BLACKWELL GLOBAL offers6 live account types [ECN, Standard, Premium, Turbo, Islamic, Professional], with a maximum leverage of 1:400. The brokerage does not have any minimum deposit amount and operates based on 3 base currencies [USD, EUR, GBP].

BLACKWELL GLOBAL serves a client base across more than 25 countries, handling an average of 12,000 trades per month. With over 65 tradable assets, the broker offers diverse opportunities across forex, commodities, indices, and cryptocurrencies.

BLACKWELL GLOBAL Company Information & Regulation

Founded in 2010, Blackwell Global Investments Limited is a multi-regulated forex and CFD broker with a global presence in key financial hubs, including the UK, Cyprus, China, and New Zealand. Its regulatory framework includes Tier-1 and offshore bodies, offering clients varying degrees of protection depending on their region.

The broker operates under three primary licenses:

- The UK entity is regulated by the FCA (License No. 687576), providing high-tier investor protection and oversight;

- In Hong Kong, Blackwell Global is licensed by the SFC, ensuring compliance with futures and derivatives trading regulations;

- The international division is authorized by the SCB in The Bahamas, which is considered an offshore regulatory environment.

Blackwell Global also participates in international arbitration through The Financial Commission, adding a layer of client dispute resolution.

Here are the regulatory details of this broker:

Parameter/Entity | Blackwell Global Investments (UK) Limited | Blackwell Global Securities Limited & Blackwell Global Futures Limited | Blackwell Global Investments Limited |

Regulation | FCA (License No. 687576) | SFC | SCB (Certificate No. SIA-F215) |

Regulation Tier | Tier-1 | Tier-1 | N/A |

Country | United Kingdom | Hong Kong | The Bahamas |

Investor Protection / Compensation | Yes, via FCA schemes | No formal scheme | No formal scheme |

Segregated Funds | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes |

Maximum Leverage | 1:400 | 1:400 | 1:400 |

Client Eligibility | Residents outside US, Belgium, New Zealand | Residents outside US, Belgium, New Zealand | Residents outside US, Belgium, New Zealand |

BLACKWELL GLOBAL Specifications

When it comes to choosing a Forex broker, details become very critical. Let's break down the key specifics that make the mentioned brokerage stand out:

Broker | BLACKWELL GLOBAL |

Account Types | ECN, Standard, Premium, Turbo, Islamic, Professional, Demo |

Regulating Authority | SCB, FCA, CySEC |

Based Currencies | USD, EUR, GBP |

Minimum Deposit | None |

Deposit Methods | Credit/Debit Cards, E-payment Systems, Bank Transfers |

Withdrawal Methods | Credit/Debit Cards, E-payment Systems, Bank Transfers |

Minimum Order | 0.01 Lots |

Maximum Leverage | 1:400 |

Investment Options | Blackwell Invest |

Trading Platforms & Apps | MetaTrader 5 |

Markets | Forex, Commodities, Indices |

Spread | Varies by Account |

Commission | Varies by Account |

Orders Execution | Market, Instant |

Margin Call / Stop Out | 80% / 50% |

Trading Features | Economic Calendar, VPS, |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Ticket, Callback Request, Phone Call, Live Chat |

Customer Support Hours | 24/5 |

Are There Various Trading Accounts?

BLACKWELL GLOBAL offers a good range of4 + 2 options as its live trading accounts. You can learn about their specifics in the table here:

Account Type | ECN | Standard | Premium | Turbo |

Min. Trade Size | 0.01 Lots | |||

Min. Deposit | $500 | $0 | $500 | $0 |

Pricing | 5 Digit Pricing | |||

Maximum Leverage | 1:200 | 1:100 | 1:200 | |

Base Currencies | USD, EUR, GBP | |||

Margin Call | 80% | |||

Stop Out | 50% | |||

The additional 2 are Islamic and Professional; the former enables trading with no swap fees, while the latter provides a higher leverage of up to1:400.

Additionally, a demo trading environment is provided with each account for practicing and testing strategies.

