Ata Yatırım’s services are specifically designed to meet the needs of Turkish investors. They offer competitive trading conditions, including a maximum leverage of 1:10 for Forex and spreads as low as 0.4 to 0.5 pips for EUR/USD.

The Forex Broker also offers a variety of deposit and withdrawal methods, with bank wire as the primary method.

In addition to real accounts, the broker also offers a demo account, allowing traders to open and close positions in MT4, MT5, and Ata Trader without risking real money.

Company Information & Regulation Status

Ata Yatırım is a well-established Turkish broker regulated by the Capital Markets Board of Turkey (SPK).

Founded in 1990, the company has been a Borsa Istanbul (formerly IMKB) membersince 1991.

The broker has also developed advanced software solutions for capital markets, including:

- ATP stock market software

- GTP software (used by various brokerage firms, portfolio management companies, banks, investment partnerships, and pension companies in Turkey)

Ata Yatırım's commitment to quality is evident from its accolades:

- One of the first brokerage firms to receive the ISO 9000Quality Assurance Certificate

- First to receive the TÜSİAD–KALDER National Quality Award

In 2000, the company acquired Meridyen Securities and rebranded as Ata Online. Later, in 2016, Ata Online merged with Ata Invest to form the current entity.

Entity Parameters/Branches | Ata Yatırım Menkul Kıymetler A.Ş. |

Regulation | SPK / CMB |

Regulation Tier | Tier-2 |

Country | Turkey |

Investor Protection Fund/Compensation Scheme | N/A |

Segregated Funds | N/A |

Negative Balance Protection | N/A |

Maximum Leverage | 1:10 |

Client Eligibility | Residents of Turkey |

Ata Yatırım is part of a larger investment group that operates in Turkey.

Summary of Specifics

The table below gives you all you need to know about the broker:

Broker | Ata Yatırım |

Account Types | Standard, Demo |

Regulating Authorities | Capital Markets Board of Turkey (SPK) |

Based Currencies | USD, EUR, TRY |

Minimum Deposit | N/A |

Deposit/Withdrawal Methods | Bank Transfer |

Minimum Order | N/A |

Maximum Leverage | 1:10 for Forex |

Investment Options | YES |

Trading Platforms & Apps | MT4, MT5, Ata Trader |

Markets | Stocks, Indices, Commodities, Futures, Options, Forex, Metals, Oils |

Spread | 0.4 to 0.5 pips for EUR/USD |

Commission | Variable |

Orders Execution | Market |

Margin Call/Stop Out | N/A |

Trading Features | Demo Trading |

Affiliate Program | No |

Bonus & Promotions | No |

Islamic Account | N/A |

PAMM Account | No |

Customer Support Ways | Phone, Email |

Customer Support Hours | N/A |

While specific details about minimum deposit are not available, Ata Yatırım offers a range of trading platforms and asset classes to cater to different investor needs.

Types Accounts on Ata Yatırım broker

The company offers two main account types for forex trading:

Account | Minimum deposit | Instruments |

Standard | N/A | Forex, indices, metals, oils, and more |

Demo | - | N/A |

Prospective clients should contact the broker for the most up-to-date information on available account options.

Advantages and Disadvantages of Ata Yatırım

To have a balanced picture with the broker, here is a table of pros and cons:

Advantages | Disadvantages |

Long-standing reputation (established in 1990) | Limited information available in English |

Regulated by SPK (Turkey) | Primarily focused on Turkish market |

Offers multiple trading platforms | No PAMM or copy trading options |

Wide range of tradable assets | Limited global presence |

Developed proprietary trading software | - |

Signing Up & Verification Process

Since Ata Yatırım is a domestic broker, it only provides services to traders residing in Turkey. The account opening process in this broker for Turkish traders is as follows:

#1 Visit The Official Ata Yatırım Website

First, access the official website of this broker and click on the "Open an Account" button on the main page.

#2 Download the Brokers Application

Download the broker's mobile app, initiate a video call, and complete the process by following the instructions.

You can also use the option “Click to open an account via the web without the mobile app” and proceed directly to the next step.

#3 Enter Personal Information

At this stage, after entering your personal information such as first name, last name and email, read the terms and conditions and check the agreement box.

Finally, by clicking the “Open an Account” button, your account will be created.

