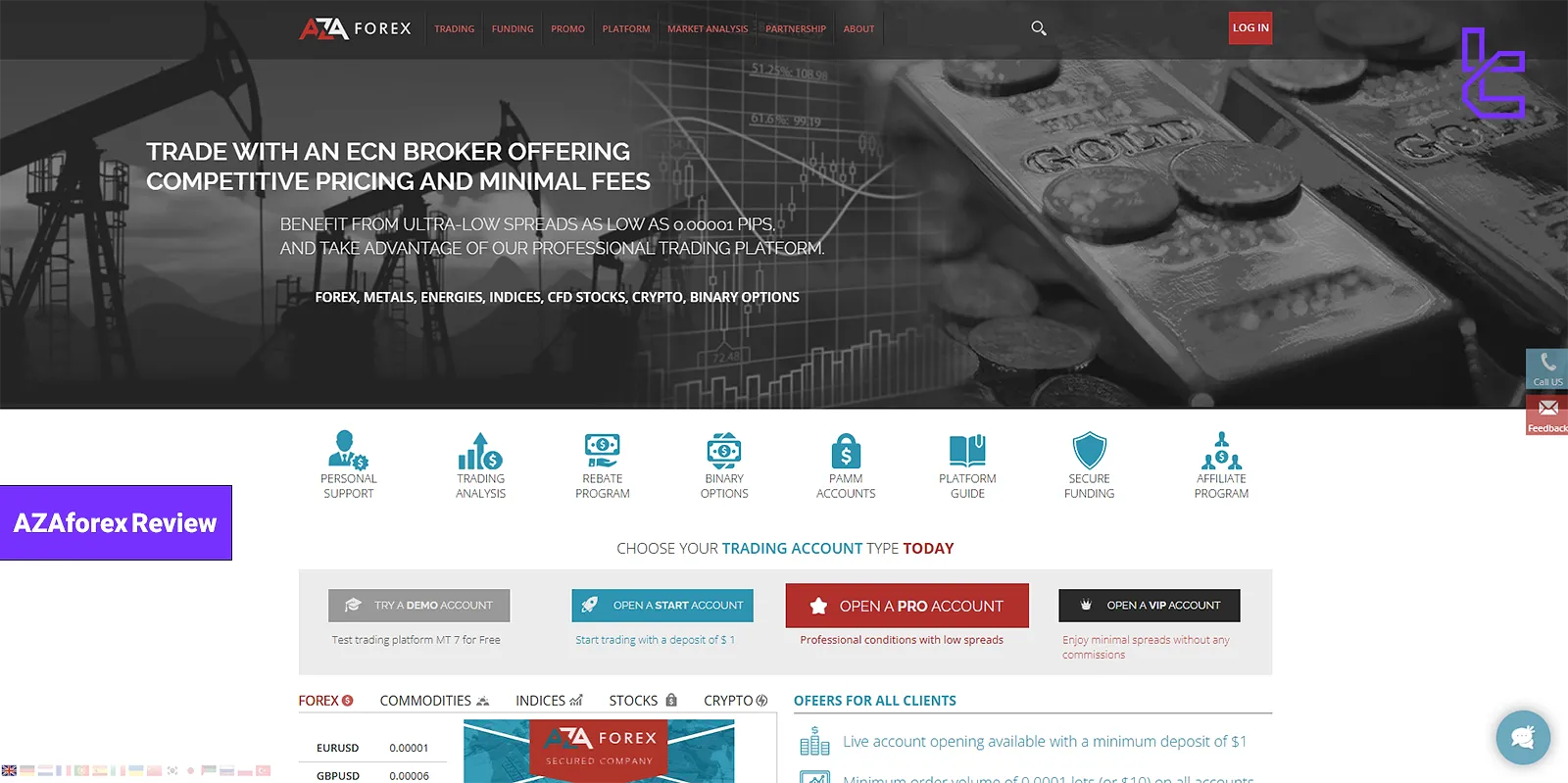

AZAForex provides CFDs and Options trading with spreads from 0.00001 pips and a stop out level of 5%. The broker allows for micro trading with aminimum order size of 0.0001 lots, and offers 25% extra funds on crypto deposits.

Company Information & Regulation Status

AZAforex was established in 2016 and is officially registered in the Marshall Islands under the oversight of the Global Financial Services Authority (GLOFSA).

However, GLOFSA is widely regarded as a low-tier regulator, and AZAforex remains essentially an unregulated broker from the perspective of major financial jurisdictions.

This lack of licensing from any recognized financial authority significantly weakens AZAforex’s credibility. Traders should be aware that operating with an unregulated broker exposes them to elevated risks, including:

- Limited protection of client funds

- No guaranteed recourse in case of disputes

- Absence of regulatory audits or oversight

Below is a summary table of the regulation-related characteristics of AZAForex:

Parameter / Branch / Entity | AZAFOREX (claimed SVG FSA) | Independent Assessment / Reality |

Regulation | Claims SVG Financial Services Authority (license “808 LLC 2021”) | No valid listing found under SVG FSA registry |

Regulation Tier | Purports regulated / offshore | Unregulated – lacks oversight by credible authority |

Jurisdiction | Saint Vincent & the Grenadines (offshore) | Offshore jurisdiction often considered weak regulatory regime |

Investor Compensation / Protection | None disclosed | No investor compensation scheme is applicable |

Segregated Funds / Custody | Not stated | No evidence of segregated client fund structure |

Negative Balance Protection | Not clearly offered | Unclear / likely not guaranteed |

Client Eligibility | Claimed global coverage (subject to local restrictions) | Restricted in many regulated jurisdictions; high risk for users in stricter markets |

This Forex broker claims to offer negative balance protection, meaning clients cannot lose more than their deposited capital. Still, in the absence of robust regulatory enforcement, the effectiveness of such features is hard to verify.

