ATC Brokers is a financial brokerage located in London, United Kingdom. It provides its services via 3 account types [Individual, Joint, Corporate] and requires a $1,000 minimum deposit.

ATC charges a monthly inactivity fee of $50 if certain conditions for inactive accounts are met.

Company Details and Authorizing Bodies

ATC Brokers operates under dual regulatory oversight, by the UK’s Financial Conduct Authority (FCA, license no. 591361) and the Cayman Islands Monetary Authority (CIMA, license no. 1448274).

These licenses enhance client trust by enforcing strict capital adequacy, operational transparency, and ongoing compliance requirements.

The broker maintains segregated accounts for all client funds, ensuring that they are not used for company operations. Additional safeguards include negative balance protection and multi-layered risk controls.

While ATC is considered secure, the account opening process involves detailed documentation and KYC screening. Its safety score of 9.2/10 reflects the platform’s strong regulatory structure and financial integrity.

Entity Parameter/Branches | ATC Brokers (UK) | ATC Brokers (Cayman) |

Regulation | FCA | CIMA |

Regulation Tier | Tier-1 | Tier-3 |

Country | United Kingdom | Cayman Islands |

Investor Protection Fund/Compensation Scheme | Yes | No |

Segregated Funds | Yes | Yes |

Negative Balance Protection | Yes | Possibly |

Maximum Leverage | 1:30 | 1:200 |

Client Eligibility | All countries except some restricted ones | International clients |

Key Specs and Information

Let's take a closer look at the key features that make ATC stand out in the crowded forex brokers marketplace. We will have an overview in the table below:

Broker | ATC Brokers |

Account Types | Individual, Joint, Corporate |

Regulating Authority | FCA, CIMA |

Based Currencies | USD, EUR, GBP |

Minimum Deposit | $1,000 |

Deposit Methods | Bank Transfers, Credit/Debit Card, Skrill |

Withdrawal Methods | Bank Transfers |

Minimum Order | 0.01 |

Maximum Leverage | 1:200 |

Investment Options | Copy Trading |

Trading Platforms & Apps | MetaTrader 4 |

Markets | Forex, Indices, Commodities, Crypto |

Spread | Variable |

Commission | $6 per Round Lot |

Orders Execution | Market |

Margin Call/Stop Out | 120%/100% |

Trading Features | Economic Calendar, Demo Account |

Affiliate Program | Yes |

Bonus & Promotions | None |

Islamic Account | No |

PAMM Account | Yes |

Customer Support Ways | Email, Live Chat, Phone, Ticket |

Customer Support Hours | 24/5 (From Sunday 22:00 to Friday 22:00 UTC) |

Trading Account Specifics

ATC Brokers does not have a variety in live account offering, providing 3 real accounts, including Individual, Joint, and Corporate, with no difference in trading specifics and a demo account:

- Individual: Standard trading account for a private trader

- Joint: Purposed for sharing with multiple clients

- Corporate: For legal entities such as companies and so on

- Demo account: Trading with virtual funds for practice

The maximum available leverage for a balance of less than $100K is 1:100, and for over $100,000, it is 1:200. Also, the minimum order size is 0.01, and the minimum required deposit for an account is $1K.

Benefits and Drawbacks of Trading with ATC Brokers

Now that you have an overall understanding of the broker, it's time to explore its key advantages and notable disadvantages. Take a look at the table below:

Benefits | Drawbacks |

Robust Regulatory Oversight By FCA And CIMA | Very High Minimum Deposit of $1,000 |

Above-Average Educational Resources And Market Analysis | No Variety in Trading Accounts |

Access to A PAMM Account | Limited Range of Tradable Instruments Compared To Some Competitors |

