Anzo Capital provides commission-free trading on Forex and Metals through its STP account with a EUR/USD target spread of 1.4 pips.

The broker offers up to 50% commission to those who promote its Social Trading feature.

Traders can also trade a wide range of instruments with a leverage of up to 1:1000 at Anzo Capital broker. It’s worth noting that Anzo is the official partner of Phoenix suns, a famous NBA basketball team.

Anzo Capital; An Introduction to the Broker and Its Regulatory Status

Anzo Capital is a Forex and CFD broker incorporated in St. Vincent and the Grenadines in 2015.

The company services its international clientele through Anzo Capital Limited LLC. The broker also has a legal entity registered in Australia. Anzo Capital Licenses:

- Australian Securities and Investments Commission (ASIC) with license No. AFSL 362215

- Vincent and the Grenadines Financial Services Authority (SVGFSA) with registration No. 308 LLC 2020

Entity Parameters/Branches | Anzo Capital |

Regulation | SVG FSA |

Regulation Tier | 3 |

Country | Saint Vincent & the Grenadines |

Investor Protection Fund/Compensation Scheme | No |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:1000 |

Client Eligibility | All countries except prohibited ones (e.g. USA, Japan) |

Anzo Capital Specific Features

Let’s dive into Anzo Capital’s offerings to see if it fits among the Forex brokers.

Broker | Anzo Capital |

Account Types | STP, ECN |

Regulating Authorities | ASIC, SVGFSA |

Based Currencies | EUR, USD |

Minimum Deposit | $100 |

Deposit Methods | Wire Transfer, Skrill, Neteller |

Withdrawal Methods | Wire Transfer, Skrill, Neteller |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:1000 |

Investment Options | Copy Trading, MAM |

Trading Platforms & Apps | MT5, MT4 |

Markets | Forex, Commodities, Index CFDs, Stock CFDs |

Spread | Floating |

Commission | STP: $0 ECN: $4/lot |

Orders Execution | Market |

Margin Call / Stop Out | 80% / 50% |

Trading Features | Social Trading, Economic Calendar, Mobile Trading |

Affiliate Program | Yes |

Bonus & Promotions | 2025 Global Trading Competition, Credit Bonus |

Islamic Account | N/A |

PAMM Account | Yes |

Customer Support Ways | Email, Phone, Live Chat, Chat Bot |

Customer Support Hours | Monday to Friday, 7:30 AM - 2:00 AM the next day (GMT+8) |