Summary of Specifics

Let's take a quick look at the key features of AZA Forex:

Broker | AZAforex |

Account Types | Start, Pro, VIP, Demo |

Regulating Authorities | GLOFSA |

Based Currencies/Cryptocurrencies | USD, EUR, GBP, JPY, AUD, CAD, CHF, NZD, UAH, RUB, CNY, ILS, IDR, MYR, THB, VND |

Minimum Deposit | $1 |

Deposit/Withdrawal Methods | Crypto |

Minimum Order | 0.0001 |

Maximum Leverage | 1:1000 |

Investment Options | YES |

Trading Platforms & Apps | Mobius Trader 7 |

Markets | Forex, Metals, Commodities, Indices, Stocks, Cryptocurrencies |

Spread | From 0.00001 |

Commission | N/A |

Orders Execution | Market |

Margin Call/Stop Out | 10 to 100% / 5% |

Trading Features | Fast Execution, VPS, Copy Trading |

Affiliate Program | YES |

Bonus & Promotions | YES |

Islamic Account | YES |

PAMM Account | YES |

Customer Support Ways | Phone, Email, Telegram, Whatsapp, Skype, Live Chat |

Customer Support Hours | 12/5 |

This table provides a snapshot of what AZAforex offers, but it's essential to dig deeper into each aspect to fully understand what you're getting into as a potential trader.

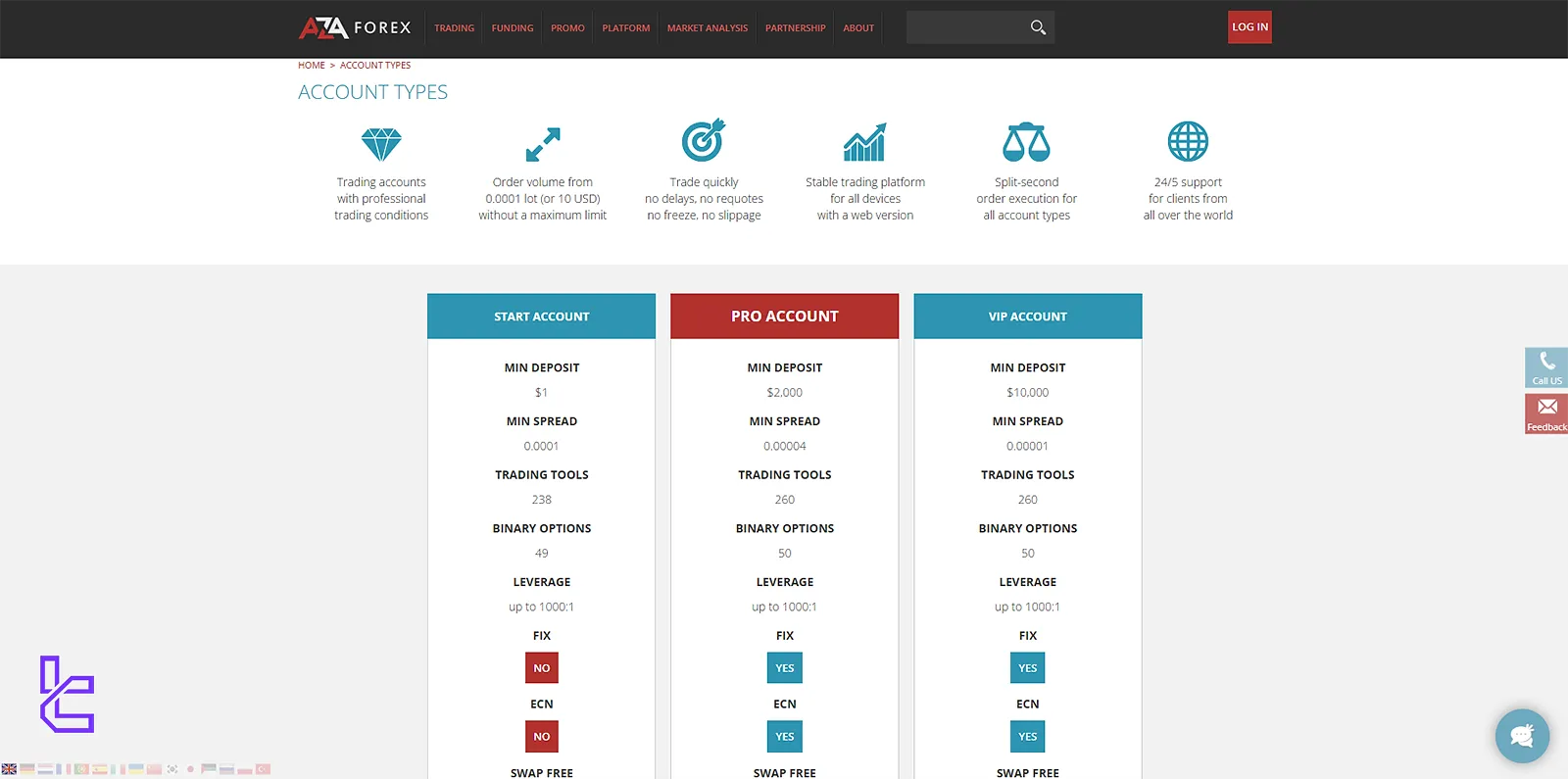

Types of accounts offered by AZA Forex

AZAforex broker caters to different types of traders with its range of account options:

Account | Min. Deposit | Leverage Up to | Execution |

Start | $1 | 1:1000 | Market |

Pro | $2,000 | 1:1000 | Market, ECN |

VIP | $10,000 | 1:1000 | Market, ECN |

Demo | $0 | 1:1000 | Market, ECN |

Each account type has different minimum deposits, leverage options, and trading conditions. The demo account is an excellent way to get a feel for the platform without risking any funds.

