ATFX provides 120+ trading instruments with leverage options of up to 1:30 for a minimum deposit of $500. The broker offers spreads from 0.0 pips and a $1M insurance scheme for clients' funds.

Company Specifics & Regulation Licenses

ATFX is a brokerage founded in September 17th, 2017 in London, England. What sets ATFX apart is its impressive list of regulatory approvals, which include:

Entity Parameters/Branches | AT Global Markets (UK) Ltd | AT Global Markets (Australia) Pty Ltd | AT Global Markets SA (Pty) Ltd | ATFX MENA Financial Services LLC | ATFX Global Markets (CY) Ltd | AT Global Markets Intl Ltd | AT Global Markets (SC) Ltd | AT Global Financial Services (HK) Ltd | ATFX (Cambodia) Co. Ltd |

Regulation | FCA | ASIC | FSCA | SCA | CySEC | FSC | FSA | SFC | SERC |

Regulation Tier | Tier-1 | Tier-1 | Tier-2 | Tier-2 | Tier-1 | Tier-3 | Tier-3 | Tier-2 | Tier-3 |

Country | UK | Australia | South Africa | UAE | Cyprus | Mauritius | Seychelles | Hong Kong | Cambodia |

Investor Compensation Scheme | FSCS (up to £85,000) | None | None | None | ICF (up to €20,000) | None | None | None | None |

Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:400 | 1:30 | 1:400 | 1:200 | 1:400 | 1:400 | 1:400 | 1:400 | 1:400 |

Client Eligibility | All countries except restricted ones (e.g. USA, Canada, Iran, Cuba) | Same restrictions apply | Same restrictions apply | Same restrictions apply | Same restrictions apply | Same restrictions apply | Same restrictions apply | Same restrictions apply | Same restrictions apply |

ATFX operates under 9 regulators worldwide, holding top-tier licenses (FCA, ASIC, CySEC) as well as offshore registrations (Mauritius, Seychelles, Cambodia).

Across many branches, maximum leverage generally reaches 1:400, while clients in the UK and EU are capped by ESMA/ASIC rules.

This multi-regulation approach ensures that ATFX operates with transparencyand adheres to strict financial standards, providing traders with a secure and trustworthy trading environment.

Summary Of Specifics and Metrics

Let's take a quick look at some of the key specifics that are essential to know for getting started with a Forex broker:

Broker | ATFX |

Account Types | Standard, Edge, Premium |

Regulating Authorities | ASIC, FCA, FSCA, SCA, CySEC, FSC, FSA, SFC |

Based Currencies | USD, EUR |

Minimum Deposit | $500 |

Deposit Methods | Credit/debit Cards, E-wallets, Bank Transfers |

Withdrawal Methods | Credit/debit Cards, E-wallets, Bank Transfers |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:30 |

Investment Options | Copy Trading |

Trading Platforms & Apps | MT4, MT5 |

Markets | Forex, Commodities, Indices, Shares |

Spread | From 0 Pips on Premium Account From 1 Pip on Standard Account |

Commission | Only on Premium Account |

Orders Execution | STP |

Margin Call/Stop Out | Not Specified |

Trading Features | Demo Account |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Live Chat, Email, Phone Call, Ticket |

Customer Support Hours | 24/7 |

Account Types Properties

ATFX offers three main account types, differentiating in trading costs, minimum deposits, and deposit requirements. Trading Accounts Specifics and Comparison:

Account Type | Standard | Edge | Premium |

Leverage | Up to 1:30 | ||

Min. Lot Size | 0.01 Lot | ||

Min. Deposit | $500 | $5,000 | $10,000 |

Free VPS | No | Yes | |

One-on-One Sessions | No | Yes | |

Quarterly Catch Up | No | Yes | |

Additionally, the broker offers a demo account for practice trading and testing strategies using virtual money.

Strengths and Weaknesses

There are pros and cons with every concept in the world. Let's investigate the benefits and drawbacks of trading with ATFX:

Strengths | Weaknesses |

Regulated By Several Trusted Authorities | Limited Product Range Compared To Some Competitors |

Negative Balance Protection | - |

An Extensive Suite Of Educational Content | - |

While the brokerage offers a solid trading experience with strong regulatory oversight, traders looking for a wider range of instruments or a proprietary platform might find it lacking in these areas.