Trading Platforms for Ata Yatırım

If you are curious about the trading platforms, here is what the broker offers:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- Ata Trader

Key features of Ata Trader:

- Cockpit-style interface for quick order entry, modification, and cancellation

- Easy monitoring of daily trade summaries and profit/loss

- Ability to trade both stocks and VIOP (Futures and Options) contracts

- Customizable layout to suit individual trading styles

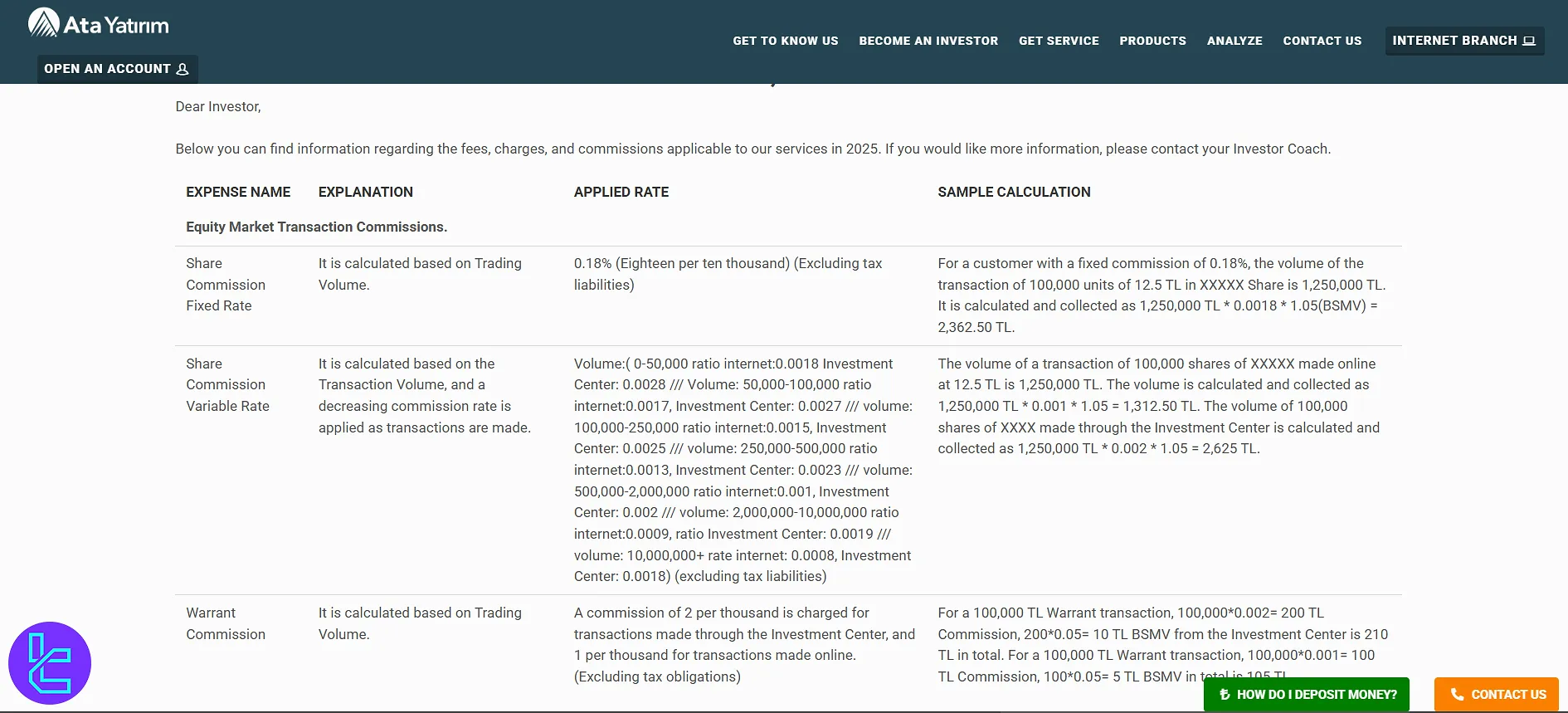

Spreads and Commission Structure

Ata Yatırım broker offers competitive spreads on forex pairs, with the EUR/USD spread typically ranging from 0.4 to 0.5 pips.

