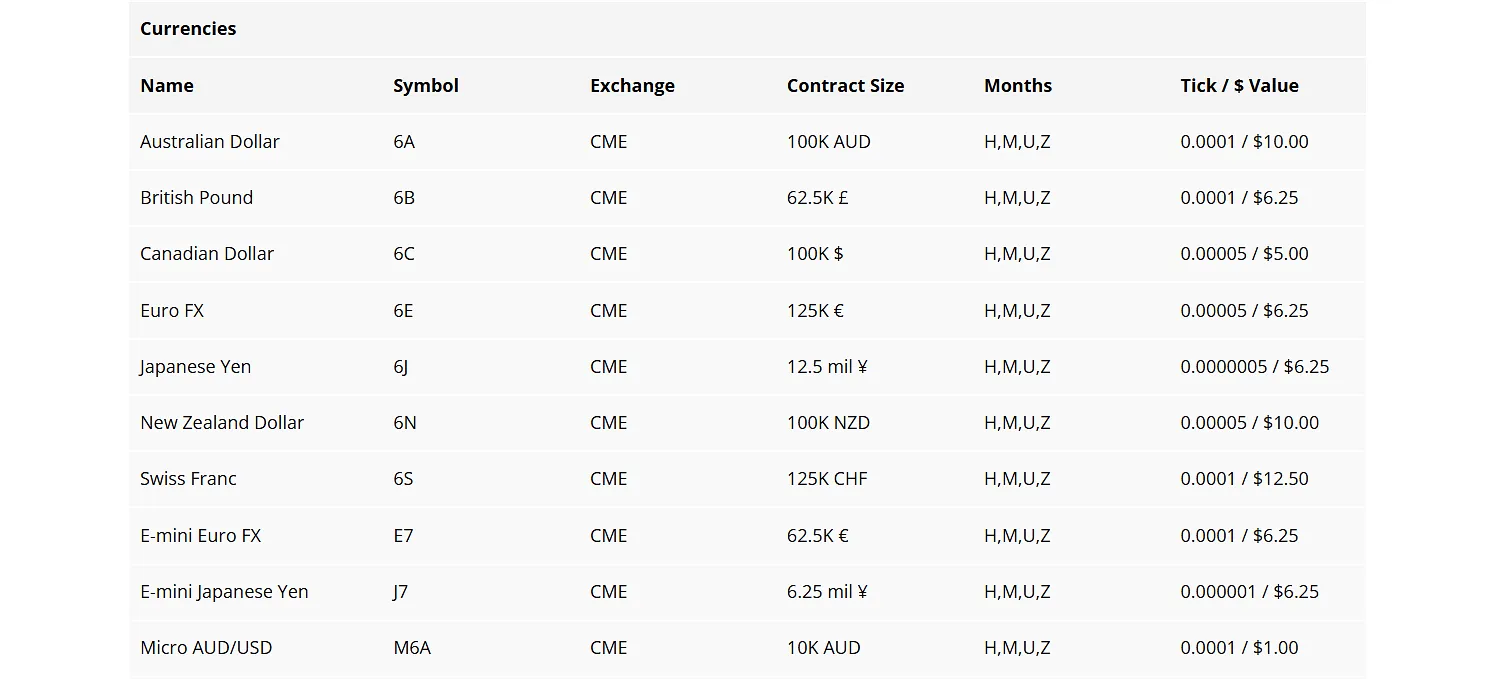

AMP Futures Financial Instruments

We must discuss the financial market coverage in this AMP Futures review.

The broker offers Futures contracts on various financial instruments, allowing traders to diversify their portfolios and capitalize on diverse market opportunities.

Full information about the trading instruments available at Amp Futures, covering all categories, contract types, and maximum leverage, is summarized in the table below.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Stock Indices | E-mini, Micro E-mini, Mini, and Micro contracts for indices like S&P 500, Nasdaq-100, Dow, Russell 2000, DAX, Euro STOXX 50 | 12 | 15–20 | 1:100 |

Currencies | Major and minor currency futures, including E-micro and standard contracts for pairs like EUR/USD, GBP/USD, JPY/USD | 15 | 20–25 | 1:100 |

Commodities | Futures for metals (gold, silver, copper), energies (crude oil, natural gas) | 20 | 25–30 | 1:100 |

Interest Rates | U.S. Treasury bonds and notes, Euro Bund, Euro BTP, Euro Schatz, Euro-Buxl, Euro-Oat, Short Sterling, Long Gilt | 10 | 15–20 | 1:100 |

Grains & Softs | Futures for corn, soybeans, wheat, oats, rough rice, ethanol, soybean oil, soybean meal, milk, lumber, cotton, coffee, orange juice, sugar, meats | 20 | 25–30 | 1:100 |

AMP Futures Broker Bonus and Promotional Offerings

The broker doesn’t offer any traditional bonus plans like a welcome gift or an extra deposit.

However, you can earn passive income through the affiliate program for non-US customers.