Important Advantages and Disadvantages

Trading with BLACKWELL GLOBAL comes with its own positives and negatives. Let's have a quick look at these points:

Advantages | Disadvantages |

Supervised by High-Tier Regulatory Authorities | Limited Range of Trading Platforms |

Various Account Types | Mixed User Reviews on Trust Platforms |

Trading Tools Including VPS and Economic Calendar | - |

Copy Trading Service (Blackwell Invest) | - |

Account Creation On BLACKWELL GLOBAL

Traders can only use BLACKWELL GLOBAL services by creating a new account with this forex broker. BLACKWELL GLOBAL registration:

#1 Fill Out the Personal Details Form

Visit the officialBLACKWELL GLOBAL website and click on “Open an Account.” Enter the following required information:

- First and last name

- Country of residence

- Nationality

- Email address and phone number

- Secure password

Confirm that you're over 18 and accept the terms and conditions to proceed.

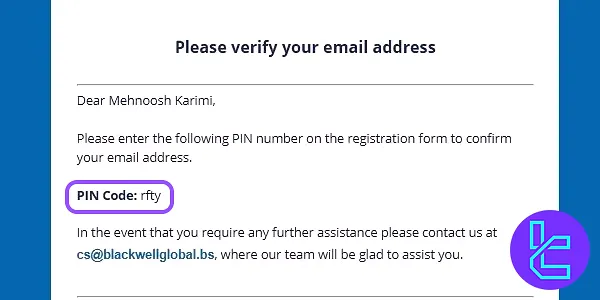

#2 Verify Your Email Address

After submitting your registration form, a verification code will be sent to the email address you provided. Check your inbox (or spam folder), then enter the code in the prompted field to complete the sign-up.

Once these steps are completed, your account will be ready for use, and you can proceed to complete identity verification (KYC) to access all features.

#3 BLACKWELL GLOBAL Verification

To verify your account and access all the broker's features, follow the steps below. BLACKWELL GLOBAL verification:

- Begin by entering personal details such as nationality, residence, date of birth, marital status, and tax ID in the KYC section;

- Provide your employment status, income source, and financial background including monthly earnings and savings; declare U.S. citizenship if applicable;

- Answer trading-related questions to outline your experience and knowledge of financial markets;

- Confirm your residency status by indicating whether you are a U.S. citizen or not;

- Upload valid identification documents such as a passport, driver’s license, national ID, or residence permit, make sure both front and back are visible;

- Submit proof of address by uploading a recentutility bill, bank statement, or official government letter (issued within the past 6 months);

- Take a real-time selfie using your device’s camera under proper lighting to confirm your identity;

- Once all steps are complete, check the KYC status in your profile section to monitor approval progress.

BLACKWELL GLOBAL Trading Platform

When it comes to trading platforms, BLACKWELL GLOBAL keeps it simple yet effective by offering MetaTrader 5 (MT5), one of the most popular terminals in the industry.

Download the platform's software via these links:

Does BLACKWELL Have Fair Spreads and Commissions?

The broker offers competitive numbers for trading fees and spreads across its account types:

Account Type | Standard | ECN | Premium | Turbo |

Spreads | From 0.8 Pips | From 0 Pips | From 0.2 Pips | From 0 Pips |

Trading Commissions per Round Lot | $0 | $9 | $0 | $5 |

Based on the investigations done by our team, the company does not charge its clients any other costs.

You can use a profit calculator tool to estimate the approximate outcome of a trade, taking into account fees.

