BlackBull Markets is amulti-award-winning broker (7 prestigious awards) that provides trading services across 6 different asset classes and over 26,000 instruments.

This broker offers ECN Standard, ECN Prime, and ECN Institutional accounts with spreads as low as 0.0 pips.

BlackBull Markets (Company Introduction and Regulatory Status)

BlackBull Markets, officially registered as Black Bull Group Limited, is a New Zealand-based financial services provider founded in 2014 by Michael Walker and Selwyn Loekman.

Multiple financial authorities regulate the broker, including the New Zealand FMA and the Seychelles FSA.

Interestingly, the company’s domain was registered on 1999-03-31 and is valid till 2026-03-30.

According to WhoIs, the registration address is “100 S. Mill Ave, Suite 1600, Tempe, Arizona, US”, with the phone number “+1 4806242599”. Key points about BlackBull Markets:

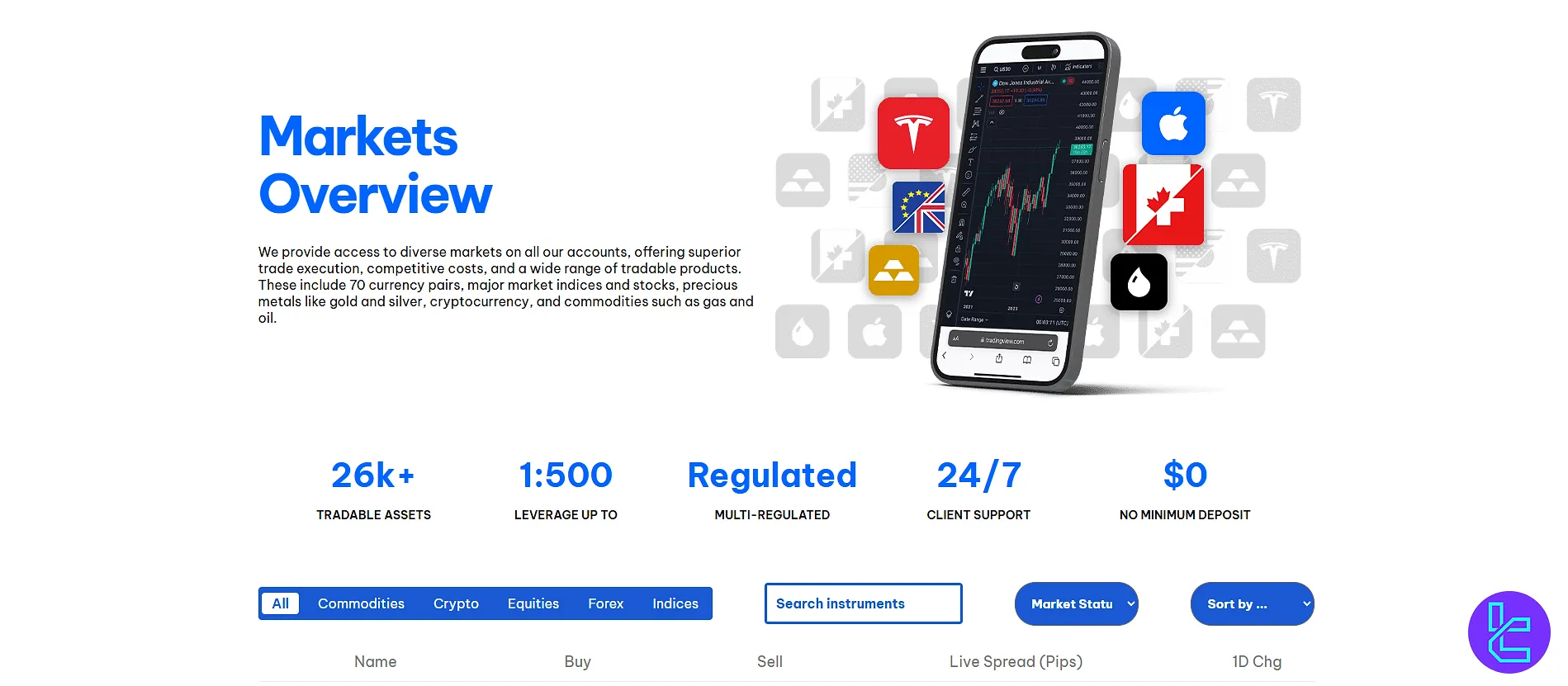

- 26000+ markets

- CFDs and Options trading

- 24/7 dedicated customer support

- Segregated client accounts

- Tier-1 banking partners

The following table outlines the key regulatory entities and protections available at BlackBull Markets:

Parameter / Branches / Entity | BBG Limited (Seychelles FSA) | Black Bull Group Limited (NZ FSP) |

Regulation | FSA | FMA |

Regulation Tier | Tier-3 | Tier-1 |

Country / Jurisdiction | Seychelles | New Zealand |

Investor Protection / Dispute Scheme | Not stated | FSCL membership 5623 |

Segregated Funds | Yes | Yes |

Negative Balance Protection | Yes | Yes |

Maximum Leverage | Up to 1:500 | Up to 1:500 |

Client Eligibility / Restrictions | Services not intended for EU/UK and other listed regions | New Zealand Clients |

BlackBull Markets Specifications

The Forex broker offers a comprehensive suite of trading services designed to meet the needs of diverse traders. BlackBull Markets key specifics:

Broker | BlackBull Markets |

Account Types | ECN Standard, ECN Prime, ECN Institutional |

Regulating Authorities | FSA, FMA |

Based Currencies | USD, EUR, GBP, AUD, NZD, SGD, CAD, JPY. ZAR |

Minimum Deposit | $0 |

Deposit Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Neteller, Skrill, SEPA, FasaPay |

Withdrawal Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Neteller, Skrill, SEPA, FasaPay |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:500 |

Investment Options | Copy Trading, Stock Trading |

Trading Platforms & Apps | MT4, MT5, TradingView, cTrader, BlackBull CopyTrader, BlackBull Invest |

Markets | FX, Crypto, Commodities, Energies, Metals, Indices, Stocks |

Spread | From 0.0 pips |

Commission | ECN Standard $0.0 ECN Prime $6.0 ECN Institutional $4.0 |

Orders Execution | Market, Limit, Stop, Trailing Stop |

Margin Call / Stop Out | 75% / 50% |

Trading Features | API Trading, Copy Trading, Economic Calendar |

Affiliate Program | Yes |

Bonus & Promotions | Referral, IB |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, Live Chat, Phone, WhatsApp |