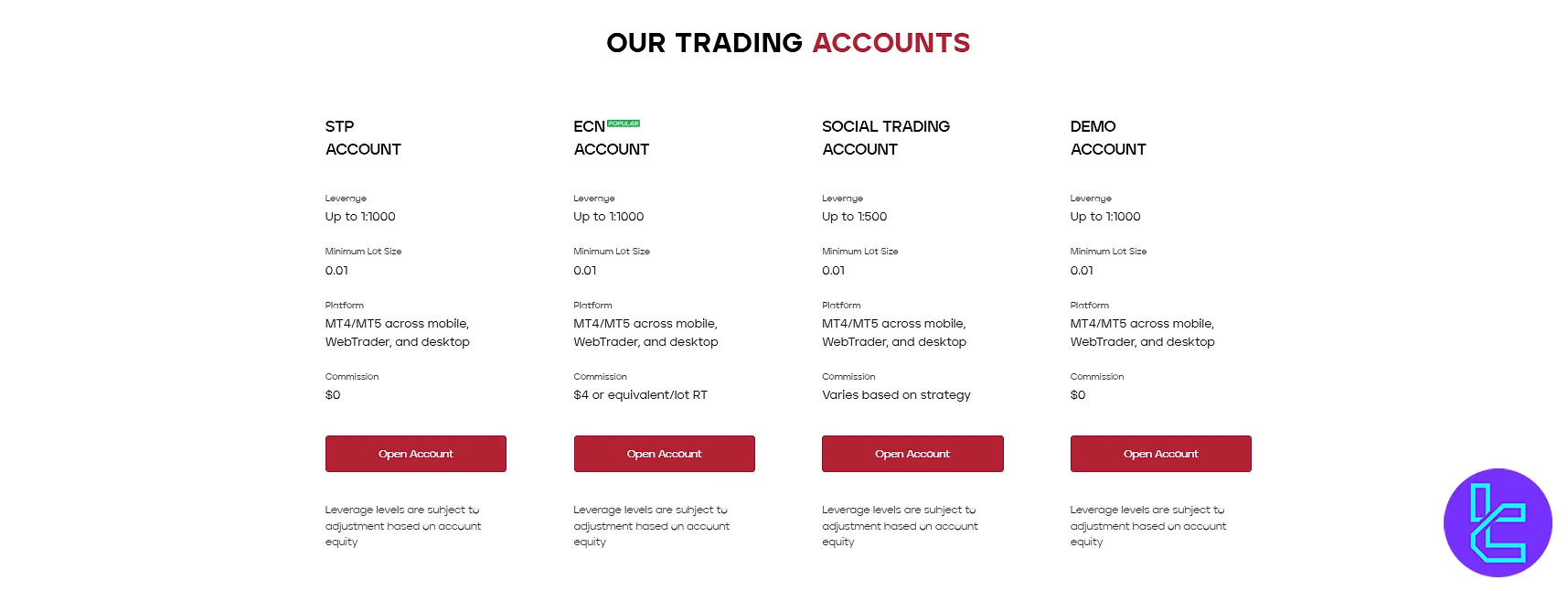

Anzo Capital Account Types

The broker offers two main trading accounts, including STP and ECN, with various fee structures.

Features | STP | ECN |

Base Currency | EUR, USD | EUR, USD |

Max Leverage | 1:1000 | 1:1000 |

Min Deposit | $100 | $100 |

Min Lot Size | 0.01 | 0.01 |

Max Lot Size | 50 | 50 |

Stop Out | 50% | 50% |

Margin Call | 80% | 80% |

Commission | $0 | $4/lot |

Account Manager | No | Yes |

Corporate Account Option | No | Yes |

Traders can also open a demo account with this broker.

Upsides & Downsides

Offering leverage options of up to 1:1000 is one of the bright sides of this Anzo Capital review.

However, like any other financial service provider, the broker has some disadvantages, too.

Pros | Cons |

Multi-regulated broker (SVGFSA and ASIC) | High minimum deposit ($100) |

Access to popular MT4 and MT5 platforms | Limited range of deposit/withdrawal methods |

Copy trading functionality | Limited asset offerings |

24/5 account manager for ECN accounts | Lack of transparency about the company’s founding and managing teams |

Anzo Capital Broker Registration and KYC

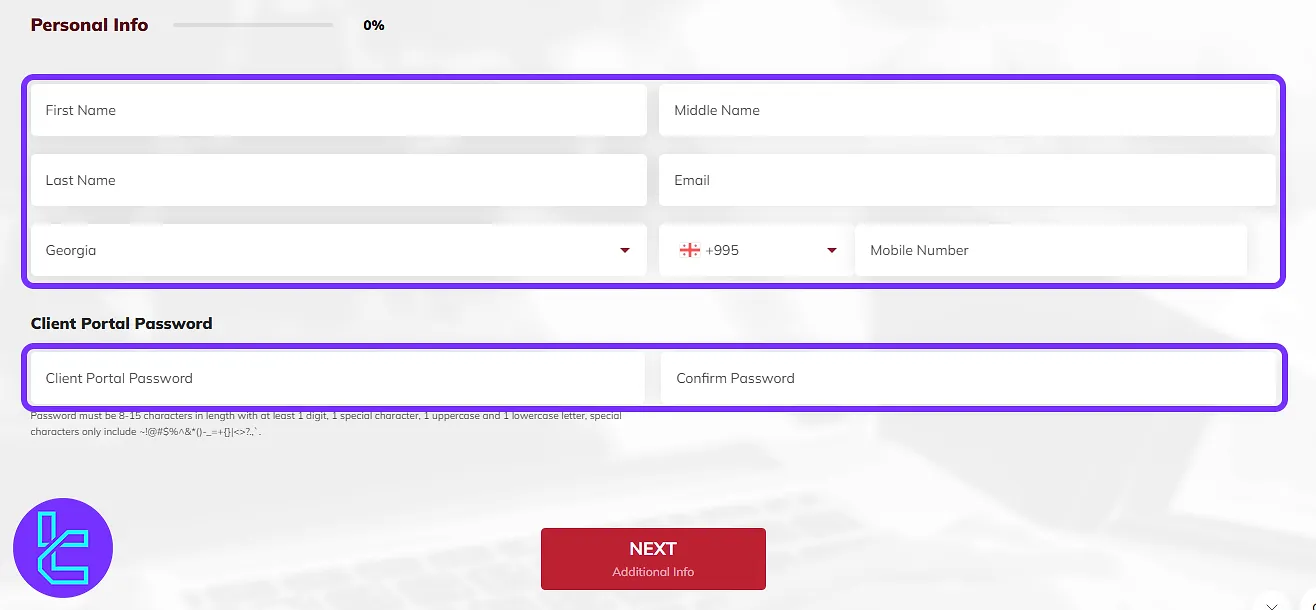

Creating an account with Anzo Capital is easy and only takes a couple of minutes to complete. Anzo Capital registration:

#1 Launch the Account Setup

Access the Client Portal from the Anzo Capital homepage and click “Sign Up” to load the registration interface.