Advantages and Disadvantages of AZAforex

Let's weigh the pros and cons of trading with AZA Forex:

Advantages | Limitations |

Low spreads | Not regulated |

High leverage | Limited withdrawal options |

Multiple account types | Mixed user reviews |

Copy trading and PAMM options | - |

While AZA Forex offers attractive trading conditions, the lack of regulation is a significant drawback that should be noted.

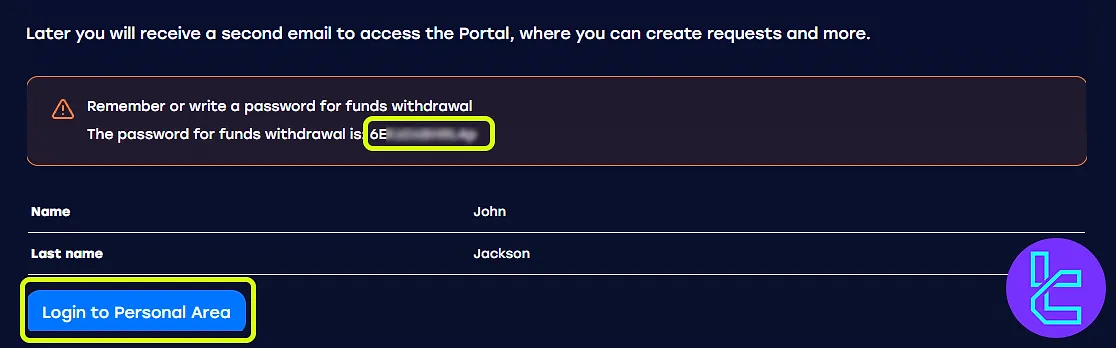

Signing Up & Verification Process

Creating a new account with AZAforex allows traders to access various markets and all the broker's services. Azaforex registration:

#1 Choose Your Trading Account Type

Head to the AZAForex website and select one of the four available options:

- Demo

- Standard

- Professional

- VIP

#2 Fill Out the Registration Form

Enter your full name, email, country, phone number, and create a secure password using a mix of letters, numbers, and symbols. Then hit “Open a Trading Account”.

#3 Save Withdrawal Password & Verify Email

After submission, note your withdrawal password for future transactions. Then, verify your email address using the code sent to activate your account and start trading.

#4 Complete Identity Verification

Although AZAforex is not a regulated broker, it still requires traders to upload documents to comply with anti-money laundering (AML) and know-your-customer (KYC) laws. For this process, traders must provide the following documents:

- Proof of identity: Passport, ID card, driver's license, utility bill, or bank statement;

- Cardholder verification: Required for traders who want to use their credit or debit card for transactions.

AZAforex’s Trading Platforms

AZA Forex utilizes the Mobius Trader 7 platform, which may not be as widely recognized as MT4 or MT5 but offers its own set of features:

- User-friendly interface

- Advanced charting tools and technical indicators

- Real-time data

- Mobile trading capabilities

- Customizable workspace

While Mobius Trader 7 provides necessary trading functionalities, it lacks advanced tools like MT5 indicators.

Spreads and Commission Structure

AZAforex applies a spread-based pricing model across its accounts, with most commissions embedded directly into the spread. While the broker does not offer zero-spread accounts, it does provide a competitive structure especially for higher-tier accounts.

Here’s how spreads are structured by account type:

- Start Account: Floating spreads from 1.1 pips

- Pro Account: Fixed or floating spreads from 0.5 pips

- VIP Account: Fixed spreads from as low as 0.1 pips

AZAforex does not explicitly charge commissions for most instruments; instead, trading costs are incorporated into the spread. However, during volatile market conditions (e.g. news events), spreads may widen, a common occurrence across brokers with dynamic pricing.

Traders aiming for the tightest spreads must commit to the VIP account’s $10,000 deposit threshold. For scalpers or high-volume traders, this account tier may be justified by its superior pricing.

AZAForex Swap Fees

At AZAForex, traders incur swap fees when holding positions overnight. These fees reflect the interest rate differential between the two currencies in a pair and vary based on the instrument.

The broker distinguishes between long and short positions, applying charges or credits accordingly.

Swap fees are categorized as follows:

- Swap Long: Applied when holding a buy position overnight; may be positive (credit) or negative (charge) depending on the currency pair;

- Swap Short: Applied when holding a sell position overnight; may also result in a charge or credit.

AZAForex publishes its swap rates directly on the trading platform, and they differ across forex pairs, commodities, and indices.

AZAForex Non-Trading Fees

AZAForex states that it does not charge additional fees on deposits and withdrawals, but clients may still face costs from banks, card issuers, or e-wallet providers depending on the chosen method. There are also no disclosed internal commission fees outside of trading spreads and swaps.

However, like many offshore brokers, AZAForex applies an inactivity fee after a certain period of account dormancy.

