AvaTrade Canada is the Canadian branch of AvaTrade, an international brokerage. This branch is a member of the Canadian Investment Regulatory Organization (CIRO).

The discussed broker offers 5 tradable markets [Forex, commodities, indices, stocks, options.] More than 35 Forex instruments are available.

AvaTrade Canada Company Details and Regulation

The broker is operated by Friedberg Direct, a division of Friedberg Mercantile Group Ltd. (FMGL). This group was established in 1971 and is a member of the Canadian Investment Regulatory Organization.

Friedberg Direct's office is located at 220 Bay Street, Suite 600, Toronto, Ontario M5J 2W4. AvaTrade Canada regulatory details:

Entity Parameters/Branches | Friedberg Direct |

Regulation | CIRO |

Regulation Tier | 1 |

Country | Canada |

Investor Protection Fund/Compensation Scheme | No |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:20 |

Client Eligibility | Only Canada |

Summary of The Broker's Details and Specifics

Let's break down the essentials of what AvaTrade Canada offers:

Broker | AvaTrade Canada |

Account Types | Standard, Islamic, Demo |

Regulating Authorities | CIRO |

Based Currencies | USD, CAD |

Minimum Deposit | 250 USD 300 CAD |

Deposit Methods | Credit/Debit Card, Bank Transfers, Google Pay |

Withdrawal Methods | Credit/Debit Card, Bank Transfers, Google Pay |

Minimum Order | 0.01 Lots |

Maximum Leverage | 1:20 |

Investment Options | None |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, AvaOptions |

Markets | Forex, Commodities, Indices, Stocks, Options |

Spread | Varies |

Commission | None on Trading |

Orders Execution | N/A |

Margin Call/Stop Out | N/A |

Trading Features | Economic Calculator, Trading Calculator, Earning Releases Tracker |

Affiliate Program | No |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | 24/5 |

Customer Support Hours | Ticket, Phone Call, Live Chat |

Account Types Details and Comparison

AvaTrade Canada doesn't offer any variety in this regard, providing only 1 real account type. Specifics and Details:

- Base Currencies: USD, CAD

- Minimum Deposit: 250 USD or 300 CAD

- Maximum Leverage: 1:20

Furthermore, there is an Islamic and a demo account available on the broker.

Pros and Cons

Let's go through the advantages and disadvantages of trading with AvaTrade Canada:

Pros | Cons |

Strong Regulatory Oversight | Spreads, While Competitive, Aren't The Lowest In The Industry |

Decent Range of Trading Platforms | Inactivity and Administration Fee |

Relatively Diverse Selection of Tradable Instruments | - |

AvaTrade Canada Account Registration and Verification

Canadian residents can easily open an account by following a simple process. AvaTrade registration:

#1 Access the AvaTrade Canada Website

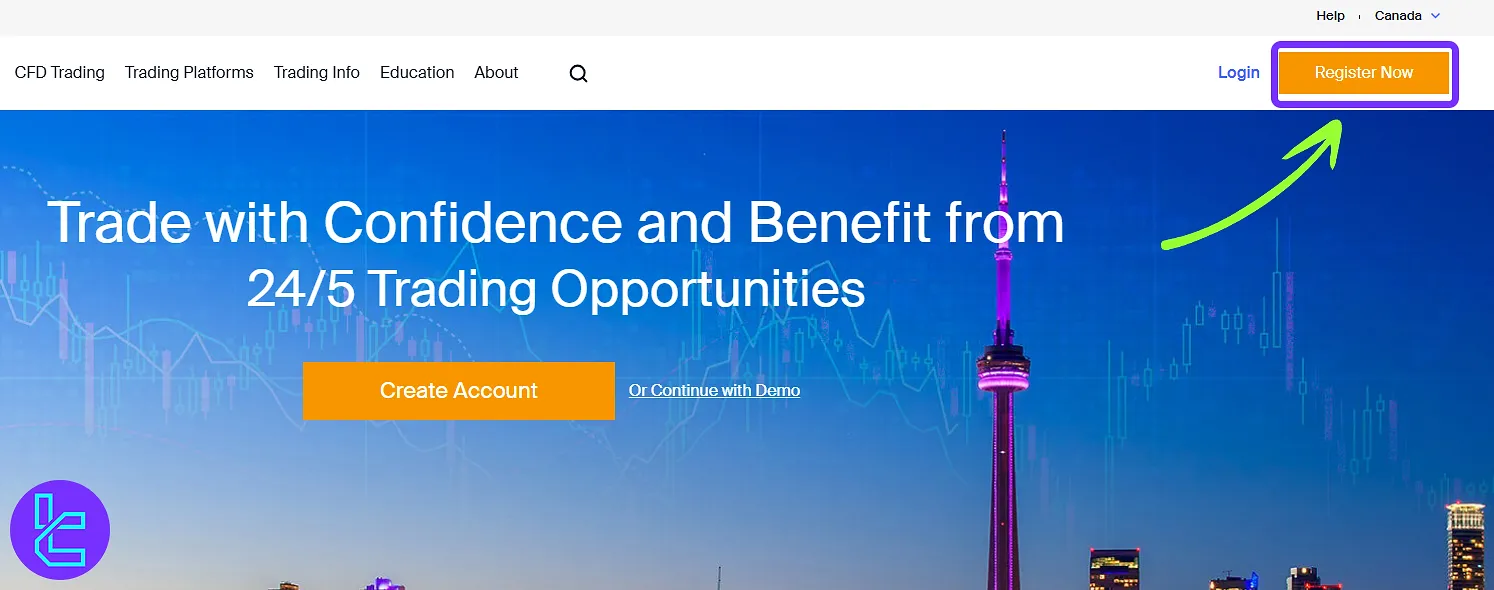

On your preferred browser, search for AvaTrade Canada and visit the broker's website. Once there, click on the "Register Now" button.

Click on the "Register" button to begin opening an account with AvaTrade Canada

Click on the "Register" button to begin opening an account with AvaTrade Canada#2 Provide Your Personal Information

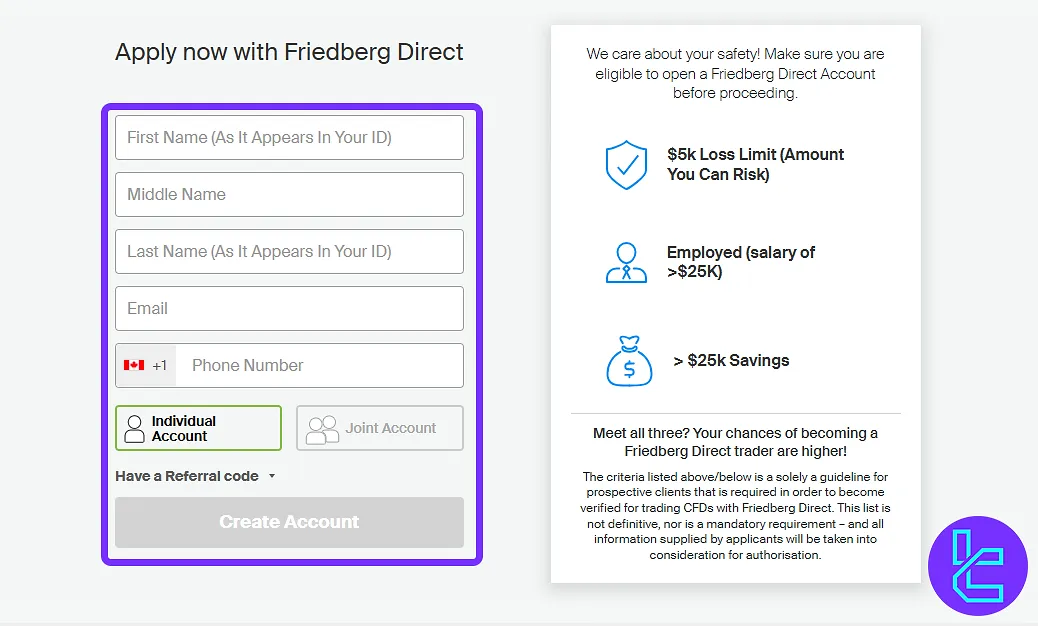

Type in the following information in the AvaTrade registration form:

- Full name

- Email address

- Phone number

Now enter your temporary password received via email and use it to log in to your new account.