#2 Submit Personal Details

Provide your full name, country of residence, contact info (email, phone), and set a secure password to proceed.

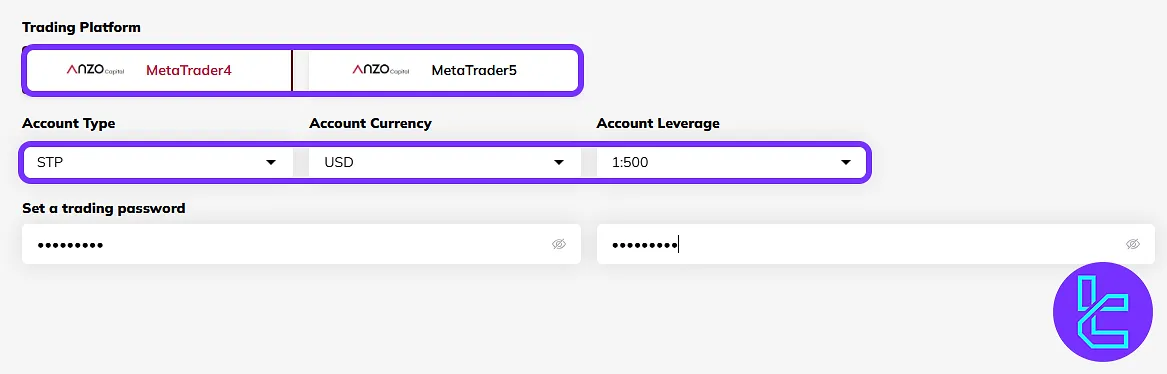

#3 Complete Profile and Trading Settings

Enter your date of birth, full address, and then customize your account:

- Choose a trading platform

- Select ECN or STP account

- Set the base currency (USD/EUR)

- Define leverage

- Create a trading password and accept the terms

Once complete, you’ll be redirected to the verification page to finalize your account activation.