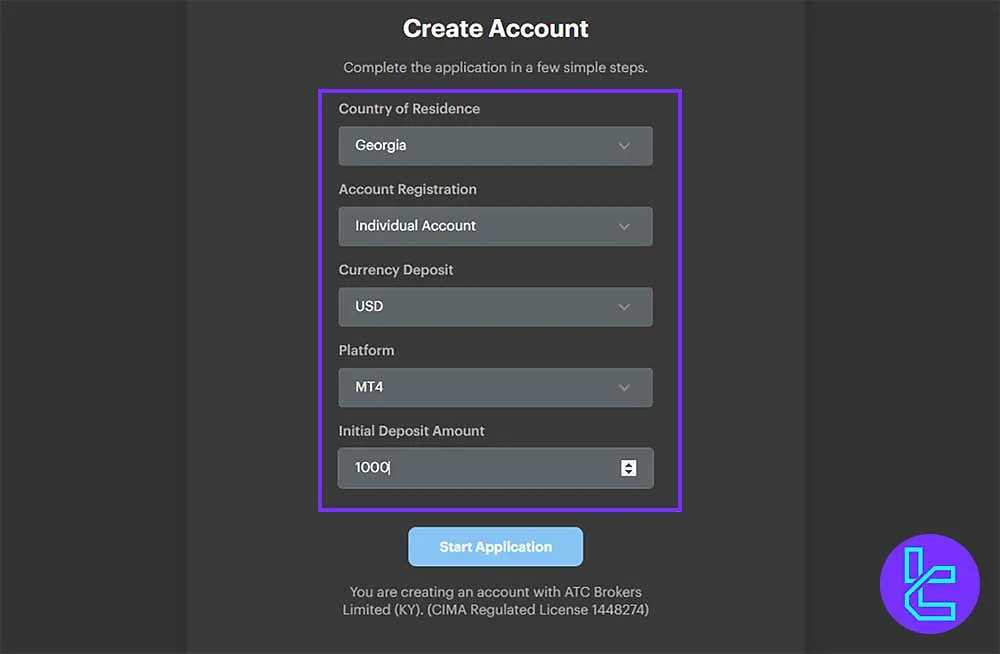

How to Open an Account and Verify with ATC

To open a new trading account with the ATC broker, traders must follow a simple 4-step process. ATC registration:

#1 Start Your Application

Visit the official website and click "Create Account". Choose your country of residence, account type, preferred trading currency, and platform (e.g., MT4). Confirm the $1,000 minimum deposit and proceed.

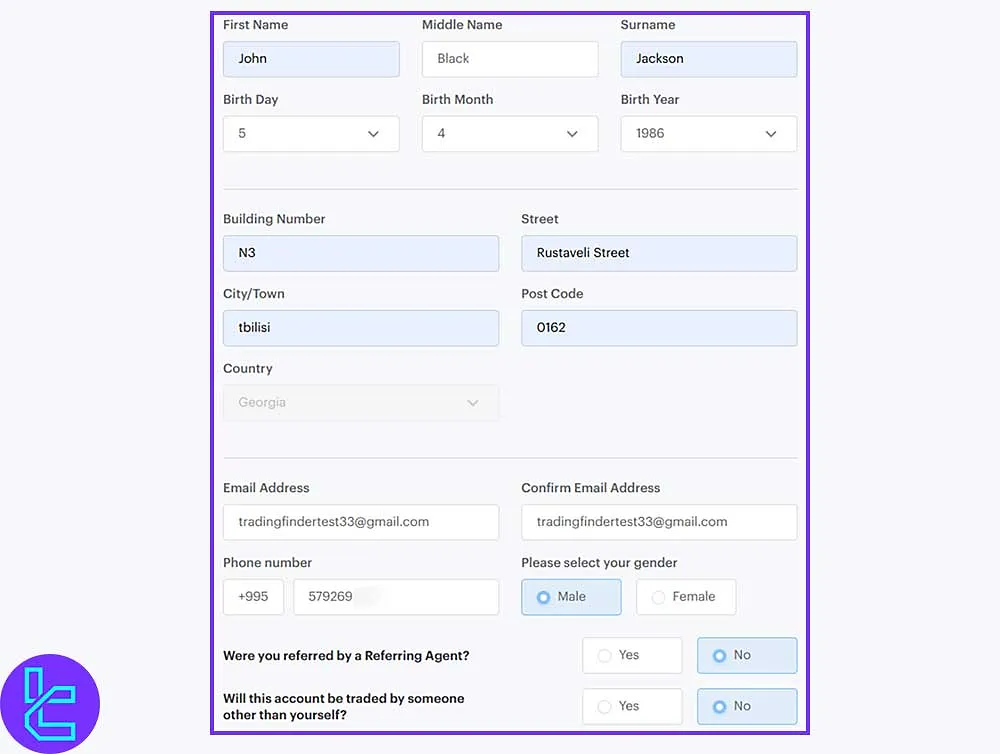

#2 Provide Identity & Contact Information

Enter your full name, date of birth, address, email, phone number, and gender. You may also note if you're referred by an agent.