BLACKWELL GLOBAL Swap Fees

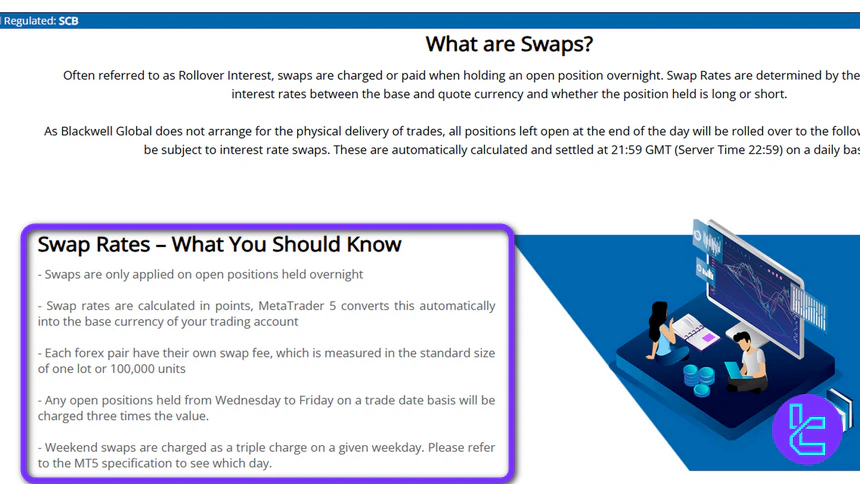

Swap charges at Blackwell Global apply exclusively to trading positions that remain open past the daily market rollover.

These overnight financing costs are quoted in points, and the MetaTrader 5 (MT5) platform automatically converts them into the base currency of the trader’s account.

Each forex pair carries its own swap rate, calculated on the standard 1-lot contract size (100,000 units). Positions kept open over the mid-week rollover incur a triple-swap adjustment, applied between Wednesday and Friday depending on the instrument’s settlement rules.

Additionally, weekend financing is consolidated into a single triple charge, applied on a designated weekday as defined in the MT5 contract specifications.

BLACKWELL GLOBAL Non-Trading Fees

An account at Blackwell Global is categorized as inactive when no deposits, withdrawals, or trading activity occur for a full 12-month period.

If such an account holds a positive balance, the firm may attempt to reach the client, either by phone or written communication, to verify whether the account should remain open.

When no response is provided, a monthly dormancy fee of 25 units in the account’s base currency can be applied until the balance is reduced to zero. Once the account reaches a nil balance or becomes overdrawn and the client is unreachable, the company may proceed with closing it.

Regarding transfers, Blackwell Global states that it does not impose internal fees on standard deposits or withdrawals.

Clients should note, however, that external costs from international banks or payment providers may still apply. Funding via debit or credit card is free up to a weekly limit of 10,000 units in the base currency, while card deposits exceeding this threshold incur a 2.45% processing charge.

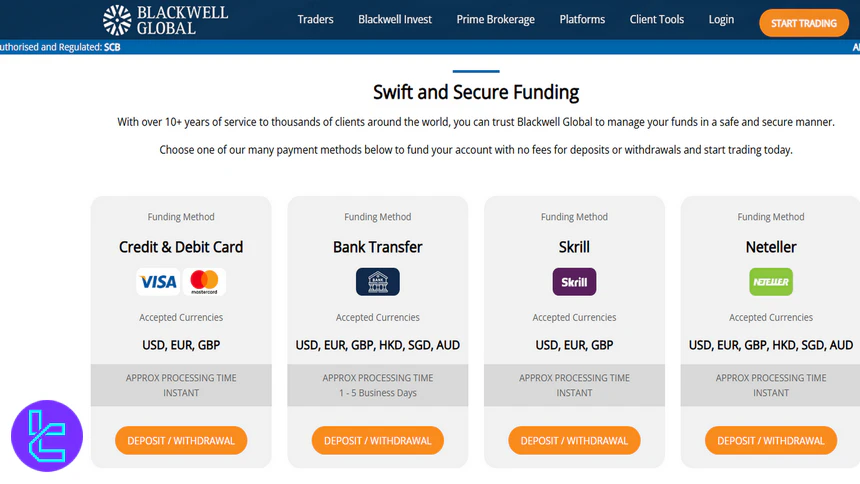

Payment Options and Systems in BLACKWELL GLOBAL

Blackwell Global provides a selection of common payment methods suitable for international traders. Clients can fund and withdraw their accounts through the following channels:

- Credit/Debit Cards (Visa, MasterCard): Supports USD, EUR, GBP with instant processing