Customer Support Hours | 24/7 |

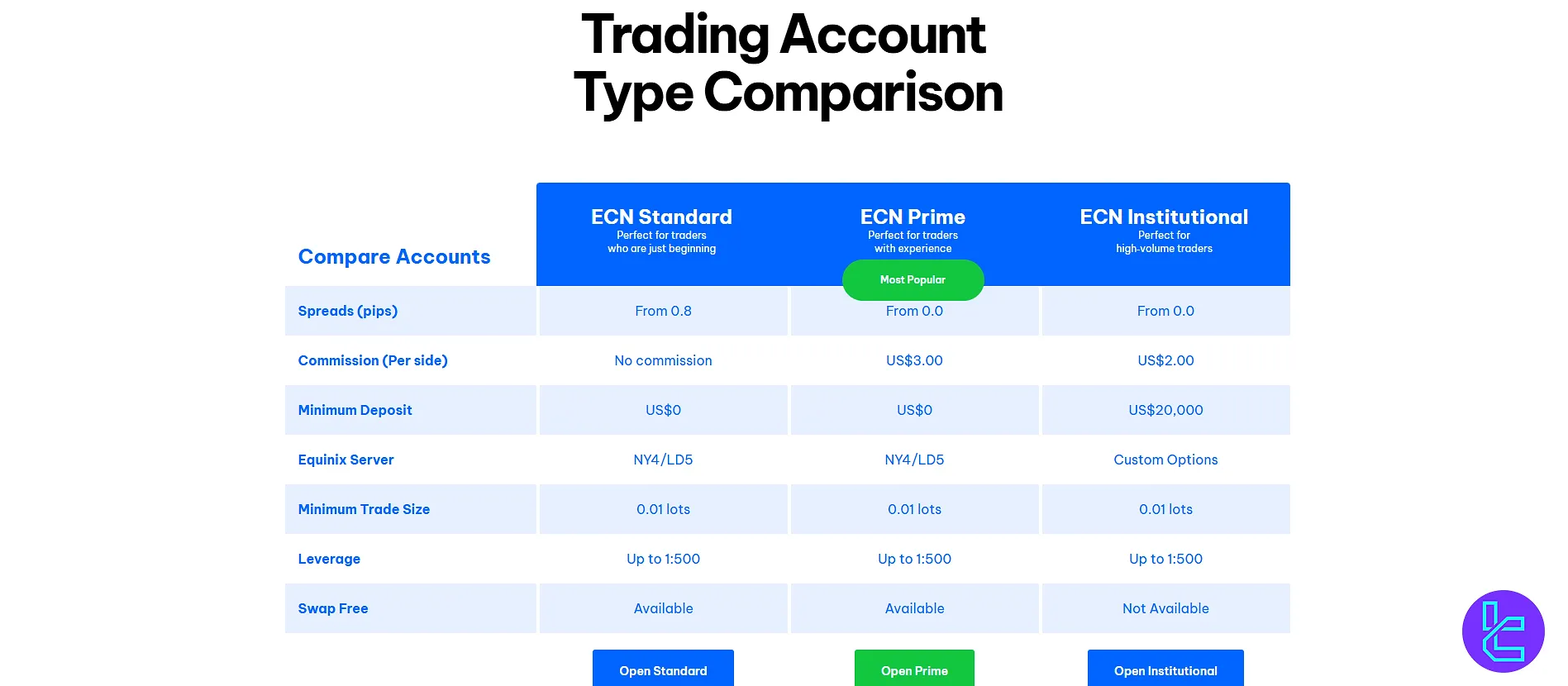

BlackBull Markets Broker Account Offerings

The company caters to a diverse range of traders with three distinct account types, each designed to meet specific trading needs and preferences.

Here's a full list of different account types offered by BlackBull Markets:

Features | ECN Standard | ECN Prime | ECN Institutional |

Min Deposit | $0 | $0 | $20,000 |

Equinix Server | NY4/LD5 | NY4/LD5 | Customizable |

Min Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

Leverage | Up to 1:500 | Up to 1:500 | Up to 1:500 |

Swap-Free | Available | Available | Not Available |

BlackBull Markets Pros and Cons

When considering BlackBull Markets as your broker, weighing the advantages and disadvantages is essential.

Pros | Cons |

Extremely fast execution speeds | Potential complexity for beginner traders due to the wide range of offerings |

Tight spreads starting from 0 pips and leverage up to 1:500 | Limited availability in some regions |

Wide selection of over 26,000 tradable instruments | |

Multi-jurisdictional regulation (New Zealand and Seychelles) | - |

Integration with popular trading platforms (MT4/5, cTrader, TradingView) | - |

BlackBull Markets Account Opening Guide

Opening an account with BlackBull Markets is easy and provides access to the broker's features. BlackBull Markets registration:

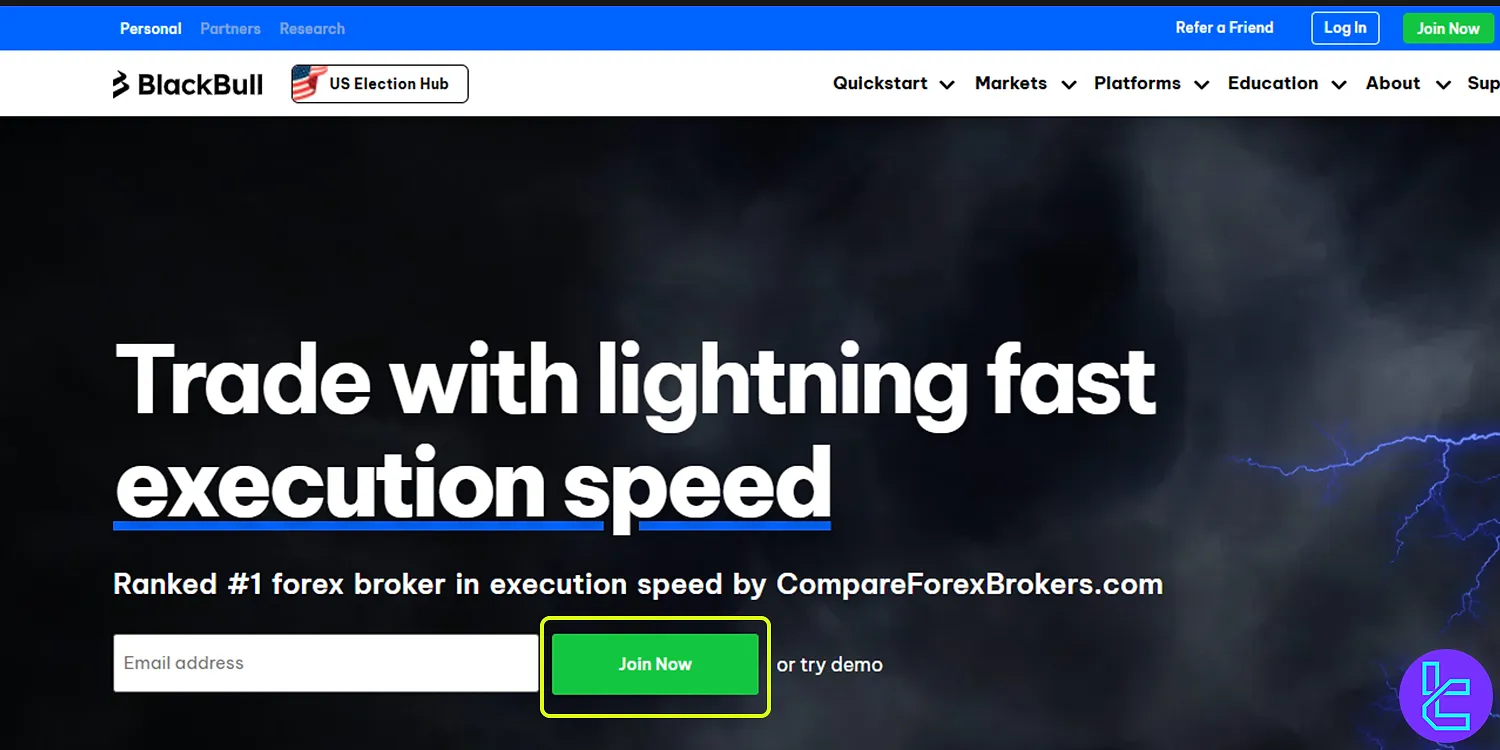

#1 Start on the Official Website

Head to the BlackBull Markets homepage and click “Join Now”. Enter your email address, set a secure password, and confirm that you're not a U.S. citizen. Accept the terms to continue.