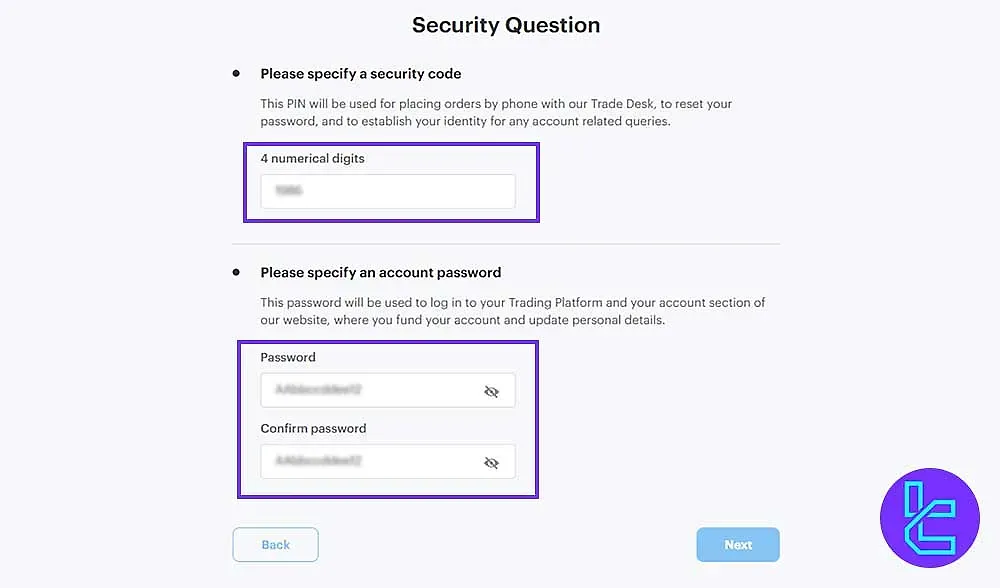

#3 Security and Compliance Setup

Create a 4-digit PIN and password, agree to ATC’s commission terms, and complete the declaration form.

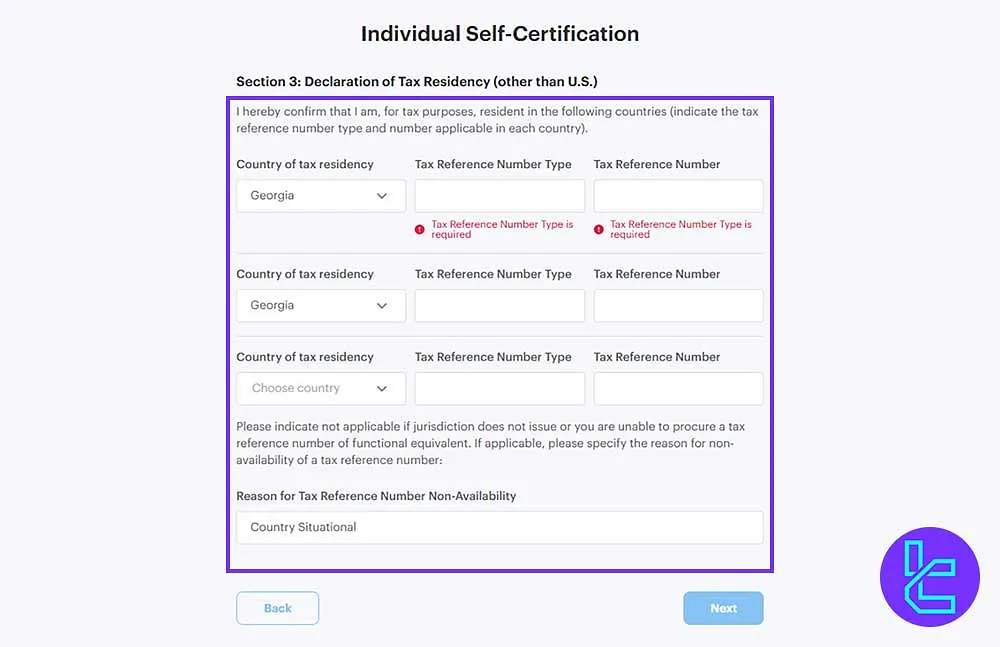

#4 Submit Tax Information

Fill out the Individual Self-Certification, specify U.S. citizenship status, enter your TIN, and confirm your tax residency details before applying.

#5 Verify Your Trading Account

Traders can verify their trading accounts by providing proof of identity and proof of address documents such as (passport, utility bill, bank statement, ID card, and driver's license).