#3 Complete Your Profile and Verify Your Identity

After logging in, complete your profile details, including date of birth, residential address, and trading preferences. Answer the trading experience questionnaire and upload the required KYC documents (e.g., government-issued ID and proof of address).

Trading Platforms and Terminals

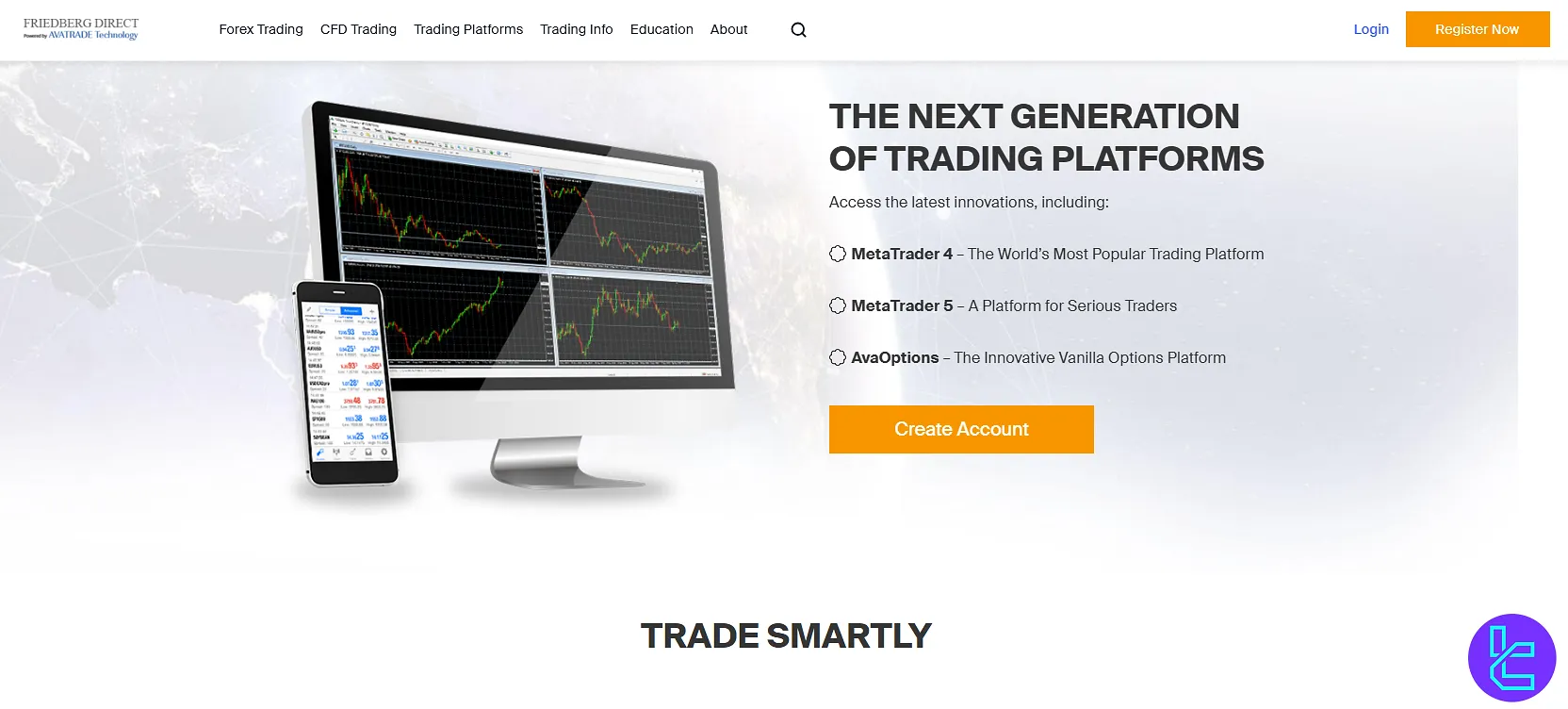

AvaTrade Canada does an acceptable job in this regard, offering a suite of trading platforms:

- MetaTrader 4 (MT4): The industry standard, known for its robust charting and automated trading capabilities;

- MetaTrader 5 (MT5): An upgraded version of MT4, offering more timeframes and analytical tools;

- AvaOptions: A proprietary platform specifically designed for options trading, with intuitive risk management tools;

- WebTrader: A browser-based platform requiring no downloads, perfect for trading on-the-go.

Commissions and Fees

AvaTrade Canada operates on a spread-based model, meaning it makes their money from the difference between buy and sell prices. Here's what you need to know:

- Spreads vary based on the trading pair

- No commissions on standard Forex and CFD trades

- Spreads can widen during volatile market conditions

Based on our investigations, there are no charges on deposits and withdrawals. However, a $50 monthly inactivity fee is deducted from the accounts that have been inactive for 3 months or more.

Also, an administration fee applies to those with 12 or more inactive months. It's a monthly $100. Note that these commissions aren't charged if prohibited by Law.

If you want an easy way to reduce your trading costs with this broker, we suggest reading the AvaTrade Canada rebate article.

Swap Fees

Unfortunately, AvaTrade doesn't disclose data on its swap or rollover fees. For traders who are concerned about this matter, we suggest chatting with the broker's support team to receive the data you need.

Non-Trading Fees

AvaTrade Canada implements inactivity fees under specific conditions. If an account remains inactive for three consecutive months and the balance falls below $2,000, a monthly fee of $10 (or the equivalent in your account currency) is applied.

Furthermore, if inactivity continues for a full year, an annual administration fee of $100 (or the equivalent in your account's currency) is charged. These fees are calculated based on the account's currency, such as $10 CAD or $100 CAD for accounts in Canadian dollars. However, AvaTrade does not impose any fees for deposits or withdrawals.

Deposits and Withdrawals: Payment Options

AvaTrade Canada offers 3 primary methods for funding and withdrawing from your account:

- Credit/Debit Cards: All major credit cards are accepted

- Wire Transfer: Direct bank transfers

- Google Pay: Available for clients

AvaTrade Canada Deposit

Friedberg Direct, powered by AvaTrade Technology, offers a variety of deposit options such as credit cards, bank transfers, and Google Pay. To comply with regulatory requirements, verification documents like proof of identity and address are necessary. Deposits may take up to 7 business days for wire transfers and 1 business day for credit cards.

A minimum deposit of $250 is required to open an account. Friedberg Direct also ensures a secure withdrawal process and offers risk management tools like AvaProtect™ for additional protection.

Method | Processing Time | Minimum Deposit |

Credit Card | Up to 1 business day | $250 |

Bank Transfer | Up to 7 business days | $250 |

Google Pay | Instant | $250 |

AvaTrade Canada Withdrawal

At AvaTrade Canada, the withdrawal process is designed to be fast and efficient. Once your account is verified, withdrawal requests are typically processed within 24 business hours. However, the time it takes to receive the funds depends on the method used.

For credit or debit card withdrawals, it can take up to 5 business days, while wire transfers may take between 5 to 10 business days, depending on the bank. To comply with regulatory requirements, any withdrawal up to the amount of your initial deposit must be returned to the same card used for funding.

After that, you can withdraw the remaining profits using another method in your name.

Method | Processing Time | Notes |

Credit/Debit Card | Up to 5 business days | First withdrawal up to 100% of the deposit must go back to the same card |

Wire Transfer | 5 to 10 business days | May vary depending on the bank's location and clearance time |

Does AvaTrade Canada Offer Any Copy Trading or Investment Options?