Registration and Verification on ATFX

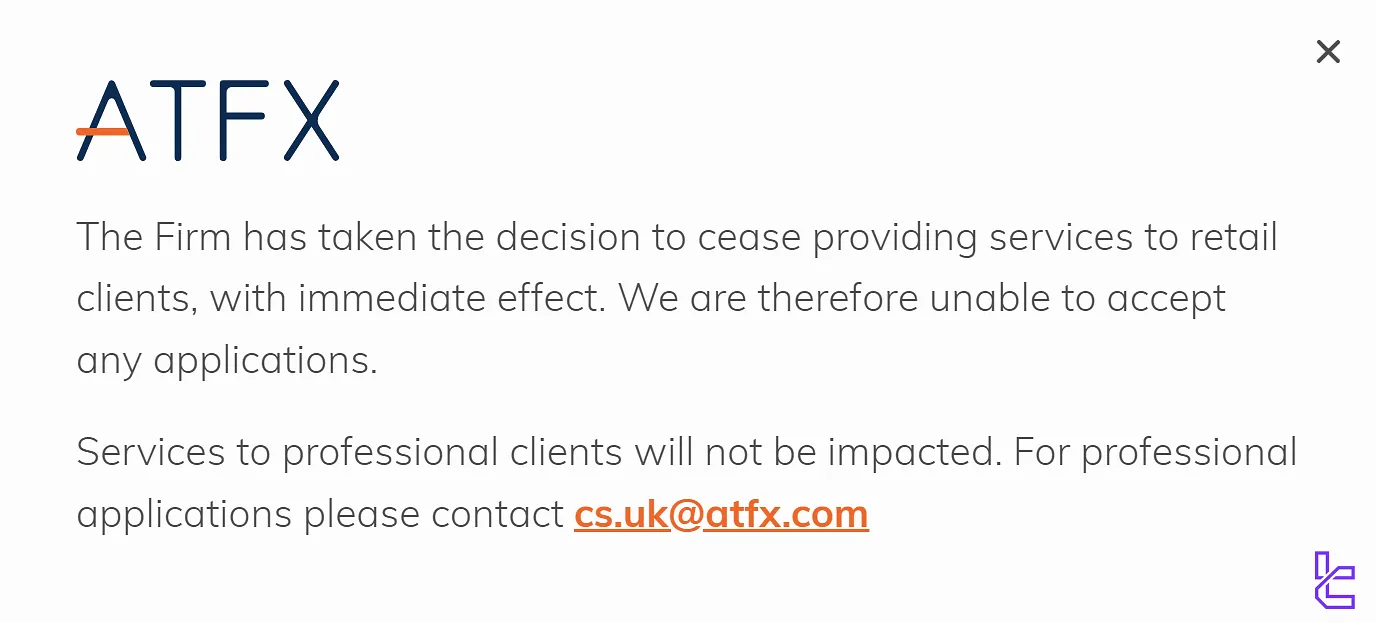

We made an attempt to register with the broker on its official website, but when we clicked "Start Trading" in the home page, this message was displayed:

Therefore, it appears that ATFX does not offer services to retail clients, at least for now, so you cannot register with this company. We will provide a sign-up guide for you if this changes in the future.

Which Trading Platforms Are Available?

ATFX offers two of the most popular trading platforms in the financial industry to its clients. In this part of the review, we will take a brief look at each of them:

- MetaTrader 4 (MT4): Extensive range of tools and features, including 30 technical indicators, trading robots, signals, VPS, etc.

- MetaTrader 5 (MT5): A successor to MT4 with additional features, such as +80 indicators and 21 timeframes

Check TradingFinder's list of MT4 indicators and MT5 indicators to access advanced and free analytical tools.

Spreads And Commissions Evaluation

ATFX’s fee structure varies by account type:

- The Standard Account charges no commission, with floating spreads starting at 1.8 pips, suitable for traders prioritizing simplicity

- The Edge Account imposes a $3 commission per side per lot but offers tighter spreads beginning at 0.5 pips, ideal for more active traders

- The Premium Account provides the tightest spreads from 0.0 pips, combined with commission charges

Swap Fee at ATFX

ATFX applies swap (overnight interest) charges or credits to open positions that remain active past the daily rollover time, directly affecting the overall trading cost structure.