Trading Terminals and Platforms

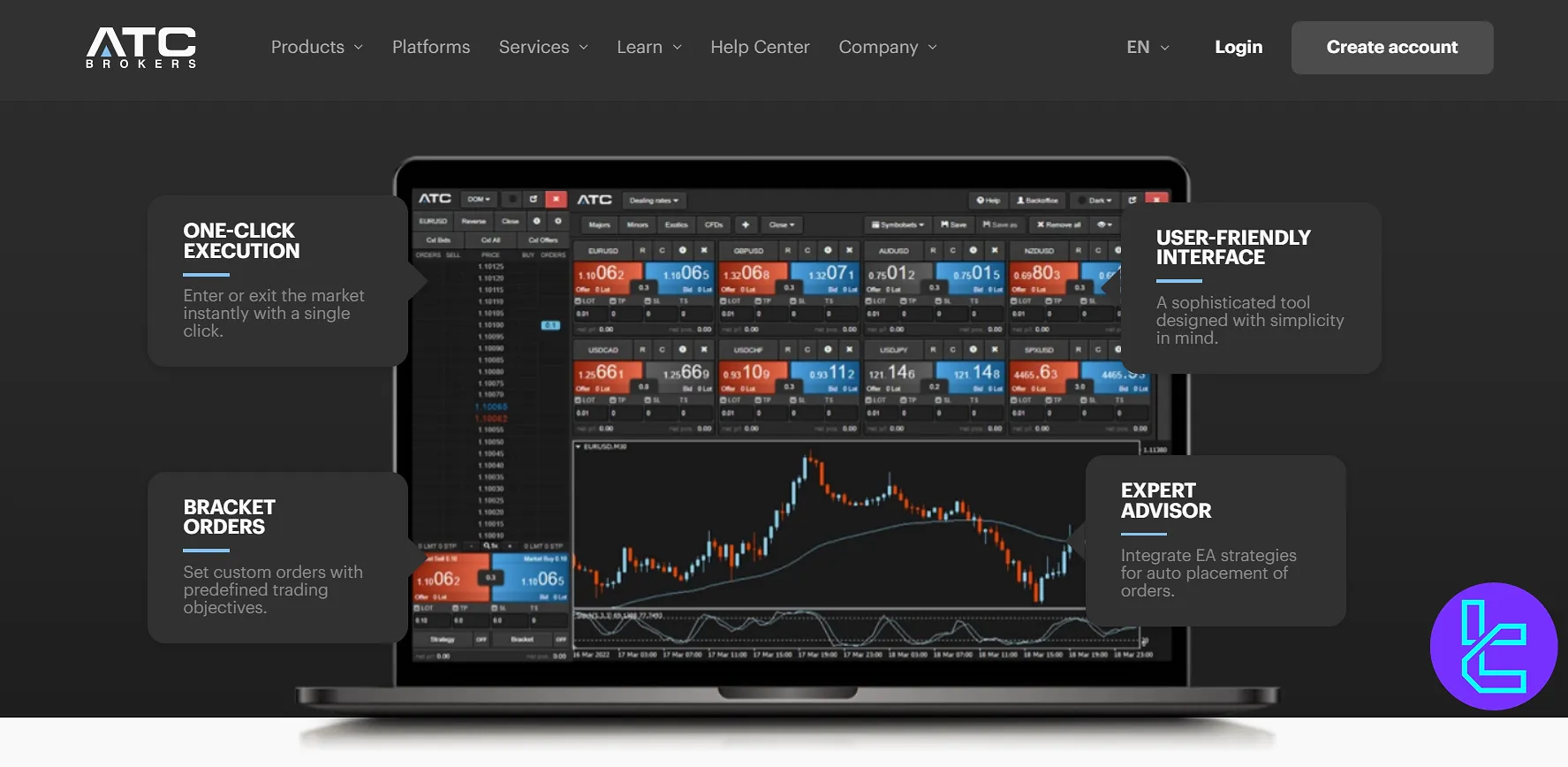

ATC offers access to a popular trading platform in the industry, MetaTrader 4.

- One-click trading for swift execution

- Bracket orders for improved risk management

- Expert Advisor integration for automated trading

- Built-in indicators and customizable chart layouts

- Available on desktop, web, and mobile devices

Trading Commissions, Spreads, and Other Fees on ATC Brokers

ATC Brokers maintains a dual pricing structure through Standard and RAW account options.

Standard account holders benefit from commission-free trading, with costs embedded in variable spreads starting at 0.3 pips for EUR/USD. In contrast, RAW account users access tighter spreads, averaging 0.1 pips, with a $15 commission per lot (round turn). Forex spreads typically range:

- EUR/USD: 0.3–0.6 pips (Standard), 0.1 pips (RAW)

- GBP/USD: 0.4–0.6 pips

Beyond trading costs, clients face the following non-trading fees:

- Deposit: 0–1% depending on method

- Withdrawal: up to $40 or 0.2%

- Inactivity: $50/month

This structure favors active traders using the RAW account, while more casual users may opt for the spread-only Standard model.

Swap Fee at ATC Brokers

ATC Brokers applies overnight swap (rollover) charges on all positions held past the daily cutoff time, meaning that any position you keep open overnight will automatically incur a fee or credit depending on the instrument, account type, and market conditions.

- Swap is calculated daily at the broker’s specified rollover hour;

- Depending on the position and currency pair, the fee may be positive or negative;

- Triple swap is applied on Wednesdays or Fridays to account for weekend market closure;

- Fees are automatically debited or credited to the client account based on the held positions;

- The swap amount varies by instrument and account type, so traders should check the rate schedule before opening positions.

Important: ATC Brokers does not offer Swap-Free or Islamic Accounts for standard clients. All accounts are subject to the standard overnight swap rules.

Non-Trading Fees at ATC Brokers

ATC Brokers charges non-trading fees for administrative and account-related services that are not part of direct trading.

For example, accounts with no activity for six months incur a $50 monthly inactivity fee, and withdrawals via international wire transfers may include fees such as $40 for USD.