- Bank Transfers: Supports USD, EUR, GBP, HKD, SGD, AUD with a processing time of 1 to 5 business days

- E-wallets: Includes Skrill and Neteller with instant processing

Key conditions include:

- No deposit fees

- No withdrawal fees

- Minimum deposit is$0 for Standard and Turbo accounts

- Minimum withdrawal amount is$0.01

- The broker does not support PayPal or cryptocurrency payments at this time

BLACKWELL GLOBAL Deposit

Blackwell Global provides several electronic and traditional channels for adding funds to a trading account. Each method supports specific settlement currencies and has its own processing timeframe, from instant confirmation to multi-day bank clearing.

All supported deposit methods operate through regulated payment providers and are designed to accommodate a range of account currencies frequently used in forex and CFD trading.

Here are the details of each deposit method available:

Deposit Method | Supported Currencies | Processing Time |

Credit / Debit Card | USD, EUR, GBP | Instant |

Bank Transfer | USD, EUR, GBP, HKD, SGD, AUD | 1–5 business days |

Skrill | USD, EUR, GBP | Instant |

Neteller | USD, EUR, GBP, HKD, SGD, AUD | Instant |

BLACKWELL GLOBAL Withdrawal

Blackwell Global processes withdrawals through the same channels used for funding, ensuring consistency with standard AML (Anti-Money Laundering) procedures.

Each method supports a defined set of currencies and follows the clearing times associated with its payment network or banking system.

Withdrawal execution depends on operational hours of banks and electronic payment providers, with processing ranging from immediate release to several business days for international transfers.

Let’s check out the withdrawal methods in detail:

Withdrawal Method | Supported Currencies | Processing Time |

Credit / Debit Card | USD, EUR, GBP | Instant (card network dependent) |

Bank Transfer | USD, EUR, GBP, HKD, SGD, AUD | 1–5 business days |

Skrill | USD, EUR, GBP | Instant |

Neteller | USD, EUR, GBP, HKD, SGD, AUD | Instant |

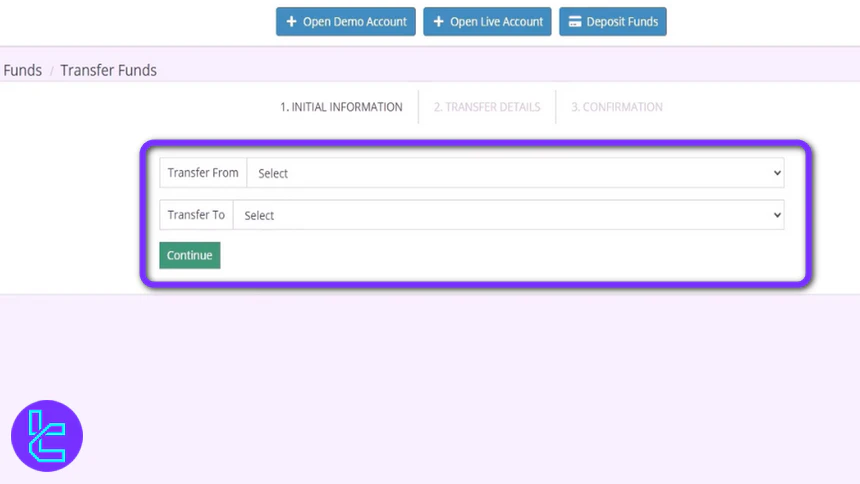

Funds Section on the BLACKWELL GLOBAL Dashboard

The Blackwell Global dashboard brings together more than seventeen account-management tools, but the funds section is central to its functionality.

Within this area, users can handle every financial operation related to their trading wallet, depositing capital, initiating withdrawals, and transferring balances internally between accounts.

Each transaction pathway includes structured steps for selecting the relevant wallet, choosing a payment method, and confirming details, while the transaction history and payment-details pages help users monitor past activity and store banking information for smoother future withdrawals.

Deposits, withdrawals, and internal transfers are supported through dedicated tabs, each designed for quick navigation and operational clarity.