- Swap rates vary by instrument and direction (long or short) and are listed in the “Specifications” window of the MT4 platform;

- A “triple swap” (3× the usual rate) is applied weekly (to account for weekend interest) for FX and metals;

- The Company offers islamic account for CFD trading that avoid swap charges (subject to terms).

Non-Trading Fees at ATFX

ATFX imposes a limited set of non-trading fees, mainly tied to periods of inactivity or small withdrawal amounts, while keeping most other services free of broker charges.

- Inactivity fee: 10 USD per month after six consecutive months without trading activity;

- Withdrawal fee: Withdrawals under €/£/$ 100 incur a fee of 5 units of that currency;

- Deposit fees: ATFX claims no broker deposit fees; however, third-party or banking charges may still apply;

- No regular account maintenance or management fees beyond the above.

Deposit & Withdrawal Options

More payment options mean more versatility in operating with a broker. ATFX provides several popular funding options:

- Credit/Debit Cards: Visa & Mastercard

- E-wallets: Skrill & Neteller

- Bank Wire Transfer: Via bank accounts

The minimum deposit for all these methods is$100, and the processing time is stated as "usually within 30 minutes", except for the bank wire transfers. For withdrawals, the processing time goes up to 1 working day.

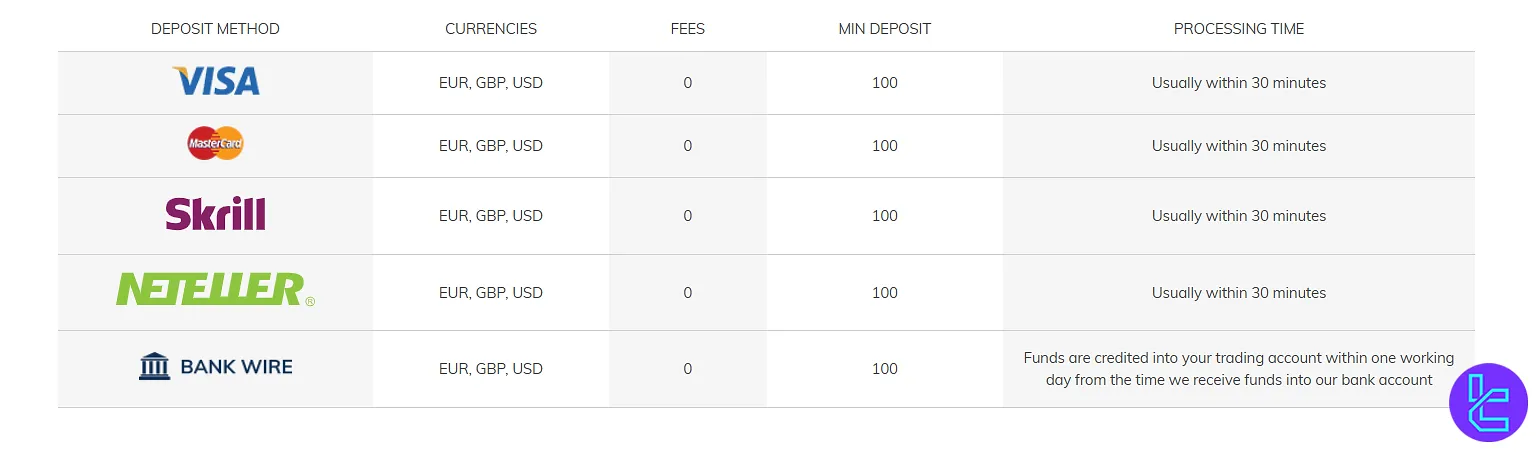

Deposit Methods at ATFX

ATFX supports multiple deposit channels including bank transfer, credit/debit cards, and popular e-wallets, giving clients flexibility depending on their jurisdiction and preferred payment method.

Their deposit processes are typically fast, though bank transfers may take up to one working day.