This charge is meant to cover administrative costs when no deposits, withdrawals, or trades have been made for several months.

Traders should confirm these conditions on the platform before funding their accounts.

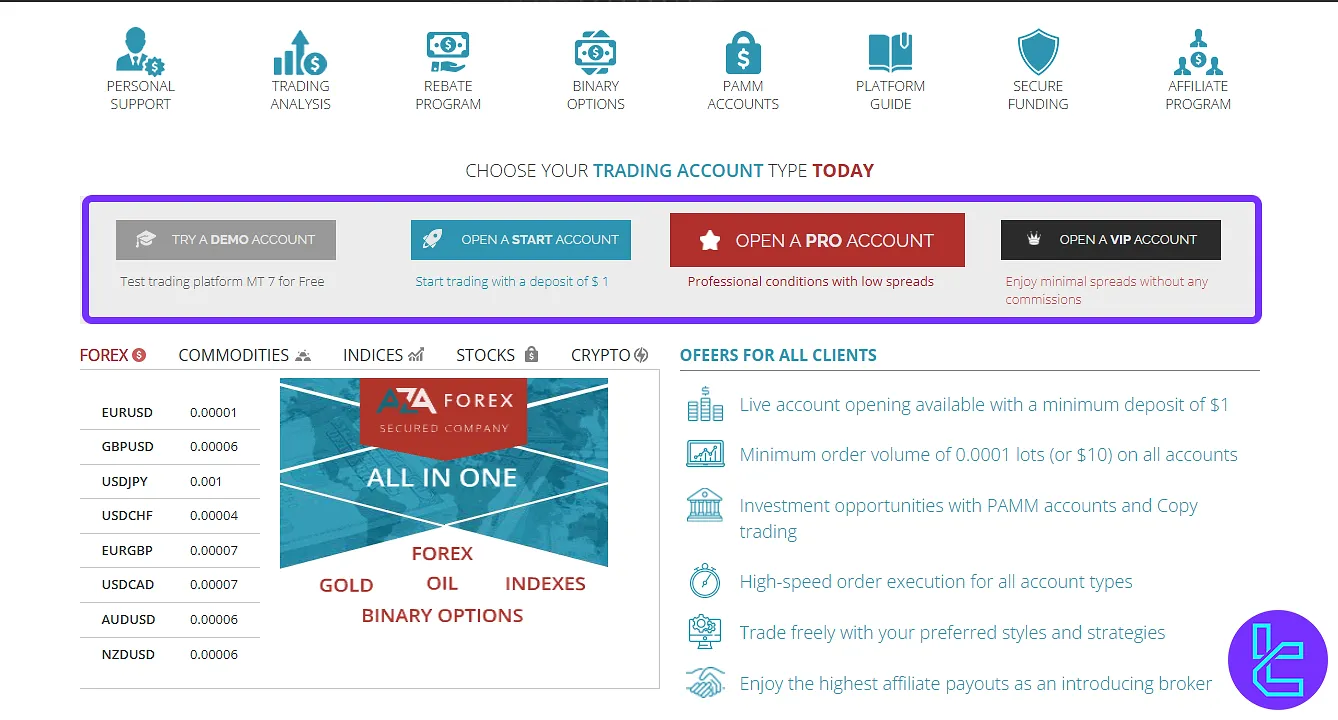

Deposit & Withdrawal Methods

AZAforex offers broad flexibility in funding and withdrawal methods, including support for both fiat and cryptocurrencies. Clients can fund their accounts using:

- Bank transfers (SWIFT & SEPA)

- Credit/debit cards (Visa, Mastercard, Maestro)

- E-wallets (Skrill, Neteller, Perfect Money, Paybis, QIWI, Volet)

- Cryptocurrencies (BTC, BCH, ETH, DASH, LTC, XMR)

While AZAforex itself does not impose direct deposit or withdrawal fees, traders may face processing charges from third-party providers. Typical costs range from 5% to 6% of the transaction amount, plus a $0.50 flat fee.

However, these fees may be waived if the deposit amount exceeds:

- $100 for e-wallets

- $300 for card payments

- $1,000 for bank transfers

Withdrawals are returned to the original funding source, and processing times vary:

- Crypto: Usually within a few hours

- E-wallets: Within one business day

- Bank transfers: 2–5 business days

All transactions must comply with AZAforex’s AML/CTF policy, requiring deposits and withdrawals to be made from accounts under the same name as the trading account holder.