The deposit feature allows instant funding through supported payment channels, while the withdrawal section guides users through account selection, method choice, and verification of payout details.

The transfer function enables movement of funds between wallets or trading accounts, ensuring flexible capital allocation. Together, these tools form the financial core of the platform, enabling seamless management of trading funds within the Blackwell Global environment.

Copy Trading and Other Investment Features

For those looking to diversify their trading strategies, BLACKWELL GLOBAL offers the "Blackwell Invest" platform. It's not a copy trading facility, though, and offers no social trading features; in fact, it provides "investment portfolios" and strategies consisting of "stocks, ETFs, and investment funds".

Here are the download links to the platform's application on theApple App Store and the Google Play Store:

Available Instruments and Markets

BLACKWELL GLOBAL lags behind compared to most competitors in this matter, providing access to only 3 financial markets:

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | CFDs on over 50 currency pairs | 50+ | 50–70 currency pairs | 1:400 |

Commodities | CFDs on precious metals and Oil | 3+ | 10–20 instruments | 1:200 |

Indices | CFDs on global stock indices | 10+ | 10–20 indices | 1:200 |

Overall, there are +65 tradable assets available.

Does BLACKWELL GLOBAL Offer Any Bonuses?

As of the last update, this broker does not offer any specific bonuses or promotions. This approach aligns with its stringent regulatory status. We will inform you on this page in case of any changes.

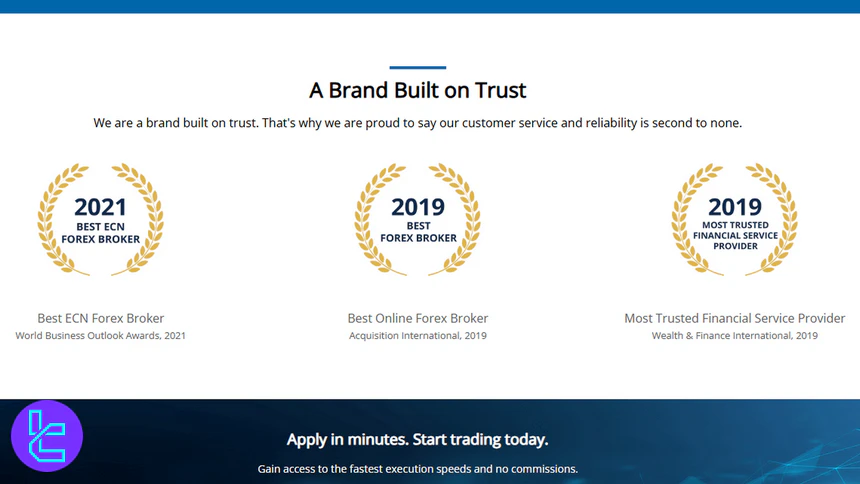

BLACKWELL GLOBAL Awards

Over the years, Blackwell Global has been acknowledged by several financial publications and award bodies for its brokerage services and overall reliability. These recognitions highlight the company’s standing within the trading industry.

Notable Awards:

- Best Forex Broker (2019) – Acquisition International

- Most Trusted Financial Service Provider (2019) – Wealth & Finance

- Best ECN Forex Broker (2021) – World Business Outlook Awards

- Most Trusted Financial Service Provider (2021) – Worldwide Finance Awards

Together, these BLACKWELL GLOBAL awards reflect the broker’s continued efforts to maintain trust, service quality, and strong execution standards across its global operations.