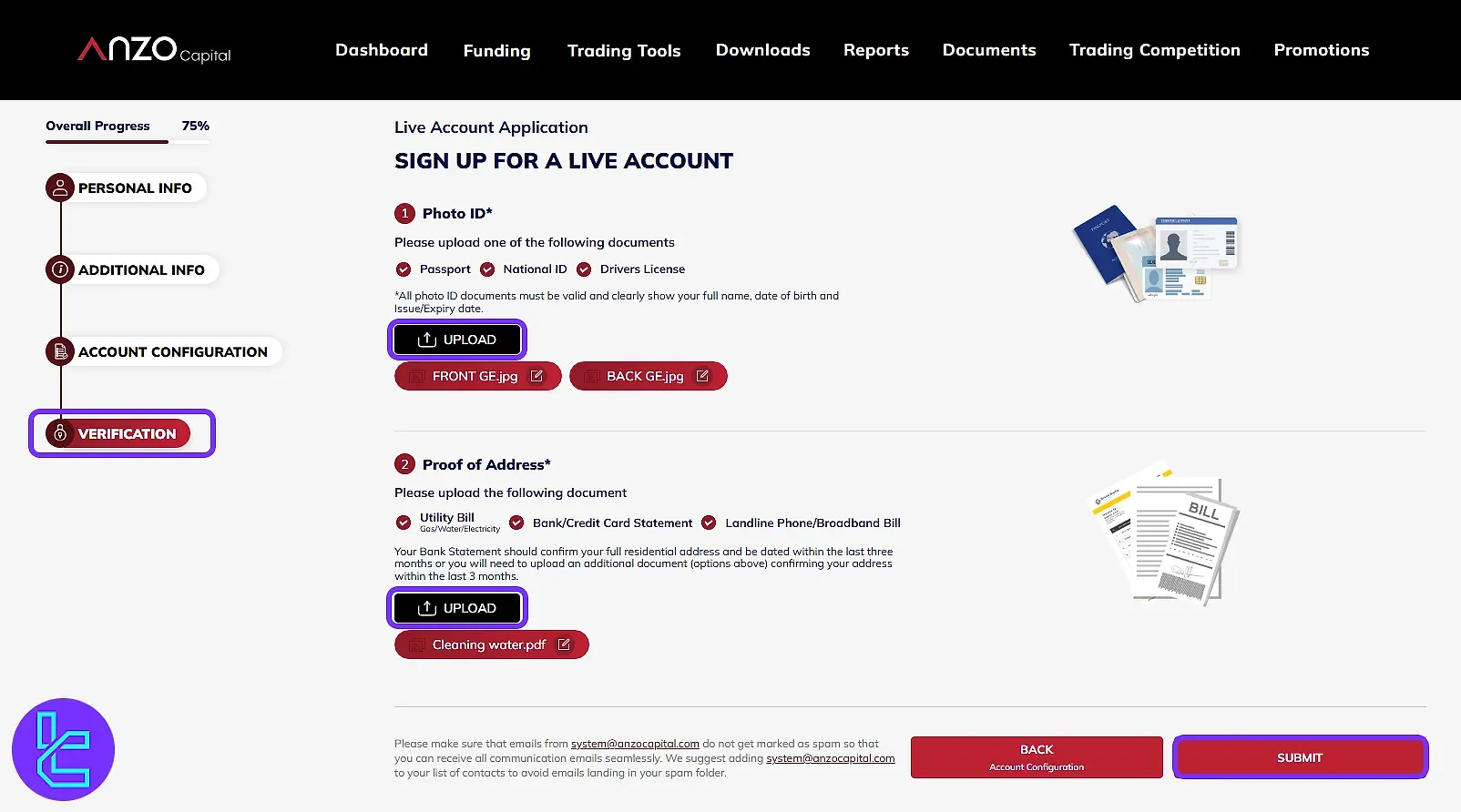

#4 Anzo Capital KYC Verification

After completing registration, clients are required to verify their accounts through the Anzo Capital verification procedure.

Only once identity and residency details are confirmed do traders gain full access to platform features.

Key Stages of Verification:

Identity and Address Submission:

From the Anzo Capital dashboard, users enter the “Verification” area to upload official identification along with a recent proof of residence.

- Accepted ID forms: passport, driver’s license, or national identity card;

- Accepted address documents: utility bills, bank or credit card statements, or fixed-line phone/broadband invoices, provided they are issued within the last three months and remain legible.

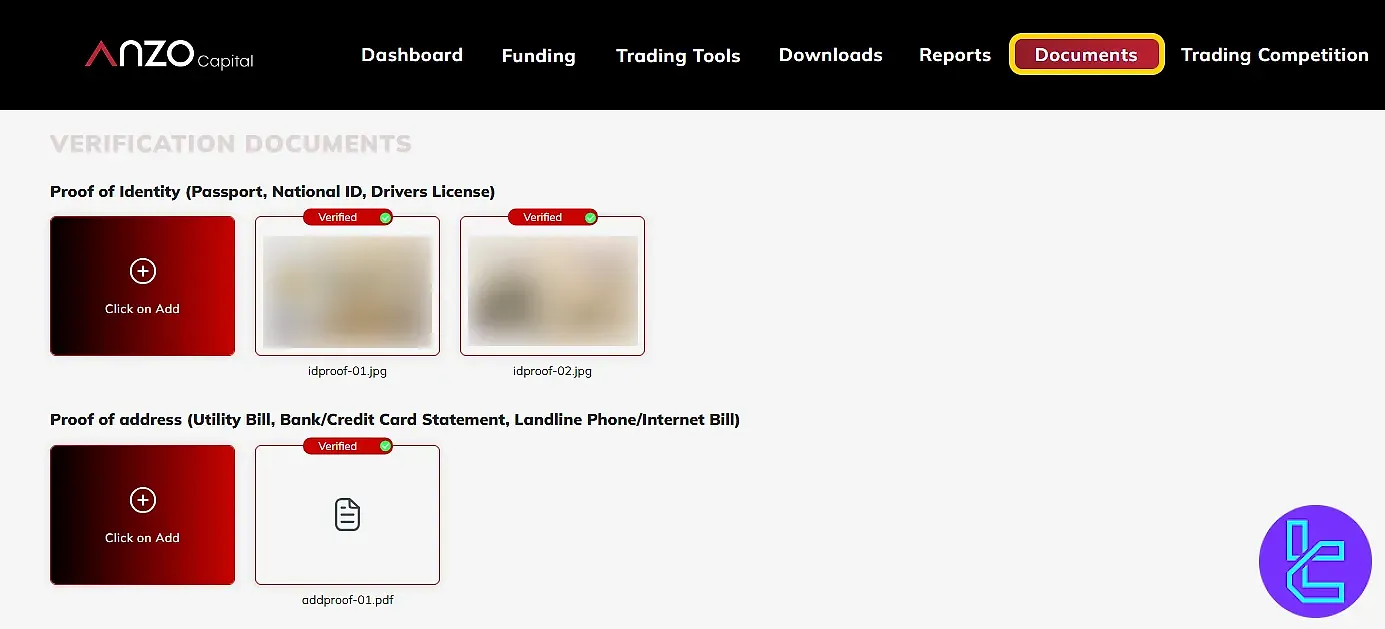

Monitoring Review Progress

Once files are submitted, the “Documents” section of the dashboard displays their current verification status, allowing clients to track whether approval is pending or completed.