Full details are provided in the table below:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Credit / Debit Card | EUR, GBP, USD | 100 | 0 | Usually within 30 minutes |

E-Wallets (e.g. Skrill, Neteller) | EUR, GBP, USD | 100 | 0 | Usually within 30 minutes |

Bank Transfer | EUR, GBP, USD | 100 | 0 | Up to one working day |

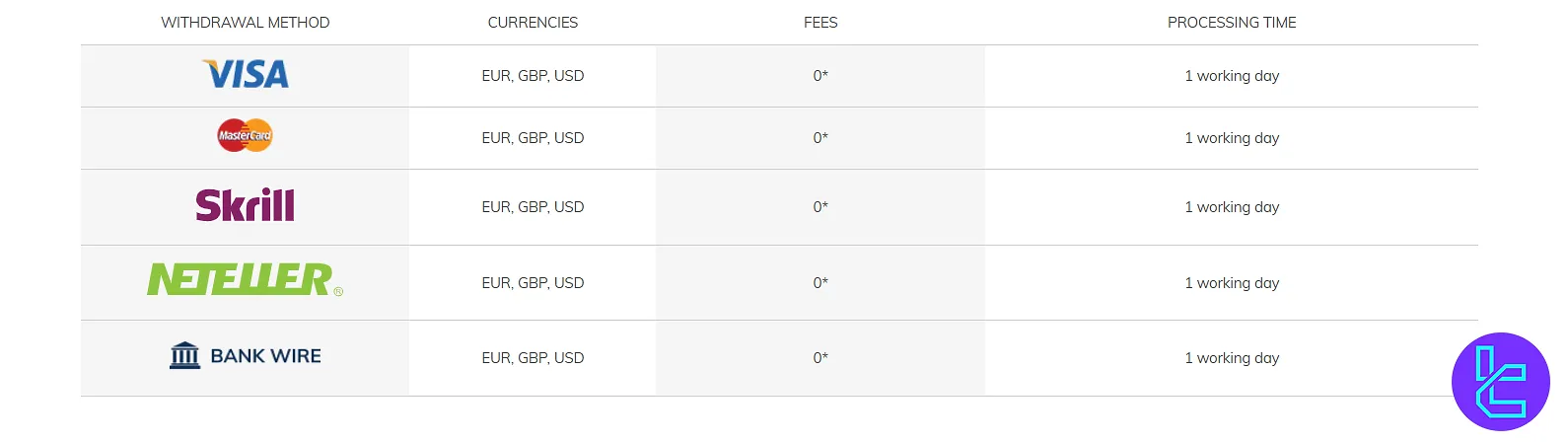

Withdrawal Methods at ATFX

ATFX enables withdrawals via the same channels used for deposits (credit/debit cards, e-wallets, and bank transfers) ensuring consistency in payout routing.

Withdrawals above €/$/£ 100 (or full balance) are generally free; smaller withdrawals incur a €/$/£ 5 fee.

Full details are provided in the table below:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Processing Time |

Credit / Debit Card | EUR, GBP, USD | 100 (or full balance) | 0 / otherwise 5 | 2–5 working days |

E-Wallets | EUR, GBP, USD | 100 (or full balance) | 0 / otherwise 5 | Up to 2 working days |

Bank Transfer | EUR, GBP, USD | 100 (or full balance) | 0 / otherwise 5 | 3–5 working days |

Investment Options: Does ATFX Offer Copy Trading Service?

The broker offers a copy trading feature, which is an entry-level investment method, allowing less experienced traders to mimic the strategies of successful traders. Here's what you need to know:

- Choose from a selection of experienced "Strategy Providers"

- Set your risk parameters and investment amount

- Automatically copy trades in real-time

- Monitor performance and adjust settings as needed

Copy trading can be an excellent way for beginners to learn from more experienced traders while potentially earning returns. Also, it's easy and does not need any specific skill.