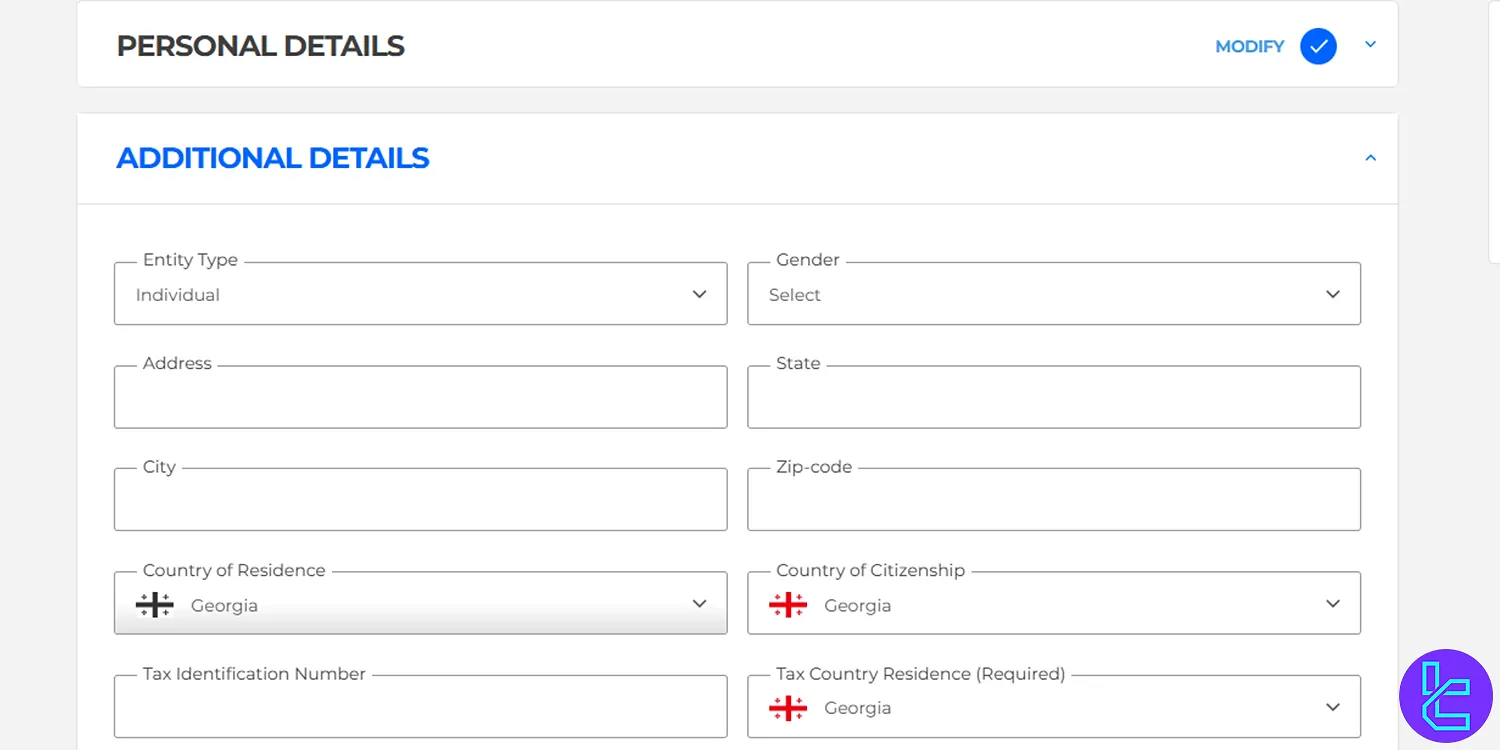

#2 Verify & Provide Personal Info

Check your inbox to verify your email, then proceed to fill in your residential address, postal code, and TIN. This step ensures KYC compliance.

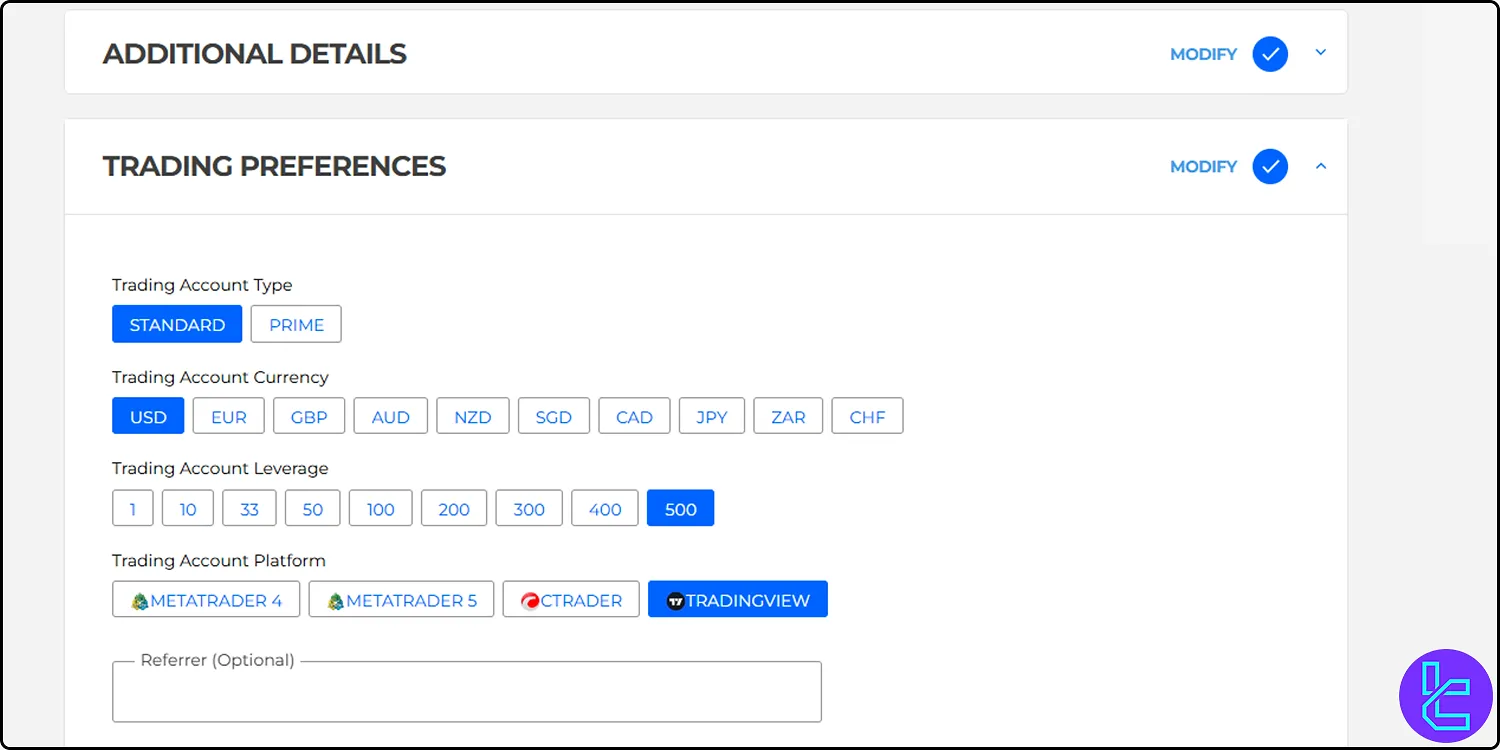

#3 Set Trading & Financial Preferences

Choose your account type, leverage, andbase currency. Then provide your employment status, income source, and estimated funding amount to complete the profile.