- Deposits via bank wire have no fees, while credit/debit card payments incur a 2.9% fee;

- Withdrawals via international wire cost $40 for USD, €30 for EUR, and £25 for GBP;

- Inactive accounts are charged $50 per month after six months of no completed trades;

- Inactivity fees are applied every six months if the account remains dormant;

- Accounts reduced to zero by inactivity fees are automatically closed.

Currency conversion may apply if funds are deposited in a different currency than the account

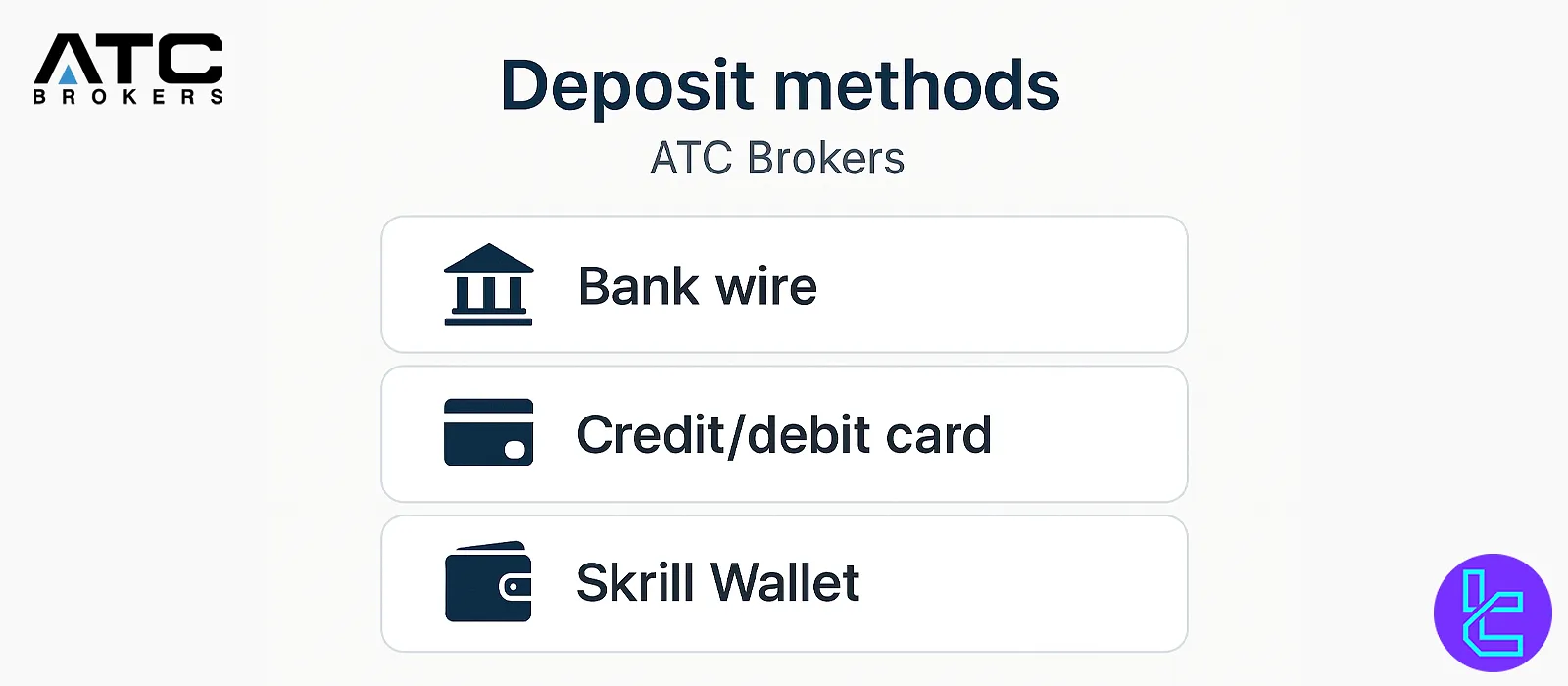

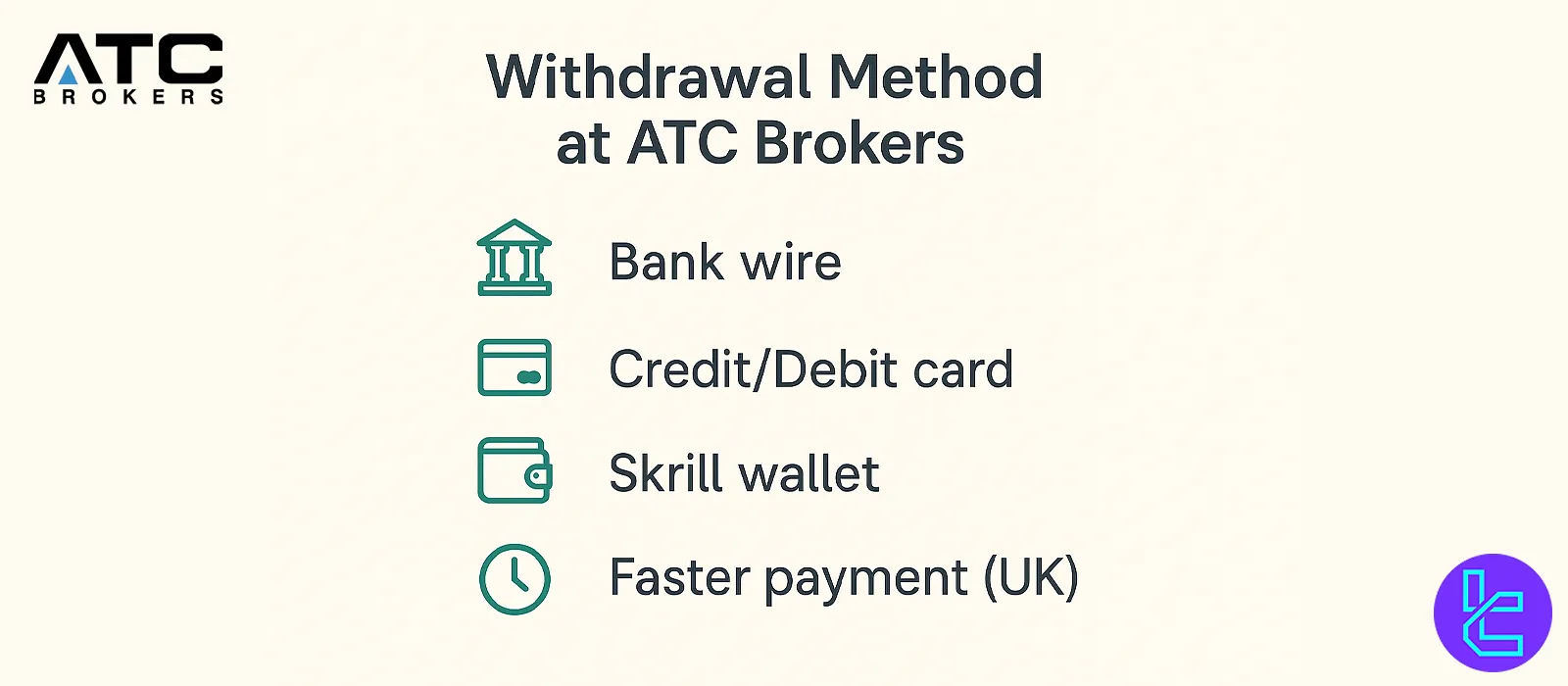

Payment Options

Based on our investigations until this point. ATC Brokers does not reveal much data in detail about its services and conditions. It's the same with funding options. Methods for deposits and withdrawals are listed below:

- Bank Transfers

- Skrill

- Credit/Debit Card

Deposit at ATC Brokers

ATC Brokers offers only one deposit method to fund your trading account which is deposit throw bank wire system.

Depositing via bank wire incurs no fee from broker side. However, the bank may charge an additional fee for processing the transaction.

Additional details, including minimum amounts, fees, and processing times, are provided in the table below:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Wire | GBP, EUR, USD | £1000 / €1000 / $1000 | No Fee | 1–3 Business Days |

Withdrawal from ATC Brokers

Withdrawing funds from your ATC Brokers account is straightforward, with several methods available to suit your preferences.

For instance, international wire withdrawals have a fee of £25 for GBP, €30 for EUR, and $40 for USD. Processing times vary depending on the chosen method.

Additional details are provided in the table below:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Processing Time |

Bank Wire | GBP, EUR, USD | £100 / €100 / $100 | £25 / €30 / $40 | 1–3 Business Days |

Credit/Debit Card | GBP, EUR, USD | £100 / €100 / $100 | No Fee | 1–3 Business Days |

Skrill Wallet | GBP, EUR, USD | £30 / €30 / $30 | 1% | Instant |

Faster Payment (UK) | GBP | £100 | £10 | Same Day (UK Only) |

Copy Trading & Investment Options Offered On ATC Brokers Forex

At the time of writing, the broker offers 2 main methods and services for earning passive income besides trading and earning profits:

- PAMM: An account funded by a group of clients managed by a master trader

- Copy Trading: Partnership with the Trade Copier platform, offering copy trading services

Overall, ATC appears to be a good choice for those looking for investment options.