This tight spread benefits traders, reducing the cost of trading and allowing for more profitable opportunities. Here is a detailed view of all kinds of fees we found in the broker:

Category | Fee Type | Details | Example |

Equity Market Transaction Commissions | Fixed Rate | Calculated on trading volume, fixed rate includes tax (BSMV) | 0.18% on 1,250,000 TL = 2,362.50 TL |

Variable Rate | Decreases with trading volume; varies by channel (online or Investment Center) | Online: 1,312.50 TL, Investment Center: 2,625 TL for 1,250,000 TL transaction | |

Warrant Commission | Investment Center: 2 per thousand, Internet: 1 per thousand | 100,000 TL transaction: Investment Center = 210 TL, Online = 105 TL | |

VIOP Market Transaction Commissions | VIOP Commission | 0.09% of trading volume, including tax (BSMV) | 1,643,486.85 TL transaction = 1,553.10 TL |

Loan and Default Interest | Loan Interest | Based on daily debt balance with TPP interest rate + 40% | - |

Default Interest | TPP rate + 80% on outstanding debt | 50,000 TL debt = 186.99 TL | |

Service Fees | Statement | Printed statement delivery (monthly) | 75.00 TL |

EFT Fees | Transfers under 400,000 TL: Online: 18.50 TL, In-person: 20.00 TL | - | |

Foreign Currency Transfer | Varies by amount and currency; minimum 25 USD | - | |

Other Fees | Emergency Cash | Early payment fee of 2.5 per thousand | 100,000 TL transaction = 525 TL |

Debt Instruments Commission | Varies by security maturity, e.g., 0-91 days: 0.00007 rate | 350-day 100,000 TL transaction = 73.50 TL |

It's important to note that while low spreads are attractive, they should not be the sole factor in choosing a broker.

Traders should consider execution speed, platform reliability, and overall trading costs.

Swap Fee at Ata Yatırım

Although Ata Yatırım provides its clients with access to the Forex market, the broker does not disclose any information regarding swap fees.

In addition, there is no indication of whether Ata Yatırım offers swap-free (Islamic) accounts for Muslim traders.

Non-Trading Fees at Ata Yatırım

Ata Yatırım applies several non-trading fees related to account services, transfers, and administrative requests.

While these charges are common among Turkish brokers, clients should carefully consider them before opening an account.

Key points (with fees):

- Monthly Service Fee: 50 TL + tax, applied to all active accounts;

- Printed Statement Fee: 250 TL + tax, if a physical account statement is requested (online statements are free);

- Postal Dispatch Fee: 250 TL + tax per request, for mailing historical statements or other documents;

- Domestic EFT (Internet Transfer): 30 TL + tax for transactions up to 500,000 TL;

- Domestic EFT (By Instruction): Higher cost, variable depending on the amount transferred;

- Foreign Currency Transfer (Outgoing): Minimum 25 USD + bank commission;

- Foreign Currency Transfer (Incoming): Bank commission passed on to the client.