Blackbull Markets Verification

To verify your trading account, you must provide the documents listed below. BlackBull Markets verification:

- Valid proof of identity: ID card, passport, or driver's license

- Valid proof of address: Utility bill or bank statement

BlackBull Markets Trading Platforms

The next topic we must discuss in this BlackBull Markets review is the trading platform.

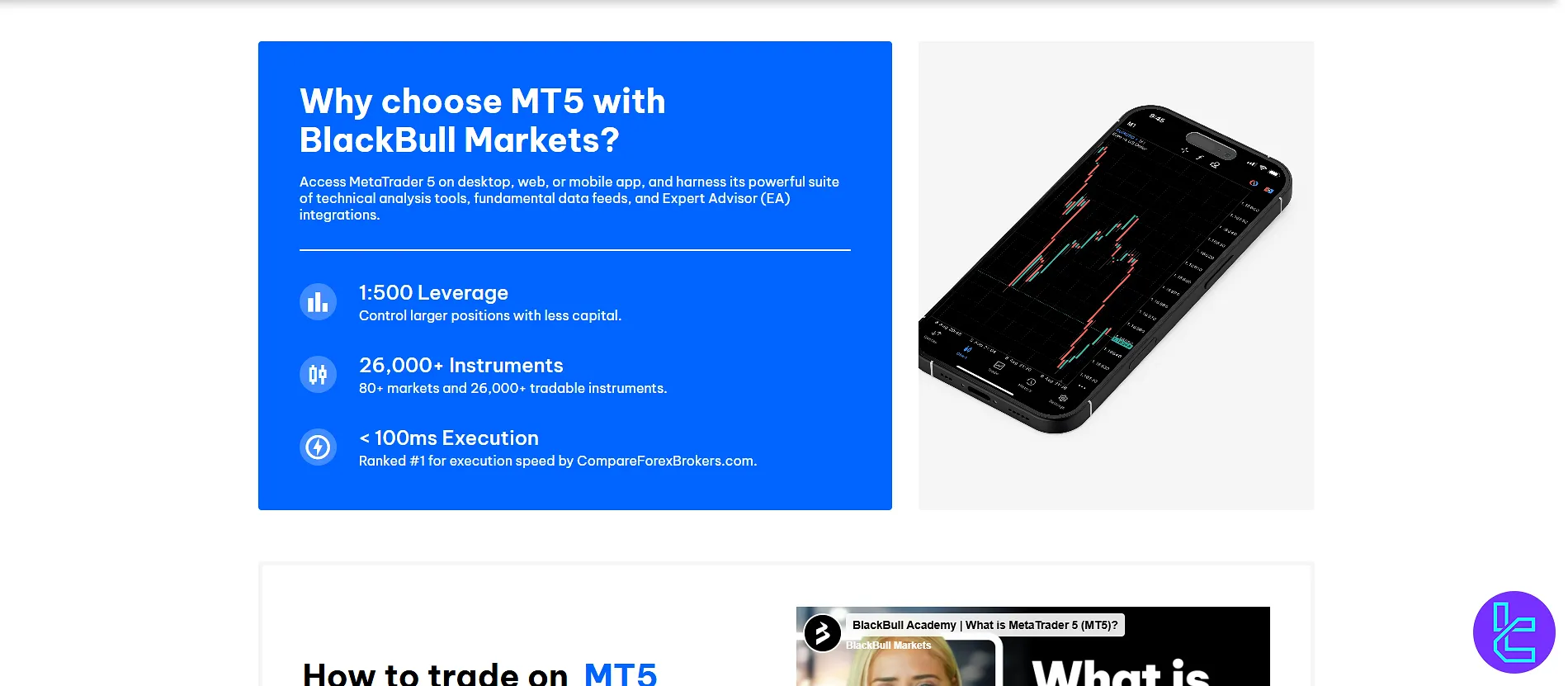

The broker offers a diverse range of trading solutions with access to analytical tools and helpful features to cater to different trading styles and preferences, including:

- TradingView

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- cTrader

- BlackBull Invest (Exclusively for Stocks)

The broker also offers a dedicated Copy Trading platform named BlackBull CopyTrader, which enables you to copy the trades of the most successful strategy providers.

BlackBull Markets Fee Structure

Understanding the fee structure is crucial when choosing a broker. BlackBull Markets offers a competitive and transparent fee structure across its account types.

Account Types | Spreads (Pips) | Commissions (Per lot) |

ECN Standard | From 0.8 | $0.0 |

ECN Prime | From 0.1 | $6.0 |

ECN Institutional | From 0.0 | $4.0 |

The company also apply swap rates to leveraged positions held overnight. Currency conversion too will be subject to additional costs. While, deposits are free, withdrawals come with a $5 commission rate.

The low spreads enable traders to employ various strategies,including day trading and scalping.

Swap Fees

BlackBull applies swap (overnight) fees based on interest-rate differentials and whether the position is long or short. Triple swaps are charged on Wednesdays to cover the weekend.

They also offer Swap-Free (Islamic) accounts: such accounts are exempt from overnight interest, but may incur administrative fees if the account remains open past certain periods.

BlackBull Non-Trading Fees

BlackBull does not charge deposit fees across all available payment methods, including bank transfer, credit/debit card, Neteller, Skrill, and POLi.

However, depending on your bank or e-wallet provider, external or intermediary charges may still apply.

For withdrawals, BlackBull applies a flat $5 processing fee per transaction, regardless of the method or amount withdrawn.

All withdrawal requests are typically processed within 24 hours during business days.

No account inactivity fee or maintenance charge is listed on the broker’s official site, meaning traders will not incur penalties for dormant accounts.