Anzo Capital Platform Offerings

Anzo Capital supports both MetaTrader 4 and MetaTrader 5, the industry’s most widely used trading platforms, on desktop, web, and mobile.

These platforms are renowned for their stability, rapid execution, and support for automated trading strategies through Expert Advisors (EAs).

MT5 in particular is suited for advanced traders, offering features such as:

- 38 built-intechnical indicators

- 24 drawing tools (Fibonacci, trendlines, etc.)

- 21 timeframes for multi-timeframe analysis

- 3 chart types: Line, bars, and candlesticks

- Built-in strategy tester for backtesting EAs

- Market Depth (Level II) and one-click trading

- Chart-based order execution with SL/TP settings

- Customizable watchlists and price alerts

The broker also supports MT4 MultiTerminal, making it suitable for account managers handling multiple portfolios.

Additionally, Anzo Capital has launched its own proprietary mobile app for iOS and Android.

It features a clean interface, integrated news feed, live charting, market sentiment insights, and fast order placement, making it a useful companion for traders on the move.

Overall, Anzo’s platform offering is robust and caters well to both beginners and algorithmic traders.

Anzo Capital Fee Structure

In this Anzo Capital review, we must mention that the broker offers floating spreads.

While there are no commissions in the STP account, trading in an ECN account incurs a $4 per lot commission.

Spread information for some of the popular trading pairs in Anzo Capital:

Trading Instrument | STP Target Spread | ECN Target Spread |

AUD/CAD | 2.2 | 0.4 |

CAD/JPY | 1.7 | 0.3 |

EUR/GBP | 1.8 | 0.2 |

EUR/USD | 1.4 | 0.1 |

XAU/USD | 3.1 | 0.8 |

XAG/USD | 3.1 | 1.1 |

XTI/USD | 3 | 1.8 |

Swap-Fee at Anzo Capital

Anzo Capital applies swap fees (also known as overnight financing charges) on positions that remain open overnight.

A swap long applies to buy positions, resulting in either a charge or a credit, while a swap short applies to sell positions under similar conditions.

For a standard contract size of 100,000 base currency units, Anzo Capital currently lists the following rates:

Instrument | Swap Long | Swap Short |

EURUSD | –$6.82 | +$2.60 |

GBPJPY | +$8.05 | –$26.20 |

Importantly, Anzo Capital does not offer swap-free or Islamic accounts, so Muslim traders seeking Sharia-compliant trading conditions may find this broker unsuitable.

Non-Trading Fees at Anzo Capital

At Anzo Capital, traders should be aware that in addition to trading costs like spreads and swaps, there are also non-trading fees.

These include charges related to account inactivity, specific withdrawal conditions, and administrative fees under certain circumstances.

While deposits and withdrawals are generally free, external bank or payment provider fees may still apply.

Key Points on Non-Trading Fees at Anzo Capital:

- Inactivity fee: USD 15 per month after 90 days of no trading activity;

- Withdrawal conditions: A 6% administrative charge applies if funds are withdrawn without any trading activity (new or dormant accounts);

- Deposit/withdrawal thresholds: Deposits below USD/EUR 3,000 may incur bank charges; minimum withdrawal is often around USD 100;

- External fees: Bank and intermediary charges may apply depending on the payment method.

Payment Methods

Anzo Capital offers a straightforward and mostly fee-free funding process, supporting major payment methods including:

- Bank Wire Transfers

- Skrill

- Neteller

All deposit methods support both USD and EUR, with a minimum deposit requirement of just $100. Deposits via Skrill and Neteller are instant, while bank wires take 1–4 business days.

Withdrawals are equally accessible with a low threshold of $100 and no internal handling fees. The broker also covers third-party fees for deposits or withdrawals exceeding $3000. Summary of Key Terms:

- Minimum deposit: $100

- Minimum withdrawal: $100

- Deposit/withdrawal fees: None (Anzo covers charges above $3000)

- Third-party banking fees may apply for lower transaction volumes

- No support for PayPal or crypto payments

Anzo Capital’s deposit and withdrawal system is relatively competitive and user-friendly, with fast processing for e-wallets andfull fee transparency for high-volume clients.