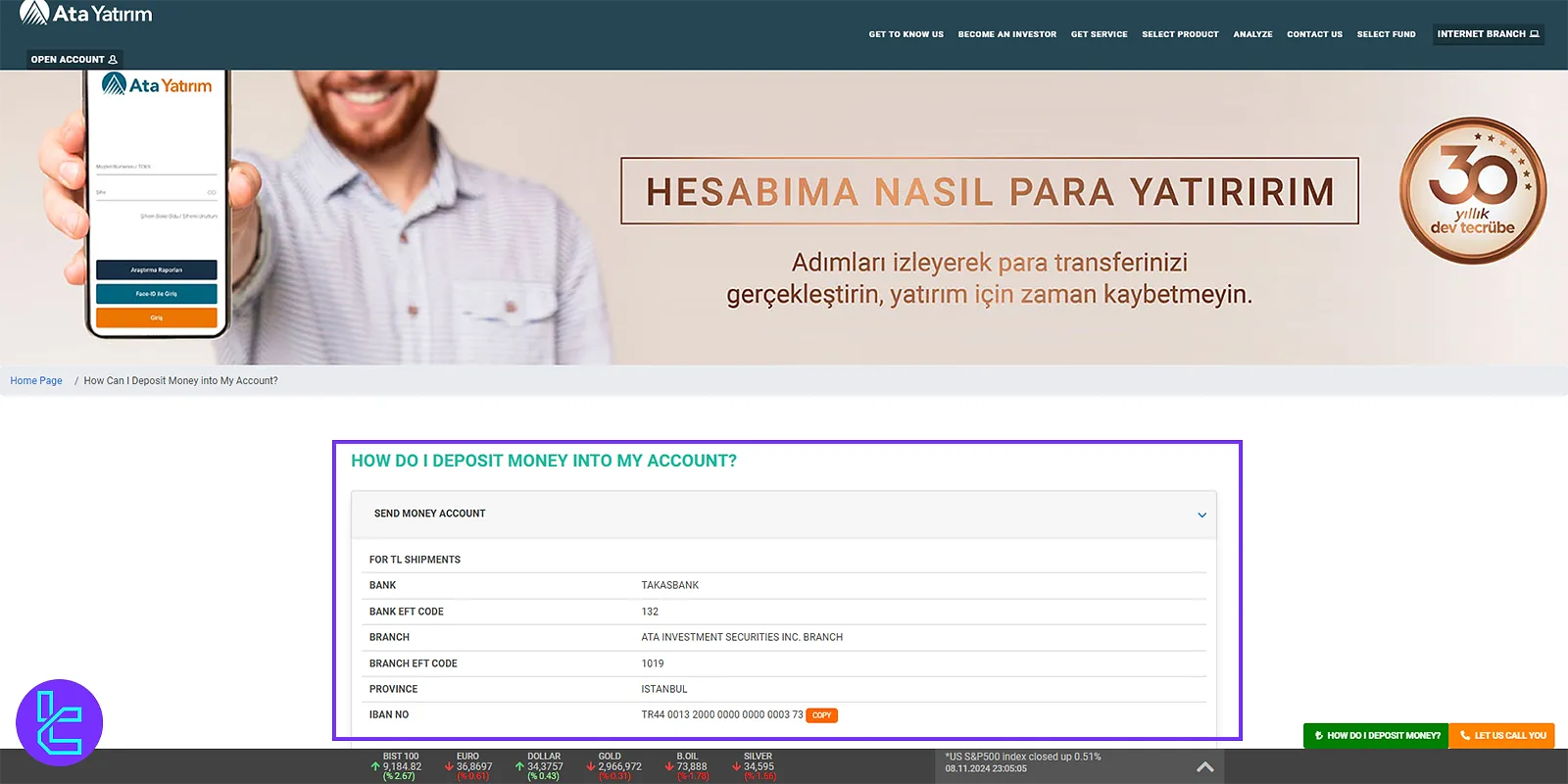

Deposit & Withdrawal Methods

Ata Yatırım provides only one option for depositing and withdrawing funds:

Transaction type | Method | Minimum |

Deposit | Bank Wire | N/A |

Withdrawal | Bank Wire | N/A |

Key points:

- Always verify bank account details before making a transfer

- Be aware of any fees charged by your bank for international transfers

- Processing times may vary, especially for international transactions

Deposit Methods at Ata Yatırım

Ata Yatırım allows clients to deposit funds primarily via bank transfers / EFT in Turkish Lira, as well as EUR and USD transfers through local banks.

While the broker provides these options, specific details such as minimum deposit amounts, deposit fees and exact funding times are not publicly disclosed.

Deposit Method | Minimum Amount | Deposit Fee | Funding Time |

Bank / EFT (TL) | N/A | N/A | Until 18:00 same day |

EUR Bank Transfer | N/A | N/A | N/A |

USD Bank Transfer | N/A | N/A | N/A |

Withdrawal Methods at Ata Yatırım

Withdrawals are primarily done via EFT / bank transfer to clients’ accounts.

TL withdrawals can be requested between 09:00-15:00; requests after 15:00 are processed the next business day.

Minimum amounts and exact fees are not publicly stated.

Withdrawal Method | Minimum Amount | Withdrawal Fee | Processing Time |

Bank Wire / Domestic Bank Transfer | N/A | N/A | 09:00–15:00 (next business day if after 15:00) |

Copy Trading & Investment Options

Unfortunately, Ata Yatırım does not offer copy trading or PAMM accounts (Percentage Allocation Management Module) services.

These features, which are popular among some brokers, allow less experienced traders to copy the trades of successful investors automatically.

Instead, Ata Yatırım provides traders a Portfolio Management option (ATA Royal) where clients can leave the investment to the broker and get profits.