Unfortunately, the company does not currently offer copy trading or social investment features. This is a notable absence, especially considering that some of AvaTrade's global entities do provide these services.

Trading Markets and Available Instruments

The discussed brokerage offers a range of more than 170 tradable assets and pairs divided in 5 markets:

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

CFDs on major, minor & select exotic currency pairs | 60 FX Pairs | 50–70 currency pairs | 1:20 | |

Stocks/ETFs | CFDs on global equities and exchange‑traded funds | 100–300 stock & ETF CFDs | 800–1,200 global stocks | Not Specified |

Commodities | CFDs on metals, energies & agricultural instruments | 20 commodity instruments | 10–20 instruments | Not Specified |

Indices | CFDs on global indices, including Canadian TSX 60 | 10–15 major indices | 10–20 indices | Not Specified |

CFDs on crypto assets | 9–10 cryptocurrency CFDs | Varies (often 5–15) | Not Specified | |

Bonds | Government bond CFDs | Few symbols | Often unavailable | Not Specified |

Options | FX & precious metal options (via AvaOptions platform) | 40+ | Varies widely | Not Specified |

Promotional Offers and Bonuses

AvaTrade Canada does not offer any bonuses or promotions to new or existing clients. This must be due to regulatory restrictions in Canada that limit such incentives.

Actually, most Forex Brokers with stringent regulatory licenses follow the same approach.

Support Team Contact Options and Schedule

The discussed brokerage has 3 channels for contacting its customer services team:

- Ticket: Accessible on the "Contact Us" page of the website;

- Live Chat: Available directly from the website and WhatsApp;

- Phone: +1-877-846-2240.

The company doesn't provide a 24/7 support service; the open hours are Sunday 21:00 to Friday 21:00 GMT. Besides this, AvaTrade offers customer services in 14 languages.

Restricted Regions and Countries

As the title suggests, AvaTrade Canada operates exclusively in the North Americancountry. Therefore, it's not available in any other regions.

AvaTrade Canada Broker Trust Scores & Reviews

Websites, including Trustpilot, are decent sources for examining a broker's trust scores. AvaTrade Trustpilot Score is 3.2 out of 5 based on 3 customer reviews.

Educational Materials and Resources

AvaTrade Canada provides a dedicated "Education" section on its website, containing a wide range of educational articles for various skill levels, covering:

- Leverage

- Technical analysis and trading strategies

- Trading guides for multiple markets and asset types

- Trading platforms

- Order types

- Online trading strategies

Additionally, it provides resources for trading rules, economic calendars, and market terminology.

Comparing AvaTrade Canada with Well-known Forex Brokers

Comparing the key features of AvaTrade Canadawith other Forex brokers helps traders understand whether this broker satisfies their needs.

Parameters | AvaTrade Canada Broker | |||

Regulation | CIRO | FSCA, FSRA | FSCA, MISA | ASIC, CySEC, FSC, FSCA, FSA |

Minimum Spread | From 0.0 pips | From 0.0 pips | From 0.0 pips | From 0.0 pips |

Commission | $0 | From $0.0 | From $0 | $3 |

Minimum Deposit | $250 | $50 | $25 | $50 |

Maximum Leverage | 1:200 | 1:1000 | 1:1000 | 1:500 |

Trading Platforms | MetaTrader 4, MetaTrader 5, AvaOptions | MT4, MT5, Pro Trader, App Trader | MT4, MT5, OctaTrader, Octa Copy | MT4, MT5, cTrader |

Account Types | Standard, Islamic, Demo | Direct, Prime, Ultra | MT4, MT5, OctaTrader | Standard, RAW |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 100+ | 1000+ | 277 | 1000+ |

Trade Execution | N/A | Market | Market | Instant |

Conclusion and Final Words

AvaTrade Canada offers 3 accounts [Standard, Demo, Islamic] with leverage up to 1:20. The broker supports 3 payment methods [Credit/Debit Card, Bank Transfers, Google Pay] for both deposits and withdrawals.

There is a $50 inactivity fee and a $100 administration fee for inactive accounts, which are charged monthly.