Deposit Methods

Anzo Capital offers a range of deposit methods for different regions, including African local options, global digital currencies, e-wallets, and Asian local payments.

Deposits are generally free of broker fees and are processed quickly, from instant up to one business day depending on the method.

Additional details, including minimum amounts, fees, and processing times, are provided in the table below:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

GT Bank NGN Local | NGN / USD | 10 USD | Free | Approx. 1 hr – next business day |

NGN Instant Pay | NGN | 10 USD | Free | Immediately |

USDT | USDT | 50 USD | Free | Immediately |

USDC | USDC | 50 USD | Free | Immediately |

Skrill | USD | 100 USD | Free | Immediately |

Neteller | USD | 100 USD | Free | Immediately |

PHP Deposit | PHP | 20 USD | Free | Immediately – next business day |

Withdrawal Methods

Anzo Capital supports a variety of withdrawal methods for different regions, including African bank transfers, global digital currencies, e-wallets, and Asian local payments.

Withdrawals are generally free of broker fees and are processed within 1–3 business days depending on the method.

Additional details, including transaction limits, processing times, and fees, are provided in the table below:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Payout Time |

Nigeria NGN Bank TF | NGN | 10 USD | Free | 1 – 2 Business Days |

Nigeria USD Bank TF | USD | 10 USD | Free | 1 – 2 Business Days |

USDT | USDT | 50 USD | Free | 1 – 2 Business Days |

USDC | USDC | 50 USD | Free | 1 – 2 Business Days |

Skrill | USD / EUR | 100 USD | Free | 1 – 2 Business Days |

Neteller | USD / EUR | 100 USD | Free | 1 – 2 Business Days |

Stic Pay | USD / EUR | 100 USD | Free | 1 – 2 Business Days |

PHP Withdrawal | PHP | 50 USD | Free | 1 – 3 Business Days |

Social Trading and MAM Accounts

Anzo Capital broker offers innovative social trading and Multi Account Manager (MAM) solutions, catering to individual traders and professional money managers.

Social Trading

- Signal Providers: up to 50% commission to provide winning strategies

- Followers: Earning profits alongside experienced traders

- Signal Promoter: Introducing strategies to other traders to earn commissions

- Available on MT4 and MT5

MAM (Multi Account Manager)

- Designed for money managers to access all of their accounts with ease

- Available on MT4

- 6 allocation methods: Percentage, Lot, Proportional by Equity, Proportional by Balance, Equal Risk, and Equity Percentage

Anzo Capital Trading Products

The company offers a wide range of tradable instruments across five asset classes, including:

Anzo Capital offers a selection of 94 CFDs across five major asset classes.

While the total instrument count is lower than the industry average, the broker compensates with a few rare and regionally tailored offerings.

Here’s an overview of Anzo Capital’s tradable products:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Currency Pairs (Minor, Major, Exotic) | 60+ | 50–100 | 1:1000 |

Precious Metals | Gold, Silver | 2 | 10–20 | 1:1000 |

Energies | WTI, Brent | 2 | 5–10 | 1:200 |

Stocks CFDs | Global Equities | 30+ | 50–100 | 1:20 |

Index CFDs | Global Indices | 10+ | 10–50 | 1:500 |

Although Anzo does not offer bonds, ETFs, or real equities, it does include uniquely tailored products for specific regional traders, such as yuan-denominated gold and Chinese equity CFDs.

This modest yet niche-focused asset range may suit short-term CFD traders, particularly those interested in Asia-focused markets and commodities.

Anzo Capital Promotions

The broker regularly offers promotions to attract new clients and reward existing ones. At the time of writing this Anzo Capital review, there are two promotional programs, including:

- Credit Bonus + Cashback: Monthly promotion offering up to $250 in cashback and a 20% credit bonus on deposits

- 2025 Global Trading Competition: Enrolling until June 2nd, 2025, available in two models, including Voyage and Pride, with $200K+ prizes