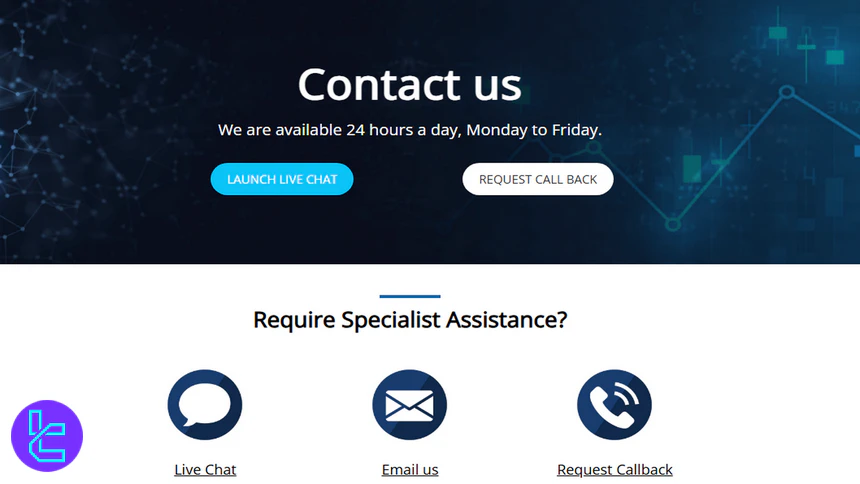

Support Contact Channels and Open Hours

BLACKWELL GLOBAL does a normal job in terms of customer service; it offers 5 contact options:

- Email: cs@blackwellglobal.bs

- Live Chat: Available directly on the official website

- Phone: 001 (242) 603-2169

- Callback Request: Submittable on the "Contact Us" page

- Ticket: Available on the "Contact Us" section

The company states that the support team is available to answer the clients on a 24/5 basis.

Which Regions and Countries Are Restricted from BLACKWELL GLOBAL's Services?

While the broker serves clients globally, there are certain restrictions based on regulatory requirements. Per the statement on the official website, the broker does not accept clients from:

- United States

- New Zealand

- Belgium

Trust Scores and Reviews

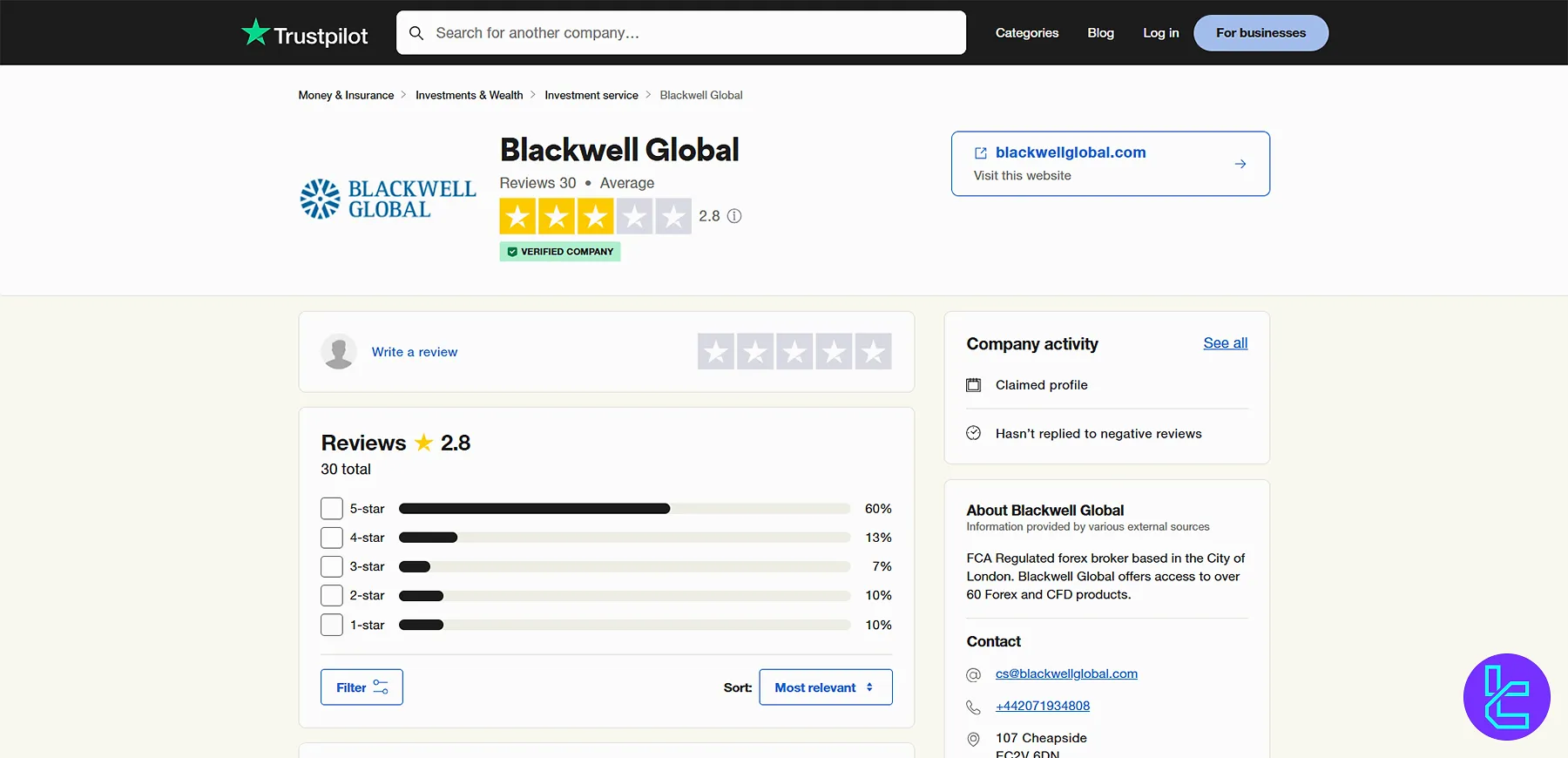

Websites and sources such as Trustpilot, BLACKWELL GLOBAL ForexPeaceArmy, and ScamAdvisor receive reviews for companies and give an average score based on them and other factors.

Here's how BLACKWELL GLOBAL fares on these platforms:

- Trustpilot: 2.8/5 based on 30 reviews

- ScamAdviser: Trustscore of 10/100, with a 2.7/5 score based on +40 user reviews

- ForexPeaceArmy: 2.4/5 with more than 10 ratings

The overall image of the brokerage on these sources is negative; however, it's not the only important factor in trusting a company.

Educational Resources

Blackwell Global provides limited educational content on its website, and much of the available material appears to be outdated. While basic guides and articles are accessible, the broker does not maintain an active or regularly updated educational hub.

The only consistently maintained resource is an economic calendar, which offers traders insights into upcoming market-moving events.

Overall, Blackwell Global is not positioned as a learning-focused broker and may not be suitable for beginners seeking structured educational tools, webinars, or interactive training.

BLACKWELL GLOBAL in Comparison with Other Brokers

The table below helps you compare the pros and cons of trading with BLACKWELL GLOBAL with other Forex brokers.

Parameters | BLACKWELL GLOBAL Broker | |||

Regulation | SCB, FCA, CySEC | FCA, FSCA, CySEC, SCB | ASIC, FSC, DFSA, CySEC | No |

Minimum Spread | 0.0 Pips | 0.0 Pips | From 0.6 Pips | 0.1 Pips |

Commission | From $0 | From $0 | None Except On Shares Account | $0 |

Minimum Deposit | $0 | $100 | $5 | $1 |

Maximum Leverage | 1:400 | 1:500 | 1:1000 | 1:3000 |

Trading Platforms | MT5 | MT4, MT5, cTrader, Web Trader, Mobile App | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | ECN, Standard, Premium, Turbo, Islamic, Professional, Demo | Standard, Pro, Raw+, Elite | Micro, Standard, Ultra Low, Shares | Standard, Premium, VIP, CIP |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 65+ | 2100+ | 1400+ | 45 |

Trade Execution | Market, Instant | Market, Pending | Market, Instant | Market, Instant |

Conclusion and Final Words

BLACKWELL GLOBAL costs $9 per round lot on its ECN account, with spreads starting from 0 pips. There are no trading fees on the Premium one, but the minimum spread is higher at0.2 pips.

The company has received a 2.8/5 score on Trustpilot, based on 30 user reviews.