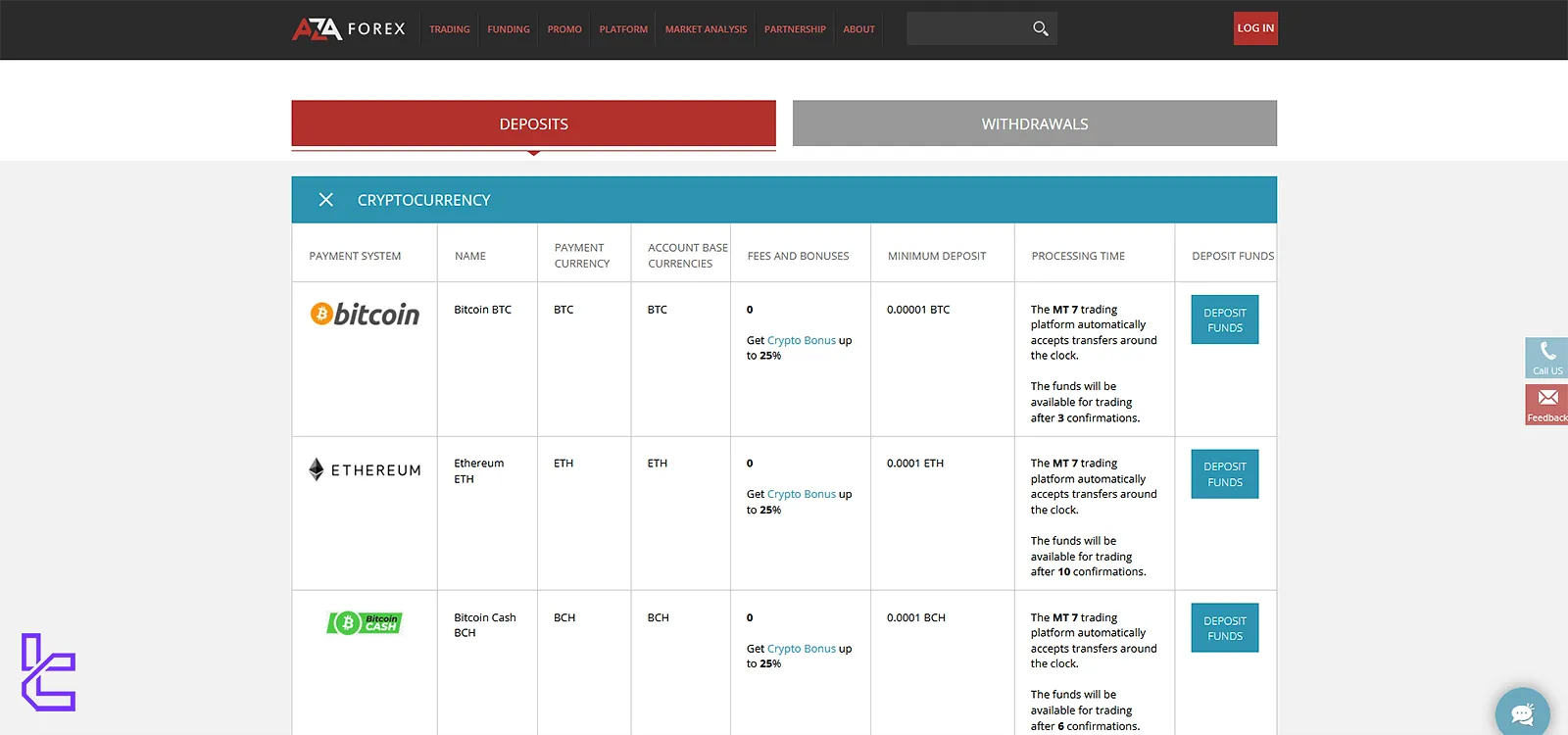

Deposit Options

AZAForex supports a range of funding methods, with a strong emphasis on cryptocurrency-based options.

Fiat deposits via bank transfer, cards, or e-wallets are accepted often converted via third-party exchanges.

AZAForex does not charge internal deposit fees, though blockchain or payment provider fees may apply.

Available deposit methods at AZAForex:

Option | Accepted Currencies / Crypto | Min. Deposit | Typical Processing Time | Notes / Fees Covered by AZAFOREX* |

Cryptocurrency (BTC, ETH, BCH, LTC, DASH, USDT, XMR, XRP) | Corresponding crypto or USD (for USDT) | 0.00001 BTC / 0.0001 ETH / 1 USDT etc. | 10 min – 1 hour | No internal fee; miner fee only |

E-wallets (Perfect Money, Advcash, Payeer) | USD, EUR, other supported fiat | ~$100 recommended | 5 – 30 minutes | AZAFOREX may cover fee if deposit ≥ $100 |

Bank Transfer / Wire (via exchanger) | USD, EUR, other fiat | ~$1,000 recommended | 1 – 5 business days | Payment system / intermediary bank fees apply |

Card (Visa / Mastercard via crypto exchange) | USD, EUR, other fiat | ~$300 recommended | ≈1 hour on business days | No AZAFOREX fee if conditions met; must convert via exchange route |

Withdrawal Solutions

AZAForex processes withdrawals to the same method used for deposit (where required) and permits crypto withdrawals independent of verification in some cases.

The broker does not charge internal withdrawal fees, only payment provider or miner fees.

Available withdrawal methods at AZAForex:

Withdrawal Solution | Processing Time | Withdrawal Fee | Notes / Restrictions |

Cryptocurrency (BTC, ETH, BCH, USDT, LTC, DASH, XMR, XRP) | ~1 hour to up to 24 hours | Miner / network fee only | No AZAFOREX fee; verification often not required |

E-wallets (Perfect Money, Advcash, Payeer) | Same business day to 12 hours | Payment system fee only | Client must be verified for e-wallet / card withdrawals |

Bank Transfer / Wire | 1 – 5 business days | ~20 units base currency (e.g. $20) | AZAFOREX deducts internal minimum fee; must withdraw to same bank used or same name account |

Debit / Credit Card | 1 – 2 business days | No AZAFOREX fee | Only up to original deposit amount can be refunded to card; profits to other method |