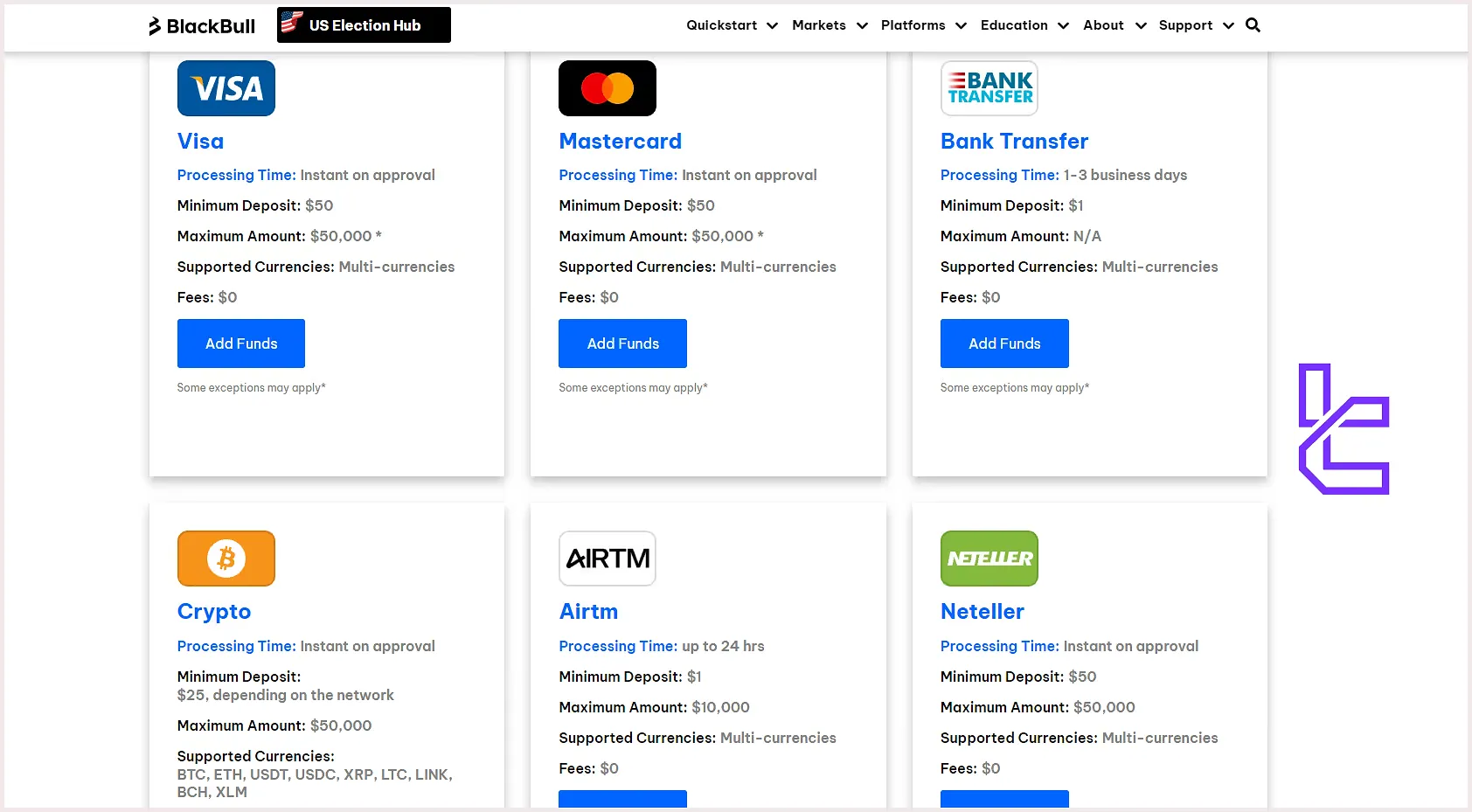

BlackBull Markets Payment Methods

We must explore the available payment options in this BlackBull Markets review.

The company offers various methods for deposit and withdrawals to accommodate traders from various regions and with different preferences.

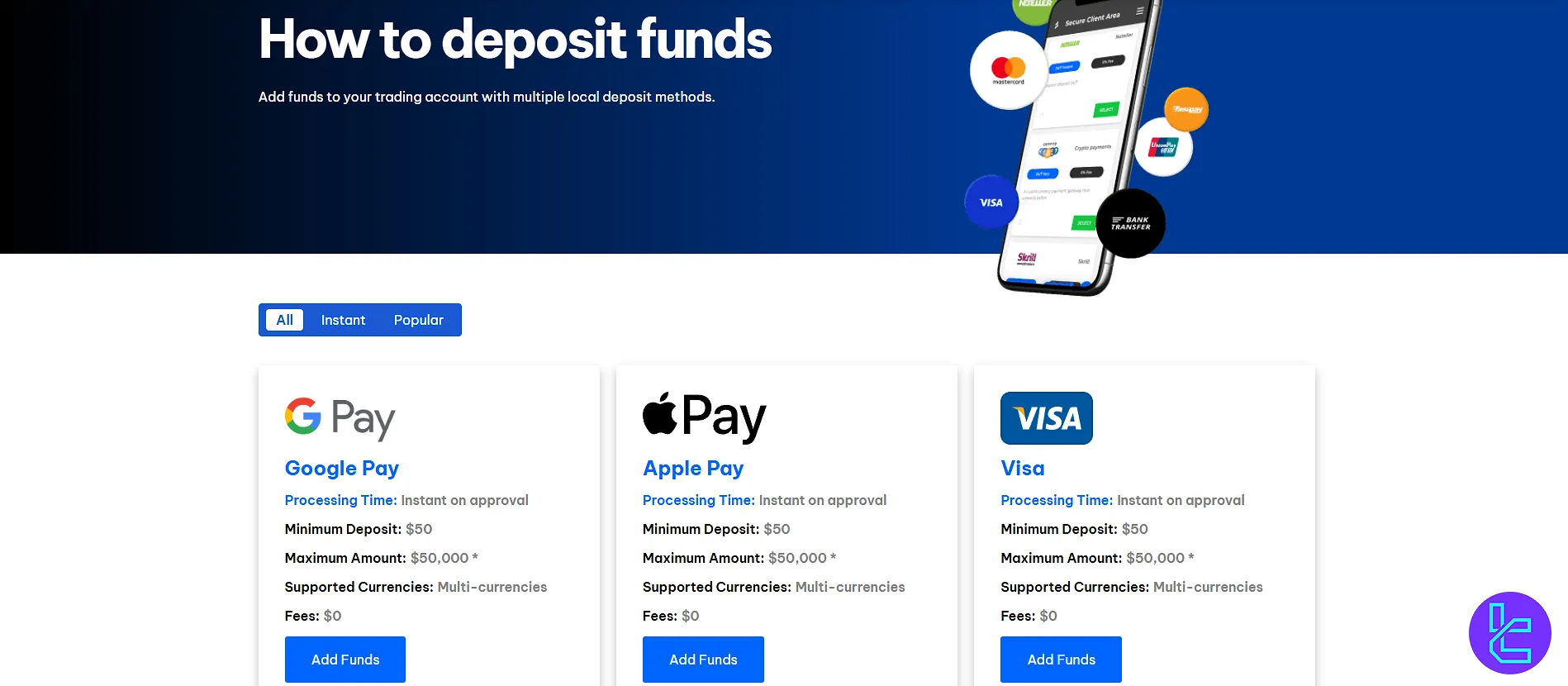

Deposit Options

BlackBull states that deposits are handled via the Secure Client Area “My Wallet”, with no deposit fees charged by the broker.

Processing is mostly instant (method-dependent), and there’s no firm broker-side minimum though some methods have their own minimums.