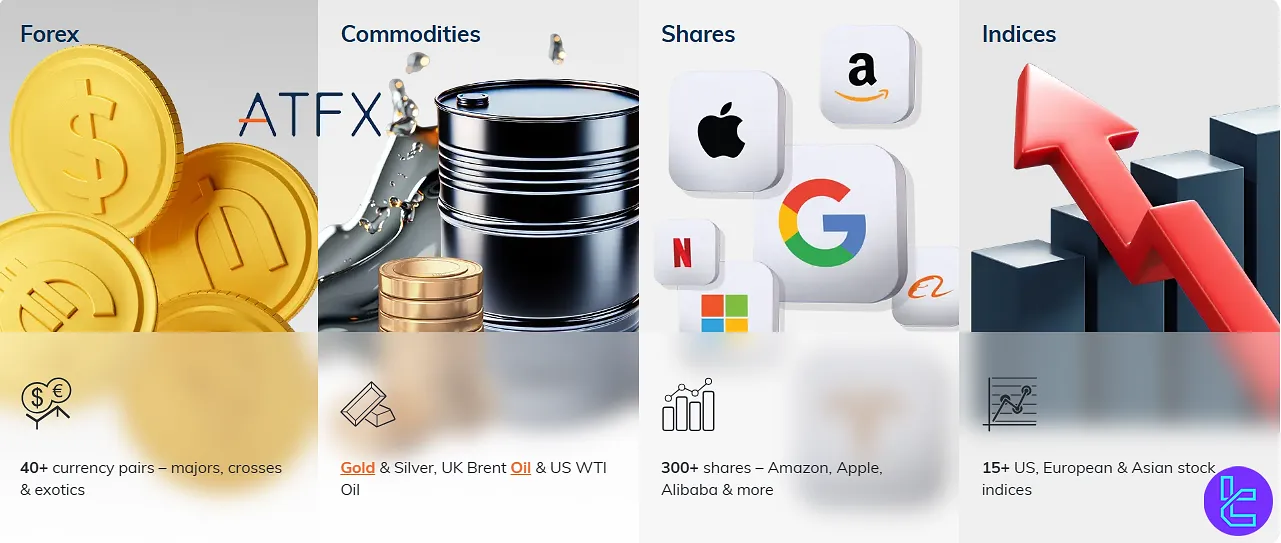

Tradable Assets & Trading Symbols

ATFX offers a diverse range of more than 350 trading instruments, spanning multiple asset classes to suit different trading preferences:

Category | Type of Instruments | Number of Symbols (ATFX) | Competitor Average | Max. Leverage (ATFX) |

Forex Pairs | Majors, Minors, Exotics | ~44 | 30-75 | 1:400 (for jurisdictions & professional clients) |

Commodities / Metals & Energy | Metals & Energy CFDs | ~5-6 | ~5-10 | 1:400 |

Share CFDs / Equities & ETFs | Company shares as CFDs + ETFs | ~250+ | ~100-500 | 1:20 for many equities – lower than for FX (depends on instrument) |

Indices | Major global indices CFDs | ~15 | ~5-10 | ~1:100 for indices in many cases |

Cryptocurrencies | Majors & minors | ~11 | ~10-20 | ~1:10 |

Although ATFX does not provide direct access to physical shares, bonds, or options, its extensive CFD portfolio enables traders to implement a wide variety of strategies, from speculative day trading to portfolio hedging.

Bonuses And Promotions

Unfortunately, based on our latest investigations on the website, ATFX doesn't currently offer any bonuses or promotions.

However, there might be some programs available on some regions. This could be because of the restrictions from the corresponding regulatory bodies.