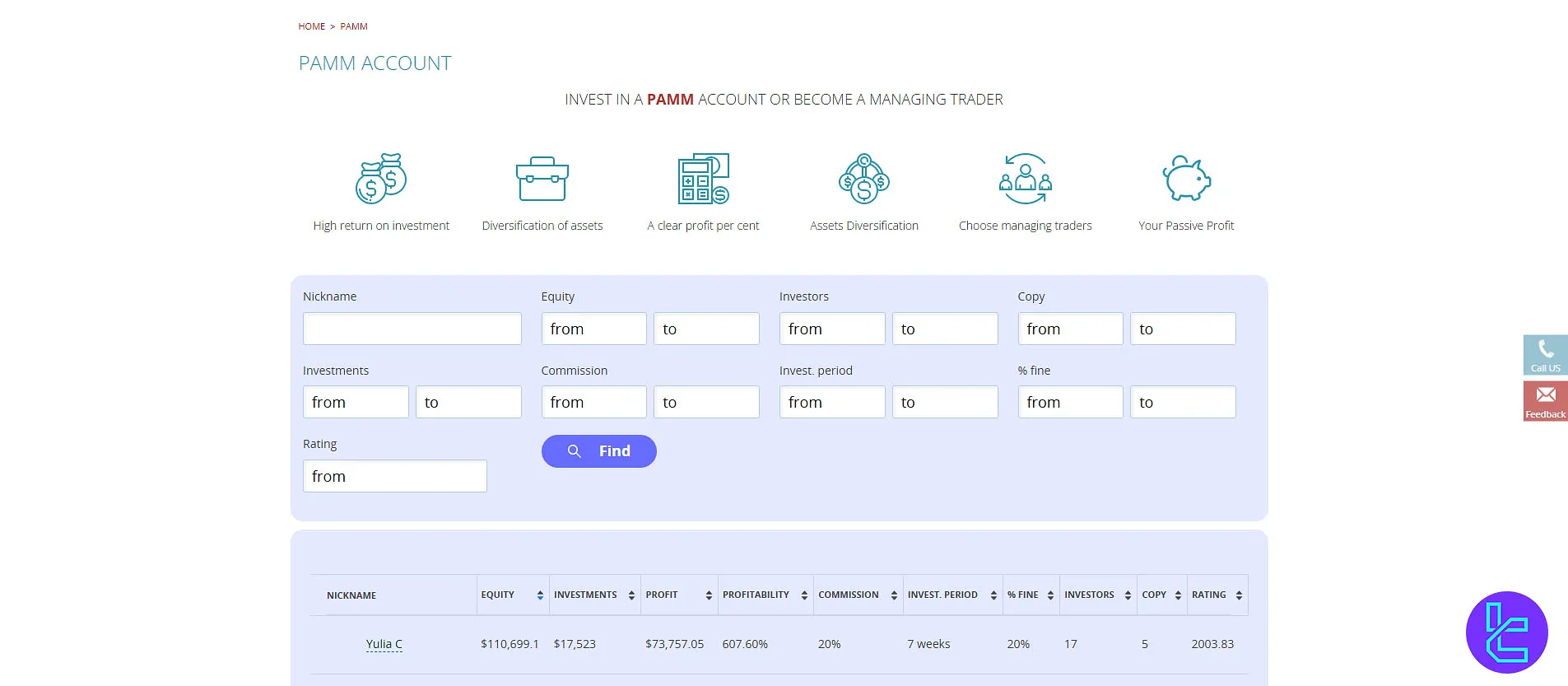

Copy Trading & Investment Options

AZAforex provides social trading features to enhance the trading experience:

- Copy Trading: Follow and automatically mimic successful traders' strategies;

- PAMM Account: Invest in professional traders' accounts.

These options can be attractive for novice traders or those looking to diversify their trading approach. However, always remember that past performance doesn't guarantee future outcomes.

Available Markets & Instruments

AZAForex gives traders access to a wide range of financial instruments, covering traditional and digital markets.

The broker lists more than 60 forex pairs including majors, minors, and exotics, alongside CFDs on commodities such as gold, silver, oil, and natural gas.

Global indices like US30, DE40, and UK100 are available, plus hundreds of CFDs on shares from major companies.

In addition, AZAForex offers cryptocurrency trading with popular tokens like Bitcoin, Ethereum, and Litecoin, providing high leverage opportunities compared to industry norms.

This diversity allows clients to diversify strategies across forex, commodities, indices, shares, and digital assets.

Asset classes available on AZAForex:

Asset Class | Type of Instruments | Number of Symbols | Max. Leverage | Competitor Average |

Forex | Major, Minor, and Exotic Currency Pairs | 60+ Currency Pairs | Up to 1:1000 | 50–70 Currency Pairs |

Shares | CFDs on Popular International Stocks | 200+ Global Stocks | Up to 1:50 | 800–1200 |

Commodities | CFDs on Metals and Energies | ~15 Instruments (Gold, Silver, Oil, Gas) | Up to 1:200 | 10–20 Instruments |

Indices | CFDs on Global Indices (US30, DE40, UK100, FR40) | ~14 Indices | Up to 1:200 | 10–20 Indices |

Cryptocurrencies | CFDs on Digital Assets (BTC, ETH, LTC, XRP, USDT) | 30+ Crypto Pairs | Up to 1:50 | 20–40 Pairs |