Supported options include bank transfer, cards, crypto, and select local methods (availability varies by region). Exact method limits, currencies, and minimums are listed on the official funding page.

Available deposit methods, supported currencies, and method minimums:

Option | Accepted Currencies | Min. Deposit |

Apple Pay | Multi-currencies | $50 |

Google Pay | Multi-currencies | $50 |

Visa | Multi-currencies | $50 |

Mastercard | Multi-currencies | $50 |

Bank Transfer | Multi-currencies | $1 |

SEPA | EUR, GBP | $1 |

Neteller | Multi-currencies | $50 |

Skrill | Multi-currencies | $50 |

Fasa Pay | USD | $1 |

Crypto (BTC, ETH, USDT, USDC, XRP, LTC, LINK, BCH, XLM) | Crypto assets | $25 (network-dependent) |

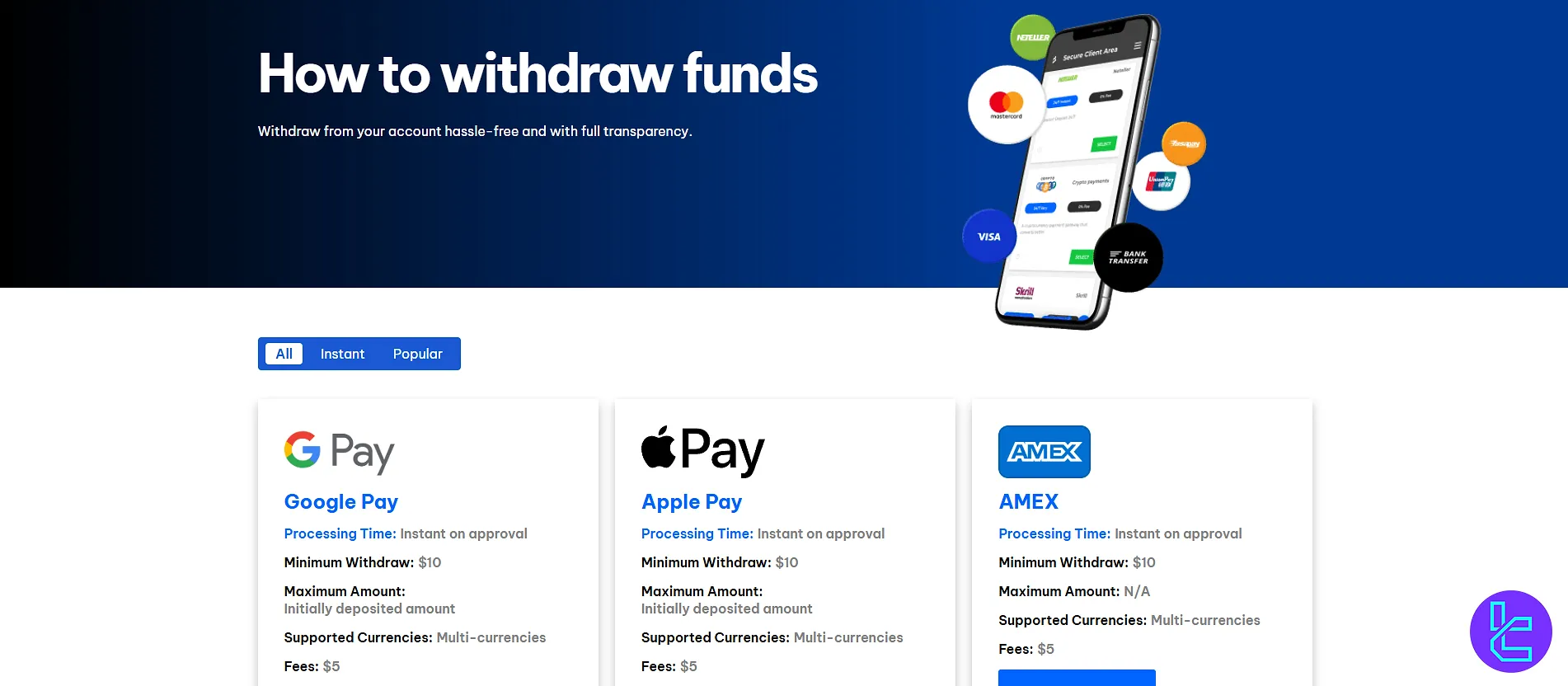

Withdrawal Solutions

Withdrawals are submitted from “My Wallet” and, per BlackBull’s support page, incur a flat US$5 fee due to manual processing.

Processing times vary by method; many e-methods are near-instant, while bank transfers typically take 1–3 business days.

Card withdrawals are limited to the initial deposit amount (standard card rules).

Available withdrawal methods, typical processing, and broker fee:

Withdrawal Solution | Processing Time | Withdrawal Fee |

Apple Pay | Instant on approval | $5 |

Google Pay | Instant on approval | $5 |

Visa | Instant on approval | $5 |

Mastercard | Instant on approval | $5 |

Bank Transfer | 1–3 business days | $5 |

SEPA | Instant on approval | $5 |

Neteller | Instant on approval | $5 |

Skrill | Instant on approval | $5 |

Fasa Pay | Instant to 48 hours | $5 |

Crypto (BTC, ETH, USDT, USDC, XRP, LTC, LINK, BCH, XLM) | 1–2 business days | $5 |

Copy Trading and Growth Plans on BlackBull Markets Broker

The company offers innovative solutions for short-term traders and long-term investors through its copy trading and investing platform(BlackBull CopyTrader and BlackBull Invest).

BlackBull CopyTrader

- Award-winning copy-trading platform

- Allows traders to replicate strategies of elite fund managers

- Transparent performance metrics of signal providers

- Flexible risk management controls

- No minimum deposit requirements to start copy-trading

- Real-time tracking of copied trades

- Option to customize allocation and risk parameters

BlackBull Invest

- Long-term investment platform to buy stocks

- Advanced analysis tools and real-time market data

- Competitive commission rates

- Ability to set price alerts

- Easy portfolio management interface

- Access to global markets

- 70+ order types

- Extended trading hours

- 66+ third-party data feed providers

Available Markets & Instruments

The broker offers a diverse range of financial instruments (26K+), catering to traders with varying interests and strategies.

Here's an overview of the available asset classes on BlackBull Markets.

Instrument availability and specifications are displayed on the site’s instruments pages and platforms.