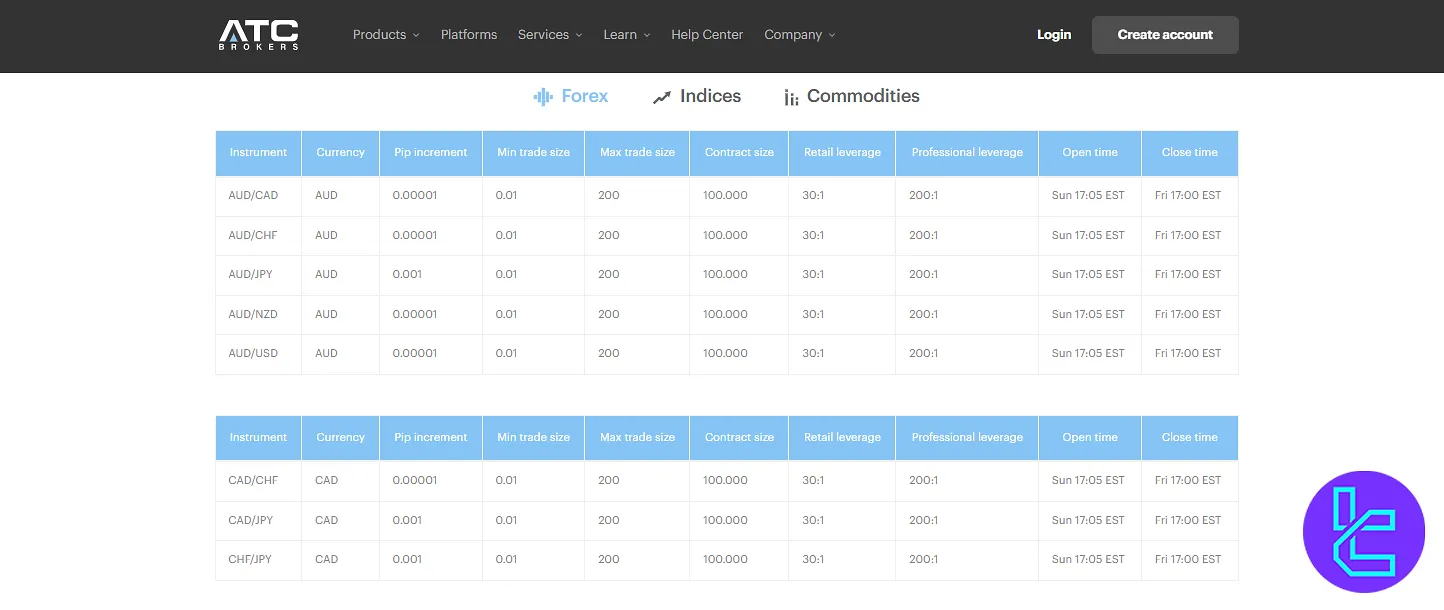

Is ATC Brokers Limited in Terms of Trading Instruments?

ATC Brokers grants access to a streamlined but focused range of around 55 tradable instruments across key asset classes:

- 40+ Forex pairs including majors, minors, and select exotics

- CFD-based exposure to commodities like gold and silver

- Leading global indices such as the S&P 500, Dow Jones, and FTSE 100

- Major cryptocurrencies including Bitcoin, Ethereum, and Litecoin (CFDs only)

While ATC does not support equities, ETFs, or bonds, its product suite covers the essential instruments favored by high-frequency and macro traders. Cryptocurrency positions are available via CFDs, not physical assets, and cannot be withdrawn as digital tokens.

This asset range supports diversified yet focused trading strategies, especially for those targeting volatility in FX and macroeconomic themes.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | majors, minors and exotics (spot/CFD) | 38 | ~136 | 1:200 |

Indices | Global index CFDs | 7–8 | ~58 | 1:20 |

Commodities | Gold, Silver, Oil | 4 | ~53 | 1:200 |

Metals | Spot Gold & Silver | 2 | Included above | 1:200 |

Crypto | Crypto CFDs | 5 | ~48 | Lower (varies by region) |

Bonuses and Promotions

Based on our investigations, as of this review, ATC Brokers does not offer any bonuses or promotional offers. This approach might be because of the adherence to strict regulatory guidelines. However, we recommend you frequently check the official sources in case of any updates or changes.

ATC Brokers Awards

ATC Brokers has not received any official or internationally recognized awards in the brokerage industry. Neither its official website nor independent review sources mention any awards, and the broker does not appear in the winners’ lists of major industry events.

Support Services; Contact Methods, and Working Schedule

The brokerage provides several standard channels for customer support. Let's have a look at these options:

- Email: support@atcbrokers.com

- Live chat: Available on the "Contact Us" section

- Phone: +44 20 3318 1399

- Online Ticketing System: On the "Contact Us" Page

Support is available 24/5, from Sunday 22:00 to Friday 22:00 UTC. Unfortunately, there is no 24/7 customer service available.

Restricted Countries

While ATC accepts clients from many countries worldwide, they do have restrictions based on regulatory requirements related to international sanctions, local jurisdictions, and other measures.

While the company does not provide a list of these regions, clients from North Korea are not allowed to register with this company, based on our investigations.

It's always best to check directly with the broker or consult their terms and conditions for the most current list of restricted countries.