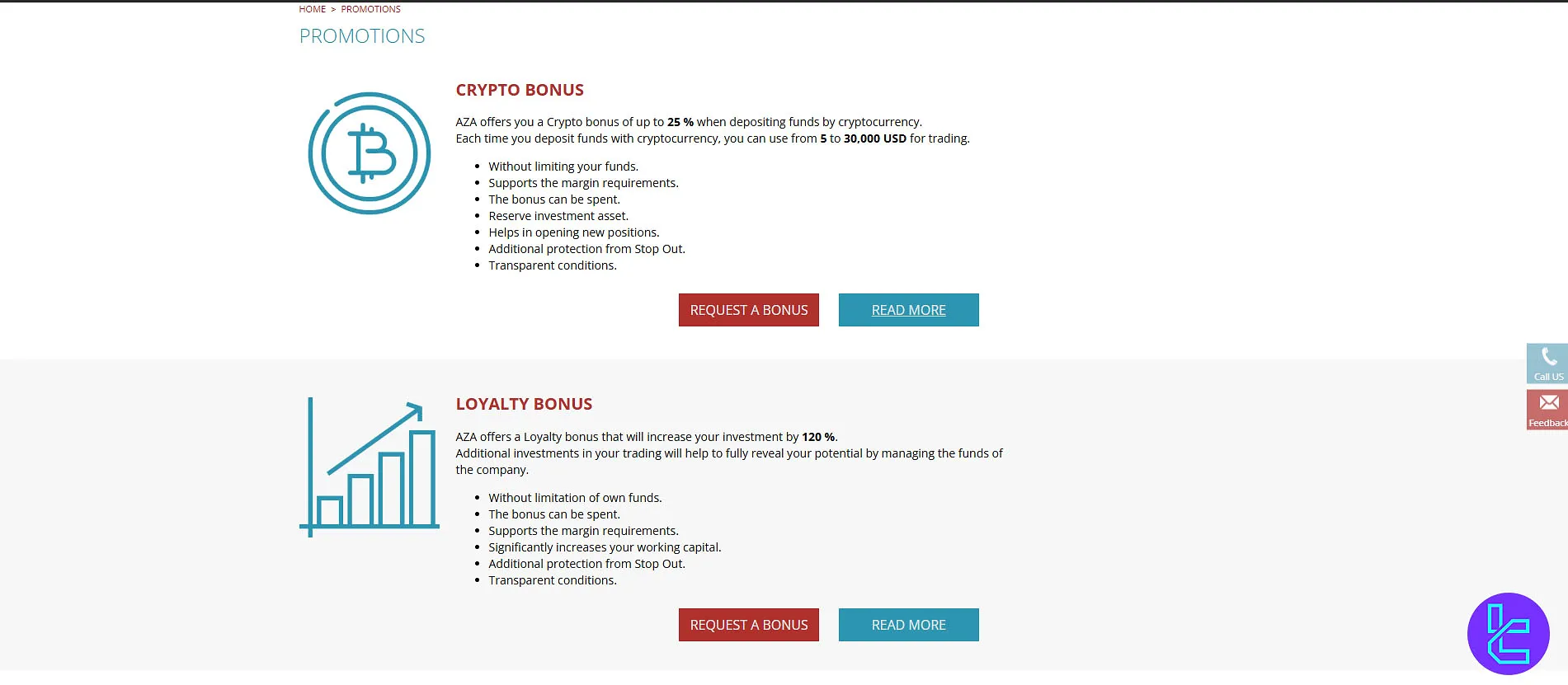

Special Bonus and Promotions

AZA Forex attempts to attract and retain traders with various bonuses and promotions:

Bonus | Up to | Qualification |

Crypto Bonus | 25% | Deposit funds by cryptocurrency |

Loyalty Bonus | 120% | Deposits of 500 USD or more |

CD Bonus | $2,000 | Deposit of 2000 USD or more |

Article Bonus | $10 | Write a unique article about forex trading |

It is also notable that with the broker’s affiliate program, you can earn commissions by referring new clients.

While these bonuses may seem attractive, reading the terms and conditions carefully is crucial. Unregulated brokers may use bonuses to lock in client funds, so approach these offers cautiously.

Awards

There is little evidence that AZAForex has been honored with credible industry awards recently. Independent broker reviews and comparison sites frequently list it as “unverified” or note its operation without recognized regulation.

That lack of formal recognition means traders should not rely on prestigious third-party accolades when assessing its trustworthiness.

Support Team and Hours

Customer support at AZAforex is available through multiple channels:

- Phone Support: +447700100833

- Email: support@azaforex.com

- Telegram: @azaforex

- WhatsApp: +447700100833

- Skype: azaforex.com

- Operating Hours: 12/5 from 8 am to 8 pm UTC

- Live Chat

While the multi-channel support is commendable, the limited hours of operation may be inconvenient for traders in different time zones or those who prefer 24/7 support.

AZAforex’s List of Restricted Countries

AZAforex broker does not explicitly specify a list of restricted countries. This lack of transparency is concerning, as it may indicate:

- The broker may accept clients from countries with strict forex regulations

- Traders might unknowingly violate local laws by using the platform

- There could be potential legal issues for traders from certain jurisdictions

Potential clients must verify their eligibility for AZAforex services based on their country of residence.