Here is a summary of asset classes:

Asset Class | Type of Instruments | Number of Symbols | Max. Leverage |

Forex | Currency pairs | 80+ | Up to 1:500 |

Commodities | Metals, energies, cash crops | 15+ | Not stated |

Indices | Major global index CFDs (e.g., NAS100, S&P 500, DJIA) | 10+ | Not stated |

Equities (Shares) | Share CFDs from major markets | 23,000+ | Not stated |

Cryptocurrencies | 22 crypto pairs | 22 pairs | Up to 1:100 |

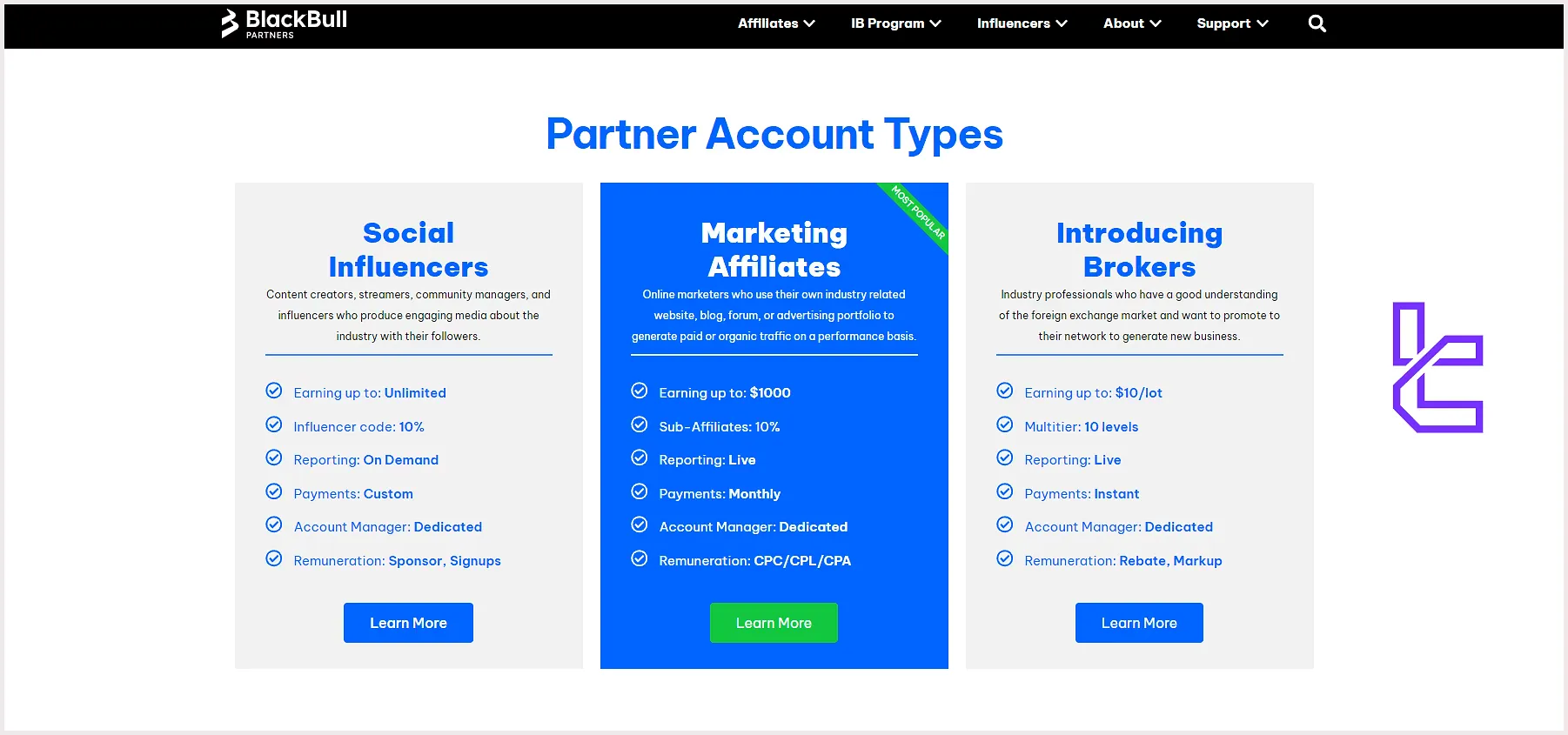

BlackBull Markets Bonus and Promotions

One of the most attractive topics in any BlackBull Markets review is promotion.

the broker offers several attractive bonus and promotional programs to both new and existing clients, as well as partnership opportunities for marketers and industry professionals.

- 100% Deposit Bonus: Up to $1,000 bonus on first deposit only available for new clients from Thailand;

- Affiliates Program: A multi-structure partnership program for social influencers, marketing affiliates, and IBs, with no minimum deposit requirements.

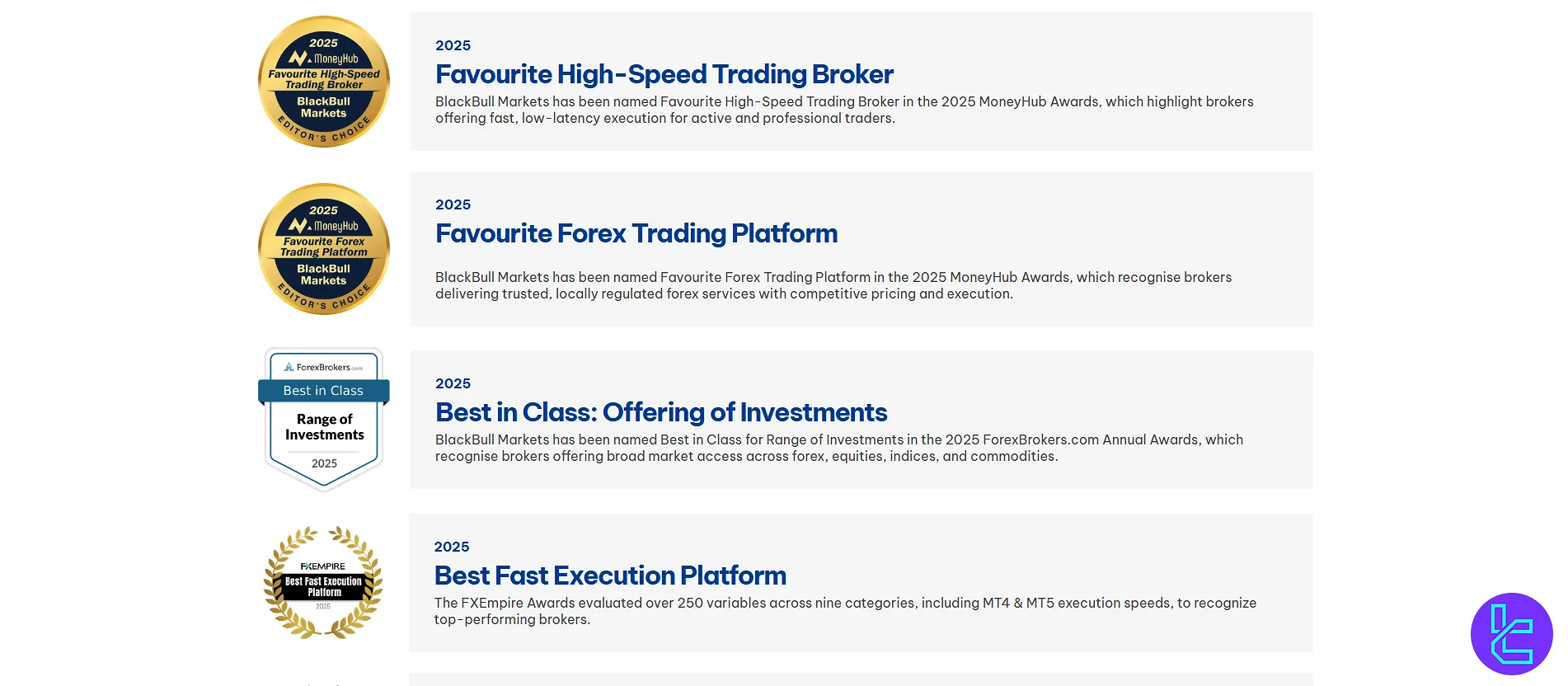

Awards

BlackBull Awards lists multiple recent recognition, highlighting platform speed, market range, and local business growth.