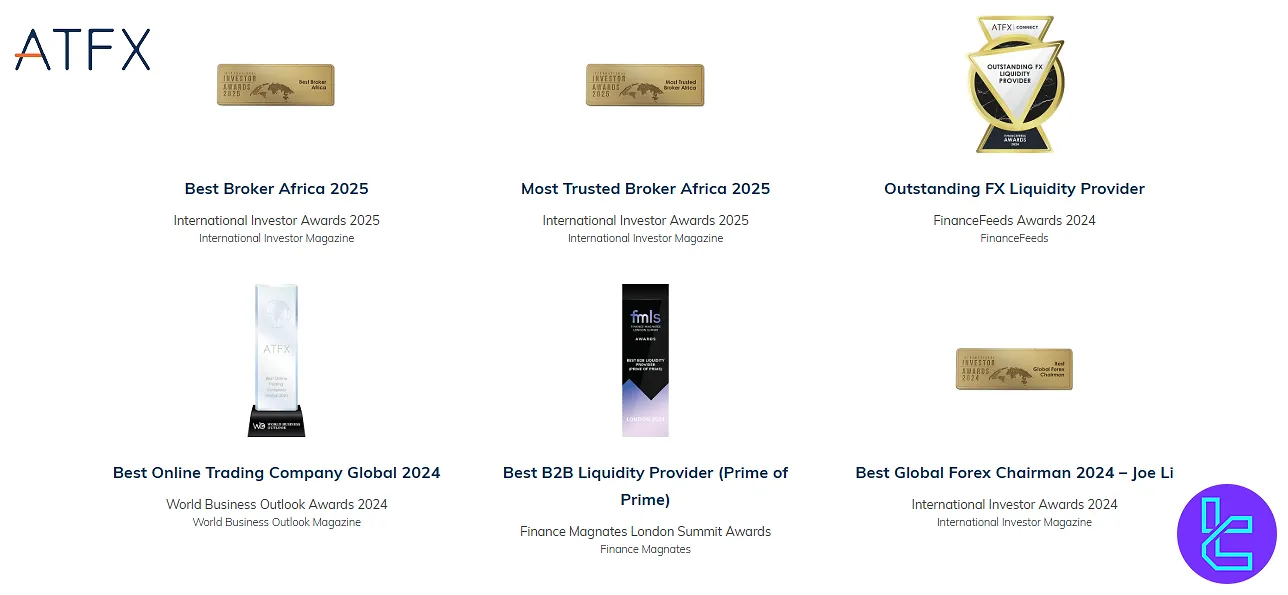

ATFX Awards and Recognitions

ATFX has established itself as a leading force in the online forex and financial markets, with its excellence reflected through numerous honors listed in the ATFX awards for outstanding trading services and industry achievements.

Over the past few years, the broker has earned accolades across different regions, highlighting its reliability, trading technology and client-focused approach.

Notable Awards and Recognitions:

- Best Broker Africa 2025 International Investor Awards

- Most Trusted Broker Africa 2025 International Investor Awards

- Outstanding FX Liquidity Provider FinanceFeeds Awards 2024

- Best Online Trading Company Global 2024 World Business Outlook Awards

- Best B2B Liquidity Provider (Prime of Prime) Finance Magnates London Summit Awards

- Best Global Forex Broker 2024 International Investor Awards

In addition to these recent accolades, ATFX has won over 45 awards across various categories between 2018 and 2025, reflecting its consistent performance and recognition in the global forex and financial markets industry.

ATFX Support Channels and Schedule

The broker claims to provide responsive and helpful customer support and answer clients' queries as soon as possible. Contact Methods of ATFX:

- Live Chat: Through the official website

- Email: sales.uk@atfx.com

- Phone: +44 203 957 7777

- Ticket System: For non-urgent queries

Based on our examinations, the broker's support team is available 24/7.

ATFX List Of Restricted Countries

While ATFX serves clients globally, there are some restrictions because of international sanctions, local regulations, etc. The broker does not provide services to residents of:

- United States

- Canada

- Japan

- North Korea

- Iran

- Cuba

- Sudan

- Syria

Always check the most up-to-date list on the website or contact the company's customer support for specific country restrictions.