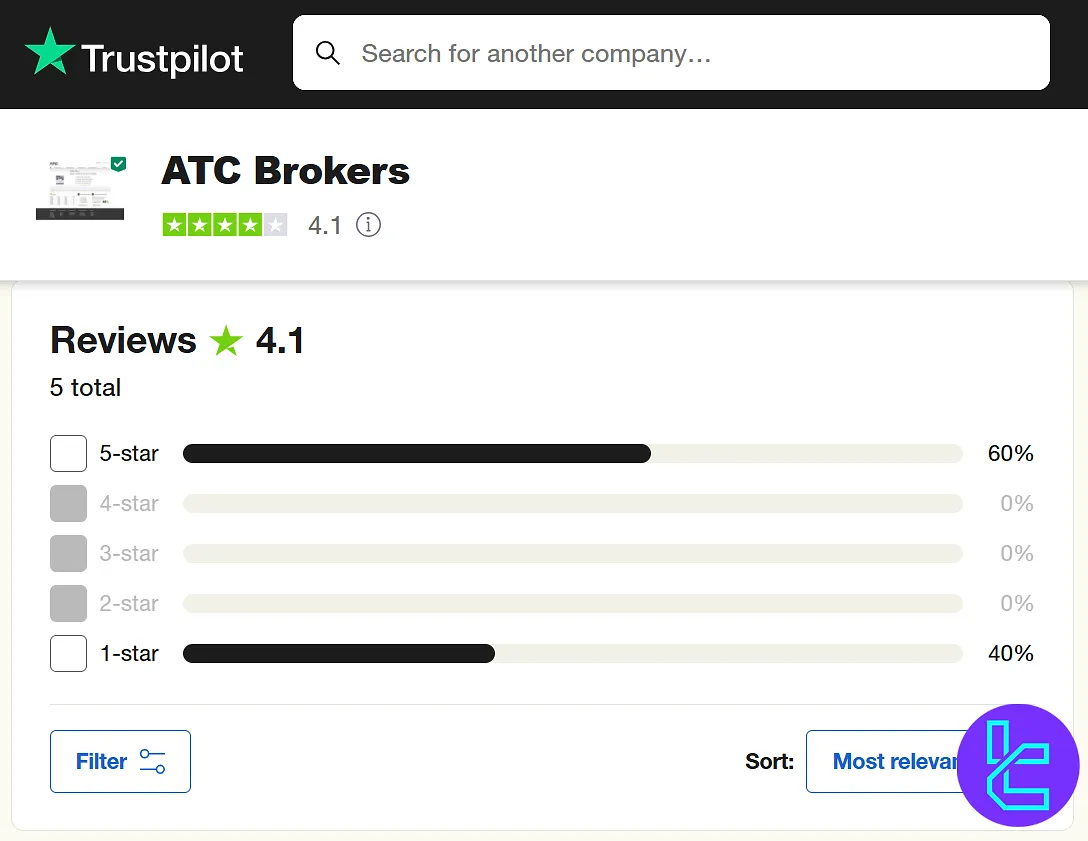

Trust Scores on Reputable Platforms

ATC Brokers has received generally positive reviews from the trading community on relevant websites, including ATC Trustpilot and ForexPeaceArmy, apparently being respected among traders.

- Trustpilot: 4.1/5 stars, only 5 reviews

- ForexPeaceArmy: 4.4 stars out of 5, based on more than 120 scores

Although the ratings on the Trustpilot website are too few to be considered, there are more than enough reviews on FPA. Therefore, these scores reflect a generally satisfied client base. However, remember that there might be various individual experiences.

Education Content and Materials

ATC Brokers provides a range of educational resources to support traders:

- Economic calendar for tracking market-moving events

- Daily market news updates

- Market insights

- Trading guides and tutorials

While not as extensive as some larger brokers, the educational content offered by this broker can be valuable for traders looking to enhance their skills and market knowledge.

ATC in Comparison with Other Brokers

Let's compare ATC features to those of other Forex brokers.

Parameters | ATC Broker | |||

Regulation | FCA, CIMA | FSA, CySEC, ASIC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA |

Minimum Spread | From 0.1 Pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | $6 | From $3 | From $0.2 to USD 3.5 | From $0 |

Minimum Deposit | $1,000 | $200 | $10 | From $0 |

Maximum Leverage | 1:200 | 1:500 | Unlimited | 1:2000 |

Trading Platforms | MetaTrader 4 | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App |

Account Types | Individual, Joint, Corporate | Standard, Raw Spread, Islamic | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 55+ | 2,250+ | 200+ | 1,000+ |

Trade Execution | Market | Market | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit |

Conclusion and Final Words

ATC Brokers offers PAMM accounts and a copy trading service via the Trade Copier platform. Furthermore, the company's support team is available from Sunday 22:00 to Friday 22:00 UTC via 4 channels [email, live chat, phone call, ticket.]

The broker has received a 4.4/5 rating on "ForexPeaceArmy", based on over 120 reviews.