In 2025, it won Favourite Forex Trading Platform and Favourite High-Speed Trading Broker at the MoneyHub Awards.

It also received Best in Class for Range of Investments in ForexBrokers.com’s 2025 Awards. Earlier, BlackBull was placed on New Zealand’s Deloitte Fast 50 (including 2021).

Some of the BlackBull awards:

- MoneyHub Awards 2025 Favourite Forex Trading Platform

- MoneyHub Awards 2025 Favourite High-Speed Trading Broker

- ForexBrokers.com 2025 Best in Class for Range of Investments

- Deloitte Fast 50 New Zealand 2021 placement

How to Reach BlackBull Markets Broker Customer Support

The broker provides 24/7 multilingual support through various channels.

In addition, it offers a comprehensive FAQ section to answer most of the clients’ questions via tutorial articles and videos.

support@blackbull.com | |

Phone | +64 9 558 5142 |

Live Chat | Accessible on the broker’s official website |

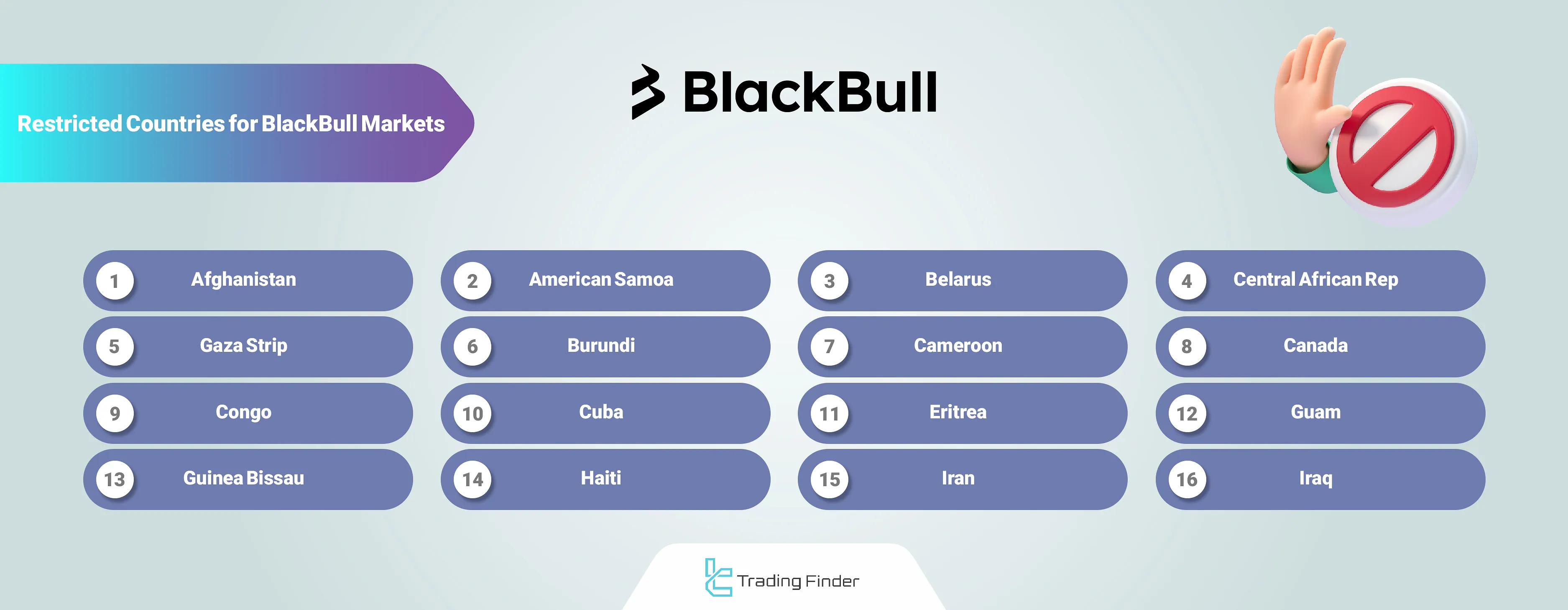

BlackBull Markets Restricted Countries

Due to regulatory requirements and compliance measures, the broker has to put some restrictions in place for various regions. Red flag countries on BlackBull Markets:

- Japan

- Kenya

- Kosovo

- Lebanon

- Libya

- Mali

- Mozambique

- Myanmar

- Nigeria

- North Korea

- North Mariana Islands

- Philippines

- Puerto Rico

- Russian Federation

- Somalia

- South Sudan

- Sudan

- Syria

- Tanzania

- Ukraine

- United States

BlackBull Markets Trust Scores

User satisfaction may be the most important topic in this BlackBull Markets review.

The broker has an outstanding performance in regard of trust scores from reputable websites.

4.8 out of 5 based on 2558 reviews | |

Forex Peace Army | 4 out of 5 based on 100 comments |

4.5 out of 5 based on 2,400 ratings |

BlackBull Markets Broker Educational Content?

The company isn't just handing out fishing rods - they're teaching you how to fish!

Their Education Hub is a veritable treasure trove of trading knowledge that covers a wide range of topics, including:

- How to Trade Courses: From beginner to advanced levels, covering forex, crypto, commodities, and stocks

- Webinars and Trading Videos: 3000+ content on YouTube

- Podcasts: Trading strategies, tutorials, and many more on Spotify

- Economic Calendar: available on iCloud, Google, or Outlook calendar

- Trading Opportunities: Highlighting timely market events and analysis

Comparing BlackBull Markets with Other Brokers

The table below helps you understand the pros and cons of trading with BlackBull Markets in comparison with other brokers.

Parameters | BlackBull Markets Broker | |||

Regulation | FSA, FMA | No | CySEC, DFSA, FCA, FSCA, FSA | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Minimum Spread | From 0.0 pips | From 0.1 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $0 | $0 | From $0 | From $0.2 to USD 3.5 |

Minimum Deposit | $0 | $1 | From $0 | $10 |

Maximum Leverage | 1:500 | 1:3000 | 1:2000 | Unlimited |

Trading Platforms | MetaTrader 4, MetaTrader 5, TradingView, cTrader, BlackBull CopyTrader, BlackBull Invest | MetaTrader 4, MetaTrader 5 | MT4, MT5, Mobile App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Account Types | ECN Standard, ECN Prime, ECN Institutional | Standard, Premium, VIP, CIP | Cent, Zero, Pro, Premium | Standard, Standard Cent, Pro, Raw Spread, Zero |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 26,000+ | 45 | 1,000+ | 200+ |

Trade Execution | Market, Limit, Stop, Trailing Stop | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Instant |

TF Expert Suggestion

BlackBull Market's low trading commissions (from $4) and various supported trading platforms, including MT4, MT5, cTrader, TradingView, and BlackBull Invest (exclusive to stock trading), have made a favorable broker for many traders.

New users must also consider BlackBull Markets’ $2,000 minimum deposit for an ECN Prime account and 4.8 Trustpilot rating before joining.