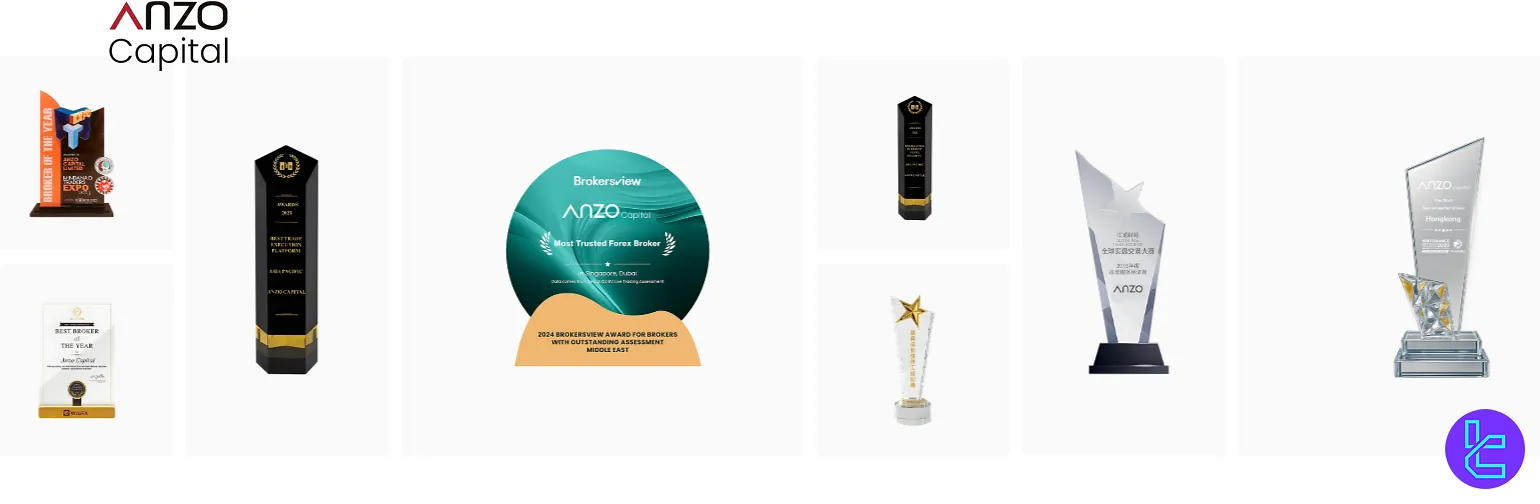

Anzo Capital Awards

Anzo Capital has been recognized with multiple prestigious awards in recent years, underscoring its commitment to excellence in the brokerage industry.

Notably, in 2024, the company was honored as the Most Trusted Forex Broker at the BrokersView Outstanding Broker Awards in Singapore.

Below are some of the notable awards Anzo Capital has received:

- Most Trusted Forex Broker 2024 – Awarded at the BrokersView Outstanding Broker Awards in Singapore;

- Most Recommended Broker 2025 – Recognized for exceptional service and client satisfaction;

- Best Forex Broker in Asia 2021 – Acknowledged for outstanding performance in the Asian market;

- Best Trading Platform 2020 – Honored for offering a user-friendly and efficient trading platform;

- Most Trusted Broker 2019 – Recognized for building a reputation of trust and reliability among traders;

- Best Customer Service 2018 – Acknowledged for exceptional customer support and service;

- Best Forex Broker 2017 – Recognized for overall excellence in forex trading services.

Customer Support

Anzo Capital provides support Monday to Friday,7:30 AM - 2:00 AM the next day (GMT+8) through various channels, including:

support@anzocapital.com | |

Phone | +5012232928 |

Live Chat | Accessible through the official website |

Chat Bot | Available 24/7 in Chinese |

Anzo Capital User Experience

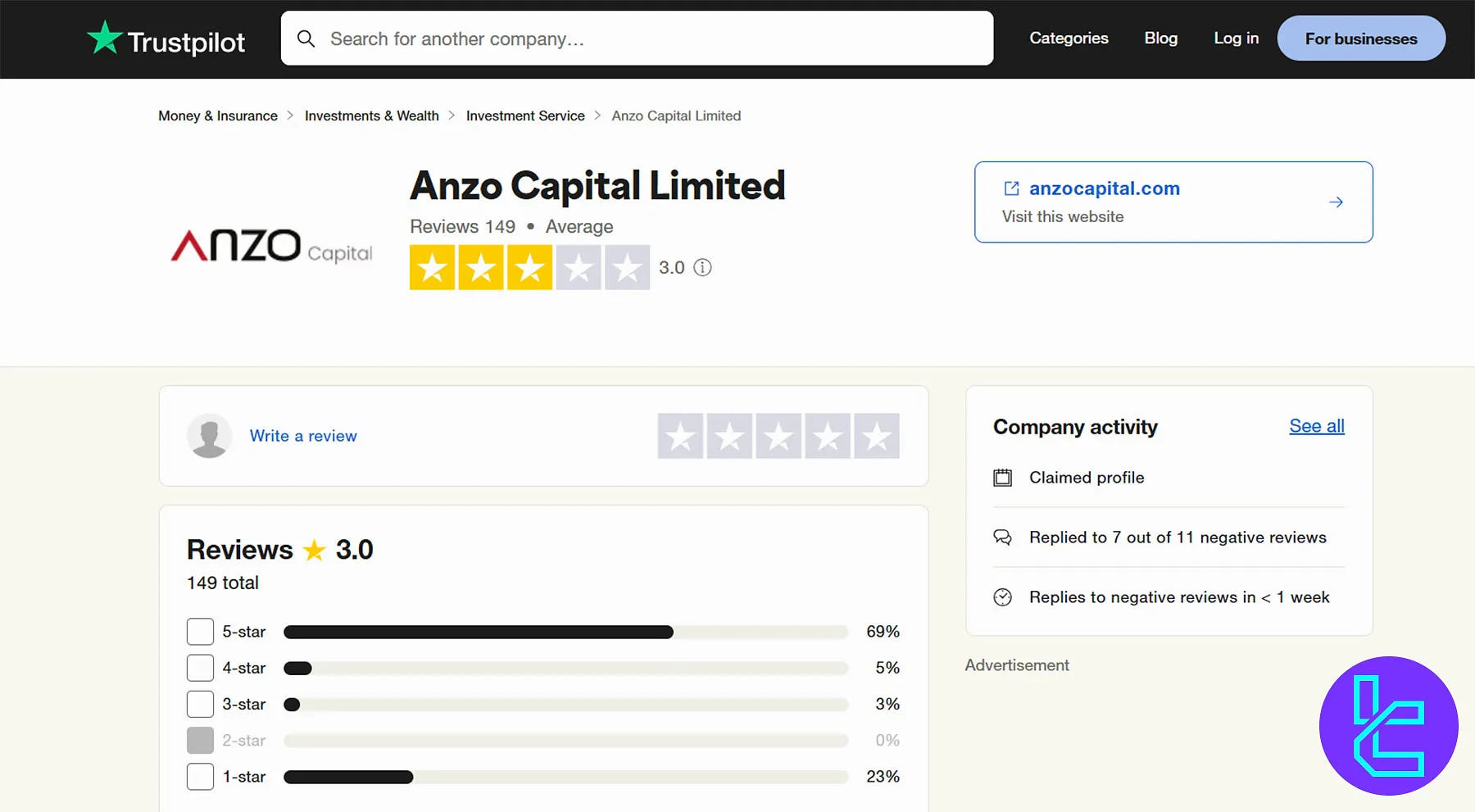

The broker has an average standing in the eyes of traders. There are149 reviews on the Anzo Capital TrustPilot profile, resulting in ascore of 3 out of 5. 74% of comments are positive (4-star and 5-star) and 23% are negative (1-star).

Anzo Capital Broker Prohibited Countries

The company doesn’t accept clients from certain countries due to regulatory requirements, including:

- United States

- Japan

Anzo Capital Broker Education

The company has developed a comprehensive “Research & Tools” section on its website to provide traders with a wide range of resources, including:

- Tutorials

- Featured Podcasts

- Forex Guide

- Forex Calculators

- MQL5 Signals

- Economic Calendar

Complete Comparison of Anzo Capital Against Other Brokers

By reading the available data in the table below, you can understand whether Anzo Capital is the right broker for you in comparison with other Forex brokers.

Parameters | Anzo Capital Broker | |||

Regulation | ASIC, SVGFSA | MISA | ASIC, SCB, FCA, DFSA, CMA, BaFin, CySEC | FSCA, MISA |

Minimum Spread | From 0.1 Pips | From 0.0 Pips | From 0.0 pips | From 0.0 pips |

Commission | STP: $0, ECN: $4/lot | From $0.0 | From $0.0 | From $0 |

Minimum Deposit | $100 | $50 | $1 | $25 |

Maximum Leverage | 1:1000 | 1:3000 | 1:500 | 1:1000 |

Trading Platforms | MT5, MT4 | MetaTrade 4, MetaTrade 5, Mobile App, Web Trader | Proprietary Platform, cTrader, Trading View, MetaTrader 4&5 | MT4, MT5, OctaTrader, Octa Copy |

Account Types | STP, ECN | Standard, ECN, Pro ECN, Demo | Standard, Razor | MT4, MT5, OctaTrader |

Islamic Account | N/A | Yes | Yes | Yes |

Number of Tradable Assets | 94 | 120+ | 1200+ | 277 |

Trade Execution | Market | Market | Instant | Market |

Conclusion and Final Words

Anzo Capital offers an ECN account with a target EUR/USD spread of 0.1 pips for aminimum deposit of $100.

It supports MT4 and MT5 platforms with leverage options of up to 1:1000. The broker has scored 3 out of 5 on TrustPilot.