AMP Futures Awards

AMP Futures has been recognized for excellence in the futures trading industry, earning accolades for its services and platforms.

This broker has repeatedly received the Best Futures Broker award from the reputable TradingView platform.

Some of AMP Futures’ awards include:

- Best Futures Broker (2023 & 2024): AMP Futures was honored as the "Best Futures Broker" for both 2023 and 2024 by TradingView, based on feedback and reviews from verified TradingView users;

- Best Futures Broker (2023): In 2023, AMP Futures received the "Best Futures Broker" award in the asset-focused competition category at the TradingView Broker Awards;

- Best Futures Broker (2024): AMP Futures was again recognized as the "Best Futures Broker" in the asset-focused competition category at the TradingView Broker Awards in 2024.

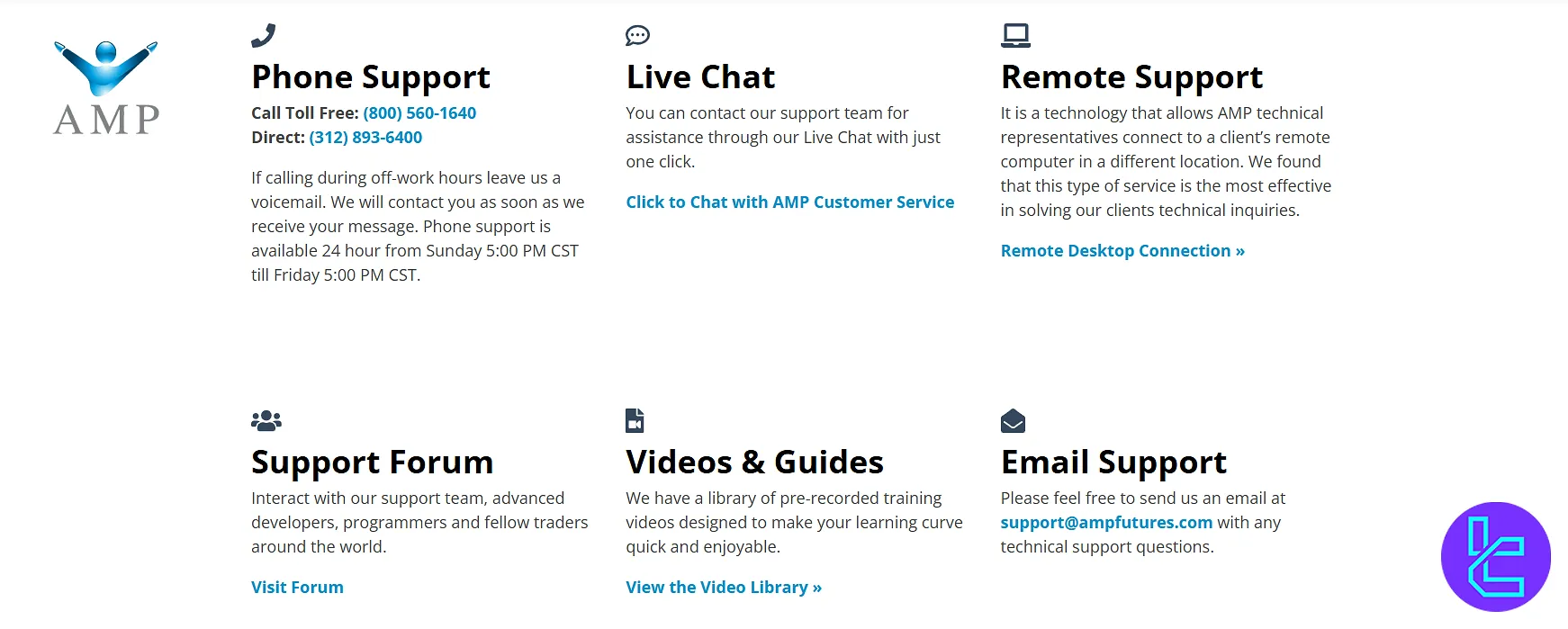

AMP Futures Customer Support Channels

The next aspect to explore in this AMP Futures review is customer support.

The broker prides itself on providing comprehensive 24/7 support to ensure a smooth trading experience for its clients.

Remote Desktop | Connect your monitor to the AMP experts |

Live Chat | Non-responsive |

Phone | (800) 560-1640 |

support@ampfutures.com | |

Forum | Communicate with the broker’s experts and clients |

Restricted Countries on AMP Futures Broker

While the broker aimed to serve a global clientele, ceasing its operation in Europe and other regulatory requirements means that it cannot offer its services in all countries. AMP Futures Geo-Restrictions:

- Afghanistan

- Albania

- Azerbaijan

- Bangladesh

- Belize

- Belarus

- Cambodia

- Central African Republic

- Cuba

- Gaza Strip

- Iran

- Iraq

- Jordan

- Libya

- Russian Federation

- Syria

- Ukraine

- Yemen

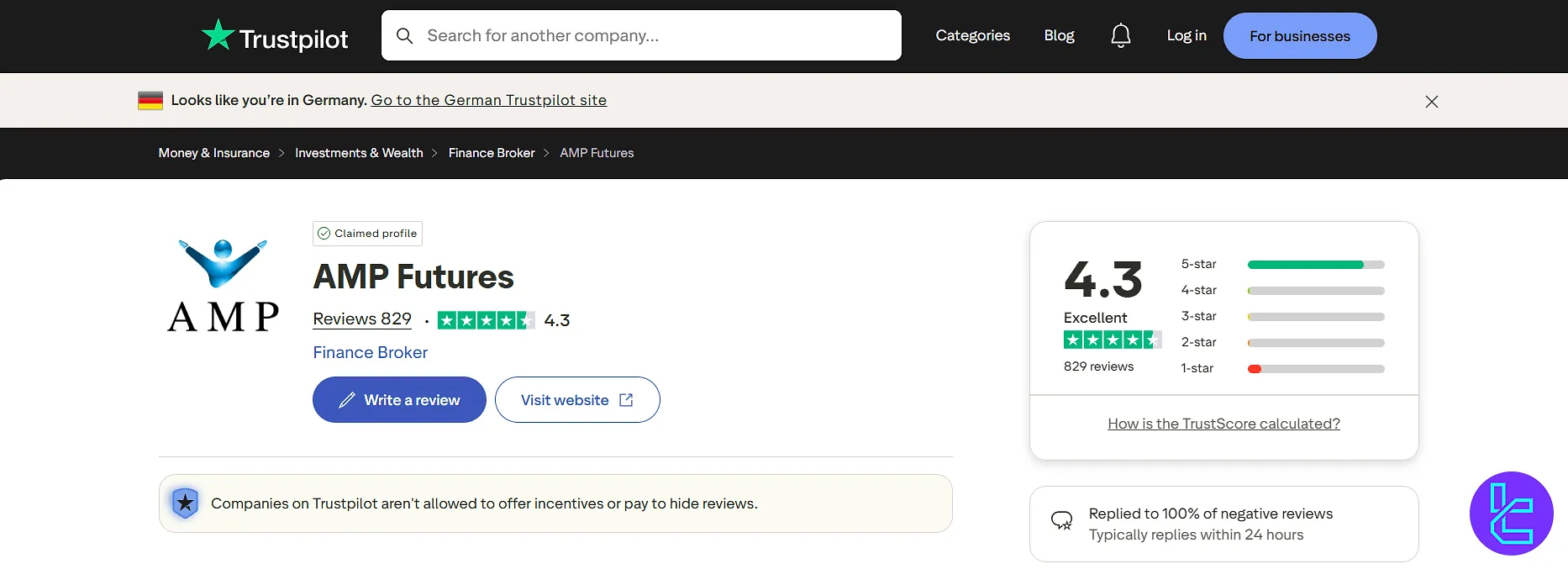

AMP Futures Broker on Review Websites

The company has garnered attention on various review websites, providing potential clients with valuable insights from real users.

4.3 out of 5 based on 653 reviews | |

TradingView | 4.7 out of 5 |

AMP Futures Educational Materials

The last thing we must mention in this AMP Futures review is the educational content.

The broker demonstrates a strong commitment to trader education by providing a wealth of resources on various subjects, including:

- Order Types

- History of Futures

- Futures vs. Stocks

- Introduction to Emini contracts

- Trading 101

- Webinars

Comparing AMP Futures with Other Forex Brokers

Parameters | AMP Futures Broker | |||

Regulation | NFA, CFTC | CySEC, MiFID, CNMV, MNB, FINANSTILSYNET, ACPR, KNF, BaFin, FI, HCMC | FSC, CySEC | VFSC, CySEC, FSA, FSCA |

Minimum Spread | Variable | From 0.00001 pips | From 0.0 Pips | From 0.0 Pips |

Commission | Variable | $8 | From $0.0 | From $0.0 |

Minimum Deposit | $100 | $100 | $5 | $5 |

Maximum Leverage | 1:100 | 1:300 | 1:3000 | 1:5000 |

Trading Platforms | MT5, TradingView, NinjaTrader, Rithmic, and 46 more solutions | MetaTrader 5 | MT4, MT5, Mobile App | MT4, MT5 |

Account Types | Individual, Joint, IRA, Corporate, LLC, Partnership, Trust | ECN, ECN Plus, ECN VIP, Demo | Standard | Standard+, ECN Zero, Mini Optimus, Pro |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | N/A | 120+ | 550+ | N/A |

Trade Execution | Market, Stop Loss, Take Profit, Limit | Market | Market | Market |

Conclusion and Final Words

AMP Futures offers Futures trading through 50+ trading platforms for a minimum deposit of $100. The broker was authorized to operate in Europe by CySEC.

However, it ceased all operations in the region in 2024, and now, it only offers services in the USA. The company provides 24/7 support and has a TrustPilot score of 4.7.