Tradable Markets & Symbols Overview

Ata Yatırım offers a diverse range of tradable markets and symbols:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Currency Pairs | 50+ | 50–100 | 1:10 |

Stocks | Equities | 300+ | 100–500 | 1:10 |

Indices | CFDs on Global Indices | N/A | 10–30 | 1:10 |

Commodities | Metals, Oil | 5 | 10–20 | 1:10 |

Futures | Various Contracts | N/A | 50–100 | 1:10 |

Options | Equity & Index Options | N/A | 50–100 | 1:10 |

The Ata Trader platform allows clients to access these various asset classes from a single, customizable interface, providing a unified trading experience across different markets.

Bonus Offerings and Promotions

As of the latest information available, Ata Yatırım does not offer bonuses or promotions, nor does it have an affiliate program.

This approach is common among regulated brokers, as some regulatory bodies discourage or prohibit specific trading bonuses.

Traders should focus on these aspects rather than being swayed by promotional offers, often with strict terms and conditions.

Ata Yatırım Awards

According to official sources and available information, Ata Yatırım has not received any specific public awards.

What exists are certifications, membership in professional associations, and reported performance achievements, but no formal or competitive awards are listed.

Support Team & Response Hours

Ata Yatırım provides customer support through multiple channels:

- Phone Support: 0212 310 60 60

- Email Support: iletisim@atayatirim.com.tr

While the broker offers these support options, it's worth noting that:

- 24/7 support may not be available

- Language support may be primarily in Turkish

- Response times for email inquiries are not specified

Traders should consider these factors when evaluating the quality of Ata Yatırım's customer support, especially if they require assistance outside of standard Turkish business hours.

List of Restricted Countries

Information about Ata Yatırım's list of restricted countries is not available.

As a Turkish broker primarily serving the domestic market, their services may be limited or unavailable to residents of certain countries.

It's crucial for traders to ensure they are eligible to open an account with Ata Yatırım based on their country of residence and local regulations.

Trust Scores & Reviews

As of the latest information available, Ata Yatırım does not have a profile or reviews on Trustpilot.

However, the broker's long-standing presence in the Turkish financial market provides some indication of its reliability.

The lack of Trustpilot reviews may make it challenging for international traders to gauge customer satisfaction, but Ata Yatırım's regulatory compliance and industry recognition in Turkey suggest trustworthiness.

Education on Ata Yatırım Broker

Ata Yatırım offers various educational resources to help traders enhance their knowledge and skills:

- Web TV (Video content covering market insights)

- Blog

- News Section

While the extent and depth of these educational resources may vary, Ata Yatırım's commitment to trader education is evident.

This can be particularly beneficial for novice traders or those seeking to expand their Turkish financial market knowledge.

Ata Yatırım Comparison Table

Check the table below to see if this is the best Forex broker you can choose as a Turkish trader.

Parameters | Ata Yatırım Broker | |||

Regulation | Capital Markets Board of Turkey (SPK) | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA | ASIC, SCB, FCA, DFSA, CMA, BaFin, CySEC | CySEC, MiFID, CNMV, MNB, FINANSTILSYNET, ACPR, KNF, BaFin, FI, HCMC |

Minimum Spread | From 0.4 Pips | From 0.0 Pips | From 0.0 pips | From 0.00001 pips |

Commission | From 75 TL | $0 | From $0.0 | $8 |

Minimum Deposit | N/A | $100 | $1 | $100 |

Maximum Leverage | 1:10 | 1:400 | 1:500 | 1:300 |

Trading Platforms | MT4, MT5, Ata Trader | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader | Proprietary Platform, cTrader, Trading View, MetaTrader 4&5 | MetaTrader 5 |

Account Types | Standard, Demo | Standard, Demo, Professional | Standard, Razor | ECN, ECN Plus, ECN VIP, Demo |

Islamic Account | N/A | Yes | Yes | Yes |

Number of Tradable Assets | N/A | 1250+ | 1200+ | 120+ |

Trade Execution | Market | Instant | Instant | Market |

Conclusion and final words

Ata Yatırım provides MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Ata Trader platform, which features a cockpit-style interface, easy trade monitoring, and customizable layouts.

Customer support is available through phone and email, primarily in Turkish.

However, there are limitations, such as the lack of copy trading, PAMM accounts, and promotions.