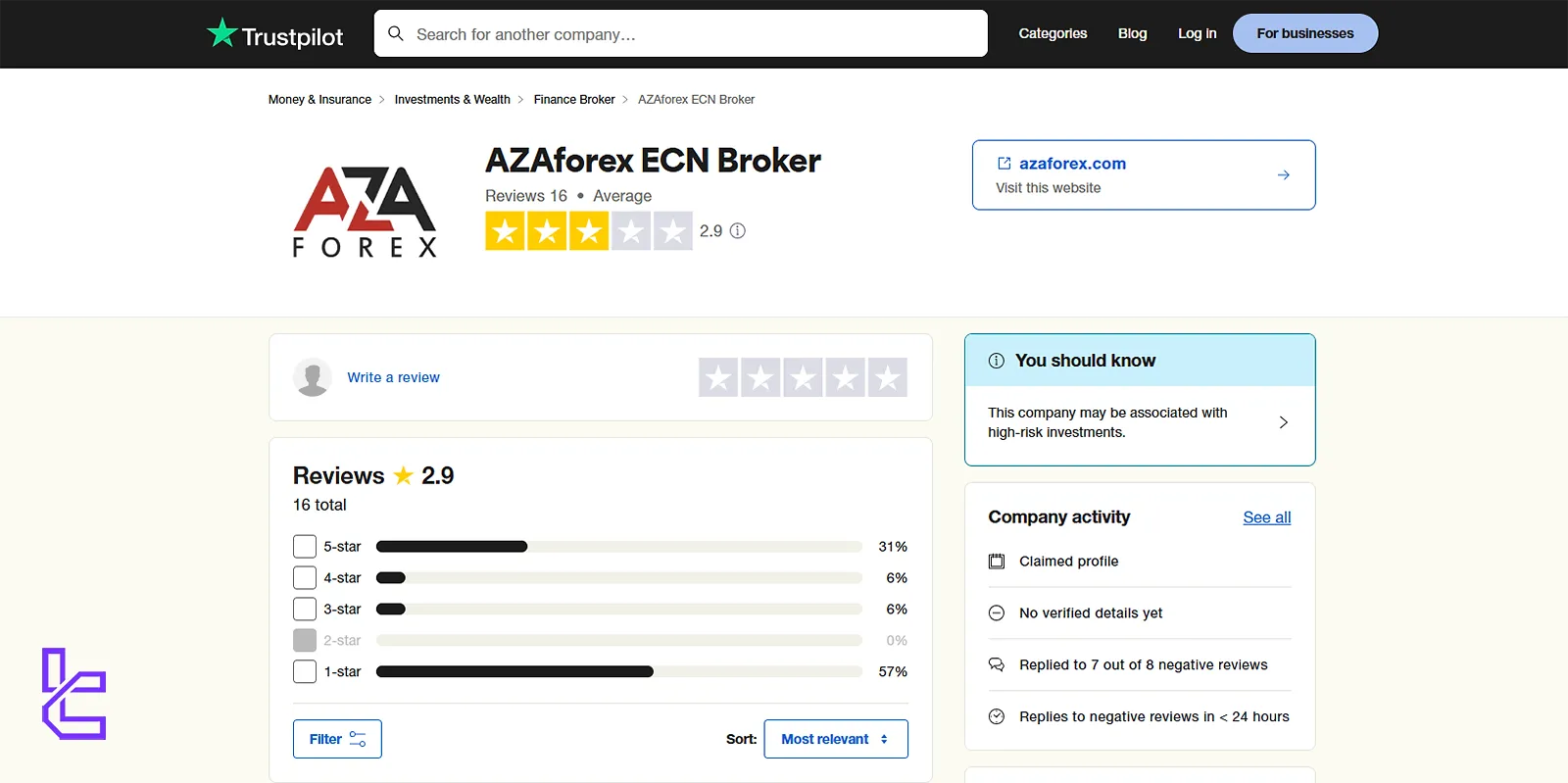

AZAforex’s Trust Scores & Reviews on Trustpilot

AZA Forex has received mixed reviews from the trading community, with a trust score of 2.9 out of 5 on the AZAforex Trustpilot website.

This mediocre rating reflects the following:

Positive Aspects | Negative Aspects |

Competitive spreads | Lack of regulation |

Fast execution | Concerns about fund safety |

Fast deposit and withdrawal | - |

The low trust score underscores the importance of thorough research and caution when considering AZA Forex as a broker.

Educational resources of AZAforex

AZAforex doesn't offer a comprehensive education section on its website, and its offerings are limited primarily to its blog, which includes:

- Market analysis and news updates;

- Trading tips and strategies;

- Platform tutorials.

While the blog can provide some insights, our website offers a wider range of Forex tutorials.

AZAforex in Comparison with Other Forex Brokers

To understand the pros and cons of trading with this broker, check the data in the table below.

Parameters | AZAforex Broker | |||

Regulation | GLOFSA | FCA, FSCA, CySEC, SCB | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | ASIC, FSC, DFSA, CySEC |

Minimum Spread | From 0.00001 Pips | From 0.0 Pips | From 0.0 Pips | From 0.6 Pips |

Commission | N/A | From $0 | From $0.2 to USD 3.5 | $0 (except on Shares account) |

Minimum Deposit | $1 | $100 | $10 | $5 |

Maximum Leverage | 1:1000 | 1:500 | Unlimited | 1:1000 |

Trading Platforms | Mobius Trader 7 | MT4, MT5, cTrader, Web Trader, Mobile App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App |

Account Types | Start, Pro, VIP, Demo | Standard, Pro, Raw+, Elite | Standard, Standard Cent, Pro, Raw Spread, Zero | Micro, Standard, Ultra Low, Shares |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 131 | 2100+ | 200+ | 1400+ |

Trade Execution | Market | Market, Pending | Market, Instant | Market, Instant |

Conclusion and final words

AZAForex offers various attractive features like copy trading service, PAMM accounts, $10 article bonuses, and access to the Mobius Trader 7 platform with leverage options of up to 1:1000.

However, AZAForex broker doesn't have any regulatory licenses and has an average score of 2.9 on Trustpilot.