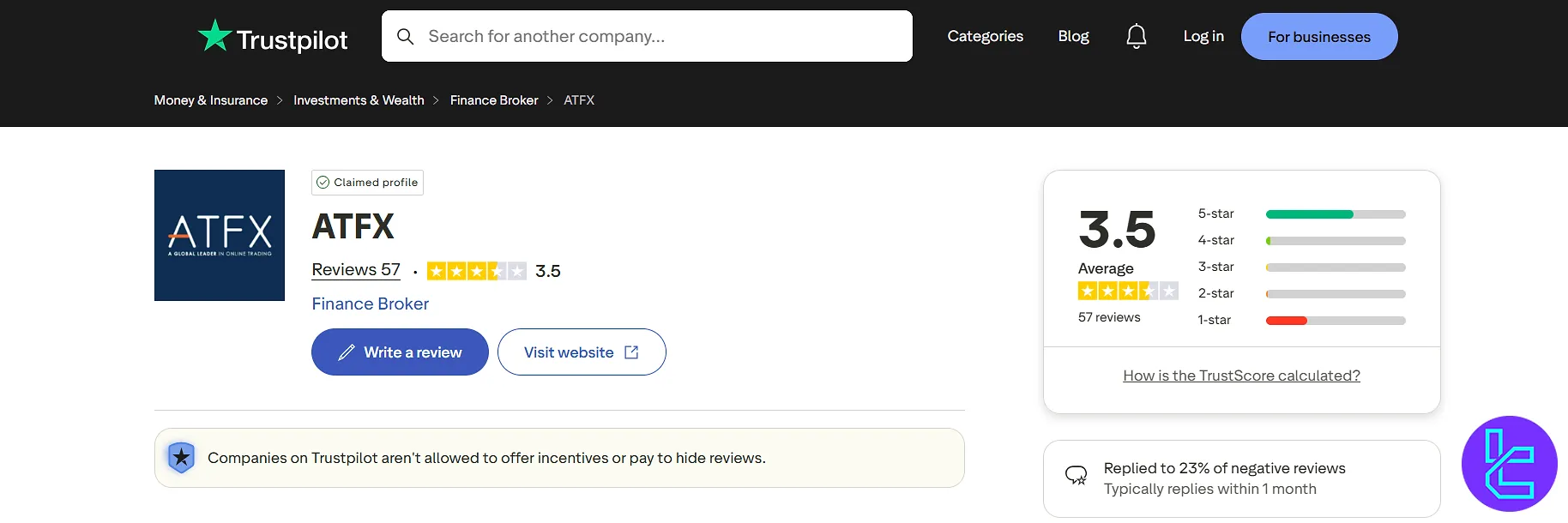

Trust Ratings

Trustpilot, ForexPeaceArmy, and ATFX REVIEWS.io are some of the platforms used for submitting trust scores by users.

While ATFX is regulated by reputable and high-tier authorities, it has received mixed reviews across mentioned websites:

- Trustpilot: 3.5/5 stars with 14 reviews

- ForexPeaceArmy: 1.0/5 stars, an average of 9 ratings

- io: 3.0/5 stars, based on over 60 scores, only about half of them recommend the brokerage

As with any broker, it's essential to do your own research and start with a small investment to test the waters.

Does ATFX Provide Comprehensive Educational Resources?

ATFX provides reliable and accessible customer support available 24 hours a day, five days a week, through multiple channels including live chat, email, and telephone.

Their multilingual team caters to a diverse client base, offering assistance in numerous languages such as English, Spanish, German, Arabic, and others.

Education is a standout feature of ATFX, offering a rich portfolio of learning resources:

- Thousands of live webinars and seminars that cover a broad range of trading topics

- Detailed, well-structured video courses comprising over 85 concise lessons

- A collection of 14 comprehensive e-books focusing on technical and fundamental analysis, trading psychology, and risk control

- Access to premium market analysis and trading signals from third-party providers like Autochartist and Trading Central

- Regular publications of an in-house Trader Magazine and an engaging YouTube channel delivering daily market insights

These resources empower traders at all levels to deepen their understanding and improve trading performance.

ATFX Comparison Table

The table below provides detailed information on the pros and cons of trading with ATFX in comparison to other Forex brokers.

Parameters | ATFX Broker | |||

Regulation | ASIC, FCA, FSCA, SCA, CySEC, FSC, FSA, SFC | FSA, CySEC, ASIC | FCA, FSCA, CySEC, SCB | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Minimum Spread | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $0 | From $3 | From $0 | From $0.2 to $3.5 |

Minimum Deposit | $500 | $200 | $100 | $10 |

Maximum Leverage | 1:30 | 1:500 | 1:500 | Unlimited |

Trading Platforms | MT4, MT5 | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, cTrader, Web Trader, Mobile App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Account Types | Standard, Edge, Premium | Standard, Raw Spread, Islamic | Standard, Pro, Raw+, Elite | Standard, Standard Cent, Pro, Raw Spread, Zero |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 120+ | 2,250+ | 2100+ | 200+ |

Trade Execution | STP | Market | Market, Pending | Market, Instant |

Conclusion And Final Words

ATFX provides access to 4 asset classes, including Forex and Metals, through its 3 account types.

While the broker has a good TrustPilot rating of 3.5, it doesn't provide services to retail clients any longer. Traders from the United States and Canada are not accepted.